Securing funding for higher education can feel daunting, but understanding the Free Application for Federal Student Aid (FAFSA) process is key to unlocking financial assistance. This guide navigates the complexities of applying for student loans through FAFSA, providing a clear pathway to accessing crucial financial aid for your academic journey. We’ll cover everything from completing the application to understanding your financial aid award.

From eligibility requirements and necessary documentation to navigating the online portal and understanding different aid types, we aim to demystify the FAFSA process. We’ll also address common pitfalls and offer practical tips to ensure a smooth and successful application.

Understanding FAFSA

The Free Application for Federal Student Aid (FAFSA) is a crucial gateway to accessing federal student financial aid. It’s a single application that determines your eligibility for various types of federal aid, including grants, loans, and work-study programs. Completing the FAFSA accurately and on time is essential for securing the financial resources you need to pursue your higher education goals.

FAFSA Purpose

The FAFSA’s primary purpose is to collect necessary information from students and their families to determine their financial need and eligibility for federal student aid. This information allows the Department of Education to assess the student’s financial situation and allocate aid accordingly. The information provided is used to calculate the Expected Family Contribution (EFC), a number that colleges use to determine how much financial aid to offer.

FAFSA Eligibility Requirements

To be eligible for federal student aid through the FAFSA, applicants must meet several criteria. They must be a U.S. citizen or eligible non-citizen, possess a valid Social Security number, have a high school degree or equivalent, and be enrolled or accepted for enrollment in an eligible educational program at a participating institution. Additionally, applicants must agree to provide their tax information and complete the application truthfully. Specific requirements regarding age, dependency status, and prior education may also apply.

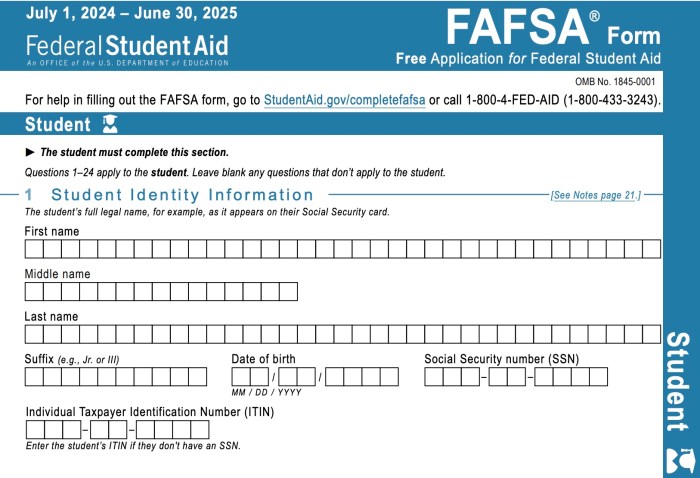

Completing the FAFSA Form: A Step-by-Step Guide

Completing the FAFSA involves several key steps. First, gather all necessary tax information, including your Federal Income Tax Return (Form 1040), W-2s, and other relevant financial documents. Next, create an FSA ID, which is a username and password used to access and sign your FAFSA. Then, begin the online application, carefully answering all questions accurately and completely. Use the IRS Data Retrieval Tool to directly import your tax information, reducing errors. Finally, review your application thoroughly for accuracy before submitting it. Remember to electronically sign the application.

Common FAFSA Mistakes

Many students make common mistakes when filling out the FAFSA. One frequent error is providing inaccurate or incomplete tax information. Another common mistake is failing to list all assets and income sources. Students often forget to include information about untaxed income or assets held in trusts. Delaying the submission of the FAFSA past the deadlines is another frequent error. Finally, neglecting to update the FAFSA annually, if needed, is also a common issue.

Comparison of FAFSA and Other Financial Aid Options

| Feature | FAFSA | Scholarships | Grants (Non-Federal) | Private Loans |

|---|---|---|---|---|

| Source | Federal Government | Organizations, Colleges, Individuals | State/Local Governments, Institutions | Private Lenders |

| Need-Based | Generally, yes | Often, but not always | Often, but not always | No |

| Repayment | Grants don’t require repayment; loans do | No repayment | No repayment | Requires repayment with interest |

Required Documents and Information

Completing the Free Application for Federal Student Aid (FAFSA) requires gathering specific documents and information. Accuracy is paramount, as errors can delay or prevent the disbursement of financial aid. This section Artikels the necessary materials and explains the importance of precise data entry.

