Navigating the process of applying for PAYE student loans can feel overwhelming, but understanding the eligibility criteria, application steps, and repayment plans is key to securing the funding you need for your education. This guide provides a comprehensive overview, demystifying the process and empowering you to make informed decisions.

From understanding income thresholds and required documentation to exploring repayment options and potential challenges, we aim to equip you with the knowledge necessary for a successful application. We’ll cover everything from interest rates and loan forgiveness to the impact on your credit score, offering practical tips and strategies throughout.

Eligibility Criteria for Student Loans

Securing a PAYE (Plan 2) student loan hinges on meeting specific eligibility criteria. These requirements ensure that the loan system effectively supports students pursuing eligible courses while maintaining financial responsibility. Understanding these criteria is crucial before applying.

The eligibility criteria for PAYE student loans are multifaceted, encompassing aspects of residency, income, course type, and previous study history. Failure to meet any of these criteria can lead to loan application rejection. It’s essential to carefully review all requirements before submitting your application.

Residency Requirements

To be eligible for a PAYE student loan, you must generally be a UK resident. This typically means you have lived in the UK for three years prior to the start of your course, with no intention of leaving the UK. Specific rules around residency can be complex and vary depending on individual circumstances. It is advisable to check the latest government guidelines on the Student Loan Company website for the most up-to-date information. There are also specific rules around those with indefinite leave to remain or settled status in the UK.

Income Thresholds

Income levels play a significant role in determining eligibility and repayment terms. While there isn’t a minimum income requirement to be eligible for the loan itself, your income will determine how much you repay each year once you are earning above the repayment threshold. The repayment threshold is adjusted annually, reflecting changes in average earnings. Those earning below the threshold will not be required to make repayments.

Eligible Courses

PAYE student loans are available for a wide range of courses at eligible universities and colleges across the UK. These typically include undergraduate and postgraduate courses leading to a recognised qualification. However, some courses, such as part-time courses or those deemed ineligible by the Student Loan Company, may not qualify for loan funding. Applicants should check the eligibility of their chosen course directly with the Student Loan Company or their chosen educational institution. For example, certain short courses or vocational training programs might not be included.

Disqualifying Factors

Several factors can disqualify an applicant from receiving a PAYE student loan. These include having previously completed a course that already reached the maximum loan limit, having already received a student loan for a similar course of study, or failing to meet the residency requirements previously detailed. A criminal record or outstanding debts to the Student Loan Company may also affect eligibility. Furthermore, providing false information on the application form is a serious issue and will lead to disqualification.

Application Process Steps

Applying for a PAYE student loan involves a straightforward process, but careful attention to detail is crucial for a smooth application. This section Artikels the steps involved, provides a visual representation of the process, details the necessary documentation, and offers a sample application form.

Steps Involved in Applying for a PAYE Student Loan

The application process is designed to be user-friendly. Following these steps will ensure your application is complete and processed efficiently.

- Create an Account: You’ll begin by creating an online account with the relevant student loan agency. This usually involves providing basic personal information and selecting a secure password.

- Complete the Application Form: This form will require detailed personal information, educational history, and financial details. Accuracy is paramount at this stage.

- Upload Supporting Documentation: You will need to upload copies of the required documents, such as proof of identity, proof of enrollment, and any other supporting evidence.

- Review and Submit: Carefully review your application for accuracy before submitting it. Once submitted, you cannot make changes without contacting the agency.

- Confirmation and Processing: After submission, you’ll receive a confirmation number and an estimated processing time. The agency will review your application and notify you of the decision.

Flowchart Illustrating the Application Process

The application process can be visualized as follows:

[Start] –> [Create Account] –> [Complete Application Form] –> [Upload Documents] –> [Review and Submit] –> [Confirmation] –> [Application Processing] –> [Approval/Rejection] –> [Loan Disbursement/Notification] –> [End]

Decision points exist at the “Application Processing” stage, where the agency verifies the information provided. Rejection may occur due to incomplete information or ineligibility. Approval leads to loan disbursement.

Required Documentation

Providing complete and accurate documentation is essential for a successful application. Generally, you will need:

- Proof of Identity: A valid passport or driver’s license.

- Proof of Enrollment: Official acceptance letter from your educational institution.

- Financial Information: This may include bank statements or tax returns, depending on the specific requirements of the loan agency.

- National Insurance Number (NIN): Your unique NIN is crucial for identification and verification.

Failure to provide the necessary documentation may delay the processing of your application or lead to rejection.

