Securing funding for higher education is a significant step, and understanding the nuances of student loan options is crucial. This guide delves into the ABSA Student Loan program, providing a comprehensive overview of eligibility criteria, the application process, repayment options, and associated costs. We’ll explore the benefits and potential drawbacks, equipping you with the knowledge to make an informed decision about your financial future.

From understanding the minimum academic requirements and income thresholds to navigating the online application and selecting the most suitable repayment plan, we aim to demystify the ABSA Student Loan process. We’ll also offer practical tips for managing your loan debt effectively and provide contact information for support should you need it.

ABSA Student Loan Eligibility Criteria

Securing funding for your education is a crucial step, and understanding the eligibility requirements for an ABSA student loan is essential. This section details the criteria you need to meet to be considered for an ABSA student loan. Failure to meet these requirements may result in your application being rejected.

Minimum Academic Requirements

To be eligible for an ABSA student loan, you must meet specific academic standards. This typically involves having been accepted into a recognized tertiary institution offering a qualification that leads to a nationally recognized qualification. Applicants should provide proof of acceptance and details of their chosen course of study. The specific minimum academic requirements may vary depending on the course and the institution. Contact ABSA directly for the most up-to-date and specific information regarding your chosen course.

Income Requirements for Students and Guarantors

ABSA assesses the financial capacity of both the student and their guarantor (if required). The student’s income, while not always a primary determinant, is considered alongside other factors. A guarantor’s income plays a significant role in the approval process, demonstrating their ability to repay the loan should the student be unable to do so. The exact income thresholds are not publicly stated and are subject to internal ABSA assessment, based on factors such as the loan amount and the repayment plan. It’s advisable to contact ABSA directly to discuss your specific financial situation.

Required Supporting Documents

Providing the necessary documentation is crucial for a smooth and efficient application process. Incomplete applications may lead to delays or rejection. Ensuring all documents are accurate and up-to-date is vital.

| Requirement | Description | Supporting Document | Notes |

|---|---|---|---|

| Acceptance into Tertiary Institution | Proof of acceptance into a recognized tertiary institution. | Official acceptance letter from the institution. | Must clearly state the course of study and duration. |

| Course Details | Details of the chosen course of study. | Course prospectus or official course information from the institution. | Including course fees and duration. |

| Student Identity | Verification of the student’s identity. | Copy of valid ID (Passport, ID card, Driver’s License). | Ensure the ID is clear and legible. |

| Student Financial Information | Information regarding the student’s financial situation. | Payslips (if applicable), bank statements (last 3 months). | Demonstrates the student’s ability to contribute to repayments. |

| Guarantor Information (if applicable) | Details of the guarantor and their financial standing. | Guarantor’s ID, payslips, bank statements (last 3 months). | Guarantor must be a South African citizen or permanent resident. |

| Proof of Residence | Verification of the student’s residential address. | Utility bill (recent, e.g., water, electricity, municipal rates) | Must match the address provided on the application. |

ABSA Student Loan Application Process

Applying for an ABSA student loan involves a straightforward online process. This guide Artikels the steps involved, ensuring a smooth and efficient application experience. Remember to gather all necessary documentation beforehand to expedite the process.

The ABSA student loan application is entirely online, eliminating the need for in-person visits. This digital approach offers convenience and allows for 24/7 access to the application portal. The process is designed to be user-friendly, guiding applicants through each step with clear instructions.

Online Application Process

The online application begins with account creation. Applicants will need to provide a valid email address and create a secure password. Following account creation, the system will guide the applicant through a series of forms requiring personal information, academic details, and financial information. Throughout the process, clear instructions and helpful prompts are provided to ensure accurate completion. Upon submission, the application will be reviewed, and the applicant will be notified of the outcome.

Required Information

The application requires comprehensive information across several sections. These sections are designed to assess the applicant’s eligibility and financial need. Accuracy is paramount in each section to avoid delays in the application process.

- Personal Information: This section requires details such as full name, ID number, contact details, and residential address. Accurate and up-to-date information is crucial for communication regarding the application.

- Academic Information: Applicants must provide details about their chosen course of study, the institution they are attending, and their expected graduation date. Proof of acceptance or enrollment is usually required as supporting documentation.

- Financial Information: This section requires information about the applicant’s income (if any), existing debts, and any other financial commitments. This information helps ABSA assess the applicant’s ability to repay the loan.

- Supporting Documentation: Applicants will need to upload supporting documents such as proof of identity, proof of address, and academic transcripts. The specific documents required will be clearly Artikeld within the application portal.

Step-by-Step Application Guide

A structured approach to the application ensures a smooth process. Following these steps will help you navigate the application efficiently.

- Create an Account: Visit the ABSA website and locate the student loan application portal. Create an account using a valid email address and a secure password.

