Navigating the complex world of student loans can feel overwhelming, but understanding the various types, application processes, and management strategies is crucial for your financial future. This guide provides a comprehensive overview, equipping you with the knowledge to make informed decisions and successfully manage your student loan debt.

From understanding the differences between federal and private loans to exploring repayment options and avoiding potential scams, we’ll cover all aspects of the student loan journey. We’ll also delve into strategies for budgeting, managing debt effectively, and exploring potential forgiveness programs. The goal is to empower you with the tools and information necessary to confidently handle your student loan responsibilities.

Types of Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the fundamental differences between loan types is crucial for making informed financial decisions. This section will clarify the distinctions between federal and private student loans, outlining repayment plans and comparing interest rates and fees.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government through programs like Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Private student loans, conversely, are provided by banks, credit unions, and other private lenders. A key difference lies in eligibility and borrower protections. Federal loans typically have more flexible repayment options and offer borrower protections such as deferment and forbearance during periods of financial hardship. Private loans, while potentially offering higher loan amounts, often have stricter eligibility requirements and may lack the same borrower protections. Furthermore, interest rates and fees can vary significantly between federal and private loans, impacting the overall cost of borrowing.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, each tailored to different financial situations. The Standard Repayment Plan involves fixed monthly payments over 10 years. Other options include Graduated Repayment, which starts with lower payments that gradually increase over time; Extended Repayment, offering longer repayment periods (up to 25 years); and Income-Driven Repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), which base monthly payments on your income and family size. Choosing the right plan depends on individual circumstances and financial goals.

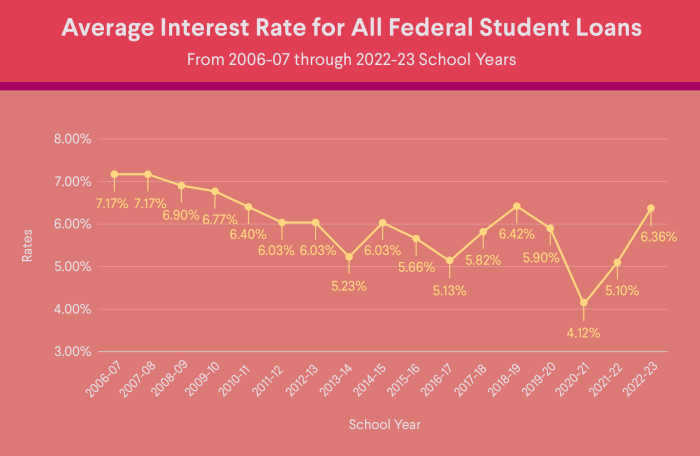

Interest Rates and Fees

Interest rates and fees for student loans vary significantly depending on the loan type, lender, and creditworthiness of the borrower. Federal student loans generally have lower interest rates than private loans, particularly for students with strong credit histories. Private loan interest rates are often variable, meaning they can fluctuate over the life of the loan, while some federal loans offer fixed interest rates. Fees associated with student loans can include origination fees (charged by the lender), late payment fees, and prepayment penalties (though these are less common with federal loans). It’s crucial to carefully compare interest rates and fees from multiple lenders before choosing a loan.

Student Loan Comparison Table

| Loan Type | Lender | Interest Rate | Repayment Options |

|---|---|---|---|

| Direct Subsidized Loan | U.S. Department of Education | Variable; depends on loan year | Standard, Graduated, Extended, Income-Driven |

| Direct Unsubsidized Loan | U.S. Department of Education | Variable; depends on loan year | Standard, Graduated, Extended, Income-Driven |

| Direct PLUS Loan | U.S. Department of Education | Variable; depends on loan year | Standard, Extended, Income-Driven |

| Private Student Loan | Banks, Credit Unions, etc. | Variable; depends on creditworthiness | Varies by lender; may include options similar to federal loans but often with less flexibility. |

Applying for Student Loans

Securing funding for higher education often involves navigating the complexities of student loan applications. Understanding the process for both federal and private loans is crucial for a smooth and successful application experience. This section Artikels the steps involved, necessary documentation, and a comprehensive guide to help students through the application process.

Federal Student Loan Application (FAFSA)

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student loans. Completing the FAFSA accurately and on time is essential to maximizing your eligibility for grants and loans. The application process involves providing detailed information about your financial situation and educational plans. This information is used to determine your Expected Family Contribution (EFC) and your eligibility for various federal aid programs.