Sample Application Form

This is a simplified representation of a student loan application form. The actual form may vary depending on the specific agency.

Applicant Name: _________________________

Date of Birth: _________________________

National Insurance Number: _________________________

Course of Study: _________________________

Institution Name: _________________________

Expected Graduation Date: _________________________

Understanding Repayment Plans

Choosing the right repayment plan is crucial for managing your student loan debt effectively. The PAYE (Pay As You Earn) system offers several options, each designed to tailor repayments to your individual income and circumstances. Understanding the differences between these plans will help you make an informed decision that best suits your financial situation.

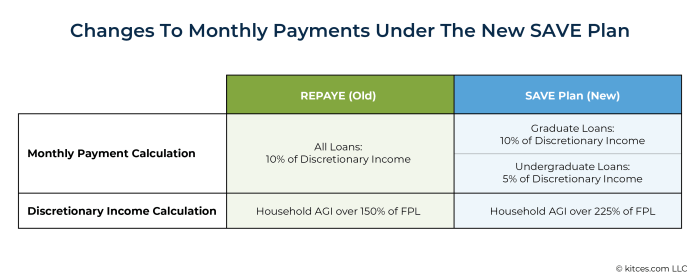

The PAYE system calculates your monthly payments based on your income and the amount you borrowed. Several repayment plans exist, each with varying payment amounts and repayment periods. The key difference lies in how your income affects your monthly payments and the overall length of your repayment term.

PAYE Repayment Plan Options

The specific repayment plans available under PAYE can vary depending on your country and the year you started your studies. However, common features include variations in repayment periods and income thresholds that trigger changes in monthly payments. For the purpose of this explanation, we will Artikel three hypothetical plans to illustrate the key differences.

| Repayment Plan | Monthly Payment Calculation | Typical Repayment Period | Income Impact |

|---|---|---|---|

| Standard PAYE | 9% of income above a set threshold (e.g., £20,000). | 25 years (or until the loan is repaid) | Higher income leads to higher monthly payments. Payments adjust annually based on income changes. |

| Accelerated PAYE | 12% of income above a set threshold (e.g., £20,000). | 15 years (or until the loan is repaid) | Higher income results in significantly higher monthly payments. Faster repayment means potentially less interest accrued. |

| Income-Contingent PAYE | Percentage of disposable income (after tax and essential expenses) above a threshold. The percentage varies depending on the income level. | Variable, potentially up to 30 years | Monthly payments are highly sensitive to income fluctuations. Lower income results in smaller payments, potentially extending the repayment period. |

Comparison of Repayment Plans

The table above highlights the core differences between these hypothetical PAYE plans. The Standard PAYE offers a balance between manageable monthly payments and a reasonable repayment timeframe. Accelerated PAYE prioritizes faster repayment but at the cost of higher monthly payments. Income-Contingent PAYE provides greater flexibility for those with fluctuating incomes, but it can lead to a longer repayment period and higher overall interest payments.

Income’s Influence on Monthly Payments

In all PAYE plans, your income is the primary factor determining your monthly repayment amount. An increase in income generally leads to higher monthly payments, while a decrease may result in lower payments. This dynamic ensures that repayments are proportionate to your earning capacity. For example, under the Standard PAYE plan, an individual earning £25,000 might pay £450 per year (£37.50 per month), while someone earning £40,000 might pay £1800 per year (£150 per month).

Potential Difficulties and Solutions

Applying for student loans can sometimes present unexpected challenges. While the process is designed to be straightforward, various factors can lead to delays or complications. Understanding these potential difficulties and having strategies in place to address them can significantly improve your chances of a successful application. This section Artikels common problems and offers solutions to help you navigate the process smoothly.

While the application process is generally clear, several issues can arise. These difficulties often stem from incomplete documentation, misunderstandings of eligibility criteria, or technical problems with the online application system. Proactive preparation and careful attention to detail are key to avoiding these issues.

Delayed Processing

Delayed processing of student loan applications can be frustrating, but it’s often due to easily rectifiable issues. The most common cause is incomplete or missing documentation. For example, failing to provide a valid transcript, proof of enrollment, or necessary tax information can significantly delay the process. To resolve this, promptly submit any requested documentation and follow up with the loan provider if you haven’t heard back within a reasonable timeframe. Keep copies of all submitted documents for your records. Another cause could be a backlog in processing applications, especially during peak periods. In such cases, patience and regular follow-up are crucial.

