Navigating the complex world of graduate student financing can feel overwhelming. Understanding aggregate loan limits is crucial for responsible borrowing and long-term financial well-being. This guide unravels the intricacies of these limits, exploring how they impact borrowing decisions, repayment strategies, and ultimately, a graduate student’s future career prospects. We’ll examine the various factors influencing these limits, from program costs and credit history to the specific loan programs available.

From defining aggregate loan limits and outlining the different types of loans available to graduate students, to exploring effective debt management strategies and the long-term implications of borrowing, this comprehensive resource provides a clear and concise overview of the key considerations for graduate students planning to finance their education. We’ll also cover practical tips for maximizing financial aid and minimizing debt.

Definition and Scope of Aggregate Loan Limits

Aggregate loan limits represent the maximum total amount a graduate student can borrow across all federal and, in some cases, private student loans during their entire graduate education. Understanding these limits is crucial for responsible financial planning and avoiding overwhelming debt. These limits are set by the federal government for federal loans and vary depending on the lender and the student’s circumstances for private loans.

Graduate students can access several types of federal and private loans to finance their education. Federal loans, offered through the government, generally offer more favorable repayment terms and options for income-driven repayment plans. Private loans, on the other hand, are provided by banks and other financial institutions, and often come with higher interest rates and less flexible repayment options.

Types of Graduate Student Loans

Federal graduate student loan programs include Direct Unsubsidized Loans and Direct PLUS Loans. Direct Unsubsidized Loans are available to all graduate students, regardless of financial need, while Direct PLUS Loans are credit-based loans available to graduate students and parents of dependent undergraduate students. Private graduate student loans are offered by various lenders and typically require a credit check and co-signer. These loans often have varying interest rates, repayment terms, and fees.

