Securing a subsidized student loan can be a pivotal step towards achieving higher education. This guide unravels the complexities of the application process, providing a clear and concise path to accessing these crucial funds. We’ll explore eligibility criteria, application procedures, various loan types, repayment strategies, and resources to help you navigate this important financial journey.

From understanding income requirements and required documentation to mastering the nuances of repayment plans and avoiding potential scams, this comprehensive resource aims to empower you with the knowledge and confidence needed to successfully apply for and manage a subsidized student loan.

Eligibility Criteria for Subsidized Student Loans

Securing a subsidized student loan can significantly ease the financial burden of higher education. However, eligibility is determined by a set of specific criteria, ensuring that the funds are allocated to those who need them most. Understanding these requirements is crucial for a successful application.

Income Requirements for Subsidized Student Loans

The primary factor determining eligibility for subsidized student loans is the applicant’s (and their family’s, if applicable) income. Lenders use a standardized measure of financial need, often calculated through the Free Application for Federal Student Aid (FAFSA). The FAFSA collects detailed financial information to determine your Expected Family Contribution (EFC). A lower EFC generally indicates greater financial need and a higher likelihood of qualifying for subsidized loans. The specific income thresholds vary yearly and depend on factors like family size and the number of students in higher education. Applicants whose EFC falls below a certain threshold are typically considered eligible. It’s essential to consult the most current FAFSA guidelines and your chosen lender’s specific requirements for the most up-to-date information.

Residency Requirements for Subsidized Student Loans

Most subsidized student loan programs have residency requirements. Generally, applicants must be legal residents or citizens of the country offering the loan program. Specific requirements can vary depending on the program and the lender. Some programs might have additional residency stipulations, such as a minimum period of residency within the state or region. For example, a state-sponsored loan program might require applicants to have lived in that state for a specific number of years before applying. International students often have different eligibility criteria and may need to explore alternative loan options. Always check the specific requirements of the program you’re applying for.

Acceptable Documentation to Prove Eligibility

To successfully apply for a subsidized student loan, you’ll need to provide documentation that verifies your eligibility. This typically includes, but is not limited to:

- Completed FAFSA form: This form provides crucial financial information used to determine your EFC.

- Tax returns (yours and your parents’, if applicable): These documents verify your income and tax filing status.

- Proof of residency: This might include a driver’s license, utility bills, or rental agreement, depending on the lender’s requirements.

- Proof of enrollment: Acceptance letter from your chosen institution or proof of enrollment.

- Social Security number: Required for verification purposes.

Failure to provide the necessary documentation can lead to delays or rejection of your application. It’s crucial to gather all required documents before submitting your application.

Loan Limits Based on Income Brackets

The maximum loan amount you can receive is often tied to your income level. The following table illustrates a hypothetical example of income brackets and corresponding loan limits. Note that these figures are illustrative and actual loan limits vary significantly depending on the lender, the specific loan program, and the year. Always refer to the official guidelines for the most accurate information.

| Income Bracket ($) | Annual Loan Limit ($) | Dependent Status | Notes |

|---|---|---|---|

| 0-20,000 | 10,000 | Dependent | This is an example and may vary |

| 20,001-40,000 | 7,500 | Dependent | These limits are subject to change |

| 40,001-60,000 | 5,000 | Independent | Consult your lender for precise figures |

| 60,001+ | 2,500 | Independent | Additional eligibility requirements may apply |

Application Process and Required Documents

Applying for a subsidized student loan involves a straightforward process, but careful attention to detail is crucial to ensure a smooth and timely approval. This section Artikels the steps involved, the necessary documentation, and the verification procedures. Understanding these steps will help you navigate the application process efficiently.

The application process begins with completing the online application form. This form will request personal information, academic details, and financial information. It’s important to accurately and completely fill out all sections of the application. Inaccurate or incomplete information can delay the processing of your application. After submitting the application, you will receive a confirmation number. This number should be kept for future reference.

Required Documents

Submitting the correct documentation is essential for a successful application. Failure to provide all necessary documents will result in delays or rejection. The following list details the required documents and their preferred formats.

- Completed Application Form: Downloadable from the lender’s website, this form requires electronic submission.

- Proof of Identity: A copy of your government-issued photo ID, such as a driver’s license or passport. Acceptable formats include clear scans or photographs of the ID.

- Proof of Enrollment: Official acceptance letter from your chosen institution, indicating your enrollment status and program of study. This should be an official document from the university or college.

- Proof of Income (for you and your parents, if applicable): Tax returns (W-2 forms, 1040 forms), pay stubs, or other official documentation showing income for the past year. These should be clear scans or photographs of the original documents.

- Financial Aid Award Letter (if applicable): If you have received any other financial aid offers, submit a copy of your award letter to show how this loan will fit into your overall financial plan. The letter should clearly state the amount of aid awarded.

