The weight of student loan debt in the United States is a significant factor impacting the financial well-being of millions. This pervasive issue affects not only individual borrowers but also the broader economy, influencing everything from homeownership rates to long-term economic growth. Understanding the complexities of all student loans—federal, private, and their various repayment plans—is crucial for navigating this challenging landscape.

This overview delves into the current state of student loan debt, examining its impact on individuals’ financial decisions, exploring government policies and programs designed to offer assistance, and analyzing the role of private student loans. We’ll also consider future trends and potential solutions to this growing national concern, providing a balanced perspective on this multifaceted issue.

The Current State of All Student Loans

The student loan debt crisis in the United States is a significant economic and social issue, impacting millions of borrowers and the overall financial health of the nation. Understanding the current state of this debt is crucial for developing effective solutions and mitigating its long-term consequences. This section provides an overview of key statistics and trends related to student loan debt in the US.

Total Outstanding Student Loan Debt

The total amount of outstanding student loan debt in the United States is staggering. As of the second quarter of 2023, the total exceeded $1.7 trillion. This figure represents a substantial portion of the overall national debt and continues to grow, despite recent payment pauses and forgiveness programs. This massive debt burden significantly impacts borrowers’ financial well-being and hinders their ability to achieve financial stability, such as purchasing homes or starting businesses.

Breakdown of Student Loan Debt by Loan Type

The majority of student loan debt is comprised of federal student loans, which are offered by the government through various programs. Private student loans, offered by banks and other financial institutions, constitute a smaller, but still significant, portion of the total debt. While precise percentages fluctuate, federal loans typically account for approximately 85-90% of the total outstanding student loan debt, leaving the remaining 10-15% to private loans. The differences in terms, interest rates, and repayment options between these two types of loans significantly impact borrowers’ experiences.

Student Loan Delinquency and Default Rates

Delinquency and default rates on student loans provide a critical indicator of the financial strain experienced by borrowers. Delinquency refers to missed or late payments, while default occurs when a borrower fails to make payments for an extended period. These rates vary depending on loan type and borrower characteristics. Historically, default rates on federal student loans have been higher than those on private loans, reflecting the potential consequences for borrowers who fail to meet their obligations. Accurate, up-to-the-minute data on these rates requires consultation with government sources like the Department of Education.

Average Student Loan Debt per Borrower

The average amount of student loan debt per borrower varies significantly depending on factors such as the level of education pursued, the type of institution attended, and the borrower’s field of study. However, a reasonable estimate places the average debt per borrower in the tens of thousands of dollars. This figure, while an average, masks the reality of many borrowers who owe significantly more. The high average reflects the increasing costs of higher education and the growing reliance on student loans to finance tuition and living expenses.

Average Student Loan Debt by Educational Level

The following table compares the average student loan debt across different educational levels. It’s important to note that these are averages and individual experiences can vary widely. Data sources for these figures include government reports and independent studies on student loan debt.

| Educational Level | Average Student Loan Debt |

|---|---|

| Associate’s Degree | $20,000 – $25,000 |

| Bachelor’s Degree | $30,000 – $40,000 |

| Graduate Degree | $50,000 – $70,000+ |

The Impact of Student Loan Debt on Individuals

Student loan debt significantly impacts borrowers’ financial well-being and life choices, extending beyond the immediate repayment period. The weight of this debt can create a ripple effect, influencing major financial decisions and significantly affecting mental health. Understanding these consequences is crucial for developing effective strategies for managing and mitigating the burden of student loan debt.

Effects on Financial Decisions

The substantial burden of student loan repayments often forces borrowers to make difficult financial compromises. Many postpone major life milestones such as homeownership, finding themselves unable to save for a down payment or meet the ongoing costs of mortgage payments while simultaneously servicing their loans. Similarly, investing for the future, whether it be retirement savings or other long-term goals, often takes a backseat to immediate loan repayment obligations. This can lead to a cycle of debt, hindering long-term financial security and wealth accumulation. For example, a recent graduate with $50,000 in student loan debt at a 6% interest rate might face monthly payments exceeding $500, leaving little room in their budget for saving or investing.

