Navigating the complex world of student loan repayment can feel overwhelming. Fortunately, numerous “save” programs exist, designed to alleviate the financial burden and pave the way for a brighter future. Understanding these programs—their eligibility criteria, benefits, and potential drawbacks—is crucial for making informed decisions about your financial well-being. This guide provides a comprehensive overview of the application process, financial implications, and strategies for successfully securing student loan relief.

From understanding different program types and eligibility requirements to mastering the application process and managing post-application procedures, this resource equips you with the knowledge and tools needed to successfully navigate the student loan landscape. We will explore common challenges and offer solutions, ensuring you’re well-prepared for every step of the journey.

Understanding Student Loan Save Programs

Navigating the complexities of student loan repayment can be daunting. Fortunately, several programs exist to help borrowers manage their debt and potentially reduce their overall cost. Understanding the nuances of these programs is crucial for making informed financial decisions. This section will Artikel various student loan save programs, their eligibility requirements, and a comparison of their benefits and drawbacks.

Types of Student Loan Save Programs

Several federal and, in some cases, state-sponsored programs aim to assist student loan borrowers. These programs often differ in their eligibility criteria, repayment options, and forgiveness provisions. Key examples include Income-Driven Repayment (IDR) plans, Public Service Loan Forgiveness (PSLF), and Teacher Loan Forgiveness programs. Each offers unique benefits and drawbacks depending on the individual borrower’s circumstances.

Eligibility Criteria for Student Loan Save Programs

Eligibility for each program varies significantly. For instance, IDR plans typically require borrowers to demonstrate financial need based on income and family size. PSLF requires borrowers to work full-time for a qualifying government or non-profit organization for 10 years while making consistent payments under an IDR plan. Teacher Loan Forgiveness programs have specific requirements related to teaching in low-income schools or educational service agencies. Careful review of each program’s specific guidelines is essential before applying.

Comparison of Benefits and Drawbacks of Student Loan Save Programs

While these programs offer significant potential benefits, it’s important to understand their limitations. IDR plans can result in longer repayment periods and potentially higher overall interest paid. PSLF, while offering complete loan forgiveness, has stringent requirements and a lengthy application process that can be easily derailed by even minor inconsistencies in employment or payment history. Teacher Loan Forgiveness programs provide a more targeted benefit but may not be applicable to all teachers. Choosing the right program requires careful consideration of individual circumstances and long-term financial goals.

Comparison of Student Loan Save Programs

| Program | Interest Rate | Repayment Plan | Forgiveness Options |

|---|---|---|---|

| Income-Driven Repayment (IDR) | Variable, based on loan type and plan | Monthly payments based on income and family size | Loan forgiveness after 20-25 years, depending on the plan |

| Public Service Loan Forgiveness (PSLF) | Variable, based on loan type | Income-Driven Repayment Plan | Complete loan forgiveness after 120 qualifying payments |

| Teacher Loan Forgiveness | Variable, based on loan type | Standard repayment plan or IDR plan | Up to $17,500 in loan forgiveness after 5 years of teaching in a low-income school |

The Application Process

Applying for a student loan save program can seem daunting, but breaking down the process into manageable steps makes it much more straightforward. Each program has its own specific requirements, but the general process typically involves gathering necessary documentation, completing an online application, and submitting supporting materials. Understanding the nuances of each program’s application is key to a successful outcome.

The application process generally involves several key steps. Careful preparation and attention to detail at each stage will significantly increase your chances of approval.

Required Documentation

Different student loan save programs require varying documentation. However, some common documents include proof of enrollment (official transcripts or acceptance letters), tax returns (for income verification), and financial aid award letters. Some programs may also require additional documentation, such as proof of residency or documentation supporting extenuating circumstances. For example, a program focusing on income-based repayment might request detailed pay stubs over the past year, while a program aimed at assisting students with disabilities may require medical documentation. Always refer to the specific program guidelines for a comprehensive list of required materials.

