Are student loans paused again in 2024? The question hangs heavy in the minds of millions of Americans burdened by student loan debt. The recent history of payment pauses, initiated in response to the COVID-19 pandemic, has created a climate of uncertainty. This uncertainty is further fueled by ongoing political debates surrounding student loan forgiveness and the economic implications of extending these pauses. Understanding the current status, potential future scenarios, and available resources is crucial for borrowers navigating this complex landscape.

This analysis delves into the current status of student loan payments, exploring the official government announcements and the timeline of past pauses. We’ll examine the potential economic impacts of extending the pause, both for borrowers and the higher education system, and consider the perspectives of student loan servicers and the government. Furthermore, we’ll explore borrower experiences, political factors influencing policy decisions, and provide practical financial planning advice for the eventual resumption of payments.

Current Status of Student Loan Payments

The status of student loan payments in 2024 is a complex issue with significant implications for millions of borrowers. Following an extended period of pandemic-related pauses, the resumption of payments has been a subject of considerable debate and legal challenges. Understanding the current situation requires examining both the official government pronouncements and the timeline of past payment suspensions.

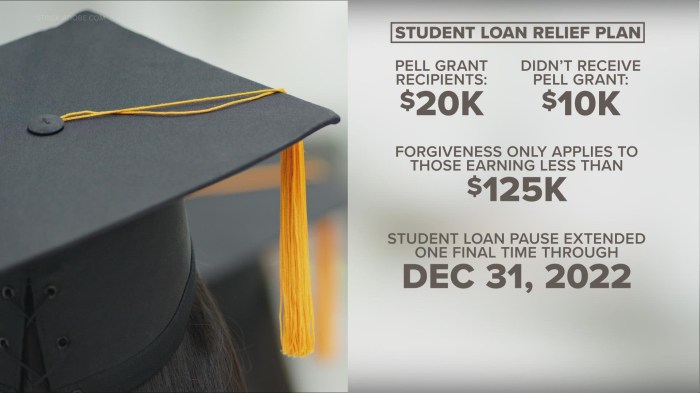

The current status is that the pause on federal student loan payments has ended. The Supreme Court struck down the Biden administration’s plan for broad student loan forgiveness, leaving borrowers to resume payments. The Department of Education has provided detailed information on repayment plans and options available to borrowers. This information can be found on the official Department of Education website and through other official government channels. Importantly, borrowers should proactively engage with their loan servicer to understand their repayment options and avoid potential delinquency.

Official Government Announcements Regarding Student Loan Payment Pauses and Extensions

Several official government announcements have shaped the landscape of student loan payments over the past few years. These announcements, originating primarily from the Department of Education and the White House, have detailed the implementation, extension, and eventual termination of payment pauses. These announcements have often been accompanied by press releases and statements clarifying the rationale behind the decisions and outlining the support services available to borrowers during the periods of suspension. The lack of a comprehensive forgiveness plan has, however, left many borrowers facing the prospect of resuming payments after a prolonged period of forbearance.

Timeline of Past Student Loan Payment Pauses

The COVID-19 pandemic led to unprecedented measures to provide economic relief, including pauses on federal student loan payments. These pauses provided temporary relief to millions of borrowers facing financial hardship. Understanding the timeline of these pauses is crucial for comprehending the current situation and the challenges facing borrowers as payments resume.

Comparison of Student Loan Payment Pause Periods

The following table summarizes the key periods of student loan payment pauses:

| Period | Start Date | End Date | Relevant Details |

|---|---|---|---|

| First Pause | March 13, 2020 | September 30, 2020 | Implemented in response to the COVID-19 pandemic. |

| Second Pause | October 1, 2020 | January 31, 2021 | Extension of the initial pause. |

| Third Pause | February 1, 2021 | September 30, 2021 | Further extension, with additional details on interest accrual. |

| Fourth Pause | October 1, 2021 | May 1, 2022 | Continued extension, with ongoing debates about potential forgiveness. |

| Fifth Pause | May 2, 2022 | August 31, 2022 | Final extension before the planned resumption of payments. |

| Sixth Pause (Postponed Resumption) | September 1, 2022 | January 1, 2023 | Postponed resumption due to legal challenges to the forgiveness plan. |

| Resumption of Payments | January 1, 2023 | Present | Payments resumed after the Supreme Court ruling against the broad forgiveness plan. |

Impact of a Potential Pause Extension

Extending the pause on student loan payments would have significant ripple effects across the economy, impacting borrowers, the higher education system, and the federal government. The ramifications are complex and multifaceted, demanding careful consideration before any decision is made. Analyzing these potential consequences is crucial for informed policymaking.

