Securing a federal direct student loan can be a pivotal step towards higher education. This process, while potentially daunting, becomes manageable with a clear understanding of eligibility, application procedures, and repayment options. This guide navigates you through the complexities of applying for federal student aid, ensuring a smooth and informed journey towards your academic goals.

From understanding eligibility requirements based on factors like enrollment status and citizenship to mastering the navigation of the Federal Student Aid (FSA) website, this resource provides a comprehensive overview. We’ll explore the nuances of the FAFSA form, different loan types (subsidized, unsubsidized, PLUS), repayment plans, and strategies to avoid common pitfalls and potential scams.

Eligibility Requirements for Federal Direct Student Loans

Securing a Federal Direct Student Loan involves meeting specific eligibility criteria. These requirements ensure that the loan program effectively supports students who demonstrate a genuine need for financial assistance to pursue their education. Understanding these requirements is crucial for a successful application.

Eligibility for federal direct student loans hinges on several key factors. These include your citizenship or immigration status, your enrollment status at an eligible educational institution, and your credit history (though credit history is generally not a significant factor for undergraduate loans).

Citizenship and Residency Status

Applicants must be U.S. citizens or eligible non-citizens. Eligible non-citizens typically include permanent residents, certain individuals with conditional permanent resident status, and those granted asylum or refugee status. Individuals who do not meet these requirements will generally be ineligible for federal direct student loans. For example, a student who is in the U.S. on a temporary visa for tourism would not qualify.

Enrollment Status

To be eligible, you must be enrolled or accepted for enrollment at least half-time in a degree or certificate program at a school participating in the federal student aid programs. This “half-time” status is defined by the institution, but generally involves a minimum number of credit hours per term. Students enrolled less than half-time, or those attending unaccredited institutions or programs that do not lead to a degree or certificate, are typically ineligible. For instance, a student taking only one course per semester would likely not meet the half-time enrollment requirement.

Financial Need (for some programs)

While not a universal requirement, some federal student loan programs consider financial need when determining eligibility or loan amounts. This assessment often involves comparing your family’s income and assets to the cost of attendance at your chosen institution. Students from families with higher incomes may receive less in federal aid or may be ineligible for certain need-based loan programs. For example, a student from a high-income family may be eligible for unsubsidized loans but not subsidized loans, which are based on financial need.

Credit History

Generally, credit history is not a significant factor for undergraduate students applying for federal direct student loans. However, graduate and professional students may face stricter credit checks. Applicants with a history of significant credit problems, such as bankruptcies or defaults on previous loans, might find it more challenging to secure federal student loans, or they may be offered loans with less favorable terms. A student with a history of missed loan payments on previous loans may find it harder to secure a new loan.

Comparison of Eligibility Requirements

| Requirement | Undergraduate | Graduate | Professional |

|---|---|---|---|

| U.S. Citizenship or Eligible Non-citizen Status | Required | Required | Required |

| Enrollment Status (at least half-time) | Required | Required | Required |

| Credit History Check | Generally Not a Major Factor | May be a Factor | May be a Factor |

| Financial Need Consideration (for some programs) | May Apply | May Apply | May Apply |

The Federal Student Aid (FSA) Website Navigation

Navigating the Federal Student Aid (FSA) website can seem daunting at first, but with a little guidance, the process becomes straightforward. The website is designed to be user-friendly, offering a wealth of information and resources to assist students in applying for federal student aid. Understanding its structure and key features will significantly streamline the application process.

The FSA website, studentaid.gov, serves as the central hub for all federal student aid programs. Locating the application portal requires a few simple steps. The site is well-organized, with clear links and a search function to help users find what they need quickly.

Locating the FAFSA Application Portal

To begin the process of applying for a federal direct student loan, you must first access the Free Application for Federal Student Aid (FAFSA) form. This is the primary application used to determine your eligibility for federal student aid, including Direct Loans.

