The escalating amount of student loans in recent years has transformed from a manageable financial hurdle to a crippling burden for many. This pervasive issue affects not only individual financial well-being but also broader economic trends and societal structures. This exploration delves into the current state of student loan debt, its far-reaching consequences, and potential solutions, aiming to provide a comprehensive understanding of this complex challenge.

From the staggering statistics reflecting the overall debt accumulation to the nuanced effects on personal life choices and mental health, we will examine the multifaceted nature of this crisis. We will also investigate government policies, alternative financing options, and potential avenues for mitigating the overwhelming amount of student loan debt impacting millions.

The Current State of Student Loan Debt

The burden of student loan debt in the United States has become a significant economic and social issue over the past decade, impacting millions of individuals and families. Understanding the current state of this debt is crucial for developing effective solutions and mitigating its long-term consequences. This section will explore the trends, distribution, and contributing factors related to the escalating cost of higher education and its impact on student loan debt.

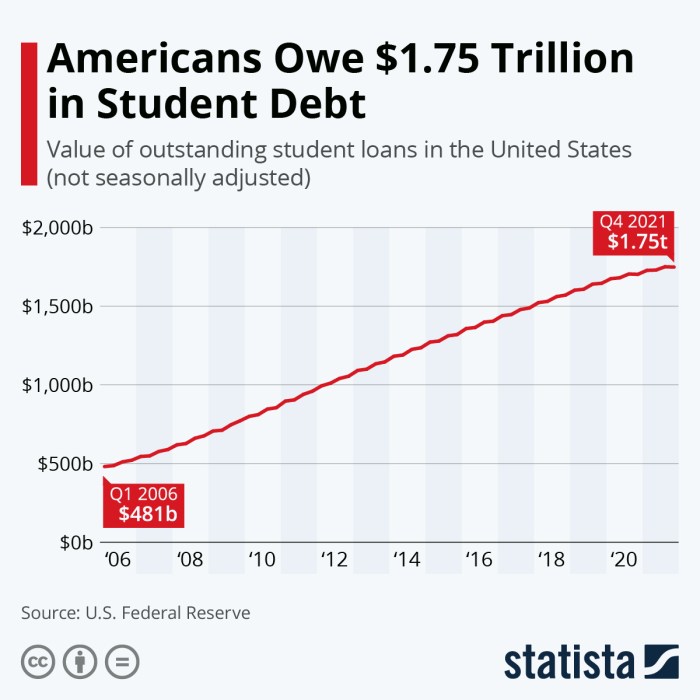

The overall trend in student loan debt amounts over the past decade shows a consistent upward trajectory. While there have been periods of slight fluctuation, the overall amount of outstanding student loan debt has significantly increased. This growth is largely attributed to factors such as rising tuition costs, increased borrowing by students, and changes in lending practices.

Student Loan Debt Amounts Over the Past Decade

The following table provides a simplified representation of the growth in student loan debt over the past decade. Note that these figures are illustrative and should not be considered precise due to the complexity of data collection and reporting. Actual figures may vary depending on the source and methodology used.

| Year | Approximate Total Student Loan Debt (USD Trillion) | Average Loan Amount per Borrower (USD Thousands) | Percentage Increase from Previous Year |

|---|---|---|---|

| 2014 | 1.0 | 28 | – |

| 2016 | 1.3 | 31 | ~30% |

| 2018 | 1.5 | 34 | ~15% |

| 2020 | 1.7 | 37 | ~13% |

Distribution of Student Loan Debt Across Income Brackets

The distribution of student loan debt is not uniform across income brackets. Lower-income borrowers often face a disproportionately high debt burden relative to their income, leading to significant financial strain.

- Borrowers in the lowest income bracket often carry a higher percentage of their income in student loan debt compared to higher-income borrowers.

- The impact of student loan debt on lower-income individuals can be exacerbated by other financial challenges, such as limited access to financial resources and higher rates of unemployment.

- Higher-income borrowers, while still burdened by debt, often have more financial flexibility to manage their repayments and are less likely to experience severe financial hardship due to student loans.

Comparison of Average Student Loan Debt for Undergraduate and Graduate Students

Graduate students typically incur significantly higher student loan debt than undergraduate students. This difference is attributable to several factors, including longer program durations, higher tuition costs for graduate programs, and the potential for higher earning potential post-graduation that justifies higher borrowing.

For example, a recent study might show that the average undergraduate student graduates with $30,000 in debt, while the average graduate student graduates with $70,000 or more. These figures can vary considerably depending on the field of study and the institution attended.

Factors Contributing to the Rising Cost of Higher Education

Several interconnected factors contribute to the rising cost of higher education, directly influencing the increasing amounts of student loan debt.

