The “America First” policy, while prioritizing domestic interests, presents complex challenges for student loan programs. This approach necessitates a careful examination of its potential effects on funding, accessibility, and the overall economic and social landscape of higher education. This analysis delves into the historical context of protectionist policies, their influence on federal student aid, and the potential ramifications for both domestic and international students.

We will explore the economic consequences of potentially restricting access to student loans, considering the financial burdens on borrowers under various scenarios. Furthermore, the social and political ramifications, including shifts in public opinion and potential increases in social inequality, will be carefully considered. Finally, alternative policy frameworks will be compared and contrasted, offering recommendations that balance domestic priorities with the needs of students and the higher education system.

The “America First” Policy and Student Loans

The “America First” policy, a prominent theme in recent US political discourse, prioritizes domestic interests in economic and foreign policy decisions. Its application to student loans reflects a broader focus on protecting and advancing the interests of American citizens, particularly in areas like employment and economic opportunity. Understanding its impact requires examining its core tenets and historical precedents.

The core tenets of the “America First” policy, as applied domestically, emphasize job creation within the United States, reducing reliance on foreign goods and services, and bolstering American industries. This often involves protectionist measures aimed at shielding domestic businesses from foreign competition. The belief is that by prioritizing American businesses and workers, the overall economic health of the nation will improve, leading to benefits for all citizens, including those burdened by student loan debt.

Historical Context of Protectionist Policies in the US

Protectionist policies have a long and complex history in the United States. Early American economic policy often involved tariffs designed to protect nascent industries from more established European competitors. The Smoot-Hawley Tariff Act of 1930, a landmark example of protectionism, is widely considered to have exacerbated the Great Depression by triggering retaliatory tariffs from other countries, disrupting international trade. Conversely, periods of greater free trade, such as after World War II, have been associated with periods of significant economic growth. The impact of protectionist policies has varied across different sectors, sometimes benefiting specific industries while harming others through higher prices or reduced access to global markets. The effects on consumers have also been mixed, with some benefiting from protected domestic industries and others facing higher prices for imported goods.

Specific Policy Decisions Affecting Student Loan Programs

While no specific student loan program has been explicitly labeled as “America First,” certain policy decisions under this banner have had indirect effects. For instance, initiatives focused on bolstering specific industries (e.g., manufacturing) could indirectly influence student loan outcomes by increasing job opportunities in those sectors for graduates, thereby improving their ability to repay loans. Conversely, policies restricting immigration, which could limit the pool of highly skilled workers, might indirectly affect the demand for higher education and the overall student loan market. Furthermore, budgetary decisions prioritizing domestic spending over international aid or other global initiatives could indirectly impact funding for student loan programs or related initiatives.

Public Discourse Surrounding “America First” and Student Loan Relief

Public discourse surrounding the application of “America First” principles to student loan relief has been largely indirect. The debate often centers on whether the resources used for student loan forgiveness or reform should be prioritized for other domestic initiatives aligned with “America First” goals, such as infrastructure development or job creation programs. Arguments for loan forgiveness often frame it as a way to stimulate the economy by freeing up borrowers’ disposable income, while counterarguments emphasize the financial burden of such programs on taxpayers and the potential for unintended consequences. This debate highlights the inherent tension between addressing immediate economic needs (student loan debt) and achieving broader long-term economic goals associated with the “America First” agenda.

Impact on Federal Student Loan Programs

An “America First” approach to student loans could significantly alter the landscape of federal funding and accessibility. Prioritizing domestic interests might lead to shifts in resource allocation, potentially impacting both domestic and international students. The implications extend beyond simple funding changes, affecting research collaborations and the overall international standing of US higher education.

The prioritization of domestic interests under an “America First” policy could manifest in several ways regarding federal student loan programs. For example, funding might be redirected from programs supporting international students or those studying abroad to programs solely benefiting US citizens. This could involve reducing loan amounts available to international students, increasing interest rates, or even eliminating certain loan programs entirely for non-citizens. Such a shift would directly impact the accessibility of higher education for international students, potentially reducing their enrollment in US universities.

