Navigating the complexities of student loan repayment can be daunting, especially when unexpected life events disrupt financial stability. Understanding the process of applying for a student loan deferment is crucial for borrowers facing temporary hardship. This guide provides a comprehensive overview of eligibility criteria, application procedures, and the long-term implications of deferment, empowering you to make informed decisions about your financial future.

From exploring various deferment types tailored to specific circumstances, like unemployment or further education, to comparing deferment with alternative repayment options, this resource equips you with the knowledge to effectively manage your student loan debt. We’ll examine the potential impact on your credit score and overall loan cost, ensuring you’re well-prepared to navigate this critical aspect of financial responsibility.

Eligibility Criteria for Student Loan Deferment

Securing a student loan deferment can provide crucial financial relief during challenging times. Understanding the eligibility requirements is the first step in successfully applying for this assistance. This section details the criteria for various federal student loan programs.

Generally, eligibility for a student loan deferment hinges on demonstrating a temporary inability to make payments due to unforeseen circumstances. These circumstances are typically documented through official verification. The specific requirements and available deferment options can vary depending on the type of federal student loan you hold and the reason for your request.

Common Reasons for Deferment

Several circumstances commonly qualify individuals for student loan deferment. These include unemployment, where you are actively seeking employment and can provide proof; illness, requiring significant medical expenses or preventing employment, supported by medical documentation; and enrollment in further education, provided you are pursuing a degree or certificate program at a qualifying institution, verified by your school. Other reasons may include serving in the military or experiencing a natural disaster that significantly impacts your financial situation.

Eligibility Criteria for Different Federal Student Loan Types

The eligibility criteria for deferment are largely similar across various federal student loan programs, but there might be subtle differences.

For example, Direct Subsidized Loans and Direct Unsubsidized Loans generally share similar deferment eligibility requirements. However, interest accrues on unsubsidized loans during deferment, while the government pays the interest on subsidized loans during certain deferment periods. PLUS Loans, designed for parents or graduate students, might have slightly different deferment options or require additional documentation.

Comparison of Deferment Program Eligibility Requirements

The following table summarizes the eligibility requirements for different deferment programs, keeping in mind that specific requirements may vary depending on the lender and the circumstances. It is always advisable to check directly with your loan servicer for the most up-to-date and accurate information.

| Loan Type | Required Documentation | Income Limits | Duration Limits |

|---|---|---|---|

| Direct Subsidized Loans | Proof of enrollment (for in-school deferment), unemployment verification (for unemployment deferment), medical documentation (for illness deferment) | Generally no income limits, but income may be considered for certain deferment types. | Varies depending on the reason for deferment; generally up to 3 years total for in-school deferment, with extensions possible under specific circumstances. |

| Direct Unsubsidized Loans | Similar to Direct Subsidized Loans; proof of circumstances justifying the deferment. | Generally no income limits, but income may be considered for certain deferment types. | Varies depending on the reason for deferment; generally up to 3 years total for in-school deferment, with extensions possible under specific circumstances. |

| PLUS Loans | May require additional documentation depending on the reason for deferment. | Generally no income limits, but income may be considered for certain deferment types. | Varies depending on the reason for deferment; specific limits may apply. |

The Application Process for Deferment

Applying for a student loan deferment involves several steps and requires specific documentation. The exact process may vary slightly depending on your loan servicer, so it’s crucial to check their website for the most up-to-date information. However, the general steps Artikeld below provide a solid framework.

