The question of whether student loans are predatory is a complex one, impacting millions globally. While providing access to higher education, these loans often come with high interest rates, opaque terms, and aggressive marketing tactics targeting vulnerable students. This exploration delves into the characteristics of predatory lending, examining specific practices within the student loan industry and their consequences for borrowers. We will analyze the role of government regulation and the broader societal implications of mounting student debt.

This analysis considers various aspects, including the impact of high-interest rates and repayment plans, the ethical implications of targeted marketing towards financially vulnerable students, the prevalence of hidden fees and lack of transparency, and the effectiveness of current governmental regulations. By understanding these factors, we can better assess whether the student loan system, in its current form, constitutes predatory lending.

Defining “Predatory” in the Context of Student Loans

Predatory lending, in the context of student loans, refers to practices that exploit students’ financial vulnerabilities and lack of experience in borrowing. These practices often result in borrowers incurring excessive debt and facing significant difficulty in repayment, even with diligent effort. The defining characteristic is the lender’s prioritization of profit over the borrower’s long-term financial well-being.

The core of predatory lending involves misrepresentation, deception, and the exploitation of borrowers’ limited financial literacy. While not all high-interest loans are predatory, the combination of certain practices elevates a loan to predatory status. This differs from traditional lending, where the focus is on assessing creditworthiness and managing risk in a transparent and ethical manner.

Characteristics of Predatory Student Loan Practices

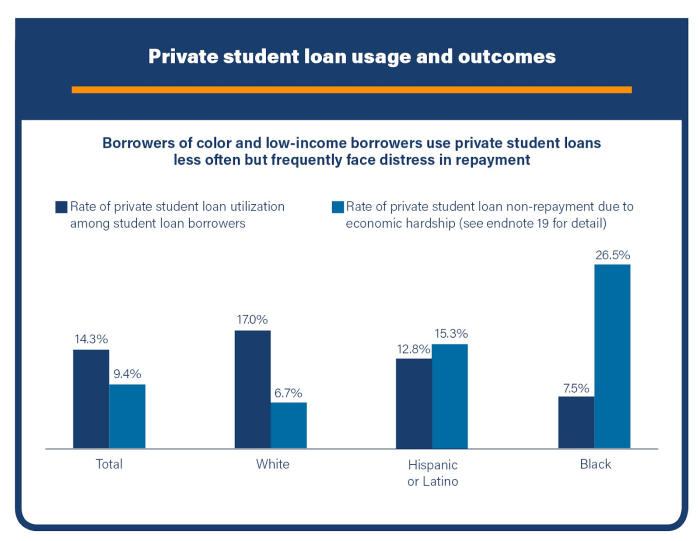

Several characteristics signal predatory practices within the student loan industry. These practices often target vulnerable populations, such as low-income students or those from under-resourced backgrounds. The lack of transparency and the high-pressure sales tactics employed often leave borrowers with little recourse after they’ve signed the loan agreements. Examples include misleading advertising that focuses on immediate benefits without clearly outlining the long-term financial implications, such as the total cost of borrowing, including interest. High fees and charges that are not clearly disclosed upfront are another red flag.

Examples of Predatory Lending Practices in the Student Loan Industry

One example is the use of deceptive marketing materials that overemphasize the ease of obtaining a loan while downplaying the risks of default. Another common tactic is the promotion of loans with excessively high interest rates, often significantly higher than the rates offered by federal student loan programs. These high-interest rates quickly escalate the total amount owed, making repayment a significant burden. Furthermore, some lenders may employ aggressive collection tactics, including threats and harassment, upon default. This is particularly damaging to borrowers’ credit scores and overall financial health.