- Step 1: Go to studentaid.gov. The homepage will feature prominent links and banners related to the FAFSA, usually near the top. Look for a button or link explicitly labeled “FAFSA” or similar wording.

- Step 2: Click on the FAFSA link. This will take you to the FAFSA application page. You may be asked to create an FSA ID or log in if you already have one. An FSA ID is a username and password combination that you’ll use to access and manage your federal student aid information.

- Step 3: Once logged in, you will be presented with the FAFSA application itself. The form is structured logically, guiding you through each section sequentially.

Completing the FAFSA Application

The FAFSA application is comprehensive, collecting a range of information to determine your financial need and eligibility for aid. Accuracy is crucial; providing false information can lead to delays or denial of your application.

- Step 1: Student Information: This section requires personal details such as your name, date of birth, Social Security number, and contact information. You’ll also need to provide information about your educational goals, such as your intended college and degree program.

- Step 2: Parent Information (if applicable): If you are a dependent student, you will need to provide information about your parents’ income, assets, and tax information. The definition of a dependent student is clearly Artikeld on the website. Independent students will skip this section.

- Step 3: Financial Information: This section involves providing details about your and your parents’ (if applicable) income, assets, and tax returns. The application will guide you through the necessary fields, often pre-filling information from the IRS Data Retrieval Tool if you allow it access.

- Step 4: School Information: You will need to provide the Federal School Code of the college or university you plan to attend. This code can usually be found on the school’s website. You will also confirm your enrollment status.

- Step 5: Review and Submission: Once you have completed all sections, carefully review your application for accuracy. Any errors can cause significant delays. After review and confirmation, submit your FAFSA application electronically. You will receive a confirmation number indicating successful submission.

Sections of the FAFSA Application and Required Information

The FAFSA application is divided into several key sections, each requesting specific information crucial for determining your eligibility for federal student aid. Failing to provide accurate and complete information in any section may delay or prevent the processing of your application.

- Student Information: Name, address, date of birth, Social Security number, email address, phone number, educational goals (intended college, degree program, enrollment status), citizenship status, and any prior college attendance.

- Parent Information (if applicable): Parents’ names, addresses, Social Security numbers, date of birth, marital status, income details (W-2s, tax returns), and asset information (bank accounts, investments).

- Financial Information: Income and tax information for both the student and parents (if applicable). This section will often use the IRS Data Retrieval Tool for pre-filling information, significantly speeding up the process.

- School Information: The Federal School Code for the institution you plan to attend. This information is essential for the proper disbursement of funds.

- Verification (if applicable): Some applicants are selected for verification, requiring additional documentation to confirm the accuracy of the information provided in the application. This is a standard procedure and does not necessarily indicate any issue with the application itself.

Completing the FAFSA Form

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student financial aid. Completing it accurately and thoroughly is crucial for maximizing your chances of receiving grants, loans, and work-study opportunities. This section will guide you through the process, highlighting key sections and common pitfalls to avoid.

The FAFSA form is organized into sections that collect information about you, your family, and your financial situation. Each section plays a vital role in determining your eligibility for federal student aid. Understanding the purpose of each section ensures a smooth and accurate application process.

Student Information

This section gathers personal details about the student applicant, including name, Social Security number, date of birth, address, and contact information. Accuracy is paramount here, as any discrepancies can lead to delays or rejection of the application. Double-checking all information entered against official documents is recommended.

Parent Information

This section requests information about the student’s parents (or legal guardians). This includes their names, Social Security numbers, addresses, and financial information, such as income and tax data. It’s important to note that the definition of “parent” used by FAFSA may differ from a legal definition and may include step-parents or adoptive parents. If the student is independent, documentation proving their independence must be provided.

Financial Information

This is arguably the most critical section of the FAFSA. It requires detailed financial information from both the student and their parents (if applicable), including income from wages, salaries, self-employment, investments, and other sources. Accurate reporting of tax information (W-2s, 1040s) is vital, as this data directly influences the Expected Family Contribution (EFC) calculation.

