Navigating the complexities of financing higher education can be daunting, especially understanding the limitations placed on borrowing. This guide delves into the crucial topic of aggregate loan limits for undergraduate students, clarifying the rules and regulations governing how much students can borrow for their education. We will explore the factors that influence these limits, the potential consequences of exceeding them, and the resources available to help students make informed financial decisions.

Understanding your aggregate loan limit is paramount to responsible financial planning during and after college. This involves knowing the different types of federal student loans, how your dependency status impacts your borrowing power, and what resources are available to assist you in navigating this process. By the end of this guide, you will have a clear understanding of your borrowing capabilities and strategies for managing your student loan debt effectively.

Definition and Scope of Aggregate Loan Limits

Understanding aggregate loan limits is crucial for undergraduate students planning to finance their education through federal student loans. These limits represent the maximum total amount a student can borrow across all federal student loan programs during their undergraduate career. Exceeding these limits isn’t possible through regular application processes.

Types of Federal Student Loans Included in the Aggregate Limit

The aggregate loan limit encompasses several types of federal student loans. These primarily include subsidized and unsubsidized Stafford Loans, which are the most common forms of federal student aid for undergraduates. Parent PLUS loans and Graduate PLUS loans are not included in the undergraduate aggregate loan limit.

Aggregate Loan Limits Versus Individual Loan Limits

While each federal student loan program has its own annual and overall loan limits, the aggregate limit represents the overarching cap on the total amount a student can borrow across all eligible loan programs during their undergraduate studies. This means a student might reach their aggregate loan limit before reaching the individual loan limits for each loan type. For example, a student could reach their maximum aggregate loan amount by borrowing the maximum amount for subsidized Stafford loans in their first year and not be able to borrow anything more for unsubsidized Stafford loans in subsequent years.

Examples of Reaching the Aggregate Loan Limit

A student might reach their aggregate loan limit if they borrow the maximum amount allowed for each eligible loan type each year. Another scenario involves a student who changes their enrollment status. For example, if a student starts as a full-time student, borrows the maximum, then reduces their course load to part-time, they may still reach their aggregate limit, as the maximum loan amounts are often dependent on enrollment status. A third example would be a student who takes a longer period to complete their degree. The longer they are in school, the higher their chances of hitting the aggregate limit before graduating.

