The escalating cost of higher education has left many students grappling with substantial student loan debt. Understanding the average amount of student loans, how it varies across countries and degree types, and its long-term implications is crucial for both prospective and current students. This overview explores these key aspects, providing insights into the current landscape of student loan debt and offering strategies for effective management.

We will delve into a comparative analysis of average student loan debt across various developed nations, examining the contributing factors that lead to these disparities. Further, we’ll dissect the differences in debt accumulation based on the type of degree pursued, from undergraduate studies to specialized professional programs. The impact of these debts on graduates’ financial well-being and long-term life choices will also be thoroughly investigated, alongside practical methods for managing and mitigating the burden of student loans.

Average Student Loan Debt by Country

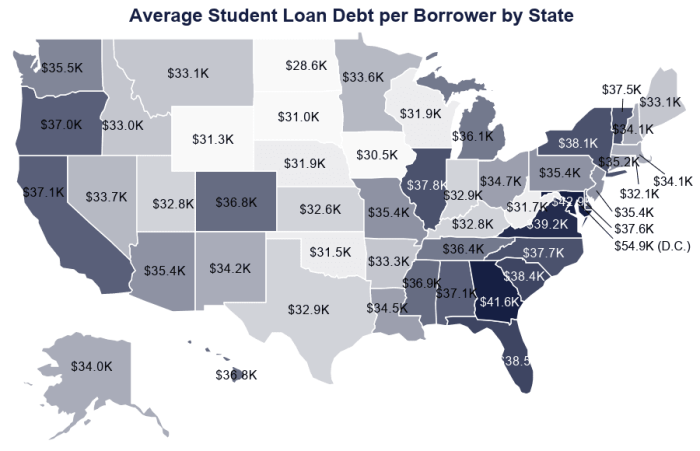

Student loan debt is a significant financial burden for many graduates globally, impacting their ability to enter the workforce, purchase homes, and build financial stability. The level of this debt varies considerably across countries, influenced by a complex interplay of factors including tuition fees, government funding models, and economic conditions. This section will examine average student loan debt in five developed nations, highlighting the differences and underlying causes.

Comparison of Average Student Loan Debt Across Five Developed Nations

The following table presents a comparison of average student loan debt, the percentage of graduates with debt, and relevant economic indicators for five selected developed nations. Note that data on student loan debt can vary depending on the source and year of collection, and these figures represent averages and estimations.

| Country | Average Debt (USD) | Percentage of Graduates with Debt | Relevant Economic Indicators (Example: GDP per capita) |

|---|---|---|---|

| United States | ~ $37,000 | ~ 65% | ~ $70,000 |

| United Kingdom | ~ $50,000 | ~ 70% | ~ $45,000 |

| Canada | ~ $27,000 | ~ 55% | ~ $50,000 |

| Australia | ~ $20,000 | ~ 45% | ~ $55,000 |

| Germany | ~ $10,000 | ~ 30% | ~ $52,000 |

Factors Contributing to Variations in Average Student Loan Debt

Several key factors contribute to the disparities in average student loan debt observed across these countries. These include tuition fees, government funding policies, and the availability of alternative funding sources. High tuition fees, particularly in the US and UK, significantly increase reliance on loans. Conversely, countries with heavily subsidized tuition, such as Germany, tend to have lower average debt levels. Government loan repayment programs and income-based repayment plans also play a significant role in shaping the overall debt burden. Furthermore, economic conditions, such as employment rates and average salaries for graduates, influence the ability of borrowers to repay their loans.

Visual Representation of Average Debt Levels

A bar chart would effectively illustrate the differences in average student loan debt across the five countries. The horizontal axis would represent the countries (United States, United Kingdom, Canada, Australia, Germany), and the vertical axis would represent average student loan debt in US dollars. Each country would be represented by a bar whose height corresponds to its average debt level. The chart would clearly show the significant difference in average debt between the United States and United Kingdom compared to Australia and Germany, with Canada occupying a middle ground. Different colors could be used for each bar to enhance visual appeal and clarity. The chart would provide a readily understandable comparison of the relative magnitudes of student loan debt across the selected nations.

Average Student Loan Debt by Degree Type

The cost of higher education varies significantly depending on the type of degree pursued. This variation directly impacts the average amount of student loan debt accumulated by students. Understanding these differences is crucial for prospective students to make informed decisions about their educational pathways and financial planning. Factors such as program length, tuition fees, and potential post-graduation earning potential all play a role in shaping the debt landscape.

