Navigating the complexities of student loan repayment can feel overwhelming, but understanding income-based repayment plans can significantly ease the burden. These plans tailor your monthly payments to your income, offering a potentially more manageable path to debt freedom. This guide provides a comprehensive overview of the application process, eligibility requirements, and long-term implications of choosing an income-driven repayment plan for your federal student loans.

From determining your adjusted gross income (AGI) and gathering necessary documentation to understanding the calculation of your monthly payments and exploring potential loan forgiveness options, we’ll walk you through each step. We’ll also address common concerns and misconceptions surrounding income-based repayment, empowering you to make informed decisions about your financial future.

Eligibility Criteria for Income-Based Repayment Plans

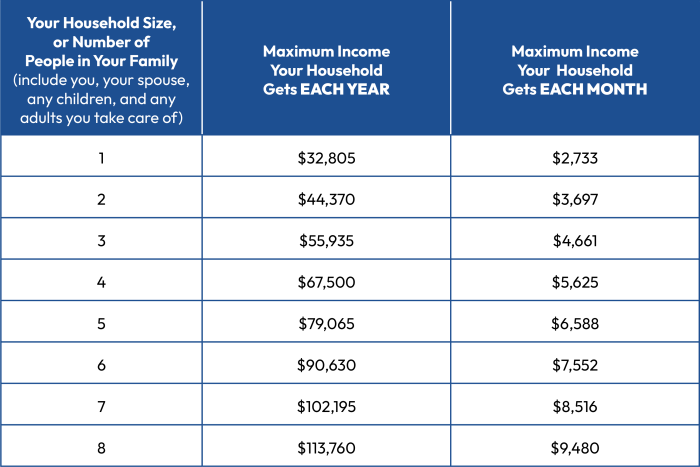

Income-driven repayment (IDR) plans offer a lifeline to federal student loan borrowers by basing monthly payments on their income and family size. Understanding the eligibility requirements is crucial for accessing these potentially more manageable repayment options. This section details the criteria for several common IDR plans.

General Income Requirements for IDR Plans

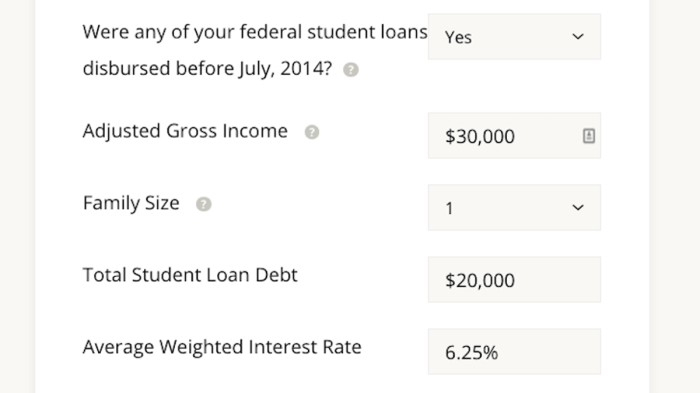

Eligibility for income-driven repayment plans hinges primarily on your adjusted gross income (AGI). Different plans have varying income thresholds and other qualifying factors, but AGI is the common denominator. Generally, you must be repaying federal student loans and meet the income requirements specified for the chosen plan. Specific income limits and family size considerations vary across plans such as Income-Driven Repayment (IDR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR). These plans all utilize your AGI to determine your monthly payment.

Determining Adjusted Gross Income (AGI) for Loan Eligibility

Your adjusted gross income (AGI) is the key figure used to determine your eligibility and payment amount under IDR plans. It’s not simply your gross income; several deductions are taken into account. AGI is calculated using your federal income tax return (Form 1040). Specifically, it’s your gross income less certain above-the-line deductions. These deductions might include contributions to a traditional IRA, student loan interest payments, and others. You will find your AGI clearly stated on your tax return. It’s important to use the most recent tax year’s AGI when applying for or recertifying your IDR plan.

Verifying Income Documentation for Application

The process for verifying your income involves submitting documentation that proves your AGI. This typically involves providing a copy of your federal tax return (Form 1040), specifically the pages showing your gross income and AGI. For self-employed individuals, additional documentation such as Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) may be required. If your income has changed significantly since filing your taxes, you might need to provide additional proof of income, such as recent pay stubs, W-2 forms, or bank statements. The exact documentation required may vary depending on the lender or servicer.