Comparison with Predatory Lending in Other Financial Areas

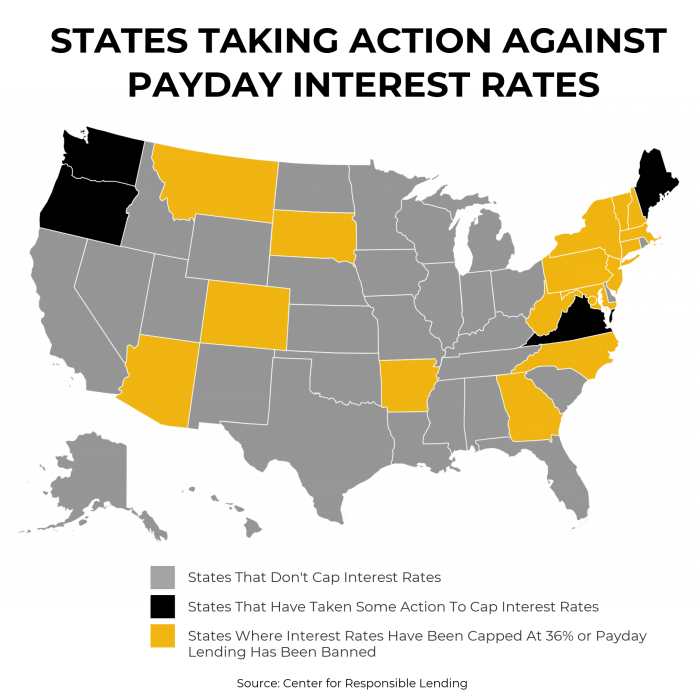

Predatory lending in the student loan sector shares similarities with predatory practices in other areas, such as subprime mortgages and payday loans. All three frequently involve high interest rates, hidden fees, and aggressive collection practices. However, the student loan context presents unique vulnerabilities. Unlike mortgages, which are typically secured by real estate, student loans are unsecured, meaning the lender has fewer options for recovering the debt in the event of default. This lack of collateral increases the risk for borrowers and incentivizes lenders to employ more aggressive tactics. Unlike payday loans, student loans often involve much larger amounts of debt, leading to more severe long-term financial consequences for borrowers. The inherent need for education and the often-limited financial literacy of young borrowers make them particularly susceptible to predatory practices.

High-Interest Rates and Loan Repayment Terms

The high cost of higher education, often financed through student loans, presents significant challenges for borrowers. Understanding the intricacies of interest rates and repayment options is crucial for navigating the complexities of loan repayment and avoiding potential financial hardship. This section will examine the impact of high interest rates, explore available repayment plans, and detail the serious consequences of loan default.

High interest rates significantly impact student loan borrowers by increasing the overall cost of their education. The longer it takes to repay a loan, the more interest accrues, leading to a substantially larger total repayment amount than the initial loan principal. This can create a long-term financial burden, potentially delaying major life milestones such as homeownership, starting a family, or investing in retirement. For example, a $50,000 loan with a 7% interest rate could easily cost tens of thousands more over the life of the loan compared to a lower interest rate. This added expense can severely limit future financial opportunities.

Repayment Plan Options and Their Implications

Several repayment plans are available to student loan borrowers, each with its own implications. Choosing the right plan depends on individual financial circumstances and long-term goals. Understanding the nuances of each plan is critical to making an informed decision and avoiding potential financial difficulties. A common misconception is that all repayment plans are created equal; however, this is far from the truth. The consequences of choosing an unsuitable plan can be severe.

Consequences of Student Loan Default

Defaulting on student loans has severe and lasting consequences. These consequences extend far beyond simply damaging a credit score. They can impact employment opportunities, future borrowing capacity, and even lead to wage garnishment and tax refund offset. The government employs robust mechanisms to recover defaulted loans, and the repercussions can significantly hinder an individual’s financial well-being for many years. In some cases, default can even lead to legal action.

Comparison of Repayment Plans

| Repayment Plan | Interest Rate | Repayment Period | Potential Consequences of Default |

|---|---|---|---|

| Standard Repayment Plan | Variable, depending on loan type | 10 years | Damage to credit score, wage garnishment, tax refund offset, difficulty obtaining future loans. |

| Graduated Repayment Plan | Variable, depending on loan type | 10 years | Similar to Standard Repayment, but potential for higher payments later in repayment period. |

| Extended Repayment Plan | Variable, depending on loan type | Up to 25 years | Similar to Standard Repayment, but longer repayment period leads to higher total interest paid. |

| Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE) | Variable, depending on loan type and income | 20-25 years | Similar to Standard Repayment, but payments are based on income, potentially leading to loan forgiveness after 20-25 years depending on plan and eligibility. Remaining balance may be subject to taxation. |

Aggressive Marketing and Targeting of Vulnerable Students

Lenders employ various strategies to attract student borrowers, some of which disproportionately target vulnerable populations. Understanding these tactics is crucial to assessing the potential for predatory lending practices within the student loan market. This section will examine the methods used to target vulnerable students, highlighting deceptive marketing and the exploitation of emotional vulnerabilities.

