Navigating the world of student loans can feel overwhelming, especially when faced with the choice between fixed and variable interest rates. The decision significantly impacts your long-term repayment costs and overall financial health. Understanding the nuances of fixed rates is crucial to making an informed choice that aligns with your financial goals and risk tolerance. This guide explores the key aspects of fixed student loan rates, helping you decipher the complexities and make the best decision for your future.

This exploration will cover the advantages and disadvantages of fixed rates, detailing how factors like credit history and prevailing economic conditions influence the interest rate you’ll receive. We’ll also examine how fixed rates affect your monthly payments and total loan cost, providing practical examples and comparisons to help you visualize the long-term implications of your choice. Ultimately, the goal is to empower you with the knowledge to select the loan type best suited to your individual circumstances.

Types of Student Loan Rates

Understanding the difference between fixed and variable interest rates is crucial for responsible student loan borrowing. Choosing the right type of loan can significantly impact the total cost of your education over time. This section will clarify the distinctions and help you make an informed decision.

Fixed and variable interest rates represent two distinct approaches to calculating the interest charged on your student loan. A fixed rate remains constant throughout the loan’s life, providing predictability in your monthly payments. Conversely, a variable rate fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR (although LIBOR is being phased out). This variability introduces uncertainty into your monthly payment amounts.

Fixed Rate Student Loans

With a fixed-rate student loan, the interest rate is set at the time you borrow the money and remains unchanged for the entire repayment period. This predictability allows for accurate budgeting and financial planning. You know exactly how much you will owe each month, simplifying repayment and reducing financial stress.

Variable Rate Student Loans

Variable-rate student loans have an interest rate that changes periodically based on a market index. This means your monthly payment amount could increase or decrease over the life of the loan. While you might initially benefit from a lower interest rate compared to a fixed-rate loan, the potential for increases poses a risk of higher overall costs if the index rises significantly.

Scenarios Favoring Fixed-Rate Loans

Several scenarios highlight the advantages of fixed-rate loans. For instance, if you anticipate limited income flexibility during repayment, a fixed rate provides stability and avoids the uncertainty of fluctuating payments. Similarly, individuals who prefer predictable budgeting and long-term financial planning would benefit from the consistent payments associated with fixed-rate loans. A borrower concerned about potential interest rate increases in the future would also find a fixed rate more advantageous.

Factors Influencing Student Loan Interest Rates

Several factors contribute to the interest rate offered on student loans. These include the type of loan (federal vs. private), the borrower’s creditworthiness (credit score and history), the loan term (length of repayment), and prevailing market interest rates. Government regulations also play a role in setting interest rates for federal student loans.

Comparison of Fixed and Variable Rate Student Loans

| Rate Type | Interest Rate Calculation | Risk Level | Long-Term Cost Implications |

|---|---|---|---|

| Fixed | Set at loan origination; remains constant | Low; predictable payments | Predictable; potentially higher overall cost compared to a variable rate loan if rates remain low |

| Variable | Changes periodically based on a market index | High; fluctuating payments | Unpredictable; potentially lower overall cost compared to a fixed rate loan if rates remain low, but potential for higher cost if rates rise |

Understanding Fixed Interest Rates

Choosing a student loan involves understanding the interest rate structure. A fixed interest rate offers predictability and stability throughout the loan’s repayment period, unlike variable rates which fluctuate with market conditions. This predictability allows for better financial planning and budgeting.

Fixed interest rates offer significant advantages to borrowers, primarily by providing certainty and simplifying long-term financial projections. This predictability is especially valuable when managing personal finances alongside the demands of higher education and early career stages. The consistent monthly payment amount reduces the risk of unexpected financial strain.

Fixed Interest Rate Protection Against Fluctuations

A fixed interest rate shields borrowers from the unpredictable nature of the financial markets. Unlike variable rates that adjust based on economic indicators, a fixed rate remains constant for the loan’s life. This protection is particularly beneficial during periods of economic uncertainty or rising interest rates. For example, if market interest rates increase significantly after a borrower secures a fixed-rate loan, their monthly payment remains unchanged, unlike those with variable-rate loans who would face higher payments. This stability provides peace of mind and helps borrowers manage their finances more effectively.

Long-Term Repayment Implications of Fixed Interest Rates

With a fixed interest rate, borrowers can accurately calculate their total repayment amount and the length of the repayment period. This allows for detailed financial planning and budgeting. For instance, a borrower can create a realistic repayment schedule, knowing precisely how much they will pay each month and the total interest paid over the loan’s lifespan. This contrasts with variable rates, where the total repayment amount and repayment duration can change due to interest rate fluctuations. This predictability simplifies long-term financial management and reduces financial uncertainty.

Key Benefits of Fixed-Rate Student Loans

The predictability and stability offered by fixed-rate student loans translate into several key advantages for borrowers.

- Predictable Monthly Payments: Knowing the exact monthly payment amount from the outset allows for better budgeting and financial planning.

- Stable Repayment Schedule: The consistent monthly payment avoids the stress of fluctuating payments and simplifies long-term financial projections.