Challenges Faced by Borrowers

Borrowers struggling with student loan repayments frequently encounter significant financial challenges. Late payments can result in penalties and increased interest charges, exacerbating the debt burden. Difficulty meeting minimum payments can lead to default, resulting in damaged credit scores, wage garnishment, and potential legal action. Many borrowers find themselves forced to make difficult choices between paying for necessities like food and housing, and meeting their loan obligations. The stress and anxiety associated with managing these competing financial demands can be overwhelming.

Impact on Mental Health and Well-being

The persistent pressure of student loan debt can significantly impact mental health and overall well-being. Chronic stress related to financial insecurity and the overwhelming feeling of being trapped in a cycle of debt can lead to anxiety, depression, and other mental health issues. The constant worry about repayment can affect sleep, relationships, and overall quality of life. The long-term effects of this chronic stress can be severe, impacting both physical and mental health.

Comparison of Financial Situations

Individuals without significant student loan debt typically enjoy greater financial flexibility and freedom. They have more disposable income available for saving, investing, and pursuing other financial goals. They are also less likely to face the stress and anxiety associated with managing substantial loan repayments. In contrast, borrowers with significant student loan debt often experience constrained financial choices, limiting their ability to save, invest, and make major life purchases like a home or car. This disparity highlights the profound impact student loan debt has on shaping individuals’ financial trajectories.

Hypothetical Budget for a Recent Graduate with Significant Student Loan Debt

A recent graduate with $50,000 in student loan debt at a 6% interest rate, earning $50,000 annually, might have a budget like this:

| Category | Monthly Amount |

|---|---|

| Student Loan Payment | $500 |

| Rent | $1200 |

| Utilities | $200 |

| Groceries | $400 |

| Transportation | $200 |

| Health Insurance | $200 |

| Savings/Investing | $100 |

| Other Expenses | $200 |

| Total | $2100 |

This budget illustrates the limited funds available for saving and investing after essential expenses and loan repayments are met. It highlights the financial constraints faced by many recent graduates with substantial student loan debt. Note: This is a simplified example, and actual expenses will vary depending on individual circumstances and location.

Government Policies and Programs Related to Student Loans

The United States government plays a significant role in the student loan system, offering various programs designed to make higher education more accessible and manageable. These programs encompass a range of loan types, repayment options, and forgiveness initiatives, each with its own set of eligibility criteria and benefits. Understanding these programs is crucial for borrowers to navigate the complexities of student loan repayment effectively.

Major Federal Student Loan Programs

The federal government offers several student loan programs, primarily categorized as Direct Loans. These loans are disbursed directly by the Department of Education, eliminating the involvement of private lenders and generally offering more favorable terms. Key programs include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans for graduate students and parents of undergraduates, and Direct Consolidation Loans, which allow borrowers to combine multiple loans into a single one. Each loan type has different eligibility requirements and interest rates. For instance, subsidized loans don’t accrue interest while the borrower is in school, whereas unsubsidized loans do. PLUS loans are available to those who meet certain credit requirements. Consolidation loans simplify repayment but may not necessarily lower the overall interest rate.

Federal Student Loan Repayment Plans

The federal government offers a variety of repayment plans to accommodate different financial situations. These plans vary in terms of monthly payments, loan term lengths, and overall interest paid. Standard repayment plans involve fixed monthly payments over a 10-year period. Extended repayment plans stretch the repayment period to up to 25 years, reducing monthly payments but increasing the total interest paid. Graduated repayment plans start with lower monthly payments that gradually increase over time. Income-driven repayment (IDR) plans, discussed further below, base monthly payments on a borrower’s income and family size.

