Navigating the world of student loans can feel overwhelming, especially when grappling with the often-misunderstood concept of APR. This seemingly simple acronym – Annual Percentage Rate – significantly impacts the total cost of your education. Understanding its components, how it’s calculated, and the strategies to minimize its effect is crucial for responsible borrowing and long-term financial well-being. This guide will demystify APR, empowering you to make informed decisions about your student loan journey.

We’ll explore the various factors influencing your APR, from your credit history to the type of lender you choose. We’ll also delve into practical strategies for lowering your APR, including credit score improvement, refinancing options, and negotiation tactics. Ultimately, our goal is to equip you with the knowledge to manage your student loan debt effectively and confidently.

Understanding APR on Student Loans

Securing a student loan is a significant financial decision, and understanding the Annual Percentage Rate (APR) is crucial for making informed choices. The APR represents the true cost of borrowing, encompassing more than just the interest rate. A thorough understanding of its components and impact is essential for responsible financial planning.

The APR on a student loan represents the annual cost of borrowing, expressed as a percentage. Unlike the interest rate alone, the APR includes all fees and charges associated with the loan, providing a comprehensive picture of the total cost. This allows for a more accurate comparison between different loan offers. It’s important to remember that a lower APR generally translates to lower overall borrowing costs.

Components of Student Loan APR

The APR is not simply the interest rate; it incorporates several other factors that significantly influence the total cost of borrowing. These components can vary depending on the lender and the type of loan. Key components include the interest rate itself, origination fees (charged by the lender to process the loan), and any other applicable fees. For federal student loans, the government sets the interest rate, but private lenders have more flexibility in determining the rates and fees they charge.

Impact of Different APRs on Total Loan Cost

Different APRs dramatically affect the total amount you’ll repay over the life of the loan. Even a seemingly small difference in the APR can lead to a substantial increase in the total interest paid. For example, consider two loans of $10,000 each, one with a 5% APR and another with a 7% APR, both repaid over 10 years. The loan with the 7% APR will result in significantly higher total interest payments compared to the 5% APR loan. This illustrates the importance of shopping around for the best possible APR.

Fixed vs. Variable APR Student Loans

Student loans can have either fixed or variable APRs. Understanding the differences is vital for budgeting and managing your repayment plan.

| Loan Type | APR Range | Example Monthly Payment ($10,000 loan over 10 years) | Total Interest Paid (over 10 years) |

|---|---|---|---|

| Fixed APR | 4% – 8% | $103 – $126 | $1,975 – $4,747 |

| Variable APR | 3% – 9% (fluctuating) | $97 – $134 (fluctuating) | $1,700 – $5,200 (fluctuating) |

Note: These are example ranges and payments; actual APRs and payments will vary based on individual creditworthiness, loan terms, and market conditions. Variable APRs are subject to change, potentially leading to unpredictable monthly payments and total interest paid.

Factors Influencing Student Loan APRs

Several key factors determine the Annual Percentage Rate (APR) you’ll receive on your student loans. Understanding these factors can help you navigate the loan application process and potentially secure a more favorable interest rate. Lenders use a complex algorithm, but some key elements consistently influence the final APR.

The APR on a student loan isn’t arbitrarily assigned; it reflects the lender’s assessment of your risk as a borrower. This assessment is based on a variety of factors, some of which you can control and others that are largely beyond your influence. A lower APR translates to lower overall borrowing costs, saving you significant money over the life of your loan. Conversely, a higher APR increases the total amount you’ll repay.

Credit History’s Impact on Student Loan Interest Rates

Your credit history plays a significant role in determining your student loan APR. Lenders use your credit score and history to gauge your creditworthiness. A strong credit history, characterized by consistent on-time payments and low credit utilization, typically results in a lower APR. Conversely, a poor credit history, marked by late payments, defaults, or high credit utilization, often leads to higher interest rates or even loan denial. For example, a student with an excellent credit score might qualify for an APR of 4%, while a student with a poor credit history might face an APR of 10% or more. The difference in repayment amounts over the life of the loan can be substantial.

The Role of Co-signers in Securing Lower APRs

A co-signer is an individual who agrees to be jointly responsible for repaying your student loan. Their creditworthiness is considered alongside yours, and a co-signer with a strong credit history can significantly improve your chances of securing a lower APR. If you lack a strong credit history or have a low credit score, a co-signer can act as a guarantor, reducing the lender’s perceived risk. However, it’s crucial to understand that the co-signer will be legally obligated to repay the loan if you default. Therefore, choosing a co-signer should be done carefully and with mutual understanding.

