Navigating the complexities of higher education often involves the crucial consideration of student loans. Beyond initial funding, many students find themselves needing additional financial support to complete their studies. This guide delves into the world of additional student loans, exploring various types, eligibility criteria, repayment options, and potential risks. Understanding these factors is paramount to making informed decisions and ensuring a smooth path towards academic success and responsible financial management.

From federal and private loan options to understanding interest rates and repayment plans, we aim to provide a clear and concise overview. We will also explore alternative funding sources and strategies for managing student loan debt effectively, empowering you to make the best choices for your financial future.

Types of Additional Student Loans

Securing additional funding for your education often involves exploring various student loan options beyond initial aid packages. Understanding the differences between federal and private loans, as well as subsidized and unsubsidized loans, is crucial for making informed financial decisions. This section will Artikel the key characteristics of different loan types to help you navigate the process effectively.

Federal vs. Private Additional Student Loans

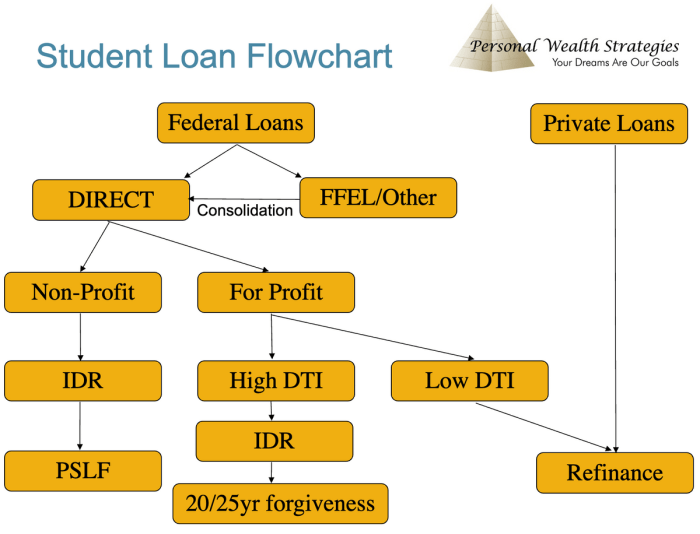

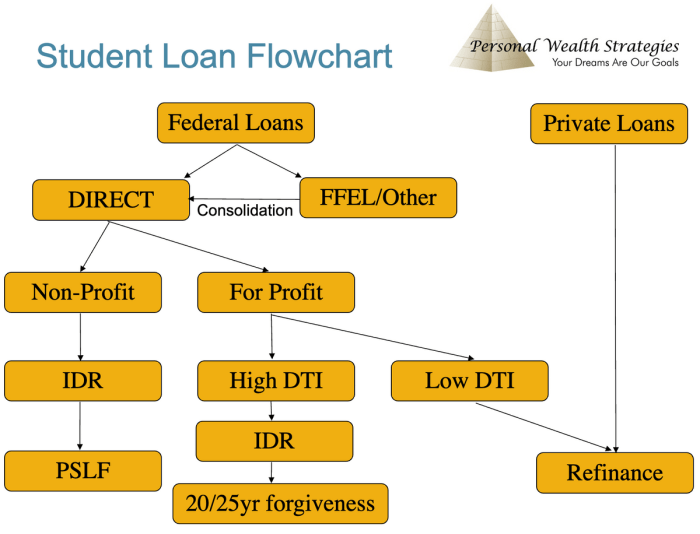

Federal student loans are offered by the U.S. government and generally offer more favorable terms than private loans. These loans are typically subject to lower interest rates, more flexible repayment plans, and various borrower protections. Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. While they may be easier to qualify for in some cases, they often come with higher interest rates, less flexible repayment options, and fewer borrower protections. The eligibility requirements also differ significantly. Federal loans consider financial need and enrollment status, while private loan eligibility is largely based on creditworthiness and income.

Subsidized vs. Unsubsidized Additional Student Loans

Within the federal loan system, there’s a distinction between subsidized and unsubsidized loans. Subsidized federal loans don’t accrue interest while the borrower is enrolled at least half-time, during grace periods, and under certain deferment situations. Unsubsidized loans, however, accrue interest from the time the loan is disbursed, regardless of the borrower’s enrollment status. This means that borrowers of unsubsidized loans will owe more upon graduation than those with subsidized loans, even if the initial loan amount was the same.

Application Process for Additional Student Loans

The application process for federal additional student loans typically involves completing the Free Application for Federal Student Aid (FAFSA). This application collects information about your financial situation and is used to determine your eligibility for federal student aid. For private loans, the application process varies by lender. Generally, you’ll need to provide personal information, academic information, and financial information, including credit history (if applicable). Documentation required might include tax returns, pay stubs, and proof of enrollment.