Aggregate Loan Limits for Dependent and Independent Students

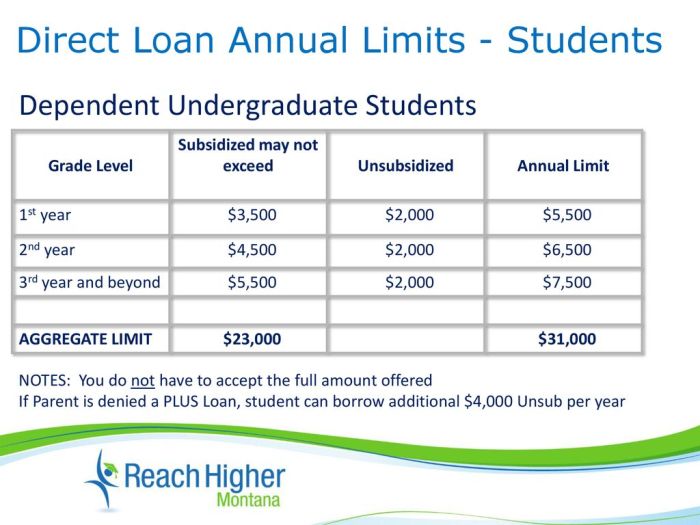

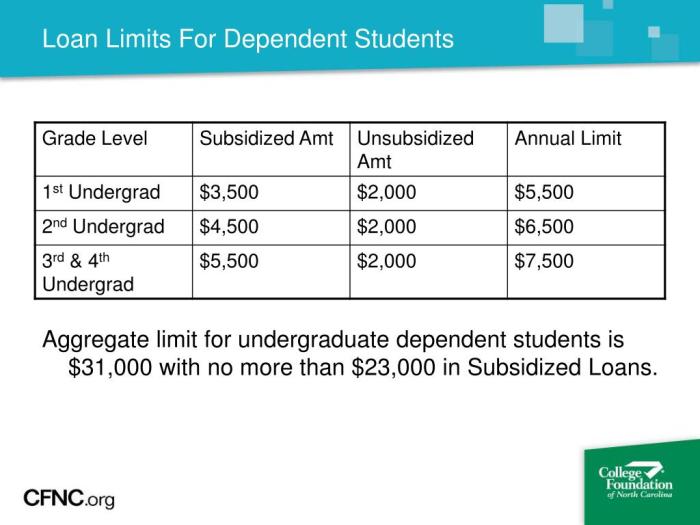

The aggregate loan limit varies depending on the student’s dependency status. Independent students generally have higher aggregate loan limits than dependent students, reflecting the assumption that independent students have more financial responsibility.

| Student Status | Year 1 Limit | Year 2-4 Limit | Aggregate Limit |

|---|---|---|---|

| Dependent Undergraduate Student | $5,500-$9,500 (depending on year in school) | $6,500-$9,500 (depending on year in school) | $31,000 |

| Independent Undergraduate Student | $9,500-$12,500 (depending on year in school) | $10,500-$12,500 (depending on year in school) | $57,500 |

Factors Influencing Aggregate Loan Limits

Several key factors interact to determine the maximum amount an undergraduate student can borrow in federal student loans. Understanding these factors is crucial for students and families planning for higher education financing. These limits are designed to balance access to education with responsible borrowing practices.

Dependency Status and Aggregate Loan Limits

A student’s dependency status significantly impacts their aggregate loan limit. Dependent students, typically those claimed as dependents on their parents’ tax returns, generally have lower aggregate loan limits than independent students. This is because lenders often assume that dependent students have access to additional financial support from their families. Independent students, having demonstrated financial independence, are eligible for higher loan amounts, reflecting the greater financial responsibility they bear. The difference in loan limits can be substantial, potentially affecting a student’s ability to cover the full cost of their education. For example, a dependent undergraduate might have an aggregate limit of $31,000, while an independent student could have an aggregate limit of $57,500. These figures are illustrative and can vary based on other factors.

Year of Enrollment and Borrowing Limits

The student’s year of enrollment—freshman, sophomore, junior, or senior—also affects their annual loan limits, which cumulatively contribute to their aggregate limit. Generally, annual loan limits increase as students progress through their undergraduate studies. This acknowledges the potentially increasing costs associated with upper-level coursework and potentially more specialized programs. For instance, a freshman might have an annual loan limit of $5,500, while a senior might have an annual limit of $7,500 or more, depending on their dependency status and loan program. This gradual increase allows students to borrow more as their educational needs and expenses evolve.