Comparison of APRs Across Different Student Loan Lenders

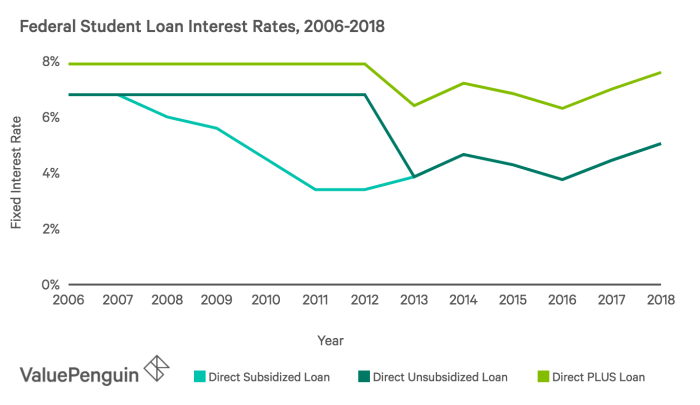

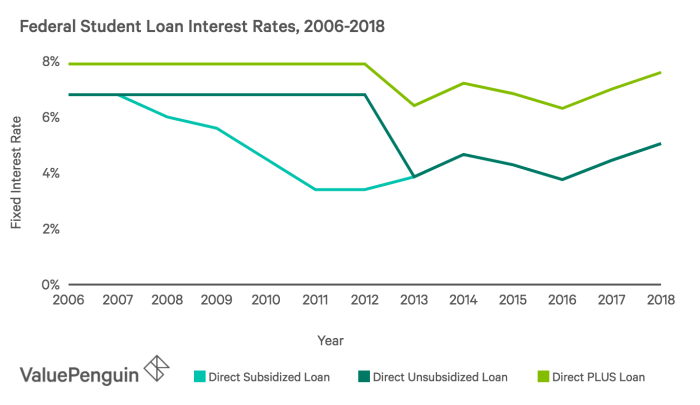

Federal and private student loans differ significantly in how APRs are determined. Federal student loans generally offer fixed interest rates that are set by the government and are typically lower than those offered by private lenders. These rates are influenced by market conditions but remain relatively stable. Private student loans, on the other hand, have variable interest rates that can fluctuate based on market conditions and the borrower’s creditworthiness. Private lenders often offer lower rates to borrowers with excellent credit, but these rates can be considerably higher for those with poor credit. For example, a federal subsidized loan might have a fixed APR of 5%, while a comparable private loan could range from 4% for borrowers with excellent credit to 12% or more for those with poor credit. It’s important to compare offers from multiple lenders to find the most favorable APR.

Calculating Total Loan Costs with APR

Understanding the Annual Percentage Rate (APR) is crucial for accurately assessing the true cost of a student loan. The APR encompasses not only the interest rate but also other fees associated with the loan, providing a comprehensive picture of the total borrowing cost over the loan’s lifespan. This section will demonstrate how to calculate both the total interest paid and the monthly payments using the APR, and will illustrate the significant impact even small differences in APR can have on the overall cost.

Calculating Total Interest Paid

To determine the total interest paid over the life of a student loan, you need the loan’s principal amount, the APR, and the loan term (length in years). While precise calculation often requires specialized loan calculators or amortization schedules (explained below), a simplified approach provides a reasonable estimate. The total interest paid is generally the difference between the total amount repaid and the original principal amount. For example, a $20,000 loan repaid over 10 years with a 6% APR might result in a total repayment of $26,000. In this case, the total interest paid would be approximately $6,000 ($26,000 – $20,000). Note that this is a simplified estimate, and the actual interest paid will vary slightly due to the compounding effect of interest.

Calculating Monthly Payments

Calculating the precise monthly payment requires a more complex formula, often using a financial calculator or online loan amortization calculator. The formula is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly Payment

* P = Principal Loan Amount

* i = Monthly Interest Rate (APR divided by 12)

* n = Total Number of Payments (loan term in years multiplied by 12)

Let’s illustrate with an example: A $10,000 loan with a 5% APR over 5 years.

* P = $10,000

* i = 0.05 / 12 = 0.004167

* n = 5 * 12 = 60

Substituting these values into the formula will give you the precise monthly payment. Online calculators readily perform this calculation.

Loan Amortization Schedule Example

An amortization schedule details the breakdown of each payment, showing how much goes towards principal and how much towards interest over the loan’s lifetime. This helps visualize how the proportion changes over time.

Understanding the amortization schedule is crucial to grasp how your payments are allocated and how the loan balance reduces.

