Navigating the complexities of student loan repayment can feel overwhelming, especially when unexpected life events arise. Understanding your options, such as applying for a deferment, is crucial for maintaining financial stability and avoiding potential negative impacts on your credit. This guide provides a clear and concise overview of the student loan deferment process, empowering you to make informed decisions about your financial future.

This comprehensive resource covers eligibility criteria, the application process, key differences between deferment and forbearance, and potential long-term financial implications. We’ll also explore alternative repayment options and provide valuable resources to guide you through each step. By the end, you’ll have the knowledge and confidence to successfully navigate the deferment process or explore other suitable alternatives.

Eligibility Criteria for Student Loan Deferment

Securing a student loan deferment can provide crucial financial relief during challenging times. Understanding the eligibility requirements is the first step in successfully applying for this assistance. This section details the criteria, provides examples of qualifying situations, and Artikels the necessary documentation.

Common Eligibility Requirements for Deferment

Generally, eligibility for a student loan deferment hinges on demonstrating a period of financial hardship or a specific life circumstance recognized by your loan servicer. These circumstances often require verification through supporting documentation. Specific requirements can vary slightly depending on the type of loan and the lender.

Examples of Situations Qualifying for Deferment

Several life events may qualify an individual for a student loan deferment. These include unemployment (requiring proof of job search efforts), economic hardship (demonstrated through financial documentation), enrollment in a graduate or professional program (requiring proof of enrollment), and active military service (requiring proof of service). Additionally, some deferment programs exist for those experiencing medical hardship or facing significant natural disaster-related financial challenges. Documentation supporting the claim of hardship is crucial in these situations.

Required Documentation for Deferment Applications

Supporting your deferment application requires providing sufficient evidence to substantiate your claim. This typically involves documentation such as pay stubs (showing unemployment or reduced income), tax returns (demonstrating financial hardship), enrollment verification forms from your educational institution, military orders (for active-duty service), medical bills or documentation from a physician (for medical hardship), and official documentation related to natural disasters (such as FEMA records). The exact requirements may vary, so consulting your loan servicer’s specific instructions is vital.

Comparison of Deferment Programs

The availability and specific eligibility criteria for deferment programs vary depending on the type of student loan and the lender. The following table provides a general comparison, but it’s essential to check with your loan servicer for the most accurate and up-to-date information.

| Deferment Type | Eligibility Criteria | Duration | Documentation Needed |

|---|---|---|---|

| Economic Hardship Deferment | Demonstrable financial difficulty, often defined by income below a certain threshold. | Up to 3 years, potentially renewable. | Tax returns, pay stubs, bank statements, proof of unemployment. |

| Unemployment Deferment | Active job search and proof of unemployment. | Up to 3 years, often with limitations on total deferment periods. | Unemployment claim documentation, proof of job search efforts. |

| Graduate/Professional School Deferment | Enrollment in a graduate or professional degree program at least half-time. | Duration of the program. | Enrollment verification from the institution. |

| Military Deferment | Active duty in the U.S. military. | Duration of active duty. | Military orders, proof of active duty status. |

The Application Process

Applying for a student loan deferment involves several steps and requires specific documentation. The exact process may vary slightly depending on your loan servicer and the type of deferment you are seeking, so it’s crucial to check your servicer’s website for the most up-to-date instructions. Generally, the process is straightforward and can be completed online or via mail.

The application process typically involves gathering necessary documentation, completing the required forms, and submitting your application to your loan servicer. Failing to provide complete and accurate information can delay the processing of your deferment request.

Required Forms and Documentation

The specific forms required will depend on the type of deferment you are applying for. However, you will generally need to complete an application form provided by your loan servicer. This often includes personal information, details about your student loans, and the reason for requesting a deferment. Supporting documentation, such as proof of unemployment or enrollment in an eligible program, is usually also required. For example, if you’re applying for an unemployment deferment, you might need to provide a copy of your unemployment benefit statement or a letter from your employer confirming your job loss. If you’re applying for a deferment due to economic hardship, you might need to provide documentation supporting your claim, such as bank statements or tax returns.

