Navigating the complex world of student loans often leaves individuals questioning their financial implications. Are student loans considered income? The answer, surprisingly, isn’t a simple yes or no. This exploration delves into the multifaceted ways student loans impact your financial picture, from tax implications and financial aid applications to credit scores and employment prospects. Understanding how student loans are treated financially is crucial for effective budgeting, responsible debt management, and long-term financial well-being.

This guide provides a comprehensive overview of how student loans affect various aspects of your financial life. We’ll examine the nuances of tax deductions, the impact on financial aid eligibility, and the role student loan repayment plays in building credit. Furthermore, we’ll explore how potential employers view student loan debt and offer strategies for managing this debt while pursuing career goals. By the end, you’ll have a clearer understanding of how student loans interact with your income and overall financial health.

Defining Student Loan Income

Student loan payments, while representing a significant financial obligation, are not typically considered income in the traditional sense. However, their impact on overall financial standing and tax implications can be nuanced and depend on several factors. Understanding how student loans are treated regarding income is crucial for accurate financial reporting and tax planning.

The primary way student loan debt affects income is indirectly, through its influence on disposable income. Essentially, the money you allocate to student loan repayments is money you cannot spend elsewhere. This reduced disposable income can affect your eligibility for certain government assistance programs or influence your ability to save or invest. This indirect impact isn’t reflected as income itself but impacts calculations based on your available resources. Directly, only the interest accrued on certain types of student loans might be considered taxable income, but this is a rare circumstance.

Student Loan Deferment and Forbearance Impact on Income Reporting

Deferment and forbearance are temporary pauses in student loan repayment. During these periods, you don’t make payments, but interest may still accrue. While these pauses don’t directly alter reported income, they can indirectly impact your financial situation. For example, if you qualify for income-driven repayment plans (IDR), your income is used to determine your monthly payment amount. A period of deferment or forbearance might temporarily lower your reported income, potentially leading to a lower payment amount upon resuming repayment under the IDR plan. Consider a scenario where a borrower is enrolled in an income-driven repayment plan and experiences a period of unemployment. They may be able to defer their loan payments, and this temporary reduction in reported income might lower their payment amount when they return to work. However, it’s crucial to understand that this doesn’t mean they’re reporting zero income; it simply means their income is factored into a recalculation of their monthly payment.

Distinction Between Student Loan Payments and Other Debt Repayment

Unlike some other forms of debt, such as business loans or credit card debt, student loan payments don’t directly contribute to reported income. Payments on business loans, for example, may be deductible as business expenses, impacting taxable income. Conversely, student loan interest (excluding the rare instances mentioned earlier) is generally not tax deductible for federal income tax purposes, unless you itemize deductions and meet specific criteria. Credit card debt repayment doesn’t impact your reported income either; it’s simply an expense. The key difference lies in the source of the debt and its purpose. Student loans are intended to fund education, while other debts are often related to business ventures or personal spending. This fundamental difference in purpose dictates how they are treated within the context of income calculations and tax reporting.

Student Loans and Tax Implications

Navigating the tax implications of student loans can be complex, impacting both your current tax liability and your long-term financial planning. Understanding these implications is crucial for responsible financial management. This section will clarify key aspects of student loan tax interactions.

Student loan interest deductions affect taxable income by reducing the amount of income subject to taxation. This deduction can lower your overall tax bill, providing a significant financial benefit to borrowers. The amount of the deduction is limited and depends on your modified adjusted gross income (MAGI). For example, if your MAGI is below a certain threshold (which varies yearly), you might be able to deduct the full amount of interest you paid during the year. However, if your MAGI exceeds that threshold, the deduction may be reduced or phased out entirely. It’s essential to consult the IRS guidelines each year to determine your eligibility and the exact deduction amount.

Student Loan Interest Deduction

The student loan interest deduction allows taxpayers to deduct the actual amount of interest they paid on qualified education loans during the tax year. This deduction is claimed on Form 1040, Schedule 1 (Additional Income and Adjustments to Income). The eligibility criteria include being the student or parent of the student, and the loan must be used for higher education expenses. The deduction is subject to income limitations; exceeding these limits will gradually reduce or eliminate the deduction. For instance, a single filer with a MAGI exceeding a certain level will see a reduced deduction, potentially to zero. Precise income limits and deduction amounts are updated annually by the IRS and should be verified on their website.

