Navigating the complex world of student loans often leaves borrowers questioning the crucial aspect of interest rates. Understanding the average interest rate for student loans is paramount to making informed financial decisions. This rate, a seemingly simple number, is actually influenced by a multitude of factors, from your creditworthiness to the type of loan you secure. This exploration delves into the intricacies of these rates, equipping you with the knowledge to effectively manage your student loan debt.

From federal to private loans, fixed to variable rates, the landscape of student loan interest can be daunting. This guide will illuminate the key factors influencing these rates, providing clear explanations and practical examples to empower you in your financial journey. We’ll examine data sources, explore historical trends, and offer strategies for minimizing your interest payments, ultimately helping you navigate the path to loan repayment with confidence.

Understanding the Term “Average Interest Rate for Student Loans”

The average interest rate for student loans represents the typical interest charged on student loan debt across a specific period. Understanding this average is crucial for prospective borrowers to budget effectively and make informed decisions about financing their education. However, it’s vital to remember that the average is just that – an average. Individual interest rates will vary significantly based on several factors.

The average interest rate reflects both fixed and variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. A variable interest rate, on the other hand, fluctuates based on market conditions, leading to potentially changing monthly payments. The average rate calculation considers the proportion of fixed and variable rate loans in the overall market.

Factors Influencing the Average Interest Rate

Several key factors influence the average interest rate a borrower will receive. A borrower’s creditworthiness is paramount; individuals with strong credit histories typically qualify for lower interest rates. The type of student loan also plays a significant role. Federal student loans, backed by the government, generally have lower interest rates than private student loans, which are offered by banks and other financial institutions. Finally, the lender themselves will impact the interest rate; different lenders have varying lending criteria and risk assessments. These assessments determine the interest rate they offer to borrowers.

Examples of Student Loan Types and Interest Rate Ranges

The following table illustrates typical interest rate ranges for various student loan types. Note that these are examples and actual rates can vary based on the factors discussed previously. Furthermore, loan forgiveness programs and repayment plans are subject to change based on government policies and individual lender programs.

| Loan Type | Interest Rate Range (Example) | Repayment Plan Options | Loan Forgiveness Programs |

|---|---|---|---|

| Federal Subsidized Loan | 0.5% – 7% | Standard, Graduated, Extended, Income-Driven | Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness |

| Federal Unsubsidized Loan | 1% – 7.5% | Standard, Graduated, Extended, Income-Driven | Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness |

| Federal PLUS Loan (Graduate/Parent) | 5% – 9% | Standard, Extended, Income-Driven | Limited loan forgiveness programs typically available |

| Private Student Loan | 2% – 12% (or higher) | Variable depending on the lender | Limited or no loan forgiveness programs |

Data Sources for Student Loan Interest Rates

Understanding the average interest rate for student loans requires access to reliable data sources. Several organizations and government agencies regularly collect and publish this information, each employing different methodologies and presenting data in various formats. Choosing a reputable source is crucial for accurate financial planning and informed decision-making.

Several reputable sources offer data on student loan interest rates. These sources vary in their data collection methods, the scope of their data, and how they present their findings. Comparing and contrasting these sources allows for a more comprehensive understanding of the current interest rate landscape.

Reputable Sources of Student Loan Interest Rate Data

Three key sources for obtaining current student loan interest rate data include the Federal Student Aid website, the National Center for Education Statistics (NCES), and various financial news outlets that specialize in personal finance.