Missing Documentation

As mentioned, missing documentation is a frequent cause of application delays. The application form will clearly specify the required documents. It is crucial to gather all necessary documents *before* beginning the application. Creating a checklist can help ensure you don’t overlook anything. If you realize a document is missing after submitting your application, contact the loan provider immediately to explain the situation and arrange for the missing document to be submitted. Be prepared to provide a clear explanation for any delay in providing the document. For example, if you are waiting on a transcript from your university, include a communication showing the expected delivery date.

Application Rejection

If your application is rejected, you’ll usually receive a notification explaining the reason. Common reasons include failing to meet the eligibility criteria (e.g., insufficient academic standing, incorrect income information), providing inaccurate information, or missing key documents. Review the rejection letter carefully to understand the specific reason. You may be able to appeal the decision if you believe the rejection was based on an error or misunderstanding. Gather any supporting evidence that might help your appeal and submit it according to the loan provider’s instructions. Remember to maintain a professional and respectful tone throughout the appeal process. Seeking advice from a student financial aid advisor can also be beneficial in this situation.

Tips for a Smooth Application Process

It’s essential to prepare thoroughly to minimize potential problems. Here are some helpful tips:

- Read the application guidelines carefully before starting.

- Gather all required documents well in advance.

- Complete the application accurately and thoroughly.

- Keep copies of all submitted documents.

- Follow up regularly if you haven’t heard back within a reasonable timeframe.

- Maintain clear and professional communication with the loan provider.

Interest Rates and Loan Forgiveness

Understanding the interest rates and potential for loan forgiveness is crucial for effective PAYE student loan management. This section will clarify how interest accrues and the circumstances under which loan forgiveness may be granted.

Interest rates on PAYE student loans are typically variable and depend on several factors, including the loan’s origination date and prevailing market interest rates. The interest rate is applied to the outstanding loan balance, and this accrued interest is typically capitalized, meaning it’s added to the principal balance, increasing the total amount owed. This capitalization occurs periodically, often annually, and can significantly impact the overall repayment amount over the life of the loan. For example, a loan with a 5% interest rate and a $10,000 balance will accrue $500 in interest in a year, and if capitalized, the new principal balance becomes $10,500. The exact calculation and capitalization schedule will be Artikeld in your loan documents.

PAYE Loan Forgiveness Conditions

Loan forgiveness under the PAYE plan is contingent upon meeting specific requirements, primarily related to consistent on-time payments and the length of time you’ve been making payments. Generally, loan forgiveness is not automatic; it requires sustained repayment adherence and may involve specific employment in public service or qualifying non-profit sectors. The exact requirements and eligibility criteria can vary based on the type of loan and the specific repayment plan chosen.

Examples of Loan Forgiveness Scenarios

Several scenarios could lead to loan forgiveness under PAYE. For instance, an individual working in a qualifying public service role (e.g., teaching in a low-income school, working for a government agency) for a defined period, consistently making their monthly payments, might qualify for Public Service Loan Forgiveness (PSLF). Another example involves individuals who have made payments for 20 or 25 years (depending on the loan type and program), under the Income-Driven Repayment (IDR) plan, including PAYE, potentially leading to loan forgiveness.

Applying for Loan Forgiveness

The process for applying for loan forgiveness under PAYE typically involves meticulous documentation of your repayment history and employment. You will need to demonstrate consistent, on-time payments for the required duration and provide verifiable proof of employment in a qualifying field. This often requires submitting forms and documentation directly to your loan servicer. Failure to maintain accurate records and submit all necessary documentation can delay or prevent loan forgiveness. It is crucial to regularly review your loan account and proactively contact your loan servicer if you anticipate any difficulties or have questions regarding the forgiveness process.

Impact of Student Loans on Credit Score

Student loans, while essential for many pursuing higher education, can significantly impact your credit score. Understanding this impact and employing responsible financial strategies is crucial for building and maintaining a strong credit history. This section will explore the relationship between student loans and credit scores, offering guidance on navigating this aspect of your financial journey.

Student loans, once you begin repayment, are considered installment loans. These loans are reported to credit bureaus, and your repayment activity directly influences your credit score. On-time payments contribute positively, while missed or late payments negatively impact your score. The amount of debt you have relative to your available credit (credit utilization) also plays a role. A high debt-to-credit ratio, even with on-time payments, can lower your credit score.

