Navigating the complexities of student loan repayment often leaves borrowers wondering about the finer details of interest calculations. A key aspect that significantly impacts the total cost of borrowing is the compounding frequency – is interest calculated monthly or annually? Understanding this difference is crucial for effective debt management and informed financial planning. This exploration delves into the mechanics of compound interest, specifically as it applies to student loans, examining how different compounding periods affect the overall repayment amount and providing practical strategies for borrowers.

We’ll examine both simple and compound interest, highlighting the key distinctions and illustrating their impact through clear examples and comparisons. We’ll also explore how various student loan types and interest rate structures interact with compounding frequency, ultimately providing you with the knowledge to make informed decisions about your student loan debt.

Understanding Loan Interest Calculation

Understanding how interest accrues on student loans is crucial for effective financial planning. This section will clarify the fundamental differences between simple and compound interest, illustrating how these calculations impact the total amount you repay.

Simple Interest

Simple interest is calculated only on the principal amount of the loan. It’s a straightforward calculation where the interest is a fixed percentage of the original loan amount each year. This means the interest amount remains constant throughout the loan term. The formula for calculating simple interest is: Simple Interest = Principal x Interest Rate x Time. For example, a $10,000 loan at a 5% annual interest rate will accrue $500 in simple interest each year ($10,000 x 0.05 x 1).

Compound Interest

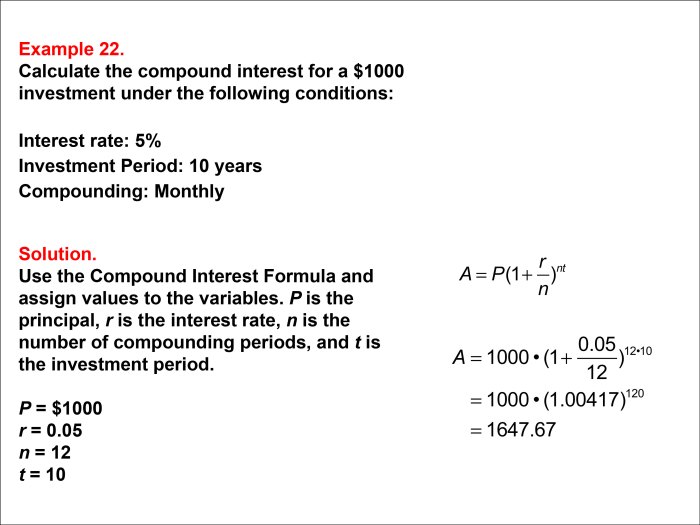

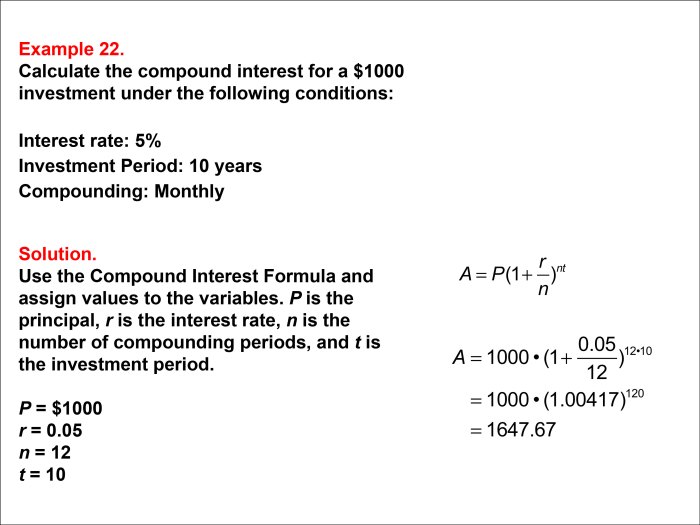

Compound interest, unlike simple interest, is calculated on both the principal amount and the accumulated interest from previous periods. This means that the interest earned in one period becomes part of the principal for the next period, leading to exponential growth of the total amount owed. The more frequently interest is compounded (e.g., monthly instead of annually), the faster the debt grows. The formula for compound interest is more complex and involves exponential calculations, but essentially, the interest earned is added to the principal, and then interest is calculated on the new, larger principal in the subsequent period.