Comparison of Income Thresholds for Different Repayment Plans

While all IDR plans use AGI, they differ in their specific eligibility criteria and calculations. For example, REPAYE is generally more inclusive than IBR, often leading to lower monthly payments. The exact income thresholds and other requirements are subject to change and should be verified on the official federal student aid website. The differences mainly lie in the calculation of the monthly payment amount based on the AGI and the available repayment periods. It’s advisable to compare the various plans to determine which best suits your financial situation.

Eligibility Requirements for Various Federal Student Loan Programs

| Plan Name | Income Requirement | Other Requirements | Key Features |

|---|---|---|---|

| Income-Based Repayment (IBR) | AGI-based; specific thresholds vary | Federal student loans; meets specific income criteria | Lower monthly payments; potential loan forgiveness after 25 years |

| Pay As You Earn (PAYE) | AGI-based; specific thresholds vary | Federal student loans; meets specific income criteria; consolidated loans | Lower monthly payments; potential loan forgiveness after 20 years |

| Revised Pay As You Earn (REPAYE) | AGI-based; specific thresholds vary | Federal student loans; meets specific income criteria | Lower monthly payments; potential loan forgiveness after 20 or 25 years (depending on loan type) |

| Income-Driven Repayment (IDR) | AGI-based; specific thresholds vary by plan | Federal student loans; meets specific income criteria | Umbrella term encompassing IBR, PAYE, and REPAYE |

Application Process and Required Documents

Applying for an income-based repayment plan for your student loans involves several steps and requires gathering specific documentation. The process aims to verify your income and determine your eligibility for a reduced monthly payment. Understanding the requirements and navigating the application process efficiently will ensure a smoother experience.

Necessary Documents for Income-Based Repayment Application

Preparing the necessary documentation beforehand streamlines the application process. Missing documents can lead to delays in processing your application. Ensure you have readily available all the required materials before starting the online application.

- Tax Returns: You’ll need copies of your federal income tax returns (Form 1040 and supporting schedules) for the past tax year. This is crucial for verifying your income.

- W-2 Forms: If you’re employed, provide your W-2 forms from your employer for the past tax year. These corroborate the income information reported on your tax return.

- Proof of Income (if self-employed): Self-employed individuals may need to provide additional documentation, such as profit and loss statements or tax schedules, to demonstrate their income.

- Student Loan Information: Have your student loan details readily available, including your loan servicer’s name and your loan identification numbers.

- Spouse’s Income Information (if applicable): If you’re married, you’ll need to provide your spouse’s income information as well. This may include their tax returns and W-2 forms.

Online Application Process

The online application process typically involves navigating a secure government portal. You will be required to create an account or log in if you already have one. The portal will guide you through a series of forms, requiring you to input your personal information, income details, and student loan information. Accurate and complete information is critical for a successful application.

- Account Creation/Login: Access the designated student loan repayment portal and either create a new account or log in using your existing credentials.

- Application Form Completion: Carefully complete all sections of the application form, ensuring accuracy in all the fields. Double-check your information before submitting.

- Document Upload: Upload the required documents as specified by the portal. Ensure the files are clear, legible, and in the correct format.

- Submission: Once you’ve completed all the sections and uploaded the documents, review everything thoroughly and submit your application.

- Confirmation: After submission, you’ll receive a confirmation message or email indicating your application has been received.

Verification Process and Potential Delays

After submitting your application, the loan servicer will initiate a verification process. This involves reviewing your submitted documentation to confirm the accuracy of your income and other information. Discrepancies or missing information can cause delays.

- Income Verification: The servicer may contact your employer or request additional documentation to verify your income.

- Data Matching: Your provided information will be compared against data from the IRS and other sources. Inconsistencies may trigger further review.

- Processing Time: The processing time can vary depending on the volume of applications and the complexity of your case. Allow ample time for processing.

- Communication: The servicer will typically communicate with you if they need additional information or if there are any issues with your application.

Application Flowchart

The following describes a simplified flowchart of the application process:

[Start] –> [Gather Documents] –> [Create/Login to Portal] –> [Complete Application Form] –> [Upload Documents] –> [Submit Application] –> [Verification Process] –> [Approval/Rejection] –> [End]

Common Application Errors and Avoidance Strategies

Common errors can delay or even prevent approval of your application. Careful attention to detail during the application process is crucial to avoid these pitfalls.

- Inaccurate Information: Providing incorrect income information or other details can lead to application rejection or delays. Double-check all entries before submitting.