- Decreased State Funding: Many states have reduced their funding for public colleges and universities, leading institutions to increase tuition fees to compensate for the shortfall.

- Administrative Costs: The growth of administrative staff and associated costs in higher education institutions has contributed to increased tuition fees.

- Increased Demand: The increasing demand for higher education has, in some cases, allowed institutions to raise tuition without significantly impacting enrollment.

- Technological Advancements: While technology can enhance learning, the costs associated with implementing and maintaining new technologies can also contribute to increased tuition.

Impact of Student Loan Debt on Individuals

The weight of student loan debt extends far beyond the monthly payment; it significantly impacts various aspects of an individual’s life, shaping their financial trajectory and overall well-being. The sheer magnitude of the debt can create a ripple effect, influencing major life decisions and generating considerable psychological stress.

The effect of high student loan debt on an individual’s ability to save for retirement is substantial. Monthly payments often consume a significant portion of disposable income, leaving little room for contributions to retirement accounts. This delayed or reduced saving can severely compromise future financial security, potentially leading to a less comfortable retirement. For example, someone burdened with $50,000 in student loan debt at a 6% interest rate might find themselves dedicating a substantial portion of their income to repayment, leaving less for investments that could grow over time to provide retirement income. This situation is further exacerbated by the fact that many borrowers are still paying off loans well into their 40s and 50s, the peak earning years when retirement savings should ideally be maximized.

Effect on Major Life Decisions

Significant student loan debt frequently delays or prevents major life milestones. The financial strain of loan repayments can make homeownership a distant dream for many young adults. The high cost of a down payment, coupled with ongoing mortgage payments and student loan debt, creates a formidable financial hurdle. Similarly, starting a family can be postponed or even ruled out entirely due to the financial pressures of childcare, healthcare, and the ongoing burden of student loan repayments. For instance, a young couple grappling with substantial student loan debt may find it impossible to afford a larger home suitable for a growing family, or they may choose to delay having children until their debt is significantly reduced or eliminated.

Psychological Impact of Student Loan Debt

The psychological toll of managing substantial student loan debt is often underestimated. The constant pressure of repayment can lead to chronic stress, anxiety, and even depression. The feeling of being trapped in a cycle of debt can be overwhelming, impacting mental health and overall well-being. This stress can manifest in various ways, from difficulty sleeping to decreased productivity at work, potentially affecting career advancement opportunities and further hindering financial progress. Many individuals report feeling a sense of hopelessness and regret, especially when they perceive their educational investment has not yielded the expected return on investment.

Financial Burden Across Demographics

The financial burden of student loan debt is not evenly distributed across all demographics. Minority groups and individuals from low-income backgrounds often face disproportionately higher levels of debt and struggle more significantly with repayment. This disparity is often linked to factors such as limited access to higher education resources, lower average incomes, and potentially higher interest rates on loans. For example, Black borrowers often have higher debt loads than their white counterparts, even after controlling for educational attainment, due to systemic inequalities in access to financial aid and employment opportunities. This disparity highlights the need for targeted support and policies aimed at addressing these inequalities and promoting equitable access to higher education and financial resources.

Government Policies and Student Loan Debt

Government policies play a crucial role in shaping the landscape of student loan debt, influencing both its accumulation and its eventual repayment. The current system, while aiming to provide access to higher education, has inadvertently contributed to a growing crisis. Understanding existing policies and exploring potential reforms is vital to mitigating the negative impacts of student loan debt on individuals and the economy.

A Hypothetical Policy Proposal: Income-Based Repayment Reform

The current student loan repayment system often leaves borrowers struggling to manage their debt, even with income-driven repayment plans. This proposal suggests a significant overhaul to prioritize affordability and long-term financial stability.

| Current System | Proposed System: Progressive Income-Based Repayment |

|---|---|

| Multiple income-driven repayment plans with varying eligibility criteria and repayment calculations. Often complex and difficult to navigate. | A single, simplified income-driven repayment plan applicable to all federal student loans. Repayment amount capped at a percentage of discretionary income (e.g., 5% for low earners, gradually increasing to a maximum of 15% for high earners). |

| Loan forgiveness after 20-25 years (depending on the plan), but often leaving borrowers with significant accumulated interest. | Loan forgiveness after 15 years for low-to-moderate earners (defined by income thresholds adjusted annually for inflation). For higher earners, forgiveness after 20 years, with interest significantly reduced or capped during the repayment period. |

| High interest rates for some loan types, exacerbating debt accumulation. | Interest rates adjusted based on borrower’s income level. Lower interest rates for low-to-moderate earners, gradually increasing for higher earners. |

| Limited transparency and communication regarding repayment options. | Comprehensive online portal with clear, easy-to-understand information on repayment plans, interest rates, and forgiveness options. Regular communication with borrowers regarding their repayment progress. |

Existing Government Programs for Student Loan Repayment Assistance

Several government programs aim to assist students with loan repayment. These programs offer varying degrees of support, often contingent on factors such as income, employment, and loan type. Understanding the eligibility criteria and benefits of each program is essential for borrowers seeking relief.