Step-by-Step Deferment Application

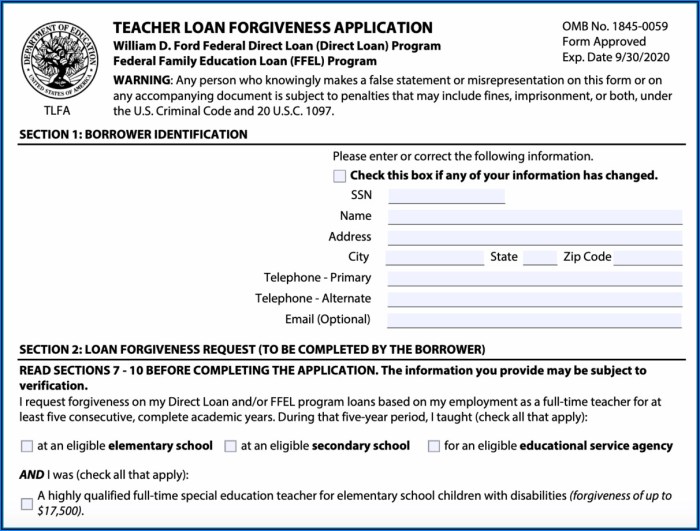

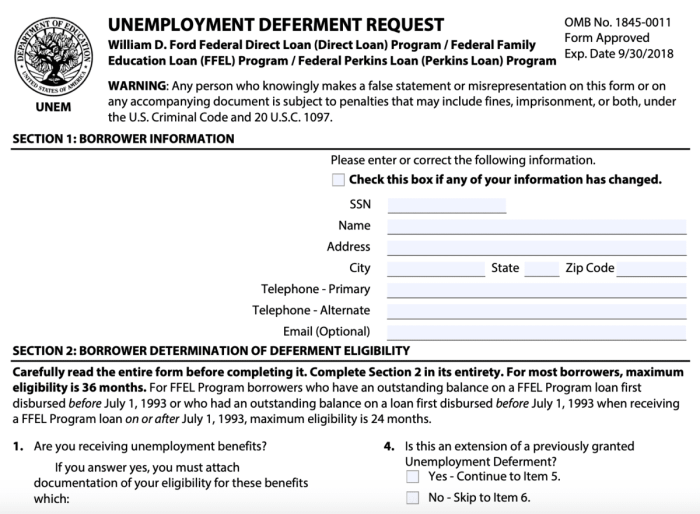

The application process typically begins with gathering the necessary documentation and then submitting your completed application to your loan servicer. You’ll need to carefully review your loan terms and the specific requirements for the type of deferment you’re seeking (e.g., economic hardship, unemployment). Failure to provide complete documentation may result in delays or rejection of your application.

Required Documentation

Before initiating the application, assemble all necessary documentation. This typically includes proof of your eligibility for the deferment you are applying for. For example, if applying for an unemployment deferment, you will need documentation verifying your unemployment status. If it’s for economic hardship, evidence of your reduced income might be required. This could include pay stubs, tax returns, or bank statements. You will also need to provide your student loan account information, including your loan ID numbers. Finally, a completed deferment application form, obtained from your loan servicer’s website, is essential.

Application Checklist

To ensure a smooth application process, use the following checklist:

- Gather all required documentation (proof of eligibility, loan account information).

- Download and complete the deferment application form from your loan servicer’s website.

- Review the completed application for accuracy and completeness.

- Submit the application and all supporting documents to your loan servicer via their preferred method (online portal, mail, fax).

- Keep copies of all submitted documents for your records.

- Track the application status through your loan servicer’s online portal or by contacting them directly.

Application Process Flowchart

The flowchart visually represents the application process:

[Imagine a flowchart here. The flowchart would begin with a “Start” box. The next box would be “Gather Required Documents,” leading to “Complete Application Form.” This would then connect to “Submit Application and Documents.” A decision box would follow: “Application Approved?” If “Yes,” the flow would go to “Deferment Granted.” If “No,” it would go to “Application Denied/Requires Further Information,” looping back to “Gather Required Documents” or “Complete Application Form” as needed. Finally, the flowchart would end with an “End” box.]

Types of Student Loan Deferment

Understanding the different types of student loan deferment is crucial for borrowers facing financial hardship or temporary life changes. Several options exist, each with its own eligibility requirements and implications. Choosing the right deferment can significantly impact your repayment schedule and overall loan cost.

Several types of deferment are available to borrowers, each designed to address specific circumstances. The key differences lie in eligibility criteria, duration, and potential impact on your credit score.

In-School Deferment

In-school deferment is available to students enrolled at least half-time in a degree or certificate program at an eligible educational institution. This deferment typically covers the period of enrollment, allowing borrowers to postpone payments while focusing on their studies. The benefit is straightforward: it provides temporary relief from loan payments during a period of intense academic focus. However, interest may still accrue on unsubsidized loans during this period, leading to a larger overall loan balance upon repayment commencement. This type of deferment generally does not negatively affect your credit score, provided you meet the eligibility requirements and follow the application process correctly.

Economic Hardship Deferment

Economic hardship deferment is granted to borrowers who are experiencing significant financial difficulty, such as unemployment or reduced income. To qualify, borrowers typically need to demonstrate a demonstrable inability to meet their minimum monthly loan payments. This deferment offers a crucial lifeline during periods of financial instability. The length of deferment can vary depending on the lender and the borrower’s circumstances, but it typically provides temporary relief from loan payments. Similar to in-school deferment, interest may still accrue on unsubsidized loans. While not directly impacting credit scores in the same way as a missed payment, prolonged use of economic hardship deferment might be flagged by lenders as a potential risk.

