Navigating the complexities of student loan repayment can feel daunting, but understanding the potential benefits of a student loan save plan can significantly ease the burden. This guide explores various save plan options, outlining the application process, financial implications, and relevant government regulations. We’ll delve into strategies to help you make informed decisions and effectively manage your student loan debt.

From understanding eligibility criteria and comparing different plan features to navigating the application process and anticipating potential challenges, this comprehensive resource aims to empower you with the knowledge necessary to make the best choices for your financial future. We’ll also explore alternative debt management strategies to provide a holistic view of your options.

Understanding Student Loan Save Plans

Saving for student loans can significantly reduce the financial burden of higher education. A well-structured plan allows students and their families to strategically manage costs and minimize the need for large loans later. Several options exist, each with its own set of benefits and drawbacks. Choosing the right plan depends on individual circumstances, financial goals, and risk tolerance.

Types of Student Loan Save Plans

Various strategies exist for saving for student loans. These aren’t formal “plans” in the sense of government programs, but rather approaches to saving and investing. They generally fall under three broad categories: high-yield savings accounts, investment accounts, and 529 plans.

Eligibility Criteria for Student Loan Save Plans

Eligibility for each saving method varies. High-yield savings accounts are generally open to anyone with a bank account. Investment accounts require meeting minimum investment thresholds, and age restrictions may apply for certain accounts (like Roth IRAs). 529 plans have beneficiary requirements (the student) and contribution limits set by each state.

Comparison of Benefits and Drawbacks

| Plan Type | Benefits | Drawbacks | Eligibility |

|---|---|---|---|

| High-Yield Savings Account | Easy access to funds, FDIC insured (up to $250,000 per depositor, per insured bank), low risk | Lower potential returns compared to investments | Anyone with a bank account |

| Investment Accounts (e.g., Roth IRA) | Higher potential returns over the long term, tax advantages (for Roth IRAs) | Higher risk, potential for loss, may have contribution limits | Generally open to those with earned income (Roth IRA has income limitations); age restrictions may apply. |

| 529 Education Savings Plan | Tax advantages on investment growth and withdrawals for qualified education expenses, potential for state tax deductions | Contribution limits, potential penalties for non-qualified withdrawals | Anyone can contribute, but funds are designated for a specific beneficiary (the student). |

Examples of Successful Student Loan Save Plan Strategies

One successful strategy involves a combination of approaches. For example, a family might contribute regularly to a 529 plan for long-term growth, while also maintaining a high-yield savings account for shorter-term needs or emergencies. Another successful strategy involves starting early. Beginning to save even small amounts when a child is young allows for the power of compounding interest to significantly increase savings over time. A third strategy involves maximizing employer-sponsored retirement plans to ensure long-term financial security and then using additional funds for student loan savings.

Application Process for Student Loan Save Plans

Applying for a student loan save plan can seem daunting, but understanding the process and required documentation can significantly ease the burden. This section Artikels the typical steps involved, potential challenges, and provides a sample application to illustrate the procedure. Remember, specific requirements may vary depending on your institution and the type of save plan.

Step-by-Step Application Procedure

The application process generally involves several key stages. First, you’ll need to gather all necessary documentation. Next, you’ll complete the application form itself. Following this, you’ll submit your application and wait for processing and approval. Finally, you’ll need to regularly monitor your account and make necessary adjustments as needed.

Required Documentation

The documents required can vary depending on the specific save plan and institution, but generally include proof of identity (such as a passport or driver’s license), proof of enrollment (an acceptance letter or current student ID), and financial information (such as bank statements or tax returns). Some plans may also require parental consent forms if the applicant is a minor. It is crucial to meticulously check the specific requirements of your chosen plan before beginning the application process to avoid delays.

Potential Application Challenges

Applicants may encounter several challenges. Incomplete applications are a common reason for delays. Incorrect or missing documentation can also lead to rejection or delays in processing. Technical difficulties with online application portals are another potential hurdle. Finally, misunderstanding the plan’s terms and conditions can result in inappropriate application choices or unmet expectations.