Private Student Loan Application

Unlike federal loans, private student loans are offered by banks, credit unions, and other private lenders. The application process for private loans generally involves a more rigorous credit check and often requires a co-signer, especially for students with limited or no credit history. Lenders assess your creditworthiness, academic standing, and repayment ability to determine your eligibility and interest rate.

Required Documentation for Federal and Private Loan Applications

The documentation needed for both federal and private loan applications varies, but there are some common requirements. Federal loan applications (FAFSA) primarily require financial information from both the student and their parents (if dependent). Private loan applications often require additional documentation such as tax returns, bank statements, and proof of enrollment.

- Federal Loans (FAFSA): Social Security numbers, tax returns (yours and your parents’), W-2s, bank statements, and information about assets.

- Private Loans: Social Security number, driver’s license or state ID, proof of enrollment, transcripts, co-signer information (if required), tax returns, bank statements, and credit history information.

Step-by-Step Guide for Applying for Student Loans

Careful planning and organization are key to a successful student loan application. Following these steps will help streamline the process and increase your chances of securing the funding you need.

- Determine your financial need: Estimate the total cost of your education, including tuition, fees, room and board, and other expenses. Subtract any financial aid you’ve already received (scholarships, grants) to determine the remaining amount you need to borrow.

- Complete the FAFSA: Gather all the necessary documentation and complete the FAFSA form online at studentaid.gov. Submit your FAFSA as early as possible to ensure timely processing.

- Review your Student Aid Report (SAR): Carefully review your SAR for accuracy. Correct any errors promptly. This report summarizes your eligibility for federal student aid.

- Explore federal loan options: Understand the different types of federal student loans (Subsidized, Unsubsidized, PLUS) and choose the option that best fits your needs and financial situation.

- Research and compare private loan options: If you need additional funding beyond federal loans, shop around and compare interest rates, fees, and repayment terms from different private lenders. Compare offers carefully before accepting a loan.

- Accept your loan offers: Once you’ve chosen your loan(s), accept the offer(s) and sign the necessary promissory notes.

- Understand your repayment responsibilities: Before accepting a loan, understand your repayment obligations, including interest rates, repayment terms, and potential penalties for late payments.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and consistent effort. Understanding repayment strategies, budgeting effectively, and avoiding common pitfalls are crucial for minimizing financial strain and achieving long-term financial stability. This section will provide practical strategies and resources to help you manage your student loan debt effectively.

Effective Budgeting Strategies for Student Loan Payments

Creating a realistic budget is the cornerstone of effective student loan management. This involves tracking your income and expenses meticulously to identify areas where you can cut back and allocate funds towards your loan payments. Consider using budgeting apps or spreadsheets to monitor your spending habits and create a visual representation of your financial situation. Prioritizing loan payments within your budget ensures timely repayments and avoids late payment fees. A key aspect is to build an emergency fund to cover unexpected expenses, preventing you from falling behind on your loan payments due to unforeseen circumstances. Remember, consistency is key; stick to your budget as much as possible to maintain control of your finances.

Common Pitfalls to Avoid When Dealing with Student Loan Debt

Ignoring your student loans or delaying repayment can lead to significant consequences. Forgetting due dates can result in late fees and negatively impact your credit score. Failing to explore repayment options, such as income-driven repayment plans, could lead to unnecessary financial hardship. Consolidating loans without fully understanding the terms and conditions could potentially increase your overall interest payments. Overspending and neglecting your budget can also make loan repayment difficult. Furthermore, relying solely on minimum payments often extends the repayment period and increases the total interest paid over the life of the loan. Finally, neglecting to contact your loan servicer when facing financial difficulties can lead to further complications.

Budgeting Tools and Resources for Managing Student Loan Debt

Numerous tools and resources are available to assist in managing student loan debt. Many budgeting apps, such as Mint or YNAB (You Need A Budget), allow you to track income and expenses, categorize spending, and create customized budgets. Spreadsheets, like those in Microsoft Excel or Google Sheets, provide a flexible platform for manual budget creation and tracking. Government websites, such as the Federal Student Aid website (studentaid.gov), offer valuable information on repayment plans and loan management strategies. Financial literacy websites and educational resources provide guidance on budgeting and financial planning. Finally, seeking advice from a financial advisor can offer personalized strategies tailored to your individual circumstances.