School Information

This section asks for the details of the college or career school you plan to attend. You’ll need the school’s Federal School Code, which can be found on the school’s website. This is essential for ensuring that your financial aid is sent to the correct institution. Listing multiple schools is possible, but it’s important to understand how that might impact the processing of your application.

Common FAFSA Errors and How to Avoid Them

Many common errors stem from inaccurate or incomplete information. For example, using incorrect Social Security numbers, providing inaccurate income data, or failing to report all assets can significantly impact the outcome of the application. Using the IRS Data Retrieval Tool (DRT) to directly transfer tax information from the IRS database into the FAFSA is highly recommended to reduce the risk of errors. Another common mistake is failing to list all sources of income, even those considered minor or irregular. A thorough review of all financial records before completing the FAFSA is crucial to minimize errors.

Documents Needed to Complete the FAFSA

To complete the FAFSA accurately and efficiently, gather the following documents:

- Social Security numbers for the student and parents (if applicable)

- Federal tax returns (IRS Form 1040, W-2s) for the student and parents (if applicable)

- Records of untaxed income for the student and parents (if applicable)

- Bank statements and records of investments for the student and parents (if applicable)

- FSA ID (Federal Student Aid ID) for the student and parent (if applicable)

- Your driver’s license or other government-issued identification

Having these documents readily available will streamline the process and help you avoid delays. Remember to double-check all information before submitting your FAFSA.

