Navigating the complexities of student loan repayment can feel overwhelming, but understanding Income-Based Repayment (IBR) plans can significantly ease the burden. IBR plans offer a lifeline to borrowers struggling with high monthly payments by adjusting payments based on income and family size. This guide provides a comprehensive overview of the IBR application process, eligibility requirements, and long-term implications, empowering you to make informed decisions about your student loan debt.

From exploring the various IBR plan options and determining eligibility to understanding the application process and long-term financial consequences, this resource aims to equip you with the knowledge necessary to successfully apply for and manage an IBR plan. We’ll cover everything from gathering the necessary documentation to anticipating potential challenges and finding solutions, ensuring a smoother path towards financial stability.

Understanding Income-Based Repayment (IBR) Plans

Income-Based Repayment (IBR) plans offer a lifeline to student loan borrowers struggling with high monthly payments. These plans tie your monthly payment to your income and family size, making repayment more manageable during periods of lower earnings. Understanding the nuances of each plan is crucial for choosing the most beneficial option.

Types of IBR Plans

Several IBR plans exist, each with its own eligibility criteria and payment calculation methods. While specific programs may vary or be discontinued, the general principles remain relevant. Historically, key plans included Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE). The details of these plans are important to understand as they can significantly impact your long-term repayment strategy.

Income Thresholds and Payment Calculations

The calculation of your monthly IBR payment involves several factors. First, your discretionary income is determined. This is your adjusted gross income (AGI) minus 150% of the poverty guideline for your family size and state. Then, this discretionary income is divided by a specific factor based on the loan’s total amount and the repayment plan’s term. For example, under a standard IBR plan, the payment might be 10% or 15% of your discretionary income, adjusted based on the loan amount and repayment period. The specific percentages and calculation methods can vary depending on the plan and the year the loan was disbursed.

Determining the Most Suitable IBR Plan

Choosing the right IBR plan requires careful consideration of your individual circumstances. A step-by-step approach is helpful. First, determine your adjusted gross income (AGI) and family size. Then, calculate your discretionary income using the appropriate poverty guideline for your state and family size. Next, compare the payment calculations under each available IBR plan using online calculators or contacting your loan servicer. Finally, select the plan that results in the lowest monthly payment while considering the potential for loan forgiveness after a set number of qualifying payments.

Benefits and Drawbacks of IBR Plans

IBR plans offer several significant benefits. Lower monthly payments can ease financial burdens, particularly during periods of unemployment or low income. Furthermore, some plans offer loan forgiveness after a certain number of payments, potentially eliminating a significant portion or all of your student loan debt. However, IBR plans also have drawbacks. The lower monthly payments often lead to a longer repayment period, resulting in the accrual of more interest over the life of the loan. Also, the amount of loan forgiveness, if any, may be less than initially anticipated, particularly if your income increases significantly during the repayment period. It’s important to weigh these factors carefully.

Eligibility Requirements for IBR

Securing an Income-Based Repayment (IBR) plan for your student loans hinges on meeting specific criteria. Understanding these requirements is crucial for a smooth application process and avoiding potential delays or denials. This section details the eligibility criteria, necessary documentation, and the consequences of not meeting the requirements.

Eligibility for IBR plans is determined by several factors, primarily focusing on your income and loan type. You must have eligible federal student loans, such as Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Federal Stafford Loans. Furthermore, your income must be below a certain threshold relative to your repayment plan and the type of loan you hold. The exact income limits and calculation methods vary depending on the specific IBR plan (IBR, ICR, PAYE, REPAYE) and may be adjusted periodically by the Department of Education.

Required Documentation for IBR Application

Submitting the correct documentation is essential for a timely and successful IBR application. Incomplete or missing documentation can lead to significant processing delays. The specific documents required may vary slightly depending on your lender or loan servicer, but generally include proof of income, tax returns, and verification of your student loan debt. It’s always advisable to contact your loan servicer directly to confirm the exact documents they need.

Consequences of Failing to Meet Eligibility Requirements

If you don’t meet the eligibility requirements for an IBR plan, your application will likely be denied. This means you will remain on your current repayment plan, which may result in higher monthly payments and potentially a larger total amount paid over the life of your loans. It is also possible that you may not be able to qualify for any income-driven repayment plan at all, necessitating exploring alternative repayment strategies with your loan servicer. Understanding the requirements beforehand and proactively addressing any potential shortcomings is vital.

Checklist of Necessary Documents for IBR Application

Before beginning your IBR application, it’s highly recommended to gather the following documents. Having these readily available will streamline the process and prevent delays. Remember to check with your loan servicer for their specific requirements.