Annual vs. Monthly Compounding

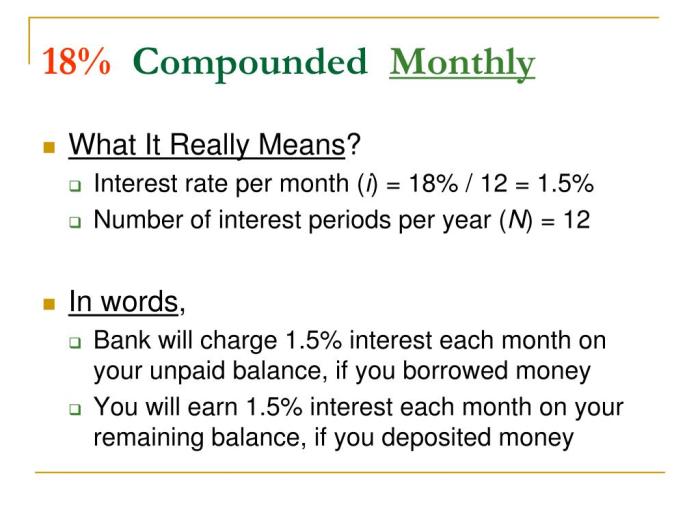

The key difference between annual and monthly compounding lies in the frequency of interest calculation. With annual compounding, interest is calculated and added to the principal once a year. With monthly compounding, interest is calculated and added to the principal twelve times a year. This seemingly small difference can significantly impact the total interest paid over the loan’s lifetime. Monthly compounding results in more frequent interest capitalization, leading to a larger total amount owed at the end of the loan term compared to annual compounding.

Interest Accrual Comparison: Simple vs. Compound Interest

The following table illustrates the difference in interest accrual over a five-year period for a $10,000 loan at a 5% annual interest rate using simple interest, annual compounding, and monthly compounding.

| Year | Simple Interest Accrued | Compound Interest (Annual) Accrued | Compound Interest (Monthly) Accrued |

|---|---|---|---|

| 1 | $500 | $500 | $511.62 |

| 2 | $1000 | $1025 | $1046.86 |

| 3 | $1500 | $1576.25 | $1610.68 |

| 4 | $2000 | $2155.06 | $2199.13 |

| 5 | $2500 | $2762.82 | $2822.68 |

Student Loan Interest Rate Structures

Understanding the interest rate structure of your student loans is crucial for effective financial planning. Different loan programs employ varying approaches to calculating and communicating interest rates, directly impacting the total repayment amount. This section will explore the common structures, influencing factors, and calculation methods.

Student loan interest rates are not uniform; they vary significantly depending on several key factors. The type of loan (federal or private), the lender, the borrower’s creditworthiness, and prevailing market conditions all play a role in determining the final interest rate. This section will detail these factors and illustrate how they contribute to the overall cost of borrowing.

Common Interest Rate Structures

Student loans typically utilize either fixed or variable interest rates. Fixed rates remain constant throughout the loan’s life, providing predictable monthly payments. Variable rates, on the other hand, fluctuate based on an underlying index, such as the prime rate or LIBOR (though LIBOR is being phased out). This fluctuation introduces an element of uncertainty into repayment planning.

Interest Rate Determination and Communication

Lenders determine student loan interest rates using a complex algorithm that considers various factors. These factors are often weighted differently depending on the lender and loan program. The interest rate is then clearly communicated to the borrower in the loan documents, usually expressed as an annual percentage rate (APR). The APR reflects the total cost of borrowing, including any fees. It’s crucial to carefully review this information before accepting a loan.

Factors Influencing Student Loan Interest Rates

Several factors significantly impact student loan interest rates. These include:

- Loan Type: Federal student loans generally offer lower interest rates than private loans due to government subsidies and risk mitigation strategies.