Sample Budget Allocating Funds for Student Loan Payments

| Income | Amount |

|---|---|

| Monthly Net Income | $3000 |

| Expenses | Amount |

| Housing | $1000 |

| Transportation | $300 |

| Food | $500 |

| Utilities | $200 |

| Student Loan Payment | $500 |

| Savings/Emergency Fund | $500 |

This is a sample budget and should be adjusted based on individual income and expenses. The key is to allocate a sufficient amount to your student loan payment while maintaining a comfortable living standard and building an emergency fund. Remember to adjust your budget regularly to reflect any changes in income or expenses.

Student Loan Forgiveness and Repayment Programs

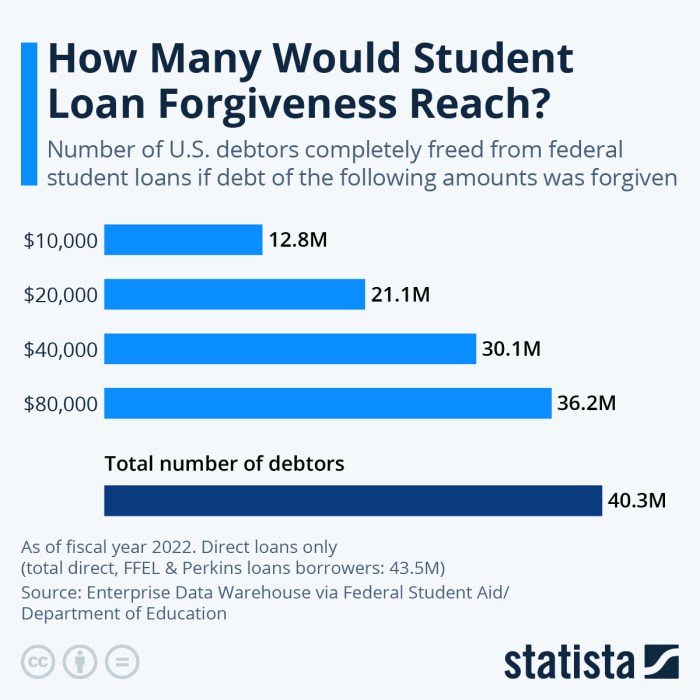

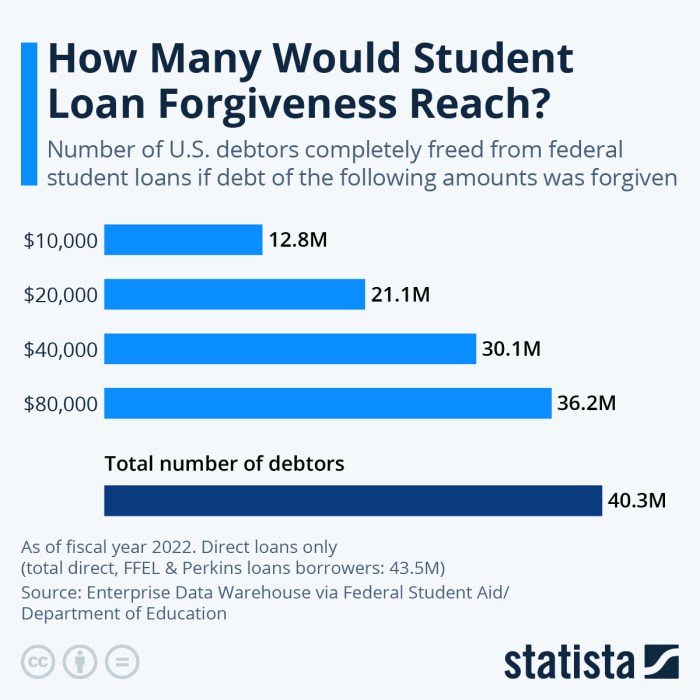

Navigating the complexities of student loan repayment can be daunting. Fortunately, several federal programs exist to help borrowers manage their debt and, in some cases, achieve complete forgiveness. Understanding these programs and their eligibility criteria is crucial for effective debt management. This section details various forgiveness and repayment options available to student loan borrowers.

Eligibility Criteria for Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each with specific eligibility requirements. These programs often target borrowers working in public service, those with disabilities, or those who experienced specific types of hardship. Meeting the precise criteria for a particular program is essential for successful application. Factors such as loan type, employment history, income level, and the type of degree earned all play a role in determining eligibility. For instance, the Public Service Loan Forgiveness (PSLF) program has strict requirements regarding the type of employer and the type of repayment plan used. Careful review of program guidelines is crucial before applying.