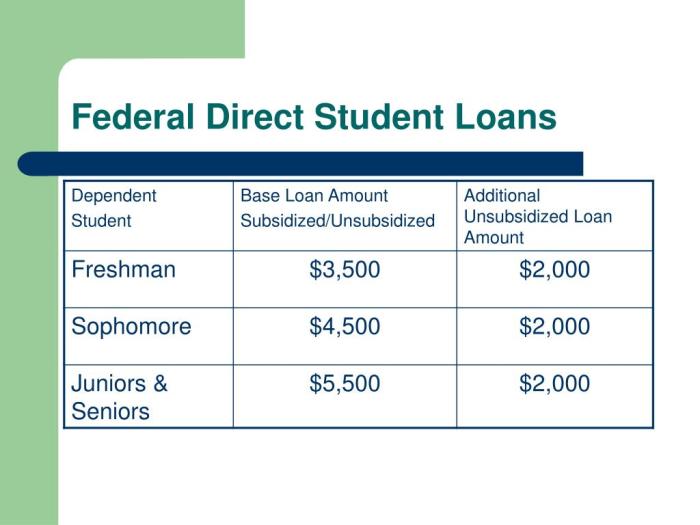

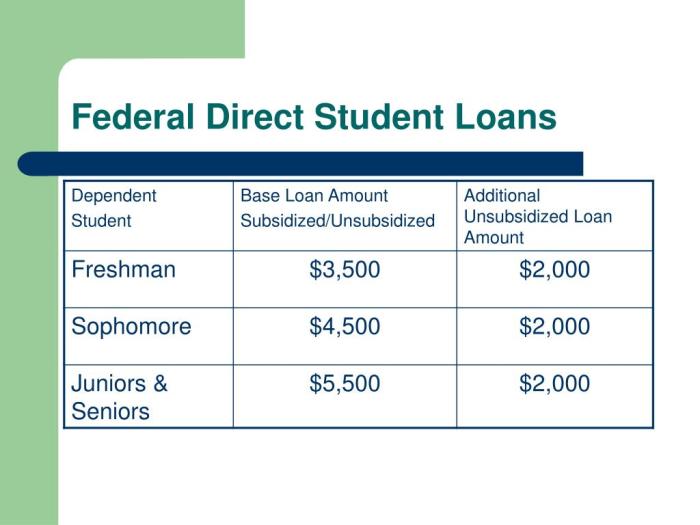

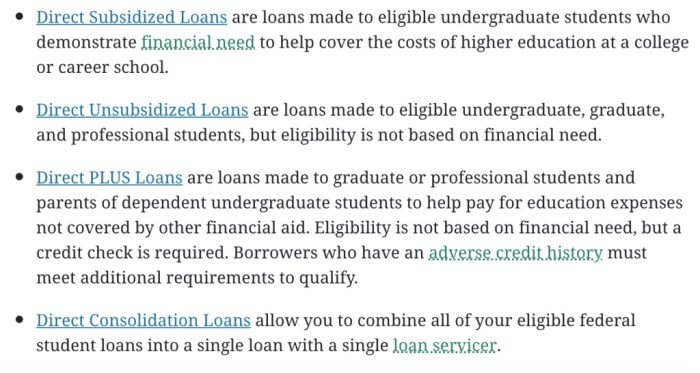

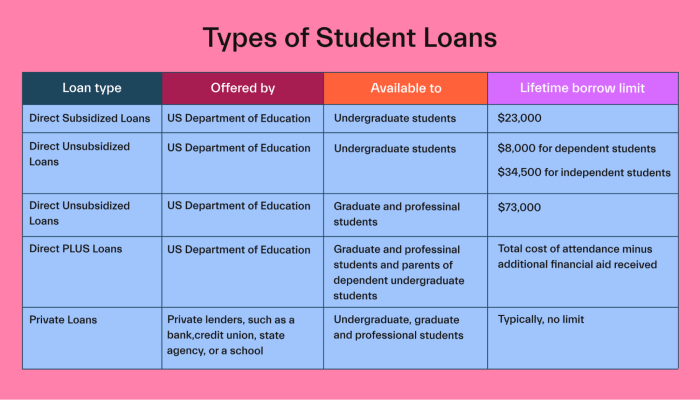

Types of Federal Direct Student Loans

Choosing the right type of federal student loan is crucial for managing your education costs and future finances. Understanding the differences between subsidized, unsubsidized, and PLUS loans is essential for making informed decisions about your borrowing. This section will Artikel the key distinctions between these loan types, helping you determine which option best suits your needs.

Federal Direct Student Loans are offered by the U.S. Department of Education and are a common way to finance higher education. They come in several varieties, each with its own set of terms and conditions. Careful consideration of these differences is important to avoid unexpected costs and repayment challenges.

Subsidized and Unsubsidized Direct Loans

Subsidized and unsubsidized loans are both available to undergraduate students who demonstrate financial need (for subsidized loans) or who don’t (for unsubsidized loans). Graduate students and professional students can only receive unsubsidized loans. The key difference lies in the government’s payment of interest during certain periods.

| Loan Type | Interest Accrual | Eligibility | Repayment |

|---|---|---|---|

| Subsidized Direct Loan | The government pays the interest while you’re in school at least half-time, during grace periods, and during deferment. | Undergraduate students demonstrating financial need. | Begins six months after graduation or leaving school. |

| Unsubsidized Direct Loan | Interest accrues from the time the loan is disbursed, regardless of your enrollment status. You are responsible for paying this accrued interest. | Undergraduate, graduate, and professional students. | Begins six months after graduation or leaving school. |

Benefits of Subsidized Loans: No interest accrues while you are enrolled at least half-time, saving you money in the long run. Drawbacks of Subsidized Loans: Eligibility is based on financial need, limiting access for some students.

Benefits of Unsubsidized Loans: Available to all students, regardless of financial need. Drawbacks of Unsubsidized Loans: Interest accrues from disbursement, potentially leading to a larger loan balance by graduation.

