Navigating the complexities of student loan repayment can feel overwhelming, but understanding your Aidvantage student loan account is key to financial freedom. This guide provides a comprehensive overview of managing your account, from logging in and viewing your balance to exploring repayment options and contacting customer service. We’ll demystify the process, empowering you to take control of your student loan debt.

Whether you’re a recent graduate facing your first loan payment or a seasoned borrower looking to optimize your repayment strategy, this resource offers practical advice and clear explanations of Aidvantage’s services. We cover essential topics like different repayment plans, deferment and forbearance options, and the benefits of loan consolidation, all designed to help you navigate your financial journey with confidence.

Account Access and Login

Accessing your Aidvantage student loan account is straightforward and designed for your convenience. You can manage your loans anytime, anywhere, using either our secure website or our user-friendly mobile application. Both options provide the same comprehensive access to your account information.

Accessing your account requires a username and password. Protecting this information is crucial for maintaining the security of your financial data.

Logging into your Aidvantage Account

To log in to your Aidvantage account, navigate to the Aidvantage website. You will find a prominent login button usually located in the upper right-hand corner of the homepage. Click this button and enter your username and password in the provided fields. After verifying the information, you will be granted access to your account dashboard. If you are using the mobile app, the login process is similar, with the username and password fields readily available on the app’s login screen.

Resetting a Forgotten Password

If you’ve forgotten your password, don’t worry; resetting it is simple. On the login page, locate the “Forgot Password” link or button. Clicking this will initiate the password reset process. You’ll typically be prompted to enter your username or the email address associated with your account. Aidvantage will then send a password reset link to your registered email address. Click this link and follow the instructions to create a new password. Remember to choose a strong password that includes a mix of uppercase and lowercase letters, numbers, and symbols.

Security Measures for Account Protection

Aidvantage employs robust security measures to protect your account information. These measures include encryption of data transmitted between your device and Aidvantage servers, multi-factor authentication options (where available), and regular security audits to identify and address potential vulnerabilities. Aidvantage also utilizes sophisticated fraud detection systems to monitor for suspicious activity and prevent unauthorized access. Your personal information is treated with the utmost confidentiality.

Accessing Account Information

Aidvantage offers two convenient ways to access your account information: through the website and via the mobile app. The website provides a comprehensive view of your account details, allowing you to make payments, view statements, and manage your loan details. The mobile app offers similar functionality, providing on-the-go access to your account information and allowing you to manage your loans from your smartphone or tablet. Both options offer a secure and user-friendly experience.

Loan Information and Repayment

Understanding your Aidvantage student loan details and repayment options is crucial for successful financial management. This section provides clear information on accessing your loan information, available repayment plans, and associated fees.

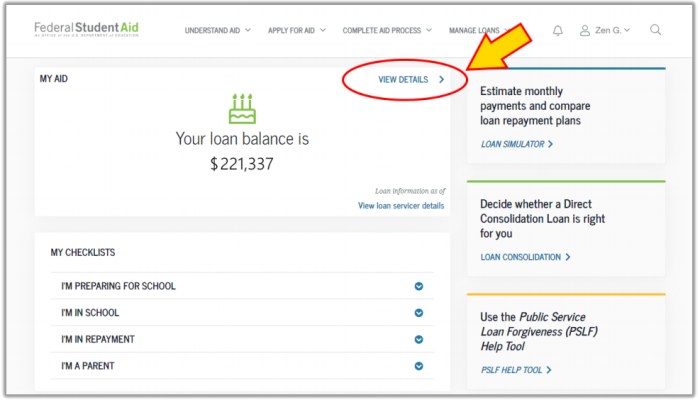

Accessing your loan balance and payment history is straightforward. Log in to your Aidvantage account. Once logged in, your dashboard will clearly display your current loan balance. A detailed payment history, including dates, amounts, and payment methods, is readily accessible through your account’s transaction history section. You can usually download this information as a PDF or CSV file for your records.