Submitting the Application

Most loan servicers offer the convenience of online application submission. This typically involves creating an online account or logging into your existing account and navigating to the deferment application section. You’ll then complete the application online and upload the necessary supporting documents. Some servicers may still allow applications to be submitted via mail. In this case, you’ll need to download and print the application form, complete it, gather your supporting documents, and mail everything to the address provided by your loan servicer. Always retain a copy of your completed application and supporting documentation for your records.

Typical Timeline for Processing a Deferment Application

The processing time for a deferment application can vary. However, you can generally expect the following timeline:

- Application Submission: This is the initial step, where you submit your completed application and supporting documents.

- Review and Verification: Your loan servicer will review your application and verify the information provided. This may involve contacting you for additional information or clarification.

- Processing: Once the information is verified, your application will be processed. This may take several weeks or even months, depending on the volume of applications and the complexity of your case.

- Notification: You will receive notification from your loan servicer once a decision has been made on your application. This notification will confirm whether your deferment has been approved or denied, and if approved, the effective dates of the deferment.

It’s important to note that this is a general timeline, and the actual processing time may vary depending on your specific circumstances and your loan servicer. It’s always advisable to contact your loan servicer directly if you have any questions or concerns about the status of your application.

Understanding Deferment vs. Forbearance

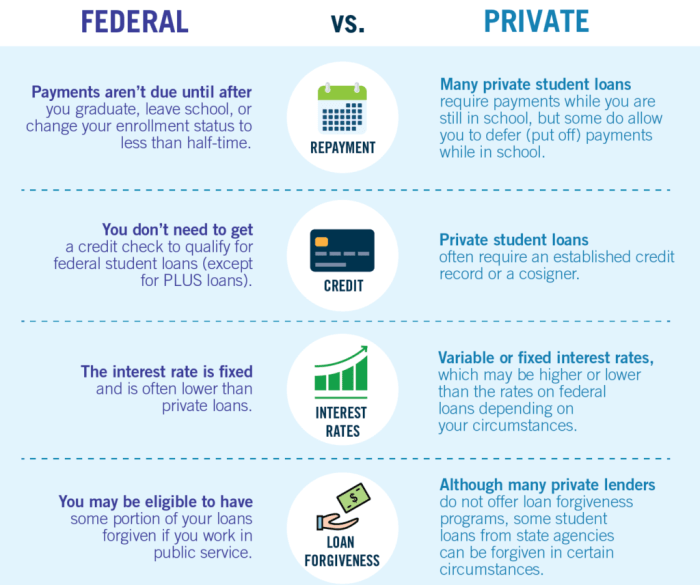

Choosing between deferment and forbearance for your student loans can significantly impact your financial future. Both options temporarily postpone your loan payments, but they differ substantially in their eligibility requirements, long-term consequences, and how they affect your credit. Understanding these differences is crucial for making an informed decision.

Deferment and forbearance are both temporary pauses on your student loan payments, but they operate under different circumstances and have varying implications. Deferment is generally preferred because it often doesn’t negatively impact your credit score, unlike forbearance. However, eligibility for deferment is typically more restrictive.

Eligibility Criteria Differences

Eligibility for deferment and forbearance varies depending on your loan type and your specific circumstances. Deferment is usually granted to borrowers who meet specific criteria, such as being enrolled at least half-time in an eligible educational program, experiencing unemployment, or facing economic hardship. Forbearance, on the other hand, is often granted more readily, with fewer stringent requirements. Lenders may grant forbearance based on documented financial difficulties, even if those difficulties don’t precisely fit the defined criteria for deferment. The specific requirements for each will be Artikeld by your loan servicer.

Impact on Credit Score and Future Repayment

A key distinction lies in the impact on your credit score. While deferment generally doesn’t negatively affect your credit score, forbearance can. Reporting of forbearance to credit bureaus varies by lender, but it can often result in a lower credit score due to the missed payments. This can make it more challenging to secure loans or credit cards in the future, and it can also affect your interest rates. Furthermore, interest may continue to accrue during both deferment and forbearance, potentially increasing your overall loan balance. The accumulated interest during a deferment period may be capitalized (added to your principal balance) upon exiting the deferment, increasing the amount you ultimately owe. With forbearance, interest capitalization is also common, though the specifics vary by loan and lender.