Graduate Fellowship Deferment

This deferment is specifically designed for graduate students receiving a fellowship or assistantship that covers their tuition and living expenses. It allows borrowers to postpone loan payments while focusing on their advanced studies. The key benefit is the alignment with the temporary nature of the funding. Once the fellowship ends, borrowers are expected to resume their loan payments. Like the other deferments, interest may still accrue on unsubsidized loans. This deferment, when used appropriately and according to eligibility guidelines, should not negatively affect a borrower’s credit score.

Deferment vs. Forbearance

It’s important to differentiate between deferment and forbearance. While both offer temporary relief from loan payments, they differ significantly. Deferment is a legally defined program with specific eligibility requirements, often linked to circumstances like those described above. Forbearance, on the other hand, is generally granted at the lender’s discretion and often involves less stringent requirements. Forbearance may be offered for various reasons, including financial hardship, but it may carry a greater risk of negative impacts on your credit score if not managed carefully. Furthermore, interest may accrue on both deferred and forborne loans (unless specified otherwise), potentially leading to a larger loan balance in the long run. Forbearance may also be granted for shorter periods compared to deferment.

Impact on Credit Score

The impact of a deferment on your credit score is generally minimal, provided you meet the eligibility criteria and comply with the terms of the deferment. It is different from a missed payment, which directly and negatively impacts your credit report. However, prolonged or frequent use of deferments might raise red flags for lenders, potentially affecting future credit applications. The key is responsible usage and adherence to the terms of the deferment agreement. It is always best to explore all options and communicate openly with your lender to determine the best course of action for your specific financial situation.

Understanding the Implications of Deferment

Deferring your student loans can provide temporary relief from repayment, but it’s crucial to understand the long-term financial consequences. This section will explore how deferment affects interest accrual, the overall cost of your loan, and how it compares to other repayment options. Failing to consider these implications could significantly impact your financial future.

Interest Accrual During Deferment

The impact of deferment on interest accrual varies depending on whether you have subsidized or unsubsidized loans. With subsidized loans, the government pays the interest while your loan is in deferment. However, with unsubsidized loans, interest continues to accrue and is added to your principal balance, increasing the total amount you owe. This capitalization of interest can substantially increase the overall cost of the loan over time. For example, imagine a $10,000 unsubsidized loan with a 5% interest rate deferred for two years. After two years, the accumulated interest will be added to the principal, leading to a higher monthly payment and a longer repayment period.

Examples of Deferment’s Impact on Total Loan Amount

Let’s consider two scenarios: Scenario A involves a $20,000 unsubsidized loan with a 6% interest rate deferred for one year. After the deferment period, the principal balance will be higher due to accrued interest. This increased principal will lead to higher monthly payments and a longer repayment period compared to a scenario where the loan wasn’t deferred. Scenario B involves the same loan but with a three-year deferment. The longer deferment period will result in a significantly larger increase in the total amount owed, showcasing the compounding effect of interest. These scenarios illustrate how deferment, while offering temporary relief, can increase the overall cost of the loan.

Long-Term Financial Implications of Deferment

Choosing deferment over other repayment options, such as income-driven repayment plans or extended repayment plans, can have significant long-term financial consequences. Deferment postpones payments, but it doesn’t reduce the total amount owed. In contrast, income-driven repayment plans adjust your monthly payments based on your income, potentially lowering your monthly burden and reducing the overall interest paid over the life of the loan. Extended repayment plans stretch the repayment period, lowering monthly payments but increasing the total interest paid. Therefore, while deferment might seem appealing in the short term, carefully evaluating other options that address both short-term and long-term financial health is essential.

Comparison of Long-Term Costs of Repayment Options

| Repayment Option | Monthly Payment (Example) | Total Interest Paid (Example) | Total Repaid (Example) |

|---|---|---|---|

| Standard Repayment | $300 | $5,000 | $25,000 |

| Extended Repayment | $200 | $7,000 | $27,000 |

| Income-Driven Repayment | $150 | $6,000 | $26,000 |

| Deferment (with unsubsidized loan) | $350 (after deferment) | $8,000 (estimated) | $28,000 (estimated) |

*Note: These are example figures and actual amounts will vary based on loan terms, interest rates, and deferment period.*

Alternative Solutions to Deferment

Deferring your student loan payments can provide temporary relief, but it’s crucial to understand that interest may continue to accrue, potentially increasing your overall debt. Exploring alternative repayment options might offer a more sustainable long-term solution. These plans often tailor payments to your income and financial situation, preventing the accumulation of significant interest and potentially leading to a lower overall repayment burden.

