Drowning in student loan debt? The avalanche method offers a powerful strategy for tackling multiple loans efficiently. Unlike the snowball method, which prioritizes smaller debts for motivational wins, the avalanche method focuses on eliminating high-interest loans first, saving you money on interest in the long run. This approach may seem less immediately gratifying, but the long-term financial benefits are substantial. This guide explores the intricacies of applying the avalanche method to your student loans, offering practical advice and strategies for success.

We will delve into the core principles of the avalanche method, detailing the steps involved in creating a personalized repayment plan. We’ll compare it to other strategies, discuss factors affecting its success (like fluctuating income and unexpected expenses), and provide practical examples to illustrate its application in diverse scenarios. Whether you’re dealing with federal or private loans, refinancing options, or unexpected financial hurdles, this guide provides the tools and insights you need to navigate the complexities of student loan repayment.

Understanding the Avalanche Method

The avalanche method is a debt repayment strategy that prioritizes paying off high-interest debt first, regardless of the loan balance. This approach aims to minimize the total interest paid over the life of the loans, ultimately saving you money and accelerating your debt-free journey. It’s a mathematically sound approach that contrasts with other methods that focus on psychological motivation.

The core principle of the avalanche method is to focus your extra payment resources on the loan with the highest interest rate. By tackling the most expensive debt first, you reduce the overall interest burden more quickly than if you were to prioritize loans with smaller balances or lower interest rates. This leads to significant long-term savings.

Steps Involved in Applying the Avalanche Method to Student Loans

Applying the avalanche method to student loans involves a systematic approach. First, you need to list all your student loans, including their balances, interest rates, and minimum monthly payments. Next, order these loans from highest interest rate to lowest. Then, make the minimum payments on all loans except for the highest-interest loan. Finally, allocate any extra money you have towards the highest-interest loan until it’s paid off. Once that loan is paid, you redirect those extra payments to the next highest-interest loan, and so on, until all debts are eliminated.

Comparison of the Avalanche Method to Other Debt Repayment Strategies

The avalanche method differs from the snowball method, another popular debt repayment strategy. The snowball method prioritizes paying off the smallest debt first, regardless of the interest rate. While the snowball method offers psychological advantages by providing early wins and motivation, the avalanche method is mathematically superior in terms of minimizing total interest paid. Choosing between the two often depends on individual preferences and financial situations. The avalanche method is generally favored for its long-term cost-effectiveness.

Calculating Minimum Payments and Interest for Each Loan

To effectively utilize the avalanche method, accurately calculating minimum payments and interest is crucial. Minimum payments are usually specified by your loan servicer and are stated on your monthly statement. Interest accrues daily on the outstanding balance of each loan. The amount of interest accrued each month depends on the interest rate and the outstanding balance. The formula for simple interest calculation is: Interest = Principal x Rate x Time, where the time is expressed as a fraction of a year (e.g., one month is 1/12 of a year).

Sample Debt Repayment Schedule Using the Avalanche Method

This example demonstrates a hypothetical scenario. Actual results will vary depending on your individual loan terms and payment amounts.

| Loan Name | Balance | Interest Rate | Monthly Payment |

|---|---|---|---|

| Loan A | $10,000 | 7% | $150 |

| Loan B | $5,000 | 5% | $100 |

| Loan C | $2,000 | 3% | $50 |

In this example, you would prioritize paying down Loan A first due to its higher interest rate, even though Loan B has a smaller balance. After paying off Loan A, you would then focus on Loan B, and finally Loan C.

Factors Affecting Avalanche Method Success with Student Loans

The avalanche method, while effective in principle, isn’t immune to external influences. Several factors can significantly impact its success, potentially lengthening repayment timelines or even derailing the entire process. Understanding these factors allows for proactive planning and mitigation strategies.