Comparison Table: Deferment vs. Forbearance

| Feature | Deferment | Forbearance |

|---|---|---|

| Eligibility | More restrictive; often requires specific circumstances (e.g., unemployment, school enrollment). | Less restrictive; often granted for general financial hardship. |

| Credit Score Impact | Generally no negative impact. | Potentially negative impact; reported as missed payments to credit bureaus. |

| Interest Accrual | Interest typically accrues (may be capitalized upon exiting deferment). | Interest typically accrues (may be capitalized upon exiting forbearance). |

| Advantages | Preserves credit score, often easier to obtain than forbearance if you meet the criteria. | Easier to obtain than deferment, provides temporary relief from payments. |

| Disadvantages | Stricter eligibility requirements. | Potential negative impact on credit score, interest accrual can significantly increase loan balance. |

Potential Impacts of Deferment on Student Loans

Deferring your student loan payments can provide temporary relief, but it’s crucial to understand the long-term financial consequences. While deferment pauses your payments, it doesn’t eliminate the debt, and several key aspects of your loan will be affected. Understanding these impacts will help you make informed decisions about your repayment strategy.

Accrued Interest During Deferment

During a deferment period, interest typically continues to accrue on subsidized and unsubsidized federal student loans. For subsidized loans, the government pays the interest while you’re in deferment, provided you meet the eligibility requirements. However, for unsubsidized loans, the interest is added to your principal balance, increasing your overall loan amount. This means that when your deferment ends, you’ll owe more than your original loan balance. The longer the deferment period, the more interest will accumulate, leading to a significantly larger debt. For example, a $10,000 unsubsidized loan with a 5% interest rate accruing interest for one year during deferment will result in an additional $500 added to the principal.

Impact on Repayment Schedule and Loan Balance

A deferment directly impacts your repayment schedule. The deferment period adds to the overall length of your repayment plan. This extension means that your monthly payments might remain the same, but you’ll be paying them for a longer period. Because interest continues to accumulate during deferment (except for subsidized loans where the government covers it), your total loan balance will increase. This increase will ultimately lead to paying more in interest over the life of the loan. For instance, a 10-year loan plan extended by two years due to deferment will result in a longer repayment period and increased total interest paid.

Deferment versus Minimum Payments

Choosing deferment instead of making minimum payments has significant financial implications. While deferment provides short-term relief from payment pressure, it leads to increased long-term costs due to accumulating interest. Making even minimum payments, though it may seem challenging, prevents the continuous growth of the principal balance and reduces the total interest paid over the loan’s lifespan. The difference can be substantial over many years. Consider a scenario where a borrower with a $20,000 loan chooses deferment for two years instead of making minimum payments. The accumulated interest during those two years, compounded over the remaining loan term, could add thousands of dollars to the total cost.

Examples of Long-Term Financial Impact

Let’s consider two borrowers with similar $30,000 unsubsidized loans and a 6% interest rate. Borrower A chooses a 10-year repayment plan and makes all payments on time. Borrower B takes a two-year deferment before beginning their 10-year repayment plan. Even with the same repayment period (10 years), Borrower B will end up paying significantly more due to the accumulated interest during the deferment. This difference can easily amount to thousands of dollars over the loan’s life, impacting their long-term financial stability. Another example might involve a borrower who defers their loan repeatedly throughout their repayment period, significantly extending the repayment timeline and dramatically increasing the overall interest paid. This could severely impact their ability to save for other financial goals like a down payment on a house or retirement.

Common Reasons for Seeking Deferment

Student loan deferment offers a temporary pause on loan repayments, providing crucial financial breathing room during challenging life circumstances. Understanding the common reasons for seeking deferment is vital for borrowers navigating the complexities of loan repayment. This section will Artikel several typical scenarios where deferment can be a beneficial tool.

Many factors can necessitate a deferment, often stemming from unexpected life events or career transitions that impact a borrower’s ability to meet their monthly payment obligations. These situations can significantly disrupt financial stability, making timely repayments difficult or impossible. Therefore, exploring deferment options is crucial to avoid default and maintain a positive credit history.