Funding Allocation Under Different Approaches

An “America First” approach would likely prioritize funding for US citizens, potentially at the expense of international students and programs benefiting international collaboration. Alternative approaches, such as a globalized approach, might distribute resources more evenly across domestic and international students, recognizing the mutual benefits of international student exchange and research collaboration. A comparative analysis of funding allocation under these different models would reveal significant differences in resource distribution and the resulting impact on access to higher education. For example, an “America First” approach might allocate 90% of federal student loan funds to US citizens, whereas a more globalized approach might allocate 60%, leaving the remaining 40% for international students and collaborative programs. The consequences of these differing allocations would be substantial.

Consequences for International Students

Restricting access to federal student loans for international students would create significant barriers to higher education in the US. Many international students rely on these loans to finance their studies, and reduced access could lead to a decline in international enrollment. This decline could negatively impact the diversity of US campuses and limit the exposure of US students to diverse perspectives and global collaborations. The reduced international student population might also affect the revenue generated by universities, as international students often pay higher tuition fees. A real-world example could be seen in a hypothetical scenario where a significant reduction in loan availability leads to a 20% decrease in international student enrollment at a particular university, resulting in a substantial loss of tuition revenue.

Implications for Research Funding and International Collaboration

An “America First” approach could also curtail research funding for collaborative projects involving international institutions. Restricting funding for such collaborations could hinder scientific progress, limit the exchange of knowledge, and weaken the US’s position in global research. The potential loss of international partnerships could impact the quality and scope of research conducted in the US, hindering innovation and potentially placing the US at a disadvantage in various fields. A specific example could be the reduction or elimination of grants for joint research projects with universities in other countries, thereby limiting access to crucial data, expertise, and resources.

Economic Implications and Effects on Borrowers

Restricting access to student loans, particularly under an “America First” policy prioritizing domestic students or specific fields of study, carries significant economic consequences for affected borrowers and the broader economy. These policies could disproportionately impact minority groups, low-income individuals, and students pursuing fields deemed less vital to national interests, leading to decreased social mobility and potential economic stagnation.

The potential for reduced access to higher education and its subsequent economic impact necessitates a careful examination of the ramifications. This analysis will explore the financial burdens on borrowers under various policy scenarios, using hypothetical examples to illustrate the potential consequences of restrictive loan policies.

Potential Economic Consequences of Restricted Access

Restricting access to student loans for certain groups could lead to several negative economic outcomes. For example, limiting loan availability for international students could hinder innovation and economic growth by reducing the pool of skilled workers and researchers. Similarly, restricting loans for students pursuing humanities or social sciences could lead to a shortage of professionals in these crucial fields. The overall effect could be a less diverse and less dynamic economy. Reduced access to higher education also contributes to increased income inequality, perpetuating existing social and economic disparities.

Hypothetical Scenario: Impact of “America First” Policies on Student Loan Debt

Let’s consider a hypothetical scenario where an “America First” policy significantly reduces federal student loan funding for non-STEM fields. This could lead to a sharp increase in tuition costs at universities with fewer STEM programs, forcing students in humanities and social sciences to rely more heavily on private loans with higher interest rates. Consequently, these students would graduate with significantly higher debt levels and face greater challenges in repaying their loans. This scenario could disproportionately impact low-income students who lack access to alternative funding sources. Furthermore, the reduced availability of loans might discourage students from pursuing higher education altogether, limiting their future earning potential and contributing to a less skilled workforce.