- Protection Against Rising Interest Rates: Borrowers are shielded from potential increases in interest rates, ensuring consistent payments regardless of market conditions.

- Simplified Financial Planning: Accurate calculation of total repayment and repayment duration allows for better long-term financial planning and budgeting.

- Reduced Financial Uncertainty: The stability provided by a fixed rate reduces financial stress and improves overall financial well-being.

Factors Affecting Fixed Student Loan Rates

Several key factors influence the fixed interest rate a student receives on their loan. Understanding these factors can help students make informed borrowing decisions and potentially secure more favorable rates. These factors interact in complex ways, and the final rate reflects the lender’s assessment of the overall risk involved in lending to a particular student.

The primary factors determining a student’s fixed interest rate are interconnected and often influence each other. A lender considers each element to arrive at a rate that reflects their perceived risk.

Credit History’s Impact on Fixed Interest Rates

A strong credit history significantly impacts the interest rate offered. Lenders view a positive credit history – characterized by consistent on-time payments, low credit utilization, and a lack of negative marks – as an indicator of responsible financial behavior. Students with established credit histories demonstrating responsible borrowing are typically offered lower interest rates compared to those with limited or poor credit. Conversely, a lack of credit history or a history of missed payments can result in higher interest rates, reflecting the increased risk the lender perceives. For example, a student with a FICO score above 750 might qualify for a lower rate than a student with a score below 600. The difference could be several percentage points, significantly impacting the total repayment cost over the life of the loan.

Loan Type’s Influence on Fixed Interest Rates

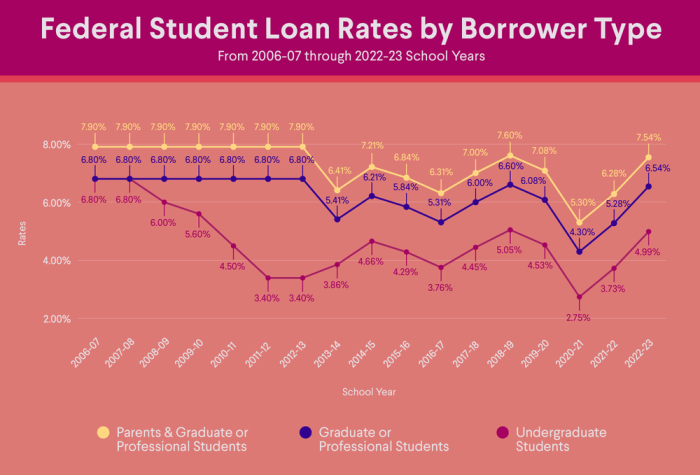

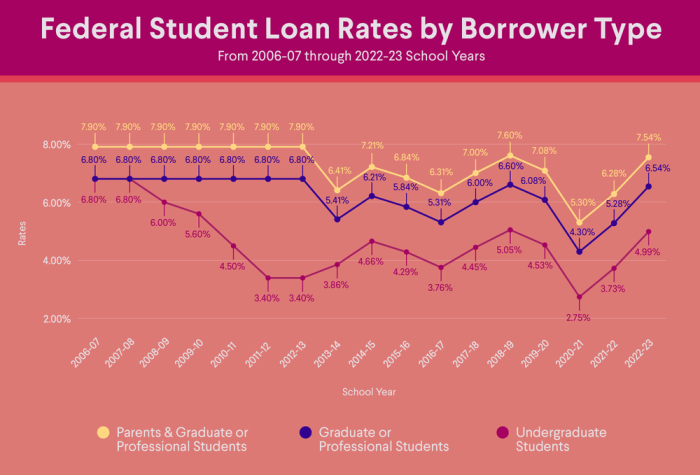

The type of student loan also plays a crucial role in determining the interest rate. Federal student loans, backed by the government, generally offer lower interest rates than private student loans. This is because the government assumes a portion of the risk. Private lenders, on the other hand, assess risk more independently, leading to a wider range of interest rates based on individual borrower profiles. Furthermore, within federal loans, different loan programs (like subsidized vs. unsubsidized) may have slightly varying interest rates. Subsidized loans, for example, often come with lower rates due to government subsidies that cover interest during certain periods.

Lender’s Risk Assessment Process and Fixed Interest Rates

The lender’s risk assessment process is central to determining the fixed interest rate. Lenders employ sophisticated models that analyze various factors, including credit history, debt-to-income ratio, loan amount, and the student’s chosen field of study. The process involves quantifying the likelihood of loan default. A higher perceived risk of default (based on these factors) leads to a higher interest rate to compensate the lender for the increased risk. For instance, a student pursuing a less lucrative field of study might face a higher rate than a student in a high-demand profession, reflecting the lender’s assessment of the borrower’s future earning potential and ability to repay the loan.