Types of Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each targeting specific professions or circumstances. These programs offer complete or partial loan cancellation under specific conditions, potentially providing significant financial relief. However, access to these programs can be challenging due to strict eligibility requirements and often lengthy application processes. Examples include Public Service Loan Forgiveness (PSLF) for those working in government or non-profit sectors, and Teacher Loan Forgiveness for teachers meeting certain criteria.

Effectiveness of Government Interventions

The effectiveness of government interventions to address student loan debt is a complex issue. While programs like income-driven repayment plans and loan forgiveness offer some relief, their impact varies widely depending on individual circumstances and the specific program design. For example, PSLF has faced criticism for its complex application process and low success rate. The overall effectiveness hinges on factors such as program accessibility, administrative efficiency, and the adequacy of financial relief provided relative to the scale of the debt crisis. The long-term impact of various interventions requires further evaluation and ongoing refinement of policies to ensure they effectively address the challenges of student loan debt.

Alternative Financing Options for Higher Education

The rising cost of higher education has led many to seek alternatives to traditional student loans. Exploring these options is crucial for mitigating the burden of educational debt and ensuring accessibility to higher learning. A diverse range of financing strategies can significantly reduce reliance on loans, offering more manageable repayment plans and potentially fostering greater financial stability for students.

Several viable alternatives exist, each with its own set of advantages and disadvantages. Careful consideration of individual circumstances and financial goals is essential when choosing the best approach.

Scholarships and Grants

Scholarships and grants represent a significant source of non-repayable financial aid. These funds are awarded based on merit, financial need, or specific criteria set by the awarding institution or organization. They are typically free money, meaning they don’t need to be repaid.

Advantages: Scholarships and grants significantly reduce tuition costs, potentially eliminating the need for loans entirely. They can come from various sources, including colleges, universities, private organizations, and corporations. They offer financial relief without adding to a student’s debt burden.

Disadvantages: Competition for scholarships and grants can be fierce. Eligibility requirements vary widely, and securing funding can require significant effort and time investment. The amount awarded may not fully cover tuition costs.

Impact on Student Loan Debt: Increased access to scholarships and grants directly correlates with a reduction in student loan debt. Successful applicants may require fewer or no loans to finance their education.

Work-Study Programs

Work-study programs offer part-time employment opportunities to students, allowing them to earn money while pursuing their education. These programs are often coordinated through the college or university and provide valuable work experience alongside financial support.

Advantages: Work-study provides a steady income stream to help cover educational expenses. The work experience gained can enhance a student’s resume and career prospects. It allows students to contribute to their education while gaining valuable professional skills.

Disadvantages: Work-study jobs may not always be readily available or aligned with a student’s interests or career goals. The income generated may not be sufficient to cover all educational costs. Balancing work and studies can be challenging and potentially impact academic performance.

Impact on Student Loan Debt: By providing supplemental income, work-study programs can reduce the amount of borrowing needed. Students may be able to cover a portion of their tuition, fees, and living expenses, lessening their reliance on loans.

Income Share Agreements (ISAs)

Income Share Agreements are a relatively newer alternative to traditional loans. Under an ISA, investors provide funding for a student’s education in exchange for a percentage of their future income for a set period.

Advantages: ISAs can reduce the immediate financial burden of tuition. Repayments are tied to income, so payments are lower during periods of low earnings. They offer a potentially more flexible repayment schedule compared to traditional loans.

Disadvantages: ISAs can be complex and require careful consideration of the terms and conditions. The percentage of income paid back can be substantial, potentially impacting long-term financial stability. Not all educational institutions or programs offer ISA options.

Impact on Student Loan Debt: The widespread adoption of ISAs could potentially reduce the overall amount of student loan debt by providing an alternative financing mechanism. However, the long-term financial implications for individuals need careful evaluation.

Family Contributions and Savings

Utilizing family contributions and savings represents a significant strategy for reducing reliance on student loans. Families can contribute directly to tuition costs or establish savings plans specifically for education.

Advantages: Family contributions avoid the accumulation of debt. It fosters a sense of shared responsibility and financial planning. Savings plans can provide a structured approach to funding education.

Disadvantages: Not all families have the financial resources to significantly contribute to higher education costs. Reliance on family contributions can place financial strain on families. Savings plans require long-term financial planning and discipline.