Online Application Process

Most student loan save programs utilize online application portals. These portals typically guide applicants through a series of forms, requiring them to input personal information, academic details, and financial data. The online process usually involves creating an account, completing the application form, uploading supporting documents, and submitting the completed application for review. Potential challenges include navigating complex online forms, ensuring accurate data entry, and managing the upload of large files. Technical difficulties, such as website outages or slow internet speeds, can also pose obstacles. It is crucial to allow ample time to complete the application thoroughly and accurately.

Step-by-Step Application Guide

- Gather Required Documents: Collect all necessary documentation, such as transcripts, tax returns, and financial aid award letters. Make copies to keep for your records.

- Create an Account: Visit the program’s website and create an online account. Ensure you use a secure password and remember your login credentials.

- Complete the Application Form: Carefully fill out the online application form, ensuring all information is accurate and complete. Double-check for any errors before proceeding.

- Upload Supporting Documents: Upload all required supporting documents in the specified formats. Ensure the files are clear and legible.

- Review and Submit: Thoroughly review your application and uploaded documents before submitting. Once submitted, you generally cannot make changes.

- Track Your Application: Many programs provide online tracking tools to monitor the status of your application. Check regularly for updates.

Financial Implications and Planning

Participating in a student loan save program can significantly impact your long-term financial health, both positively and negatively. Understanding these implications is crucial for making informed decisions and ensuring the program aligns with your overall financial goals. Careful planning is key to maximizing the benefits and mitigating potential risks.

Long-Term Financial Impact of Save Programs

Save programs, by reducing your monthly student loan payments, free up cash flow that can be allocated towards other financial priorities. This could include accelerated debt repayment on other loans, increased savings for emergencies or retirement, or investments for future growth. Conversely, extending the repayment period, as often happens with save programs, can lead to paying more in interest over the life of the loan. The net financial impact depends on factors such as the interest rate on your loans, the length of the save period, and how you utilize the extra disposable income. For example, someone with high-interest debt might find that aggressively paying down that debt outweighs the extra interest paid on their student loans under the save program. Conversely, someone with low-interest student loans and limited savings might benefit more from using the extra cash flow to bolster their emergency fund.

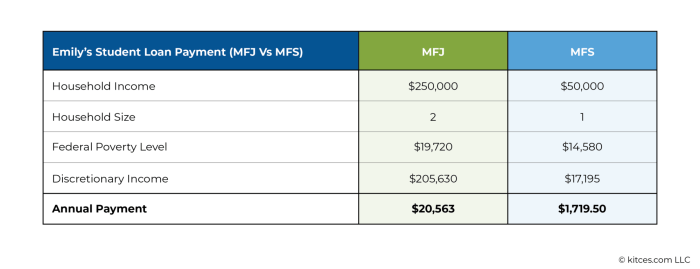

Tax Implications of Save Programs

The tax implications of save programs are generally minimal, but it’s important to understand the basics. Interest paid on student loans is usually deductible, but the rules and limits can be complex. The amount you can deduct might be reduced if your modified adjusted gross income (MAGI) exceeds a certain threshold. Save programs don’t directly affect your tax liability, but the changes in your payment amount could impact your eligibility for certain deductions or credits. It’s recommended to consult a tax professional or utilize tax software to accurately assess your tax situation considering your participation in a save program.

Sample Budget: Impact of a Save Program

Let’s consider a hypothetical example. Suppose a student has monthly student loan payments of $500 before enrolling in a save program. The save program reduces this to $250. This $250 saved can be allocated as follows:

| Category | Before Save Program | After Save Program |

|---|---|---|

| Student Loan Payment | $500 | $250 |

| Rent/Mortgage | $1000 | $1000 |

| Groceries | $300 | $300 |

| Utilities | $150 | $150 |

| Transportation | $100 | $100 |

| Savings/Debt Repayment | $0 | $250 |

| Total Expenses | $2100 | $2000 |

This example shows how the extra $250 can directly increase savings or be used to pay down other debts, improving the overall financial picture. Individual circumstances will vary, requiring a personalized budget adjustment.

Managing Student Loan Debt While in a Save Program

Effective management of student loan debt during a save program involves proactive steps. This includes:

First, create and maintain a detailed budget, tracking all income and expenses. This provides a clear picture of your financial situation and allows for informed decision-making regarding the allocation of the extra funds freed up by the save program.