Income-Driven Repayment Plans: Requirements and Benefits

Income-driven repayment (IDR) plans offer a flexible approach to student loan repayment by basing monthly payments on your income and family size. This means that your payments can be significantly lower than under a standard repayment plan, making repayment more manageable, particularly during periods of lower income. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has slightly different eligibility criteria and calculation methods. A key benefit is the potential for loan forgiveness after a specified period of qualifying payments, typically 20 or 25 years, depending on the plan. However, it’s crucial to understand that the remaining loan balance may be subject to taxation upon forgiveness.

Comparison of Student Loan Repayment Programs

Different student loan repayment programs cater to various borrower needs and circumstances. Standard repayment plans offer fixed monthly payments over a 10-year period. However, these payments can be substantial, making them challenging for some borrowers. In contrast, IDR plans provide lower monthly payments but extend the repayment period, potentially leading to higher overall interest paid. Loan forgiveness programs, such as PSLF, offer the possibility of complete loan forgiveness after a set number of qualifying payments but have stringent eligibility requirements. The best repayment plan depends on individual financial circumstances and long-term goals. Careful consideration of the trade-offs between payment amount, repayment period, and potential forgiveness is essential.

Student Loan Forgiveness Programs: A Summary

The following table summarizes key information on several prominent student loan forgiveness programs. Remember that program details and eligibility criteria can change, so it is always advisable to check the official government website for the most up-to-date information.

| Program Name | Eligibility Requirements | Benefits | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Work full-time for a qualifying government or non-profit organization; make 120 qualifying monthly payments under an IDR plan. | Forgiveness of the remaining federal student loan balance. | Apply through the Federal Student Aid website; requires documentation of employment and loan repayment history. |

| Teacher Loan Forgiveness | Work full-time for five consecutive academic years at a low-income school; teach in a subject area with a shortage of qualified teachers. | Forgiveness of up to $17,500 in federal student loans. | Apply through the Federal Student Aid website; requires documentation of employment and teaching experience. |

| Income-Driven Repayment (IDR) Plans (IBR, PAYE, REPAYE, ICR) | Federal student loans; meet income requirements. | Lower monthly payments based on income; potential for loan forgiveness after 20 or 25 years of qualifying payments. | Apply through your loan servicer; requires annual income and family size updates. |

| Total and Permanent Disability (TPD) Discharge | Documentation of total and permanent disability from the Social Security Administration or the Department of Veterans Affairs. | Discharge of all federal student loans. | Apply through your loan servicer; requires medical documentation. |

The Impact of Student Loans on Personal Finances

Student loan debt can significantly influence your financial well-being for years, even decades, after graduation. Understanding the long-term implications and proactively managing your debt is crucial for achieving your financial goals. Failing to do so can lead to serious consequences that impact your credit score, savings potential, and overall quality of life.

The weight of student loan repayments can dramatically affect your ability to save for major life events and investments. Monthly payments reduce disposable income, limiting your capacity to build an emergency fund, contribute to retirement accounts, or save for a down payment on a home. This can lead to delayed milestones and reduced financial security in the long run.

Long-Term Financial Implications of Student Loan Debt

Student loan debt can create a ripple effect across various aspects of your financial life. High monthly payments can restrict your ability to save for retirement, hindering the accumulation of necessary funds for a comfortable post-retirement life. Furthermore, the debt can impact your credit score, making it more difficult to secure loans for major purchases like a car or a house, or even obtaining favorable interest rates on other loans. The extended repayment period also means that a significant portion of your income may be committed to loan repayment for many years, impacting your capacity for other financial commitments. For example, someone with $50,000 in student loan debt at a 7% interest rate and a 10-year repayment plan would pay approximately $600 per month and over $12,000 in interest over the life of the loan. This significantly reduces the amount of money available for other financial priorities.

Minimizing the Impact of Student Loans on Future Financial Goals

Strategic planning and disciplined financial habits can help mitigate the impact of student loan debt on future goals. Creating a realistic budget that prioritizes loan repayments while still allowing for savings is essential. Exploring income-driven repayment plans, which adjust monthly payments based on your income, can provide temporary relief. Additionally, focusing on high-yield savings and investment opportunities, even with smaller amounts, can help build wealth over time, offsetting the financial burden of the debt. For instance, consistently contributing to a retirement account, even a small amount each month, can take advantage of compounding interest and potentially significantly boost your retirement savings over the long term.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe repercussions. It severely damages your credit score, making it extremely difficult to obtain loans, rent an apartment, or even secure certain jobs. Wage garnishment, tax refund offset, and even legal action are potential consequences. Furthermore, defaulting can impact your ability to obtain government benefits or certain professional licenses. The long-term financial implications of default are substantial and far-reaching, making it a last resort to be avoided at all costs. For example, a default could lead to the collection agencies aggressively pursuing the outstanding balance, potentially leading to further fees and legal action.