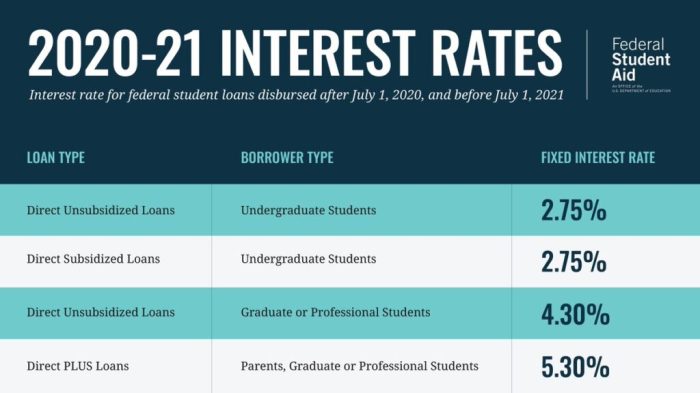

The Federal Student Aid website, managed by the U.S. Department of Education, provides the most comprehensive data on federal student loan interest rates. It details the interest rates for various federal loan programs, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. The NCES, also a part of the Department of Education, offers broader statistical data on student loan borrowing and repayment, including average interest rates, though often at a higher level of aggregation than the Federal Student Aid website. Finally, reputable financial news organizations, such as the Wall Street Journal or Bloomberg, often compile and report on average student loan interest rates, drawing data from various sources and offering analysis alongside the numbers. These sources may focus on specific market trends or average interest rates across different loan types.

Comparison of Data Presentation Methods

The presentation of data varies significantly across these sources. The Federal Student Aid website presents its data in a clear, tabular format, with specific interest rates listed for each loan program and loan year. The NCES data is often presented in aggregated form, using charts and graphs to illustrate trends over time. Financial news outlets generally integrate interest rate data into their articles and reports, often highlighting key trends and comparing them to historical averages. The Federal Student Aid website offers the most precise and granular data, while the NCES provides a broader contextual view. Financial news outlets often offer simplified summaries tailored for a general audience, but might lack the detail found on government websites.

Data Collection and Verification at the Federal Student Aid Website

The Federal Student Aid website’s data collection and verification process is rigorous. The data originates directly from the Department of Education’s loan servicing systems. These systems track all aspects of federal student loans, including the interest rate assigned to each loan at the time of disbursement. The data is regularly updated to reflect changes in interest rates, which are set annually for federal student loans based on market indices. The website’s data is subject to internal quality control checks and audits to ensure accuracy and consistency. Before publication, the data undergoes several validation steps to minimize errors and inconsistencies. This process ensures that the information available on the Federal Student Aid website is reliable and reflects the actual interest rates applied to federal student loans.

Factors Affecting Individual Student Loan Interest Rates

Several key factors influence the interest rate you’ll receive on your student loans. These factors are considered by both federal and private lenders, though the weighting and specific criteria may vary. Understanding these factors can help you strategize for securing a lower interest rate.

Credit History’s Role in Determining Student Loan Interest Rates

Your credit history plays a significant role, particularly for private student loans. Lenders assess your creditworthiness based on your past borrowing and repayment behavior. A strong credit history, demonstrated by consistent on-time payments and a low credit utilization ratio, indicates a lower risk to the lender, resulting in a potentially lower interest rate. Conversely, a poor credit history, marked by late payments, defaults, or high debt, will likely lead to a higher interest rate or even loan denial. For federal student loans, credit history is generally less of a factor, as eligibility is primarily based on factors like enrollment status and financial need. However, even with federal loans, a poor credit history could impact your ability to obtain a loan or may influence the terms of loan consolidation or refinancing in the future.

The Impact of Co-Signers on Interest Rates

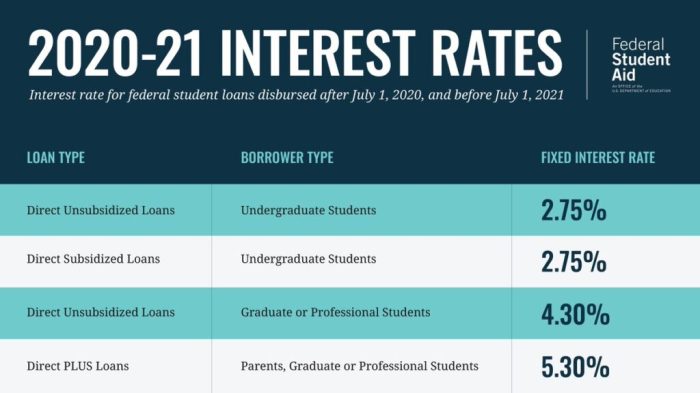

A co-signer is an individual who agrees to share responsibility for repaying your student loan. Their creditworthiness is factored into the lender’s assessment of risk. Including a co-signer with excellent credit can significantly improve your chances of securing a lower interest rate, especially if your own credit history is weak or nonexistent. The lender considers the co-signer’s credit score, debt-to-income ratio, and overall financial stability. While the co-signer assumes financial responsibility, it’s a crucial element in securing favorable loan terms. However, it’s important to note that adding a co-signer benefits both parties; the student benefits from a lower rate, while the co-signer benefits from the potential of strengthening their credit history through timely repayment.

