The weight of American student loan debt is a pervasive issue impacting millions, shaping financial futures and national economic trends. This staggering sum represents not just numbers on a balance sheet, but the aspirations, anxieties, and realities of a generation burdened by the cost of higher education. This exploration delves into the complexities of this financial landscape, examining its current state, individual impacts, government policies, and long-term economic consequences.

From the average debt burden per borrower to the effectiveness of government repayment plans and the role of universities in responsible borrowing, we aim to provide a balanced and insightful overview of the multifaceted challenges and potential solutions surrounding American student loans. Understanding this system is crucial for both current and prospective students, as well as policymakers seeking to navigate this critical issue.

The Current State of American Student Loans

The American student loan system is a complex and significant aspect of the national economy, impacting millions of individuals and families. Understanding the current state of this debt requires examining several key metrics, including the total outstanding debt, average debt per borrower, the breakdown between federal and private loans, and the rates of delinquency and default. These figures paint a picture of the challenges and opportunities within the system.

Total Outstanding Student Loan Debt

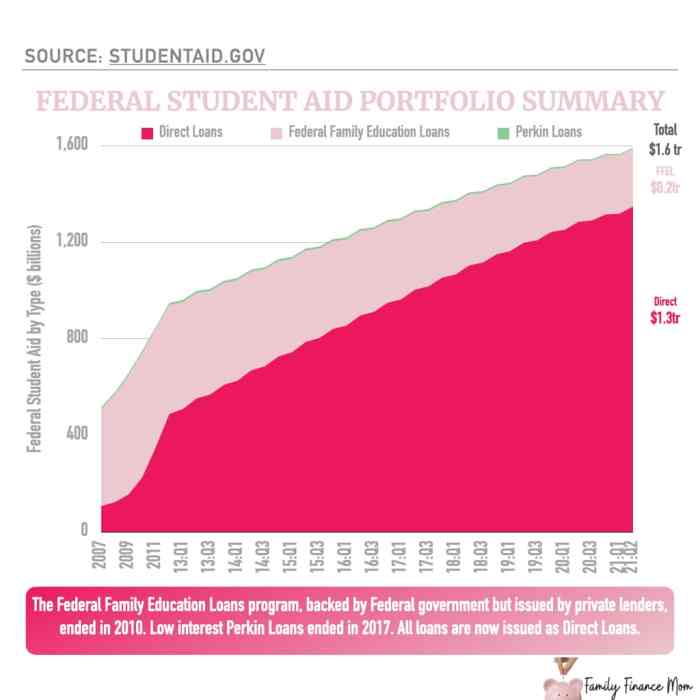

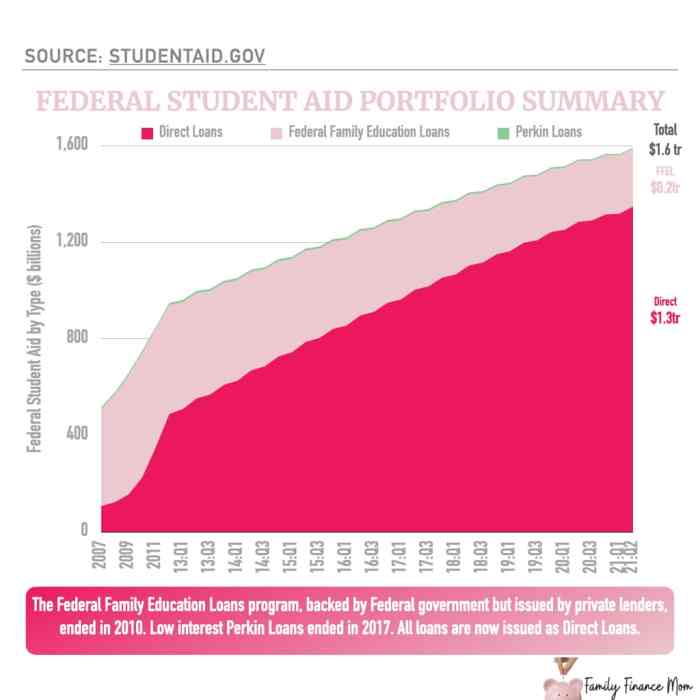

The total amount of outstanding student loan debt in the United States is a staggering figure, constantly fluctuating but remaining in the trillions of dollars. As of late 2023, this figure hovered around $1.7 trillion, representing a substantial burden on the national economy and individual borrowers. This massive debt accumulation reflects years of rising tuition costs and increased reliance on borrowing to finance higher education.