Illustrative Example of Interest Accrual

Imagine a $30,000 student loan with a 5% annual interest rate. Without any payments, the interest alone would add approximately $1,500 to the principal balance in the first year. Year two would see interest calculated on the now-larger principal, leading to an even greater increase. This snowball effect demonstrates how interest can dramatically inflate the total amount owed over time. A visual representation would show a steadily increasing curve, starting at $30,000 and rising sharply as the years progress, showcasing the significant impact of compounded interest on the overall loan balance. This visual would clearly depict how a small initial debt can balloon into a much larger amount over time due to the accumulation of interest. A table would clearly show the increase in the principal balance year over year, further emphasizing the compounding effect of interest.

Student Loan Scams and Avoiding Them

Navigating the student loan process can be complex, making individuals vulnerable to scams. Understanding common tactics and red flags is crucial for protecting yourself from financial exploitation. This section will Artikel strategies to identify and avoid fraudulent student loan offers.

Common Tactics Used in Student Loan Scams

Fraudulent student loan schemes often employ deceptive tactics to lure unsuspecting borrowers. These tactics frequently involve promises that are too good to be true, high-pressure sales techniques, and a lack of transparency. Scammers may falsely claim to offer government-backed loans with exceptionally low interest rates or loan forgiveness programs that don’t exist. They might also pressure applicants to provide personal information quickly, without allowing time for thorough research. Another common tactic involves impersonating legitimate lenders or government agencies.

Red Flags Indicating Potential Student Loan Scams

Several warning signs can indicate a potential student loan scam. These red flags should trigger caution and prompt further investigation before proceeding with any loan application. Unsolicited offers of student loans, particularly those received via email or text message, are often a major red flag. Requests for upfront fees or payments before loan disbursement should be viewed with extreme suspicion, as legitimate lenders do not typically require such payments. Guarantees of loan approval regardless of credit history or income are another major indicator of a scam. Furthermore, pressure to make quick decisions without sufficient time for review or comparison shopping is a significant warning sign. Finally, any communication that seems unprofessional, uses vague language, or lacks clear contact information should raise serious concerns.

Protecting Yourself from Student Loan Fraud

Safeguarding yourself from student loan scams requires vigilance and proactive measures. Always research lenders thoroughly before applying for a loan. Verify the lender’s legitimacy through the Department of Education’s website or other reliable sources. Never share personal information, such as your Social Security number or bank account details, unless you are absolutely certain of the recipient’s legitimacy. Be wary of unsolicited offers, and never pay upfront fees for a student loan. If something seems too good to be true, it probably is. Take your time, compare offers from multiple lenders, and read all documents carefully before signing anything. Finally, report any suspected scams to the appropriate authorities, such as the Federal Trade Commission (FTC).

Verifying the Legitimacy of a Student Loan Lender or Servicer

Verifying the legitimacy of a student loan lender or servicer is a critical step in avoiding scams. Begin by checking the lender’s or servicer’s registration with the appropriate government agencies. For federal student loans, verify the lender’s participation in the federal student loan program through the Department of Education’s website. For private student loans, confirm the lender’s licensing and registration with state regulatory bodies. Compare the lender’s contact information with publicly available information to ensure consistency. Look for reviews and complaints from other borrowers online. A high volume of negative reviews or complaints may indicate a problematic lender. If you have any doubts about a lender’s legitimacy, contact the Department of Education or your state’s attorney general’s office for assistance.

Closing Summary

Successfully managing student loan debt requires careful planning, proactive engagement, and a thorough understanding of available resources. By understanding the various loan types, application processes, repayment options, and potential pitfalls, you can navigate this significant financial commitment effectively. Remember to utilize available resources, budget diligently, and stay informed to ensure a positive outcome for your financial well-being.

FAQ Summary

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, refinancing federal loans into private loans means losing federal protections like income-driven repayment plans. Carefully weigh the pros and cons before refinancing.

How long does it take to repay student loans?

The repayment period varies depending on the loan type, amount borrowed, and repayment plan chosen. Standard repayment plans typically last 10 years, but other plans may extend the repayment period.

What is the difference between forbearance and deferment?

Both temporarily suspend or reduce your payments, but deferment typically doesn’t accrue interest on subsidized federal loans, while forbearance often does.