- Incomplete Documents: Missing documents can halt the verification process. Ensure you have all required documents ready before starting the application.

- Incorrect File Formats: Uploading documents in incorrect formats can prevent the system from processing your application. Follow the specified file format guidelines.

- Technical Issues: Technical difficulties can occur during the online application process. If you encounter problems, contact the student loan servicer’s customer support for assistance.

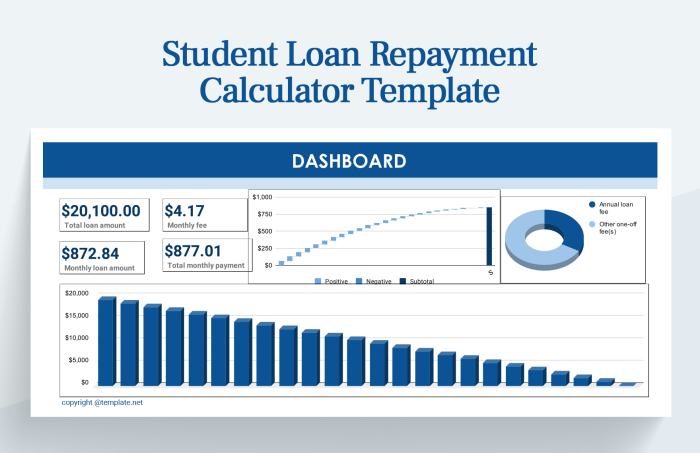

Understanding Repayment Amounts and Calculations

Income-driven repayment (IDR) plans for student loans adjust your monthly payments based on your income and family size. This means your payments are more manageable, especially during periods of lower earnings. Understanding how these calculations work is crucial for planning your long-term finances.

Monthly Payment Calculation

The calculation of your monthly payment under an IDR plan is a multi-step process. First, your adjusted gross income (AGI) is determined, which is your gross income minus certain deductions. This AGI is then adjusted based on your family size; a larger family generally results in a lower payment. This adjusted income is then used to calculate a payment percentage, which varies depending on the specific IDR plan (e.g., Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE)). Finally, this percentage is applied to your adjusted income to determine your monthly payment. The specific formulas and percentages used differ between plans, and the Department of Education provides detailed information on their websites.

Examples of Repayment Calculations Under Different Income-Driven Plans

Let’s consider a hypothetical example. Suppose an individual has an AGI of $50,000 and a family size of one. Under the IBR plan, the payment percentage might be 10%, resulting in a monthly payment of $416.67 ($50,000 * 10% / 12 months). Under PAYE, with the same income and family size, the payment percentage could be lower, leading to a smaller monthly payment. REPAYE often incorporates the outstanding loan balance into the calculation, resulting in potentially higher or lower payments depending on the loan amount and income. It’s important to note that these are simplified examples, and the actual calculations are more complex and involve factors such as loan type and interest accrual.

Factors Influencing Monthly Payment Amounts

Several factors influence your monthly payment amount under an IDR plan. These include:

* Adjusted Gross Income (AGI): Higher income leads to higher payments.

* Family Size: A larger family size generally results in lower payments.

* Type of IDR Plan: Different plans use different formulas and percentages, leading to varying payment amounts.

* Outstanding Loan Balance: Some plans, like REPAYE, consider the remaining loan balance, impacting the payment amount.

* Interest Accrual: While payments are based on income, interest continues to accrue on the loan balance, potentially increasing the total amount paid over time.

Long-Term Cost Implications of Various Income-Driven Repayment Options

While IDR plans offer lower monthly payments, they often extend the repayment period significantly. This can lead to paying more in interest over the life of the loan compared to a standard repayment plan. For instance, a standard 10-year repayment plan might result in paying less interest overall but require higher monthly payments. An IDR plan might stretch the repayment period to 20 or even 25 years, reducing monthly payments but significantly increasing the total interest paid. The choice depends on individual financial circumstances and priorities.

Income Levels and Corresponding Monthly Payments

| Adjusted Gross Income | Family Size | IBR Estimated Monthly Payment | PAYE Estimated Monthly Payment |

|---|---|---|---|

| $30,000 | 1 | $250 | $200 |

| $50,000 | 2 | $350 | $280 |

| $70,000 | 3 | $450 | $360 |

| $90,000 | 4 | $550 | $440 |

*Note: These are illustrative examples only and do not reflect actual payments. Actual payments will vary depending on numerous factors including the specific IDR plan selected, loan type, interest rates, and the borrower’s individual circumstances. Consult the Department of Education’s website for accurate information.*

Potential Benefits and Drawbacks of Income-Based Repayment

Income-based repayment (IBR) plans offer a potentially life-changing approach to managing student loan debt, particularly for borrowers facing financial hardship. These plans adjust your monthly payments based on your income and family size, making them significantly more manageable than standard repayment plans for many individuals. However, it’s crucial to understand both the advantages and disadvantages before opting for this type of plan.