Exploring alternative repayment plans can be a strategic move for borrowers seeking a more manageable path to loan repayment. These options offer flexibility and can be particularly beneficial for individuals experiencing temporary financial hardship or those with lower incomes. Careful consideration of the pros and cons of each plan is crucial in determining the best fit for your individual circumstances.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans calculate your monthly payment based on your income and family size. Several types of IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans generally offer lower monthly payments than standard repayment plans, making them more manageable for borrowers with limited incomes. However, the lower monthly payments often translate to a longer repayment period, potentially leading to increased overall interest paid. For example, a borrower with a low income might find an IDR plan significantly more affordable than a standard repayment plan, even if it extends the repayment term by several years.

Extended Repayment Plans

Extended repayment plans stretch out your repayment period over a longer timeframe, typically up to 25 years. This results in lower monthly payments, making them more manageable for borrowers struggling with high monthly payments. However, it’s important to note that the total interest paid will likely be significantly higher than with shorter repayment terms. Consider a scenario where a borrower opts for an extended repayment plan to reduce immediate financial strain. While this provides short-term relief, the long-term cost in accumulated interest should be carefully weighed.

Comparison of Deferment and Alternative Repayment Plans

The decision between deferment and an alternative repayment plan hinges on individual circumstances. Deferment provides temporary relief from payments but doesn’t address the underlying debt; interest usually continues to accrue, increasing the total loan amount. In contrast, alternative repayment plans offer long-term solutions that adjust payments based on income or extend the repayment period. While interest still accrues, the adjusted payments may be more manageable, potentially preventing default and leading to a more sustainable repayment strategy. For instance, a borrower facing a temporary job loss might benefit from deferment for a short period. However, a borrower with consistently low income would likely be better served by an income-driven repayment plan.

Repayment Plan Features

| Plan Type | Eligibility | Payment Calculation | Loan Forgiveness Potential |

|---|---|---|---|

| Standard Repayment | All federal student loans | Fixed monthly payment over 10 years | None |

| Extended Repayment | Federal student loans; may require specific loan types | Fixed monthly payment over 25 years | None |

| Income-Based Repayment (IBR) | Federal student loans; income verification required | Based on discretionary income and family size | Potential for loan forgiveness after 20-25 years, depending on plan and payment history |

| Pay As You Earn (PAYE) | Federal student loans; income verification required | Based on discretionary income and family size | Potential for loan forgiveness after 20 years |

| Revised Pay As You Earn (REPAYE) | Federal student loans; income verification required | Based on discretionary income and family size | Potential for loan forgiveness after 20-25 years, depending on payment history |

| Income-Contingent Repayment (ICR) | Federal student loans; income verification required | Based on income and loan amount | Potential for loan forgiveness after 25 years |

Contacting Your Loan Servicer

Direct communication with your loan servicer is crucial for navigating the student loan deferment process. Understanding their contact methods, response times, and the information you need to provide will streamline the application and ensure a smooth process. This section details how to effectively contact your servicer and what to expect during the interaction.

Successfully contacting your loan servicer involves several key steps. First, you need to identify your servicer. This information is typically found on your monthly loan statement or on the National Student Loan Data System (NSLDS) website. Once you’ve identified your servicer, locate their contact information – this is usually available on their website or your loan statement. This information often includes phone numbers, email addresses, and mailing addresses. Choose the contact method that best suits your needs and preferences. For complex issues or if you prefer a documented record of the conversation, a phone call might be best. For simpler inquiries, email may suffice. When contacting your servicer, be prepared to provide your full name, student loan account number(s), and the reason for your contact – in this case, your request for a deferment.

Examples of Information to Share with Your Loan Servicer

When discussing deferment options, having specific questions prepared will ensure you receive the information you need. Providing your loan servicer with relevant information upfront will also expedite the process. The following are examples of factual statements representing questions that you may have.

- My current financial situation prevents me from making my loan payments.

- I am interested in learning about the eligibility requirements for a deferment.

- I would like to understand the implications of a deferment on my loan repayment schedule and interest accrual.

- I want to know what documentation is needed to support my deferment application.

- I would like to confirm the specific type of deferment I qualify for based on my circumstances.

