Navigating the complexities of graduate school often involves understanding the financial landscape. A crucial element of this is grasping the aggregate limit for graduate student loans – the maximum amount you can borrow across all federal and private loan programs. This limit significantly impacts your borrowing capacity and long-term financial well-being, necessitating careful planning and understanding of the factors that influence it.

This guide explores the intricacies of aggregate loan limits, examining the components of the calculation, factors affecting eligibility, strategies for responsible borrowing, and the consequences of exceeding the limit. We’ll delve into government regulations, offer practical budgeting tips, and provide resources to help you make informed decisions about your graduate education financing.

Definition and Components of Aggregate Loan Limits

Understanding aggregate loan limits is crucial for graduate students planning to finance their education through federal and private loans. These limits represent the maximum total amount a student can borrow across all their graduate loan programs, preventing excessive indebtedness. Exceeding these limits can have significant long-term financial consequences.

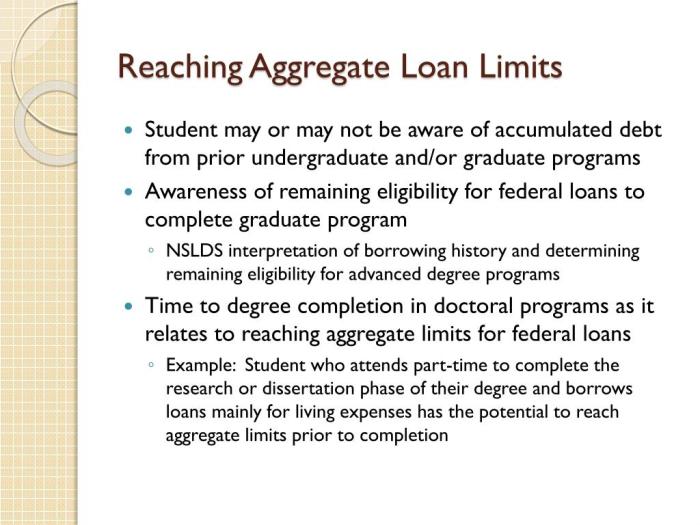

The aggregate loan limit refers to the total amount of money a graduate student can borrow across all their federal and, in some cases, private graduate student loans. This limit is established to protect students from accumulating unsustainable debt. The specific amount varies depending on the loan program, the student’s enrollment status, and the type of degree being pursued. It is important to note that this limit is cumulative, meaning it encompasses all graduate loans taken out over the student’s entire graduate education, regardless of the year or program.