Successfully navigating the FAFSA process hinges on having the correct documentation readily available. This not only streamlines the application process but also minimizes the risk of delays or rejections. Careful preparation significantly reduces stress and ensures a smoother path to securing financial aid.

Essential Documents for FAFSA Completion

The specific documents required may vary slightly depending on individual circumstances, but generally include tax information (both yours and your parents’, if applicable), Social Security numbers, and driver’s license or state ID. Having these documents readily accessible will significantly expedite the application process.

- Tax Returns (IRS Tax Transcripts): These provide the IRS-verified income information needed for accurate financial need calculations. Using the IRS Data Retrieval Tool (DRT) within the FAFSA website is the preferred and most accurate method of providing this information.

- Social Security Numbers (SSNs): Your SSN and the SSNs of your parents (if applicable) are crucial for identifying you and verifying your information within the federal system.

- Driver’s License or State-Issued ID: These documents are often required for verification purposes and to confirm your identity.

- Alien Registration Number (If Applicable): Non-citizens may need to provide their Alien Registration Number for verification.

Importance of Accurate Tax Information

Accurate tax information is the cornerstone of a successful FAFSA application. The information provided directly impacts the calculation of your Expected Family Contribution (EFC), which determines your eligibility for federal student aid. Inaccurate information can lead to an incorrect EFC calculation, resulting in either an insufficient award or, in some cases, ineligibility. The use of the IRS Data Retrieval Tool is highly recommended to minimize errors and ensure accuracy.

Obtaining Missing Documents or Correcting Errors

If you are missing documents or discover errors in your application, promptly addressing these issues is crucial. Contacting the IRS to obtain tax transcripts or contacting the FAFSA help line to correct errors are recommended steps. Remember, timeliness is key; delays in correcting errors could impact your financial aid eligibility.

FAFSA Document Checklist

Before beginning your FAFSA application, use this checklist to ensure you have all the necessary documents:

- Your Social Security number

- Your parents’ Social Security numbers (if applicable)

- Your federal income tax returns (IRS Tax Transcripts are preferred)

- Your parents’ federal income tax returns (if applicable)

- Your driver’s license or state-issued ID

- Alien Registration Number (if applicable)

- FSA ID (if you’ve already created one)

Frequently Requested Information for FAFSA

This list details the common information points required for the FAFSA. Having this information ready before you begin will significantly speed up the application process.

- Student Information: Full name, date of birth, address, Social Security number.

- Parent Information (if applicable): Full names, dates of birth, addresses, Social Security numbers, and tax information.

- Financial Information: Adjusted Gross Income (AGI), untaxed income, assets, and tax filing status.

- Education Information: Intended college or university, expected graduation date, and degrees sought.

Navigating the FAFSA Website

The official FAFSA website, studentaid.gov, serves as the central hub for completing the Free Application for Federal Student Aid. Its design aims for user-friendliness, guiding students through the application process with clear instructions and helpful resources. Understanding its layout and functionality is key to a smooth and efficient application experience.

The website features a clean and intuitive interface. The main navigation bar typically includes sections for starting the application, managing your FAFSA profile, tracking your progress, and accessing help resources. The site is designed to be responsive, adapting to various screen sizes for easy access on desktops, tablets, and smartphones.

Creating and Managing a FAFSA Account

Creating a FAFSA account involves providing your FSA ID, a username and password combination that you’ll use to access and manage your FAFSA application. You’ll need to create separate FSA IDs for both yourself and your parent(s) if required. The website guides you through this process step-by-step, ensuring that you have the correct information before proceeding. Managing your account involves securely storing your FSA ID and password, and regularly checking your FAFSA dashboard for updates and notifications.