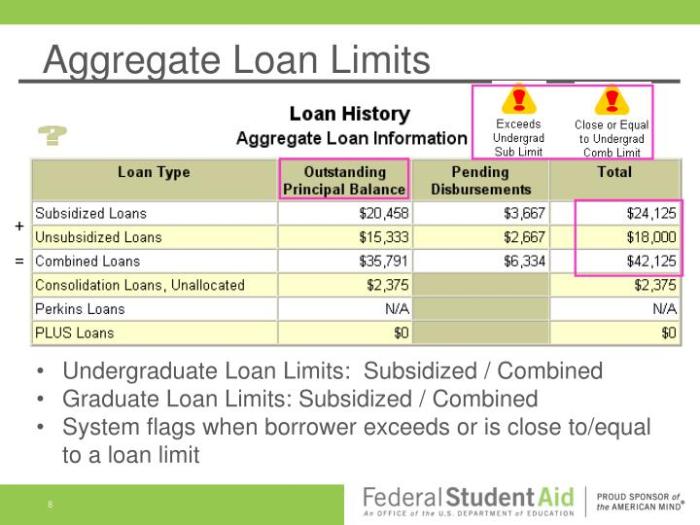

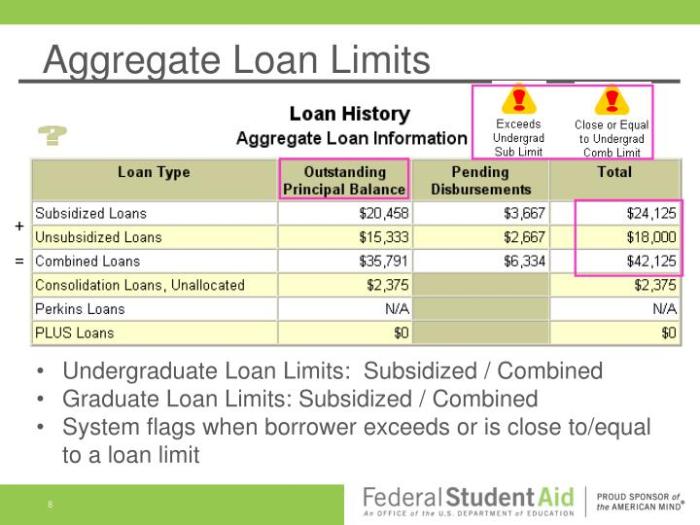

Aggregate Loan Limits Across Federal Loan Programs

Different federal student loan programs have varying aggregate loan limits. The primary programs are the Subsidized and Unsubsidized Stafford Loans, and sometimes PLUS loans (for parents). Subsidized Stafford Loans offer interest subsidies while the student is enrolled at least half-time, whereas unsubsidized loans accrue interest from the time the loan is disbursed. The aggregate loan limits for subsidized and unsubsidized Stafford loans combined are generally higher than the limits for just one type of loan. PLUS loans have their own separate limits and eligibility criteria. The specific limits for each program are set annually by the federal government and can be found on the Federal Student Aid website. A comparison of limits across these programs highlights the importance of understanding the nuances of each loan type when planning a borrowing strategy.

Determining a Student’s Aggregate Loan Limit: A Flowchart

The process of determining a student’s aggregate loan limit can be visualized using a flowchart.

[Descriptive Flowchart]

The flowchart would begin with a decision point: Is the student dependent or independent? This would branch into two separate paths. Each path would then include further decision points based on the student’s year of enrollment and chosen loan program(s). Each path would eventually lead to a final box indicating the calculated aggregate loan limit based on the specific factors. The flowchart would clearly show how each factor contributes to the final loan limit calculation, offering a visual representation of the process.

Consequences of Exceeding the Aggregate Loan Limit

Exceeding your aggregate loan limit for undergraduate studies has significant repercussions that can impact your financial well-being for years to come. Understanding these consequences is crucial for responsible financial planning during your college years. Failure to adhere to these limits can lead to immediate and long-term financial challenges.

Exceeding the aggregate loan limit prevents you from receiving additional federal student loans. This means you’ll need to find alternative funding sources to cover your educational expenses. The inability to access federal loans can significantly hinder your ability to complete your education, potentially leading to increased debt through private loans or other methods of financing. The consequences extend beyond the immediate inability to borrow; it also affects your credit history and long-term financial stability.

Options for Students Needing Additional Funding

Students who require funding beyond their aggregate loan limit must explore alternative financing options. These options typically come with higher interest rates and less favorable repayment terms compared to federal student loans. Carefully weighing the pros and cons of each option is essential to make an informed decision.

- Private Student Loans: These loans are offered by private lenders, such as banks and credit unions. Interest rates and repayment terms vary depending on the lender and the borrower’s creditworthiness. They often require a co-signer, especially for students with limited or no credit history. The interest rates are usually higher than federal loans, potentially leading to a greater overall debt burden.

- Scholarships and Grants: These are forms of financial aid that do not need to be repaid. Numerous scholarships and grants are available from various sources, including colleges, universities, private organizations, and government agencies. Proactively searching for and applying to these opportunities can significantly reduce the need for additional borrowing.

- Work-Study Programs: Many colleges and universities offer work-study programs that allow students to earn money while attending school. These programs provide a way to supplement educational expenses without incurring additional debt.

- Family Contributions: If possible, leveraging financial support from family members can help bridge the funding gap. Open communication with family about financial needs and resources is crucial.

Alternative Funding Sources for Undergraduate Education

Beyond the options listed above, other avenues for funding exist. These alternatives can help students offset the cost of tuition and other educational expenses, potentially mitigating the need to exceed loan limits.

- Part-Time Employment: Working part-time during the academic year or full-time during breaks can provide a significant source of income to help cover educational costs. This requires careful time management to balance work and studies effectively.