Repayment Plan Options

Aidvantage offers several repayment plans designed to accommodate various financial situations. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. Factors to consider include your income, expenses, and long-term financial goals.

The availability of specific plans may depend on your loan type and other factors. It is advisable to carefully review the details of each plan to determine which best suits your needs. Contacting Aidvantage directly for personalized guidance is also recommended.

Aidvantage Student Loan Fees

Several fees may be associated with your Aidvantage student loans. These fees can vary depending on your loan type and repayment plan. It’s essential to understand these fees to accurately budget for your loan repayments.

Common fees may include late payment fees, returned payment fees, and potentially fees for certain loan modifications or changes to your repayment plan. A detailed breakdown of fees applicable to your specific loan is available within your online account or by contacting Aidvantage customer service.

Repayment Plan Comparison

The following table compares the key features of several common Aidvantage repayment plans. Remember that specific details and availability may vary, so always refer to your loan agreement and the Aidvantage website for the most up-to-date information.

| Repayment Plan | Payment Amount | Repayment Term | Potential Benefits |

|---|---|---|---|

| Standard Repayment | Fixed monthly payment | 10 years (typically) | Simple, predictable payments |

| Graduated Repayment | Payments start low and gradually increase | 10 years (typically) | Lower initial payments, but higher payments later |

| Extended Repayment | Lower monthly payments | Up to 25 years | Lower monthly payments, but potentially higher total interest paid |

| Income-Driven Repayment (IDR) | Payment based on income and family size | 20-25 years | Payments are adjusted based on your income, potentially leading to lower monthly payments and loan forgiveness after a certain period |

Making Payments

Paying back your Aidvantage student loan is straightforward and can be managed through several convenient methods. We understand that managing your finances can be challenging, so we’ve designed a system to accommodate various payment preferences. Choosing the right method ensures timely payments and helps you avoid any potential late payment fees.

Making your payments on time is crucial for maintaining a positive credit history and avoiding negative consequences. Let’s explore the available options and the importance of consistent payments.

Payment Methods

Aidvantage offers several convenient ways to make your student loan payments. You can choose the method that best fits your lifestyle and financial habits. These options provide flexibility and ensure you can always stay on top of your repayment schedule.

- Online Payments: This is often the quickest and easiest method. You can log into your Aidvantage account and make a payment directly using your bank account or debit/credit card. This method provides immediate confirmation of your payment.

- Mail Payments: For those who prefer traditional methods, you can mail a check or money order to the address provided on your billing statement. Remember to include your loan account number for accurate processing. Allow sufficient time for postal delivery when using this method.

- Phone Payments: While less common, some lenders may offer phone payment options. You would typically provide your account information and payment details over the phone. However, this method is generally less secure and less efficient than online payments.

Setting Up Automatic Payments

Automating your loan payments simplifies the repayment process and eliminates the risk of missed payments. By setting up automatic payments, you authorize Aidvantage to deduct your monthly payment from your chosen bank account on your due date. This ensures consistent and timely payments, helping you maintain a good credit standing.

- Log in to your Aidvantage account.

- Navigate to the “Payments” section.

- Select “Set up Automatic Payments.”

- Provide your banking information (account number and routing number).

- Confirm your payment amount and frequency.

- Review and submit your information.

Consequences of Late or Missed Payments

Failing to make your student loan payments on time can have significant consequences. Late payments can result in late fees, damage your credit score, and potentially lead to loan default. A damaged credit score can affect your ability to obtain loans, credit cards, or even rent an apartment in the future. Loan default can have even more severe consequences, potentially leading to wage garnishment or legal action. It’s crucial to prioritize timely payments to avoid these negative outcomes.

Deferment and Forbearance

Managing your student loan payments can sometimes feel overwhelming, especially during life transitions. Understanding your options for temporary payment pauses, such as deferment and forbearance, is crucial for navigating these challenges. Both offer temporary relief from your monthly payments, but they differ significantly in their eligibility requirements and consequences.