Here’s a hypothetical example for a $10,000 loan at 5% APR over 5 years (approximately $188.71 monthly payment):

- Month 1: Principal: $150.29; Interest: $38.42

- Month 6: Principal: $160.57; Interest: $28.14

- Month 12: Principal: $171.28; Interest: $17.43

- Month 60: Principal: $188.17; Interest: $0.54

Note that the initial payments are heavily weighted towards interest, with the principal repayment gradually increasing over time.

Comparing Loans with Different APRs

Consider two scenarios:

* Scenario A: $20,000 loan at 7% APR over 10 years. Using a loan calculator, the total repayment might be around $29,000, meaning approximately $9,000 in interest.

* Scenario B: $20,000 loan at 5% APR over 10 years. The total repayment could be closer to $26,000, resulting in roughly $6,000 in interest.

This comparison clearly shows that a seemingly small difference in APR (2% in this case) can lead to a significant difference in total interest paid ($3,000 in this example). Choosing a loan with a lower APR can save thousands of dollars over the loan’s lifetime.

Strategies for Lowering Student Loan APRs

Securing a lower Annual Percentage Rate (APR) on your student loans can significantly reduce your overall borrowing costs. Several strategies can help you achieve this, from improving your creditworthiness to exploring refinancing options and negotiating directly with lenders. Understanding these strategies empowers you to make informed decisions and potentially save thousands of dollars over the life of your loans.

Improving Credit Scores to Qualify for Lower APRs

A higher credit score is often a key factor in securing a lower APR on student loans. Lenders view individuals with strong credit histories as less risky borrowers. Improving your credit score involves consistent responsible financial behavior. This includes paying all bills on time, maintaining low credit utilization (the amount of credit you use compared to your total available credit), and avoiding opening multiple new credit accounts in a short period. Monitoring your credit report regularly for errors and addressing them promptly is also crucial. A consistent pattern of responsible credit management over several months can lead to a noticeable improvement in your credit score, making you a more attractive candidate for lower interest rates. For example, consistently paying your credit card bills in full and on time each month, while keeping your credit utilization below 30%, can significantly boost your score over time.

Refinancing Student Loans to Obtain a Lower APR

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can be particularly beneficial if interest rates have fallen since you initially took out your loans, or if your credit score has improved significantly. However, refinancing has potential drawbacks. You might lose access to federal loan benefits, such as income-driven repayment plans or loan forgiveness programs. Furthermore, refinancing typically involves fees, and the process can be time-consuming. Carefully weigh the potential benefits of a lower APR against the potential loss of federal loan protections before deciding to refinance. For instance, a borrower with a high credit score and stable income might find refinancing advantageous, achieving a significantly lower APR and reducing their monthly payments. Conversely, a borrower with a lower credit score or inconsistent income might find the risks associated with losing federal loan benefits outweigh the potential savings.

Negotiating a Lower APR with a Lender

While not always successful, negotiating a lower APR directly with your lender is worth considering. Before contacting your lender, gather information about your credit score, income, and other relevant financial details. Present yourself as a responsible borrower and highlight any positive changes in your financial situation since you initially took out the loan. Be prepared to discuss your options and potentially negotiate a compromise. For example, you could offer to increase your loan payments in exchange for a reduced interest rate. Remember to document all communication with your lender. The success of this strategy depends largely on your creditworthiness and the lender’s policies.

Resources Available to Students Seeking Information on Student Loan Interest Rates

Several resources can help students find information on student loan interest rates. The Federal Student Aid website (studentaid.gov) provides comprehensive information on federal student loan programs and interest rates. Many financial websites and educational institutions offer resources and tools for comparing loan options and understanding interest rates. Independent financial advisors can also provide personalized guidance on managing student loan debt. Consulting these resources enables students to make informed decisions about their borrowing and repayment strategies. Comparing interest rates from multiple lenders before accepting a loan is crucial to secure the most favorable terms.

The Impact of APR on Repayment Plans

Understanding your student loan’s Annual Percentage Rate (APR) is crucial because it significantly impacts your repayment plan and overall cost. A higher APR means you’ll pay more in interest over the life of the loan, affecting both your monthly payments and the total amount you repay. This section explores how different APRs influence repayment plan choices and their long-term financial consequences.

APR’s Influence on Repayment Length

The APR directly determines how long it takes to repay your student loans. A higher APR necessitates longer repayment periods to manage monthly payments, even with the same loan amount. Conversely, a lower APR allows for shorter repayment periods and less overall interest paid. For example, a loan with a 7% APR might be repaid in 10 years, while the same loan amount at 10% APR could stretch the repayment to 15 years or more, significantly increasing the total interest paid.