Applying for Student Loan Forgiveness or Discharge

Student loan forgiveness or discharge programs eliminate the borrower’s responsibility for the remaining loan balance under specific circumstances. These programs often require meeting stringent eligibility requirements and may involve lengthy application processes. Forgiveness programs may be available to borrowers working in public service, those with disabilities, or those who have experienced certain types of fraud. Discharge may be granted in cases of death, total and permanent disability, or bankruptcy (though this is rare). The application process typically involves submitting extensive documentation to verify eligibility.

Comparison of Income-Driven Repayment Plans

Income-driven repayment (IDR) plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), link monthly payments to the borrower’s discretionary income and family size. These plans offer lower monthly payments than standard plans, but they typically extend the repayment period and result in higher total interest paid over the life of the loan. The specific details of each IDR plan vary slightly, influencing the calculation of monthly payments and the length of the repayment period. Choosing the most appropriate IDR plan depends on individual financial circumstances and long-term goals.

Resources for Borrowers Seeking Assistance

Navigating the student loan system can be challenging. Fortunately, several resources are available to provide support and guidance.

- The Federal Student Aid website (StudentAid.gov): This website provides comprehensive information about federal student loan programs, repayment options, and forgiveness opportunities.

- Your loan servicer: Your loan servicer is responsible for managing your student loans. They can answer questions about your account, payment options, and available programs.

- National Student Loan Data System (NSLDS): This system provides a central location to access your federal student loan information.

- Local non-profit credit counseling agencies: These agencies offer free or low-cost assistance with student loan repayment planning and debt management.

- The Department of Education’s Office of Federal Student Aid: This office can answer questions about federal student aid programs and provide assistance with resolving loan issues.

The Role of Private Student Loans

Private student loans represent a significant, albeit often complex, component of the higher education financing landscape. Unlike federal loans, they are offered by private institutions such as banks, credit unions, and online lenders, and they come with a distinct set of terms, benefits, and risks. Understanding these differences is crucial for prospective borrowers to make informed decisions about financing their education.

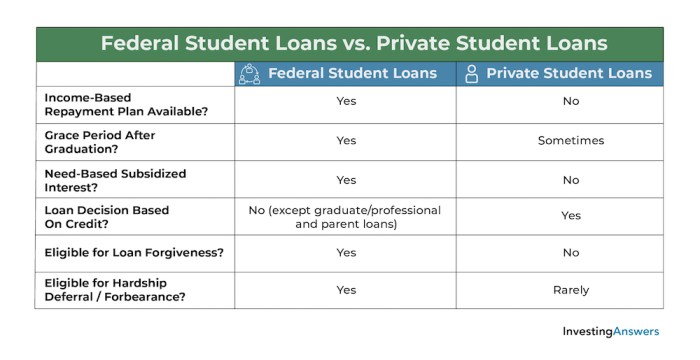

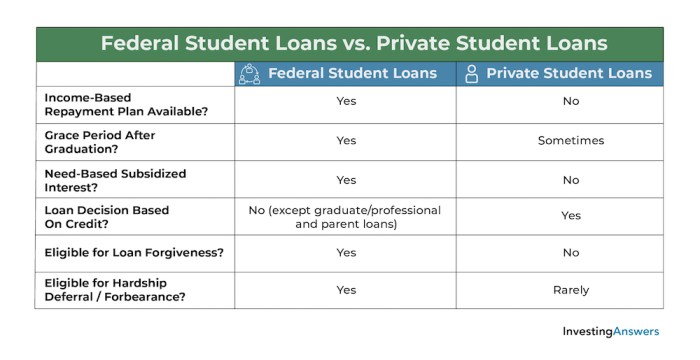

Differences Between Federal and Private Student Loans

Federal student loans are offered by the U.S. government and generally come with more borrower protections and flexible repayment options compared to private loans. Federal loans typically undergo a credit check but offer various repayment plans based on income and financial hardship. Private loans, on the other hand, are subject to more stringent credit checks and approval processes, often requiring a co-signer if the applicant lacks a strong credit history. Eligibility for federal loans is determined based on financial need and enrollment status, whereas private loan eligibility depends primarily on creditworthiness and the lender’s specific criteria. The interest rates and fees associated with federal loans are usually lower than those of private loans.