The economic effects of an extended pause are multifaceted. For borrowers, a continued pause provides immediate financial relief, allowing them to allocate funds towards other essential expenses like rent, groceries, and healthcare. This could stimulate consumer spending in the short term. However, delaying repayment could also lead to a buildup of interest, ultimately increasing the total debt burden for many borrowers. The longer the pause, the larger this accrued interest becomes, potentially negating any short-term economic benefits. This deferred payment could also delay the ability of some borrowers to build credit history or improve their financial standing. For example, a borrower relying on on-time loan payments to secure a mortgage might face delays.

Economic Effects on Borrowers

An extended pause offers short-term financial relief to millions of borrowers, freeing up disposable income for immediate needs. However, this relief is potentially temporary, as the accumulated interest will eventually need to be repaid, potentially leading to a larger overall debt. This could hinder long-term financial planning and negatively impact credit scores for some borrowers, creating a cycle of debt. The potential for increased delinquency and default rates also poses a risk. For instance, if the pause extends for another year, a borrower with a $50,000 loan might accrue thousands of dollars in additional interest, significantly impacting their future financial stability.

Impact on the Higher Education System

The impact on the higher education system is less direct but still significant. A prolonged pause could influence enrollment decisions, potentially leading to decreased demand for higher education if prospective students perceive less urgency to repay loans. Conversely, it could also create an incentive for increased enrollment if students feel more financially secure in taking on debt. The long-term effects on the financial health of colleges and universities, which rely heavily on tuition revenue, remain uncertain and depend largely on the overall impact on student enrollment. Universities might need to adjust their financial planning and resource allocation based on the changing landscape of student loan repayment.

Perspectives from Student Loan Servicers

Student loan servicers, the companies responsible for managing student loan accounts, would likely face operational challenges with a pause extension. They would need to continue managing accounts without receiving payments, requiring adjustments to their staffing and technology infrastructure. The increased complexity of managing the pause, including communicating with borrowers and handling potential disputes, would likely increase operational costs. Furthermore, a longer pause could strain their relationships with borrowers, particularly if communication regarding repayment options becomes less clear. The added administrative burden could lead to operational inefficiencies and increased costs for these companies.

Financial Implications for the Government

The government faces a trade-off. An extended pause delays the collection of loan repayments, reducing immediate revenue. This loss of revenue could necessitate adjustments to the federal budget, potentially impacting other government programs. However, a pause might also reduce the risk of widespread defaults, which would be significantly more costly for the government in the long run. The overall financial impact would depend on several factors, including the length of the extension, the rate of interest accrual, and the ultimate repayment rates following the end of the pause. A detailed cost-benefit analysis, comparing various extension scenarios, would be crucial for informed decision-making. For example, a shorter extension might minimize the revenue loss while still providing sufficient relief to borrowers, reducing the overall fiscal risk to the government.

Borrower Experiences and Perspectives

The extended pauses on student loan payments, while offering temporary relief, have created a complex tapestry of experiences among borrowers. The impact varied widely depending on individual financial situations, pre-existing debt levels, and personal coping mechanisms. Understanding these diverse perspectives is crucial for navigating the eventual resumption of payments.

The periods of forbearance provided a much-needed breathing room for many borrowers. Some were able to use the time to address other financial priorities, such as paying down high-interest credit card debt or saving for emergencies. Others used the pause to focus on career advancement, further education, or family needs. However, the pause also created uncertainty and anxiety for many. The temporary nature of the relief meant that the underlying debt remained, and the looming resumption of payments created considerable stress.