Sample Application Form Completion

Let’s consider a fictional application form for the “FutureForward Student Loan Save Plan.”

| Field Name | Applicant Input |

|---|---|

| Applicant Name | Jane Doe |

| Student ID Number | 1234567 |

| Date of Birth | 01/01/2005 |

| Institution Name | Example University |

| Program of Study | Computer Science |

| Desired Savings Amount | $5,000 |

| Bank Account Details | [Account Number and Bank Name Redacted for Privacy] |

This table demonstrates how to fill out a typical application form. Remember to accurately and completely fill out all fields.

Application Checklist

A well-organized checklist is essential for a smooth application process. Before starting, ensure you have all necessary documents. This includes proof of identity, proof of enrollment, and financial documentation. Next, carefully review the application form instructions. Complete the application form accurately and completely. Finally, submit your application and keep a copy for your records. Regularly check the status of your application.

Financial Implications of Student Loan Save Plans

Understanding the financial ramifications of a student loan save plan is crucial before enrollment. These plans offer potential long-term savings, but also involve costs and potential risks. Careful consideration of these factors is essential to making an informed decision.

Long-Term Financial Impact of Student Loan Save Plans

Enrolling in a student loan save plan can significantly impact your long-term financial health. The primary benefit is the potential reduction in the total interest paid over the life of your loan. By making additional payments or strategically managing your loan repayment, you can shorten the repayment period and, consequently, reduce the overall interest accrued. This translates to substantial savings over time, freeing up funds for other financial goals like investing, homeownership, or starting a family. However, the extent of these savings depends on factors such as the specific plan features, your initial loan amount, and the interest rate. A lower interest rate will naturally result in smaller savings, while a higher interest rate will amplify the benefits of the plan.

Comparison of Savings Against Costs and Fees

While student loan save plans promise savings, it’s essential to weigh these potential benefits against any associated costs and fees. Some plans might charge upfront enrollment fees or monthly maintenance fees. These fees should be carefully compared to the projected interest savings to determine the plan’s overall cost-effectiveness. For example, a plan that charges a $500 enrollment fee might still be beneficial if it saves you $2,000 in interest over the loan’s lifespan. However, a plan with high recurring fees might negate the potential interest savings, rendering it financially unfavorable. Always request a detailed breakdown of all fees and charges before committing to a plan.

Impact of Student Loan Save Plans on Credit Score

The effect of a student loan save plan on your credit score is primarily indirect. Consistent on-time payments, a hallmark of participation in many save plans, positively contribute to your credit score. Reducing your loan balance faster through the plan also lowers your credit utilization ratio (the percentage of available credit you’re using), which can further improve your credit score. Conversely, failing to make payments as stipulated by the plan could negatively impact your credit score, potentially leading to late payment marks and a lower credit rating.

Hypothetical Scenario Illustrating Financial Benefits

Let’s consider a hypothetical scenario: Sarah has a $30,000 student loan with a 7% interest rate and a 10-year repayment period. Without a save plan, she’d pay approximately $36,000 in total (principal and interest). With a save plan that allows for an extra $100 monthly payment, she could pay off her loan in approximately 7 years, saving roughly $5,000 in interest and several years of payments. This demonstrates how a save plan can significantly reduce the overall cost of borrowing and accelerate debt repayment.

Potential Financial Risks and Rewards of Different Save Plan Options

Before choosing a student loan save plan, understanding the potential risks and rewards associated with various options is vital.

The following points highlight the key considerations:

- Reward: Reduced interest payments leading to significant long-term savings.

- Reward: Faster loan repayment, freeing up funds for other financial goals.

- Reward: Potential improvement in credit score due to consistent on-time payments and lower credit utilization.

- Risk: High upfront or recurring fees that could negate the potential interest savings.

- Risk: Inability to maintain consistent extra payments, potentially leading to penalties and negative credit impact.