Impact on Student Loan Debt: Increased family contributions and savings directly reduce the need for student loans, leading to lower overall debt levels. This approach emphasizes proactive financial planning and responsible resource allocation.

Visual Representation of Student Loan Debt Data

Data visualization is crucial for understanding the complex issue of student loan debt. Charts and graphs can effectively communicate trends and patterns that are difficult to discern from raw numbers alone. By presenting the data visually, we can gain a clearer picture of the scope and impact of this growing financial burden.

Bar Chart: Growth of Student Loan Debt Over Time

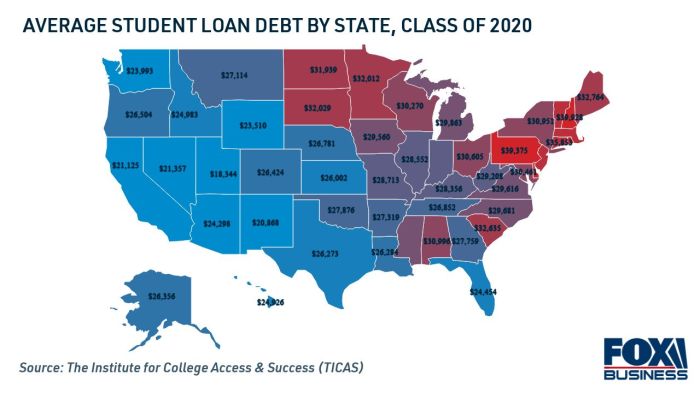

A bar chart effectively displays the growth of student loan debt over time. The horizontal axis (x-axis) would represent years, spanning perhaps from 1990 to the present, showing a decade-by-decade increase for better clarity. The vertical axis (y-axis) would represent the total amount of student loan debt outstanding in trillions of dollars. Each bar would represent a specific year, with its height corresponding to the total debt for that year. For example, a bar for 2000 might show a height representing $1 trillion in debt, while a bar for 2023 would be significantly taller, reflecting the substantial increase in debt over the period. The chart would clearly demonstrate the exponential growth of student loan debt over the past few decades. Data points could be sourced from the Federal Reserve or the Department of Education.

Pie Chart: Distribution of Student Loan Debt Across Educational Fields

A pie chart can illustrate the proportion of student loan debt held by borrowers in various fields of study. The entire pie would represent the total student loan debt. Each slice would represent a different educational field (e.g., Business, Medicine, Engineering, Humanities). The size of each slice would be proportional to the amount of student loan debt accumulated by borrowers in that field. For instance, a large slice might represent the debt incurred by medical students, reflecting the high cost of medical education, while a smaller slice might represent debt in the humanities. This visual representation would highlight the disparity in debt accumulation across different academic disciplines.

Infographic: Relationship Between Student Loan Debt and Future Earning Potential

An infographic could effectively illustrate the complex relationship between student loan debt and future earning potential. It could incorporate a line graph showing the average starting salary for graduates in various fields, overlaid with a second line representing the average student loan debt for those same fields. This would visually demonstrate how higher earning potential in some fields (like engineering or medicine) might offset the higher debt incurred during education, while lower-earning fields might struggle with a disproportionately high debt-to-income ratio. The infographic could also include text boxes highlighting key statistics, such as the average debt-to-income ratio for specific fields or the percentage of graduates who are able to repay their loans within a reasonable timeframe. Real-life examples of graduates in high-debt, low-income fields versus low-debt, high-income fields would further illustrate the points made in the infographic. The infographic could conclude with a brief discussion of the potential long-term financial implications of various educational choices.

Conclusive Thoughts

The sheer amount of student loan debt represents a significant societal challenge demanding innovative solutions and a renewed focus on affordability in higher education. While government interventions and alternative financing options offer some relief, a multifaceted approach addressing rising tuition costs, improved financial literacy, and responsible borrowing practices is crucial. Ultimately, reducing the burden of student loan debt requires a collective effort to ensure accessible and affordable higher education for all.

Query Resolution

What is the average repayment period for student loans?

The average repayment period varies depending on the loan type and lender, but it typically ranges from 10 to 20 years.

Can I consolidate multiple student loans?

Yes, consolidating multiple student loans into a single loan can simplify repayment and potentially lower your monthly payments. However, it’s crucial to carefully consider the terms and interest rates before consolidating.

What happens if I default on my student loans?

Defaulting on student loans has severe consequences, including wage garnishment, tax refund offset, and damage to your credit score. It can also make it difficult to obtain future loans or credit.

Are there income-driven repayment plans available?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size. These plans can make repayment more manageable, but they may extend the repayment period.