- Completed IBR application form (obtained from your loan servicer).

- Federal tax returns (for you and your spouse, if applicable), including W-2 forms and any relevant tax schedules.

- Proof of income (pay stubs, employment verification letter, self-employment documentation if applicable).

- Student loan debt verification (this information is usually available through the National Student Loan Data System (NSLDS)).

- Documentation of any dependents (if claiming dependents to reduce your payment amount).

The Application Process for IBR

Applying for an Income-Based Repayment (IBR) plan involves several steps to ensure your eligibility and successful enrollment. The process can seem daunting, but with careful preparation and attention to detail, you can navigate it efficiently. This section provides a clear, step-by-step guide to help you through the application.

Step-by-Step Guide to Applying for IBR

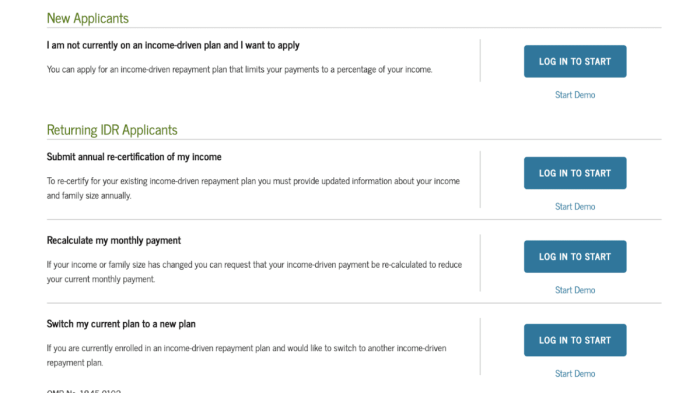

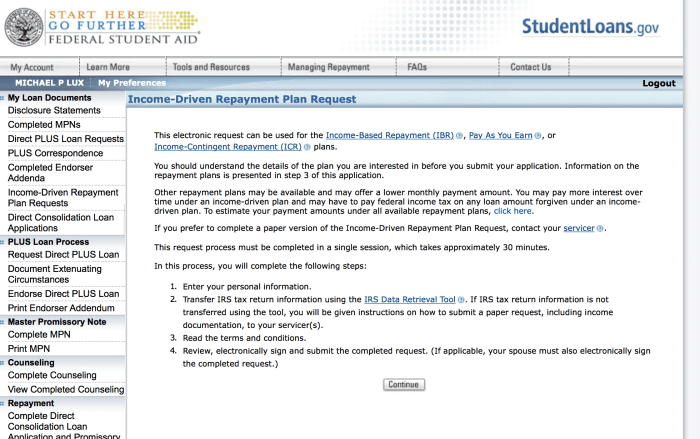

The application process for IBR generally involves submitting your information through the Federal Student Aid website (StudentAid.gov). This process requires accurate and up-to-date financial information. Incorrect information can delay or prevent approval.

| Step | Action | Required Documents | Timeline |

|---|---|---|---|

| 1 | Log in to StudentAid.gov | Your Federal Student Aid PIN | Immediately |

| 2 | Verify your loan information | None (information is pre-populated) | A few minutes |

| 3 | Select your IBR plan type | None (information is provided on the website) | A few minutes |

| 4 | Complete the IBR application | Tax returns (for the previous year), W-2 forms, pay stubs (if self-employed, additional documentation may be required) | 15-30 minutes |

| 5 | Review and submit your application | None (review is done on the website) | A few minutes |

| 6 | Receive confirmation | None (confirmation is sent electronically) | Within a few days to a few weeks |

| 7 | Monitor your account for updates | None (updates are available on the website) | Ongoing |

Flowchart of the IBR Application Process

The following flowchart visually represents the steps involved in applying for an IBR plan:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Start,” leading to a box labeled “Log in to StudentAid.gov.” This would branch to “Verify Loan Information,” then “Select IBR Plan,” followed by “Complete IBR Application.” This would branch to “Review and Submit,” leading to “Receive Confirmation.” Finally, an arrow points from “Receive Confirmation” to “Monitor Account for Updates” and ends with a box labeled “End.”]

Common Application Errors and How to Avoid Them

Several common errors can delay or prevent the approval of your IBR application. These errors are often related to incomplete or inaccurate information.

- Inaccurate Income Reporting: Providing incorrect income information is a major issue. Ensure your tax returns and other documentation accurately reflect your income for the previous tax year. Double-check all numbers before submission.

- Missing Documents: Failure to provide all required documents will delay processing. Gather all necessary documents before starting the application process. Keep copies for your records.