Deferment and forbearance are temporary pauses in your student loan payments. They are available under certain circumstances, but it’s important to understand the distinctions between them to make the best choice for your situation. Improper use can have long-term implications, so carefully consider your options and their potential impact before applying.

Deferment Eligibility Criteria, Duration, and Credit Score Impact

Deferment is generally granted to borrowers facing specific financial hardships or life circumstances. It’s often viewed as a more favorable option than forbearance because it usually doesn’t negatively impact your credit score. However, interest may still accrue on unsubsidized loans during a deferment period.

| Eligibility Criteria | Duration | Impact on Credit Score |

|---|---|---|

| Unemployment; Enrollment in school at least half-time; Economic hardship; Military service; Deferment for parents of dependent children (in some cases) | Varies depending on the reason and loan type; can range from a few months to several years. | Generally, no negative impact. |

Forbearance Eligibility Criteria, Duration, and Credit Score Impact

Forbearance is a temporary suspension of your student loan payments granted when you are experiencing financial difficulty. Unlike deferment, forbearance is often granted on a case-by-case basis and may negatively affect your credit score if payments are missed. It’s crucial to contact your lender as soon as possible if you anticipate difficulty making payments.

| Eligibility Criteria | Duration | Impact on Credit Score |

|---|---|---|

| Financial hardship (demonstrated inability to make payments); Unforeseen circumstances (illness, natural disaster). | Varies depending on the lender and reason; can be granted for several months, potentially longer in some situations, but typically shorter than deferment periods. | Potentially negative impact; missed payments can be reported to credit bureaus. |

Contacting Aidvantage Customer Service

Reaching out to Aidvantage customer service is a crucial step if you encounter any issues with your student loan account. Whether you need clarification on your repayment plan, have questions about your account balance, or require assistance with a deferment request, having access to efficient and helpful customer service is paramount. This section provides you with the necessary information to effectively contact Aidvantage and resolve your concerns.

Aidvantage offers multiple channels for contacting their customer service department. Choosing the most appropriate method depends on the urgency of your inquiry and your personal preference.

Contact Information

Aidvantage provides several ways to get in touch. You can reach them by phone, email, or mail. Their phone number is typically available on their website and is often a toll-free number. While a specific email address may be listed on their website for general inquiries, it’s important to note that more complex or sensitive issues may require contacting them via phone. Finally, a mailing address is also available for sending written correspondence, though this method usually takes longer to receive a response. It’s recommended to always check the Aidvantage website for the most up-to-date contact information, as these details may change.

Typical Wait Times

Wait times for Aidvantage customer service can vary depending on several factors, including the time of day, day of the week, and the volume of calls. Generally, expect to spend some time on hold. Peak times, such as the beginning and end of the business day or during periods of high demand (e.g., tax season, loan disbursement periods), often result in longer wait times. While Aidvantage may not publicly state average wait times, anecdotal evidence suggests that wait times can range from a few minutes to over an hour during busy periods. Consider calling during off-peak hours to potentially minimize your wait time.

Tips for Effective Communication

Effective communication is key to resolving your issue quickly. Before contacting Aidvantage, gather all necessary information, such as your account number, loan details, and a clear description of your problem. When speaking with a representative, be polite and patient. Clearly and concisely explain your situation, and listen carefully to their responses. If you need to leave a message, ensure you provide all the necessary information for them to follow up effectively. Keeping a record of your interaction, including the date, time, and representative’s name (if provided), can be helpful for future reference.

Common Customer Service Issues and Resolutions

Understanding common issues and their typical resolutions can help you prepare for your interaction with Aidvantage.

- Issue: Difficulty accessing your online account. Resolution: Check your password for accuracy, reset your password if needed using the website’s password reset function, or contact customer service for assistance.

- Issue: Questions about your repayment plan. Resolution: Review your loan documents, use the online tools available on the Aidvantage website to explore different repayment options, or contact customer service for personalized guidance.

- Issue: Making a payment. Resolution: Use the online payment portal, follow the instructions provided on the website, or contact customer service if you encounter any difficulties.