Aggressive marketing techniques often exploit the financial anxieties and lack of experience of prospective student borrowers. The high stakes associated with financing education, coupled with limited financial literacy, make students particularly susceptible to misleading or high-pressure sales tactics.

Methods Used to Target Vulnerable Student Populations

Lenders frequently target students through channels where they are most likely to be receptive to loan offers. This often includes direct outreach on college campuses, partnerships with universities, and targeted online advertising. Vulnerable populations, such as first-generation college students, students from low-income backgrounds, and students with disabilities, may be particularly susceptible to these targeted campaigns due to their lack of experience navigating the financial aid system. For example, a lender might offer simplified loan applications or advertise expedited processing times to attract students who are already feeling overwhelmed by the application process. This targeted approach can be particularly effective in influencing students who are not fully aware of the long-term implications of their borrowing decisions.

Deceptive or Misleading Marketing Tactics

Several marketing tactics can be considered deceptive or misleading. These often involve downplaying the long-term costs of borrowing, focusing solely on the immediate benefits of securing funds, and using simplified language that obscures the complexities of loan repayment. Examples include: advertising low initial monthly payments without clearly disclosing the total amount to be repaid; highlighting the convenience of the loan application process without mentioning potential risks; and using testimonials or endorsements from seemingly credible sources to build trust. These tactics can create a false sense of security and encourage students to borrow more than they can realistically afford.

Exploitation of the Emotional State of Prospective Borrowers

The pressure and stress associated with higher education financing can significantly impact a student’s decision-making process. Lenders may exploit this emotional vulnerability by using language that emphasizes the importance of pursuing educational opportunities, regardless of the financial burden. Marketing materials might portray borrowing as a necessary step towards achieving personal and professional goals, thereby downplaying the potential negative consequences of debt. For example, advertisements might show images of successful graduates or feature testimonials from individuals who attribute their success to having taken out student loans. This creates an aspirational narrative that can overshadow the realities of debt repayment.

The Role of Lack of Financial Literacy

A significant factor contributing to student vulnerability is the lack of financial literacy among many prospective borrowers. Many students lack a clear understanding of interest rates, loan repayment schedules, and the long-term implications of accumulating debt. This lack of knowledge makes them more susceptible to misleading marketing tactics and less likely to critically evaluate loan offers. Without a strong foundation in personal finance, students may struggle to compare loan options, understand the terms and conditions, and make informed decisions about borrowing. This financial naiveté leaves them particularly vulnerable to predatory lending practices.

Lack of Transparency and Hidden Fees

The lack of transparency surrounding student loan fees and terms is a significant contributor to the predatory nature of some lending practices. Unclear language and hidden fees can easily trap borrowers into agreements that are far more expensive than they initially anticipated, leading to long-term financial hardship. This lack of clarity disproportionately affects vulnerable students who may lack the financial literacy to navigate complex loan documents.

Hidden fees and unclear terms contribute to predatory lending by obscuring the true cost of borrowing. Students often focus on the headline interest rate, neglecting smaller fees that accumulate over time and significantly increase the total amount repaid. This deceptive practice makes it difficult for borrowers to compare loan offers effectively and choose the most affordable option. The cumulative effect of these seemingly insignificant fees can be substantial, transforming a manageable loan into an overwhelming debt burden.

Examples of Overlooked Student Loan Fees

Several fees are commonly overlooked by students applying for loans. These include origination fees, which are charged by the lender to process the loan application; late payment fees, levied when payments are not made on time; and prepayment penalties, charged if a borrower pays off the loan early. Additionally, some lenders may charge fees for specific services, such as loan consolidation or deferment. These fees, often buried within lengthy and complex loan agreements, can easily escape notice, adding considerably to the overall cost of borrowing.