- Creditworthiness: Borrowers with strong credit histories often qualify for lower interest rates. Lenders perceive them as less risky.

- Market Conditions: Prevailing interest rates in the broader financial market influence the rates offered on student loans. Higher market rates generally translate to higher loan rates.

- Repayment Plan: The choice of repayment plan can indirectly influence the total interest paid, although the initial interest rate may not change. Longer repayment terms lead to more interest accruing over time.

- Loan Term: Longer loan terms often come with higher interest rates, reflecting the increased risk for the lender.

Student Loan Interest Rate Calculation Methods

| Loan Type | Interest Rate Type | Compounding Frequency | Example Calculation |

|---|---|---|---|

| Federal Subsidized Loan | Fixed | Monthly | Let’s say the annual interest rate is 4.5%. The monthly interest rate would be 4.5%/12 = 0.375%. Interest is calculated on the principal balance each month. |

| Federal Unsubsidized Loan | Fixed | Monthly | Similar to subsidized loans, the annual interest rate is fixed, and compounding occurs monthly. Interest accrues even during grace periods. |

| Private Student Loan | Variable | Monthly | A variable rate might start at 6% but fluctuate based on an index. The monthly interest rate would change accordingly, impacting monthly payments. |

| Private Student Loan | Fixed | Monthly | Similar to federal loans, but with a potentially higher fixed interest rate determined by the lender’s assessment of the borrower’s creditworthiness. |

Impact of Compounding Frequency on Loan Repayment

Understanding how often your student loan interest compounds significantly impacts the total amount you’ll repay. While the annual interest rate might seem like the primary factor, the compounding frequency—monthly versus annually—plays a crucial role in determining your overall loan cost. This section will explore the long-term implications of these different compounding schedules.

The key difference lies in how often interest is calculated and added to your principal balance. With annual compounding, interest is calculated once a year and added to your principal. Monthly compounding, on the other hand, calculates and adds interest to your principal balance twelve times a year. This seemingly small difference leads to substantial variations in the total interest paid over the life of the loan.

Comparison of Repayment Schedules

The following example illustrates the difference between monthly and annual compounding for a $10,000 loan with a 5% annual interest rate over a 10-year repayment period. We’ll use simplified calculations for illustrative purposes; actual loan calculations incorporate more complex amortization schedules.

Let’s assume a fixed monthly payment for both scenarios. With annual compounding, the interest is calculated at the end of each year, while with monthly compounding, the interest is calculated and added to the principal at the end of each month. Although the annual interest rate is the same (5%), the more frequent compounding of the monthly option leads to a higher effective interest rate. Consequently, the total amount repaid over the 10 years would be higher with monthly compounding.

For the sake of clarity, consider this simplified scenario. In the annual compounding example, the interest accrued at the end of the first year would be $500 ($10,000 x 0.05). This $500 is then added to the principal, resulting in a new principal of $10,500 for the second year’s calculation. This process continues for ten years.

Conversely, with monthly compounding, the interest is calculated on 1/12th of the annual interest rate each month. This means that for the first month, interest would be approximately $41.67 ($10,000 x 0.05/12). This amount is added to the principal before the next month’s interest calculation. This iterative process leads to a larger accumulated interest over the ten-year period compared to annual compounding.

While precise figures require complex amortization calculations, the fundamental principle remains: more frequent compounding leads to a higher effective interest rate and, therefore, a greater total repayment amount.

Impact of Compounding Frequency on Total Loan Cost

To summarize the key differences between monthly and annual compounding on the total loan cost, consider the following:

- Effective Interest Rate: Monthly compounding results in a higher effective annual interest rate than annual compounding, even if the stated annual rate is the same.

- Total Interest Paid: Borrowers will pay significantly more in total interest over the life of the loan with monthly compounding compared to annual compounding.

- Total Repayment Amount: The total amount repaid (principal plus interest) will be substantially higher with monthly compounding.