- Incomplete Application: Leaving fields blank or providing incomplete information can lead to rejection. Carefully review each section of the application before submitting.

- Incorrect Contact Information: Providing an incorrect email address or phone number will hinder communication from the loan servicer. Verify all contact details before submitting.

Understanding Your IBR Payment

Income-Based Repayment (IBR) plans offer a flexible way to manage your student loan debt by basing your monthly payments on your income and family size. Understanding how your IBR payment is calculated is crucial for effective financial planning. This section details the calculation process and factors influencing your monthly payment.

IBR Payment Calculation

The exact formula for calculating your IBR payment varies slightly depending on the specific IBR plan (IBR, PAYE, REPAYE). However, the core principle remains the same: your payment is a percentage of your discretionary income, which is your income minus 150% of the poverty guideline for your family size and state. The percentage applied to your discretionary income depends on your loan type and the plan you’re enrolled in. This percentage is generally lower for those with larger families and lower incomes. The calculation also takes into account your total student loan debt.

For example, a simplified representation of the calculation might look like this:

Discretionary Income = (Adjusted Gross Income) – (150% of Poverty Guideline)

IBR Payment = (Discretionary Income) x (Payment Percentage) / (Number of Months in Repayment Period)

Note that this is a simplified illustration and the actual calculation is more complex and considers various factors and potential adjustments made by your loan servicer.

Factors Affecting IBR Payment Amount

Several factors can influence the amount of your monthly IBR payment. Changes in any of these can lead to adjustments in your payment amount.

- Income Changes: A significant increase or decrease in your annual income will directly affect your discretionary income and, consequently, your IBR payment. An increase will likely lead to a higher payment, while a decrease may result in a lower one.

- Family Size: The poverty guideline used in the calculation is adjusted based on your family size. A larger family size typically results in a higher poverty guideline, leading to a lower IBR payment.

- Loan Balance: While the payment percentage applied to your discretionary income remains relatively consistent, a larger loan balance may extend the repayment period, which can slightly affect the monthly payment amount.

- Loan Type: Different types of federal student loans may have slightly different IBR calculation methods.

Sample IBR Payment Calculation

Let’s illustrate a simplified IBR payment calculation. Assume an individual has an adjusted gross income of $50,000, a family size of one, and a 150% poverty guideline of $15,000 (this is a hypothetical example and actual poverty guidelines vary by state and year). The payment percentage for their loan type under their chosen IBR plan is 10%.

Discretionary Income = $50,000 – $15,000 = $35,000

Annual IBR Payment = $35,000 x 0.10 = $3,500

Monthly IBR Payment = $3,500 / 12 = $291.67 (approximately)

Examples of IBR Payments at Different Income Levels

The following table demonstrates how IBR payments can vary based on income. Remember that these are simplified examples, and the actual calculation involves many more variables.

| Adjusted Gross Income | Family Size | 150% Poverty Guideline (Hypothetical) | Discretionary Income (Hypothetical) | Annual IBR Payment (10% Payment Percentage) | Monthly IBR Payment (Approximate) |

|---|---|---|---|---|---|

| $30,000 | 1 | $15,000 | $15,000 | $1,500 | $125 |

| $50,000 | 1 | $15,000 | $35,000 | $3,500 | $292 |

| $75,000 | 2 | $20,000 | $55,000 | $5,500 | $458 |

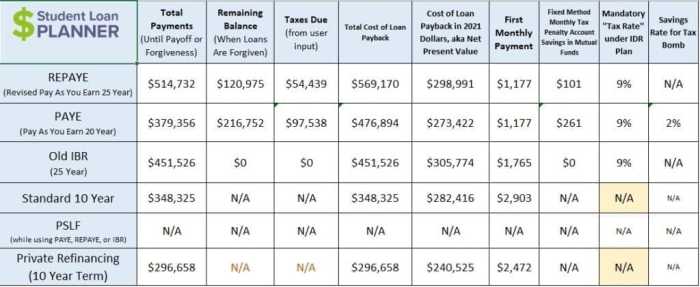

Long-Term Implications of IBR

Choosing an Income-Based Repayment (IBR) plan for your student loans has significant long-term consequences that extend beyond your monthly payment amount. Understanding these implications is crucial for making an informed decision about your repayment strategy. Factors such as loan forgiveness, accumulated interest, and tax liabilities all play a vital role in the overall cost and timeline of your repayment journey.

