Navigating the world of student loans can feel overwhelming, especially when grappling with the concept of Annual Percentage Rate (APR). This seemingly simple number significantly impacts your overall loan cost, potentially adding thousands to your total repayment. Understanding APR, its components, and how it influences your long-term financial health is crucial for responsible borrowing and repayment planning. This guide will demystify APR in student loans, equipping you with the knowledge to make informed decisions.

We’ll explore the calculation of APR, the differences between fixed and variable rates, and the key factors lenders consider when setting your rate. Furthermore, we’ll delve into practical strategies for securing a lower APR, including improving your credit score and exploring refinancing options. Finally, we’ll analyze the long-term financial implications of different APRs on your repayment journey, helping you visualize the impact of your choices.

Understanding APR in Student Loans

Understanding the Annual Percentage Rate (APR) on your student loan is crucial for making informed borrowing decisions. The APR represents the true cost of borrowing, encompassing not only the interest rate but also other fees and charges associated with the loan. A higher APR means you’ll pay more in interest over the life of the loan.

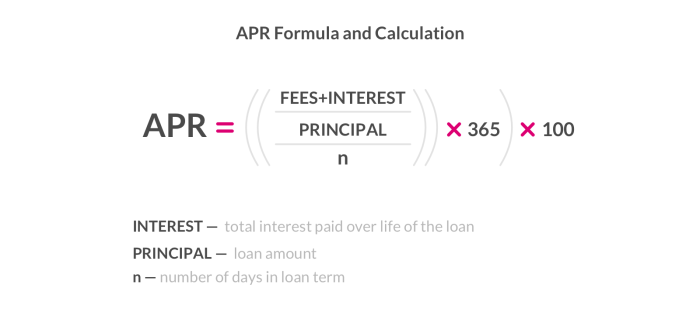

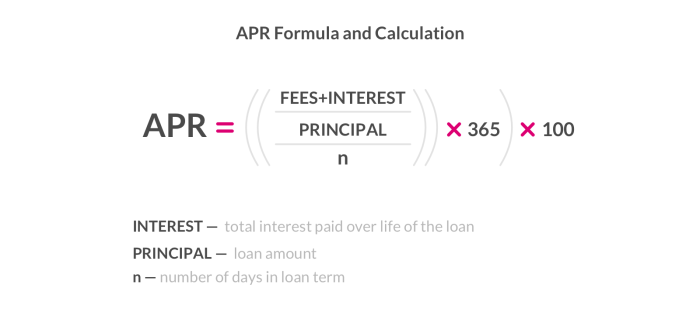

APR Calculation in Student Loans

The APR calculation for student loans incorporates several factors. The most significant is the interest rate, which reflects the lender’s cost of capital and the perceived risk of lending to you. However, the APR also includes other fees, such as origination fees, which are charged upfront to process the loan application. These fees are added to the interest rate to provide a complete picture of the loan’s cost. The calculation is complex and usually involves a formula that takes into account the loan amount, the interest rate, the loan term, and any associated fees. The precise calculation method can vary slightly depending on the lender and the type of loan. For example, a loan with a 5% interest rate and a 1% origination fee will have a higher APR than a loan with only a 5% interest rate.

Fixed vs. Variable APRs

Student loans can have either fixed or variable APRs. A fixed APR remains constant throughout the loan’s repayment period. This predictability makes budgeting and financial planning easier, as you know exactly how much you’ll pay each month. In contrast, a variable APR fluctuates based on an underlying benchmark interest rate, such as the prime rate or LIBOR. This means your monthly payments could increase or decrease over time, depending on market conditions. While a variable APR might start lower than a fixed APR, it carries the risk of significantly higher payments if interest rates rise.

Impact of Different APRs on Total Loan Cost

Different APRs dramatically affect the total cost of a student loan over its lifetime. Consider two loans of $20,000, one with a 5% fixed APR and another with a 7% fixed APR, both repaid over 10 years. The loan with the 7% APR will accumulate significantly more interest, leading to a much higher total repayment amount. For example, the 5% loan might have a total repayment cost around $25,000, while the 7% loan could cost closer to $28,000 or more. This difference in total cost can be substantial, impacting a borrower’s long-term financial health.

Fixed vs. Variable APR Student Loans: A Comparison

| Feature | Fixed APR | Variable APR |

|---|---|---|

| Interest Rate | Constant throughout the loan term | Fluctuates based on a benchmark rate |

| Predictability | High; monthly payments are consistent | Low; monthly payments can change |

| Risk | Lower risk of unexpected payment increases | Higher risk of unexpected payment increases |

| Long-term Cost | Potentially higher initial cost if the variable rate is initially lower | Potentially lower initial cost, but higher long-term cost if rates rise |

Factors Influencing APR on Student Loans

Securing a student loan involves understanding the factors that determine the annual percentage rate (APR), a crucial element influencing the overall cost of borrowing. Several key elements contribute to the APR assigned to your loan, impacting the monthly payments and total amount repaid over the loan’s lifetime. These factors are primarily considered by lenders to assess the risk associated with lending to you.