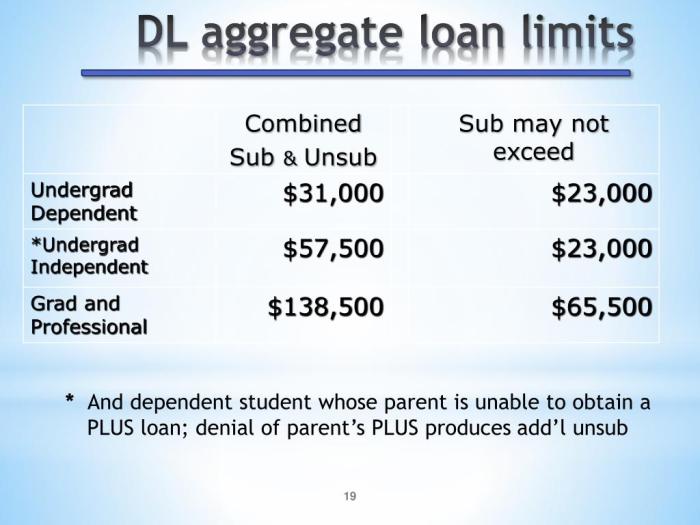

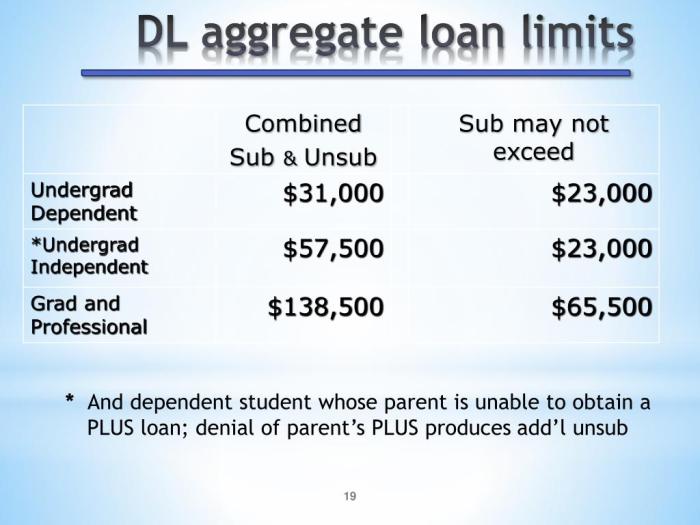

Aggregate Loan Limits Based on Graduate Student Status

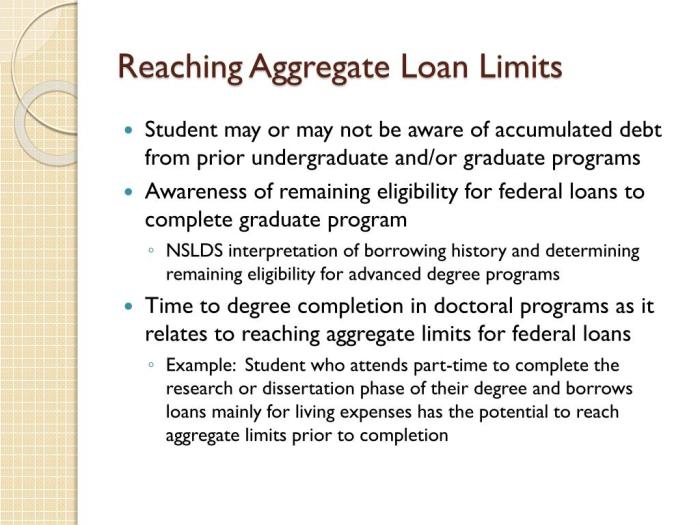

The aggregate loan limit for federal graduate student loans isn’t tied directly to the student’s year of study (first-year, second-year, etc.). Instead, the limit is a cumulative amount that applies throughout the student’s graduate career. This cumulative limit is dependent on the type of loan and the student’s dependency status. However, the amount a student can borrow annually may be limited by factors like program length and the cost of attendance. For instance, a student enrolled in a five-year doctoral program might reach their aggregate limit before completing their degree, necessitating careful budgeting and potentially the need to explore alternative funding sources like scholarships or grants.

Examples of Aggregate Loan Limits Affecting Borrowing Decisions

Consider two graduate students: Student A is pursuing a two-year Master’s degree and Student B is pursuing a five-year doctoral program. Both have the same aggregate loan limit of $250,000 (a hypothetical example, actual limits vary). Student A can potentially borrow a larger amount each year without exceeding the limit, whereas Student B needs to manage their borrowing more carefully to avoid reaching the limit before completing their degree. If Student B reaches their limit early, they will have to explore other financing options like scholarships or fellowships to cover the remaining educational costs.

Comparison of Aggregate Loan Limits Across Different Loan Programs

| Loan Program | Loan Type | Aggregate Loan Limit (Example – Hypothetical) | Interest Rate (Example – Hypothetical) |

|---|---|---|---|

| Federal Direct Unsubsidized Loan | Federal | $250,000 | Variable, subject to change |

| Federal Direct PLUS Loan | Federal | Up to the cost of attendance minus other financial aid | Variable, subject to change |

| Private Graduate Loan (Lender A) | Private | Varies by lender and creditworthiness | Variable, typically higher than federal loans |

| Private Graduate Loan (Lender B) | Private | Varies by lender and creditworthiness | Variable, typically higher than federal loans |

Factors Influencing Aggregate Loan Limits

Several key factors interact to determine a graduate student’s aggregate loan limit, impacting their ability to finance their education. Understanding these factors is crucial for prospective graduate students to effectively plan their financial strategy. These factors are not independent; they often influence one another in complex ways.

Loan Eligibility and Credit History

A strong credit history is not a prerequisite for federal student loans, which form the basis of most graduate student funding. However, a poor credit history might impact eligibility for private loans, a crucial supplementary source of funding for many students. Lenders assess creditworthiness based on factors like payment history, debt levels, and credit utilization. A higher credit score typically translates to better loan terms, including potentially higher loan limits or lower interest rates. Conversely, a poor credit score could lead to loan denials or less favorable terms, effectively reducing the available borrowing capacity. For instance, a student with significant outstanding debt and a history of late payments might find their private loan applications rejected or receive offers with substantially lower limits compared to a student with a clean credit history.

Cost of Attendance and Program Type

The cost of attendance for a specific graduate program significantly influences the aggregate loan limit. The cost of attendance encompasses tuition fees, living expenses, books, and other related educational costs. Federal loan programs generally set limits based on the program’s cost of attendance, ensuring students can borrow enough to cover their expenses without exceeding reasonable borrowing levels. A program with higher tuition and living expenses will generally have a higher cost of attendance, thus potentially allowing for a higher aggregate loan limit. For example, an MBA program in a high-cost city will likely have a higher cost of attendance and therefore potentially higher loan limits than a similar program in a lower-cost location. This does not mean students are guaranteed to receive the full cost of attendance in loans, but it does influence the maximum they can borrow.