Types of Graduate Student Loans Included in the Aggregate Limit

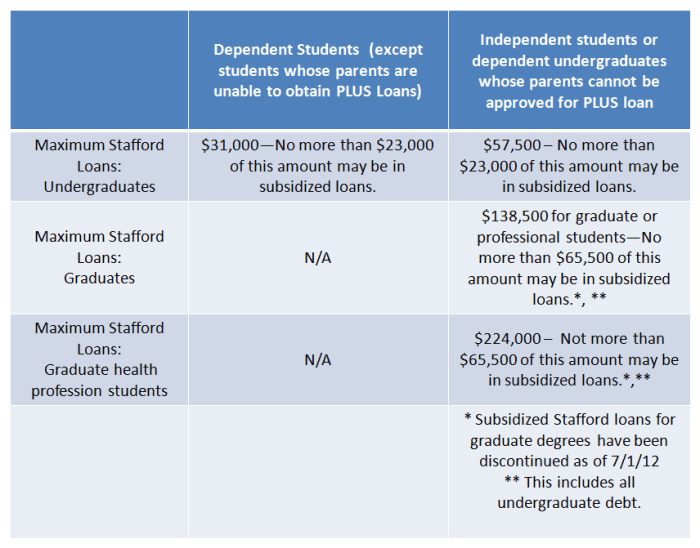

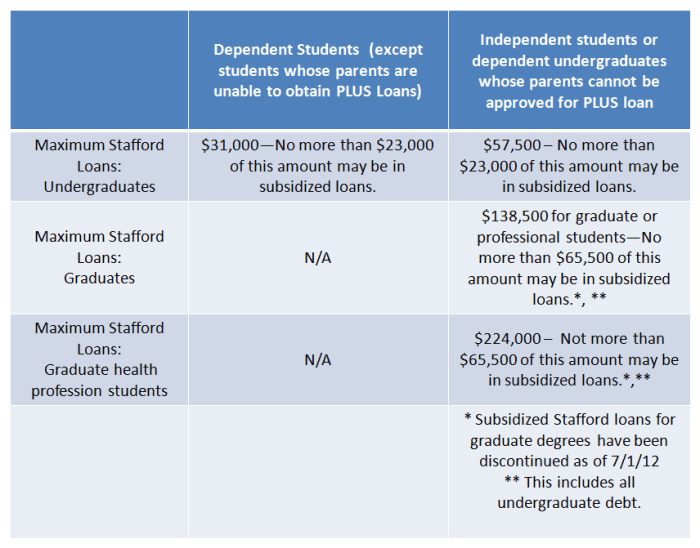

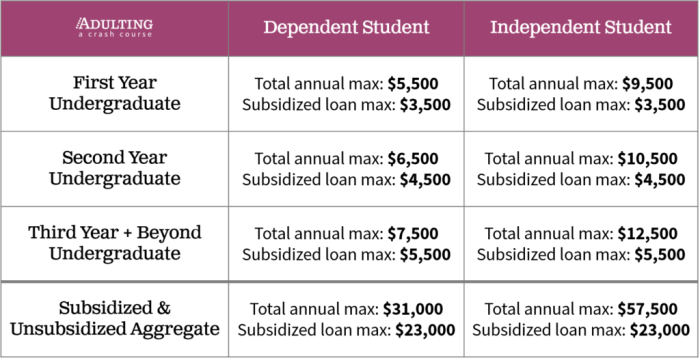

The aggregate loan limit typically includes federal graduate student loans, such as Direct Unsubsidized Loans and Direct PLUS Loans. While private graduate student loans are not directly included in the federal aggregate limit calculation, borrowing heavily from private sources can still impact a student’s overall debt burden and ability to manage their finances. It’s crucial for students to consider the total amount borrowed from all sources, both federal and private, to avoid exceeding their capacity to repay. The calculation for the aggregate limit primarily focuses on federal loans due to the government’s role in setting borrowing limits and providing repayment options.

Components Contributing to the Aggregate Loan Limit

Several factors contribute to a graduate student’s individual aggregate loan limit. These include the student’s enrollment status (full-time versus part-time), the type of degree program (master’s, doctoral, etc.), and the loan program utilized (Direct Unsubsidized, Direct PLUS). The specific limits for each program may change annually, and it is essential to consult the most up-to-date information from the U.S. Department of Education. For example, a full-time doctoral student may have a higher aggregate limit than a part-time master’s student, reflecting the generally longer duration and higher costs associated with doctoral programs.

Aggregate Loan Limits for Different Loan Programs (Past 5 Years – Example Data)

Note: The following table presents example data for illustrative purposes only. Actual loan limits vary and should be verified with official sources such as the U.S. Department of Education website. These figures do not include private loans, which are subject to lender-specific limits.

| Loan Program | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | 2023-2024 |

|---|---|---|---|---|---|

| Direct Unsubsidized Loans (Graduate) | $20,500 | $20,500 | $20,500 | $21,000 | $21,500 |

| Direct PLUS Loans (Graduate) | Cost of Attendance – Financial Aid | Cost of Attendance – Financial Aid | Cost of Attendance – Financial Aid | Cost of Attendance – Financial Aid | Cost of Attendance – Financial Aid |

Factors Influencing Aggregate Loan Limits

Several key factors interact to determine a graduate student’s eligibility for federal student loans and, consequently, their aggregate loan limit. Understanding these factors is crucial for prospective students to accurately plan their financing and avoid exceeding their borrowing capacity. These factors are not independent; they often influence each other, creating a complex picture of individual loan eligibility.