Comparison of Additional Student Loan Types

The following table summarizes key features of four common types of additional student loans. Remember that specific terms and conditions can vary based on the lender and your individual circumstances.

| Loan Type | Interest Rate | Repayment Terms | Eligibility Requirements |

|---|---|---|---|

| Federal Subsidized Loan | Variable, set by the government | Standard repayment plans, income-driven repayment options available | Financial need, enrollment status |

| Federal Unsubsidized Loan | Variable, set by the government | Standard repayment plans, income-driven repayment options available | Enrollment status |

| Private Loan (Credit-Based) | Variable, based on credit score and other factors | Variable, determined by the lender | Good credit history, income verification |

| Private Loan (No Credit Check) | Fixed or variable, generally higher than credit-based loans | Variable, determined by the lender, often shorter terms | Co-signer often required |

Eligibility and Qualification Criteria

Securing an additional student loan hinges on meeting specific eligibility requirements set by lenders. These criteria aim to assess the borrower’s ability and willingness to repay the loan, protecting both the lender and the borrower from potential financial hardship. Lenders carefully evaluate several key factors to determine loan eligibility.

Credit Score and Income Requirements

Lenders typically use credit scores as a primary indicator of creditworthiness. A higher credit score generally translates to better loan terms and a greater likelihood of approval. While specific minimum credit score requirements vary among lenders and loan programs, a score above 670 is often considered favorable for securing favorable interest rates. Income requirements also play a crucial role. Lenders need assurance that the borrower has sufficient income to make timely repayments. This assessment often involves reviewing tax returns, pay stubs, or bank statements to verify income stability and amount. For example, a federal student loan program might require a minimum annual income of $20,000, while a private lender may set a higher threshold based on their risk assessment.

Impact of Credit History and Co-signers

A strong credit history, demonstrating responsible borrowing and repayment behavior, significantly increases the chances of loan approval. Conversely, a poor credit history, marked by late payments or defaults, can lead to loan denial or less favorable terms, such as higher interest rates. In cases where a borrower has limited or poor credit history, a co-signer can significantly improve their eligibility. A co-signer, typically a parent or other financially responsible individual, agrees to repay the loan if the primary borrower defaults. The co-signer’s creditworthiness is considered alongside the borrower’s, enhancing the overall application strength. For instance, a student with a thin credit history might secure a loan with a co-signer possessing an excellent credit score, thereby mitigating the lender’s risk.

Documentation for Financial Need and Academic Standing

Demonstrating financial need and maintaining good academic standing are crucial for loan approval, particularly for need-based loans. Financial need is typically assessed by comparing the borrower’s income and assets to the cost of education. Documentation such as tax returns, bank statements, and financial aid award letters can be used to demonstrate financial need. Academic standing is equally important; lenders want to ensure that the borrower is making satisfactory academic progress toward degree completion. Official transcripts showing enrollment status and GPA are usually required. Failure to maintain satisfactory academic progress may lead to loan suspension or termination. For example, a lender might require a minimum GPA of 2.0 to remain eligible for continued loan disbursement.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for additional student loans is crucial for effective financial planning. Choosing the right repayment plan can significantly impact the total cost of your loan and your monthly budget. This section details how interest rates are determined and compares various repayment options, illustrating their long-term financial consequences with example calculations.

Interest Rate Calculation

The interest rate applied to your additional student loan is determined by several factors. These typically include your creditworthiness (credit score and history), the prevailing market interest rates at the time of loan disbursement, the loan term (length of the loan), and the type of loan (federal or private). Lenders use complex algorithms incorporating these factors to calculate your specific interest rate. This rate is usually fixed for the life of the loan, meaning it won’t change, but some loans offer variable interest rates that can fluctuate based on market conditions. It’s essential to carefully review the loan agreement to understand precisely how your interest rate was calculated and whether it’s fixed or variable. A higher credit score generally leads to a lower interest rate, reflecting a lower perceived risk to the lender.

Repayment Plan Options

Several repayment plans are typically available for additional student loans, each with its own advantages and disadvantages.

Standard Repayment Plan

This is usually the default option. It involves fixed monthly payments over a standard loan term (often 10 years). While the payments are consistent, the total interest paid over the life of the loan can be significant due to the shorter repayment period.

Extended Repayment Plan

This plan extends the loan repayment period, resulting in lower monthly payments. However, it also leads to a higher total interest paid over the loan’s life because you’re paying interest for a longer period. This option can be beneficial for borrowers with limited immediate income.

Graduated Repayment Plan

Under this plan, monthly payments start low and gradually increase over time. This can be helpful initially but results in higher payments later in the repayment period. The total interest paid is typically higher than with a standard plan but lower than an extended plan.

