Navigating the complexities of student loan repayment can feel overwhelming, especially when grappling with the concept of Adjusted Gross Income (AGI). This crucial figure significantly impacts your eligibility for various repayment plans, forgiveness programs, and even the student loan interest deduction. Understanding how your AGI is calculated and its implications is key to effectively managing your student loan debt and making informed financial decisions.

This guide provides a clear and concise explanation of AGI’s role in the student loan process. We will explore how AGI is calculated, its influence on income-driven repayment (IDR) plans and forgiveness programs, and its impact on your tax liability. We’ll also examine how your AGI might affect your ability to secure future loans. By the end, you’ll have a much clearer picture of how your AGI affects your overall student loan journey.

Defining Adjusted Gross Income (AGI) in the Context of Student Loans

Understanding Adjusted Gross Income (AGI) is crucial for student loan borrowers, as it significantly impacts eligibility for various repayment plans and potential loan forgiveness programs. AGI represents your total gross income minus certain above-the-line deductions. This adjusted figure, rather than your total gross income, is the key metric used to determine your repayment plan options and potential benefits.

AGI Calculation and Relevant Deductions for Students

AGI is calculated by subtracting certain allowable deductions from your gross income. Gross income includes wages, salaries, self-employment income, interest, dividends, capital gains, and other sources of income. For students, common above-the-line deductions that reduce their gross income to arrive at AGI might include deductions for student loan interest payments (up to a certain limit), education expenses (depending on eligibility), and IRA contributions (if applicable). It’s important to note that the specific deductions available and their limitations can change annually, so consulting the most recent IRS guidelines is vital. For example, a student might have a gross income of $30,000, but after deducting $2,500 in student loan interest, their AGI becomes $27,500.

Impact of Tax Brackets on AGI and Student Loan Repayment

Your AGI determines your tax bracket, which, in turn, influences your tax liability. While AGI itself doesn’t directly determine your student loan repayment amount, it plays a pivotal role in determining your eligibility for income-driven repayment (IDR) plans. IDR plans, such as the Income-Driven Repayment (IDR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR) plans, base your monthly payment on your AGI and family size. Lower AGI generally translates to lower monthly payments under these plans. For instance, a borrower in a lower tax bracket with a lower AGI might qualify for a significantly reduced monthly payment compared to a borrower with a higher AGI.

Examples of AGI’s Impact on Income-Driven Repayment Plan Eligibility

Let’s consider two examples to illustrate how AGI affects eligibility for income-driven repayment plans. Suppose Borrower A has an AGI of $30,000 and Borrower B has an AGI of $60,000. Both have the same amount of student loan debt. Borrower A, with the lower AGI, would likely qualify for a substantially lower monthly payment under an IDR plan than Borrower B. In fact, depending on the specific IDR plan and family size, Borrower A might even qualify for a payment that is significantly less than the interest accruing on their loans, potentially leading to loan forgiveness after a specified period. Conversely, Borrower B, with a higher AGI, will likely have higher monthly payments and may not qualify for as much loan forgiveness. These scenarios highlight the substantial impact of AGI on student loan repayment strategies. The specific calculations are complex and depend on the chosen repayment plan and current government guidelines, which are subject to change. It’s recommended to use the official Department of Education’s repayment calculators and consult with a financial advisor for personalized guidance.

AGI’s Role in Student Loan Repayment Plans

Your Adjusted Gross Income (AGI) plays a crucial role in determining your eligibility for and monthly payments under various income-driven repayment (IDR) plans for federal student loans. These plans are designed to make repayment more manageable by basing your monthly payment on your income and family size. Understanding how AGI is used in these plans is vital for borrowers seeking affordable repayment options.

Understanding how AGI is calculated and applied to different IDR plans is key to minimizing your monthly payments and avoiding potential pitfalls. This section will detail the AGI requirements for several common IDR plans and guide you through calculating your AGI for your application.