Average Student Loan Debt per Borrower

The average student loan debt per borrower provides a more granular view of the debt burden. This average, while providing a general indication, masks significant variations based on factors such as degree pursued, institution attended, and individual borrowing habits. Recent data suggests an average debt exceeding $37,000 per borrower, although this figure varies significantly depending on the data source and methodology used. This average underscores the significant financial commitment many individuals make to pursue higher education.

Breakdown of Student Loan Debt by Loan Type

Student loan debt is primarily categorized into federal and private loans. Federal loans, backed by the U.S. government, generally offer more favorable repayment terms and options for borrowers facing financial hardship. Private loans, on the other hand, are offered by banks and other financial institutions and typically have less flexible terms. A substantial majority of student loan debt in the U.S. is comprised of federal loans, reflecting the government’s significant role in financing higher education. However, the proportion of private loans continues to grow, representing a growing segment of the overall student loan market.

Student Loan Delinquency and Default Rates

Delinquency and default rates provide insights into the financial struggles faced by student loan borrowers. Delinquency refers to missed or late payments, while default occurs when a borrower fails to make payments for an extended period. These rates fluctuate based on economic conditions and government policies. Historically, default rates have been a concern, highlighting the challenges some borrowers face in managing their student loan debt. While precise, up-to-the-minute figures require access to constantly updated government data, these rates generally remain a significant issue for policymakers and financial institutions alike.

Summary Table of Key Statistics

| Statistic | Amount/Rate | Source/Notes |

|---|---|---|

| Total Outstanding Student Loan Debt | Approximately $1.7 Trillion (as of late 2023) | Estimates vary depending on the source and reporting period. Data from the Federal Reserve and the Department of Education are commonly cited. |

| Average Student Loan Debt per Borrower | Over $37,000 (as of late 2023) | This is an average and individual debt varies significantly. Data from the Federal Reserve and various research institutions are frequently used. |

| Federal vs. Private Loan Breakdown | Predominantly Federal Loans, with a growing proportion of Private Loans | The exact proportion changes frequently. Data from the Department of Education and private lenders provide this information. |

| Delinquency and Default Rates | Fluctuate, but remain a significant concern | Specific rates require accessing regularly updated government data from the Department of Education. |

The Impact of Student Loans on Individuals

The burden of student loan debt significantly impacts borrowers’ financial well-being, extending far beyond the monthly payment itself. It casts a long shadow over numerous aspects of their lives, influencing major financial decisions and overall quality of life. Understanding these impacts is crucial for both individuals facing this debt and policymakers seeking to address the issue.

The weight of student loan debt can profoundly affect a borrower’s financial stability. High monthly payments often consume a substantial portion of their income, leaving less for essential expenses like rent, groceries, and healthcare. This can lead to chronic financial stress and difficulty saving for the future. The constant pressure of loan repayments can also limit opportunities for career advancement, as borrowers may be less willing to take on new jobs that might require relocation or further education, even if these opportunities offer higher earning potential.

Effects on Major Life Decisions

Student loan debt frequently delays or prevents borrowers from making significant life decisions. Homeownership, for instance, becomes a much more challenging goal. The high debt-to-income ratio resulting from student loans can make it difficult to qualify for a mortgage, even with a stable income. Similarly, starting a family is often postponed or altered due to financial constraints. The cost of raising children, coupled with existing student loan payments, can make it financially difficult to manage a growing family. Borrowers may delay having children or choose to have fewer children than they initially planned. The financial burden of student loan debt can therefore profoundly shape an individual’s family life and long-term plans.

Comparison of Financial Situations

A stark contrast exists between the financial situations of borrowers with and without significant student loan debt. Individuals without substantial student loans generally enjoy greater financial flexibility. They have more disposable income, allowing them to save for retirement, invest in their education or businesses, and make large purchases such as homes and cars with greater ease. They are also less vulnerable to unexpected financial setbacks, as they have a larger financial cushion to fall back on. In contrast, individuals burdened by significant student loan debt often struggle to save, invest, or make major purchases. They may face constant financial stress and limited opportunities for upward mobility. This disparity underscores the significant advantage those without large student loan debts possess in building long-term financial security.

Strategies for Managing Student Loan Debt

Borrowers employ various strategies to manage their student loan debt. Income-driven repayment plans, which adjust monthly payments based on income and family size, provide some relief. Consolidation loans can simplify repayment by combining multiple loans into a single loan with a potentially lower interest rate. Refinancing, though potentially risky, can also lower interest rates, leading to significant savings over the life of the loan. Many borrowers also prioritize aggressive repayment strategies, dedicating extra income to pay down their loans as quickly as possible. Finally, careful budgeting and financial planning are essential tools for managing student loan debt effectively. However, the effectiveness of these strategies varies greatly depending on individual circumstances and the amount of debt involved.