IBR plans offer several key advantages, but also present some potential drawbacks that borrowers should carefully consider. A thorough understanding of both sides is essential for making an informed decision about your student loan repayment strategy.

Advantages of Income-Driven Repayment for Low-Income Borrowers

For borrowers with low incomes, IBR plans offer a crucial lifeline. Lower monthly payments can prevent delinquency and default, allowing borrowers to maintain financial stability while still working towards paying off their debt. This reduced financial strain can also free up funds for essential expenses like housing, food, and healthcare, improving overall well-being. The reduced monthly payment amount can be especially beneficial for individuals facing unemployment or underemployment, allowing them to focus on securing more stable employment without the overwhelming pressure of high student loan payments.

Potential Disadvantages of Income-Based Repayment

While IBR plans offer significant benefits, they also come with potential drawbacks. A major consideration is the extended repayment period. Because payments are lower, the overall repayment time can stretch to 20 or 25 years, or even longer depending on the specific plan and income. This longer repayment period results in the accumulation of significantly more interest over the life of the loan. This accrued interest can substantially increase the total amount repaid, potentially exceeding the original loan principal. Furthermore, the lower monthly payments may not always reflect a true affordability assessment, leaving borrowers struggling even with the reduced payment.

Examples of Scenarios Where Income-Based Repayment is Particularly Beneficial

IBR plans are particularly advantageous in situations where a borrower experiences a period of low income or unexpected financial hardship. For example, a new graduate entering a low-paying profession, a parent taking time off work to care for a child, or someone facing unemployment can benefit significantly from the reduced monthly payments. A teacher working in a low-income area, a nurse working in a rural setting, or a social worker supporting a low-income community are all examples of individuals whose income might not align with the demands of a standard repayment plan. These plans provide flexibility and support during challenging financial times.

Comparison of Income-Based Repayment to Standard Repayment Plans

Standard repayment plans typically require fixed monthly payments over a 10-year period. While this results in a shorter repayment period and less overall interest paid, the monthly payments can be significantly higher, making them unaffordable for many borrowers. IBR plans, on the other hand, offer lower monthly payments adjusted to income, but at the cost of a longer repayment period and higher overall interest. The choice between the two depends on the individual’s financial situation and priorities. A borrower with a higher income might find a standard repayment plan more suitable, while a borrower with a lower income might benefit more from the flexibility of an IBR plan.

Impact of Income-Driven Repayment on Long-Term Credit Scores

The impact of IBR on long-term credit scores is complex and not always negative. While consistently making even reduced payments demonstrates responsible financial behavior which can positively impact credit scores, the extended repayment period can negatively affect credit utilization ratios. Furthermore, the potential for significantly higher total repayment amounts due to accrued interest could also be viewed negatively by lenders. The overall effect on credit scores depends on various factors, including the borrower’s payment history, other credit obligations, and the specific credit scoring model used. It’s crucial to monitor credit reports regularly and manage other aspects of credit responsibly to mitigate potential negative impacts.

Changes in Income and Family Circumstances

Life is dynamic, and your financial situation can change significantly throughout your student loan repayment period. Income-based repayment plans are designed to adapt to these changes, offering flexibility to manage your monthly payments. Understanding how to update your information and the impact of life events is crucial for maintaining a manageable repayment schedule and avoiding potential penalties.

Income-based repayment plans require periodic recertification of your income and family size. This process ensures that your monthly payments accurately reflect your current financial circumstances. Failure to update your information promptly can lead to overpayments or underpayments, potentially impacting your long-term repayment strategy. Accurate reporting is essential for both you and your loan servicer.

Updating Income Information

To update your income information, you’ll typically need to contact your loan servicer directly. This usually involves completing a new income verification form, providing documentation such as your most recent tax return or pay stubs. The exact process may vary slightly depending on your servicer and the specific income-based repayment plan you’re enrolled in. Your servicer will guide you through the necessary steps and provide deadlines for submission. Promptly reporting changes, ideally within 30 to 60 days of the change, ensures your payments remain accurate and aligned with your income. For example, if you receive a promotion resulting in a significant salary increase, you should promptly notify your servicer so your payment amount can be adjusted accordingly. Conversely, a reduction in income should also be reported to potentially lower your monthly payments.