Illustrative Repayment Scenarios

Let’s consider a $10,000 additional student loan to illustrate the impact of different interest rates and repayment plans. We will assume three scenarios: a standard 10-year repayment plan with a 5% interest rate, a 15-year extended repayment plan with a 6% interest rate, and a graduated repayment plan over 10 years with a 5% interest rate (note that graduated repayment plan interest calculations are more complex and this example simplifies for clarity).

| Repayment Plan | Interest Rate | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|---|

| Standard (10-year) | 5% | $106 | $2720 |

| Extended (15-year) | 6% | $77 | $4260 |

| Graduated (10-year) | 5% | Variable, starting lower than standard | Approximately $2720 (simplified example) |

Note: These are simplified examples. Actual monthly payments and total interest paid can vary based on the specific loan terms and the lender’s calculation methods. It’s crucial to consult your loan agreement for precise figures.

Potential Risks and Consequences of Additional Borrowing

Taking on additional student loan debt can significantly impact your financial future. While it might seem like a necessary step to achieve your educational goals, it’s crucial to understand the potential risks and consequences before committing to more borrowing. Failing to do so can lead to serious financial hardship and long-term difficulties.

High Interest Rates and Repayment Challenges

High interest rates are a major concern associated with additional student loans. These rates can quickly accumulate, increasing the total amount you owe significantly over the life of the loan. For example, a relatively small additional loan of $5,000 at a 7% interest rate could easily cost you thousands more in interest over a ten-year repayment period. This added expense can make repayment a considerable burden, potentially impacting your ability to meet other financial obligations. The difficulty in repaying these loans can lead to stress and even financial instability. Careful consideration of the total cost, including interest, is vital before taking on any additional debt.

Consequences of Student Loan Default

Defaulting on student loans has severe consequences. A default occurs when you fail to make payments for a specific period. This negatively impacts your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future. Furthermore, the government can take legal action, including wage garnishment, tax refund offset, and even the seizure of assets to recover the outstanding debt. The impact of a default extends far beyond the financial realm, potentially affecting employment opportunities and overall financial well-being for years to come. For instance, a default can make it extremely difficult to qualify for a mortgage, preventing homeownership.

Strategies for Effective Student Loan Debt Management

Effective management of student loan debt is crucial to avoid the negative consequences described above. Creating a comprehensive budget that prioritizes loan repayments is a key first step. Exploring different repayment plans offered by your loan servicer, such as income-driven repayment plans, can significantly reduce monthly payments. Consolidating multiple loans into a single loan with a lower interest rate can simplify repayment and potentially reduce the total interest paid. Finally, actively communicating with your loan servicer to address any challenges or explore options for hardship assistance is essential to prevent default.

Impact on Future Financial Planning

Additional student loan debt can significantly hinder future financial planning. The large monthly payments can limit your ability to save for major life events, such as purchasing a home or investing for retirement. High debt levels can also impact your creditworthiness, making it more challenging to secure favorable interest rates on mortgages or other loans. For example, someone with a high student loan debt burden might find it difficult to qualify for a mortgage, delaying or preventing homeownership. Similarly, the need to allocate a substantial portion of income to loan repayments can leave less available for retirement savings, potentially impacting financial security in later life. Careful planning and a realistic assessment of your debt burden are crucial for achieving long-term financial goals.

Resources and Support for Borrowers

Navigating the complexities of student loan repayment can be challenging. Fortunately, numerous resources are available to help borrowers understand their options and manage their debt effectively. These resources offer guidance on repayment strategies, consolidation options, and potential avenues for loan forgiveness or deferment. Understanding and utilizing these resources is crucial for successful loan management.

Government Websites and Non-Profit Organizations

Several government websites and non-profit organizations provide valuable information and support for student loan borrowers. The Federal Student Aid website (studentaid.gov) is a primary resource, offering detailed information on federal student loan programs, repayment plans, and borrower rights. Other helpful government resources include the Consumer Financial Protection Bureau (CFPB) website, which provides guidance on avoiding predatory lending practices and managing debt effectively. Non-profit organizations, such as the National Foundation for Credit Counseling (NFCC), offer free or low-cost credit counseling services, helping borrowers create personalized debt management plans. These organizations can also provide guidance on budgeting, financial literacy, and exploring options like loan consolidation or refinancing.

Loan Consolidation and Refinancing Options

Loan consolidation combines multiple student loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment by reducing the number of payments and potentially lowering monthly payments, although the total interest paid may increase depending on the new interest rate. Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This option is typically available to borrowers with good credit scores. Both consolidation and refinancing can impact your overall repayment costs and timeline; it’s crucial to carefully compare options and consider the long-term implications before making a decision. For example, a borrower with multiple federal loans at varying interest rates might consolidate to simplify payments and potentially achieve a lower average interest rate. Conversely, a borrower with a strong credit history might refinance their federal loans with a private lender to secure a lower interest rate, but should be aware of potential loss of federal loan benefits.

