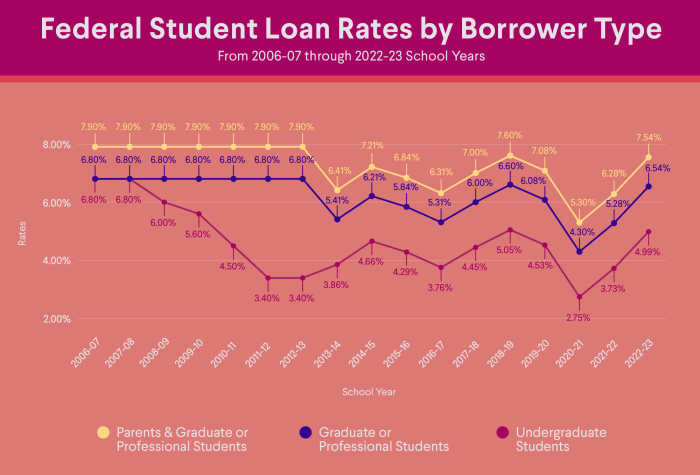

Navigating the world of student loans can be daunting, especially in a state as diverse as Georgia. This guide delves into the complexities of Georgia’s student loan landscape, offering a clear understanding of available loan types, repayment options, and the overall economic impact of student debt within the state. We’ll explore both federal and private loan options, highlighting key differences in interest rates and repayment plans. Understanding these nuances is crucial for Georgia students and graduates aiming to manage their debt effectively and plan for a secure financial future. From exploring eligibility for repayment assistance programs to examining the long-term Read More …