- Issue: Requesting a deferment or forbearance. Resolution: Gather the necessary documentation, submit the request through the appropriate channels (online or mail), and follow up with customer service if you haven’t received a response within a reasonable timeframe.

- Issue: Inaccurate account information. Resolution: Provide Aidvantage with the correct information through the appropriate channels (online or mail), and follow up with customer service to confirm the update.

Understanding Loan Consolidation

Consolidating your student loans through Aidvantage can simplify your repayment process by combining multiple loans into a single, manageable payment. This can lead to a streamlined budgeting experience and potentially a more favorable interest rate, though it’s crucial to understand both the advantages and disadvantages before making a decision.

Loan consolidation isn’t a one-size-fits-all solution, and it’s essential to carefully weigh the potential benefits against any drawbacks specific to your financial situation. This section will guide you through the process, eligibility requirements, and a comparison of terms to help you make an informed choice.

Loan Consolidation Benefits and Drawbacks

Consolidating your loans with Aidvantage offers several potential benefits, including a simplified repayment schedule with a single monthly payment, and the possibility of a lower monthly payment amount (though the total interest paid may be higher over the life of the loan). However, it’s important to be aware of potential drawbacks. Consolidation may result in a longer repayment period, leading to higher overall interest costs compared to repaying individual loans aggressively. Furthermore, you may lose access to certain repayment plans or benefits available for specific loan types.

Applying for Loan Consolidation

The application process for loan consolidation through Aidvantage typically involves completing an online application form. This form will require information about your existing loans, including loan numbers, lenders, and outstanding balances. You’ll also need to provide personal information for verification purposes. After submitting your application, Aidvantage will review your information and notify you of the decision. It’s advisable to carefully review all documents and understand the terms of the consolidated loan before accepting the offer.

Loan Consolidation Eligibility Requirements

To be eligible for loan consolidation through Aidvantage, you must generally meet certain criteria. These may include having multiple federal student loans, being in good standing with your current lenders, and providing necessary documentation to verify your identity and loan information. Specific eligibility requirements may vary, so it’s essential to check Aidvantage’s website or contact their customer service for the most up-to-date information. Failure to meet these requirements will result in your application being rejected.

Comparison of Consolidated and Individual Loan Terms

The following table compares and contrasts the terms and conditions of consolidated loans versus individual loans. Remember that these are general comparisons, and your specific terms will depend on your individual loan details and the consolidation agreement.

| Feature | Consolidated Loan | Individual Loans |

|---|---|---|

| Number of Payments | One monthly payment | Multiple monthly payments |

| Interest Rate | Weighted average of individual loan rates (potentially higher or lower) | Varying interest rates for each loan |

| Repayment Term | Potentially longer than the shortest individual loan term | Varying terms for each loan |

| Repayment Plan Options | May have fewer options than available with individual loans | Wider range of repayment plan options potentially available |

| Total Interest Paid | Potentially higher due to longer repayment term | Potentially lower if loans are repaid aggressively |

Managing Your Account Online

Your Aidvantage online account portal provides a convenient and secure way to manage your student loan accounts 24/7. This self-service platform offers a range of features designed to streamline your loan management process, saving you time and effort. You can access your account from any computer or mobile device with an internet connection.

The online portal provides a comprehensive view of your loan information, allowing you to monitor your account activity, make payments, and update your personal details efficiently. It’s a central hub for all your student loan needs, offering greater control and transparency over your financial obligations.

Updating Personal Information

Updating your contact information is crucial to ensure you receive important notifications regarding your loan account. The online portal makes this process straightforward. To update your address or phone number, simply log in to your account, navigate to the “Personal Information” section (usually found under a “Profile” or “Account Settings” tab), and follow the on-screen prompts to make the necessary changes. You’ll typically be required to verify your identity before making any updates. Remember to save your changes after completing the update. Accurate information ensures timely communication from Aidvantage regarding payments, important deadlines, and other relevant updates.