The primary long-term effect of IBR is the potential for loan forgiveness after a specified period of qualifying payments. While this offers the enticing prospect of eliminating student loan debt entirely, it’s important to consider the trade-offs. The longer it takes to reach forgiveness, the more interest will accrue, potentially increasing the total amount repaid compared to other repayment plans.

Loan Forgiveness and Total Interest Paid

Reaching loan forgiveness under IBR doesn’t mean you’ll pay nothing. The total interest paid will depend on several factors, including your income, the interest rate on your loans, and the length of time it takes to qualify for forgiveness. For example, a borrower with a high initial loan balance and a relatively low income might find themselves making payments for 20 or 25 years, accumulating substantial interest even if their remaining balance is eventually forgiven. Conversely, a borrower with a smaller loan balance and a higher income might qualify for forgiveness sooner, paying less total interest. The crucial element is understanding your individual circumstances and projecting your potential total repayment amount under IBR.

Tax Implications of IBR and Loan Forgiveness

A significant consideration is the tax treatment of forgiven student loan debt. Currently, forgiven loan amounts under IBR are generally considered taxable income. This means that the amount forgiven could be subject to federal and state income taxes in the year of forgiveness. This can represent a substantial tax liability, potentially offsetting some of the perceived financial benefits of loan forgiveness. It’s advisable to consult with a tax professional to understand the potential tax implications in your specific situation and plan accordingly. For example, a borrower receiving $50,000 in loan forgiveness might face a significant tax bill, depending on their tax bracket.

Comparison of Total Repayment Costs

Comparing the total cost of repayment under IBR to other repayment plans requires careful consideration of several factors. While IBR offers lower monthly payments, it often extends the repayment period significantly. This extended period leads to the accumulation of more interest. Standard repayment plans, with their shorter repayment terms, may result in paying less interest overall, even though monthly payments are higher. To illustrate, consider a $50,000 loan with a 6% interest rate. Under a standard 10-year repayment plan, the total repayment might be around $65,000, while under an IBR plan, the total repayment could exceed $80,000 due to the extended repayment period and accumulated interest, even with the potential for loan forgiveness. This comparison should be tailored to individual loan details and income projections.

Potential Challenges and Solutions with IBR

Income-Based Repayment (IBR) plans offer significant benefits to student loan borrowers, but navigating them can present unique challenges. Understanding these potential hurdles and developing proactive strategies is crucial for successfully managing your student loan debt under an IBR plan. This section Artikels common difficulties and provides solutions to help borrowers stay on track.

Common Challenges Faced by IBR Borrowers

Many borrowers encounter difficulties with IBR, often stemming from fluctuating incomes, unforeseen life events, or a lack of understanding of the plan’s intricacies. These challenges can lead to missed payments, increased interest accrual, and even loan default. Effective planning and proactive communication with loan servicers can mitigate these risks.

Managing IBR Payments During Unemployment or Reduced Income

Periods of unemployment or reduced income are significant challenges for borrowers on IBR plans. Fortunately, several strategies can help manage payments during these difficult times. Borrowers can explore options like requesting a temporary forbearance or deferment, which temporarily suspends or reduces payments. They may also qualify for an income-driven repayment plan adjustment based on their current financial situation. Documentation of income reduction, such as a layoff notice or pay stubs, is crucial when applying for these adjustments. Furthermore, actively seeking employment and exploring options like part-time work can help maintain some level of repayment while navigating financial hardship.

Options for Borrowers Struggling to Make IBR Payments

For borrowers struggling to make their IBR payments, several options exist to prevent default. Contacting the loan servicer promptly is paramount. They can explain available options, such as income-driven repayment plan adjustments, temporary forbearance, or deferment. Exploring credit counseling services can also provide valuable guidance on budgeting and financial management. In some cases, loan consolidation might simplify repayment and potentially lower monthly payments. Failing to communicate with the servicer can lead to negative consequences, while proactive communication can often lead to solutions tailored to individual circumstances. It is also important to understand that the consequences of default can be severe, including damage to credit scores and potential wage garnishment.

A Guide for Addressing Common IBR-Related Problems

This guide offers a structured approach for borrowers facing IBR-related challenges:

- Track Income and Expenses: Maintain detailed records of income and expenses to accurately reflect your financial situation when applying for adjustments or seeking assistance.

- Communicate Proactively with Your Servicer: Contact your loan servicer immediately if you anticipate difficulty making payments. Early communication is key to preventing negative consequences.

- Explore Available Options: Familiarize yourself with options like forbearance, deferment, and income-driven repayment plan adjustments. Determine which best suits your circumstances.