Tips for Efficiently Navigating the Online Application

Before starting the FAFSA, gather all necessary documents and information. This includes Social Security numbers, tax returns, and financial records. Having this information readily available will significantly speed up the application process. The website allows you to save your progress and return later. Utilize this feature to avoid information loss and complete the form at your own pace. Familiarize yourself with the different sections of the form beforehand, allowing for a more streamlined application process.

Different Sections of the FAFSA Form and Their Significance

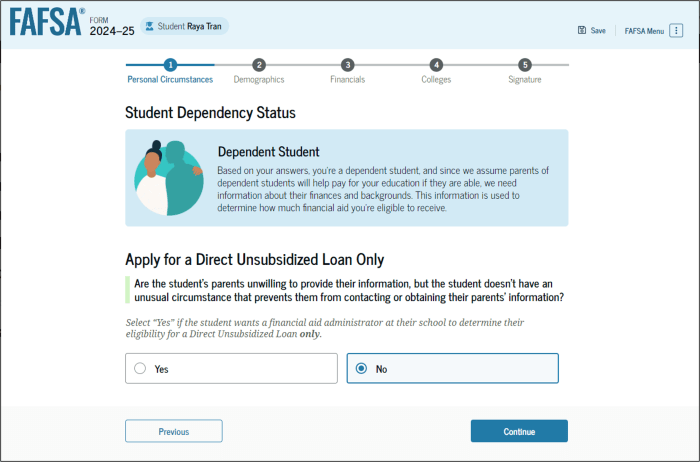

The FAFSA form is divided into several key sections. The Student Information section requests details about the applicant, including their name, address, date of birth, and Social Security number. The Parent Information section collects similar information from the applicant’s parents if they are claimed as a dependent. The School Information section requires details about the colleges or universities the applicant is applying to. The Financial Information section gathers details about the family’s income, assets, and tax information, which is used to determine the student’s financial need. Each section is crucial for accurately determining the student’s eligibility for federal student aid.

Flowchart Illustrating the FAFSA Application Process

A flowchart visually depicting the FAFSA application process would begin with a “Start” node. This would branch to “Create FSA ID” and “Gather Required Information.” These two branches would then converge at a “Begin FAFSA Application” node. Next, the flowchart would show sequential boxes representing the completion of each section of the FAFSA form (Student Information, Parent Information, School Information, Financial Information). After completing all sections, the process would lead to a “Review and Submit” node. Finally, the flowchart would conclude with a “Submission Confirmation” node, followed by a “Track Your Status” node which points to checking the status of the application online. A final “End” node completes the process.

Financial Aid Types and Awarding

Completing the FAFSA opens the door to various types of federal student aid designed to help finance your education. Understanding these aid types and how they’re awarded is crucial for effectively planning your college funding strategy. This section will clarify the different options available and the factors determining your aid package.

Types of Federal Student Aid

The federal government offers several types of financial aid, each with its own characteristics and eligibility requirements. These primarily fall into three categories: grants, loans, and work-study.

Grants

Grants are essentially free money for college. Unlike loans, they don’t need to be repaid. Several federal grant programs exist, such as the Pell Grant, which is awarded based on financial need and is available to undergraduate students. Other grants may be offered by individual colleges or universities, often based on merit or specific criteria. The amount of a grant varies depending on factors such as financial need, cost of attendance, and enrollment status.

Loans

Federal student loans provide borrowed funds to cover educational expenses. These loans must be repaid with interest after you graduate or leave school, although grace periods are typically offered. Several types of federal student loans exist, including subsidized and unsubsidized loans, with differing interest rates and repayment terms. Subsidized loans typically do not accrue interest while you are enrolled at least half-time, while unsubsidized loans accrue interest from the time they are disbursed. Federal loans are generally preferable to private loans due to more favorable repayment terms and protections for borrowers.

Work-Study

Federal Work-Study is a program that provides part-time employment opportunities to students who demonstrate financial need. Earnings from a work-study job can help offset educational costs and reduce reliance on loans. Work-study positions are often located on campus, offering flexible schedules that accommodate academic commitments. The amount of earnings varies depending on the position and the number of hours worked.