Interest Rate Impact on Repayment Time

High interest rates dramatically affect the overall repayment time when using the avalanche method. The method prioritizes paying down the loan with the highest interest rate first. However, even with this focus, a significantly higher interest rate on one loan compared to others can lead to a longer overall repayment period. For example, if one loan has an 8% interest rate and others are around 4%, the 8% loan will consume a substantial portion of your payment, slowing down the progress on the lower-interest loans. This effect is compounded by the accruing interest on the lower-interest loans while you concentrate on the high-interest debt.

Fluctuating Income and its Effect on the Avalanche Method

Inconsistent income poses a considerable challenge to the avalanche method’s effectiveness. The method relies on consistent, predictable payments to maintain momentum. Unexpected income decreases, such as job loss or reduced work hours, can severely disrupt the carefully planned repayment schedule. This may force borrowers to reduce payments across the board or even default on loans, thereby negating the benefits of the avalanche method. Conversely, unexpected income increases can accelerate repayment, but consistent budgeting remains crucial for long-term success.

Managing Unexpected Expenses While Using the Avalanche Method

Unexpected expenses, like car repairs or medical bills, are common occurrences that can derail the avalanche method if not managed carefully. The key is to have an emergency fund specifically designed to absorb these shocks. This fund should ideally cover 3-6 months of essential living expenses. When an unexpected expense arises, the emergency fund should be used to cover it, preventing the need to dip into loan repayments or accumulate additional debt. Failing to have a robust emergency fund can necessitate renegotiating the avalanche method strategy, potentially extending the overall repayment timeline.

Decision-Making Process for Unexpected Financial Challenges

A clear decision-making process is vital when facing unexpected financial challenges while using the avalanche method. The following flowchart illustrates a structured approach:

[Illustrative Flowchart Description: The flowchart begins with a “Start” node. An arrow points to a decision node: “Unexpected Expense?”. If “No,” an arrow leads to “Continue Avalanche Method.” If “Yes,” an arrow leads to “Sufficient Funds in Emergency Fund?”. If “Yes,” an arrow points to “Use Emergency Fund, Continue Avalanche Method.” If “No,” an arrow leads to “Re-evaluate Budget and Loan Prioritization.” From this node, arrows lead to “Adjust Avalanche Method” and “Seek Financial Counseling/Debt Consolidation.” Both these options lead to a “Continue Modified Plan” node. Finally, an arrow leads from “Continue Modified Plan” and “Continue Avalanche Method” to an “End” node.]

Practical Application and Refinancing

Applying the avalanche method effectively requires understanding your specific loan portfolio and strategically leveraging available options. This section will delve into the practical aspects of implementing the avalanche method, including refinancing strategies and the impact of different repayment plans.

Student Loan Types and Avalanche Method Application

The avalanche method prioritizes paying off the loan with the highest interest rate first, regardless of loan type. However, understanding the nuances of different loan types is crucial for effective implementation. For instance, federal subsidized loans typically have lower interest rates than unsubsidized loans or private student loans. Therefore, under the avalanche method, a high-interest private loan would be tackled before a lower-interest subsidized federal loan, even if the private loan’s principal balance is smaller. Similarly, federal Parent PLUS loans, often carrying higher interest rates, would be prioritized over federal Stafford loans. This strategic approach maximizes long-term savings by minimizing total interest paid. Consider a scenario with three loans: a $10,000 private loan at 7%, a $15,000 federal unsubsidized loan at 5%, and a $20,000 federal subsidized loan at 4%. The avalanche method would focus on the $10,000 private loan first, despite its smaller balance.

Refinancing Student Loans and the Avalanche Method

Refinancing can significantly impact the avalanche method. By refinancing multiple loans into a single loan with a lower interest rate, you effectively consolidate high-interest debts, potentially accelerating the repayment process. However, refinancing has potential drawbacks. Refinancing federal loans into private loans means losing federal protections, such as income-driven repayment plans and loan forgiveness programs. Carefully weigh the benefits of a lower interest rate against the potential loss of these protections before refinancing. For example, if you have a mix of high-interest private and lower-interest federal loans, refinancing the private loans might be beneficial. However, if you have mostly federal loans, the potential loss of federal benefits may outweigh the advantages of a slightly lower interest rate.