Direct PLUS Loans

Direct PLUS Loans are designed for parents of dependent undergraduate students and for graduate or professional students. These loans don’t require a credit check, but they do require a credit history. They allow parents or students to borrow additional funds to cover educational expenses beyond what is available through subsidized and unsubsidized loans.

| Loan Type | Interest Accrual | Eligibility | Repayment |

|---|---|---|---|

| Direct PLUS Loan (Parent) | Interest accrues from the time the loan is disbursed. | Parents of dependent undergraduate students; credit check required (though adverse credit history doesn’t automatically disqualify). | Begins 60 days after the final disbursement of the loan. |

| Direct PLUS Loan (Graduate/Professional Student) | Interest accrues from the time the loan is disbursed. | Graduate and professional students; credit check required (though adverse credit history doesn’t automatically disqualify). | Begins 60 days after the final disbursement of the loan. |

Benefits of PLUS Loans: Provides additional funding options for students and parents. Drawbacks of PLUS Loans: Higher interest rates than subsidized and unsubsidized loans; credit check is required and can result in loan denial. Borrowers are responsible for all interest accrued.

Understanding Loan Repayment Options

Successfully navigating the federal student loan process extends beyond securing the funds; understanding repayment options is crucial for responsible financial management. Choosing the right repayment plan significantly impacts your monthly payments and overall loan repayment timeline. This section will Artikel several available plans and factors influencing the selection process.

Federal Direct Student Loans offer various repayment plans designed to accommodate different financial situations and income levels. The most common options include Standard, Graduated, and Extended Repayment Plans. Each plan differs in its monthly payment amount and the total repayment period.

Standard Repayment Plan

The Standard Repayment Plan is a fixed monthly payment plan spread over 10 years. The monthly payment remains consistent throughout the repayment period, making budgeting easier. This plan is often the best choice for borrowers with stable incomes and the ability to make consistent, higher monthly payments.

Graduated Repayment Plan

The Graduated Repayment Plan features lower initial monthly payments that gradually increase over time. This option can be beneficial for borrowers anticipating income growth in the future, such as recent graduates. While starting with lower payments is attractive, it’s important to remember that the total repayment period is still 10 years, and the later payments will be substantially higher.

Extended Repayment Plan

The Extended Repayment Plan offers longer repayment periods, up to 25 years, resulting in lower monthly payments than the Standard or Graduated plans. This option is suitable for borrowers with significant loan balances or lower incomes who need more manageable monthly payments. However, it’s crucial to remember that extending the repayment period increases the total interest paid over the loan’s life.

Factors Influencing Repayment Plan Selection

Several factors influence the choice of a repayment plan. These factors should be carefully considered to ensure the selected plan aligns with individual financial circumstances and long-term goals.

- Current Income and Expenses: Your current financial situation is a primary determinant. A borrower with a higher income and lower expenses may opt for a Standard Repayment Plan, while someone with a lower income might prefer a Graduated or Extended plan.

- Expected Future Income: Anticipated income growth can influence the choice. A recent graduate expecting a salary increase may find a Graduated plan suitable, as the payments will increase along with their income.

- Loan Balance: The total amount of your loan significantly impacts the monthly payment. Larger loan balances generally necessitate a longer repayment period or higher monthly payments.

- Financial Goals: Consider other financial goals, such as saving for a down payment on a house or starting a family. Choosing a repayment plan that balances loan repayment with other financial priorities is essential.

Consequences of Defaulting on a Federal Student Loan

Defaulting on a federal student loan has severe financial consequences. Understanding these consequences is crucial to ensuring timely repayment.

- Damage to Credit Score: Defaulting negatively impacts your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The government can garnish your wages to recover the defaulted loan amount. This means a portion of your paycheck will be directly deducted to repay the debt.

- Tax Refund Offset: Your federal and state tax refunds can be seized to repay the defaulted loan.

- Difficulty Obtaining Future Federal Aid: Future access to federal student loans or grants may be restricted.

- Collection Agency Involvement: The debt may be transferred to a collection agency, which can further complicate the repayment process and potentially lead to additional fees.

The Loan Application Process

Applying for a Federal Direct Student Loan involves several key steps. Successfully navigating this process requires careful attention to detail and adherence to deadlines. This section provides a clear, step-by-step guide to help you through the application.

The application process is largely online, making it convenient and efficient. However, understanding each stage is crucial for a smooth and successful outcome. Remember to keep all your documentation organized and readily accessible.