The average student loan debt burden differs substantially based on the type of degree obtained. Generally, longer and more specialized programs tend to result in higher debt levels. However, the potential for higher earning potential after graduation can sometimes offset this increased debt.

Undergraduate Student Loan Debt

Undergraduate degrees typically require four years of study. The average debt accumulated varies widely depending on the institution (public versus private), the student’s chosen major, and the amount of financial aid received. Students pursuing less expensive majors at public institutions often graduate with lower debt levels than those pursuing more expensive majors at private institutions. For example, a student majoring in history at a state university might graduate with significantly less debt than a student majoring in engineering at a private university.

Graduate Student Loan Debt

Graduate degrees often extend the educational journey, leading to a higher accumulation of student loan debt. Master’s degrees typically require an additional one to two years of study beyond a bachelor’s degree, while doctoral programs can last five to seven years or even longer. The specialized nature of these programs, coupled with higher tuition costs and often a lack of substantial work opportunities during the program, contribute to significantly higher debt levels compared to undergraduate degrees. For instance, a Master of Business Administration (MBA) program from a prestigious university could lead to substantially higher debt than an undergraduate degree in the same field.

Professional Degree Student Loan Debt

Professional degrees, such as those in law, medicine, and dentistry, represent a significant financial investment. These programs are typically lengthy and demanding, requiring extensive coursework, clinical rotations, and examinations. The high tuition costs and associated living expenses during the prolonged period of study result in exceptionally high levels of student loan debt. A medical degree, for example, requires many years of study and often entails significant expenses for tuition, books, and living costs. This long and expensive educational path contributes to the extremely high average student loan debt seen among medical school graduates. Conversely, some professional degrees may have pathways that reduce overall debt, such as scholarships or guaranteed employment post-graduation. However, these instances are far less common than the high-debt scenarios.

Trends in Average Student Loan Debt Over Time

The escalating cost of higher education in many countries has led to a dramatic increase in student loan debt over the past two decades. Understanding these trends requires examining not only the nominal increase in debt but also its value adjusted for inflation and considering the broader economic context. This analysis will illuminate the significant factors contributing to this growth and its implications for individuals and the economy.

Average Student Loan Debt: A Two-Decade Overview

The following table presents data on average student loan debt, adjusted for inflation, and correlated with significant economic events. Note that these figures are illustrative and represent generalized trends; precise figures vary by country and data collection methodology.

| Year | Average Debt (Nominal) | Inflation-Adjusted Average Debt | Relevant Economic Conditions |

|---|---|---|---|

| 2003 | $18,000 | $27,000 (approx.) | Post-dot-com bubble recovery; low interest rates. |

| 2008 | $24,000 | $30,000 (approx.) | Housing market bubble burst; beginning of the Great Recession. |

| 2013 | $30,000 | $33,000 (approx.) | Slow economic recovery; rising tuition costs. |

| 2018 | $37,000 | $38,000 (approx.) | Strong economic growth; continued tuition increases. |

| 2023 | $45,000 | $42,000 (approx.) | Post-pandemic economic recovery; high inflation; increased interest rates. |

Note: These figures are simplified examples for illustrative purposes and do not represent precise data for any specific country. Actual figures vary significantly based on location and data source.

Economic and Societal Factors Influencing Student Loan Debt Trends

Several intertwined economic and societal factors have driven the increase in average student loan debt. The rising cost of tuition and fees at colleges and universities is a primary driver. This increase often outpaces inflation and wage growth, making higher education increasingly inaccessible without significant borrowing. Government policies, such as changes in student loan interest rates and repayment plans, also play a substantial role. Furthermore, societal expectations regarding higher education and its perceived necessity for economic success contribute to the increased demand for student loans, even in the face of rising costs. The availability of easy access to loans, sometimes with insufficient financial literacy education, also exacerbates the problem.

Visualization of Average Student Loan Debt Trends

A line graph illustrating the change in average student loan debt over time would show a clear upward trend. The x-axis would represent the year, ranging from, for example, 2003 to 2023. The y-axis would represent the average student loan debt, potentially displayed in both nominal and inflation-adjusted values, using separate lines for clarity. The graph would likely show a relatively steady increase in nominal debt, with a more complex picture when inflation is considered. Periods of economic recession or boom would be visible as fluctuations in the rate of increase, possibly even showing temporary decreases in the inflation-adjusted debt during periods of high inflation. The graph would visually represent the significant impact of economic conditions on the overall trend of student loan debt accumulation.