- Complete the Application Form: Carefully fill in all required fields in the application form, ensuring accuracy and completeness. Refer to the provided instructions for guidance.

- Upload Supporting Documents: Upload all required supporting documents in the designated section. Ensure the documents are clear, legible, and in the correct format.

- Review and Submit: Thoroughly review all information provided before submitting the application. Once submitted, you cannot make changes.

- Await Notification: ABSA will review your application and notify you of their decision. This process may take several weeks.

ABSA Student Loan Repayment Options

Choosing the right repayment plan for your ABSA student loan is crucial for managing your finances effectively after graduation. Understanding the different options available and their implications will help you make an informed decision that aligns with your post-graduation income and financial goals. The repayment plan you select will directly impact your monthly payments, the total interest paid, and the overall length of your repayment period.

Understanding ABSA’s Repayment Structures

ABSA typically offers a range of repayment options tailored to individual circumstances. These options often involve variations in repayment periods and monthly payment amounts, influencing the total interest paid over the loan’s lifetime. The specific plans available may vary depending on the loan amount, interest rate, and individual borrower profile. Factors such as income stability and employment prospects also play a significant role in determining the most suitable repayment plan.

Factors Influencing Repayment Plan Selection

Several key factors influence the selection of an appropriate ABSA student loan repayment plan. Income is a primary consideration, as it directly determines the affordability of different monthly payment amounts. The size of the loan itself also plays a critical role; larger loan amounts typically necessitate longer repayment periods or higher monthly payments. Furthermore, the borrower’s financial goals and risk tolerance should be factored in. Someone aiming for rapid debt reduction might opt for a shorter repayment period with higher monthly payments, while someone prioritizing lower monthly payments might choose a longer repayment period, accepting potentially higher overall interest costs. Finally, future income projections can influence the choice, allowing borrowers to anticipate potential changes in their financial capacity over the repayment period.

Comparison of ABSA Student Loan Repayment Plans

The following table provides a hypothetical comparison of potential ABSA student loan repayment plans. Note that these are illustrative examples and actual plans and interest rates offered by ABSA may vary. It’s crucial to consult directly with ABSA for the most up-to-date and accurate information regarding current repayment options and associated terms.

| Repayment Plan | Interest Rate (Annual %) | Repayment Period (Years) | Monthly Payment (Example: R10,000 Loan) |

|---|---|---|---|

| Standard Repayment | 7.5 | 10 | R1180 |

| Accelerated Repayment | 7.0 | 7 | R1580 |

| Extended Repayment | 8.0 | 15 | R850 |

*Note: These figures are for illustrative purposes only and do not reflect actual ABSA rates or plans. Actual repayment amounts will vary based on the loan amount, interest rate, and repayment period selected.*

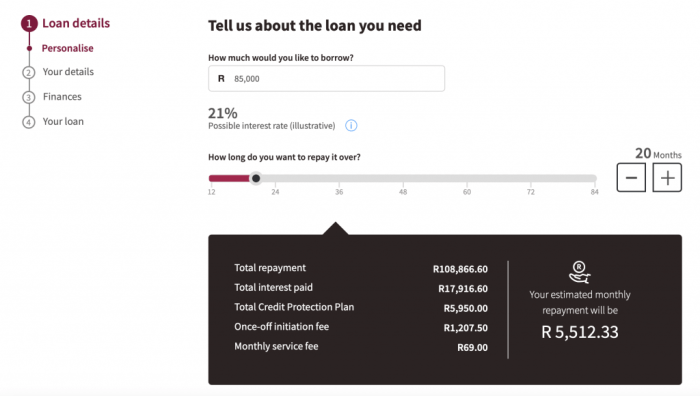

ABSA Student Loan Interest Rates and Fees

Understanding the interest rates and fees associated with your ABSA student loan is crucial for effective financial planning. This section details the different types of interest rates offered and Artikels any applicable fees, enabling you to make informed decisions about your loan. Knowing these costs upfront will help you budget effectively and manage your repayments responsibly.

ABSA typically offers both fixed and variable interest rates on student loans. A fixed interest rate remains constant throughout the loan term, providing predictable monthly payments. In contrast, a variable interest rate fluctuates based on market conditions, potentially leading to varying monthly payments. The specific interest rate offered will depend on various factors, including your creditworthiness, the loan amount, and the repayment period. It’s important to note that ABSA’s interest rates are competitive within the South African market, but it’s always advisable to compare offers from other lenders before making a final decision.

Fixed Interest Rates

Fixed interest rates offer predictability and stability. With a fixed rate, you know exactly how much you will be paying each month in interest, allowing for easier budgeting and financial planning. For example, a student might secure a fixed interest rate of 8% per annum for the duration of their loan. This means that 8% of the outstanding loan balance will accrue as interest each year. This rate remains consistent irrespective of changes in the prime lending rate or other market fluctuations.

