Navigating the complexities of higher education often involves considering the significant financial investment required. Student loans, while representing debt, can unlock unprecedented opportunities, fostering both professional and personal growth. This exploration delves into the multifaceted advantages of student loans, examining their impact on career prospects, financial well-being, and personal development.

We will analyze how student loans can bridge the financial gap for aspiring students, ultimately leading to increased earning potential and a higher quality of life. By comparing student loans to alternative funding methods and showcasing real-world examples, we aim to provide a comprehensive understanding of their potential benefits.

Financial Advantages of Student Loans

Student loans can be a crucial tool for accessing higher education, particularly for individuals facing financial barriers. While the debt itself presents challenges, the potential for increased earning power and long-term financial security often outweighs the initial investment. This section explores the financial benefits of utilizing student loans to fund a college education.

Student loans bridge the gap between tuition costs and available resources. Many students lack the savings or family support necessary to cover the full expense of college. Student loans provide the necessary funding to enroll, allowing individuals to pursue higher education opportunities that might otherwise be inaccessible.

Increased Earning Potential

A college degree significantly enhances earning potential throughout a lifetime. Individuals with a bachelor’s degree, even with student loan debt, tend to earn substantially more over their careers than those with only a high school diploma. This increased income allows for better financial stability, improved quality of life, and greater opportunities for career advancement. For instance, a software engineer with a bachelor’s degree might earn significantly more than a technician with a high school diploma, allowing for quicker debt repayment and greater long-term financial security. The initial investment in education, financed by loans, pays off considerably over time.

Lifetime Earnings Comparison

The following table illustrates the difference in lifetime earnings between college graduates with and without student loan debt. Note that these are average figures and actual results may vary depending on factors such as chosen major, career path, and individual financial management. The data presented is a simplified illustration and should not be taken as a precise prediction for all individuals. Further research from reliable sources such as the Bureau of Labor Statistics (BLS) or the National Center for Education Statistics (NCES) should be consulted for a more comprehensive analysis.

| Education Level | Average Annual Income | Average Student Loan Debt | Net Income After Loan Repayment (Estimated, 20 years) |

|---|---|---|---|

| High School Diploma | $40,000 | $0 | $800,000 |

| Bachelor’s Degree (with loan debt) | $65,000 | $30,000 | $1,000,000 |

Long-Term Financial Benefits

Despite the burden of student loan debt, the long-term financial benefits of a college degree are substantial. The increased earning potential allows for quicker debt repayment, leading to greater financial security in the long run. This increased income also provides opportunities for homeownership, investments, and improved retirement planning. Moreover, a college education often leads to better health outcomes and a higher quality of life, contributing to overall long-term well-being. The initial investment in education, even with associated debt, ultimately provides a significant return on investment over a lifetime.

Career Advantages Facilitated by Student Loans

Student loans, while representing a significant financial commitment, can unlock substantial career advantages. The investment in higher education often translates to increased earning potential, enhanced career prospects, and access to professional development opportunities that might otherwise be unattainable. This section explores the specific ways in which student loans can facilitate career advancement.

Higher education, often financed through student loans, opens doors to a wide range of careers that require specialized knowledge and skills. These careers typically offer higher earning potential and greater job security compared to roles requiring only a high school diploma. The ability to pursue these advanced educational opportunities directly impacts an individual’s long-term career trajectory and financial stability.

Specific Career Paths Requiring Higher Education

Many professions require a college degree as a minimum qualification. These range from highly technical fields to creative and social service roles. Securing these positions often necessitates the use of student loans to cover tuition, fees, and living expenses during the educational period. Examples include medical professions (doctors, nurses, pharmacists), engineering (software, civil, mechanical), law, education (teachers, professors), and business (accountants, financial analysts). These careers typically demand years of rigorous study and training, justifying the investment in student loans.