Field of Study and Program Length

While not a direct determinant, the field of study and program length can indirectly affect aggregate loan limits. Programs with higher costs, such as medical or law school, typically have higher cost of attendance figures, and thus potentially higher aggregate loan limits. Similarly, longer programs will naturally result in higher cumulative borrowing needs. For example, a doctoral program lasting six years will typically allow for higher aggregate borrowing compared to a two-year master’s program, even if the annual cost of attendance is similar. This is because the overall cost over the program’s duration is significantly higher. However, the specific loan limits are still ultimately determined by the cost of attendance calculation and the applicable federal loan programs.

Hierarchical Structure of Factors Influencing Aggregate Loan Limits

The factors influencing aggregate loan limits can be organized hierarchically. At the top level is the Cost of Attendance, which is the primary determinant of the maximum loan amount. This cost is influenced by factors like Program Type (MBA, MD, PhD, etc.) and Program Location (high cost of living vs. low cost of living). Below this, Loan Eligibility is influenced by factors such as Credit History, which impacts the accessibility of private loans. Finally, Program Length indirectly affects the overall borrowing capacity by extending the period over which the student needs to finance their education.

Strategies for Managing Graduate Student Debt within Limits

Navigating graduate school finances requires careful planning and proactive debt management. Understanding aggregate loan limits is crucial, but equally important is developing strategies to stay within those limits and minimize long-term debt burden. This section Artikels practical approaches to achieve this goal.

Budgeting for Graduate Students

Creating a realistic budget is paramount. Graduate students often face unique financial challenges, including fluctuating income from part-time jobs, tuition costs, living expenses, and loan repayments. A comprehensive budget should account for all income sources (including loans, scholarships, and employment) and meticulously track expenses. Categorizing expenses (housing, food, transportation, books, entertainment) allows for identification of areas where savings can be made. Budgeting tools, both digital and manual, can be immensely helpful in this process. Consider using budgeting apps or spreadsheets to monitor spending and ensure alignment with the overall financial plan. Regularly reviewing and adjusting the budget based on actual spending is key to its effectiveness.

Strategies for Minimizing Graduate Student Loan Debt

Minimizing loan debt requires a multifaceted approach. Prioritizing scholarships and grants significantly reduces reliance on loans. Exploring opportunities for part-time employment, even if only for a few hours a week, can provide supplemental income to cover living expenses and reduce the need to borrow. Careful consideration of program length is also important; shorter programs often translate to less accumulated debt. Living frugally and making conscious spending choices can free up additional funds. For instance, opting for affordable housing, cooking at home more often, and utilizing free or low-cost entertainment options can lead to significant savings over time.

Examples of Scholarships and Grants for Graduate Students

Numerous scholarships and grants are available to graduate students. Federal sources, such as the Federal Pell Grant (although primarily for undergraduates, some programs extend eligibility), and state-specific grants, offer financial assistance. Many universities also provide institutional scholarships and fellowships based on academic merit, research potential, or financial need. Private organizations, foundations, and professional associations frequently offer scholarships targeted at specific fields of study or demographics. Thorough research, using online databases and university financial aid offices, is essential to uncovering these opportunities. For example, the National Science Foundation (NSF) offers various graduate research fellowships, while the American Association of University Women (AAUW) provides fellowships for women pursuing graduate studies.

Repayment Plans for Graduate Loans

Several repayment plans exist for graduate loans, each with its own benefits and drawbacks. The standard repayment plan involves fixed monthly payments over a 10-year period. While straightforward, it often results in higher monthly payments. Income-driven repayment plans (IDR) adjust monthly payments based on income and family size. These plans offer lower monthly payments but extend the repayment period, leading to higher overall interest payments. Deferment and forbearance options temporarily postpone payments, but interest may still accrue during these periods. Choosing the right repayment plan depends on individual financial circumstances and long-term goals. For example, a recent graduate with a high income might opt for the standard plan to pay off the loan quickly, while someone with a lower income might prefer an IDR plan for more manageable monthly payments.