- Crowdfunding Platforms: Online platforms allow students to create campaigns to raise funds from friends, family, and the broader community. While not guaranteed to be successful, crowdfunding can supplement other funding sources.

- Community Resources: Local community organizations or charities might offer financial assistance programs for students facing financial hardship. Exploring these resources can uncover unexpected opportunities for support.

Long-Term Financial Implications of Exceeding the Aggregate Loan Limit

Exceeding the aggregate loan limit often results in a substantially larger overall debt burden. This can have significant long-term financial implications, including higher monthly payments, prolonged repayment periods, and potential difficulty in achieving major financial goals, such as buying a home or starting a family. The high interest rates associated with private loans can exacerbate the problem, leading to a much larger amount of interest paid over the life of the loan. For example, a small increase in loan amount can result in tens of thousands of dollars more paid in interest over the loan term.

Strategies for Responsible Borrowing and Managing Student Loan Debt

Careful planning and responsible borrowing are essential to avoid overwhelming student loan debt. Implementing the following strategies can significantly improve your financial outlook after graduation.

- Create a Realistic Budget: Understand your expenses and income to determine how much you can realistically borrow and repay.

- Explore All Financial Aid Options: Exhaust all possibilities for grants, scholarships, and work-study programs before resorting to loans.

- Borrow Only What You Need: Avoid taking out more loans than necessary to cover your educational expenses.

- Understand Loan Terms: Carefully review the terms and conditions of any loan before signing.

- Develop a Repayment Plan: Create a realistic plan to repay your loans after graduation, considering your expected income and expenses.

- Consider Income-Driven Repayment Plans: Explore options to lower your monthly payments if you are struggling to repay your loans.

Resources and Support for Understanding Aggregate Loan Limits

Navigating the complexities of federal student loan limits can be challenging. Fortunately, numerous resources are available to help students understand their borrowing limits and access the financial aid they need. Understanding these resources is crucial for responsible borrowing and avoiding exceeding the aggregate loan limit.

Reliable Websites and Government Resources

Several government websites and reliable organizations offer comprehensive information on federal student loan programs and limits. These resources provide clear explanations of eligibility criteria, loan types, and aggregate loan limits. Accessing this information proactively allows students to make informed decisions about their borrowing.

- Federal Student Aid (FSA): This website, studentaid.gov, is the official source for information on federal student aid, including detailed explanations of loan limits, repayment plans, and other relevant information. It provides tools and calculators to estimate loan needs and understand repayment implications.

- National Student Loan Data System (NSLDS): NSLDS (nslds.ed.gov) allows students to access their federal student loan history, including disbursement information and loan balances. This is crucial for tracking borrowing against the aggregate limit.

- The College Board: While not a government entity, The College Board provides valuable resources and information on financial aid, including explanations of loan programs and limits. Their website offers tools and guides to help students navigate the financial aid process.

Services Offered by Financial Aid Offices

Colleges and universities employ dedicated financial aid offices to assist students with navigating the financial aid process. These offices offer personalized guidance and support, tailored to each student’s individual circumstances.

Financial aid officers can provide detailed explanations of aggregate loan limits, help students complete the Free Application for Federal Student Aid (FAFSA), and offer advice on budgeting and financial planning. They can also answer questions about different loan types and repayment options, ensuring students understand the implications of their borrowing choices. Many institutions offer workshops and individual counseling sessions to support students in managing their finances effectively.

Financial Literacy Programs and Workshops

Numerous financial literacy programs and workshops are available to students, often offered through colleges, universities, and community organizations. These programs equip students with the knowledge and skills necessary to make informed decisions about their finances, including borrowing for education.

These programs typically cover topics such as budgeting, saving, debt management, and understanding credit scores. Participation in such programs can significantly improve students’ understanding of financial responsibility and help them avoid potential pitfalls related to student loan debt.

Steps to Understand Borrowing Limits

Understanding your borrowing limits requires a proactive approach. Here’s a short guide outlining the necessary steps:

- Complete the FAFSA: Submitting the FAFSA is the first step in determining your eligibility for federal student aid, including loans.

- Review your Student Aid Report (SAR): Your SAR provides preliminary information about your eligibility for federal student aid. Review it carefully.

- Contact your college’s financial aid office: Discuss your financial aid award letter with a financial aid officer to understand the different loan options and your aggregate loan limits.