Tax Implications of Student Loan Forgiveness Programs

Student loan forgiveness programs, while offering financial relief, often have tax implications. Forgiven student loan debt is generally considered taxable income in the year it’s forgiven. This means that the forgiven amount will be added to your gross income, potentially increasing your tax liability. However, there are exceptions. For example, forgiven debt under certain programs, like those for teachers or public service employees, might not be considered taxable income. It’s critical to understand the specifics of the forgiveness program to determine the tax consequences. For instance, if $10,000 of student loan debt is forgiven under a program that isn’t tax-exempt, the borrower would need to report this amount as income on their tax return. This could significantly impact their tax bracket and overall tax liability.

Student Loan Payments as a Business Expense

Generally, student loan payments are not deductible as a business expense. This differs from other education expenses, which may be deductible under certain circumstances, such as continuing education related to one’s profession. However, there might be very specific exceptions, such as when the education is required for a particular job or license. This is highly dependent on the individual circumstances and requires careful consideration of tax laws and regulations. Consulting with a tax professional is highly recommended in such cases to ensure compliance and to explore any potential avenues for deduction.

Student Loans and Financial Aid Applications

Navigating the financial aid process can be complex, especially when student loan debt is a factor. Understanding how various financial aid applications consider existing student loan payments is crucial for maximizing your eligibility for assistance. This section will clarify how different applications treat student loan debt and what other factors influence financial need assessments.

The impact of student loan debt on financial aid eligibility is significant. While student loans themselves aren’t directly counted as income on most applications, the burden of repayment can significantly influence your demonstrated financial need. This is because financial aid formulas consider your overall financial picture, including your existing debt obligations.

FAFSA and Other Application Treatment of Student Loan Payments

The following table compares how different financial aid applications commonly treat student loan payments in the calculation of financial need. Note that specific requirements and calculations can vary slightly from year to year and between institutions, so it’s always best to consult the official application guidelines.

| Application | Student Loan Payments as Income | Impact on Need-Based Aid | Other Relevant Factors |

|---|---|---|---|

| FAFSA (Free Application for Federal Student Aid) | Not directly counted as income | Indirectly impacts need calculation through the assessment of total debt and repayment burden | Considers total debt, monthly payments, and the type of loan |

| CSS Profile (College Scholarship Services Profile) | Not directly counted as income | Considers total debt and repayment burden, offering a more holistic view of financial circumstances | Similar to FAFSA, but may delve deeper into family assets and income |

| Institutional Aid Applications | Varies widely by institution | Some institutions may consider loan payments in their need analysis, while others may not | Each institution has its own specific criteria and may use different formulas |

Factors Considered When Assessing Financial Need

Understanding the factors that influence financial need assessments is vital for students seeking aid. These factors are used to determine eligibility and the amount of aid awarded. Student loan burdens are a key component of this assessment.

- Parent/Student Income: Your annual income (and your parents’ income, if you are a dependent student) is a primary factor.

- Assets: Savings accounts, investments, and other assets are considered.

- Family Size: The number of people in your household influences the calculation of need.

- Number of Children in College: If multiple children are attending college simultaneously, this can significantly impact financial need.

- Student Loan Debt: Existing student loan debt, including both the total amount owed and the monthly payment burden, significantly impacts your demonstrated need. A larger debt burden typically translates to a greater need for financial assistance.

- Unusual Expenses: High medical expenses or other unusual financial circumstances may be considered.

Hypothetical Case Study: Impact of Student Loans on Financial Aid Eligibility

Let’s consider two hypothetical students applying for financial aid:

Student A has no existing student loan debt and a relatively high family income. Student B has significant student loan debt from a previous degree and a lower family income. Even though Student A’s family has a higher income, Student B’s substantial loan burden may result in them being deemed to have a greater financial need and, therefore, receiving more financial aid than Student A. This highlights how existing student loan debt can influence the financial aid application process, even when income levels differ.