Higher Education and Career Advancement

A college degree frequently serves as a stepping stone to higher-level positions and increased earning potential within a chosen field. Individuals with advanced degrees often possess a broader skill set and deeper understanding of their respective disciplines, making them more competitive candidates for promotions and leadership roles. For instance, a registered nurse with a bachelor’s degree might be more likely to advance to a management position than a nurse with only an associate’s degree. Similarly, a software engineer with a master’s degree in computer science may have greater opportunities for career advancement compared to a counterpart with only a bachelor’s degree.

Salary Comparison Across Different Educational Levels

The financial benefits of higher education are often reflected in starting salaries. A comparison across various fields reveals a significant difference in compensation based on educational attainment.

It’s important to note that these are average figures and can vary based on factors such as location, experience, and specific employer.

- Entry-Level Software Engineer: Associate’s Degree – $60,000 (average), Bachelor’s Degree – $75,000 (average), Master’s Degree – $90,000 (average)

- Registered Nurse: Associate’s Degree – $65,000 (average), Bachelor’s Degree – $75,000 (average), Master’s Degree – $85,000 (average)

- Teacher (Secondary Education): Bachelor’s Degree – $45,000 (average), Master’s Degree – $55,000 (average)

Supporting Professional Development with Student Loans

Student loans can extend beyond covering tuition. They can also support crucial professional development activities that enhance career prospects. Attending industry conferences, obtaining professional certifications, or pursuing continuing education courses can significantly boost an individual’s marketability and earning potential. These investments, often funded through student loans or loan refinancing, can lead to higher salaries, better job opportunities, and a more fulfilling career path. For example, a project manager obtaining a Project Management Professional (PMP) certification significantly increases their earning potential and job opportunities.

Personal Advantages Associated with Student Loans

Accessing higher education, often facilitated by student loans, offers significant personal advantages beyond career prospects. The transformative experience of college extends to personal growth, skill development, and expanded social networks, enriching one’s life in profound ways. These benefits contribute to a more fulfilling and successful life, regardless of the specific career path chosen.

The pursuit of higher education, even with the financial burden of student loans, fosters substantial personal development. The college environment encourages self-reliance, independence, and adaptability – qualities highly valued in all aspects of life. Students learn to manage their time effectively, juggle responsibilities, and navigate complex situations, building resilience and problem-solving skills. Furthermore, exposure to diverse perspectives and challenging coursework cultivates critical thinking and intellectual curiosity, enriching personal growth beyond the academic realm.

Enhanced Social and Professional Networks

A college education provides access to a diverse and expansive network of individuals. Students connect with peers from various backgrounds, fostering collaboration, understanding, and lifelong friendships. These relationships often extend into professional spheres, creating opportunities for mentorship, collaboration, and career advancement. Furthermore, participation in extracurricular activities, clubs, and organizations expands networking possibilities, providing valuable connections that can benefit personal and professional lives long after graduation. The college environment facilitates the development of strong interpersonal skills, including communication, teamwork, and leadership, which are essential for building and maintaining successful relationships.

Development of Personal Skills

Higher education significantly contributes to the development of essential personal skills crucial for success in both personal and professional life. These skills extend beyond technical expertise and encompass a range of abilities that enhance one’s overall well-being and effectiveness.

- Critical Thinking: College courses consistently challenge students to analyze information, evaluate arguments, and form their own informed opinions.

- Problem-Solving: Students regularly encounter complex problems requiring creative and analytical solutions, honing their problem-solving skills.

- Communication Skills: Effective communication, both written and oral, is essential for academic success and is actively developed through coursework and interactions.

- Time Management: Balancing academic demands, extracurricular activities, and personal life necessitates strong time management skills.

- Adaptability: The college environment is dynamic and ever-changing, requiring students to adapt to new challenges and situations.

Personal Goal Achievement Through Student Loans

Maria, a talented artist, always dreamed of opening her own art studio. Lacking the initial capital, she took out a student loan to pursue a degree in Fine Arts, believing the enhanced skills and professional network would be essential for her success. The loan enabled her to attend a prestigious art school, where she honed her skills, built a strong portfolio, and made connections with influential figures in the art world. After graduation, she used her savings and secured a small business loan to open her studio, realizing her lifelong dream. While repaying her student loan, she experienced the personal satisfaction of achieving her goal and contributing her art to the community.