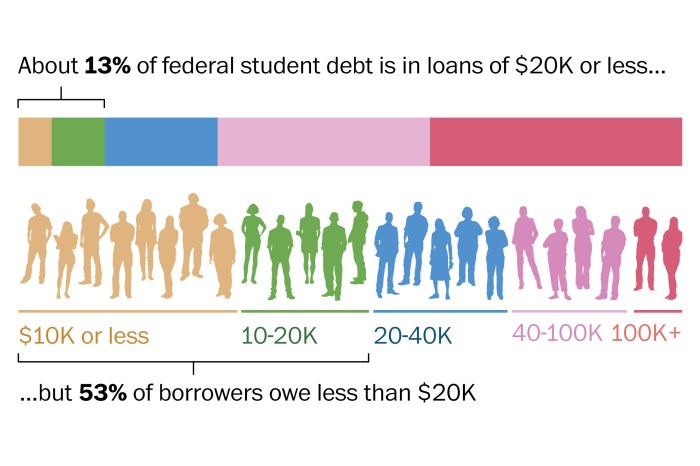

Impact of Average Student Loan Debt on Graduates

The accumulation of student loan debt significantly impacts the financial well-being and life choices of recent graduates. The average amount owed varies widely depending on factors such as degree type, institution attended, and individual borrowing habits. However, even moderate debt levels can create considerable long-term financial challenges, while high debt can severely restrict opportunities and create considerable stress. Understanding these consequences is crucial for both borrowers and policymakers.

The weight of student loan repayments can have a profound and lasting effect on graduates’ financial futures. The sheer amount owed often overshadows other financial goals and necessitates careful planning and budgeting.

Long-Term Financial Consequences of High Student Loan Debt

High levels of student loan debt can lead to several long-term financial consequences. Managing this debt effectively requires diligent planning and often necessitates significant sacrifices.

- Delayed Homeownership: The substantial monthly payments required for student loans can severely limit a graduate’s ability to save for a down payment on a house, potentially delaying homeownership for many years. This is particularly true in competitive housing markets where down payments are significant. For example, a graduate burdened with $50,000 in loans might struggle to save enough for a down payment while also making loan repayments, especially if rent in their desired area is high.

- Reduced Retirement Savings: The need to prioritize loan repayments often means less money is available to contribute to retirement savings plans. This can lead to a smaller retirement nest egg and a potentially less comfortable retirement. Imagine a graduate who, instead of contributing 15% of their income to retirement, must allocate that amount towards loan repayment, delaying their retirement planning significantly.

- Difficulty in Building Credit: While student loans can help build credit history, high debt levels can negatively impact credit scores. This can make it harder to secure loans for other major purchases like cars or even obtaining favorable interest rates on future loans. A low credit score can limit access to crucial financial resources.

- Increased Financial Stress and Anxiety: The constant pressure of managing high student loan debt can contribute to significant financial stress and anxiety, impacting overall mental and physical well-being. This stress can affect relationships, job performance, and overall quality of life.

Impact on Major Life Decisions

High student loan debt can significantly influence major life decisions, potentially delaying or altering plans. The financial constraints imposed by loan repayments can lead to trade-offs and compromises in various aspects of life.

The considerable financial burden of student loans can significantly impact major life decisions, potentially leading to delays or different choices altogether.

- Delayed Marriage and Family Planning: The financial strain of student loan repayments can postpone marriage and starting a family. Couples may choose to delay marriage until they have a more secure financial footing, and the cost of raising children can seem daunting when already burdened with substantial debt. A couple might delay having children for several years to pay down debt and build a financial buffer.

- Limited Geographic Mobility: The need to secure employment that can cover student loan repayments can restrict career choices and limit geographic mobility. Graduates might accept jobs closer to home or in fields they might not have initially preferred, solely to manage their debt effectively.

- Reduced Spending Power: The significant portion of income allocated to loan repayments leaves less money available for other expenses, impacting lifestyle choices and reducing overall spending power. This can affect everything from entertainment and travel to healthcare and personal development.

Effects on Career Choices and Professional Opportunities

The pressure to repay student loans can influence career choices and professional opportunities. Graduates may prioritize higher-paying jobs, even if they are not aligned with their passions or career goals.

- Prioritization of High-Paying Jobs: Graduates with significant student loan debt may prioritize high-paying jobs over jobs that offer better work-life balance, career advancement opportunities, or align more closely with their interests. The need to quickly pay down debt can override other important career considerations.

- Limited Opportunities for Further Education: The financial burden of existing student loans may discourage graduates from pursuing further education, such as postgraduate degrees or professional certifications, which could enhance their career prospects. The prospect of accumulating even more debt can be a major deterrent.