AGI Requirements for Various Income-Driven Repayment (IDR) Plans

Different IDR plans utilize AGI in slightly different ways. While the core concept remains the same – using your AGI to determine your payment – the specific calculations and eligibility criteria vary. For example, some plans may have stricter AGI thresholds for qualification, or they may use a different formula to calculate your payment based on your AGI and family size. It’s essential to research the specific requirements for each plan you are considering. The most common IDR plans include Income-Driven Repayment (IDR), Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). Each plan has its own nuances regarding AGI calculations and eligibility criteria. Consult the official federal student aid website for the most up-to-date and accurate information.

Determining AGI for IDR Plan Applications: A Step-by-Step Guide

Accurately determining your AGI is paramount for accessing the correct IDR plan and payment amount. The process involves gathering necessary tax documents and following a specific calculation procedure. Here’s a step-by-step guide:

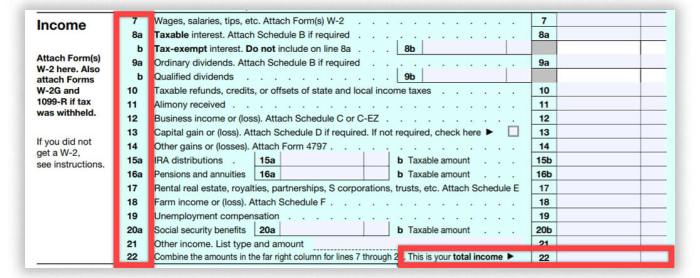

- Gather your tax documents: You’ll need your most recent federal income tax return (Form 1040) and any relevant schedules showing additional income sources (e.g., Schedule C for self-employment income, Schedule W-2 for wages).

- Locate your AGI: Your AGI is clearly stated on your Form 1040, usually line 8b. This figure represents your gross income minus certain above-the-line deductions.

- Verify accuracy: Double-check the AGI figure for any errors. If you’ve made any significant changes to your income since filing your taxes, you may need to update your AGI calculation accordingly, possibly requiring amended tax documents.

- Consider family size: Most IDR plans consider family size when calculating your monthly payment. Be prepared to provide information on the number of dependents you have.

- Submit your AGI: Use the official government website or your loan servicer’s portal to submit your AGI when applying for an IDR plan. Ensure the information is accurate and matches your tax documents.

Consequences of Inaccurate AGI Reporting on IDR Plans

Providing inaccurate AGI information on your IDR plan application can have significant repercussions. Underreporting your AGI could result in lower monthly payments initially, but you may face serious consequences later. This could include:

- Higher payments in the future: When your actual income is discovered, you may be required to repay the difference, potentially with interest and penalties.

- Loan forgiveness ineligibility: Inaccurate AGI reporting could jeopardize your eligibility for loan forgiveness programs, impacting your long-term financial goals.

- Legal ramifications: In some cases, intentional misrepresentation of your income could lead to legal penalties.

Conversely, overreporting your AGI will lead to higher monthly payments than necessary. While this might seem beneficial initially, it could create unnecessary financial strain. Therefore, accuracy is paramount.

AGI and Student Loan Forgiveness Programs

Adjusted Gross Income (AGI) plays a significant role in determining eligibility for various student loan forgiveness programs. These programs, designed to alleviate the burden of student loan debt, often incorporate AGI as a key factor in their eligibility criteria. Understanding the relationship between AGI and these programs is crucial for borrowers seeking relief.

AGI Thresholds in Student Loan Forgiveness Programs

Several federal student loan forgiveness programs utilize AGI as a primary determinant of eligibility. The Public Service Loan Forgiveness (PSLF) program, for example, doesn’t directly use AGI as a qualifying factor, focusing instead on employment in public service. However, income-driven repayment (IDR) plans, which can lead to forgiveness after a specified period, heavily rely on AGI to calculate monthly payments. The amount of forgiven debt at the end of an IDR plan can indirectly be affected by a borrower’s AGI over the repayment period because the payment amount is tied to income. Other programs, such as those offered by specific states or employers, may also have AGI-based eligibility requirements. These requirements can vary significantly, impacting a borrower’s access to loan forgiveness.