Variable Interest Rates

Variable interest rates are linked to a benchmark rate, often the prime lending rate set by the South African Reserve Bank. This means that your interest rate can change over the life of your loan, reflecting fluctuations in the broader economic environment. While this can potentially lead to lower interest payments during periods of low prime rates, it also carries the risk of higher payments if the prime rate increases. For instance, if a student has a variable rate loan and the prime rate rises, their monthly repayments may increase accordingly.

Associated Fees

Besides interest, several fees might be associated with your ABSA student loan. Understanding these fees is essential for accurate budgeting. These fees can significantly impact the overall cost of your loan.

Application Fee

ABSA may charge an application fee to process your student loan application. This fee covers the administrative costs associated with assessing your application and verifying your information. The exact amount of this fee should be clearly stated in the loan agreement.

Late Payment Penalties

Missing a loan repayment can result in late payment penalties. These penalties are designed to incentivize timely repayments and cover the administrative costs incurred by ABSA in managing overdue accounts. The penalty amount varies depending on the loan agreement and the number of missed payments.

Interest Calculation and Capitalization

Understanding how interest is calculated and capitalized is crucial for managing your student loan effectively. Interest is typically calculated on the outstanding loan balance. Capitalization refers to the process of adding accumulated interest to the principal loan amount, increasing the overall loan balance. This means that future interest calculations will be based on a larger principal amount, leading to potentially higher overall interest payments over the life of the loan.

Interest is usually calculated daily and added to your loan balance monthly. The frequency of capitalization will be specified in your loan agreement.

ABSA Student Loan Benefits and Drawbacks

Choosing a student loan can be a significant decision, impacting your finances for years to come. Understanding the advantages and disadvantages of each lender is crucial for making an informed choice. This section will explore the benefits and drawbacks associated with ABSA student loans, comparing them to potential alternatives.

ABSA student loans offer several compelling advantages, primarily stemming from their established reputation and extensive network within South Africa. However, it’s essential to consider potential limitations before committing to this specific loan provider. A thorough comparison against competitors will help you determine if an ABSA student loan aligns with your individual needs and circumstances.

Advantages of ABSA Student Loans

ABSA, being a major financial institution, offers the stability and security associated with a well-established lender. This translates to a degree of confidence in loan disbursement and ongoing support. Furthermore, their established infrastructure often facilitates a smoother application process and potentially quicker approval times compared to smaller, less-established lenders. Access to various repayment options and potentially competitive interest rates (depending on prevailing market conditions and individual creditworthiness) further enhances their appeal. Finally, ABSA’s widespread branch network provides convenient access to customer service and support.

Drawbacks of ABSA Student Loans

While ABSA offers several advantages, potential drawbacks should be considered. Interest rates, while potentially competitive, may not always be the absolute lowest available in the market. Specific terms and conditions, including penalties for late payments or early repayment, should be carefully reviewed. The loan approval process, while generally efficient, may still involve a certain degree of bureaucratic complexity. Finally, the specific features and benefits offered by ABSA might not always perfectly align with the needs of every student borrower.

Comparison with Competitor Offerings

Understanding how ABSA stacks up against other student loan providers is crucial for making a well-informed decision. The following table provides a simplified comparison, noting that specific terms and conditions are subject to change and individual circumstances. It’s crucial to independently verify the current offerings of each lender before making any decisions.

| Feature | ABSA Student Loan | Competitor A (Example: Standard Bank) | Competitor B (Example: Nedbank) |

|---|---|---|---|

| Interest Rate (Illustrative Example) | 8.5% – 12% (Variable) | 8% – 11% (Variable) | 9% – 13% (Variable) |

| Repayment Options | Various options available, including flexible repayment schedules. | Offers flexible repayment plans and potential for deferment. | Provides standard repayment plans with potential for extensions. |

| Application Process | Generally efficient, but may involve documentation. | Similar to ABSA, requires documentation. | May have a more streamlined online application process. |

| Customer Service | Extensive branch network and online support. | Strong online and branch presence. | Good online support, fewer branches. |

Note: The interest rates and other details provided are illustrative examples only and should not be considered definitive. Always check the latest information directly with the respective lenders.

Managing ABSA Student Loan Debt

Successfully navigating your ABSA student loan requires proactive planning and a commitment to responsible financial management. Understanding your repayment options and developing effective budgeting strategies are crucial for minimizing stress and ensuring timely repayments. This section provides practical advice to help you manage your ABSA student loan debt effectively.

Effective management of your ABSA student loan debt hinges on a multi-pronged approach encompassing budgeting, repayment strategies, and a strong foundation of financial literacy. Failing to plan effectively can lead to missed payments, accumulating interest, and potentially negatively impacting your credit score. By proactively addressing these aspects, you can mitigate financial strain and achieve financial freedom sooner.