Impact of Changes in Family Size

Changes in family size, such as marriage, birth of a child, or adoption, can also affect your income-based repayment amount. These changes often alter your household income and expenses, impacting your calculated payment. When reporting changes in family size, you will typically need to provide supporting documentation such as a marriage certificate, birth certificate, or adoption papers. Your loan servicer will recalculate your payment based on the updated information. For instance, adding a dependent to your household might reduce your discretionary income and thus lower your monthly payment.

Reporting Significant Life Changes

Significant life changes, such as job loss, divorce, or a disability, necessitate immediate notification to your loan servicer. These events can substantially alter your financial capabilities. You’ll likely need to provide supporting documentation, such as a layoff notice, divorce decree, or disability certification, to substantiate your claim. These situations may qualify you for temporary forbearance, deferment, or a lower payment amount under your income-based repayment plan. For example, if you lose your job, you may be able to temporarily suspend your payments or significantly reduce them until you find new employment.

Examples of Income Changes Affecting Monthly Payments

Let’s consider a few scenarios:

* Scenario 1: Salary Increase: An individual with an initial annual income of $40,000 sees a promotion resulting in a $10,000 increase. Their monthly payment under an income-based plan might increase from $200 to $275, reflecting the higher income.

* Scenario 2: Job Loss: An individual earning $60,000 annually loses their job. Their payment could be significantly reduced or even temporarily suspended, depending on the terms of their income-based repayment plan and the servicer’s policies.

* Scenario 3: Part-Time Employment: An individual working full-time at $50,000 annually transitions to part-time work earning $25,000. Their monthly payment would likely be reduced considerably to reflect their lower income.

Situations Requiring Income Recertification

It’s crucial to understand when you need to recertify your income. Here’s a list of situations requiring this:

- Annual recertification (as mandated by your plan).

- Significant change in income (e.g., job loss, promotion, significant raise or decrease).

- Change in family size (marriage, birth, adoption, divorce).

- Significant life event impacting your ability to repay (e.g., disability, major illness).

Forgiveness and Loan Discharge Options

Income-based repayment plans offer a pathway to potential loan forgiveness, significantly reducing or eliminating your student loan debt. However, understanding the requirements and implications of these programs is crucial. This section details the various forgiveness options available and the steps involved in pursuing them.

Loan Forgiveness After a Specific Repayment Period

Many income-driven repayment plans, including Income-Driven Repayment (IDR) plans, provide for loan forgiveness after a set number of qualifying payments. The specific number of payments and the requirements for qualification vary depending on the plan and loan type. Generally, after making 20 or 25 years of qualifying payments under an IDR plan, the remaining balance of your eligible federal student loans may be forgiven. It’s important to note that this forgiven amount is considered taxable income in the year it’s forgiven. Careful planning and consultation with a financial advisor are recommended to prepare for this tax liability.

Public Service Loan Forgiveness (PSLF) Requirements

The Public Service Loan Forgiveness (PSLF) program offers complete loan forgiveness after 120 qualifying monthly payments under an IDR plan for borrowers working full-time in eligible public service jobs. To qualify, you must meet several criteria: you must have direct loans, be employed full-time by a government organization or a non-profit organization, and make 120 qualifying monthly payments while employed. Careful documentation of employment and payment history is crucial for successful PSLF application. The PSLF program has undergone significant changes, so it’s vital to check the latest guidelines on the Federal Student Aid website.

Applying for Loan Forgiveness or Discharge

The application process for loan forgiveness or discharge varies depending on the program. Generally, it involves submitting an application to your loan servicer, providing documentation to prove your eligibility (such as employment verification, payment history, and income information), and undergoing a review process. It’s essential to maintain meticulous records throughout the repayment period and carefully follow the instructions provided by your loan servicer. Early and proactive engagement with your servicer can help prevent delays or complications in the application process.

Consequences of Failing to Meet Forgiveness Requirements

Failure to meet the requirements for loan forgiveness can result in the continuation of loan repayment obligations. This means that the borrower will remain responsible for the full loan balance, potentially leading to significant financial burden. Furthermore, if the borrower defaults on the loan, it can have severe consequences, including damage to credit score, wage garnishment, and tax refund offset. Understanding the requirements and meticulously adhering to them is crucial to avoid these negative outcomes.