Experiences During Past Payment Pause Periods

The past payment pauses offered a mixed bag of experiences. While some borrowers used the time to improve their financial standing, others found the reprieve insufficient to address deeply entrenched financial difficulties. For example, individuals facing unemployment or unexpected medical expenses might have found the pause helpful in preventing immediate delinquency, but the underlying financial fragility remained. Conversely, those with stable employment and manageable budgets may have used the pause to strategically pay down other debts or save for future expenses. The overall impact was highly individualized, dependent on the borrower’s unique financial circumstances.

Concerns and Anxieties Regarding Future Payments

Borrowers express a wide range of concerns about the resumption of student loan payments. A primary concern is the potential for financial hardship. Many borrowers fear that the added expense will significantly impact their ability to meet other essential needs, such as housing, food, and healthcare. Uncertainty about future employment prospects also fuels anxiety. The fear of unexpected job loss or reduced income adds another layer of stress to the already considerable burden of student loan debt. Furthermore, many borrowers lack a clear understanding of their repayment options and available resources, leading to feelings of helplessness and confusion.

Strategies Borrowers Are Using to Prepare for Resuming Payments

Facing the imminent return of student loan payments, many borrowers are actively seeking strategies to mitigate the financial impact. Many are budgeting meticulously, tracking expenses, and identifying areas where they can cut back. Others are exploring income-driven repayment plans, which adjust monthly payments based on income and family size. Some borrowers are proactively contacting their loan servicers to discuss their options and explore potential deferments or forbearances. Finally, many are seeking financial counseling to gain a better understanding of their financial situation and develop a comprehensive repayment plan. The approach taken is highly individualized, with borrowers adapting strategies to their unique circumstances and risk tolerance.

Examples of Financial Hardship Cases Related to Student Loan Debt

The impact of student loan debt can be devastating for some borrowers. Consider the case of a single parent struggling to balance childcare costs, rent, and student loan payments. The added financial strain can lead to difficult choices, potentially impacting the quality of life for both the parent and child. Another example is an individual who experienced a job loss during the pandemic and now faces the prospect of resuming student loan payments with significantly reduced income. These situations illustrate how student loan debt can exacerbate existing financial vulnerabilities, potentially leading to homelessness, food insecurity, or medical debt accumulation. These cases underscore the need for robust support systems and flexible repayment options to mitigate the potential for severe financial hardship.

Political and Legislative Factors

The ongoing debate surrounding student loan forgiveness and payment pauses reflects a deep partisan divide in American politics. Differing views on the economic impact, the fairness of the system, and the role of government intervention have shaped the policy landscape and continue to fuel intense political discussions. These disagreements significantly influence the likelihood of future legislative actions affecting student loan borrowers.

The political debate centers on several key points. Republicans generally express concerns about the cost of widespread loan forgiveness, arguing it would increase the national debt and unfairly benefit higher earners. They often advocate for market-based solutions and reforms to the higher education system to address affordability. Democrats, conversely, tend to emphasize the social and economic benefits of loan forgiveness, arguing it would stimulate the economy and alleviate financial burdens for millions of borrowers, particularly those from marginalized communities. They frequently highlight the systemic inequalities within the student loan system and advocate for government intervention to correct these imbalances.

The Role of Political Parties in Shaping Student Loan Policies

The differing philosophies of the Democratic and Republican parties have resulted in contrasting approaches to student loan policy. Democrats have historically supported more expansive loan forgiveness programs and payment pause extensions, viewing them as necessary tools to address economic inequality and promote social mobility. Republicans, on the other hand, have generally favored more targeted relief measures or reforms to the student loan system itself, often focusing on measures to control costs and promote responsible borrowing. The balance of power in Congress significantly impacts the potential for legislative action on student loan issues. For example, during periods of unified Democratic control, there have been more significant pushes for broad-based loan forgiveness plans. Conversely, when Republicans hold sway, legislative efforts have tended to focus on more conservative approaches, often involving targeted reforms rather than large-scale forgiveness initiatives.