The aggregate loan limit, representing the maximum amount a student can borrow across all federal graduate student loans, is not a fixed number. It’s dynamically determined based on a combination of individual circumstances and program specifics. This dynamic nature emphasizes the importance of understanding the contributing factors to make informed financial decisions.

Credit History and Credit Score

A student’s credit history and credit score, while not always explicitly used in determining initial eligibility for federal graduate student loans, can indirectly influence loan access and terms. A strong credit history, reflecting responsible borrowing and repayment behavior, might lead to more favorable interest rates or better loan terms from private lenders if federal loans are insufficient to cover educational expenses. Conversely, a poor credit history might make it more difficult to secure private loans or could result in higher interest rates, effectively reducing the amount a student can realistically borrow. The federal government, however, prioritizes factors such as enrollment status and degree program when assessing eligibility for federal graduate student loans.

Graduate Program Type and Length

The type and length of a graduate program significantly impact the total amount a student can borrow. Doctoral programs, typically longer and more expensive than master’s programs, generally allow for higher aggregate loan limits. This reflects the increased cost of tuition, fees, and living expenses associated with longer programs. For example, a doctoral student in engineering might be eligible for a substantially higher aggregate loan limit than a student pursuing a one-year master’s degree in education. The increased loan limit acknowledges the greater financial burden of a longer and more intensive educational pursuit.

Comparison of Aggregate Loan Limits for Different Graduate Programs

While specific numbers vary year to year and are subject to change based on federal regulations, a general comparison can be made. Doctoral programs consistently offer higher aggregate loan limits than master’s programs. This difference stems from the longer duration and generally higher costs associated with doctoral studies. For instance, a doctoral program in a STEM field might have a substantially higher aggregate loan limit than a master’s program in the humanities. Moreover, professional programs like law or medicine often have their own unique loan limit structures, sometimes exceeding those of other graduate programs due to the significant expenses involved. It’s essential to consult the official website of the federal student aid agency for the most up-to-date and accurate information on aggregate loan limits for specific programs.

Strategies for Managing Graduate Student Loan Debt within Limits

Managing graduate student loan debt effectively requires careful planning and proactive strategies. Staying within the aggregate loan limit is crucial to avoid overwhelming debt after graduation. This section Artikels practical steps and resources to help graduate students navigate the complexities of borrowing and repayment.

Budgeting and Financial Planning Tools

Creating a realistic budget is paramount to understanding your financial capacity for borrowing. This involves meticulously tracking income and expenses to identify areas where savings can be maximized. Several budgeting methods can be employed, including the 50/30/20 rule (allocating 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment), the zero-based budget (allocating every dollar to a specific category), or using budgeting apps like Mint or YNAB (You Need A Budget). These tools offer automated tracking, expense categorization, and visual representations of spending habits, aiding in informed financial decision-making. Furthermore, developing a comprehensive financial plan that incorporates short-term and long-term goals is essential. This plan should include realistic estimates of graduate school expenses, potential income after graduation, and a repayment strategy for student loans.

Step-by-Step Guide to Applying for and Monitoring Graduate Student Loans

- Research Loan Options: Explore federal and private loan options, comparing interest rates, repayment terms, and fees. Understand the differences between subsidized and unsubsidized loans.

- Complete the FAFSA (Free Application for Federal Student Aid): This application determines your eligibility for federal student aid, including grants and loans. Submit the FAFSA as early as possible to maximize your chances of receiving aid.

- Accept Loan Offers Strategically: Borrow only the amount you absolutely need. Prioritize grants and scholarships before considering loans. Carefully review loan terms before accepting.

- Monitor Aggregate Borrowing: Regularly check your loan balance and track your total borrowing against the aggregate limit. Utilize online portals provided by your lender or institution to monitor your loan status.