Comparison of Loan Forgiveness Programs

| Program | Eligibility | Payment Requirement | Forgiveness Amount |

|---|---|---|---|

| Income-Driven Repayment (IDR) | Federal student loans | 20-25 years of qualifying payments | Remaining loan balance |

| Public Service Loan Forgiveness (PSLF) | Direct loans, full-time public service employment | 120 qualifying monthly payments | Entire loan balance |

| Teacher Loan Forgiveness | Federal student loans, teaching in a low-income school | 5 years of qualifying teaching service | Up to $17,500 |

| Other Federal Programs | Specific criteria depending on program | Varies by program | Varies by program |

Resources and Support for Borrowers

Navigating the complexities of income-based repayment (IBR) plans can be challenging. Fortunately, numerous resources and support systems are available to assist student loan borrowers throughout the process, from application to repayment and potential loan forgiveness. Understanding these resources is crucial for a smooth and successful experience.

Contact Information for Relevant Government Agencies and Organizations

The primary source of information and assistance for federal student loans is the Federal Student Aid (FSA) website. This website offers comprehensive information on all aspects of federal student loan repayment, including IBR plans. You can find detailed explanations, application forms, and contact information for various support services. For specific questions or concerns, you can contact the FSA directly through their online help center or by phone. Additionally, your loan servicer plays a vital role in managing your account and answering your questions. Their contact information is usually available on your student loan statements or through the National Student Loan Data System (NSLDS).

Helpful Online Resources and Educational Materials

Beyond the official government websites, several non-profit organizations and educational institutions provide valuable resources on student loan repayment strategies. These organizations often offer free webinars, workshops, and downloadable guides that explain the intricacies of IBR plans in an accessible way. Many offer personalized financial counseling services to help borrowers create a repayment plan that aligns with their financial circumstances. Searching online for terms like “student loan repayment resources” or “income-driven repayment plans” will yield numerous helpful websites and articles.

Frequently Asked Questions about Income-Based Repayment

Understanding the common questions surrounding IBR plans is key to a successful application and repayment process. For example, many borrowers want to know the specific criteria for eligibility, the process for recalculating payments based on income changes, and the implications of various IBR plan options. Others may need clarification on the process for applying for loan forgiveness after making payments for a specified period. Detailed answers to these and other common questions are usually readily available on the FSA website and through other reputable sources.

Steps to Take When Experiencing Difficulties with Repayment

Facing difficulties with student loan repayment can be stressful, but proactive steps can help mitigate the situation. First, it’s crucial to contact your loan servicer immediately to discuss your financial challenges. They can explain your options, which might include deferment, forbearance, or modifying your repayment plan. If you’re struggling significantly, consider seeking professional financial counseling. A financial counselor can help you create a comprehensive budget, explore debt management strategies, and navigate the complexities of student loan repayment.

Visual Representation of the Application Process

Imagine a flowchart. The first box represents the initial assessment of eligibility, followed by a box indicating the gathering of necessary documents (tax returns, income verification). The next box shows the submission of the application to the loan servicer. Then, a box indicating the processing of the application and verification of information. Finally, a box shows the notification of approval or denial and subsequent steps, such as payment plan setup. Each box connects to the next, visually illustrating the sequential nature of the application process.

Last Point

Successfully applying for an income-based repayment plan requires careful planning and a thorough understanding of the eligibility criteria and the application process. While these plans offer significant benefits for borrowers with lower incomes, it’s crucial to weigh the long-term implications, including potentially extended repayment periods and accrued interest. By understanding the nuances of these plans and utilizing the resources available, you can effectively manage your student loan debt and work towards a financially secure future. Remember to regularly review your repayment plan and update your information as your circumstances change.

Clarifying Questions

What happens if my income changes during the repayment period?

You’ll need to update your income information with your loan servicer. Failure to do so could result in inaccurate payment calculations.

Can I switch from a standard repayment plan to an income-driven repayment plan?

Yes, you can usually switch plans, but there may be restrictions depending on your loan type and repayment history. Check with your loan servicer for details.

What if I lose my job?

Most income-driven repayment plans offer options for temporary forbearance or deferment in case of job loss or other financial hardship. Contact your loan servicer immediately to discuss your options.

How long does the application process take?

Processing times vary, but it generally takes several weeks to receive confirmation of your enrollment in an income-driven repayment plan.