Interest Rate Differences Based on Loan Type

Federal and private student loans differ significantly in how interest rates are determined. Federal student loans typically have fixed interest rates that are set by the government each year and are generally lower than private loan rates. The rate for federal loans often depends on the loan type (e.g., subsidized vs. unsubsidized), the borrower’s credit history (although less significant than for private loans), and the repayment plan chosen. Private student loans, on the other hand, have variable or fixed interest rates determined by the lender based on market conditions and the borrower’s creditworthiness. Private loan interest rates are often higher than federal loan rates and can fluctuate over time if the rate is variable. The specific interest rate will vary widely among lenders, so it is advisable to shop around for the best rates.

Flowchart Illustrating the Student Loan Interest Rate Determination Process

The following flowchart illustrates a simplified process of determining a student’s interest rate:

[Imagine a flowchart here. The flowchart would start with a box labeled “Application Received.” This would branch to two boxes: “Federal Loan Application” and “Private Loan Application.” The Federal Loan Application would branch to a box indicating factors considered: “Enrollment Status,” “Financial Need,” and “Loan Type.” This would then lead to a box showing “Interest Rate Determined (Based on Government Set Rates).” The Private Loan Application would branch to boxes representing factors considered: “Credit Score,” “Debt-to-Income Ratio,” “Co-signer Credit (if applicable),” and “Market Interest Rates.” This would lead to a box showing “Interest Rate Determined (Based on Lender’s Assessment).” Finally, both paths would converge to a box labeled “Loan Offered.”]

Trends in Student Loan Interest Rates

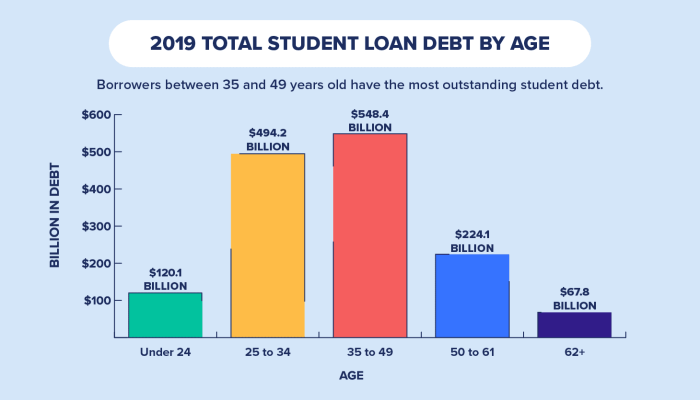

Over the past decade, student loan interest rates have fluctuated significantly, influenced by economic conditions and government policies. Understanding these trends is crucial for prospective and current borrowers to make informed financial decisions. This section will examine historical trends, compare undergraduate and graduate loan rates, and offer a reasoned forecast for the future.