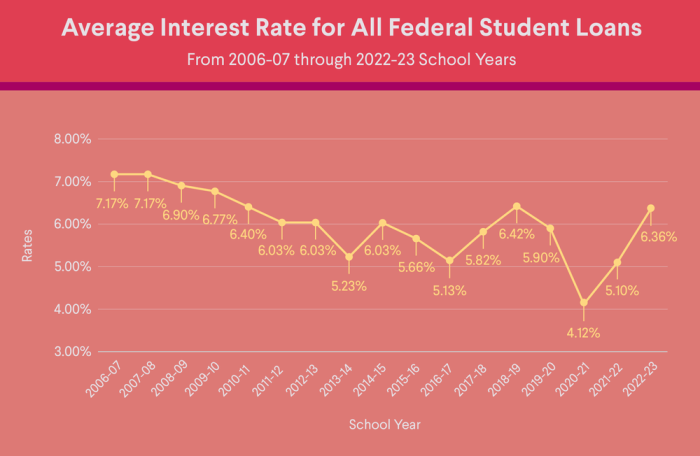

Prevailing Economic Conditions and Fixed Interest Rates

Prevailing economic conditions significantly influence student loan interest rates. Interest rates are generally linked to broader market interest rates. When the overall economy is strong and interest rates are low, student loan rates tend to be lower. Conversely, during periods of economic uncertainty or inflation, interest rates may rise, making student loans more expensive. For example, during periods of high inflation, the Federal Reserve might raise the federal funds rate, which in turn influences other interest rates, including those on student loans. This ripple effect can be observed in the fluctuation of interest rates offered by both federal and private lenders.

Repayment Implications of Fixed Rates

Understanding how fixed interest rates affect your student loan repayment is crucial for effective financial planning. A fixed rate provides predictability, allowing you to accurately budget for monthly payments and anticipate the total loan cost. However, the impact of the rate and loan terms significantly influences the overall expense.

Monthly Payment Calculation

The monthly payment on a fixed-rate student loan is determined using an amortization formula. This formula considers the loan principal (the original amount borrowed), the annual interest rate, and the loan term (the repayment period in months). A common formula is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly payment

* P = Principal loan amount

* i = Monthly interest rate (annual interest rate divided by 12)

* n = Total number of payments (loan term in months)

This formula calculates the consistent monthly payment required to fully repay the loan within the specified timeframe, including both principal and interest. Online calculators and financial software readily perform these calculations.

Impact of Fixed Interest Rate on Total Borrowing Cost

A fixed interest rate directly influences the total cost of borrowing over the loan’s life. The higher the interest rate, the more you’ll pay in interest charges over time. This is because interest is calculated on the outstanding loan balance each month. Even with consistent monthly payments, a larger portion goes towards interest initially, gradually shifting towards principal repayment as the loan matures. A longer repayment period, while reducing monthly payments, will generally increase the total interest paid.

Repayment Scenarios Under Fixed Interest Rates

Let’s consider two scenarios:

Scenario 1: A $20,000 loan at a 5% annual fixed interest rate, repaid over 10 years (120 months). Using the formula (or a calculator), the monthly payment would be approximately $212. The total interest paid over the 10 years would be around $5,456.

Scenario 2: The same $20,000 loan, but at a 7% annual fixed interest rate and a 15-year repayment period (180 months). The monthly payment would be lower, approximately $170, but the total interest paid would be significantly higher, around $10,700, due to the extended repayment period.

Relationship Between Loan Amount, Interest Rate, and Repayment Period

Imagine a three-dimensional graph. The X-axis represents the loan amount, the Y-axis represents the interest rate, and the Z-axis represents the total repayment period. As you move along the X-axis (increasing loan amount), the Z-axis (repayment period) generally increases to maintain manageable monthly payments, unless the monthly payment is adjusted independently. Similarly, increasing the Y-axis (interest rate) also generally increases the Z-axis to keep monthly payments affordable. The total cost of the loan (which could be represented by a fourth dimension) will increase as you move further along any of these axes. This illustrates the interconnectedness of these three factors and their combined impact on the overall cost of borrowing.

Last Word

Choosing between a fixed and variable interest rate on your student loan is a significant financial decision. While variable rates might offer lower initial payments, the inherent risk of fluctuating interest rates can lead to unpredictable and potentially higher long-term costs. A fixed rate provides stability and predictability, offering peace of mind knowing your monthly payments will remain consistent throughout the loan term. By carefully weighing the advantages and disadvantages of each option, considering your financial situation, and understanding the factors influencing interest rates, you can make a well-informed decision that sets you on the path to successful loan repayment.

Frequently Asked Questions

What happens if my financial situation changes after I take out a fixed-rate student loan?

With a fixed-rate loan, your monthly payment remains consistent regardless of changes in your financial situation or interest rates. However, you may explore options like income-driven repayment plans to adjust your payments based on your income.

Can I refinance my fixed-rate student loan to a lower rate?

Yes, you may be able to refinance your fixed-rate student loan to a lower rate with a different lender, provided you meet their eligibility criteria. This is often dependent on your credit score and current financial standing.

Are there any penalties for paying off a fixed-rate student loan early?

Most federal student loans do not have prepayment penalties. However, it’s always best to check your loan agreement to confirm this.

How are fixed student loan interest rates determined?

Fixed interest rates are influenced by a variety of factors, including prevailing market interest rates, the lender’s risk assessment of the borrower, the type of loan (federal vs. private), and the borrower’s credit history.