Information Verification

After submitting your application and supporting documents, the lender will verify the information you provided. This process may involve contacting your educational institution, your employer, or the relevant tax authorities. This verification step is crucial to ensure the accuracy of the information provided and to prevent fraud.

Verification typically involves comparing the information you submitted against data held by third-party sources. Any discrepancies may lead to delays in processing your application or even rejection. Providing accurate and truthful information is vital for a successful outcome.

Application Submission Methods

Applicants have several options for submitting their completed applications and supporting documents. Choosing the most convenient method is important for a smooth application process.

- Online Submission: Most lenders offer online portals for application submission. This is often the fastest and most convenient method.

- Mail Submission: Applicants can also mail their application and supporting documents to the lender’s designated address. This method typically takes longer for processing.

- In-Person Submission: Some lenders may allow in-person submission of applications, though this is less common.

Financial Aid Resources and Counseling

Navigating the financial aspects of higher education can be challenging. Fortunately, numerous resources and support services are available to help students secure the funding they need to pursue their academic goals. Understanding these resources and utilizing available counseling services can significantly ease the burden of financing your education.

Successfully securing financial aid often involves more than simply completing an application. Understanding your options, exploring different funding sources, and strategically planning your financial approach are crucial. This section details the resources available and the vital role of financial aid advisors in guiding you through this process.

Financial Aid Advisors’ Role in the Loan Application Process

Financial aid advisors act as invaluable guides throughout the student loan application process. They provide personalized assistance, helping students understand their eligibility for various aid programs, including subsidized loans. Advisors can clarify complex financial aid terminology, explain the implications of different loan options, and help students navigate the often-confusing application procedures. They can also assist with completing the Free Application for Federal Student Aid (FAFSA) and other necessary forms, ensuring accuracy and maximizing the student’s chances of receiving aid. Furthermore, they offer guidance on budgeting, financial planning, and managing student loan debt after graduation. Their expertise ensures students make informed decisions that align with their individual financial circumstances and academic aspirations.

Benefits of Seeking Professional Financial Aid Guidance

Seeking professional financial aid guidance offers several key advantages. Firstly, it significantly increases the likelihood of securing the maximum amount of financial aid available. Advisors possess in-depth knowledge of various funding opportunities, including scholarships, grants, and work-study programs, often overlooked by students navigating the process independently. Secondly, professional guidance helps students avoid costly mistakes. Understanding the terms and conditions of different loan options is crucial; advisors can help students choose repayment plans that suit their post-graduation financial projections. Thirdly, financial aid advisors provide personalized support and address individual financial concerns. They can help students create realistic budgets, manage expenses, and develop strategies for repaying student loans effectively. Finally, their expertise can reduce stress and anxiety associated with the financial complexities of higher education.

Available Financial Aid Resources

Many resources provide support and information to students seeking financial aid. Utilizing these resources can significantly enhance the application process and increase the likelihood of securing funding. The following table lists several key resources and their contact information. Remember to verify contact details independently as they may change.

| Resource | Website | Phone Number | Email Address (if available) |

|---|---|---|---|

| Federal Student Aid (FSA) | studentaid.gov | 1-800-4-FED-AID (1-800-433-3243) | |

| Your College or University Financial Aid Office | (Check your institution’s website) | (Check your institution’s website) | (Check your institution’s website) |

| National Association of Student Financial Aid Administrators (NASFAA) | nasfaa.org | (Check their website for contact information) | (Check their website for contact information) |

| Sallie Mae | salliemae.com | (Check their website for contact information) | (Check their website for contact information) |

Impact of Subsidized Loans on Future Finances

Securing a subsidized student loan can significantly impact your financial future, both positively and negatively. While it provides crucial access to higher education, understanding the long-term implications and developing effective management strategies are essential for navigating this financial commitment successfully. Careful planning and responsible borrowing habits can minimize the burden and pave the way for a financially secure future.

The primary impact of subsidized student loans is the accumulation of debt. This debt, while helping you achieve your educational goals, will require repayment after graduation, potentially extending over several years. The interest rate, loan amount, and repayment plan all contribute to the overall cost and length of repayment. Failing to adequately plan for repayment can lead to financial stress and hinder other financial goals like saving for a home, investing, or starting a family.

Managing Student Loan Debt

Effective management of student loan debt involves a multi-pronged approach. This includes understanding your repayment options, creating a realistic budget, and exploring strategies to reduce your overall loan burden.

A crucial first step is understanding your loan terms. This involves knowing the interest rate, the principal amount, and the repayment schedule. Several repayment plans exist, including standard, graduated, and income-driven repayment plans. Each plan offers a different monthly payment amount and overall repayment period. Choosing the right plan depends on your post-graduation income and financial goals. For example, an income-driven repayment plan adjusts your monthly payment based on your income, making it more manageable in the early stages of your career, but potentially extending the repayment period.