Applying for Federal and Private Graduate Student Loans

Applying for graduate student loans involves a step-by-step process. First, complete the Free Application for Federal Student Aid (FAFSA) to determine eligibility for federal loans. Next, review loan offers from the federal government and compare them to private loan options. Private loans often have higher interest rates but may offer larger loan amounts. Carefully review the terms and conditions of each loan, including interest rates, fees, and repayment terms. Before accepting any loan, ensure it aligns with your financial capabilities and long-term goals. Finally, maintain good credit history, as it can influence interest rates and loan approval. The process of comparing federal and private loan offers should be approached methodically to ensure the most favorable terms are secured.

The Impact of Aggregate Loan Limits on Graduate Student Outcomes

Aggregate loan limits, while designed to protect graduate students from crippling debt, significantly influence their educational and career trajectories. Understanding these impacts is crucial for both students making educational choices and policymakers shaping financial aid programs. The consequences of exceeding these limits, the long-term financial burdens of high debt, and the effects on career paths and enrollment decisions all need careful consideration.

Consequences of Exceeding Aggregate Loan Limits

Exceeding aggregate loan limits forces students to explore alternative financing options, often with less favorable terms. These may include private loans with higher interest rates, potentially leading to a significantly larger debt burden over the repayment period. Furthermore, exceeding limits can delay or prevent graduation as students may need to take on part-time jobs to cover living expenses, hindering their academic progress. In extreme cases, students may be forced to withdraw from their programs altogether, resulting in lost investment in education and potential career setbacks.

Long-Term Financial Implications of High Graduate Student Loan Debt

High graduate student loan debt can have profound and lasting financial consequences. The significant monthly payments can restrict major life decisions such as homeownership, starting a family, or investing in retirement. High debt levels can also limit career choices, as individuals may be forced to prioritize higher-paying jobs over those offering greater personal fulfillment. For example, a graduate with $200,000 in debt might choose a high-paying but less desirable corporate job over a lower-paying position in academia that aligns better with their passion. This financial strain can lead to increased stress and decreased overall well-being. The impact on credit scores can also affect future financial opportunities, such as securing a mortgage or auto loan.

Career Paths of Graduate Students with Varying Levels of Loan Debt

The level of graduate student loan debt can influence career choices. Students with minimal debt may have greater flexibility to pursue careers with lower salaries but higher personal satisfaction. They might be more likely to consider non-profit work, research positions, or entrepreneurship, even if these options offer less immediate financial reward. Conversely, students with substantial debt may feel compelled to prioritize high-paying jobs to aggressively repay their loans, potentially limiting their career exploration and long-term career satisfaction. A study by the National Bureau of Economic Research, for example, found a correlation between higher loan debt and a greater likelihood of choosing high-paying but potentially less fulfilling jobs in finance or consulting.

Effects of Aggregate Loan Limits on Graduate Student Enrollment Choices

Aggregate loan limits can directly impact graduate student enrollment choices. Students may choose less expensive programs or institutions, even if they are not their preferred options. This could mean selecting a state university over a private institution or foregoing a specific program with a higher cost of attendance. Furthermore, some prospective students may decide against pursuing graduate education altogether if they anticipate exceeding the loan limits and facing insurmountable debt. This can have implications for the overall diversity of the graduate student population and the availability of skilled professionals in various fields.

Impact of Aggregate Loan Limits on Career Choices Post-Graduation

Aggregate loan limits can indirectly influence post-graduation career choices. The pressure to repay substantial loans quickly may lead graduates to accept jobs that don’t fully align with their career goals. For instance, a graduate with a degree in environmental science might be forced to accept a high-paying position in the energy sector instead of pursuing a less lucrative but more environmentally conscious career. The need to quickly repay loans might also limit entrepreneurial pursuits, as starting a business often requires significant upfront investment and involves higher financial risk. The immediate financial need can overshadow long-term career aspirations, leading to potential career dissatisfaction and unfulfilled potential.

Resources and Support for Graduate Students Regarding Loan Limits

Navigating the complexities of graduate student loan limits can be daunting. Fortunately, numerous resources and support systems exist to guide students through the process, from understanding eligibility to managing repayment. This section Artikels key resources and services available to help graduate students make informed decisions about financing their education and effectively manage their debt.

Reputable Resources for Graduate Student Loan Information

Understanding your options and rights regarding federal and private student loans is crucial. Several reputable organizations provide comprehensive information on graduate student loan limits, repayment plans, and financial literacy. These resources offer unbiased information, helping students make informed choices.