Comparison of Financial Burden Under Different Policy Scenarios

| Policy Scenario | Average Debt | Default Rate | Employment Rate |

|---|---|---|---|

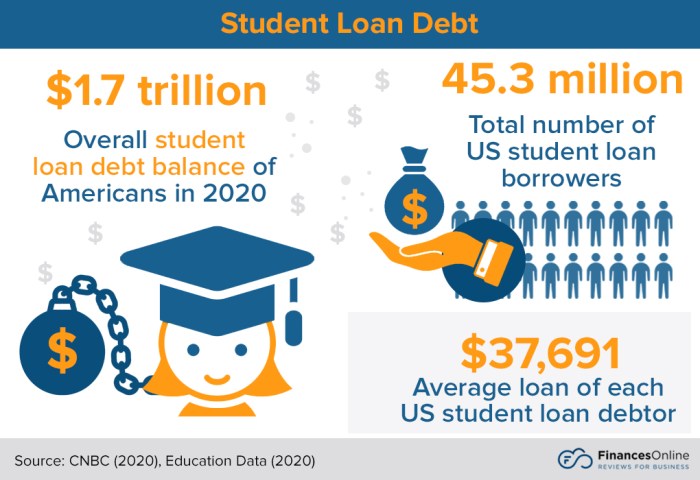

| Current System | $37,000 | 10% | 85% |

| Restricted Access (Non-STEM) | $55,000 | 15% | 78% |

| Increased Funding (STEM) | $35,000 | 9% | 88% |

| Targeted Grants (Low-Income) | $30,000 | 8% | 87% |

Note: These figures are hypothetical and intended for illustrative purposes. Actual figures may vary based on various economic and policy factors. The data points toward a significant increase in debt burden and default rates under restrictive policies, while targeted support programs demonstrate the potential for positive outcomes.

Summary of Key Economic Impacts

Restricting access to student loans based on an “America First” framework carries considerable economic risks. Our hypothetical scenario and comparative data suggest that such policies could lead to higher average student loan debt, increased default rates, and potentially lower employment rates for affected borrowers. These negative economic consequences could outweigh any perceived benefits of prioritizing certain groups or fields of study. Conversely, policies focused on increased funding for specific fields or targeted grants for low-income students show promise in mitigating these negative effects.

Social and Political Ramifications

Prioritizing domestic interests in student loan programs, while potentially beneficial to some, carries significant social and political ramifications. The potential for increased social inequality, shifts in public opinion, and altered political engagement are all key consequences that require careful consideration. These ramifications extend beyond the immediate impact on borrowers and reach into the broader fabric of American society and its political landscape.

The implementation of an “America First” approach to student loans could significantly alter the social and political landscape. This approach, focused on prioritizing domestic needs over international considerations in the allocation of loan funds and resources, may lead to unforeseen consequences. The potential for heightened social divisions based on access to higher education and loan repayment options is a primary concern.

Shifting Public Opinion on Higher Education Accessibility and Affordability

A policy prioritizing domestic students might lead to a decline in international student enrollment, potentially impacting the diversity of American universities and the global competitiveness of American institutions. Conversely, it could bolster support among domestic students and families who feel their interests are being prioritized, potentially shifting public opinion toward greater support for government intervention in higher education financing. The perception of fairness and equity in access to higher education will likely become a key battleground in the public discourse. For example, a policy that dramatically increases funding for domestic students while simultaneously reducing aid for international students could be perceived as discriminatory, potentially leading to negative public sentiment.

Impact on Voter Turnout and Political Engagement Related to Student Debt

Student loan debt is already a significant driver of political engagement among young voters. Policies perceived as unfairly disadvantaging certain groups of students could lead to increased voter turnout and activism, particularly among those who feel negatively impacted. Conversely, policies seen as beneficial could lead to increased political apathy. The 2020 election demonstrated the power of young voters, and student loan debt played a significant role in their political engagement. A policy that offers significant debt relief to a specific demographic could galvanize support for the political party implementing it, while a policy perceived as unfair could lead to a backlash.

Increased Social Inequality Based on Access to Higher Education and Loan Repayment Options

An “America First” approach, if not carefully implemented, could exacerbate existing social inequalities. For example, prioritizing funding for students in specific states or those pursuing specific fields of study could disproportionately benefit certain demographic groups, potentially widening the gap between the haves and have-nots in terms of access to higher education and career opportunities. This could lead to increased social unrest and political polarization, as those who feel excluded from the benefits of such a policy may become increasingly disenfranchised. Consider a scenario where funding is directed predominantly toward STEM fields, potentially leaving students in the humanities or social sciences with limited financial support. This could disproportionately affect students from lower socioeconomic backgrounds who may be less likely to pursue STEM careers.

Alternative Approaches and Policy Recommendations

The “America First” approach to student loan debt, prioritizing domestic interests above all else, contrasts sharply with alternative frameworks that emphasize broader economic and social considerations. These alternatives often incorporate international comparisons, acknowledge the role of higher education in national competitiveness, and prioritize equitable access to education regardless of socioeconomic background. A balanced approach is crucial, recognizing both the need to manage national debt and the importance of investing in human capital.