- Repayment Schedule: While monthly payments might be slightly higher with annual compounding (due to a lower total interest paid), the cumulative effect of monthly compounding leads to a greater total repayment over the loan term.

Practical Implications for Borrowers

Understanding the intricacies of student loan interest, particularly the impact of compounding frequency, is crucial for effective debt management. Failing to grasp these concepts can lead to significantly higher repayment amounts and extended repayment periods. This section will provide practical guidance on navigating your loan agreements and employing strategies to minimize the overall cost of borrowing.

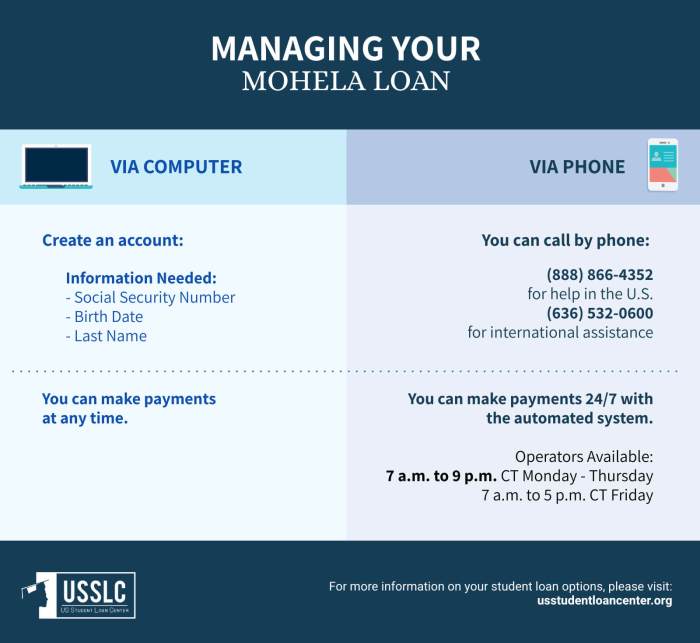

Understanding Loan Agreements and Interest Calculations

Borrowers should carefully examine their loan agreements to fully understand the terms and conditions. This includes identifying the interest rate, the compounding frequency (monthly, quarterly, or annually), and the repayment schedule. Many loan servicers provide online tools and resources to help borrowers calculate their monthly payments and project their total repayment costs. These tools often allow borrowers to simulate different repayment scenarios, such as making extra payments or refinancing, allowing for informed decision-making. It’s important to note that the compounding frequency directly affects the total interest accrued over the life of the loan; more frequent compounding leads to faster growth of the principal balance and ultimately, a higher total repayment amount.

Identifying Compounding Frequency in Loan Documents

Carefully review the loan documents provided by your lender. The compounding frequency should be clearly stated within the terms and conditions. Look for phrases such as “interest compounded monthly,” “interest compounded annually,” or similar language. If you are unable to locate this information, contact your loan servicer directly for clarification. Misunderstanding this crucial detail can lead to inaccurate estimations of your total repayment cost and can significantly impact your long-term financial planning.

Strategies for Minimizing the Impact of Compound Interest

Several strategies can help mitigate the effects of compound interest on your student loans. Making extra payments, even small ones, can significantly reduce the principal balance and thus the amount of interest accrued over time. Consider paying more than the minimum monthly payment whenever possible. Another effective strategy is to refinance your loans to a lower interest rate, if available. Refinancing can consolidate multiple loans into one, potentially simplifying repayment and reducing the overall interest paid. Exploring income-driven repayment plans may also provide relief, adjusting payments based on your income and making them more manageable, though it may extend the repayment period.

Steps to Effectively Manage Student Loan Debt

Understanding the impact of compound interest is fundamental to effective student loan debt management. Here are key steps borrowers can take:

- Understand your loan terms completely: Thoroughly review all loan documents, paying close attention to the interest rate and compounding frequency.

