The rising cost of higher education has left many graduates burdened by substantial student loan debt. However, the advent of Artificial General Intelligence (AGI) presents a potential paradigm shift in how we manage and approach this pervasive issue. This exploration delves into the multifaceted ways AGI could revolutionize student loan repayment, forgiveness programs, and financial literacy, ultimately shaping a more equitable and efficient system.

From automating tedious administrative tasks to personalizing financial advice and predicting the economic impact of forgiveness programs, AGI offers a range of possibilities. This analysis will examine both the transformative potential and the inherent ethical considerations associated with integrating AGI into the complex world of student loan management, paving the way for a thoughtful discussion on its responsible implementation.

The Impact of AGI on Student Loan Debt

The rise of Artificial General Intelligence (AGI) presents a transformative potential across numerous sectors, and the management of student loan debt is no exception. Its impact could be profound, reshaping the landscape of repayment, reducing administrative burdens, and potentially even increasing earning potential for graduates. This section will explore how AGI could revolutionize the student loan system.

AGI’s Automation of Student Loan Processes

AGI’s ability to process vast amounts of data with speed and accuracy offers significant opportunities for streamlining student loan management. Imagine a system where AGI automatically verifies income, assesses repayment plans based on individual circumstances, and flags potential issues like missed payments, all with minimal human intervention. This automation could lead to substantial cost savings for both lenders and borrowers, reducing the need for extensive human resources dedicated to administrative tasks. For instance, AGI could analyze a borrower’s financial data in real-time to proactively adjust repayment schedules based on fluctuating income, preventing defaults and minimizing late payment fees. This proactive approach would benefit both borrowers, who avoid penalties, and lenders, who minimize losses.

AGI’s Influence on Graduate Employment and Earning Potential

AGI could indirectly impact student loan repayment by creating new job opportunities and boosting earning potential for graduates. The development and implementation of AGI systems themselves will require a skilled workforce, generating high-paying jobs in fields like AI development, data science, and AI ethics. Furthermore, AGI-powered tools and applications are likely to increase productivity and efficiency across various industries, leading to economic growth and higher demand for skilled workers. For example, the automation of repetitive tasks in various sectors frees human workers to focus on more complex and creative endeavors, potentially increasing their value and earning potential. This increased earning capacity would directly translate into a greater ability to repay student loans.

AGI-Enhanced Student Loan Repayment Solutions Compared to Traditional Methods

The following table compares traditional student loan repayment methods with potential AGI-enhanced solutions:

| Feature | Traditional Methods | AGI-Enhanced Solutions |

|---|---|---|

| Repayment Plan Selection | Manual selection based on income and loan amount; often requires extensive paperwork and human interaction. | Automated selection of optimal repayment plan based on real-time financial data analysis, personalized recommendations, and streamlined application process. |

| Payment Processing | Manual processing of payments, prone to errors and delays; requires human intervention for handling discrepancies. | Automated payment processing with real-time tracking and error detection; proactive alerts for missed or late payments; integrated with various banking systems for seamless transactions. |

| Income Verification | Manual verification process, involving paperwork, delays, and potential for fraud. | Automated income verification through secure data integration with various sources; real-time updates and fraud detection capabilities. |

| Debt Management Counseling | Limited access to counseling services; often requires scheduling appointments and navigating complex bureaucratic processes. | AI-powered personalized debt management tools and resources; 24/7 access to customized advice and support; proactive identification of potential financial difficulties. |

AGI and Student Loan Forgiveness Programs

The integration of Artificial General Intelligence (AGI) into student loan forgiveness programs presents a significant opportunity to streamline the process, enhance accuracy, and potentially improve the overall effectiveness of these initiatives. AGI’s capacity for complex data analysis and pattern recognition can address many of the challenges currently faced in evaluating eligibility and predicting economic impact.

AGI’s Role in Eligibility Evaluation and Verification

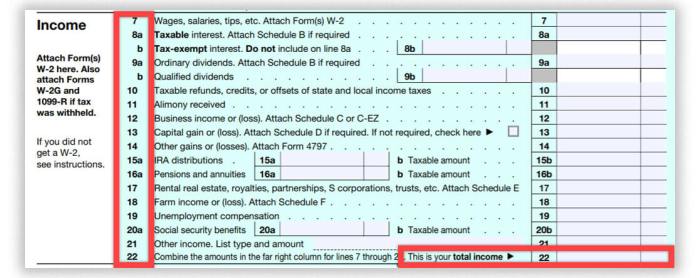

AGI could revolutionize the evaluation of eligibility for student loan forgiveness programs by automating the verification of applicant information. Currently, this process is often slow, manual, and prone to errors. AGI systems could cross-reference data from various sources – including tax returns (AGI data), loan servicer databases, and employment records – to quickly and accurately confirm applicant details and eligibility criteria. This would significantly reduce processing times and minimize instances of fraudulent applications. For example, AGI could identify inconsistencies between self-reported income and data obtained from tax filings, flagging potentially fraudulent claims for further investigation. Moreover, AGI could be trained to identify patterns indicative of potential fraud, such as unusually high numbers of applications originating from a single IP address or exhibiting similar application details.