Credit History’s Impact on Student Loan APRs

A strong credit history is a significant factor influencing the APR offered on student loans, especially private loans. Lenders view a positive credit history—demonstrated by responsible credit card use, timely loan repayments, and the absence of defaults or bankruptcies—as a low-risk indicator. Individuals with excellent credit scores typically qualify for lower APRs, reflecting the lender’s confidence in their ability to repay the loan. Conversely, a poor or nonexistent credit history can lead to higher APRs or even loan rejection. For example, an individual with a FICO score above 750 might secure an APR several percentage points lower than someone with a score below 600. This difference can significantly impact the total cost of the loan over its term.

The Role of Co-signers in Securing Lower APRs

A co-signer acts as a guarantor for the student loan, agreeing to repay the debt if the borrower defaults. The inclusion of a co-signer with a strong credit history can significantly improve the borrower’s chances of securing a lower APR. Lenders view the co-signer’s creditworthiness as a mitigating factor against the risk of default, especially if the borrower has limited or poor credit history. The co-signer’s excellent credit score essentially underwrites the loan, providing reassurance to the lender and resulting in a more favorable interest rate for the borrower. This is particularly beneficial for students entering higher education with limited or no credit history.

Comparison of APRs Across Different Student Loan Lenders

Federal and private student loans differ significantly in how APRs are determined. Federal student loan APRs are generally fixed and determined by the government, based on prevailing market interest rates and the type of loan (e.g., subsidized or unsubsidized). These rates are often lower than those offered by private lenders. Private student loans, however, typically have variable APRs that fluctuate with market conditions. These APRs are determined by the lender based on an individual’s creditworthiness, credit history, and other factors. Consequently, APRs on private student loans can vary considerably depending on the lender and the borrower’s profile. For example, a borrower with excellent credit might obtain a lower APR from a private lender compared to a borrower with a less-than-stellar credit history, even though both may be applying for the same loan amount. The variability inherent in private loan APRs underscores the importance of comparing offers from multiple lenders before making a decision.

Strategies for Lowering Your Student Loan APR

Securing a lower Annual Percentage Rate (APR) on your student loans can significantly reduce the total amount you pay over the life of your loan. Several strategies can help you achieve this, impacting your long-term financial health. By understanding and implementing these strategies, you can make your student loan repayment more manageable.

Improving Credit Score

A higher credit score is a key factor in securing favorable loan terms. Lenders view a strong credit history as an indicator of responsible borrowing behavior. Improving your credit score before applying for loans or refinancing can lead to a lower APR. This involves consistently paying bills on time, maintaining low credit utilization (keeping your credit card balances low relative to your credit limit), and avoiding opening too many new credit accounts in a short period. A consistent track record of responsible credit management demonstrates your creditworthiness to lenders, resulting in better loan offers.

Choosing the Right Loan Type

Different types of student loans come with varying APRs. Federal student loans generally offer lower interest rates than private student loans, especially for students with good academic standing. Federal subsidized loans, for example, don’t accrue interest while you’re in school, unlike unsubsidized loans. Understanding the nuances of each loan type and their associated interest rates is crucial for making an informed decision. Carefully compare the terms and conditions of federal and private loan options before committing to one.

Exploring Loan Refinancing Options

Refinancing your student loans can potentially lower your APR, especially if interest rates have fallen since you initially took out your loans. Refinancing involves consolidating multiple loans into a single loan with a new lender, often at a lower interest rate. For example, if you initially had loans with APRs of 7% and 8%, refinancing could result in a single loan with a lower APR, such as 6%. However, it’s important to carefully review the terms and conditions of the refinancing offer, as some lenders may have stricter eligibility requirements.

Comparison of Strategies for Lower APR

Understanding the pros and cons of each approach is crucial for making an informed decision.

- Improving Credit Score:

- Pros: Leads to lower APRs on various loans, improves overall financial health.

- Cons: Requires time and consistent effort to build a good credit history; immediate impact may not be seen.

- Choosing the Right Loan Type:

- Pros: Access to potentially lower interest rates, especially with federal loans.

- Cons: Limited options depending on eligibility and financial need; may require navigating complex application processes.

- Loan Refinancing:

- Pros: Potential for significantly lower APR, simplification of loan repayment.

- Cons: May involve fees, potential loss of federal loan benefits (e.g., income-driven repayment plans), eligibility requirements may be stringent.

Impact of APR on Repayment

Understanding your student loan’s APR is crucial because it directly impacts the total cost of your education. A seemingly small difference in APR can translate into thousands of extra dollars paid over the life of your loan. This section explores the long-term financial consequences of various APRs and repayment strategies.

The APR significantly influences the total interest accrued on your student loans. Higher APRs lead to exponentially larger interest payments over time, ultimately increasing the total amount you repay. Conversely, lower APRs result in lower interest payments and a smaller overall repayment burden. This effect is magnified by the loan term; longer repayment periods allow more time for interest to accumulate, increasing the total cost even with a lower APR.