Comparing Student Loan Advantages with Alternative Funding Methods

Securing funding for higher education is a crucial step in the pursuit of academic goals. While student loans offer a readily available avenue, it’s essential to weigh their advantages against alternative financing options to make an informed decision that aligns with individual financial circumstances and long-term objectives. A comprehensive understanding of the pros and cons of each method allows for a strategic approach to funding higher education.

Student loans provide access to funds that might otherwise be unavailable, enabling students to pursue their chosen field of study. However, scholarships and grants offer a distinct advantage by providing free money, eliminating the burden of repayment. Similarly, relying on family support or personal savings can reduce long-term financial strain, but these options aren’t universally accessible. This comparison highlights the importance of exploring all available options before committing to a specific funding strategy.

Scholarships and Grants versus Student Loans

Scholarships and grants represent a highly desirable form of funding because they don’t require repayment. This eliminates the long-term financial burden associated with student loans and allows graduates to enter the workforce with a cleaner financial slate. However, securing scholarships and grants is often competitive, requiring diligent research, strong academic records, and sometimes, specific talents or skills. Student loans, while incurring debt, offer a more predictable and accessible funding source for a broader range of students. The choice depends on the individual’s circumstances and their ability to secure non-repayable funding.

Drawbacks of Relying Solely on Family Support or Personal Savings

Funding education solely through family support or personal savings presents several potential drawbacks. Over-reliance on family resources can strain familial finances and create intergenerational debt. Furthermore, personal savings may not be sufficient to cover the full cost of education, especially for expensive programs or extended periods of study. This can force students to compromise their academic choices or take on part-time jobs that may negatively impact their academic performance. While these options offer the benefit of avoiding debt, the potential limitations should be carefully considered.

Comparison of Student Loan Programs

The following table compares various student loan programs, highlighting key differences in terms and conditions:

| Loan Type | Interest Rate | Repayment Period | Eligibility Criteria |

|---|---|---|---|

| Federal Subsidized Loan | Variable, set annually by the government | 10-20 years, depending on loan amount | Demonstrated financial need, enrollment in eligible program |

| Federal Unsubsidized Loan | Variable, set annually by the government | 10-20 years, depending on loan amount | Enrollment in eligible program |

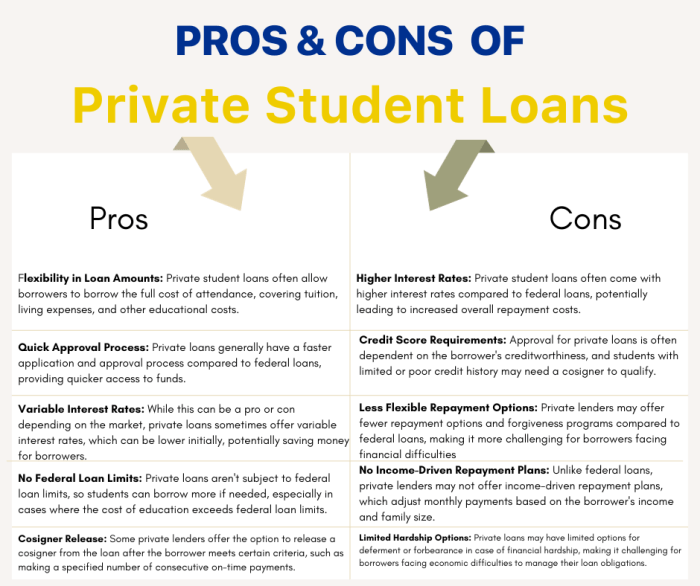

| Private Student Loan | Variable or fixed, determined by lender | Varies depending on lender and loan amount | Creditworthiness (often requires a co-signer for students with limited credit history), enrollment in eligible program |

| Parent PLUS Loan | Variable, set annually by the government | 10-25 years, depending on loan amount | Parent of a dependent student enrolled in an eligible program, meets credit requirements |

Note: Interest rates and repayment periods are subject to change and are illustrative examples. Always consult the lender for the most up-to-date information.