- Create a Repayment Plan: Develop a realistic repayment plan before graduation. Explore options like income-driven repayment plans to manage monthly payments.

Resources for Managing Student Loan Debt

Several valuable resources can provide guidance and support in managing graduate student loan debt. The Federal Student Aid website (studentaid.gov) offers comprehensive information on federal student loans, repayment options, and financial literacy resources. Your university’s financial aid office provides personalized assistance with loan applications, budgeting, and financial planning. Additionally, numerous non-profit organizations and credit counseling agencies offer free or low-cost financial guidance. These resources can help you navigate the complexities of student loan debt and make informed decisions about your financial future. Examples include the National Foundation for Credit Counseling (NFCC) and the Consumer Financial Protection Bureau (CFPB).

Consequences of Exceeding Aggregate Loan Limits

Exceeding the aggregate loan limit for graduate student loans carries significant financial repercussions that can impact a student’s short-term and long-term financial well-being. These consequences extend beyond simply not being able to borrow more; they affect credit scores, future borrowing capabilities, and overall financial stability. Understanding these potential consequences is crucial for responsible financial planning during graduate studies.

The most immediate consequence of exceeding the aggregate loan limit is the inability to access further federal student loans. This can leave students with a funding gap, forcing them to rely on alternative, often more expensive, financing options such as private loans or personal savings. This can significantly increase the overall cost of their education and lead to a heavier debt burden.

Impact on Credit Scores and Future Borrowing

Exceeding loan limits doesn’t directly damage your credit score, but the actions taken to address the shortfall might. For example, relying heavily on high-interest private loans can negatively impact your credit utilization ratio and potentially lower your credit score. A lower credit score can then make it more difficult and expensive to secure loans in the future, affecting not only further education but also major life purchases like a home or car. Furthermore, lenders may view exceeding loan limits as a sign of poor financial management, making them less likely to approve future loan applications, even if the borrower is now in a better financial position.

Options for Students Who Have Exceeded Aggregate Loan Limits

Students who have already exceeded their aggregate loan limits have limited options to manage their debt. Refinancing and consolidation are two potential strategies. Refinancing involves replacing existing loans with a new loan, often at a lower interest rate, potentially lowering monthly payments. However, refinancing federal loans into private loans means losing the benefits of federal loan programs, such as income-driven repayment plans and loan forgiveness programs. Consolidation combines multiple loans into a single loan, simplifying repayment, but it doesn’t necessarily reduce the total amount owed or the interest rate. The best option depends on individual circumstances and should be carefully considered.

Long-Term Financial Impact of Exceeding the Aggregate Limit

The long-term financial impact of exceeding aggregate loan limits can be substantial and far-reaching. Consider these hypothetical scenarios:

- Scenario 1: A student exceeds their limit by $20,000, taking out private loans with a 10% interest rate. Over a 10-year repayment period, they’ll pay significantly more in interest than if they had stayed within the limit and used federal loans with a lower interest rate. This could delay major life milestones like homeownership or starting a family.

- Scenario 2: A student, burdened by excessive debt due to exceeding the limit, struggles to secure a high-paying job after graduation. The weight of loan repayments could significantly impact their ability to save for retirement or build wealth, potentially delaying financial independence for many years.

- Scenario 3: A student defaults on their loans due to the overwhelming debt burden. This negatively impacts their credit score, making it nearly impossible to secure loans or credit cards in the future. It can also lead to wage garnishment and legal action, severely impacting their financial stability.

Government Regulations and Policies Regarding Aggregate Limits

Government regulations and policies surrounding graduate student loan aggregate limits are complex and vary across nations. These limits are designed to balance the need for accessible higher education financing with responsible borrowing practices and the prevention of unsustainable debt burdens for students. Understanding these regulations is crucial for graduate students to effectively plan their financing strategies.