Factors Influencing Financial Aid Awards

The amount of financial aid awarded is determined by a complex formula considering several factors. These include your Expected Family Contribution (EFC), which is an estimate of how much your family can contribute towards your education, calculated based on the information you provide on the FAFSA. The cost of attendance at the college or university you are attending also plays a significant role, as does your enrollment status (full-time versus part-time). Finally, the availability of funds for each aid program also influences the final award package. For example, a high demand for Pell Grants might mean that not every eligible student receives the full amount requested.

Understanding Your Student Aid Report (SAR)

After submitting your FAFSA, you will receive a Student Aid Report (SAR). This report summarizes the information you provided and your calculated EFC. The SAR does not represent your actual financial aid award; it serves as the foundation for colleges to determine your eligibility for aid. Carefully review your SAR for any errors or discrepancies. If you find any mistakes, contact the Federal Student Aid office immediately to make corrections. The SAR also provides your FSA ID, which you will need to access your financial aid information online.

Examples of Financial Aid Usage

Financial aid can cover a wide range of educational expenses. For example, Pell Grant funds could be used to pay for tuition, fees, room and board, books, and supplies. Loan funds could be used similarly, while work-study earnings could help cover living expenses or reduce the need to borrow as much. A student receiving $5,000 in Pell Grants, $10,000 in federal loans, and earning $2,000 through work-study could potentially cover $17,000 of their educational expenses. This illustrates how various aid types can combine to meet a significant portion of college costs. The specific allocation of funds will depend on the individual student’s financial aid package and the college’s billing procedures.

After Submitting the FAFSA

Submitting your FAFSA is a significant step in the financial aid process, but it’s not the end. Understanding how to track your application, handle potential issues, and manage your aid offers is crucial to securing the funding you need for your education. This section Artikels the next steps to take after hitting the “submit” button.

Tracking Your FAFSA Application Status

After submitting your FAFSA, you’ll receive a confirmation number. This number is your key to tracking your application’s progress. You can access your FAFSA data and track its status online through the official FAFSA website (studentaid.gov). The website provides updates on the processing of your application, including whether it’s been received, if any information is missing, and when it has been processed by the federal government and sent to your chosen schools. Regularly checking your status allows you to identify and address any issues promptly. You can also expect to receive email notifications regarding the status of your application.

Addressing Incomplete or Rejected FAFSA Applications

If your FAFSA application is flagged as incomplete, the website will usually indicate what information is missing. Common reasons for incompleteness include missing tax information, discrepancies in reported data, or insufficient documentation. You will need to log back into your FAFSA account, correct the errors, and resubmit the application. A rejected application may result from more serious issues, such as providing false information or failing to meet eligibility requirements. If your application is rejected, the website will usually explain the reason for rejection. You should carefully review the explanation and contact the Federal Student Aid office or your school’s financial aid office for clarification and guidance on how to resolve the issue. Resubmission may be possible depending on the nature of the error.

Accepting or Declining Financial Aid Offers

Once your FAFSA is processed, your chosen schools will send you financial aid award letters outlining the types and amounts of aid you’ve been offered. These offers might include grants, scholarships, loans, and work-study opportunities. Carefully review each award letter to understand the terms and conditions of each offer. Most institutions will provide an online portal or a specific deadline for accepting or declining the aid. Failure to respond by the deadline may result in the loss of the offered aid. If you accept an offer, it’s generally binding, so make sure you understand the implications before accepting any loan offers. If you decline an offer, make sure to do so through the proper channels and within the designated timeframe.

Appealing a Financial Aid Decision

If you disagree with a financial aid decision, you can usually appeal the decision. Each institution has its own appeal process, so you should review your school’s specific policies and procedures. You’ll typically need to submit a written appeal explaining your reasons for appealing the decision. Supporting documentation, such as evidence of unexpected changes in your financial circumstances, is often required. Be prepared to provide a detailed and compelling explanation of your situation and why you believe the original decision was incorrect. The success of an appeal depends on the strength of your case and the institution’s policies.