Budgeting and Prioritizing Loan Repayments

Creating a realistic budget is the cornerstone of successful debt management. This involves tracking your income and expenses to identify areas where you can reduce spending and allocate funds towards your loan repayments. Prioritizing your loan repayments within your budget ensures consistent progress towards eliminating your debt. Consider using budgeting apps or spreadsheets to monitor your spending and track your progress. For example, you might allocate a specific percentage of your monthly income, say 20%, directly to your loan repayment, ensuring this amount is treated as a non-negotiable expense. Prioritize higher-interest loans first to minimize the overall interest paid.

Strategies for Repaying ABSA Student Loans

Several strategies can expedite loan repayment. The most common include increasing your monthly payments, making additional lump-sum payments whenever possible (e.g., tax refunds, bonuses), and exploring loan refinancing options if interest rates fall. Refinancing could lower your monthly payment or shorten the repayment period. However, carefully evaluate the terms and conditions of any refinancing offer before committing. For example, if you receive a bonus at work, consider allocating a portion of that towards your loan principal to significantly reduce the overall loan term and interest paid.

The Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy plays a vital role in effective debt management. Understanding concepts like interest rates, amortization schedules, and credit scores empowers you to make informed decisions regarding your loan repayment. Utilizing online resources, attending financial literacy workshops, or consulting with a financial advisor can significantly improve your understanding and help you develop a personalized debt management plan. A solid understanding of these concepts enables you to proactively identify and address potential financial challenges, leading to more confident and effective debt management.

Contacting ABSA Student Loan Support

Securing efficient and effective communication with ABSA Student Loan support is crucial for addressing queries, resolving issues, and ensuring a smooth loan experience. Various channels are available to facilitate this communication, each offering distinct advantages depending on the nature of your inquiry. Understanding these options and the process for lodging complaints allows for prompt and effective resolution of any concerns.

ABSA provides multiple avenues for contacting their student loan support team. These include phone support, email, and online resources, each designed to cater to different communication preferences and urgency levels. For complex issues or formal complaints, understanding the process for lodging a dispute is essential to ensure your concerns are addressed appropriately and efficiently.

ABSA Student Loan Contact Information

The following table summarizes the various contact methods available to ABSA student loan customers. It is recommended to utilize the most appropriate method based on the urgency and complexity of your query.

| Contact Method | Details | Additional Notes |

|---|---|---|

| Phone | [Insert ABSA Student Loan Phone Number Here – This should be verified from the official ABSA website] | Phone support may offer immediate assistance for urgent matters. Be prepared to provide your student loan account details. |

| [Insert ABSA Student Loan Email Address Here – This should be verified from the official ABSA website] | Email is suitable for non-urgent inquiries and providing supporting documentation. Expect a response within a reasonable timeframe (typically within a few business days). | |

| Online Resources | [Insert Link to ABSA Student Loan Online Portal/FAQ Here – This should be verified from the official ABSA website] | The online portal often contains FAQs, application status updates, and self-service tools that may resolve your query without needing direct contact. |

Lodging a Complaint or Dispute

If you have a complaint or dispute regarding your ABSA student loan, it’s crucial to follow a structured process to ensure your issue receives appropriate attention. ABSA likely has an internal complaints procedure. This typically involves submitting a formal written complaint detailing the issue, supporting evidence, and your desired resolution.

The process may involve escalating the complaint through different levels of management within ABSA. It is advisable to keep records of all communication and responses received. If the internal complaint resolution process is unsatisfactory, you may have the option to escalate the matter to an external ombudsman or regulatory body, depending on your location and the nature of your complaint. Always retain copies of all correspondence.

Closing Summary

Navigating the world of student loans can be daunting, but with a clear understanding of the ABSA Student Loan program, the process becomes significantly more manageable. By carefully considering eligibility requirements, meticulously completing the application, and choosing a repayment plan aligned with your financial circumstances, you can confidently pursue your educational goals. Remember to leverage the resources provided by ABSA to ensure a smooth and successful experience.

Common Queries

What happens if I miss a repayment?

Missing repayments will likely incur late payment fees and negatively impact your credit score. Contact ABSA immediately to discuss options.

Can I change my repayment plan after the loan is approved?

Generally, yes, but you’ll need to contact ABSA and meet specific criteria. There may be fees associated with changing plans.

What are the consequences of defaulting on my loan?

Defaulting can severely damage your credit rating, making it difficult to obtain future loans or credit. ABSA may also pursue legal action to recover the debt.

Is there a grace period before repayments begin?

The existence and length of a grace period will depend on the specific terms of your loan agreement. Check your loan documents for details.