Total Interest Paid Across Different APRs and Repayment Plans

The total interest paid depends heavily on both the APR and the chosen repayment plan. For example, consider two loans of $20,000: one with a 5% APR and another with a 7% APR. Both loans are repaid over 10 years using a standard repayment plan. The loan with the 7% APR will accumulate significantly more interest than the loan with the 5% APR. Choosing an income-driven repayment plan, while potentially lowering monthly payments, often extends the repayment period, leading to higher total interest paid regardless of the APR. Conversely, accelerated repayment plans, while requiring higher monthly payments, significantly reduce the total interest paid by shortening the repayment period.

Total Repayment Costs with Varying APRs and Loan Terms

The total repayment cost—principal plus interest—increases with both higher APRs and longer loan terms. A $10,000 loan with a 4% APR over 10 years will have a significantly lower total repayment cost than the same loan with an 8% APR over 20 years. The longer repayment period allows for much more interest to accrue, making the overall cost considerably higher. This difference becomes even more pronounced with larger loan amounts. For instance, a $50,000 loan with an 8% APR repaid over 20 years will result in substantially more interest and total repayment than the same loan repaid over 10 years.

Visual Representation of APR and Total Repayment

Imagine a graph with the APR on the x-axis and the total repayment amount on the y-axis. Several lines could be plotted, each representing a different loan term (e.g., 10 years, 15 years, 20 years). Each line would show an upward trend, demonstrating that as the APR increases, the total repayment amount increases as well. The steeper the slope of the line, the longer the loan term and the greater the impact of the APR on the total repayment. For example, the line representing a 20-year loan would be much steeper than the line for a 10-year loan, illustrating how a longer repayment period exacerbates the effect of a higher APR. The graph would clearly show that even small increases in APR can result in substantial increases in total repayment cost, particularly over longer loan terms. This visual representation would powerfully demonstrate the importance of securing the lowest possible APR and choosing a repayment plan that balances affordability with minimizing overall cost.

Understanding Student Loan Terms and Conditions

Navigating the world of student loans requires a thorough understanding of the terms and conditions associated with your loan. Failing to grasp these details can lead to unexpected costs, difficulties in repayment, and even serious financial consequences. This section will clarify key terms and help you understand your rights and responsibilities as a borrower.

Understanding the specific terms and conditions of your student loan is crucial for responsible debt management. This includes knowing your interest rate, repayment schedule, and any associated fees. Ignoring these details can lead to unforeseen financial burdens and potentially damage your credit score. A clear understanding empowers you to make informed decisions and proactively manage your student loan debt.

Grace Periods

A grace period is the time after you graduate or leave school before you are required to begin making student loan payments. The length of the grace period varies depending on the type of loan and lender, but it’s typically six months for federal loans. During this period, interest may or may not accrue, depending on your loan type. Understanding your grace period is important for planning your post-graduation finances and budgeting for your upcoming loan payments. Failing to understand this period can lead to unexpected debt accumulation.

Deferment and Forbearance Options

Deferment and forbearance are temporary pauses in your student loan payments. Deferment is typically granted for specific reasons, such as returning to school or experiencing unemployment. During a deferment period, interest may or may not accrue, depending on the type of loan. Forbearance, on the other hand, is a temporary suspension of payments often granted due to financial hardship. Interest typically accrues during forbearance, leading to a larger loan balance upon resumption of payments. Both options provide temporary relief, but it’s essential to understand the implications of each before applying. Misunderstanding these options can lead to significant increases in overall loan costs.

Consequences of Defaulting on Student Loan Payments

Defaulting on your student loan payments has severe consequences. It can lead to damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, tax refund offset, and even legal action are all potential outcomes of default. The impact on your financial well-being can be substantial and long-lasting. Understanding these potential consequences emphasizes the importance of responsible repayment planning. For example, a default could prevent you from buying a house or securing a favorable interest rate on a car loan for years to come.

Resources for Managing Student Loan Debt

Several resources are available to help students manage their student loan debt effectively. The National Student Loan Data System (NSLDS) provides access to your federal student loan information. Your loan servicer is another valuable resource, offering assistance with repayment plans, deferment options, and other related matters. Additionally, many non-profit organizations and government agencies offer free financial counseling services to help you create a personalized debt management plan. Utilizing these resources can significantly improve your chances of successfully managing and repaying your student loans. Proactive engagement with these resources is key to avoiding financial hardship.

Conclusive Thoughts

Securing a favorable APR on your student loan is a significant step towards responsible financial management. By understanding the factors influencing your rate and employing effective strategies to lower it, you can significantly reduce your overall borrowing costs and pave the way for a smoother repayment experience. Remember, informed decision-making is key to navigating the complexities of student loan debt and achieving your long-term financial goals. Proactive planning and a thorough understanding of your loan terms are essential for success.

FAQ Guide

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has serious financial consequences.

Can I consolidate my student loans to get a lower APR?

Loan consolidation might offer a lower APR, but it depends on your creditworthiness and the terms of the new loan. Explore options carefully.

How long does it typically take to repay student loans?

Repayment timelines vary widely depending on loan amount, APR, and repayment plan chosen. Standard plans often span 10-20 years.

What is a grace period on a student loan?

A grace period is a temporary period after graduation or leaving school before loan repayment begins.