Historical Trends in Average Student Loan Interest Rates

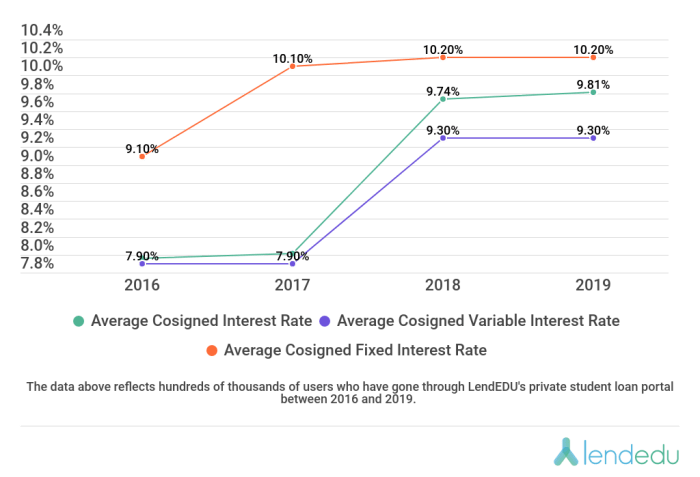

The average interest rate for federal student loans has shown a somewhat cyclical pattern over the past ten years. Initially, rates were relatively low in the early 2010s, reflecting a period of low overall interest rates. However, rates gradually increased throughout much of the decade, peaking around 2018-2019. This increase was partly due to rising inflation and a general upward trend in interest rates across the broader economy. Subsequently, rates experienced a decline in the later part of the decade, in part due to economic responses to the COVID-19 pandemic which included temporary interest rate reductions. These fluctuations demonstrate the sensitivity of student loan interest rates to macroeconomic factors.

Comparison of Undergraduate and Graduate Student Loan Interest Rates

Generally, graduate student loans carry higher interest rates than undergraduate loans. This difference reflects the perceived higher risk associated with graduate borrowers, who often have larger loan amounts and potentially less established earning potential upon graduation. For example, while a subsidized undergraduate Stafford loan might have an interest rate around 4-6%, a graduate PLUS loan might carry a rate closer to 7-9%. This disparity highlights the importance for graduate students to carefully consider the long-term financial implications of borrowing larger sums at higher interest rates. The specific rate differences can also vary depending on the lender and the type of loan.

Forecast for Future Trends in Student Loan Interest Rates

Predicting future interest rates is inherently uncertain, but several factors suggest potential trends. Continued inflation and potential future interest rate hikes by the Federal Reserve could push student loan rates higher. However, government intervention, such as loan forgiveness programs or targeted rate reductions for specific demographics, could moderate these increases. Considering current economic forecasts and the historical relationship between overall interest rates and student loan rates, a moderate increase in rates over the next few years seems plausible, potentially hovering around the higher end of the recent historical range, barring significant policy changes. However, significant economic downturns or shifts in government policy could substantially alter this forecast. For instance, a major recession might lead to lower rates, while increased government subsidies could lower rates as well.

Graphical Representation of Interest Rate Trends

A line graph would effectively illustrate the historical trends. The horizontal axis would represent the year (e.g., 2013-2023), while the vertical axis would represent the average interest rate (as a percentage). Two separate lines could be used to represent undergraduate and graduate loan rates. The graph would show the fluctuating nature of interest rates over the decade, with the graduate loan rate line consistently positioned above the undergraduate loan rate line, reflecting the higher rates for graduate borrowers. Data points would be plotted for each year, showing the average rate for that year. The overall trend would likely show an upward trend followed by a period of decline and then a potential leveling off or modest increase in the years to come. This visual representation would clearly show the historical context and provide a basis for understanding potential future trends.

The Impact of Interest Rates on Student Loan Repayment

Understanding the interest rate on your student loan is crucial because it directly impacts the total amount you’ll repay. A seemingly small difference in interest rates can significantly increase the overall cost of your loan over its lifetime, leading to a substantially larger debt burden. This section will explore how different interest rates affect repayment and demonstrate the importance of considering this factor when choosing a loan.

The interest rate determines the cost of borrowing money. It’s expressed as a percentage of the principal loan amount and is applied over the loan’s repayment period. The higher the interest rate, the more you’ll pay in interest charges, increasing the total cost of your loan beyond the original principal amount. This increased cost directly affects your monthly payments and your overall financial well-being after graduation.

Comparison of Repayment Amounts at Different Interest Rates

To illustrate the impact of interest rates, let’s compare two scenarios: a $20,000 loan at 5% interest and a $20,000 loan at 7% interest, both repaid over a 10-year period. We’ll use a standard amortization calculator (widely available online) to determine the monthly payments and total repayment amounts. The results will highlight the substantial difference in total cost due to a seemingly small 2% difference in interest rates.

| Loan Amount | Interest Rate | Monthly Payment (approx.) | Total Repayment (approx.) |

|---|---|---|---|

| $20,000 | 5% | $212 | $25,440 |

| $20,000 | 7% | $229 | $27,480 |

Note: These figures are approximate and may vary slightly depending on the specific amortization calculation used. The key takeaway is the significant difference in total repayment: approximately $2,040 more for the 7% loan.