Potential Legislative Actions Affecting Student Loan Payments in 2024

Several legislative actions could impact student loan payments in 2024. These range from extending the current payment pause to enacting comprehensive loan forgiveness programs or implementing significant reforms to the student loan system. The outcome will depend on the political climate, the composition of Congress, and the priorities of the administration. For instance, a Republican-controlled Congress might prioritize legislative efforts focused on reforming the current student loan system, possibly by streamlining the repayment process or introducing income-driven repayment plans with stricter eligibility criteria. Conversely, a Democratic-controlled Congress might be more inclined to pursue further extensions of the payment pause or even consider a more comprehensive loan forgiveness plan, potentially targeting specific demographics or loan amounts.

Potential Future Legislative Scenarios and Their Impact on Borrowers

The following scenarios illustrate potential legislative actions and their impact:

The potential legislative outcomes are highly dependent on the political landscape and prevailing economic conditions. These scenarios highlight the range of possibilities and the uncertainty surrounding the future of student loan policies.

- Scenario 1: Extension of the Payment Pause: Congress extends the payment pause for another period, providing temporary relief to borrowers but delaying the eventual reckoning with outstanding debt. This would offer short-term financial relief, but ultimately postpone the need to address the underlying systemic issues within the student loan system.

- Scenario 2: Targeted Loan Forgiveness: Congress approves a targeted loan forgiveness program, focusing on specific demographics (e.g., public service workers) or loan amounts. This approach would provide relief to a specific group of borrowers while limiting the overall cost to taxpayers compared to broader forgiveness initiatives. This would likely be seen as a compromise between complete forgiveness and no action.

- Scenario 3: Reforms to the Student Loan System: Congress focuses on reforms to the student loan system, such as implementing more streamlined repayment plans or improving the income-driven repayment program. This approach would aim to make the system more sustainable and equitable in the long run, but would not offer immediate relief to borrowers already burdened by debt. This could potentially include increased transparency and stricter regulations on lending practices.

- Scenario 4: No Action: Congress takes no action, leading to the resumption of student loan payments without any changes to the existing system. This would represent a significant shift away from the previous policies of payment pauses and would likely lead to immediate financial hardship for many borrowers. The long-term consequences could involve increased defaults and potential economic instability.

Financial Planning for Resumption of Payments

The resumption of student loan payments requires careful financial planning to avoid overwhelming debt and maintain financial stability. A proactive approach, encompassing budgeting, exploring repayment options, and utilizing available resources, is crucial for successful navigation of this transition. This section Artikels strategies and tools to assist borrowers in effectively managing their student loan debt post-pause.

Sample Budget for Borrowers

Creating a realistic budget is the cornerstone of successful student loan repayment. This involves tracking income and expenses to identify areas for potential savings. A sample budget might allocate a significant portion to the student loan payment, ensuring it’s treated as a non-negotiable expense. Other essential expenses, such as housing, transportation, food, and healthcare, should also be accounted for, leaving room for savings and discretionary spending. For example, a borrower earning $4,000 per month might allocate $800 for student loan payments (20%), $1,000 for rent (25%), $500 for groceries (12.5%), $200 for transportation (5%), and $500 for other expenses (12.5%), leaving $1,000 for savings and discretionary spending (25%). This is a sample and needs to be adjusted based on individual circumstances.

Repayment Plan Options

Several repayment plans are available, each tailored to different financial situations. The Standard Repayment Plan involves fixed monthly payments over 10 years. The Extended Repayment Plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher total interest paid. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base monthly payments on income and family size. These plans often lead to loan forgiveness after 20 or 25 years, depending on the plan and income level. Finally, Graduated Repayment Plans start with lower payments that gradually increase over time. Borrowers should carefully consider their financial situation and long-term goals when selecting a repayment plan.

Resources and Tools for Debt Management

Numerous resources and tools are available to assist borrowers in managing their student loan debt. The Federal Student Aid website (studentaid.gov) provides comprehensive information on repayment plans, loan forgiveness programs, and other relevant resources. Many lenders and non-profit organizations offer free financial counseling services to help borrowers create a personalized repayment strategy. Budgeting apps and personal finance software can also help track expenses, create budgets, and monitor progress towards loan repayment goals. These tools provide valuable insights and support for effective debt management.