Second, prioritize high-interest debt. While the save program lowers your student loan payments, focus on aggressively paying down any other debts with higher interest rates to minimize overall interest payments.

Third, explore additional income streams. Part-time jobs or freelance work can provide extra funds to further accelerate debt repayment or increase savings.

Finally, regularly review your progress. Track your loan balance, interest paid, and savings growth to ensure you are on track to achieve your financial goals. Adjust your budget and repayment strategy as needed.

Potential Challenges and Solutions

Applying for student loan save programs can present several hurdles, from navigating complex application processes to managing the financial stress inherent in the process. Understanding these potential challenges and proactively developing strategies to overcome them is crucial for a successful application. This section will Artikel common issues, provide solutions for application rejections or delays, and offer advice for managing financial stress during this period.

Application Rejection or Delay Reasons and Solutions

Application rejections or delays often stem from incomplete or inaccurate information, missing documentation, or failing to meet specific eligibility criteria. Careful review of application requirements, thorough documentation preparation, and proactive communication with the loan provider are vital steps in preventing these issues. For example, failing to submit tax returns or proof of enrollment can lead to immediate rejection. Addressing such issues promptly, by resubmitting the necessary documents with a clear explanation of the delay, can help rectify the situation. Similarly, misunderstandings about eligibility requirements, such as GPA thresholds or specific program limitations, can be addressed by contacting the program administrator directly for clarification. Proactive communication and meticulous attention to detail significantly improve the chances of a successful application.

Managing Financial Stress During the Application Process

The application process itself can be financially stressful. Uncertainty about loan approval, coupled with existing financial burdens, can create significant anxiety. Creating a detailed budget that accounts for all expenses, including application fees and potential living costs, is a crucial first step. Exploring potential sources of temporary financial assistance, such as short-term loans or grants specifically designed to support students during the application period, can provide crucial relief. Additionally, seeking guidance from a financial advisor or university financial aid office can provide valuable support and personalized strategies for managing financial stress. For instance, a student facing unexpected medical expenses might explore options like crowdfunding or negotiating payment plans with creditors.

Addressing Common Misunderstandings Regarding Program Eligibility and Benefits

Many applicants face confusion regarding eligibility criteria and the specific benefits offered by different save programs. This often stems from unclear program guidelines or a lack of understanding of the application process. Thoroughly reviewing the program’s official website and contacting the program administrator directly to clarify any uncertainties is highly recommended. For example, a common misunderstanding might involve the difference between need-based and merit-based programs. Clarifying these distinctions early in the process ensures applicants focus their efforts on programs they are truly eligible for. Similarly, understanding the repayment terms, interest rates, and potential deferment options associated with each program is crucial for making informed decisions. Proactive research and clear communication are essential in avoiding these misunderstandings.

Post-Application Procedures

Submitting your student loan save program application is a significant step. However, the process doesn’t end there. Understanding the post-application procedures is crucial to ensure a smooth transition and successful enrollment. This section Artikels the necessary steps to take after submission, methods for tracking your application, available communication channels, and a checklist for post-approval actions.

Following the submission of your application, several key steps are essential. These steps ensure your application is processed efficiently and that you’re well-informed throughout the process. Proactive engagement will minimize potential delays and uncertainties.

Application Status Tracking

Several methods exist to monitor the progress of your application. The most common include online portals provided by the loan servicer or government agency managing the save program. These portals usually require a login using your application reference number or other identifying information. You can typically view the current stage of processing, any required documents, and anticipated timelines. Additionally, some programs offer email or text message updates, providing automated notifications of significant milestones in the application process. For example, you might receive an email confirming receipt of your application, followed by another notification when it’s under review, and a final email confirming approval or denial. Regularly checking your application portal and reviewing your emails will keep you informed of your application’s progress.

Applicant Communication Channels

Effective communication is key throughout the application process. Most save programs offer multiple communication channels for applicants. These typically include a dedicated phone number for inquiries, an online contact form on their website, and a frequently asked questions (FAQ) section. Some programs may also offer live chat support on their website during business hours. It’s advisable to utilize the official channels provided by the program to ensure you receive accurate and timely information. Avoid relying on unofficial sources or third-party websites for updates. Keeping a record of all communications – emails, phone calls, and online interactions – can be beneficial should any issues arise.