The “America First” approach, with its focus on immediate debt reduction, potentially overlooks the long-term economic benefits of a well-educated workforce. Alternative approaches, such as targeted income-driven repayment plans or increased funding for need-based grants, aim to address both debt burdens and the need for a skilled workforce. These strategies often involve a more nuanced approach to loan forgiveness, potentially focusing on specific fields or demographics critical to national needs.

Comparison of “America First” and Alternative Policy Frameworks

The “America First” approach can be visualized as a single, sharply focused beam of light directed at immediate debt reduction. This approach prioritizes short-term fiscal responsibility and potentially neglects other aspects of the student loan crisis and the broader higher education ecosystem. In contrast, alternative frameworks resemble a broader, more diffuse light source illuminating the entire landscape of student debt and higher education. This approach considers multiple factors, including access, affordability, and long-term economic impact, leading to a more holistic and potentially more sustainable solution. One might envision a spectrum, with the “America First” approach at one extreme, prioritizing immediate debt reduction even at the cost of future investment in human capital, and alternative approaches at the other, emphasizing long-term investment in education and workforce development, even if it means a slower reduction in overall debt.

Policy Recommendations for a Balanced Approach

A balanced approach requires a multi-pronged strategy that addresses both the immediate concerns of borrowers and the long-term needs of the higher education system and the economy. This includes implementing more robust income-driven repayment plans, expanding access to need-based grants and scholarships, and investing in affordable higher education options, such as community colleges and vocational training programs. Simultaneously, targeted loan forgiveness programs focused on specific fields crucial to national priorities, such as STEM or healthcare, could incentivize investment in these areas while mitigating the overall debt burden. Such a strategy aims to provide relief to borrowers while simultaneously investing in the future workforce.

Implementation Plan for Policy Changes

Implementing these changes requires a phased approach. Phase 1 would involve a comprehensive review and reform of existing income-driven repayment plans to ensure they are truly affordable and accessible to all borrowers. Phase 2 would focus on increasing funding for need-based grants and scholarships, prioritizing students from low-income backgrounds. Phase 3 would involve targeted investments in affordable higher education options and the creation of a streamlined system for applying for and receiving financial aid. Phase 4 would entail the careful design and implementation of targeted loan forgiveness programs, ensuring transparency and accountability. This phased approach minimizes disruption while ensuring the long-term sustainability of the reforms.

Visual Representation of Different Approaches

Imagine a pie chart. The “America First” approach would be represented by a pie chart with a single, dominant slice representing “Debt Reduction,” with all other segments – such as “Investment in Higher Education,” “Economic Growth,” and “Social Equity” – being relatively small. In contrast, a balanced approach would show a more equitable distribution of the pie chart, with significant slices dedicated to all four areas, reflecting a holistic strategy that acknowledges the interconnectedness of debt reduction, investment in higher education, economic growth, and social equity. The difference is a stark contrast between a singular focus and a multi-faceted approach.

Outcome Summary

Ultimately, the “America First” approach to student loans requires a nuanced understanding of its multifaceted impacts. While prioritizing domestic interests is understandable, a balanced approach that ensures equitable access to higher education and avoids exacerbating existing inequalities is crucial. The analysis presented here highlights the need for careful consideration of both the economic and social consequences of such policies, advocating for policy solutions that promote both national interests and the well-being of students.

Essential Questionnaire

What specific programs are affected by the “America First” approach to student loans?

The impact varies depending on the specific policy implementation. Potentially affected programs include federal grant and loan programs, as well as programs supporting international student exchange and research collaborations.

How might this policy affect the cost of higher education?

Reduced funding or restricted access to loans could potentially lead to increased tuition costs as universities seek to maintain their budgets. Conversely, it might also incentivize universities to focus on domestic students.

Are there any legal challenges associated with these policies?

Potential legal challenges could arise if policies discriminate against specific groups of students or violate existing laws regarding equal access to education. The specifics would depend on the precise nature of the implemented policies.

What are the long-term implications for the US economy?

Long-term effects are complex and depend on various factors. Restricted access to education could hinder innovation and economic growth, while a focus on domestic talent could lead to a more skilled domestic workforce. The net effect is uncertain.