Interest Rates and Repayment Terms for Private Student Loans

Private student loan interest rates are variable and depend on several factors, including the borrower’s credit score, the loan amount, the repayment term, and the prevailing market interest rates. These rates can fluctuate throughout the loan’s life, potentially leading to higher overall costs. Repayment terms for private loans vary depending on the lender and the loan agreement but typically range from 5 to 20 years. Shorter repayment terms lead to higher monthly payments but lower overall interest paid, while longer terms result in lower monthly payments but significantly higher total interest costs. For example, a $30,000 private loan with a 7% interest rate and a 10-year repayment term would result in significantly higher total payments than a similar loan with a 15-year term.

Risks Associated with Private Student Loans

Borrowing from private lenders carries several risks. One significant risk is the potential for higher interest rates compared to federal loans, leading to substantially higher total repayment costs. The absence of federal protections, such as income-driven repayment plans or loan forgiveness programs, exposes borrowers to a greater risk of default. Private lenders may also be less flexible in dealing with financial hardship, making it more difficult to manage payments during times of unemployment or unexpected expenses. Additionally, the terms and conditions of private loans can be complex and less transparent than those of federal loans, potentially leading to unexpected fees or penalties.

Protections Offered to Borrowers of Federal Versus Private Student Loans

Federal student loans offer various borrower protections, including income-driven repayment plans, deferment and forbearance options, and loan forgiveness programs for certain professions (like teaching or public service). These options provide flexibility and relief to borrowers facing financial difficulties. In contrast, private student loans generally offer limited or no such protections. Borrowers of private loans typically have fewer options for modifying their repayment plans and may face significant penalties for late or missed payments. The lack of government oversight and intervention in private loan disputes can leave borrowers with limited recourse in case of disputes with the lender.

Scenarios Where Private Student Loans Might Be Beneficial and Detrimental

Private student loans might be beneficial in situations where a student has exhausted their federal loan eligibility and still needs additional funding. They can also be advantageous if a student qualifies for a lower interest rate than is offered on federal loans, although this is less common. However, private loans can be detrimental if a borrower lacks a strong credit history or co-signer, resulting in higher interest rates and less favorable repayment terms. It’s also detrimental if the borrower doesn’t fully understand the terms and conditions of the loan, potentially leading to unexpected costs and financial hardship. For example, a student with excellent credit might secure a private loan with a lower interest rate than a federal loan, making it a beneficial option. Conversely, a student with poor credit might face extremely high interest rates and unfavorable terms, making the loan a significant financial burden.

Future Trends and Potential Solutions

The future of student loan debt is inextricably linked to evolving economic conditions, shifting demographics, and evolving government policies. Understanding these factors is crucial for predicting potential outcomes and developing effective solutions to address the challenges posed by the current system. This section will explore potential future changes, analyzing arguments surrounding debt forgiveness, examining the long-term economic implications of high debt levels, and detailing the impact of interest rate fluctuations.

Potential Changes to Student Loan Policies and Programs

Several significant shifts in student loan policies and programs are foreseeable. One likely trend is increased emphasis on income-driven repayment plans, allowing borrowers to make monthly payments based on their income. This approach aims to make repayment more manageable and prevent borrowers from defaulting. Another potential change is a greater focus on transparency and simplification of the loan application and repayment processes. Streamlining these processes could reduce confusion and improve borrower outcomes. Finally, there might be a greater push for reforms in higher education financing, potentially including exploring alternative models that reduce reliance on student loans. For instance, greater emphasis on vocational training and apprenticeships, or exploring government-backed income share agreements could reduce the reliance on large loans for expensive college degrees.