Step-by-Step Application Guide

The following steps Artikel the typical application procedure. While specific details might vary slightly depending on your circumstances, this guide provides a comprehensive overview.

- Complete the FAFSA: This is the foundational step. The Free Application for Federal Student Aid (FAFSA) determines your eligibility for federal student aid, including loans. Accurate and complete information is essential for a timely processing.

- Receive your Student Aid Report (SAR): After submitting your FAFSA, you’ll receive a SAR. Review it carefully for accuracy. Any discrepancies should be corrected immediately.

- Review your Financial Aid Offer: Your school will send you a financial aid offer letter detailing the types and amounts of aid you’ve been awarded, including loans. Understand the terms and conditions of each loan before accepting.

- Accept your Loan Offer: Once you’ve reviewed and understand your offer, you’ll need to formally accept the loan offer through your school’s financial aid portal. This usually involves an online process.

- Master Promissory Note (MPN): You’ll need to sign a Master Promissory Note (MPN) which is a legally binding agreement outlining your responsibilities as a borrower. Read this document thoroughly before signing.

- Entrance Counseling: Before receiving your first loan disbursement, you’ll be required to complete entrance counseling. This online session covers important information about loan repayment and your rights and responsibilities as a borrower.

- Loan Disbursement: After completing all the necessary steps, your loan will be disbursed directly to your school to cover your tuition and fees. The disbursement schedule varies depending on the school and loan type.

Tips for a Successful Application

Following these tips can significantly increase your chances of a smooth and successful loan application process.

- Complete the FAFSA early: Many schools have deadlines for FAFSA submission, so completing it early allows ample time for processing and minimizes potential delays.

- Gather all necessary documents: Have your Social Security number, tax returns, and other required documents readily available before starting the FAFSA.

- Double-check all information: Accuracy is paramount. Carefully review all information before submitting the FAFSA and any other forms.

- Understand your loan terms: Familiarize yourself with the interest rates, repayment options, and other terms associated with your loan before accepting.

- Contact your school’s financial aid office: If you have any questions or encounter any problems, don’t hesitate to contact your school’s financial aid office for assistance.

Flowchart of the Application Process

The following description illustrates the loan application process. Imagine a flowchart with boxes and arrows connecting them.

The first box would be “Complete the FAFSA.” An arrow points to the next box, “Receive SAR.” This is followed by “Review Financial Aid Offer,” then “Accept Loan Offer,” “Sign MPN,” “Complete Entrance Counseling,” and finally, “Loan Disbursement.” Each box represents a stage, and the arrows indicate the sequential progression of the process. This visual representation provides a clear overview of the application’s flow.

Federal Student Loan Forgiveness Programs

Navigating the complexities of federal student loan repayment can be daunting. Fortunately, several federal programs offer pathways to loan forgiveness, reducing or eliminating the debt burden for eligible borrowers. Understanding these programs, their eligibility requirements, and application processes is crucial for borrowers seeking debt relief.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations (federal, state, local, or tribal) and not-for-profit organizations. The application process involves submitting an Employment Certification form annually, and a PSLF form at the end of 120 payments. The benefit is complete loan forgiveness, but limitations include strict requirements for both employment and repayment plan types. For example, only Direct Loans qualify, and borrowers must be employed full-time by a qualifying employer for the entire 120-month period. Failure to meet these criteria can result in ineligibility for forgiveness.

Teacher Loan Forgiveness Program

This program offers forgiveness of up to $17,500 on Direct Subsidized and Unsubsidized Loans, Stafford Loans, and Federal Consolidation Loans for teachers who have completed five years of full-time teaching in a low-income school or educational service agency. Eligibility requires teaching in a low-income school or educational service agency as defined by the Department of Education, and the application process involves submitting documentation of employment and teaching experience. The benefit is a significant reduction in loan debt, but the limitation is the specific requirements for teaching location and type of school. For instance, teachers in affluent school districts generally do not qualify.