Government regulations concerning aggregate loan limits primarily aim to protect both borrowers and the lending institutions. These regulations often dictate the maximum amount a student can borrow across all federal loan programs, setting annual and aggregate caps. Furthermore, regulations may specify eligibility criteria, such as enrollment status and degree program type, impacting the amount a student can access. Enforcement of these regulations is typically handled by government agencies responsible for student financial aid. Failure to comply can lead to penalties, including loan default and potential legal repercussions.

Federal Student Loan Program Regulations in the United States

The U.S. Department of Education sets the aggregate loan limits for federal graduate student loans. These limits are periodically reviewed and adjusted based on factors like inflation and the cost of higher education. For example, the aggregate loan limit for graduate students has increased incrementally over the past two decades, reflecting the rising cost of tuition. Changes are typically announced through official publications and updates on the Department of Education’s website. These changes directly impact the borrowing capacity of graduate students, influencing their ability to finance their education and potentially affecting their long-term financial planning. Specific details regarding current limits and eligibility criteria are readily available on the official website of the U.S. Department of Education.

Recent Changes and Proposed Changes to U.S. Regulations

In recent years, there have been discussions about potential modifications to the aggregate loan limit system. These discussions often center around concerns regarding student debt levels and the affordability of higher education. For instance, some proposals have suggested increasing the aggregate limits to align with rising tuition costs, while others advocate for stricter regulations to prevent excessive borrowing. The implementation of any significant changes depends on legislative actions and budgetary considerations. Any changes will directly influence the amount graduate students can borrow, impacting their access to higher education and subsequent financial obligations. These proposed changes are typically debated in Congress and undergo rigorous review processes before any final decisions are made.

Comparison of Regulations Across Countries

While the United States has a well-established system of federal student loan programs, other countries have varying approaches. Some countries have national loan programs with aggregate limits, similar to the U.S. system. Other nations may rely more heavily on private loans or grants, which may not have the same types of aggregate limits. For example, some European countries provide generous government grants and subsidies, reducing the reliance on loans. The differences in these systems reflect the distinct priorities and approaches to higher education financing adopted by different governments. A comprehensive comparison would require an in-depth analysis of the specific regulations and policies of each country, considering factors such as the cost of higher education, national income levels, and societal priorities.

Timeline of Significant Changes in Aggregate Loan Limits (United States)

To visualize the changes, imagine a line graph. The x-axis represents the years from 2003 to 2023, and the y-axis represents the aggregate loan limit in US dollars. The graph would show a generally upward trend, with several noticeable jumps corresponding to specific legislative changes or adjustments based on inflation. For example, one could plot a significant increase around 2008, reflecting adjustments made in response to the economic crisis and rising tuition costs. Another significant increase might be shown around 2010-2012, reflecting further adjustments. The graph would clearly illustrate the fluctuating nature of the aggregate loan limits and their responsiveness to economic and political factors. Precise figures for each year would need to be obtained from official government sources, such as the U.S. Department of Education website.

Last Recap

Successfully managing graduate student loan debt hinges on a thorough understanding of aggregate loan limits. By carefully considering your borrowing capacity, employing sound financial planning strategies, and staying informed about relevant regulations, you can mitigate the risks associated with exceeding these limits and pave the way for a financially secure future after graduation. Remember to utilize available resources and seek professional advice when needed to navigate this crucial aspect of graduate school funding.

Common Queries

What happens if I exceed my aggregate loan limit?

Exceeding your limit can negatively impact your credit score, limit future borrowing opportunities, and lead to long-term financial difficulties. Options like refinancing or consolidation might be available, but they should be carefully considered.

Are private loans included in the aggregate limit?

The aggregate limit primarily refers to federal student loans. Private loans are not typically included in this calculation, but their amounts should still be factored into your overall borrowing plan.

How often are aggregate loan limits adjusted?

Aggregate loan limits are periodically reviewed and adjusted by the government, often in response to inflation or changes in the economic climate. It’s important to check for updates annually.

Where can I find my current aggregate loan limit?

You can find this information on the official websites of the relevant government agencies that manage federal student loan programs (e.g., the U.S. Department of Education).