Strategies for Consolidation and Refinancing

Consolidation combines multiple federal student loans into a single loan, simplifying repayment. Refinancing, on the other hand, involves replacing existing student loans with a new loan from a private lender, potentially securing a lower interest rate. Consolidation is generally advisable for borrowers with multiple federal loans seeking simplified repayment, while refinancing might be beneficial for borrowers with good credit scores seeking lower interest rates. However, refinancing federal loans with private loans means losing potential benefits like income-driven repayment plans and loan forgiveness programs. Borrowers should carefully weigh the pros and cons before deciding on consolidation or refinancing.

Visual Representation of Key Data

Understanding the scale and distribution of student loan debt requires clear visual representations. The following sections present visualizations illustrating the total outstanding debt, its demographic distribution, and the historical trend of delinquency rates. Data sources and methodologies are explicitly detailed for transparency and verification.

Total Outstanding Student Loan Debt

A bar chart would effectively illustrate the total amount of outstanding student loan debt. The chart’s vertical axis would represent the dollar amount in trillions, while the horizontal axis would represent the year. Data for this chart could be sourced from the Federal Reserve’s “Flow of Funds Accounts of the United States,” the U.S. Department of Education’s National Student Loan Data System (NSLDS), or the New York Federal Reserve’s data releases on student loan debt. The methodology would involve aggregating data from these sources, potentially adjusting for inflation to provide a clearer picture of debt growth over time. The chart would visually depict the dramatic increase in student loan debt over the past two decades, highlighting the magnitude of the problem. For example, a comparison between the total debt in 2000 and 2023 would starkly show the exponential growth.

Distribution of Student Loan Debt Across Demographics

A segmented pie chart or a series of stacked bar charts would effectively visualize the distribution of student loan debt across different demographic groups. Data for this visualization could be obtained from the U.S. Department of Education’s surveys and statistical reports on student loan borrowers. This data would include information on borrower age, race, gender, income level, and educational attainment. The methodology would involve calculating the percentage of total student loan debt held by each demographic group. For instance, one segment of the pie chart might represent the percentage of debt held by borrowers aged 25-34, while another segment could represent the percentage held by borrowers with graduate degrees. A comparison across different demographic groups would highlight potential disparities in student loan debt burdens. For example, the visualization could show a disproportionately high percentage of debt held by minority borrowers or those from lower-income backgrounds.

Historical Trend of Student Loan Delinquency Rates

A line graph would best depict the historical trend of student loan delinquency rates. The horizontal axis would represent time (e.g., yearly data points), and the vertical axis would represent the delinquency rate (percentage of loans in delinquency). Data for this chart could be sourced from the U.S. Department of Education’s data releases on student loan performance. The methodology would involve calculating the delinquency rate using the number of delinquent loans divided by the total number of loans. The graph would show the fluctuation of delinquency rates over time, potentially correlating with economic recessions or changes in government policies. For example, a spike in delinquency rates during the Great Recession of 2008-2009 could be visually highlighted to demonstrate the impact of economic downturns on borrowers’ ability to repay their loans. The graph could also show the impact of forbearance and deferment periods on delinquency rates.

Final Wrap-Up

The future of student loan payments remains uncertain, but by understanding the current landscape, potential scenarios, and available resources, borrowers can better prepare for the resumption of payments. Staying informed about government announcements, exploring various repayment options, and proactively managing finances are crucial steps in navigating this complex situation. While the possibility of further extensions exists, proactive financial planning is essential to mitigate potential hardship and ensure a smoother transition when payments resume.

FAQ Section

What happens if the pause ends and I can’t afford payments?

Contact your loan servicer immediately. They can discuss options like income-driven repayment plans or deferment/forbearance.

Where can I find reliable information about student loan updates?

Check the official websites of the Department of Education and your loan servicer for the most up-to-date information.

Are there any penalties for missing payments after the pause?

Yes, late payments can result in negative impacts on your credit score and potentially lead to collection actions.

Can I refinance my student loans to lower my monthly payments?

Potentially, yes. Explore refinancing options with private lenders, but be aware of the terms and conditions.