- Utilize online resources: Explore the websites mentioned earlier to gain a comprehensive understanding of federal student loan programs and limits.

- Create a budget: Develop a realistic budget to estimate your educational expenses and determine how much you need to borrow.

Appealing a Denied Loan Application

If your loan application is denied due to reaching the aggregate loan limit, understanding the appeals process is crucial. While there isn’t a guaranteed path to overturning the decision, students should carefully review the reasons for denial and gather any supporting documentation that might strengthen their case.

This may involve demonstrating exceptional financial circumstances or unforeseen events that significantly impact their ability to afford college without exceeding the limit. Contacting the financial aid office at your institution is the first step in exploring appeal options. They can provide guidance on the process and the required documentation. It’s important to be prepared to clearly explain your situation and provide evidence to support your appeal.

Visual Representation of Aggregate Loan Limits Over Time

Understanding the historical trends in aggregate loan limits for undergraduate students provides valuable context for current borrowing regulations. Analyzing these changes reveals how federal policy has adapted to shifting economic conditions and evolving student needs. The following table illustrates these changes over the past decade, highlighting key differences between dependent and independent student borrowers.

Aggregate Loan Limits: A Decade of Change

The table below displays the annual aggregate loan limits for undergraduate students over the past ten years (note: These figures are illustrative and should be verified with official government sources as actual limits may vary slightly based on specific program details and year of enrollment). We assume a consistent definition of “dependent” and “independent” status for simplicity. Real-world data may show minor variations due to legislative changes impacting eligibility criteria.

| Year | Dependent Student Limit | Independent Student Limit | Significant Changes |

|---|---|---|---|

| 2014 | $31,000 | $57,500 | Baseline year for comparison. |

| 2015 | $31,000 | $57,500 | No change from previous year. |

| 2016 | $31,000 | $57,500 | No change from previous year. |

| 2017 | $31,000 | $57,500 | No change from previous year. |

| 2018 | $31,000 | $57,500 | No change from previous year. |

| 2019 | $31,000 | $57,500 | No change from previous year. |

| 2020 | $31,000 | $57,500 | No change from previous year. Note: COVID-19 pandemic impacted student borrowing and repayment options. |

| 2021 | $31,000 | $57,500 | No change from previous year. Continued impact of the pandemic. |

| 2022 | $32,500 | $60,000 | Increase reflects adjustments to account for inflation and rising educational costs. |

| 2023 | $32,500 | $60,000 | No change from previous year. |

Factors Contributing to Changes in Aggregate Loan Limits

Several factors influence adjustments to aggregate loan limits. Inflation plays a significant role, as the cost of education consistently outpaces the rate of inflation. Changes in government policy, reflecting evolving views on student debt and affordability, also influence these limits. Economic conditions, particularly the availability of federal funding for student aid programs, have a direct impact. Finally, lobbying efforts from educational institutions and student advocacy groups can affect legislative decisions concerning loan limits. The absence of significant changes in many years shown in the table may reflect a period of relative stability in these influencing factors. The increase in 2022 could be attributed to a combination of higher inflation and a renewed focus on affordability in higher education.

Closing Notes

Successfully managing student loan debt requires careful planning and a thorough understanding of the rules and regulations surrounding federal student aid. By comprehending your aggregate loan limit and exploring available resources, you can create a responsible borrowing strategy that minimizes future financial strain. Remember, proactive planning and informed decision-making are key to navigating the complexities of higher education financing and achieving your academic goals without unnecessary financial burdens.

FAQ Summary

What happens if I exceed my aggregate loan limit?

Your loan application may be denied, and you will need to explore alternative funding options such as scholarships, grants, or private loans.

Can I appeal a denied loan application due to exceeding the limit?

Appeals are possible, but success depends on demonstrating exceptional circumstances. Contact your financial aid office to understand the appeal process.

How often are aggregate loan limits reviewed and adjusted?

Limits are typically reviewed and adjusted annually by the federal government, reflecting changes in the cost of education and other economic factors.

Are there any penalties for exceeding the aggregate loan limit?

There aren’t specific penalties beyond loan application denial. However, exceeding the limit could lead to increased overall debt and potential financial hardship.