- Risk: Lack of flexibility in some plans, making it difficult to adjust payments based on changing financial circumstances.

Government Regulations and Student Loan Save Plans

Student loan save plans, while offering potential benefits to borrowers, operate within a complex framework of government regulations designed to protect both borrowers and the integrity of the financial system. These regulations vary across countries and even within different programs within a single country, making it crucial to understand the specific rules governing any particular plan.

Government agencies play a vital role in overseeing student loan save plans. Their responsibilities include ensuring compliance with regulations, protecting consumers from predatory lending practices, and maintaining the stability of the financial markets. The specific agencies involved and their powers differ based on the jurisdiction and the type of loan save plan. For example, in the United States, agencies like the Department of Education and the Consumer Financial Protection Bureau (CFPB) play significant roles.

Government Agencies’ Oversight of Student Loan Save Plans

The oversight of student loan save plans typically involves several key functions performed by government agencies. These include the establishment of eligibility criteria for borrowers, the regulation of lenders’ practices to prevent unfair or deceptive practices, the monitoring of loan terms and interest rates to ensure fairness, and the enforcement of regulations through investigations and penalties for violations. Agencies also often provide consumer education resources to help borrowers understand their rights and responsibilities. The specific agencies involved and their exact roles vary considerably depending on the country and the specific type of loan save plan.

Legal Implications for Borrowers and Lenders

Borrowers face legal implications if they fail to meet their obligations under a student loan save plan. This can include defaulting on payments, leading to damage to their credit scores, wage garnishment, and potential legal action. Lenders, on the other hand, face legal implications if they engage in deceptive or predatory lending practices, violating regulations related to disclosure requirements, interest rates, or other aspects of the loan agreement. Failure to comply with these regulations can result in significant fines and legal action from regulatory agencies.

Examples of Past Changes in Government Regulations Affecting Save Plans

Historical examples of changes in government regulations affecting student loan save plans are numerous and varied. For instance, some countries have implemented changes to eligibility criteria, making it easier or harder for certain groups to qualify. Other changes have focused on altering interest rates, often in response to economic conditions or to promote greater affordability. Regulations regarding loan forgiveness programs have also been subject to significant changes over time, reflecting evolving policy priorities. These changes highlight the dynamic nature of the regulatory landscape and the importance of staying informed about current rules.

Key Legal Aspects of Student Loan Save Plans

A structured overview of key legal aspects of student loan save plans could include the following: definitions of key terms (e.g., “save plan,” “eligible borrower,” “lender”); eligibility requirements for borrowers; requirements for lenders regarding disclosure, transparency, and fair lending practices; terms and conditions of the loan agreement, including interest rates, repayment schedules, and default provisions; government oversight mechanisms, including enforcement procedures and penalties for violations; consumer protection provisions; and dispute resolution mechanisms for borrowers. This information is typically available through government websites and legal documents related to specific student loan save plans.

Alternative Strategies for Managing Student Loan Debt

Choosing the right strategy to manage student loan debt is crucial for long-term financial health. While Student Loan Save Plans offer a structured approach, other methods exist, each with its own advantages and disadvantages. Understanding these alternatives allows for a more informed decision based on individual circumstances.

Comparison of Student Loan Save Plans with Other Debt Management Strategies

Student Loan Save Plans, which typically involve pre-paying a portion of the loan, differ significantly from other strategies like debt consolidation or income-driven repayment plans. Consolidation combines multiple loans into one, potentially lowering interest rates but extending the repayment period. Income-driven repayment plans adjust monthly payments based on income, making them more manageable in the short term but potentially leading to higher overall interest payments. Unlike these, save plans focus on proactive reduction of the principal balance, leading to faster payoff and less overall interest. However, save plans require disciplined saving and may not be suitable for everyone facing immediate financial constraints.