Student Loans and Credit Scores

Managing student loan debt effectively is crucial not only for your financial well-being but also for building a strong credit history. Your student loan repayment behavior significantly impacts your credit score, a key factor in obtaining loans, credit cards, and even some rental agreements. Understanding this relationship allows you to make informed decisions and maximize the positive impact of your loan repayment on your creditworthiness.

Student loan payments, whether on-time or missed, are meticulously tracked by credit bureaus and directly influence your credit score. The impact of consistent, timely payments is dramatically different from the consequences of missed or late payments. This section will delve into the specifics of how your student loan repayment history affects your credit score.

Impact of On-Time versus Missed Student Loan Payments on Credit Scores

On-time student loan payments contribute positively to your credit score by demonstrating responsible financial behavior. Credit bureaus view this consistent repayment as a sign of reliability and trustworthiness, leading to an improved credit score. Conversely, missed or late payments significantly damage your credit score. Even a single missed payment can negatively impact your creditworthiness, potentially leading to higher interest rates on future loans and difficulty securing credit. The severity of the impact depends on factors such as the number of missed payments and the length of delinquency. For example, consistently making on-time payments for several years can boost a credit score considerably, while multiple missed payments can severely depress it, potentially resulting in a lower credit score for years.

Key Metrics Used to Assess the Impact of Student Loans on Creditworthiness

Credit bureaus use several key metrics to assess the impact of student loans on your creditworthiness. These include payment history, which accounts for the largest portion of your credit score. Consistent on-time payments on your student loans contribute significantly to a positive payment history. Amounts owed, another crucial factor, refers to the outstanding balance on your student loans. A high balance relative to your available credit can negatively impact your credit utilization ratio, which measures how much of your available credit you are using. Length of credit history, encompassing the duration you’ve had student loans, also plays a role. A longer history of responsible repayment demonstrates financial stability and contributes positively to your score. Finally, credit mix, referring to the diversity of credit accounts (including student loans), can also have a slight impact on your credit score. A diverse credit mix can be viewed favorably.

Consistent Student Loan Repayment and Positive Credit Profile

A consistent history of on-time student loan repayment is a cornerstone of a positive credit profile. This consistent behavior signals to lenders that you are a responsible borrower, increasing your creditworthiness. This positive track record can lead to lower interest rates on future loans, better terms on credit cards, and easier access to credit overall. Furthermore, building a positive credit history early in life, through responsible student loan management, lays the groundwork for a strong financial future. This can significantly benefit you when applying for mortgages, auto loans, and other significant financial commitments later in life. For example, individuals with consistently positive student loan repayment histories are often approved for better loan terms and lower interest rates compared to those with a history of missed payments.

Student Loans and Employment Opportunities

Navigating the job market with student loan debt can feel daunting, but understanding how potential employers view this debt and developing effective strategies to manage it can significantly improve your job prospects and overall financial well-being. The presence of student loan debt doesn’t automatically disqualify a candidate, but it’s a factor that employers may consider, particularly in conjunction with other aspects of the applicant’s financial profile.

The impact of student loan debt on employment opportunities is multifaceted. While it’s not typically a direct barrier to employment, it can indirectly influence a candidate’s attractiveness to potential employers. For example, high levels of debt might suggest a candidate is risk-averse or less likely to pursue opportunities that require relocation or career changes, due to financial constraints. Conversely, successfully managing student loan debt demonstrates financial responsibility and discipline, qualities valued by many employers.

Employer Perceptions of Student Loan Debt

Employers generally understand that many young professionals graduate with student loan debt. However, the *amount* of debt and the applicant’s demonstrated ability to manage it are key considerations. A candidate with a manageable debt load and a clear repayment plan may be viewed more favorably than someone with significantly higher debt and no demonstrable strategy for repayment. Some employers even offer financial wellness programs to assist employees with debt management, recognizing the impact it can have on employee productivity and well-being. The overall financial health of the applicant, as reflected in their credit report and debt-to-income ratio, provides a more complete picture than simply the presence of student loan debt.