- Federal Student Aid (FSA): The official website for the U.S. Department of Education’s Federal Student Aid program. It offers detailed information on federal student loan programs, eligibility requirements, and repayment options. This is a primary source for accurate and up-to-date information.

- National Association of Student Financial Aid Administrators (NASFAA): NASFAA is a professional association for financial aid administrators. Their website offers resources and information for students, including articles and guides on various aspects of student financing.

- The Institute for College Access & Success (TICAS): TICAS conducts research and advocacy on issues related to college affordability and student debt. Their website offers data and analysis on student loan debt trends and policies.

Contact Information for University Financial Aid Offices

Each university maintains a financial aid office dedicated to assisting students with the financial aspects of their education. Direct contact with your university’s financial aid office is highly recommended. While providing specific contact information for all universities is impractical, a typical contact method would involve visiting the university’s website and searching for the “Financial Aid” or “Student Financial Services” section. You will typically find email addresses, phone numbers, and physical addresses there.

Services Offered by Federal and Private Loan Servicers

Federal and private loan servicers play a crucial role in managing student loans. Understanding the services they offer is vital for effective loan management.

- Federal Loan Servicers: These servicers manage federal student loans and offer services such as loan repayment plan options (standard, graduated, extended, income-driven repayment), deferment and forbearance applications, and loan consolidation options. Specific contact information for your federal loan servicer can be found on the Federal Student Aid website.

- Private Loan Servicers: Private loan servicers handle loans from private lenders. Services offered can vary depending on the lender and servicer, but generally include similar options to federal loan servicers, such as repayment plan options and customer support.

Process of Obtaining Graduate Student Loans: A Flowchart

The process of obtaining graduate student loans can be visualized as follows:

[Diagrammatic Representation]

1. Determine Financial Need: Assess the cost of graduate education and available resources (savings, scholarships, grants).

2. Complete FAFSA (Free Application for Federal Student Aid): Submit the FAFSA to determine eligibility for federal student aid.

3. Explore Federal Loan Options: Review federal loan programs (Direct Unsubsidized Loans, Grad PLUS Loans) and eligibility criteria.

4. Apply for Federal Loans: Complete the loan application process through the student’s university or the Federal Student Aid website.

5. Explore Private Loan Options: If needed, research and compare private loan options from various lenders.

6. Accept Loan Offers: Review loan terms and conditions before accepting loan offers.

7. Loan Disbursement: Funds are disbursed according to the university’s schedule.

Stages of Loan Repayment: A Visual Representation

[Diagrammatic Representation]

The repayment process is typically divided into stages:

1. Grace Period: A period after graduation or leaving school before repayment begins (usually 6 months for federal loans).

2. Repayment Period: The period during which the borrower makes regular loan payments. This can be several years to decades depending on the loan amount and repayment plan chosen.

3. Loan Consolidation (Optional): Combining multiple loans into a single loan with a new interest rate and repayment schedule.

4. Loan Forgiveness (Potential): Certain professions or loan repayment programs may offer partial or full loan forgiveness after meeting specific criteria. This is not guaranteed.

Outcome Summary

Successfully managing graduate student loan debt requires careful planning and a thorough understanding of aggregate loan limits. By understanding the factors influencing these limits, developing a sound budget, exploring diverse funding options, and proactively managing repayment, graduate students can navigate their financial journey with confidence. Remember, responsible borrowing today sets the stage for a brighter financial future tomorrow. This guide provides a strong foundation for informed decision-making, enabling graduate students to pursue their educational goals without undue financial strain.

Answers to Common Questions

What happens if I exceed my aggregate loan limit?

Exceeding your aggregate loan limit typically means you’ll be ineligible for additional federal loans. You may need to explore private loan options, but these often come with higher interest rates and less favorable terms.

Can I refinance my graduate student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it’s important to compare offers carefully and understand the terms before refinancing. Be aware that refinancing federal loans into private loans may mean losing certain federal protections.

Are there any loan forgiveness programs for graduate students?

Some professions, such as teaching or public service, offer loan forgiveness programs. Eligibility requirements vary widely depending on the program.

How does my credit score affect my loan eligibility?

A good credit score can improve your chances of loan approval and potentially secure more favorable interest rates, particularly with private loans. A poor credit score may limit your options or result in higher interest rates.

What resources are available to help me budget for graduate school?

Many universities offer financial aid offices and counseling services that can assist with budgeting and financial planning. Online budgeting tools and resources are also readily available.