Enrolling in Email or Text Alerts

Staying informed about your loan payments is vital for avoiding late fees and maintaining a good credit history. Aidvantage’s online portal allows you to subscribe to email or text message alerts that remind you of upcoming payment deadlines. To enroll, log in to your account and locate the “Alerts” or “Notifications” section. Select your preferred communication method (email or text) and specify the frequency of alerts (e.g., daily, weekly). You’ll need to provide a valid email address or mobile phone number. These timely reminders can help you manage your payments effectively and prevent any potential late payment issues.

Downloading Account Statements

Accessing and downloading your account statements is a simple process through the online portal. This allows you to maintain accurate records of your payment history and loan balances. To download a statement, log in to your account and locate the “Statements” or “Documents” section. You’ll typically find a list of available statements, usually organized chronologically. Select the statement you need and click the “Download” button. The statement will likely be downloaded as a PDF file, which you can then save to your computer or mobile device for your records. Regularly reviewing your statements helps you monitor your loan progress and ensure accuracy.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payment on your income and family size. Several plans are available, each with its own eligibility requirements and calculation methods. Choosing the right plan depends on your individual financial circumstances and long-term goals.

Types of Income-Driven Repayment Plans

Several federal income-driven repayment plans exist. Understanding their differences is crucial for selecting the most suitable option. These plans generally offer lower monthly payments than standard repayment plans, potentially resulting in longer repayment periods and increased overall interest paid.

Applying for an Income-Driven Repayment Plan

The application process for an IDR plan typically involves completing a form that requires information about your income and family size. This information is used to calculate your monthly payment. You’ll need to recertify your income annually to maintain your plan. The application can usually be completed online through the student loan servicer’s website. You’ll need to provide documentation to support your income and family size, such as tax returns or pay stubs. The exact process might vary slightly depending on your loan servicer and the specific IDR plan you choose.

Eligibility Criteria for Income-Driven Repayment Plans

Eligibility criteria vary slightly among the different IDR plans, but generally, you must have federal student loans and be enrolled in or have completed a qualifying repayment plan. Specific income thresholds may apply, and you’ll need to provide documentation to verify your income and family size. Certain types of loans may not be eligible for all IDR plans.

Comparison of Key Features of Income-Driven Repayment Plans

Imagine a table visualizing the key features. Each row represents a different IDR plan (e.g., Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), Income-Contingent Repayment (ICR)). The columns would include: Plan Name, Eligibility Requirements (including income thresholds and loan types), Payment Calculation Formula (a simplified description), Maximum Repayment Period, and Forgiveness Eligibility (after 20 or 25 years, depending on the plan). For example, one row might show: Plan Name: IBR; Eligibility Requirements: Federal student loans, income below a certain threshold; Payment Calculation Formula: Based on discretionary income and family size; Maximum Repayment Period: 25 years; Forgiveness Eligibility: Remaining balance forgiven after 25 years of payments. Each plan would have its own row with its specific details, allowing for a clear comparison. Note that the exact formulas and eligibility criteria can be complex and should be verified on the official government websites.

Closure

Successfully managing your Aidvantage student loan account requires proactive engagement and a clear understanding of your options. By utilizing the online portal, understanding repayment plans, and proactively contacting customer service when needed, you can effectively manage your debt and work towards a financially secure future. Remember, informed decisions lead to better outcomes, so take advantage of the resources available to you and stay engaged with your account.

FAQ

What happens if I miss a payment?

Missing a payment can result in late fees, negatively impact your credit score, and potentially lead to further collection actions. Contact Aidvantage immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

How can I update my contact information?

Log into your Aidvantage account online and navigate to your profile settings. There you can update your address, phone number, and email address.

Can I pay my loan early?

Yes, you can make extra payments on your loan at any time without penalty. Paying ahead can significantly reduce the total interest you pay over the life of the loan.

What is the difference between deferment and forbearance?

Deferment temporarily suspends your payments, often due to specific circumstances like returning to school. Forbearance also temporarily suspends or reduces payments, but is generally granted for reasons of financial hardship.