Managing Student Loan Debt While Seeking Employment

Effective management of student loan debt during a job search involves careful budgeting and proactive planning. This might involve prioritizing essential expenses, seeking out affordable housing options, and minimizing non-essential spending. Many lenders offer forbearance or deferment options that temporarily suspend or reduce monthly payments, providing some financial breathing room during a job search. It’s crucial to communicate openly and honestly with lenders about your circumstances to explore available options and avoid negative impacts on your credit score. Utilizing budgeting apps and creating a detailed financial plan can also provide clarity and control over personal finances. For example, a recent graduate might prioritize finding a roommate to share housing costs, use public transportation instead of owning a car, and carefully track expenses to ensure they stay within their budget.

Negotiating Salary Considering Student Loan Obligations

When negotiating a salary, it’s important to present a professional and confident approach. While directly mentioning student loan debt might not be necessary or advisable in initial salary discussions, a comprehensive understanding of your total compensation package (including benefits like health insurance and retirement contributions) is crucial. A higher salary can help offset the burden of student loan repayments. It’s advisable to research industry salary standards for the specific role and location to ensure your salary request is competitive. Focusing on the value you bring to the employer and the skills and experience you possess will strengthen your negotiation position. For example, a candidate might highlight their relevant skills and experience, emphasizing their potential contribution to the company’s success, to justify a higher salary that will help them manage their student loan debt effectively.

Student Loans and Budgeting

Effective budgeting is crucial for successfully managing student loan debt alongside other financial responsibilities. A well-structured budget allows you to prioritize loan repayments while ensuring you meet your essential living expenses. Failing to plan can lead to missed payments, impacting your credit score and potentially increasing the overall cost of your loans.

Sample Student Loan Budget

Creating a realistic budget requires careful consideration of your income and expenses. The following sample budget demonstrates how to incorporate student loan payments. Remember, this is a template; your specific budget will depend on your individual circumstances.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Monthly Salary/Income | $2500 | Rent/Mortgage | $1000 |

| Part-time Job Income | $500 | Student Loan Payment | $300 |

| Other Income (e.g., scholarships) | $0 | Groceries | $300 |

| Utilities (Electricity, Water, Gas) | $150 | ||

| Transportation | $200 | ||

| Health Insurance | $100 | ||

| Total Income | $3000 | Other Expenses (Entertainment, etc.) | $150 |

| Total Expenses | $2200 | ||

| Savings/Emergency Fund | $800 |

Creating a Realistic Budget

Developing a realistic budget involves a step-by-step process. First, accurately track your income from all sources. Next, meticulously list all your expenses, categorizing them (housing, food, transportation, etc.). Then, compare your total expenses to your total income. If expenses exceed income, identify areas where you can reduce spending or increase income. Finally, allocate a specific amount for your student loan payments and ensure this amount is consistently paid. Regularly review and adjust your budget as needed.

Budgeting Methods for Managing Student Loan Debt

Several budgeting methods can effectively manage student loan debt. The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. The zero-based budget method involves allocating every dollar of your income to a specific expense category, ensuring that all income is accounted for. The envelope system involves allocating cash to specific expense categories in envelopes, promoting mindful spending. Choosing the right method depends on your personal preferences and financial situation. Experiment to find the method that best suits your needs and helps you stay on track with your loan repayments.