Comparison of Forgiveness Programs Based on AGI

The following table compares different hypothetical student loan forgiveness programs based on their AGI thresholds and requirements. Note that these are examples and actual program details may vary. It is crucial to consult the official program guidelines for the most accurate and up-to-date information.

| Program Name | AGI Threshold (Annual) | Additional Requirements | Forgiveness Amount (Example) |

|---|---|---|---|

| Program A (Income-Driven Repayment) | No specific threshold, but payment amount is based on AGI. | 120 qualifying monthly payments; Employment in qualifying field not required. | Remaining balance after 20 years |

| Program B (State-Specific Program) | $60,000 or less | 10 years of employment in the state; Specific job types may qualify | $10,000 |

| Program C (Employer-Sponsored Program) | $75,000 or less | Employment with the sponsoring employer for 5 years; Completion of a specific degree. | 50% of the loan balance |

| Program D (Targeted Loan Forgiveness) | $50,000 or less | Specific loan type; Borrower must have faced financial hardship | Varies based on hardship |

The Impact of AGI on Student Loan Interest Deduction

The student loan interest deduction allows taxpayers to reduce their taxable income by the amount of interest they paid on qualified student loans during the tax year. However, the amount you can deduct is not unlimited and is significantly influenced by your Adjusted Gross Income (AGI). Higher AGI levels result in reduced or eliminated deductions. Understanding this relationship is crucial for accurate tax filing.

The student loan interest deduction is phased out for taxpayers with higher AGIs. This means that as your AGI increases, the amount you can deduct decreases until it eventually reaches zero. The specific AGI thresholds and phase-out rates are adjusted annually by the IRS and are subject to change. It’s essential to consult the most up-to-date IRS publications for the current year’s limits.

AGI Limits on Student Loan Interest Deduction

The amount of student loan interest you can deduct is dependent on your Modified Adjusted Gross Income (MAGI), which is your AGI with certain adjustments. For single filers in a given tax year (the specific year’s limits should be checked on the IRS website), the deduction may begin to phase out once MAGI exceeds $70,000. For married couples filing jointly, the phase-out might start when MAGI surpasses $140,000. Once the phase-out begins, the deduction is reduced dollar for dollar until it reaches zero.

Examples of Student Loan Interest Deduction Calculation Based on AGI

To illustrate, let’s consider a few examples. Assume the maximum student loan interest deduction for a single filer in a particular tax year is $2,500.

- Example 1: A single filer with a MAGI of $60,000 paid $2,500 in student loan interest. Their AGI is below the phase-out threshold, so they can deduct the full $2,500.

- Example 2: A single filer with a MAGI of $75,000 paid $2,500 in student loan interest. Their MAGI exceeds the $70,000 threshold. Assuming a phase-out rate of $1 for every $1 of MAGI above the threshold, their deduction is reduced by $5,000 ($75,000 – $70,000). Since the reduction exceeds the deduction, the student loan interest deduction is $0.

- Example 3: A married couple filing jointly with a MAGI of $150,000 paid $5,000 in student loan interest. Similar to the previous example, their MAGI is above the threshold for married couples. The deduction would be reduced, and the exact amount would depend on the specific phase-out rate for that tax year as defined by the IRS. This would require calculating the amount of the phase-out based on the difference between their MAGI and the threshold and the applicable phase-out rate.

AGI and the Implications for Future Borrowing

Your Adjusted Gross Income (AGI) plays a significant role not only in your current student loan repayment but also in your ability to secure future loans. Lenders use AGI, alongside other financial indicators, to assess your creditworthiness and determine your eligibility for various loan products. A higher AGI generally suggests a greater capacity to repay debt, leading to more favorable loan terms. Conversely, a lower AGI might present challenges in securing loans or result in less advantageous interest rates.