AGI’s Predictive Capabilities for Economic Impact

AGI’s predictive modeling capabilities offer invaluable insights into the long-term economic consequences of various student loan forgiveness program designs. By analyzing historical data on loan forgiveness, economic indicators, and demographic trends, AGI can simulate the effects of different forgiveness models on key economic variables, such as consumer spending, GDP growth, and inflation. For instance, an AGI model could predict the potential increase in consumer spending following widespread loan forgiveness, factoring in variables like the income levels of borrowers and their repayment histories. Similarly, it could forecast the impact on the federal budget, considering the costs of forgiveness versus the potential economic benefits. A real-world example could involve simulating the impact of the Public Service Loan Forgiveness (PSLF) program, analyzing its actual outcomes and projecting potential adjustments based on various modification scenarios.

Potential Benefits and Drawbacks of Using AGI in Student Loan Forgiveness Programs

The use of AGI in student loan forgiveness programs presents both advantages and disadvantages that need careful consideration.

- Benefits: Increased efficiency and accuracy in eligibility verification; reduced processing times and costs; improved fraud detection; better prediction of economic impacts; fairer and more equitable distribution of resources.

- Drawbacks: Potential for bias in algorithms; concerns about data privacy and security; high initial investment costs; the need for ongoing maintenance and updates; reliance on accurate and comprehensive data sets.

The Role of AGI in Student Loan Counseling and Education

Artificial General Intelligence (AGI) offers transformative potential for improving student loan counseling and education. By leveraging its capabilities in data analysis, personalization, and interactive simulations, AGI can significantly enhance students’ understanding of their debt and empower them to make informed financial decisions. This leads to better outcomes, reduced stress, and improved financial well-being.

Personalized Financial Literacy Resources

AGI can analyze a student’s individual financial profile, including income, expenses, loan amounts, and repayment plans, to create personalized financial literacy resources tailored to their specific needs. For example, a student with high debt and low income might receive resources focused on income-driven repayment plans and debt management strategies, while a student with lower debt and higher income might receive resources focused on aggressive repayment strategies and long-term financial planning. This targeted approach ensures that students receive relevant and actionable information, maximizing the effectiveness of the counseling. This contrasts sharply with traditional, one-size-fits-all approaches that often fail to address the unique circumstances of individual borrowers.

Comparison of Traditional and AGI-Powered Counseling Methods

Traditional student loan counseling often relies on generic workshops, pamphlets, or one-on-one sessions with counselors. While valuable, these methods can lack personalization and may not effectively address the diverse needs and challenges faced by students. AGI-powered counseling, on the other hand, offers a dynamic and personalized experience. It can provide customized recommendations, simulate various repayment scenarios, and offer interactive tools to help students understand the implications of their borrowing decisions. This personalized approach allows for more effective engagement and a deeper understanding of complex financial concepts. For instance, an AGI system could identify a student at risk of default and proactively offer tailored resources and support, something a traditional system might miss.

Interactive Simulations for Understanding Long-Term Consequences

AGI can create sophisticated interactive simulations that allow students to visualize the long-term consequences of their borrowing decisions. Students can experiment with different repayment plans, interest rates, and income scenarios to see how these factors affect their total repayment costs and overall financial health. For example, a simulation could show the difference between choosing a standard repayment plan versus an income-driven repayment plan, illustrating the impact on monthly payments and total interest paid over the life of the loan. These interactive tools provide a powerful learning experience that goes beyond static information, fostering a deeper understanding of financial planning and responsible borrowing. This interactive element is crucial for effective learning and decision-making.

Step-by-Step Implementation of an AGI-Powered System

The implementation of an AGI-powered student loan counseling system requires a phased approach:

1. Data Collection and Integration: Gather relevant student data, including loan details, financial information, and educational background, ensuring data privacy and security compliance.

2. AGI Model Development: Develop an AGI model capable of analyzing student data, generating personalized recommendations, and creating interactive simulations. This requires expertise in machine learning and financial modeling.

3. System Design and Development: Design and develop a user-friendly interface for students to access the AGI-powered counseling system. This should be accessible on various devices and platforms.