Income-Driven Repayment (IDR) Plans and Forgiveness

Income-Driven Repayment (IDR) plans, such as the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans, calculate monthly payments based on income and family size. After making payments for a specific period (typically 20 or 25 years), the remaining loan balance may be forgiven. The benefit is lower monthly payments and eventual forgiveness, but limitations include the length of time to forgiveness and the potential for a higher total amount paid over the life of the loan due to accrued interest. The application process involves selecting an IDR plan and providing income documentation annually. The amount forgiven may be considered taxable income.

Other Forgiveness Programs

Other federal student loan forgiveness programs exist, often targeted at specific professions or circumstances. These programs may have varying eligibility criteria and application procedures. It is essential to research these programs individually to understand their specific requirements and benefits. Examples might include programs for borrowers with disabilities or those who worked in specific fields like nursing or public health. These programs often have limited funding or are subject to change, so staying informed about their availability is crucial.

Potential Scams and How to Avoid Them

Navigating the world of student loans can be confusing, and unfortunately, this confusion is often exploited by scammers. These individuals prey on students’ anxieties and lack of knowledge to steal their money or personal information. Understanding common scams and implementing preventative measures is crucial to protecting yourself during the loan application process.

Scammers employ a variety of tactics to deceive prospective borrowers. They often impersonate government officials or legitimate loan providers, creating convincing websites or sending misleading emails and text messages. These communications may promise quick loan approvals, low interest rates, or loan forgiveness programs that don’t exist. Their ultimate goal is to obtain your personal information, such as your Social Security number, bank account details, or FSA ID, which they can then use for identity theft or financial fraud.

Common Student Loan Scams

Several types of scams target student loan applicants. One prevalent method involves unsolicited emails or phone calls offering loan consolidation or forgiveness programs that require upfront fees. Legitimate federal loan programs never charge fees for application or consolidation. Another common scam involves phishing attempts, where scammers create fake websites mimicking the official Federal Student Aid website (StudentAid.gov). These websites look authentic but are designed to steal your login credentials and personal data when you try to access them. Finally, some scammers offer loans with unbelievably low interest rates or quick approval processes, which are often too good to be true.

Recognizing and Avoiding Scams

Protecting yourself from student loan scams requires vigilance and a healthy dose of skepticism. Always verify the legitimacy of any communication you receive regarding student loans. Never provide personal information unless you have independently verified the recipient’s identity and legitimacy through official channels. Be wary of unsolicited offers promising unusually favorable terms, and never pay upfront fees for federal student loan applications or consolidation. Instead, access information directly from trusted sources.

Legitimate Sources of Information

Reliable sources for information on federal student loans include the official Federal Student Aid website (StudentAid.gov), your school’s financial aid office, and independent, non-profit organizations dedicated to student financial aid. The Federal Student Aid website provides comprehensive information on all aspects of federal student loans, including eligibility requirements, application processes, and repayment options. Your school’s financial aid office can offer personalized guidance and support. Remember to always cross-reference information from multiple trusted sources before making any decisions. Never rely solely on information received through unsolicited emails, text messages, or phone calls.

Closure

Successfully navigating the federal student loan application process empowers you to pursue higher education with confidence. By understanding the eligibility criteria, mastering the application steps, and choosing the right repayment plan, you can effectively manage your student loan debt and focus on your academic pursuits. Remember to be vigilant against scams and utilize reliable resources to ensure a secure and successful application.

User Queries

What happens if I don’t complete the FAFSA?

You will likely be ineligible for federal student aid, including grants and loans.

Can I appeal a loan denial?

Yes, you can typically appeal a loan denial by providing additional documentation or explaining extenuating circumstances.

What if my financial situation changes after I submit the FAFSA?

You can usually update your FAFSA information through the FSA website. Check for deadlines.

How long does it take to receive loan disbursement?

Disbursement times vary but typically take several weeks after your application is processed and your school certifies your enrollment.