Long-Term Financial Planning Implications

The choice of funding method significantly impacts long-term financial planning. Student loans, while creating debt, provide immediate access to funds. However, this debt requires careful management and repayment planning to avoid long-term financial strain. Conversely, scholarships and grants or family support avoid debt but might limit educational choices or require significant sacrifices. A balanced approach, combining various funding sources where possible, is often the most prudent strategy for long-term financial well-being. Careful budgeting and financial literacy are crucial regardless of the chosen funding method.

Visual Representation of Student Loan Advantages

An infographic effectively communicates the multifaceted benefits of student loans by visually representing complex data in an easily digestible format. This allows potential borrowers to quickly grasp the potential return on investment associated with higher education financed through student loans. A well-designed infographic uses a combination of charts, graphs, and icons to illustrate key advantages across financial, career, and personal development spheres.

A hypothetical infographic illustrating the advantages of student loans would begin with a compelling headline, such as “Unlock Your Potential: The Power of Student Loans.” The main body could be divided into three distinct sections, each representing a key advantage category.

Financial Advantages Illustrated

This section would utilize a bar graph comparing the average lifetime earnings of college graduates with and without student loan debt. The graph would clearly show a significant increase in earning potential for those with a college degree, even after accounting for loan repayment. Supporting data points could include average salary figures for various professions requiring a college degree, juxtaposed against similar professions accessible with only a high school diploma. A pie chart could then visually break down the typical composition of student loan repayment, showcasing the percentage allocated to principal versus interest, and potentially illustrating the impact of different repayment plans. A small icon representing a growing money bag could further reinforce the message of increased financial stability over time.

Career Advantages Depicted

This section would employ a combination of icons and a simple chart. Icons representing various professional fields (e.g., medicine, engineering, law) could be linked to bars indicating the average required level of education for entry-level positions within those fields. The chart would visually highlight the increased access to higher-paying, specialized career opportunities that a college education, often financed by student loans, provides. A small icon depicting a graduation cap superimposed on a rising graph could effectively symbolize career advancement. A brief description under each icon could mention the average starting salary in that field, reinforcing the correlation between higher education and higher earning potential.

Personal Advantages Shown

This section would focus on the less quantifiable, but equally important, personal benefits of higher education. A circular graphic showing interconnected elements – improved confidence, enhanced problem-solving skills, increased networking opportunities, and broadened perspectives – could represent the holistic personal growth facilitated by a college experience. Each element could be linked to a brief descriptive sentence. For instance, “Broadened Perspectives” could be linked to a short description about increased exposure to diverse ideas and cultures. A simple icon representing a lightbulb could symbolize the enhanced critical thinking and problem-solving skills gained through higher education.

Epilogue

In conclusion, while student loans represent a financial commitment, their advantages extend far beyond immediate monetary gains. They provide access to higher education, leading to enhanced career opportunities, increased earning potential, and significant personal growth. Careful consideration of repayment plans and responsible borrowing practices are crucial, but the potential long-term benefits of leveraging student loans to invest in one’s future are undeniable. A well-informed decision, considering both the advantages and potential drawbacks, is key to successfully navigating this important financial journey.

Quick FAQs

What are the different types of student loans available?

Several types exist, including federal loans (subsidized and unsubsidized) and private loans. Federal loans often have more favorable terms and repayment options.

How do I determine if I qualify for student loans?

Eligibility criteria vary depending on the loan type. Generally, factors like credit history (for private loans), enrollment status, and financial need are considered.

What happens if I can’t repay my student loans?

Failure to repay can lead to negative credit impacts, wage garnishment, and potential legal action. Contacting your lender to explore repayment options like deferment or forbearance is crucial.

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.