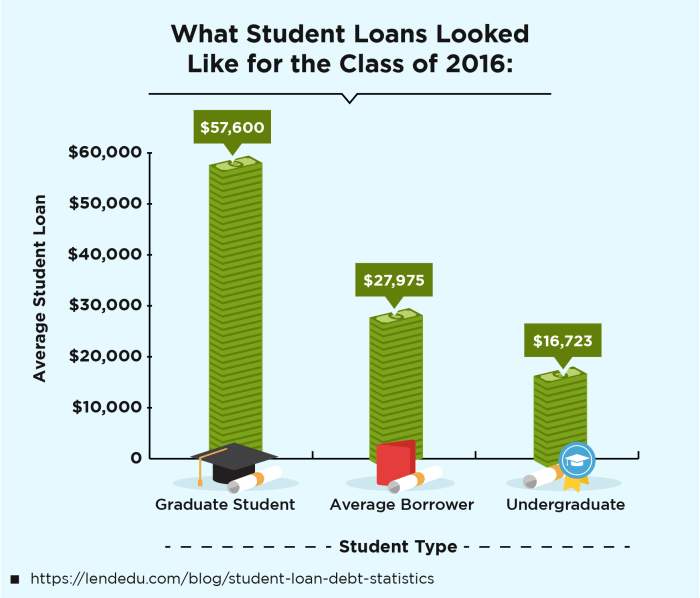

Visual Representation of Student Loan Impact

Visual representations are crucial for understanding the significant financial burden student loans can impose. Graphs and charts effectively illustrate the allocation of income towards loan repayments and the overall impact on personal finances across various income levels and timeframes. The following sections detail how different visual tools can help clarify this complex issue.

Bar Graph: Percentage of Income Allocated to Student Loan Payments Across Income Brackets

A bar graph can effectively depict the percentage of income dedicated to student loan payments across different income brackets. The horizontal axis would represent income brackets (e.g., $20,000 – $30,000, $30,000 – $40,000, and so on), while the vertical axis would show the percentage of income allocated to student loan repayments. Each bar would represent a specific income bracket, with its height corresponding to the average percentage of income spent on loan payments within that bracket. For instance, a taller bar for the $20,000-$30,000 bracket compared to the $80,000-$90,000 bracket would visually demonstrate the disproportionate impact of student loan payments on lower-income individuals. This visual representation clearly highlights how a larger percentage of a lower income is often consumed by loan repayments.

Pie Chart: Distribution of Income Among Various Expenses, Including Student Loan Payments

A pie chart offers a clear picture of how income is distributed among various expenses, with a dedicated slice representing student loan payments. The entire circle represents total monthly or annual income. Each slice represents a different expense category (e.g., housing, food, transportation, student loan payments, entertainment). The size of each slice is proportional to the amount of income allocated to that category. A large slice dedicated to student loan payments would visually emphasize its significant impact on overall budget allocation. For example, a pie chart might show a 25% slice for student loan payments, highlighting its substantial portion of the total income. This provides a quick and intuitive understanding of the relative cost of student loan repayments compared to other expenses.

Line Graph: Trend of Student Loan Debt Accumulation and Repayment Over Time

A line graph can effectively illustrate the accumulation and repayment of student loan debt over time. The horizontal axis represents time (e.g., years since graduation), and the vertical axis represents the total student loan debt. The graph would show two lines: one representing the accumulation of debt (increasing initially) and another representing the repayment of debt (decreasing over time). The intersection point of these lines would represent the point at which the repayment process begins to reduce the overall debt. This visual would showcase the initial growth of debt followed by a gradual decrease as loan payments are made. For instance, the line representing debt accumulation could show a sharp rise in the first few years after graduation, followed by a slower, more gradual decline as repayment progresses. This allows for an easy visualization of the debt’s trajectory.

Conclusion

In conclusion, understanding whether and how student loans are considered income is essential for responsible financial planning. The complexities surrounding tax implications, financial aid eligibility, credit scores, and employment prospects highlight the need for a thorough understanding of this topic. By carefully considering the information presented here, individuals can make informed decisions about their student loan repayment strategies and proactively manage their financial future. Remember, proactive planning and informed decision-making are key to navigating the financial landscape shaped by student loan debt.

Essential FAQs

Are student loan deferments considered income?

No, deferred student loan payments are not considered income. However, the interest that accrues during deferment may still impact your tax liability.

Can I deduct student loan interest from my taxes even if I don’t itemize?

No, the student loan interest deduction is an itemized deduction. You can only claim it if you itemize deductions on your tax return rather than using the standard deduction.

How do private student loans differ from federal student loans in terms of income reporting?

The tax implications are generally similar, but the specific terms of your loan (e.g., interest rates, repayment plans) will influence your overall financial picture. Always refer to your loan documents.

Will my student loan debt affect my ability to get a mortgage?

Yes, lenders consider student loan debt as part of your debt-to-income ratio when assessing your mortgage application. A high debt-to-income ratio can make it harder to qualify for a mortgage.