4. Testing and Refinement: Thoroughly test the system to ensure accuracy, reliability, and user satisfaction. Refine the AGI model based on user feedback and performance data.

5. Deployment and Integration: Integrate the system with existing student loan platforms and counseling services. Provide training and support to counselors and students on using the system effectively.

6. Ongoing Monitoring and Evaluation: Continuously monitor the system’s performance and make adjustments as needed to optimize its effectiveness and ensure it meets the evolving needs of students.

Ethical Considerations of AGI in Student Loan Management

The integration of Artificial General Intelligence (AGI) into student loan management systems presents significant ethical challenges that demand careful consideration. While AGI offers the potential for improved efficiency and personalized support, its application must be approached with a strong ethical framework to mitigate potential harms and ensure equitable outcomes for all borrowers. Failure to do so risks exacerbating existing inequalities and undermining public trust.

Potential Biases in Algorithms

Algorithms used in student loan assessment and management are trained on historical data, which may reflect existing societal biases. For instance, an algorithm trained on data showing a higher default rate among borrowers from certain demographic groups might unfairly assign higher risk scores to individuals from those groups, leading to discriminatory lending practices or denial of loan modifications. This could manifest as algorithms prioritizing certain socioeconomic backgrounds over others when determining eligibility for loan forgiveness programs or repayment plans, perpetuating existing inequalities. Addressing this requires rigorous auditing of algorithms for bias, using techniques like fairness-aware machine learning and ensuring diverse and representative datasets are used for training.

Data Privacy Concerns

The use of AGI in student loan management necessitates the collection and analysis of vast amounts of sensitive personal data, including financial information, educational history, and even social media activity. This raises significant concerns about data privacy and security. Unauthorized access or misuse of this data could lead to identity theft, financial fraud, or reputational damage. Robust data protection measures, including encryption, anonymization techniques, and strict adherence to data privacy regulations like GDPR and CCPA, are crucial to mitigate these risks. Transparency regarding data collection practices and the purposes for which data is used is also essential to build borrower trust.

Exacerbation of Existing Inequalities

The application of AGI in student loan management, if not carefully designed and implemented, could exacerbate existing inequalities in access to higher education and loan repayment. For example, AGI-powered systems might inadvertently disadvantage borrowers from low-income backgrounds or those with limited digital literacy by prioritizing borrowers who are more technologically adept or have better access to resources. This could lead to a widening gap in educational opportunities and economic mobility. To prevent this, it is crucial to ensure that AGI systems are designed to be inclusive and accessible to all borrowers, regardless of their socioeconomic background or technological proficiency. This might involve providing multilingual support, offering alternative modes of interaction (beyond digital platforms), and actively addressing the digital divide.

Illustration of Ethical Dilemmas

Imagine an illustration depicting a scale. On one side, a meticulously crafted algorithm, representing the promise of efficiency and personalized support offered by AGI, is depicted. On the other side, a shadowy figure representing bias, data privacy breaches, and the exacerbation of inequalities, hangs precariously. The scale is unbalanced, with the negative consequences outweighing the positive potential. This visual representation powerfully highlights the ethical dilemmas inherent in the use of AGI in student loan systems and underscores the urgent need for responsible development and implementation that prioritizes fairness, transparency, and accountability. The image serves as a stark reminder that technological advancement must be guided by ethical considerations to ensure equitable outcomes for all.

Final Wrap-Up

The integration of AGI into student loan management presents both immense opportunities and significant challenges. While AGI holds the promise of streamlining processes, improving efficiency, and fostering greater financial literacy, careful consideration of ethical implications, data privacy, and potential biases in algorithms is crucial. Successfully navigating these complexities will be key to harnessing the power of AGI to create a more just and accessible higher education landscape for future generations.

Questions Often Asked

What are the potential downsides of using AGI in student loan processing?

Potential downsides include algorithmic bias leading to unfair treatment, data privacy breaches, and the risk of over-reliance on technology, potentially overlooking individual circumstances.

How could AGI impact the job market for student loan counselors?

AGI could automate some tasks currently performed by counselors, potentially reducing the need for certain roles while creating new opportunities in areas like AGI system development and oversight.

Will AGI completely replace human intervention in student loan management?

It’s unlikely AGI will completely replace human intervention. Instead, it’s more probable that AGI will augment human capabilities, improving efficiency and accuracy while still requiring human oversight and judgment in complex situations.

What regulations might be necessary to govern the use of AGI in student loan systems?

Regulations should focus on data privacy, algorithmic transparency, bias mitigation, and accountability mechanisms to ensure fair and equitable treatment for all borrowers.