Consequences of Extended Repayment Plans Due to Higher APR

Choosing an extended repayment plan due to a high APR might seem appealing initially because it lowers monthly payments. However, this seemingly beneficial strategy often leads to paying significantly more interest over the loan’s lifetime. The longer repayment period magnifies the cumulative interest charges, resulting in a substantially higher total repayment amount compared to a shorter repayment period with lower monthly payments. This can severely impact long-term financial goals, such as saving for a down payment on a house or investing.

Comparison of Total Interest Paid Under Various Repayment Plans

The total interest paid varies considerably across different repayment plans, even with the same APR. Standard repayment plans typically have the shortest repayment periods, resulting in less total interest paid. Graduated repayment plans start with lower monthly payments, gradually increasing over time, but often extend the repayment period and lead to higher total interest. Income-driven repayment plans adjust monthly payments based on income, potentially extending the repayment period and increasing total interest compared to standard plans.

| Repayment Plan | Monthly Payment (Example) | Total Interest Paid | Loan Repayment Period |

|---|---|---|---|

| Standard | $500 | $10,000 | 10 years |

| Graduated | $300 (initially) | $15,000 | 15 years |

| Income-Driven | $250 (variable) | $20,000 | 20 years |

Note: These are example figures and actual amounts will vary based on loan amount, APR, and individual circumstances.

Financial Implications of Different APRs on Long-Term Repayment

Consider two borrowers, both with a $30,000 loan. Borrower A secures a loan with a 5% APR, while Borrower B has a 10% APR. If both choose a 10-year standard repayment plan, Borrower A will pay significantly less in total interest than Borrower B. However, if Borrower B opts for a longer repayment plan to lower their monthly payments, the total interest paid could exceed the initial loan amount, making the long-term financial burden considerably higher. This illustrates the critical importance of securing the lowest possible APR and carefully considering the implications of various repayment plans before committing to a student loan.

Visual Representation of APR Impact

Understanding the impact of APR on student loan repayment requires visualizing the relationship between the interest rate and the total cost. Graphs and charts provide a clear and concise way to demonstrate how even small differences in APR can significantly affect the total amount paid over the loan’s lifespan.

A simple line graph can effectively illustrate the relationship between APR and total interest paid. The x-axis would represent the Annual Percentage Rate (APR), ranging from a low rate to a high rate (e.g., 2% to 10%). The y-axis would represent the total interest paid over the loan’s term (e.g., 10 years). Each point on the graph would represent a specific APR and the corresponding total interest paid for a loan of a fixed principal amount. The resulting line would show a clear upward trend: as the APR increases, the total interest paid also increases substantially. For instance, a loan with a 5% APR might result in $5,000 in interest over 10 years, while a 10% APR on the same loan amount could lead to $10,000 or more in interest. The steeper the slope of the line, the more sensitive the total interest paid is to changes in the APR.

APR and Loan Balance Growth Comparison

A bar chart or a line graph could effectively compare the growth of loan balances over time with varying APRs. Let’s consider a hypothetical $20,000 student loan with three different APRs: 4%, 7%, and 10%. The chart’s x-axis would represent the years of repayment (e.g., years 1 through 10), and the y-axis would represent the outstanding loan balance. Three lines (or bars) would represent the outstanding loan balance for each APR over the 10-year period. The chart would visually demonstrate how the 10% APR loan balance remains significantly higher than the 4% APR loan balance throughout the repayment period. The difference between the loan balances would likely increase over time due to the compounding effect of interest. For example, after 5 years, the 4% APR loan might show a balance around $14,000, the 7% APR loan around $16,000, and the 10% APR loan around $18,000. This visual representation would clearly highlight the considerable impact of APR on the overall repayment burden.

Final Thoughts

Successfully navigating student loan debt requires a proactive approach to understanding and managing APR. By carefully considering the factors influencing your interest rate, exploring strategies to lower it, and diligently planning your repayment, you can significantly reduce the overall cost of your education. Remember, informed decisions lead to better financial outcomes. Take control of your student loan journey and build a secure financial future.

Questions and Answers

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default, with severe financial consequences.

Can I consolidate my student loans?

Yes, consolidating multiple loans into a single loan can simplify repayment, potentially lowering your monthly payment, but it may not always reduce the total interest paid.

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do, impacting the total amount you’ll owe.

How does my credit score affect my APR?

A higher credit score generally qualifies you for a lower APR, reflecting lower risk to the lender.