Budgeting and Financial Planning Post-Graduation

Creating a comprehensive budget is vital for managing student loan debt and achieving financial stability after graduation. This budget should account for all income sources, including employment earnings, and all expenses, including housing, food, transportation, and loan repayments. Tracking your spending and identifying areas for potential savings can help free up funds for loan repayments and other financial goals.

For example, a recent graduate earning $50,000 annually might allocate 10-15% of their income to student loan repayment, while carefully managing expenses in other areas like housing and transportation. This may involve choosing a more affordable apartment or opting for public transportation instead of car ownership. Effective budgeting requires consistent monitoring and adjustments as circumstances change.

Strategies for Minimizing Borrowing Costs

Minimizing the overall cost of borrowing involves proactive steps taken both during and after your education. These include exploring scholarships and grants to reduce the need for loans, maintaining a high GPA to qualify for additional financial aid, and diligently repaying your loans to reduce the total interest paid.

For instance, a student who secures a $5,000 scholarship will reduce their loan amount by that amount, directly impacting the total interest paid over the loan’s lifetime. Similarly, prompt repayment of loans, even small extra payments, can significantly reduce the total interest paid and shorten the repayment period. Understanding and utilizing these strategies can lead to substantial savings over time.

Final Review

Successfully applying for a subsidized student loan requires careful planning and attention to detail. By understanding the eligibility criteria, diligently completing the application process, and proactively managing your repayment strategy, you can leverage this valuable financial tool to pursue your educational goals without undue financial burden. Remember to utilize the available resources and seek professional guidance when needed.

Answers to Common Questions

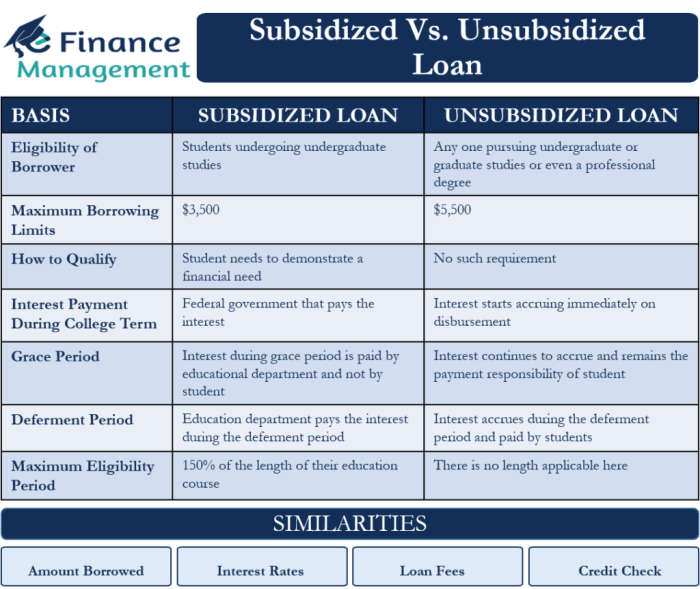

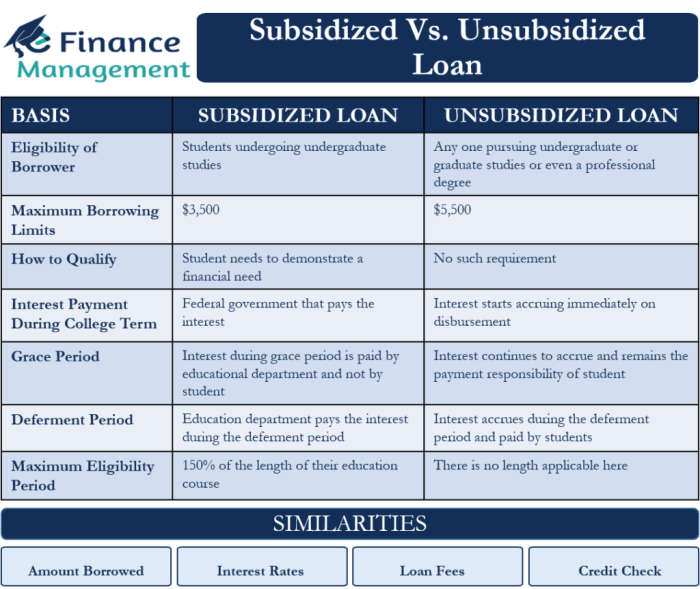

What is the difference between a subsidized and unsubsidized student loan?

With a subsidized loan, the government pays the interest while you’re in school (and sometimes during grace periods). Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I apply for a subsidized loan if I’m a graduate student?

Subsidized loans are primarily for undergraduate students. Graduate students typically qualify only for unsubsidized loans.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and ultimately, default on the loan, resulting in serious financial consequences.

Where can I find a list of reputable financial aid organizations?

The Federal Student Aid website (studentaid.gov) is a reliable resource. Your college’s financial aid office can also provide guidance.