Unemployment and Underemployment

Unemployment or underemployment significantly impacts a borrower’s ability to meet their loan repayment obligations. A job loss, reduction in work hours, or a transition to a lower-paying position can create immediate financial strain. Deferment can offer temporary relief, allowing borrowers to focus on securing new employment without the added pressure of loan payments. For example, a recent college graduate who has been actively searching for a job for several months might benefit from a deferment until they secure stable employment. Similarly, someone experiencing a temporary layoff due to company restructuring could use a deferment to manage their finances during the job search.

Return to School

Returning to school, whether for further education or professional development, often requires a significant financial commitment. Balancing tuition fees, living expenses, and student loan payments can be overwhelming. A deferment allows borrowers to prioritize their studies without the immediate burden of loan repayment, allowing them to focus on their academic pursuits and future career prospects. For instance, a registered nurse returning to school to become a nurse practitioner could utilize a deferment to reduce financial strain while pursuing their advanced degree.

Medical Emergencies and Illness

Unexpected medical emergencies or prolonged illnesses can create substantial financial burdens, including medical bills and lost income. Facing these challenges while simultaneously managing student loan repayments can be extremely difficult. A deferment can provide much-needed financial relief, allowing borrowers to focus on their health and recovery without the additional stress of loan payments. For example, someone undergoing extensive cancer treatment might qualify for a deferment due to the significant financial and physical strain associated with their condition.

Situations Where Deferment Might Not Be the Best Option

It’s important to consider the potential drawbacks of deferment before applying. While it provides temporary relief, it doesn’t eliminate the debt; interest may still accrue on unsubsidized loans, increasing the overall loan balance. Additionally, deferment may impact credit scores, albeit temporarily. The following situations highlight when alternative options might be more beneficial:

- When you can afford minimal payments: If you can make even small payments, it’s generally better to continue making payments to avoid accruing interest and potentially maintain a good credit history.

- When you have a short-term financial setback: For minor, temporary financial difficulties, exploring income-driven repayment plans or contacting your loan servicer to discuss payment options might be more suitable than a deferment.

- When you are close to loan repayment: If you are nearing the end of your repayment period, deferment might not be the most efficient option, as it extends the repayment timeline and potentially increases the total interest paid.

Alternatives to Deferment

Deferring your student loan payments can provide temporary relief, but it’s not always the best long-term solution. Several alternatives offer more sustainable approaches to managing your student loan debt, potentially leading to faster repayment and lower overall interest costs. Understanding these options allows you to make informed decisions aligned with your financial circumstances.

Income-driven repayment plans represent a significant alternative to deferment. These plans calculate your monthly payment based on your income and family size, making them attractive for borrowers facing financial hardship or unpredictable income streams. Unlike deferment, which temporarily suspends payments, income-driven repayment plans adjust payments to fit your current budget, offering a more manageable long-term approach.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer monthly payments based on your discretionary income. Several federal IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has slightly different eligibility requirements and calculation methods, resulting in varying monthly payments and loan forgiveness timelines. For example, REPAYE generally offers lower monthly payments than IBR, but the total amount paid over the life of the loan may be higher depending on income fluctuations. Choosing the right plan involves carefully comparing your potential monthly payments under each option, considering factors such as your current income, family size, and projected future earnings. It’s recommended to use the Department of Education’s repayment estimator to compare your options.

Deferment vs. Income-Driven Repayment Plans

A key difference between deferment and IDR plans lies in the long-term impact on your loan. Deferment pauses payments but accrues interest, leading to a larger total debt upon repayment resumption. IDR plans, however, adjust payments based on your income, potentially resulting in lower monthly payments and a more manageable repayment journey. While interest still accrues, the lower monthly payment can be more sustainable in the long run. The ultimate choice depends on your financial situation and long-term goals. If you anticipate a short-term financial hardship, deferment might be a viable temporary solution. However, for long-term financial instability, an IDR plan might be a more suitable and sustainable strategy.

Determining the Best Option

Selecting the best option – deferment or an IDR plan – depends on your individual circumstances. Consider your current income, expected future income, length of anticipated financial hardship, and your risk tolerance for accumulating interest. For example, a borrower experiencing a temporary job loss might find deferment beneficial for a short period. However, a borrower with consistently low income might find an IDR plan a more practical solution for long-term debt management. If you are unsure which option suits your needs, consider consulting a financial advisor or student loan counselor for personalized guidance. They can help you analyze your financial situation, explore available options, and develop a comprehensive debt management strategy.