Challenges Faced by Student Loan Borrowers

The challenges faced by student loan borrowers are multifaceted and can significantly impact their lives.

- High monthly payments consuming a large portion of income.

- Difficulty saving for retirement, emergencies, and major purchases.

- Delayed or forgone major life events such as homeownership and starting a family.

- Limited career advancement opportunities due to financial constraints.

- Increased financial stress and anxiety.

- Potential impact on mental and physical health.

- Difficulties in qualifying for loans or credit cards.

- Risk of default and its negative consequences on credit score.

Government Policies and Programs Related to Student Loans

The United States government plays a significant role in the student loan system, offering various programs and policies aimed at making higher education more accessible and managing repayment for borrowers. These initiatives range from different repayment plans to loan forgiveness programs, all designed to address the complexities of student debt. Understanding these government programs is crucial for borrowers to navigate their repayment journey effectively.

Federal Student Loan Repayment Plans

The federal government offers several repayment plans to help borrowers manage their student loan debt. These plans vary in terms of monthly payments and repayment periods, catering to different financial situations. Choosing the right plan can significantly impact a borrower’s long-term financial health.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s the default plan for most federal student loans.

- Graduated Repayment Plan: Payments start low and gradually increase over a 10-year period. This option can be helpful for borrowers anticipating increased income in the future.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR) Plans: These plans base monthly payments on income and family size, offering more flexibility for borrowers with limited financial resources. There are several types of IDR plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

Eligibility Requirements for Income-Driven Repayment Plans

Eligibility for income-driven repayment plans generally requires borrowers to have federal student loans and to meet certain income requirements. Specific requirements can vary depending on the plan chosen. Generally, borrowers must demonstrate financial need based on their income and family size relative to their loan amount. This often involves completing an application and providing documentation of income and family size.

Applying for Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, offering the potential for partial or complete loan cancellation under specific circumstances. These programs typically target borrowers working in public service or specific professions, or those who have made consistent payments for a prolonged period under an income-driven repayment plan. The application process usually involves demonstrating eligibility through documentation and submitting an application through the appropriate channels.

Recent Legislative Changes Affecting Student Loan Policies

Recent years have seen significant legislative changes impacting student loan policies. For example, the pause on federal student loan payments during the COVID-19 pandemic was a major development, offering temporary relief to millions of borrowers. Additionally, there have been ongoing debates and legislative proposals regarding expanding income-driven repayment options, increasing loan forgiveness opportunities, and reforming the overall student loan system. These changes significantly impact borrowers’ repayment responsibilities and overall access to higher education. Specific examples of legislation would require citing the actual bills and their content for accuracy.

Applying for Federal Student Aid: A Flowchart

The following describes a flowchart illustrating the process. Imagine a flowchart with boxes and arrows.

Box 1: Determine Eligibility: This box encompasses assessing your financial need, academic record, and citizenship status.

Arrow 1: Points from Box 1 to Box 2 if eligible, otherwise ends the process.

Box 2: Complete the FAFSA (Free Application for Federal Student Aid): This box details filling out the application, providing accurate information, and submitting it electronically.

Arrow 2: Points from Box 2 to Box 3.

Box 3: Receive Student Aid Award Letter: This box shows receiving notification of your financial aid package, including grants, loans, and work-study.

Arrow 3: Points from Box 3 to Box 4 if you accept the aid.

Box 4: Accept and Enrol: This box shows accepting your financial aid and enrolling in your chosen educational program.

The Role of Higher Education Institutions

Higher education institutions play a multifaceted role in the American student loan landscape, significantly influencing both the accumulation and repayment of debt. Their pricing strategies, financial aid advising, and institutional practices directly impact the financial well-being of their graduates. Understanding this role is crucial to addressing the broader student loan crisis.

The Relationship Between Tuition Costs and Student Loan Debt

The escalating cost of tuition at many colleges and universities is strongly correlated with the rise in student loan debt. As tuition increases outpace the growth of financial aid and family incomes, students are increasingly reliant on loans to cover the cost of attendance. This creates a cycle where higher tuition necessitates more borrowing, leading to higher debt burdens upon graduation. For example, the average tuition at private four-year colleges has risen far faster than inflation over the past few decades, forcing students to take out significantly larger loans to afford these institutions. This dynamic is less pronounced but still present in public institutions, particularly those with higher out-of-state tuition rates.