Repayment Plan Impact on Avalanche Method Timeline

Different repayment plans directly affect the avalanche method timeline. Standard repayment plans typically involve shorter repayment periods and higher monthly payments, accelerating the payoff process. Extended repayment plans, while offering lower monthly payments, lengthen the repayment period, potentially increasing total interest paid. The choice depends on your financial situation and risk tolerance. For instance, choosing a standard repayment plan allows for faster debt elimination, aligning with the avalanche method’s core principle, but it requires higher monthly payments. Conversely, an extended repayment plan might provide financial breathing room but could extend the overall timeline significantly.

Obstacles and Solutions in Avalanche Method Implementation

Successfully implementing the avalanche method often involves overcoming various obstacles.

- Unexpected Expenses: Emergency expenses can disrupt the carefully planned budget. Solution: Establish an emergency fund to cover unexpected costs and avoid dipping into loan repayment funds.

- Income Fluctuations: Changes in income can make consistent payments challenging. Solution: Build flexibility into your budget, allowing for adjustments based on income fluctuations.

- High Minimum Payments: High minimum payments across multiple loans might leave little room for extra payments towards the highest-interest loan. Solution: Explore refinancing options to potentially lower overall monthly payments.

- Interest Rate Changes: Changes in interest rates can alter the prioritization of loans. Solution: Regularly review your loan balances and interest rates to adjust your repayment strategy accordingly.

Adjusting the Avalanche Method to Changing Circumstances

Life throws curveballs. Job loss, unexpected medical expenses, or changes in family size can significantly impact your ability to stick to the avalanche method. The key is adaptability. If your income decreases, you might need to temporarily reduce extra payments towards the high-interest loan and focus on making minimum payments across all loans. If you receive a raise or a bonus, you can reallocate those funds towards accelerated repayment. Regularly reassess your financial situation and adjust your repayment strategy as needed to maintain progress towards your goal. Flexibility is crucial for long-term success.

Visualizing Progress and Maintaining Motivation

Successfully tackling student loan debt using the avalanche method requires more than just a repayment plan; it demands consistent effort and unwavering motivation. Visualizing your progress and strategically maintaining your enthusiasm are crucial for long-term success. This section will explore practical methods for tracking your progress and staying motivated throughout the repayment journey.

One of the most effective ways to stay on track is by visualizing your progress. The sheer volume of debt can feel overwhelming, but breaking it down visually can make the process feel more manageable and less daunting. A simple chart or graph can transform abstract numbers into a tangible representation of your achievements. Consider creating a bar graph where each bar represents a loan, and the length of the bar decreases as you make payments. Alternatively, a line graph could illustrate the overall decrease in your total debt over time. The visual representation of your progress serves as a powerful motivator, offering a clear picture of your hard work paying off.