- Seek Professional Assistance: Consider consulting a credit counselor or financial advisor for personalized guidance and support in managing your student loan debt.

- Understand the Long-Term Implications: Recognize that while IBR plans provide short-term relief, they may extend the repayment period and increase the total interest paid over the life of the loan.

Resources and Further Information

Navigating the complexities of Income-Based Repayment (IBR) plans can be challenging. Fortunately, numerous resources are available to help borrowers understand their options and manage their student loan debt effectively. This section provides valuable links and answers frequently asked questions, clarifying the role of student loan servicers and outlining how to contact them for assistance.

Reputable Websites and Organizations

Several trustworthy organizations offer comprehensive information on IBR and student loan repayment. These resources provide guidance on eligibility, application procedures, and long-term implications of different repayment plans. They also often offer tools and calculators to help borrowers estimate their monthly payments and project their debt payoff timelines. Examples include the Federal Student Aid website (studentaid.gov), the Consumer Financial Protection Bureau (consumerfinance.gov), and the National Foundation for Credit Counseling (nfcc.org). These sites provide unbiased information and tools to help you make informed decisions about your student loans. Additionally, many non-profit organizations focused on financial literacy offer resources specific to student loan repayment strategies.

Frequently Asked Questions about IBR

Understanding the nuances of IBR often requires clarifying several common questions. The following list addresses frequently asked questions, offering concise and informative answers.

- Question: What is the difference between IBR and other income-driven repayment plans? Answer: While IBR is an income-driven repayment (IDR) plan, several IDR plans exist, each with slightly different eligibility criteria and payment calculation methods. IBR, PAYE, REPAYE, and ICR all adjust payments based on income, but the formulas and income thresholds vary.

- Question: How often do I need to recertify my income for IBR? Answer: You typically need to recertify your income annually to maintain your IBR plan. Failure to recertify may result in your payments being recalculated based on your previous income or your plan being cancelled.

- Question: What happens if my income changes significantly during the year? Answer: While annual recertification is standard, you can usually request an income adjustment if your circumstances change drastically (e.g., job loss, significant pay cut). Contact your servicer to discuss this.

- Question: Can I switch from IBR to another repayment plan? Answer: Yes, you can generally switch between different repayment plans, although there may be limitations depending on your loan type and current repayment status. Consult your servicer for details.

- Question: What happens after 20 or 25 years of IBR payments? Answer: After making qualifying payments for 20 or 25 years (depending on your loan type and when you entered repayment), any remaining loan balance may be forgiven. However, this forgiveness is considered taxable income.

The Role of Student Loan Servicers

Student loan servicers act as intermediaries between borrowers and the federal government. They process payments, answer questions, and manage the overall administration of your student loans. In the context of IBR, servicers are crucial for determining eligibility, calculating payments, and processing income recertification requests. They are the primary point of contact for any questions or issues related to your IBR plan. It’s important to note that your servicer may change over time, so staying updated on your current servicer’s contact information is vital.

Contacting Your Student Loan Servicer

Contacting your student loan servicer is straightforward. You can typically find their contact information on your monthly billing statement or through the National Student Loan Data System (NSLDS) website. Most servicers offer multiple contact methods, including phone, mail, and online portals. Their websites usually have FAQs, online account access, and secure messaging systems to assist with inquiries. When contacting your servicer, be prepared to provide your loan information (loan ID numbers) for quick and efficient service.

Conclusive Thoughts

Successfully applying for an IBR student loan plan requires careful planning and understanding of the process. By carefully reviewing your eligibility, gathering the necessary documentation, and understanding the long-term implications of your chosen plan, you can navigate the complexities of student loan repayment and work towards a more manageable financial future. Remember to utilize the available resources and contact your loan servicer for assistance if needed. Taking proactive steps towards managing your student loan debt can lead to significant long-term financial benefits.

FAQs

What happens if my income changes after I enroll in IBR?

You should contact your loan servicer to report any changes in income or family size. Your monthly payment will be recalculated based on your updated information.

Can I switch from another repayment plan to IBR?

Yes, you can usually switch to an IBR plan from other repayment plans. Check with your servicer for specific eligibility requirements and the process for switching.

What if I miss an IBR payment?

Missing payments can negatively impact your credit score and potentially lead to loan default. Contact your servicer immediately if you anticipate difficulty making a payment to explore options such as forbearance or deferment.

How long does the IBR application process typically take?

Processing times vary, but it generally takes several weeks. It’s advisable to apply well in advance of when you need the plan to take effect.

Is there a fee to apply for IBR?

No, there is typically no fee to apply for an IBR plan.