Resources and Further Assistance

Navigating the student loan deferment process can be complex, and additional support is often beneficial. This section provides resources to help you find further information and assistance should you need it. Remember to always verify information independently with official sources.

Finding reliable information and appropriate support is crucial for a successful deferment application. Several avenues exist to assist you, including government websites, dedicated student loan servicers, and non-profit organizations specializing in student loan assistance. Understanding your options and knowing where to seek help is key to managing your student loan debt effectively.

Reliable Resources for Information on Student Loan Deferment

The federal government provides comprehensive information on student loan deferment. The Federal Student Aid website (studentaid.gov) offers detailed explanations of eligibility criteria, application procedures, and frequently asked questions. Additionally, many reputable non-profit organizations focused on financial literacy and student loan debt management offer guidance and resources. These organizations often provide free or low-cost workshops and online resources to assist students in navigating the complexities of federal student aid programs. Always verify the legitimacy of any third-party resource before relying on its information.

Contact Information for Relevant Government Agencies and Student Loan Servicers

The primary contact for federal student loans is the Federal Student Aid (FSA) office. Their website, studentaid.gov, provides a comprehensive contact section with phone numbers, email addresses, and mailing addresses depending on your specific needs. Your individual student loan servicer will also be a valuable point of contact. Your servicer’s contact information should be readily available on your student loan statements or on the National Student Loan Data System (NSLDS) website. The NSLDS allows you to view your federal student loan information and locate your servicer. Always keep your contact information updated with your servicer to ensure timely communication.

Appealing a Denied Deferment Application

If your deferment application is denied, you have the right to appeal the decision. The appeal process typically involves submitting a formal request to your loan servicer, providing additional documentation to support your claim for deferment. This documentation might include updated financial information, medical documentation, or other relevant evidence demonstrating your eligibility. The appeal process and requirements are usually Artikeld in the denial letter you receive. It’s important to carefully review this letter and follow the instructions precisely to maximize your chances of a successful appeal. Keep detailed records of all correspondence and documentation submitted during the appeal process.

Helpful Tips for Navigating the Deferment Application Process

Careful planning and preparation can significantly improve your chances of a successful deferment application. Here are some helpful tips:

- Gather all necessary documentation well in advance of the application deadline. This might include tax returns, employment verification, and medical records, depending on the reason for your deferment request.

- Complete the application thoroughly and accurately. Errors or omissions can lead to delays or denial.

- Submit your application well before the deadline to allow ample processing time.

- Keep copies of all submitted documents for your records.

- Follow up with your loan servicer if you haven’t received a response within a reasonable timeframe.

- Understand the terms and conditions of the deferment before accepting it. Be aware of any potential impact on your credit score or future loan repayment.

End of Discussion

Successfully managing student loan debt requires careful planning and a thorough understanding of available options. Applying for a deferment can provide temporary relief, but it’s vital to weigh the long-term implications against alternatives like income-driven repayment plans. Remember to thoroughly research your eligibility, gather necessary documentation, and utilize the resources provided to ensure a smooth and effective application process. Taking proactive steps towards responsible debt management will contribute significantly to your overall financial well-being.

Common Queries

What happens to interest during a deferment period?

Interest typically continues to accrue on subsidized and unsubsidized loans during a deferment period, increasing your overall loan balance. The interest may be capitalized at the end of the deferment, meaning it’s added to your principal balance.

Can I defer my student loans indefinitely?

No, deferments are typically granted for a limited time period, often ranging from several months to a year or two. The specific length depends on the type of deferment and your eligibility.

What if my deferment application is denied?

If your application is denied, you typically have the option to appeal the decision. Carefully review the reasons for denial and provide any additional supporting documentation that might strengthen your case.

How does a deferment affect my credit score?

While a deferment itself doesn’t directly impact your credit score, consistently missing payments (even during a deferment, if applicable) can negatively affect your credit history.

Are there any fees associated with applying for a deferment?

Generally, there are no fees associated with applying for a student loan deferment. However, always check with your loan servicer to confirm.