Visual Progress Tracking Methods

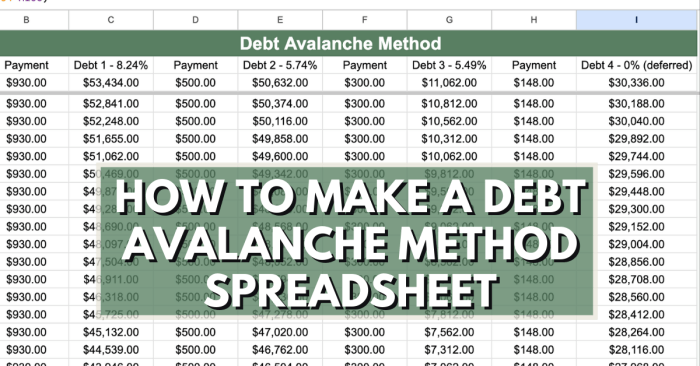

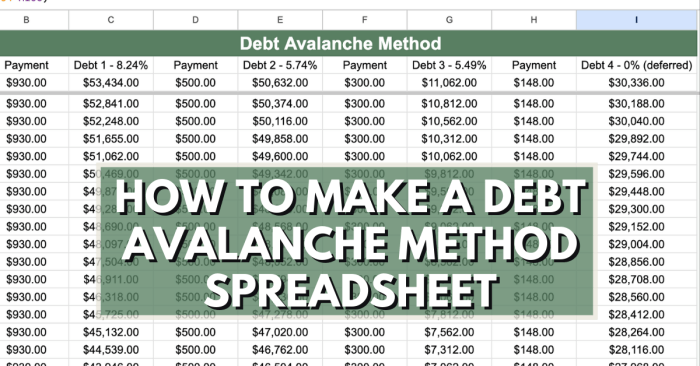

Several methods can effectively visualize your progress. A simple spreadsheet can be used to track payments and outstanding balances. More visually appealing options include creating a bar chart showing the decreasing balance of each loan, or a pie chart illustrating the proportion of each loan to the total debt. Color-coding the bars or slices can further enhance visual appeal and aid in identifying progress on specific loans. Dedicated budgeting apps often include features for visualizing debt repayment progress, offering a user-friendly interface for tracking and monitoring.

Maintaining Motivation and Avoiding Burnout

The avalanche method requires sustained commitment, and maintaining motivation can be challenging. Strategies to prevent burnout include setting realistic goals, celebrating milestones (even small ones), and rewarding yourself for consistent effort. Remember to acknowledge your progress and avoid focusing solely on the remaining debt. Building a support system—sharing your goals with friends, family, or a financial advisor—can provide encouragement and accountability.

Motivational Speech for Consistent Application

“Friends, fellow debt warriors! We stand here today, not defeated by the weight of student loans, but emboldened by the power of the avalanche method. Each payment is a victory, each loan conquered a testament to our resilience. The path may seem long, but look at how far we’ve come! Visualize that final payment, the freedom it represents. Let that vision fuel your dedication. Don’t falter, don’t give up. Together, we will conquer this mountain of debt, one payment at a time!”

Regular Review and Adjustments

Regularly reviewing and adjusting your repayment plan is vital. Life circumstances change, and your financial situation may evolve. Perhaps your income increases, allowing for larger payments, or unexpected expenses arise, requiring adjustments. Regularly assess your progress, ensuring the avalanche method remains aligned with your current financial reality. This proactive approach prevents setbacks and maintains momentum.

Benefits of Seeking Professional Financial Advice

While the avalanche method is a powerful tool, seeking professional financial advice can provide invaluable support. A financial advisor can offer personalized guidance, help optimize your repayment strategy, and address any unique financial circumstances you may face. They can also provide broader financial planning advice, ensuring your debt repayment plan integrates seamlessly with your overall financial goals. Professional advice can significantly increase your chances of successfully navigating the complexities of student loan repayment.

Illustrative Scenarios

Understanding the avalanche method’s practical application requires examining various scenarios. These examples will highlight its strengths, potential challenges, and the importance of adaptability in managing student loan debt.

Scenario 1: Applying the Avalanche Method to Multiple Loans

Sarah has three student loans: a federal subsidized loan of $20,000 at 4.5% interest, a federal unsubsidized loan of $15,000 at 6%, and a private loan of $10,000 at 7%. Using the avalanche method, she prioritizes the loan with the highest interest rate—the private loan. The following table illustrates a simplified repayment schedule over five years, assuming consistent monthly payments and no additional principal payments:

| Month | Private Loan (7%) | Unsubsidized Loan (6%) | Subsidized Loan (4.5%) |

|---|---|---|---|

| 1-12 | $190 | $120 | $100 |

| 13-24 | $195 | $125 | $105 |

| 25-36 | $200 | $130 | $110 |

| 37-48 | $205 | $135 | $115 |

| 49-60 | $210 | $140 | $120 |

Note: This is a simplified example. Actual payments may vary slightly due to compounding interest and loan amortization schedules. The amounts above are illustrative and not exact figures from a loan calculator.