Arguments For and Against Student Loan Debt Forgiveness

The debate surrounding student loan debt forgiveness is complex and deeply divisive. Proponents argue that forgiveness would stimulate the economy by freeing up borrowers’ disposable income, allowing them to spend more and boost economic activity. They also contend that forgiveness would address systemic inequities in access to higher education, benefiting those from disadvantaged backgrounds disproportionately burdened by student loan debt. Conversely, opponents argue that forgiveness would be fiscally irresponsible, costing taxpayers billions of dollars and potentially leading to inflation. They also suggest that forgiveness might disincentivize responsible borrowing behavior in the future. The long-term economic effects of such a massive undertaking remain uncertain, and economic modeling often produces vastly different results depending on the assumptions used. For example, some models suggest a significant positive economic impact, while others suggest minimal effects or even negative consequences.

Long-Term Economic Consequences of High Levels of Student Loan Debt

High levels of student loan debt pose significant long-term economic risks. The most immediate concern is reduced consumer spending and economic growth. Individuals burdened by debt may postpone major purchases like homes or cars, hindering economic activity. Furthermore, high debt levels can negatively impact entrepreneurship, as individuals may be less likely to start businesses due to financial constraints. This can stifle innovation and economic growth. The accumulation of student loan debt also contributes to wealth inequality, as those with higher levels of debt may struggle to accumulate assets, widening the gap between socioeconomic groups. This could lead to decreased social mobility and other societal challenges. The 2008 financial crisis showed how systemic debt problems can negatively impact the entire economy, underscoring the importance of responsible debt management and potential reforms.

Impact of Potential Changes in Interest Rates on Student Loan Borrowers

Fluctuations in interest rates directly impact student loan borrowers. Increases in interest rates lead to higher monthly payments and increased total repayment costs. This can put borrowers under significant financial strain, potentially leading to defaults. Conversely, decreases in interest rates can provide borrowers with some relief, lowering their monthly payments and reducing their overall debt burden. The impact is most significant for borrowers with variable-rate loans, whose interest rates adjust periodically based on market conditions. For example, a sudden 1% increase in interest rates on a $50,000 loan could significantly increase the total cost and monthly payment, causing significant hardship for many borrowers.

Projected Growth of Student Loan Debt Over the Next Decade

A projected growth graph of student loan debt over the next decade would show an upward trend, although the precise slope would depend on various factors including interest rates, future enrollment numbers, and government policies. The graph would likely start at the current level of outstanding student loan debt and increase gradually, potentially accelerating in the later years of the projection period. The y-axis would represent the total amount of student loan debt (in trillions of dollars), and the x-axis would represent the years from the present to ten years in the future. The line representing the growth would likely not be perfectly linear, reflecting potential fluctuations due to economic downturns or policy changes. For example, periods of economic recession might show a slight flattening of the curve, while periods of robust economic growth might show a steeper incline. The overall picture would highlight the continued substantial growth in student loan debt if current trends persist.

Conclusion

Navigating the complexities of all student loans requires careful consideration of various factors, from the type of loan and repayment options to the long-term financial implications. While the burden of student debt is undeniable, understanding the available resources and potential solutions is key to empowering borrowers to make informed decisions and work towards financial stability. The future of student loan policies remains a topic of ongoing debate, but awareness and proactive planning are crucial for managing this significant financial responsibility.

Key Questions Answered

What is the difference between federal and private student loans?

Federal loans are offered by the government and typically offer more borrower protections, including income-driven repayment plans and loan forgiveness programs. Private loans are offered by banks and other financial institutions and often have higher interest rates and fewer protections.

Can I consolidate my student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new repayment plan. This may simplify your payments but may not necessarily lower your interest rate.

What happens if I default on my student loans?

Defaulting on student loans can have serious consequences, including wage garnishment, tax refund offset, and damage to your credit score. It’s crucial to contact your loan servicer immediately if you’re struggling to make payments.

What are income-driven repayment plans?

Income-driven repayment plans adjust your monthly payment based on your income and family size. They can significantly lower your monthly payments, but they may extend your repayment period.