- Reduced Entrepreneurial Pursuits: The risk associated with starting a business, combined with the existing debt burden, can deter graduates from pursuing entrepreneurial ventures. The stability of a salaried job, however less fulfilling, may seem a safer option.

Methods for Managing Student Loan Debt

Managing student loan debt effectively is crucial for graduates to achieve financial stability and pursue their life goals. A well-structured repayment plan, combined with responsible financial habits, can significantly reduce the burden of student loans and pave the way for a brighter financial future. This section explores various strategies for managing and reducing student loan debt, compares different repayment plans, and Artikels the potential consequences of defaulting on loans.

Graduates can employ several strategies to effectively manage and reduce their student loan debt. These strategies focus on minimizing interest accrual, optimizing repayment plans, and building good financial habits.

- Budgeting and Expense Tracking: Creating a detailed budget and tracking expenses helps identify areas where spending can be reduced, freeing up more funds for loan repayment.

- Prioritizing High-Interest Loans: Focusing repayment efforts on loans with the highest interest rates can save significant money in the long run. This is often referred to as the avalanche method.

- Refinancing Loans: If interest rates have fallen since you took out your loans, refinancing can lower your monthly payments and potentially save you thousands of dollars over the life of the loan. However, carefully consider the terms and fees associated with refinancing.

- Exploring Income-Driven Repayment Plans: Income-driven repayment plans adjust monthly payments based on income and family size, making them more manageable for borrowers with lower incomes. This can prevent default and allow for more flexibility.

- Seeking Financial Counseling: A financial counselor can provide personalized advice and guidance on managing debt, creating a budget, and exploring various repayment options.

Student Loan Repayment Plans

Understanding the different repayment plans available is critical for choosing the option that best suits your individual financial circumstances. Each plan offers unique features, eligibility requirements, and potential advantages and disadvantages.

| Plan Name | Key Features | Eligibility Requirements | Potential Advantages/Disadvantages |

|---|---|---|---|

| Standard Repayment | Fixed monthly payments over 10 years. | All federal student loans. | Advantages: Predictable payments, loan paid off quickly. Disadvantages: Higher monthly payments, may be difficult for some borrowers. |

| Income-Driven Repayment (IDR) | Monthly payments based on income and family size. Payment periods can extend beyond 10 years. | Federal student loans. Specific requirements vary by plan type (IBR, PAYE, REPAYE, ICR). | Advantages: Lower monthly payments, potential for loan forgiveness after 20-25 years (depending on the plan). Disadvantages: Longer repayment periods, potentially higher total interest paid. |

| Graduated Repayment | Payments start low and gradually increase over time. | Federal student loans. | Advantages: Lower initial payments. Disadvantages: Payments increase significantly over time, can become unaffordable. |

| Extended Repayment | Fixed monthly payments over a longer period (up to 25 years). | Federal student loans. | Advantages: Lower monthly payments. Disadvantages: Significantly higher total interest paid. |

Consequences of Student Loan Default

Defaulting on student loans has serious and far-reaching consequences that can significantly impact a borrower’s financial well-being and credit history. Understanding these potential consequences is essential to avoid default.

- Damage to Credit Score: Defaulting will severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The government can garnish a portion of your wages to repay the defaulted loan.

- Tax Refund Offset: Your federal and state tax refunds can be seized to repay the debt.

- Difficulty Obtaining Future Loans: Defaulting makes it nearly impossible to obtain future federal student loans or other types of loans.

- Collection Agency Involvement: The debt may be turned over to a collection agency, which can pursue aggressive collection tactics.

Closing Summary

In conclusion, the average amount of student loan debt is a complex issue with significant ramifications for individuals and economies alike. While the financial burden can be substantial, understanding the factors influencing debt accumulation, coupled with proactive management strategies, can empower graduates to navigate their financial future successfully. By carefully considering the information presented here, individuals can make informed decisions regarding their educational pursuits and financial planning, paving the way for a more secure and prosperous future.

Popular Questions

What are income-driven repayment plans?

Income-driven repayment plans base your monthly student loan payments on your income and family size. They generally offer lower monthly payments than standard repayment plans, but may result in a longer repayment period and potentially higher overall interest paid.

Can I consolidate my student loans?

Yes, consolidating your student loans combines multiple loans into a single loan with a new interest rate and repayment terms. This can simplify repayment, but may not always lower your overall interest cost.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score. It can also make it difficult to obtain future loans or credit.

Are there any grants or scholarships available to help with student loan debt?

Yes, various grants and scholarships are available to help students finance their education and reduce their reliance on loans. Check with your college’s financial aid office and explore online resources for available opportunities.