The Impact of Interest Capitalization

Interest capitalization occurs when accrued interest is added to the principal loan balance. This means you’ll start paying interest on your interest, significantly increasing the total cost of your loan. For example, if you have a grace period after graduation before repayment begins, interest accrues during that period. If that interest is capitalized, it becomes part of the principal, meaning you’ll pay interest on that accumulated interest throughout the repayment period. This can substantially increase the overall amount you owe and extend your repayment timeline. Understanding the terms of your loan and the potential for interest capitalization is crucial to planning for effective repayment.

Strategies for Managing Student Loan Interest Rates

Managing student loan interest rates effectively is crucial for minimizing the overall cost of repayment. Several strategies can help borrowers reduce their interest burden and accelerate debt payoff. Understanding these strategies and their implications is key to responsible debt management.

Minimizing Student Loan Interest Payments

Several proactive steps can significantly reduce the amount paid in interest over the life of your student loans. Prioritizing high-interest loans for early repayment is a common and effective strategy. This involves making extra payments toward the loan with the highest interest rate first, while still making minimum payments on other loans. Another approach is to make more frequent payments, even if they’re smaller amounts. Bi-weekly payments, for instance, can effectively reduce the total interest paid over the life of the loan compared to monthly payments. Finally, exploring opportunities for loan consolidation or refinancing can potentially lower your overall interest rate.

Refinancing Student Loans to Lower Interest Rates

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can be beneficial if your credit score has improved since you initially took out your loans, or if interest rates have fallen. However, refinancing has potential drawbacks. You might lose access to federal loan benefits, such as income-driven repayment plans or loan forgiveness programs. Furthermore, refinancing might extend the loan term, leading to higher total interest paid despite a lower interest rate. Carefully weigh the pros and cons before pursuing this option. A thorough comparison of interest rates and repayment terms from various lenders is essential.

Student Loan Repayment Plans

Different repayment plans offer varying degrees of flexibility and impact on total interest paid. The standard repayment plan involves fixed monthly payments over a 10-year period. This plan is simple but can result in higher monthly payments. Extended repayment plans stretch payments over a longer period (up to 25 years), lowering monthly payments but increasing the total interest paid. Income-driven repayment plans (IDR) tie monthly payments to a percentage of your discretionary income. These plans offer lower monthly payments, but they often extend the repayment period and potentially increase the total interest paid. The specific repayment plan that suits an individual best depends on their financial situation and long-term goals.

Resources for Managing Student Loan Debt

The effective management of student loan debt requires information and support. Here are some valuable resources:

- The National Student Loan Data System (NSLDS): Provides a centralized location to access your federal student loan information.

- Your Loan Servicer: Your loan servicer can answer questions about your specific loan terms, repayment options, and available assistance programs.

- The Federal Student Aid website (studentaid.gov): Offers comprehensive information on federal student loans, repayment plans, and debt management strategies.

- Nonprofit Credit Counseling Agencies: These agencies can provide free or low-cost counseling and assistance with developing a student loan repayment plan.

Closing Notes

Successfully managing student loan debt requires a thorough understanding of interest rates. By comprehending the factors that influence these rates, exploring available resources, and employing effective repayment strategies, borrowers can significantly reduce their overall financial burden. This guide has provided a foundational understanding, empowering you to make informed decisions and navigate the complexities of student loan repayment successfully. Remember, proactive planning and diligent management are key to achieving financial freedom.

FAQ Resource

What is the difference between fixed and variable interest rates for student loans?

Fixed interest rates remain constant throughout the loan’s life, offering predictability. Variable rates fluctuate based on market conditions, potentially leading to lower initial payments but higher costs if rates rise.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can lower your interest rate, but it typically involves consolidating your loans with a private lender. Carefully weigh the pros and cons before refinancing, as it may impact loan forgiveness programs.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payments on your income and family size. They often result in lower monthly payments but extend the repayment period and may increase the total interest paid.

How does my credit score affect my student loan interest rate?

A higher credit score generally qualifies you for lower interest rates, as lenders perceive you as a lower risk. A poor credit score may result in higher interest rates or even loan denial.