Lenders’ Assessment of Creditworthiness Considering AGI

Lenders employ a multifaceted approach to evaluating creditworthiness, with AGI serving as a key component. They analyze your AGI to gauge your income stability and repayment potential. A consistent and growing AGI demonstrates financial responsibility and reduces the perceived risk associated with lending. In addition to AGI, lenders consider your credit score, debt-to-income ratio, employment history, and the purpose of the loan. The weight assigned to each factor varies depending on the lender and the type of loan. A strong AGI can offset weaknesses in other areas, improving your chances of loan approval and potentially securing a lower interest rate.

AGI’s Influence on Loan Approval and Interest Rates

Consider two hypothetical scenarios: Sarah, a recent graduate with a high AGI due to a well-paying job, applies for a loan to purchase a car. Her strong AGI, combined with a good credit score, makes her a low-risk borrower. The lender is likely to approve her loan application with a favorable interest rate, reflecting her demonstrated ability to manage finances effectively. In contrast, Mark, also a recent graduate, has a lower AGI due to a lower-paying job. Even with a good credit score, his lower AGI might make lenders perceive him as a higher risk. He may face difficulties securing the loan or might receive a higher interest rate to compensate for the perceived increased risk. This illustrates how AGI, while not the sole determinant, significantly influences loan approval and the associated interest rates.

Visual Representation of AGI and Student Loan Debt

Understanding the relationship between Adjusted Gross Income (AGI) and student loan debt requires a clear visual representation. A well-designed chart can effectively illustrate the debt burden faced by individuals at different income levels, highlighting disparities and trends. This allows for a more intuitive grasp of the financial challenges posed by student loans across the income spectrum.

A scatter plot would be an effective visual tool to display this relationship.

Scatter Plot of AGI and Student Loan Debt

The horizontal axis (x-axis) of the scatter plot would represent the Adjusted Gross Income (AGI), ranging from a minimum value (e.g., $0) to a maximum value representing a high income bracket (e.g., $250,000). The vertical axis (y-axis) would represent the total amount of student loan debt. Each data point on the chart would represent an individual borrower, with its horizontal position determined by their AGI and its vertical position determined by their total student loan debt. The size of each data point could be adjusted to represent the number of borrowers with similar AGI and debt levels, providing a visual representation of the frequency of different combinations. For example, a larger point would indicate a higher number of borrowers with that specific AGI and debt level. Different colors could be used to segment borrowers by factors like loan type (federal vs. private) or repayment plan, allowing for comparisons between groups. A trend line could be added to the scatter plot to visually represent the overall correlation between AGI and student loan debt. This line would show whether there’s a positive, negative, or no correlation. A key would clearly define all visual cues used, such as point size, color coding, and the meaning of the trend line. This comprehensive visualization would provide a clear and easily understandable picture of how student loan debt burdens vary across different income levels.

Closure

Successfully managing student loan debt requires a thorough understanding of various financial factors, and AGI is paramount. From influencing eligibility for income-driven repayment plans and loan forgiveness programs to impacting your tax deductions and future borrowing capacity, AGI plays a central role. By carefully considering your AGI and its implications, you can develop a more effective strategy for repaying your student loans and achieving long-term financial stability. Remember to consult with a financial advisor for personalized guidance tailored to your specific circumstances.

Frequently Asked Questions

What happens if I report my AGI incorrectly on my IDR application?

Inaccurate AGI reporting can lead to incorrect payment calculations, potentially resulting in overpayments or underpayments. This could affect your eligibility for loan forgiveness programs and may even lead to penalties.

Can I change my IDR plan if my AGI changes significantly?

Yes, you can typically recertify your income annually or as your circumstances change. Significant changes in your AGI may qualify you for a different IDR plan with lower monthly payments.

How does my AGI affect my chances of getting a private student loan in the future?

Lenders consider AGI as an indicator of your repayment ability. A higher AGI generally improves your chances of loan approval and may result in more favorable interest rates.

Where can I find my AGI?

Your AGI is reported on your federal income tax return (Form 1040), specifically on line 8b.