Typical Response Time and Communication Methods

Loan servicers typically utilize various communication methods, including phone, email, and online portals. Response times can vary depending on the servicer, the complexity of your inquiry, and the current volume of requests. While some servicers may offer same-day responses to simple inquiries via email or online chat, more complex requests, such as deferment applications, may take several business days or even weeks to process fully. Expect to receive confirmation of your contact and updates on the status of your request through the method you initially used to contact them.

Locating Your Loan Servicer’s Contact Information

Finding your loan servicer’s contact information is straightforward. The most reliable source is your monthly loan statement. This statement clearly identifies the servicing institution and provides their contact details. Alternatively, you can access your loan information through the NSLDS website (StudentAid.gov). This federal database allows you to view your loan details, including the name and contact information of your loan servicer. The servicer’s website will also generally contain contact information, including phone numbers, email addresses, and mailing addresses. Be sure to look for a “Contact Us” or “Customer Service” section.

Illustrative Scenarios of Deferment

Deferment can offer crucial financial breathing room during challenging life events. Understanding how deferment applies in different situations is key to making informed decisions about your student loan repayment. The following scenarios illustrate the potential benefits and implications of deferment.

Scenario 1: Recent Graduate Facing Job Loss

Imagine Sarah, a recent college graduate with a significant amount of student loan debt. She secured a position after graduation but was unfortunately laid off six months later due to company restructuring. Facing unexpected unemployment, Sarah’s income drastically decreased, making her student loan payments a significant burden. Deferment could provide temporary relief, allowing her to pause her payments while she searches for new employment. The potential outcome is avoiding default and maintaining her credit score. The emotional stress would be considerable, encompassing anxiety about finances, job searching pressures, and the uncertainty of the future. Financially, she’d face the challenges of living on limited savings, potential depletion of emergency funds, and the possibility of accruing interest on her deferred loans (depending on the loan type).

Scenario 2: Student Returning to School for Advanced Degree

Consider John, a registered nurse who wishes to pursue a master’s degree in nursing administration. Returning to school requires a significant time commitment, reducing his ability to work full-time and impacting his income. Deferment might be a suitable option, allowing him to focus on his studies without the added pressure of student loan repayments. The outcome would likely be successful completion of his degree, leading to improved career prospects and increased earning potential in the long run. Emotionally, John might experience stress related to managing his time effectively between studies and personal life, along with the financial strain of reduced income. Financially, he would likely face living expenses, tuition fees, and the potential accumulation of interest on his deferred loans.

Scenario 3: Individual Facing a Medical Emergency

Let’s consider Maria, who experienced a serious medical emergency requiring extensive and costly treatment. The medical bills, coupled with ongoing student loan repayments, created an overwhelming financial burden. Deferment could offer much-needed temporary relief, allowing her to focus on her recovery without the added stress of loan payments. The outcome could be improved health and a better chance to manage her finances once recovered. Emotionally, Maria would likely experience significant stress and anxiety related to her health, the medical expenses, and the financial uncertainty. Financially, the situation is precarious; she would face significant medical expenses, potential loss of income due to illness, and the possibility of accumulating interest on her deferred loans. The deferment would alleviate some immediate financial pressure but would not eliminate the underlying debt.

Final Wrap-Up

Successfully navigating the student loan deferment process requires careful planning and a thorough understanding of your options. By carefully considering your eligibility, gathering necessary documentation, and understanding the long-term financial implications, you can confidently manage your student loan debt and navigate unexpected life challenges. Remember to actively communicate with your loan servicer throughout the process to ensure a smooth and efficient experience. Proactive financial planning can alleviate significant stress and contribute to long-term financial well-being.

Essential Questionnaire

What happens to my interest during a deferment?

For subsidized loans, the government pays the interest during certain deferment periods. Unsubsidized loans accrue interest, which is added to your principal balance.

How long can I defer my student loans?

The length of a deferment varies depending on the reason and type of loan. Check your loan servicer’s guidelines for specific durations.

Will deferring my loans affect my credit score?

While deferment itself doesn’t typically negatively impact your credit score, failure to make payments (even during a deferment period if applicable) can negatively affect your credit.

Can I defer my private student loans?

The availability of deferment for private student loans depends entirely on your lender’s policies. Contact your lender directly to inquire about their deferment options.

What if my circumstances change during my deferment period?

You should notify your loan servicer immediately if your circumstances change, as this may affect your eligibility for continued deferment or require a reevaluation of your repayment plan.