Examples of Alternative Approaches to Reducing Student Loan Debt

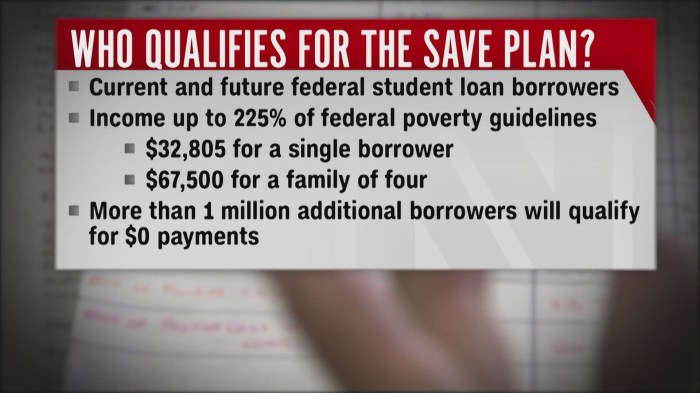

Several approaches can effectively reduce student loan debt. Debt consolidation, as mentioned, simplifies repayment by combining loans. Income-driven repayment plans, such as ICR, PAYE, REPAYE, andIBR, offer lower monthly payments based on income and family size. Refinancing involves obtaining a new loan with a lower interest rate to replace existing loans. Finally, exploring loan forgiveness programs, such as those for public service or teaching, can eliminate a portion or all of the debt under specific conditions.

Advantages and Disadvantages of Alternative Strategies

Each strategy presents unique advantages and disadvantages. Debt consolidation simplifies payments but may extend the repayment period and increase total interest paid if the new interest rate isn’t significantly lower. Income-driven repayment plans offer affordability but often lead to higher long-term interest costs and a longer repayment timeline. Refinancing can lower interest rates, reducing overall costs, but requires qualifying for a new loan. Loan forgiveness programs offer debt elimination but often have stringent eligibility requirements and may require years of service.

Factors to Consider When Choosing a Debt Management Approach

Selecting the best approach requires careful consideration of several factors. These include the total loan amount, interest rates, income and expenses, credit score, and long-term financial goals. The individual’s risk tolerance, ability to save consistently, and the availability of alternative financial resources also play a significant role. A thorough evaluation of these factors helps determine the most suitable and sustainable debt management strategy.

Visual Representation of Debt Management Strategy Effectiveness

Imagine a bar graph. The horizontal axis represents different debt management strategies: Student Loan Save Plan, Debt Consolidation, Income-Driven Repayment, Refinancing, and Loan Forgiveness. The vertical axis represents the percentage of debt eliminated over a 10-year period. The Student Loan Save Plan bar would be the tallest, reflecting its potential for faster debt reduction. The Income-Driven Repayment bar would be the shortest, representing its slower payoff due to lower payments. Debt Consolidation and Refinancing would show moderate heights, depending on the new interest rates secured. Loan Forgiveness would have a height contingent upon meeting all eligibility criteria and the percentage of debt forgiven. This illustrates that while each strategy contributes to debt reduction, their effectiveness varies considerably.

Last Word

Successfully applying for a student loan save plan requires careful planning and a thorough understanding of the available options. By weighing the financial implications, considering alternative strategies, and staying informed about government regulations, you can significantly reduce your long-term debt and improve your financial well-being. Remember to carefully review all plan details and seek professional financial advice if needed to ensure you choose the best plan for your individual circumstances.

FAQ Section

What happens if I miss a payment on my student loan save plan?

Missing payments can negatively impact your credit score and may lead to penalties or increased interest rates. Contact your lender immediately if you anticipate difficulties making a payment to explore potential solutions.

Can I refinance my student loans after enrolling in a save plan?

Refinancing options depend on the specific terms of your save plan and your overall financial situation. It’s advisable to consult with a financial advisor to determine if refinancing is a beneficial step.

Are there tax benefits associated with student loan save plans?

Tax benefits vary depending on your location and the specific save plan. Consult a tax professional to understand any applicable tax implications.