Responsible Repayment Habits and Credit Rating

Responsible repayment habits are paramount in maintaining a good credit score while repaying student loans. Consistent and timely payments demonstrate creditworthiness to lenders. This positive history contributes to a higher credit score, opening doors to better interest rates on future loans and credit products. Conversely, consistent late payments or defaults can severely damage your credit score, making it difficult to secure loans or even rent an apartment in the future. Consider setting up automatic payments to ensure consistent on-time repayment.

Tips for Maintaining a Good Credit Score While Repaying Student Loans

Maintaining a good credit score while managing student loan debt requires proactive strategies. First, prioritize on-time payments above all else. Even small delays can negatively affect your score. Second, monitor your credit report regularly for errors. You can obtain a free credit report annually from AnnualCreditReport.com. Addressing any inaccuracies promptly is vital. Third, keep your credit utilization low. Aim to keep your credit card balances below 30% of your credit limit. Fourth, consider exploring different repayment plans, such as income-driven repayment, to manage your monthly payments effectively. Finally, if you are struggling to make payments, contact your loan servicer immediately to explore options like deferment or forbearance. Proactive communication can help mitigate negative impacts on your credit.

Key Considerations: Consistent on-time payments are crucial. Maintain a low credit utilization ratio. Monitor your credit report regularly. Explore repayment options if you face difficulties. Proactive communication with your loan servicer is vital in managing potential challenges.

Illustrative Example of a Successful Application

This example showcases a fictional but realistic application for a PAYE student loan, highlighting the process from initial application to loan approval and repayment planning. It demonstrates the typical steps involved and considers the applicant’s financial circumstances to illustrate how these impact repayment options.

Sarah, a 22-year-old aspiring teacher, decided to pursue a Bachelor of Education degree at a reputable university. Anticipating the financial burden of tuition fees and living expenses, she researched student loan options and determined that a PAYE student loan would be the most suitable choice. Her family’s financial support was limited, and she needed a loan that aligned with her expected post-graduation income.

Sarah’s Application Process

Sarah began her application process in early spring. She meticulously gathered all the necessary documentation, including her acceptance letter from the university, proof of identity, and her most recent tax returns (to demonstrate her financial situation and projected income). The application itself was completed online, and she found the process straightforward and well-guided. She submitted her application by the deadline, ensuring all information was accurate and complete.

Sarah’s Financial Situation and Repayment Plan

Sarah’s annual income during her studies was limited to part-time work earnings of approximately £8,000. Her loan application reflected this, allowing the loan provider to accurately assess her repayment capabilities post-graduation. Based on her chosen degree and projected salary upon graduation (approximately £28,000 per year as a newly qualified teacher), a repayment plan was automatically generated. This plan indicated that her monthly repayments would be manageable, within a percentage of her post-graduation salary, ensuring affordability without undue financial hardship.

Timeline and Key Milestones

- March: Research of student loan options and eligibility criteria.

- April: Gathering of necessary documentation and completion of the online application.

- May: Submission of the complete application.

- June: Confirmation of application receipt and initial assessment.

- July: Loan approval notification and detailed repayment plan provided.

- September: Loan funds disbursed to the university.

Sarah’s proactive approach and thorough preparation ensured a smooth application process. The clarity of the online application and the readily available support resources contributed to her success. The transparent repayment plan, calculated based on her predicted income, instilled confidence in her ability to manage the loan effectively. Her experience serves as a positive example for prospective students considering a PAYE student loan.

Wrap-Up

Securing a PAYE student loan can significantly impact your educational journey and future financial well-being. By carefully reviewing the eligibility requirements, diligently completing the application process, and understanding the repayment options, you can confidently navigate this important step. Remember to proactively address any potential challenges and maintain responsible repayment habits to protect your credit score. With careful planning and preparation, you can successfully obtain the financial support you need to achieve your academic goals.

FAQ Section

What happens if my application is rejected?

If your application is rejected, you’ll typically receive a notification explaining the reasons. You can then review the reasons and potentially reapply after addressing the identified issues or appeal the decision if you believe there’s been an error.

Can I change my repayment plan after I’ve started repaying?

Depending on your circumstances and the specific loan provider, you may be able to change your repayment plan. Contact your loan provider to discuss your options and eligibility.

How long does the application process usually take?

Processing times can vary, but generally, expect a timeframe of several weeks. Providing all necessary documentation promptly can help expedite the process.

What if I lose my job during repayment?

Most PAYE plans offer flexibility for those experiencing job loss. Contact your loan provider immediately to discuss your options, such as deferment or reduced payments.