The Role of Universities in Advising Students on Responsible Borrowing

Universities have a responsibility to provide comprehensive and unbiased financial literacy education and guidance to their students. This includes educating students about the long-term implications of borrowing, helping them understand different loan types and repayment options, and encouraging responsible budgeting practices. Effective advising should empower students to make informed decisions about their borrowing, avoiding unnecessary debt accumulation. However, the quality and accessibility of this advising vary widely across institutions. Some universities excel in providing personalized financial planning and budgeting workshops, while others offer only limited resources, leaving students to navigate the complex loan process largely on their own.

Strategies Universities Can Implement to Reduce Student Loan Debt for Their Graduates

Several strategies can be implemented by universities to mitigate student loan debt. These include increasing the availability of need-based and merit-based financial aid, implementing tuition freezes or controlled increases, expanding opportunities for internships and work-study programs that provide income during college, and investing in more affordable online or hybrid learning models to reduce overall program costs. Furthermore, universities can enhance their financial literacy programs, offering workshops and personalized counseling to help students develop effective budgeting and debt management skills. Promoting completion within a reasonable timeframe, thus reducing overall program costs and associated borrowing, is also a crucial strategy.

Tuition Costs and Average Student Loan Debt Across Different Types of Institutions

The following table compares tuition costs and average student loan debt levels for different types of institutions. These figures are averages and can vary significantly based on specific programs, location, and individual student circumstances. Data is based on recent national averages and may vary slightly depending on the source.

| Institution Type | Average Annual Tuition (Estimate) | Average Student Loan Debt Upon Graduation (Estimate) |

|---|---|---|

| Public Four-Year In-State | $10,000 – $25,000 | $20,000 – $30,000 |

| Public Four-Year Out-of-State | $25,000 – $40,000 | $30,000 – $45,000 |

| Private Four-Year | $35,000 – $60,000+ | $40,000 – $60,000+ |

Alternative Financing Options for Higher Education

Securing funding for higher education can be a significant challenge, but relying solely on student loans isn’t the only path. A diverse range of alternative financing options exists, each with its own merits and drawbacks. Understanding these alternatives and strategically utilizing them can significantly reduce the burden of student loan debt and make higher education more accessible.

Scholarships

Scholarships represent a form of “free money” for education, typically awarded based on merit, academic achievement, athletic ability, or demonstrated financial need. They don’t require repayment, making them highly desirable. However, competition for scholarships can be fierce, and securing them often involves extensive research and application processes. The availability of scholarships also varies widely depending on factors like the student’s field of study, ethnicity, and geographic location. For example, a student pursuing a STEM major might find more scholarship opportunities than a student studying the humanities. Similarly, scholarships targeted towards underrepresented minority groups can offer significant support.

Grants

Similar to scholarships, grants provide financial aid that doesn’t need to be repaid. Unlike scholarships, grants are often awarded based primarily on financial need, determined through the completion of the Free Application for Federal Student Aid (FAFSA). Federal Pell Grants are a prime example, providing funding to undergraduate students demonstrating exceptional financial need. State and institutional grants also exist, often with specific eligibility requirements. While grants alleviate the financial strain of higher education, the amount awarded may not fully cover tuition and other expenses, and securing them requires careful application and meeting specific criteria.

Work-Study Programs

Work-study programs offer part-time employment opportunities to students, allowing them to earn money to contribute towards their educational costs. These programs are often subsidized by the government or the institution, offering wages that are higher than minimum wage in many cases. The availability of work-study positions varies depending on the institution and the student’s academic schedule. While work-study helps reduce reliance on loans, it also demands a commitment of time and effort, potentially impacting academic performance if not managed effectively. A student participating in a work-study program might need to balance work hours with study time, potentially leading to a more demanding schedule.

Steps to Explore Alternative Financing Options

Exploring alternative financing options requires a proactive approach. Here’s a structured approach students can take:

- Complete the FAFSA: This crucial application unlocks access to federal grants and other financial aid opportunities.

- Research Institutional Aid: Explore scholarships and grants offered directly by the college or university.

- Utilize Online Scholarship Databases: Numerous websites compile scholarship opportunities, filtering by criteria such as major, ethnicity, and academic achievements.

- Contact Your Guidance Counselor: High school and college counselors can offer valuable advice and resources.

- Network and Seek Mentorship: Professionals in your field of interest may offer guidance and support in finding funding opportunities.