Seeking Student Loan Forgiveness or Deferment

Student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, offer the possibility of partial or total loan forgiveness after meeting specific eligibility requirements. These programs often require consistent on-time payments for a set period and employment in qualifying fields (e.g., public service). Deferment postpones loan payments temporarily, often due to financial hardship or enrollment in school. However, interest may still accrue during deferment periods, potentially increasing the total loan amount owed. Eligibility requirements and application processes vary depending on the specific program or deferment option. For example, PSLF requires 120 qualifying monthly payments under an IDR plan while employed full-time by a qualifying government or non-profit organization.

Steps to Take When Struggling to Repay Loans

Facing difficulty repaying student loans can be stressful, but proactive steps can mitigate the situation.

- Contact your loan servicer immediately: Discuss your financial situation and explore available options, such as forbearance, deferment, or an income-driven repayment plan.

- Create a realistic budget: Identify areas where you can reduce spending and allocate funds towards loan repayment.

- Explore income-driven repayment plans: These plans base your monthly payments on your income and family size, potentially lowering your monthly payments.

- Seek professional financial counseling: A credit counselor can help you create a comprehensive debt management plan and navigate available resources.

- Consider additional income sources: Explore part-time jobs or freelance opportunities to supplement your income.

Alternatives to Additional Student Loans

Before committing to additional student loan debt, exploring alternative funding sources is crucial. Many students successfully finance their education without relying solely on loans, leveraging a combination of financial aid and personal resourcefulness. This section will examine several viable alternatives, highlighting their advantages and disadvantages to help you make an informed decision.

Several options exist beyond student loans to help fund your education. These alternatives often require more effort in research and application, but the potential rewards—avoiding significant debt—make the investment worthwhile. The most common alternatives include scholarships, grants, and work-study programs.

Scholarships and Grants

Scholarships and grants represent a significant source of non-repayable financial aid. Unlike loans, these funds do not need to be repaid. Scholarships are typically awarded based on merit, such as academic achievement, athletic ability, or specific talents. Grants, on the other hand, are usually awarded based on financial need. Both require diligent searching and application.

Finding and applying for scholarships and grants requires proactive effort. Numerous online resources, such as Fastweb, Scholarships.com, and the College Board, maintain extensive databases of scholarship opportunities. Many professional organizations, community groups, and individual colleges also offer scholarships. Each application typically involves completing a form and submitting supporting documentation, including transcripts and letters of recommendation. It’s advisable to begin searching early and apply to numerous scholarships to maximize your chances of success. The application process can be time-consuming, but the potential financial reward makes it a worthwhile endeavor.

Work-Study Programs

Federal Work-Study programs offer part-time employment opportunities to eligible students. These jobs are often related to the student’s field of study or campus life. Earnings from work-study can help cover tuition, fees, books, and living expenses, reducing the need for additional loans. Eligibility is determined based on financial need, and students must apply through their college’s financial aid office. While work-study provides income, it also requires managing a work schedule alongside academic responsibilities.

Comparison of Funding Alternatives

The following table compares the advantages and disadvantages of three common alternatives to additional student loans:

| Funding Option | Advantages | Disadvantages | Application Process |

|---|---|---|---|

| Scholarships | Free money; no repayment required; can be substantial amounts. | Competitive; requires significant application effort; may be specific to certain criteria. | Extensive online searches; completion of application forms; submission of supporting documents. |

| Grants | Free money; no repayment required; based on financial need. | Limited availability; highly competitive; strict eligibility criteria. | Application through the FAFSA; additional college-specific applications may be required. |

| Work-Study | Provides income to cover expenses; related work experience; flexible scheduling options (sometimes). | Limited earnings; requires time management skills; may not fully cover educational costs. | Application through the FAFSA; acceptance into the program; securing a work-study position. |

Summary

Securing additional student loans requires careful planning and a thorough understanding of the associated implications. By carefully weighing the benefits and drawbacks of different loan types, exploring alternative funding options, and implementing sound debt management strategies, students can navigate the complexities of financing their education responsibly. Remember, informed decision-making is key to achieving both academic and financial success.

Query Resolution

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I refinance my additional student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it’s crucial to compare offers carefully.

What happens if I default on my student loans?

Defaulting can severely damage your credit score, lead to wage garnishment, and impact your ability to obtain future loans or credit.

Where can I find more information on student loan forgiveness programs?

The Federal Student Aid website (studentaid.gov) and other government resources provide detailed information on loan forgiveness programs and eligibility requirements.