Strategies for Identifying and Avoiding Hidden Fees

Borrowers should meticulously review all loan documents before signing any agreement. This includes not only the loan agreement itself but also any accompanying disclosures or supplementary materials. It is crucial to carefully read all the fine print, paying particular attention to sections detailing fees and charges. Comparing offers from multiple lenders is essential, as fees and terms can vary significantly. Students should also seek assistance from financial aid advisors or independent financial counselors who can help them understand complex loan documents and identify potential hidden costs. Finally, actively searching for information online and reading reviews from other borrowers can provide valuable insights into the practices of different lenders.

Importance of Understanding Loan Terms Before Signing

Fully understanding loan terms before signing any agreement is paramount to avoiding predatory lending practices. This includes a clear comprehension of the interest rate, repayment schedule, fees, and any other conditions associated with the loan. Borrowers should be aware of the total amount they will repay, including interest and fees, and should ensure that the loan terms align with their financial capabilities and repayment plans. Failure to fully understand these terms can lead to unforeseen financial difficulties and potentially long-term debt problems. Taking the time to thoroughly review and understand all aspects of a student loan agreement is a crucial step in protecting oneself from predatory lending.

The Role of Government Regulation and Oversight

Government regulation plays a crucial role in shaping the student loan landscape, influencing accessibility, affordability, and the overall fairness of the system. The effectiveness of these regulations, however, is a subject of ongoing debate, particularly concerning their ability to prevent predatory lending practices. A balanced approach is needed to ensure both borrower protection and the continued availability of student loans to fund higher education.

The current regulatory framework governing student loans in the United States is complex and multifaceted, involving various federal agencies. The primary regulator is the Department of Education, which oversees federal student loan programs, including eligibility criteria, disbursement procedures, and default management. Other agencies, such as the Consumer Financial Protection Bureau (CFPB), also play a role in protecting borrowers from unfair or deceptive practices by private lenders. These regulations cover aspects like interest rate caps (though these are often absent in private loans), loan repayment plans, and disclosure requirements. However, the effectiveness of these regulations varies depending on the type of loan and the lender involved.

Current Student Loan Regulations and Their Limitations

Current regulations, while intending to protect borrowers, often fall short in several key areas. For instance, while federal regulations mandate certain disclosure requirements, the complexity of loan terms and repayment options can still leave borrowers confused and vulnerable. Furthermore, the enforcement of existing regulations can be inconsistent, leading to a lack of accountability for lenders engaging in questionable practices. The rise of private student loans, often with less stringent regulations, further exacerbates the problem. The absence of uniform interest rate caps across all loan types allows for significant variations, making some loans considerably more expensive than others. Finally, the lack of robust mechanisms for addressing complaints and resolving disputes efficiently can leave borrowers feeling powerless.

Potential Benefits and Drawbacks of Increased Government Oversight

Increased government oversight could bring several benefits, including enhanced borrower protection through stricter regulations on interest rates, fees, and lending practices. Improved transparency and simplified loan terms could empower borrowers to make more informed decisions. Stronger enforcement mechanisms could deter predatory lending and hold lenders accountable. However, increased regulation could also lead to higher administrative costs, potentially reducing the availability of student loans or increasing their cost. Overly stringent regulations might stifle innovation in the lending market and limit access to credit for some borrowers. A delicate balance is required to ensure that increased oversight does not inadvertently harm the very students it intends to protect.

Comparative Analysis of International Regulatory Frameworks

Different countries employ diverse approaches to regulating student loans. For example, some countries, such as Germany, heavily subsidize higher education, resulting in lower tuition fees and more accessible government-backed loan programs with favorable terms. In contrast, other countries, such as the UK, rely more on market-based solutions, with a greater role for private lenders and potentially less stringent regulations. A comparative analysis reveals that countries with robust government oversight and significant public funding tend to have more affordable and accessible student loan systems, while those with less government intervention often face higher tuition fees and more complex loan structures. Understanding these differences can inform policy discussions aimed at improving student loan systems globally.

The Impact of Student Loan Debt on Individual Lives and Society

The burden of student loan debt extends far beyond the immediate financial strain; it casts a long shadow over individuals’ lives and has significant repercussions for society as a whole. The sheer magnitude of this debt impacts financial stability, career choices, and even community development, creating a complex web of interconnected challenges.