- Explore External Scholarships: Many organizations, businesses, and community groups offer scholarships.

The Long-Term Economic Consequences of Student Loan Debt

The escalating burden of student loan debt in the United States presents a significant challenge with far-reaching economic consequences. The sheer volume of outstanding loans impacts various facets of the national economy, from consumer spending to income inequality, ultimately shaping the nation’s long-term economic trajectory. Understanding these consequences is crucial for developing effective policy solutions.

Impact on the National Economy

High levels of student loan debt exert a considerable drag on the national economy. A substantial portion of young adults’ disposable income is diverted towards loan repayments, reducing their capacity for consumer spending on goods and services. This reduced consumer demand can stifle economic growth, as businesses experience decreased sales and investment opportunities. Furthermore, the accumulation of student loan debt can hinder entrepreneurship, as individuals may be less likely to start businesses due to financial constraints. The ripple effect of reduced consumer spending and entrepreneurial activity can lead to slower overall economic growth and reduced tax revenue for the government. For example, the significant increase in student loan debt since the 2000s correlates with periods of slower economic recovery following recessions.

Effect on Consumer Spending and Economic Growth

Student loan debt significantly curtails consumer spending. Young adults burdened with substantial loan repayments often postpone major life decisions like homeownership, marriage, and starting a family. These delays translate into reduced spending on housing, furniture, vehicles, and other goods and services typically associated with these life milestones. This decreased consumer demand can lead to slower economic growth, impacting businesses across various sectors. Consider the impact on the housing market, where a significant portion of young adults are unable to afford down payments due to student loan debt, thereby depressing demand and slowing the overall growth of the sector.

Relationship Between Student Loan Debt and Income Inequality

The rising student loan debt burden exacerbates existing income inequality. Individuals from lower socioeconomic backgrounds are disproportionately affected by high tuition costs and often rely more heavily on student loans to finance their education. The resulting debt can trap them in a cycle of poverty, limiting their ability to save, invest, and accumulate wealth. Conversely, individuals from wealthier backgrounds often have access to alternative financing options or family support, allowing them to navigate higher education with less debt and greater opportunities for upward mobility. This disparity in access to resources and the resulting unequal distribution of debt further widens the gap between the rich and the poor.

Potential Policy Solutions to Mitigate Long-Term Economic Consequences

Several policy solutions can mitigate the long-term economic consequences of student loan debt. These include targeted loan forgiveness programs for specific professions or income levels, expanded income-driven repayment plans, and increased investment in affordable higher education options, such as community colleges and vocational training programs. Furthermore, strengthening consumer protections and improving financial literacy education can empower borrowers to make informed decisions and manage their debt effectively. Implementing policies that incentivize institutions to keep tuition costs under control would also reduce the burden on students and the economy. For example, the government could tie federal funding to tuition increases, disincentivizing rapid tuition growth.

A Potential Future Scenario: High versus Low Student Loan Debt

A future scenario with high student loan debt could see persistent economic stagnation, exacerbated income inequality, and a significant drain on consumer spending. This could lead to a less dynamic and innovative economy, with limited opportunities for upward mobility, particularly for younger generations. Conversely, a future with lower student loan debt would likely foster greater economic growth, increased consumer spending, and a more equitable distribution of wealth. This scenario would see a more robust economy, with greater opportunities for entrepreneurship and innovation, benefiting both individuals and society as a whole. The contrast between these two scenarios highlights the critical importance of addressing the student loan debt crisis proactively.

Final Conclusion

The American student loan system is a complex tapestry woven from individual financial burdens, government policy, and institutional practices. While the challenges are significant, understanding the various facets of this system – from available repayment options and alternative financing strategies to the long-term economic implications – empowers individuals to make informed decisions and advocates to push for meaningful reform. Ultimately, a brighter future hinges on fostering responsible borrowing practices, accessible financial aid, and policies that prioritize equitable access to higher education for all.

FAQs

What is the difference between federal and private student loans?

Federal student loans are offered by the government and generally have more favorable repayment options and protections for borrowers. Private student loans are offered by banks and other financial institutions and often come with higher interest rates and less flexible repayment plans.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score. It can also make it difficult to obtain future loans or credit.

Can I consolidate my student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a potentially simplified repayment plan. Consolidation doesn’t lower your interest rate but can make managing your payments easier.

Are there any student loan forgiveness programs?

Yes, several programs exist, such as Public Service Loan Forgiveness (PSLF) and income-driven repayment (IDR) plans that can lead to loan forgiveness after a specific period of qualifying payments. Eligibility requirements vary.