Timeline for Key Events After FAFSA Submission

The timeline below is an estimate and may vary depending on individual circumstances and the institution’s processing times.

| Event | Timeline (Approximate) |

|---|---|

| FAFSA Submission | Anytime after October 1st (prior to deadlines) |

| FAFSA Processing | 3-7 days |

| Financial Aid Award Notification | Within a few weeks to a couple of months after FAFSA processing |

| Financial Aid Acceptance/Declination Deadline | Usually within a few weeks of receiving the award letter |

| Financial Aid Disbursement | Typically before or at the start of each academic term |

Illustrative Examples

Understanding the FAFSA process can be challenging. To clarify, let’s examine some examples illustrating different scenarios and outcomes. This will help demystify the application process and provide a clearer picture of how financial aid is determined.

We’ll look at a sample application, a visual representation of key form fields, and a problem-solving scenario to further enhance your comprehension.

A Fictional Student’s FAFSA Application

Meet Sarah, a high school senior applying for financial aid to attend State University. Her family’s financial information is as follows:

| Category | Amount |

|---|---|

| Parents’ Adjusted Gross Income (AGI) | $65,000 |

| Parents’ Untaxed Income (Social Security, etc.) | $5,000 |

| Parents’ Assets (Savings, Investments) | $20,000 |

| Number of Family Members | 4 |

| Number of Parents in College | 0 |

Based on this information, and assuming Sarah’s expected cost of attendance at State University is $25,000 per year, the FAFSA calculator would determine her Expected Family Contribution (EFC). This EFC is then subtracted from the cost of attendance to determine her financial need. The resulting financial need will then be met by a combination of grants, loans, and work-study, if available.

In Sarah’s case, let’s assume her EFC is calculated to be $10,000. This means her financial need is $15,000 ($25,000 – $10,000). State University might offer her a $5,000 grant, a $7,000 subsidized federal loan, and a $3,000 work-study opportunity. This combination covers her entire financial need.

Sample FAFSA Form Visualization

Imagine a form with clearly labeled sections. The top section would include the student’s and parent’s identifying information: names, addresses, social security numbers, and dates of birth. Below that, a section dedicated to collecting tax information: AGI, untaxed income, and asset information. Another section would require information about the student’s college plans: the school’s name and code, anticipated enrollment date, and degree program. A final section might include questions regarding family size, number of dependents, and citizenship status. Each field is clearly marked with instructions, making the form easy to navigate.

Problem Encountered During FAFSA Application and Resolution

Imagine John, another student, is completing his FAFSA. He enters his parents’ tax information, but receives an error message indicating a mismatch between the information provided and the IRS data. John’s parents recently filed an amended tax return, and the FAFSA system hasn’t yet updated its records.

To resolve this, John first verifies the accuracy of the information he entered, comparing it to his parents’ amended tax return. He then contacts the IRS to confirm the amended return’s processing status. Once he has confirmation, he waits a few days for the IRS data to update within the FAFSA system. If the issue persists, he contacts the FAFSA help desk for assistance, providing them with the necessary documentation to verify the accuracy of his amended tax return information. The FAFSA help desk assists him with the necessary updates and his application is successfully processed.

Last Point

Successfully navigating the FAFSA application is a significant step towards achieving your educational goals. By understanding the process, gathering necessary documents, and carefully completing the form, you can unlock access to federal student aid. Remember to track your application status and don’t hesitate to seek assistance if needed. With careful planning and attention to detail, securing financial aid through FAFSA can be a manageable and rewarding experience.

FAQ Overview

What happens if I make a mistake on my FAFSA application?

You can correct errors online before submitting. After submission, contact the Federal Student Aid office for guidance on correcting information.

Can I apply for FAFSA after the deadline?

While there are deadlines, some schools may still accept applications after the priority deadline. Contact your school’s financial aid office for details.

What if I don’t have all the required documents?

You can still start the application and complete it later. The FAFSA website provides instructions for adding information later.

How long does it take to process my FAFSA application?

Processing times vary, but you can generally expect to receive your Student Aid Report (SAR) within a few weeks of submission.