Post-Approval Checklist

Once your application is approved and you’re enrolled in the save program, several actions are necessary to fully benefit from the program. This checklist ensures a smooth transition and helps avoid potential problems.

- Review the program terms and conditions carefully to understand your responsibilities and benefits.

- Confirm your enrollment details, including payment schedule and any required actions.

- Update your contact information with the loan servicer to ensure you receive timely updates.

- Familiarize yourself with the repayment options available under the save program.

- Set up automatic payments to avoid late payment fees and maintain a good payment history.

- Keep records of all correspondence and transactions related to the save program.

Illustrative Examples

Understanding the application process for student loan save programs is best illustrated through real-world scenarios. These examples showcase both successful applications and instances where challenges were encountered and overcome, highlighting the diverse experiences students may face. They also demonstrate the variety of programs available.

Successful Application Scenario

Imagine Sarah, a diligent engineering student, diligently researched various student loan save programs offered by her university and the government. She identified a program that matched her academic goals and financial situation – a grant based on demonstrated financial need and academic merit. Sarah meticulously gathered all the necessary documentation, including transcripts, tax returns, and proof of enrollment. She submitted her application well before the deadline, ensuring it was complete and error-free. As a result of her thorough preparation and timely submission, Sarah was awarded the grant, significantly reducing her overall loan burden. This allowed her to focus more on her studies and less on financial stress, ultimately leading to her graduating with honors and securing a well-paying job upon graduation. Her proactive approach and careful planning yielded substantial positive outcomes.

Challenging Application Scenario

Consider David, a talented music student who faced unforeseen challenges during his application. He initially missed the application deadline for a crucial loan forgiveness program due to a family emergency. However, instead of giving up, David immediately contacted the financial aid office. He explained his situation, providing supporting documentation. The office, understanding his circumstances, granted him an extension. While completing the application, he encountered difficulties understanding certain requirements. He proactively sought assistance from the financial aid advisor, who provided clarification and guidance. Through persistence and effective communication, David successfully completed his application and secured the loan forgiveness program, mitigating his future repayment obligations.

Types of Student Loan Save Programs and Benefits

Several types of student loan save programs exist, each offering unique benefits. Income-driven repayment plans adjust monthly payments based on income and family size, making repayment more manageable for lower-income borrowers. Forgiveness programs, often targeted at specific professions (like teaching or public service), can eliminate a portion or all of a borrower’s loan balance after a certain period of qualifying employment. Grants, awarded based on financial need or merit, provide non-repayable funding to assist with educational expenses. Scholarships, similar to grants, are also non-repayable funds, often awarded based on academic achievement, extracurricular activities, or demonstrated talent. Each program’s specific eligibility criteria and benefits vary, emphasizing the importance of thorough research before applying. For instance, a Public Service Loan Forgiveness program might require 10 years of qualifying employment in a public service role to qualify for loan forgiveness, while an income-driven repayment plan could significantly reduce monthly payments for a period of time. A merit-based scholarship might require a high GPA and strong extracurricular involvement, while a need-based grant would consider a student’s financial background and demonstrated need.

Last Recap

Securing student loan relief through a save program requires careful planning and understanding of the various options available. By diligently following the application process, proactively addressing potential challenges, and effectively managing your finances, you can significantly reduce the long-term impact of student loan debt. Remember to utilize available resources and seek guidance when needed to ensure a smooth and successful application process. Your financial future is within reach.

Clarifying Questions

What happens if my application is rejected?

If your application is rejected, review the reasons provided and address any deficiencies. Consider appealing the decision or exploring alternative programs.

Can I apply for multiple save programs simultaneously?

Generally, you can’t apply for multiple programs simultaneously that offer overlapping benefits. However, you may be eligible for different types of assistance, so research options carefully.

What if I encounter problems during the online application process?

Most programs offer customer support via phone or email. Contact them for assistance with technical issues or clarification on application requirements.

Are there income limits for these programs?

Yes, many save programs have income-based eligibility requirements. Check the specific program guidelines for details.