Scenario 2: Refinancing and its Impact on the Avalanche Method

John initially had $30,000 in federal loans with varying interest rates. He refinanced into a single private loan at a lower fixed rate of 5%. While this reduced his monthly payment and simplified his repayment, refinancing eliminated the higher interest rates on his original federal loans. This potentially slowed his progress if he had previously been using the avalanche method, as he lost the advantage of aggressively paying down higher-interest debt first. The long-term implication could be a slightly longer repayment period, although the lower overall interest rate would still result in lower total interest paid compared to not refinancing.

Scenario 3: Unexpected Expenses and Recovery

Maria diligently followed the avalanche method. However, an unexpected car repair cost $2,000, forcing her to dip into her emergency fund and temporarily reduce her extra payments towards her highest-interest loan. To recover, she immediately replenished her emergency fund and, once that was secure, resumed her aggressive repayment strategy, prioritizing the loan she had previously been focusing on. This highlights the importance of having an emergency fund to avoid derailing the avalanche method.

Scenario 4: Successful Completion of Student Loan Repayment

David successfully paid off his student loans in 7 years using the avalanche method. He meticulously tracked his progress using a spreadsheet, consistently made extra payments, and celebrated small milestones along the way. His dedication and discipline resulted in significant savings on interest and a sense of accomplishment. This demonstrates the potential for success when the method is consistently applied.

Scenario 5: Resources for Managing Student Loan Debt

Managing student loans effectively often requires leveraging available tools. The following resources can assist in applying the avalanche method:

- Student Loan Calculators: Many websites offer free student loan calculators that allow you to simulate different repayment scenarios and visualize the impact of the avalanche method. Examples include websites like NerdWallet and Bankrate.

- Spreadsheet Software: Excel or Google Sheets can be used to create a personalized repayment schedule, track progress, and visualize the reduction of debt over time.

- Budgeting Apps: Apps like Mint or YNAB (You Need A Budget) can help track income and expenses, ensuring sufficient funds are available for loan payments and preventing overspending.

Conclusion

Successfully navigating student loan debt requires a strategic approach, and the avalanche method provides a powerful framework for achieving financial freedom. By prioritizing high-interest loans and meticulously tracking your progress, you can significantly reduce your overall repayment time and minimize interest costs. Remember, consistent effort, disciplined budgeting, and a proactive approach to managing unexpected expenses are crucial for long-term success. While the journey may be challenging, the financial rewards of employing the avalanche method are well worth the effort. This guide serves as a roadmap, but seeking personalized financial advice is always recommended to tailor the strategy to your unique circumstances.

User Queries

What if I can’t afford the minimum payments on all my loans using the avalanche method?

If you can’t afford minimum payments, explore options like income-driven repayment plans or contact your loan servicers to discuss forbearance or deferment. These options may temporarily reduce your payments but often accrue additional interest. It’s crucial to weigh the pros and cons carefully and seek professional financial advice.

How often should I review and adjust my avalanche method plan?

Review and adjust your plan at least annually, or more frequently if your income or expenses change significantly. Life throws curveballs; regular review ensures your plan remains relevant and effective.

Can I use the avalanche method with both federal and private student loans?

Yes, the avalanche method works equally well with a mix of federal and private student loans. Simply prioritize based on interest rates, regardless of loan type.

What if I refinance my loans mid-way through the avalanche method?

Refinancing can be beneficial if you secure a lower interest rate, potentially accelerating your repayment. However, carefully consider any fees or changes in repayment terms. Re-evaluate your repayment plan after refinancing to ensure it remains optimal.