The long-term financial consequences of significant student loan debt are substantial and far-reaching. High monthly payments can severely restrict an individual’s ability to save for retirement, purchase a home, or build other forms of wealth. This financial burden can persist for decades, delaying major life milestones and creating ongoing stress. The inability to manage debt can lead to defaults, impacting credit scores and limiting future financial opportunities. This cycle of debt can be especially difficult to break for individuals who chose lower-paying jobs in fields like social work or teaching, which are often driven by a sense of social responsibility rather than pure financial gain.

Long-Term Financial Consequences of Student Loan Debt

High monthly payments often necessitate lifestyle adjustments, delaying major life purchases like a home or car. This can lead to delayed family formation and reduced overall quality of life. The weight of student loan debt can also impact mental health, causing significant stress and anxiety. Furthermore, the accumulation of interest can dramatically increase the total amount owed, making repayment even more challenging. For example, a $50,000 loan at a 7% interest rate could balloon to over $80,000 over 10 years if only minimum payments are made. The long-term financial insecurity created by student loan debt limits future economic mobility and perpetuates cycles of poverty.

Effect of Student Loan Debt on Career Choices and Life Decisions

Student loan debt significantly influences career choices. Graduates may prioritize higher-paying jobs over those that align with their passions or values, leading to job dissatisfaction and a reduced sense of fulfillment. The pressure to repay loans quickly can limit career exploration and opportunities for professional development, potentially hindering long-term career growth. For instance, a recent graduate might accept a lucrative but unfulfilling corporate job to accelerate loan repayment, instead of pursuing a less profitable but more personally rewarding career in the arts. This debt also affects life decisions such as where to live; graduates may be forced to relocate to areas with higher-paying jobs, even if it means being further away from family and support networks.

Broader Societal Impact of High Levels of Student Loan Debt

The widespread accumulation of student loan debt has profound societal consequences. It can hinder economic growth by reducing consumer spending and investment. Individuals burdened by debt may delay major purchases, impacting overall economic activity. High levels of student loan debt also contribute to increased income inequality, exacerbating existing social and economic disparities. Furthermore, the burden of student loan debt can disproportionately affect marginalized communities, perpetuating systemic inequalities. The inability of many borrowers to repay their loans puts a strain on the financial system, potentially leading to broader economic instability.

Cascading Effects of Student Loan Debt

Imagine a visual representation starting with a single individual burdened by significant student loan debt. This debt leads to delayed homeownership (represented by a smaller, less detailed house icon compared to a larger, more detailed house icon representing someone without debt). This, in turn, impacts family formation (represented by a smaller, less vibrant family icon compared to a larger, more vibrant one), reducing their economic contribution to the community. The individual’s reduced spending power ripples outwards, impacting local businesses (represented by smaller, less vibrant shop icons) and ultimately the wider economy (represented by a less robust economic graph). This illustrates the cascading effect, where the initial burden of debt creates a domino effect impacting various aspects of individual lives and communities.

Final Review

The student loan landscape presents a multifaceted challenge. While access to education is crucial, the potential for predatory practices necessitates careful consideration. High interest rates, aggressive marketing, and a lack of transparency contribute to a system that can trap borrowers in cycles of debt. Increased regulatory oversight, improved financial literacy programs, and transparent lending practices are essential to mitigate the risks and ensure a fairer system for all students seeking higher education. Ultimately, a more ethical and sustainable approach to student lending is crucial for individual well-being and societal progress.

FAQ Compilation

What constitutes a “reasonable” interest rate on a student loan?

A “reasonable” interest rate is subjective and depends on market conditions and the borrower’s creditworthiness. However, excessively high rates compared to other loan types or market averages may indicate predatory practices.

What are my options if I can’t afford my student loan payments?

Explore options like income-driven repayment plans, deferment, forbearance, or loan consolidation. Contact your loan servicer immediately to discuss your situation and avoid default.

Can I sue my lender for predatory lending practices?

Potentially, yes. You need to demonstrate that the lender engaged in deceptive or unfair practices violating consumer protection laws. Consult with a consumer rights attorney to assess your legal options.

How can I protect myself from predatory student loan practices?

Thoroughly research lenders, compare interest rates and terms, understand all fees, and carefully read all loan documents before signing. Seek independent financial advice.