- Budget effectively: Create a realistic budget that incorporates your student loan payments. This ensures consistent payments and avoids missed payments or late fees.

- Explore repayment options: Research and compare different repayment plans offered by your lender. This may include standard, accelerated, or income-driven repayment options.

- Make extra payments when possible: Even small additional payments can significantly reduce your principal balance and shorten your repayment period.

- Consider refinancing: Explore the possibility of refinancing your loans to secure a lower interest rate or consolidate multiple loans.

- Seek professional advice: If needed, consult with a financial advisor to develop a comprehensive student loan repayment strategy.

Illustrative Scenarios

Understanding the impact of compounding frequency on student loan repayment requires examining specific scenarios. The following examples illustrate how the differences between monthly and annual compounding, and between fixed and variable interest rates, can significantly affect the total cost of a loan.

Significant Increase in Interest with Monthly Compounding

Scenario: A student borrows $20,000 at a 6% annual interest rate for 10 years. If the interest is compounded annually, the total interest paid will be considerably less than if the interest is compounded monthly.

In this scenario, the monthly compounding means interest is calculated and added to the principal balance each month. This leads to a snowball effect, where the interest accrued in each subsequent month is calculated on a slightly larger principal balance. Over the ten-year loan term, this seemingly small difference in calculation frequency results in a noticeably higher total interest paid compared to annual compounding. The exact figures would require a loan amortization calculator, but the difference can amount to hundreds or even thousands of dollars.

Minimal Difference Between Monthly and Annual Compounding

Scenario: A student borrows $5,000 at a 2% annual interest rate for 2 years.

With a lower interest rate and shorter repayment period, the difference between monthly and annual compounding becomes less pronounced. The total interest accrued over two years is relatively small to begin with. The additional interest generated by monthly compounding, while still present, is minimal in this case. The difference in total repayment cost would likely be negligible, possibly only a few dollars.

Fixed vs. Variable Interest Rates with Compounding

Scenario 1: A student borrows $15,000 at a fixed 4% annual interest rate compounded monthly for 5 years. Scenario 2: A student borrows $15,000 at a variable interest rate that starts at 3% annually compounded monthly, but increases to 7% annually compounded monthly after the second year for the remaining 3 years.

In Scenario 1, the predictability of the fixed rate allows for accurate calculation of total repayment cost. The monthly compounding will increase the total cost compared to annual compounding, but the amount is consistent and predictable. Scenario 2, however, illustrates the risks associated with variable interest rates. While initially lower, the interest rate increase significantly impacts the total interest paid, especially when combined with monthly compounding. The increasing interest rate during the latter part of the loan magnifies the effect of monthly compounding, leading to a potentially substantial increase in the total repayment amount compared to the fixed-rate scenario, despite the initial lower rate. This highlights the importance of carefully considering the risks of variable interest rates, particularly when monthly compounding is in effect.

Conclusion

Ultimately, understanding whether your student loans are compounded monthly or annually is vital for accurate budgeting and effective long-term financial planning. While the difference might seem small at first glance, the cumulative effect of compounding over several years can be substantial. By carefully reviewing your loan documents, understanding the specific terms of your loan, and employing effective debt management strategies, you can minimize the impact of compound interest and navigate your student loan repayment journey with greater confidence and control. Remember, proactive engagement with your loan details is key to responsible borrowing and successful repayment.

Clarifying Questions

What is the difference between fixed and variable interest rates on student loans?

Fixed interest rates remain constant throughout the loan term, while variable rates fluctuate based on market indices, potentially leading to unpredictable repayment amounts.

Can I refinance my student loans to get a lower interest rate or different compounding frequency?

Yes, refinancing may be an option to secure a lower interest rate or a more favorable compounding frequency. However, carefully compare offers from different lenders before making a decision.

How can I estimate the total interest I’ll pay on my student loans?

Many online loan calculators allow you to input your loan details (principal, interest rate, compounding frequency, and loan term) to estimate the total interest you will pay over the life of the loan.

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to default, with serious financial consequences.