Navigating the complexities of higher education often involves a significant financial commitment, with student loans playing a pivotal role for many. Understanding the average interest rates on these loans is crucial for prospective and current borrowers alike, as these rates directly impact the overall cost of a degree and long-term financial well-being. This exploration delves into the current landscape of student loan interest rates, examining historical trends, calculation methods, and the various factors influencing both average and individual rates.

From federal subsidies to private lender variations, the world of student loan interest is multifaceted. This analysis aims to provide a clear and comprehensive understanding of how these rates are determined, how they fluctuate over time, and how borrowers can make informed decisions to minimize their financial burden. We will examine both the immediate implications of interest rates on repayment schedules and the long-term financial consequences of carrying significant student loan debt.

Current Average Interest Rates

Understanding current average interest rates for student loans is crucial for prospective and current borrowers. These rates significantly impact the overall cost of higher education and the length of repayment. Variations exist depending on the loan type, lender, and repayment plan selected.

The average interest rates for student loans fluctuate based on several key economic factors. These rates are not static and change periodically. Understanding these influencing factors can help borrowers make informed decisions.

Factors Influencing Student Loan Interest Rate Fluctuation

Several interconnected factors influence the fluctuation of average interest rates for student loans. These include prevailing market interest rates, the federal government’s fiscal policy, and the overall economic climate. Market interest rates, often tied to Treasury bond yields, directly influence the cost of borrowing for both federal and private lenders. Changes in federal fiscal policy, such as adjustments to the federal budget or changes in lending programs, can also impact interest rates. Finally, macroeconomic conditions, such as inflation and economic growth, play a significant role in determining the overall cost of borrowing. For example, during periods of high inflation, lenders may increase interest rates to compensate for the decreased purchasing power of money.

Comparison of Federal and Private Student Loan Interest Rates

Federal and private student loans differ significantly in their interest rate structures and overall cost. Federal student loans generally offer fixed interest rates, providing borrowers with predictability and stability. These rates are typically lower than those offered by private lenders, making them a more affordable option for many students. However, eligibility for federal loans is subject to creditworthiness and income limitations. In contrast, private student loans often have variable interest rates, meaning that the interest rate can change over the life of the loan, potentially increasing the overall cost. Private lenders also tend to offer higher interest rates compared to federal loans, particularly for borrowers with lower credit scores. The availability of various repayment plans, such as income-driven repayment options, also differs between federal and private lenders. Federal loans typically offer more flexible repayment options, while private loan options may be less accommodating.

Average Interest Rates for Student Loans

The following table presents a generalized overview of average interest rates. Actual rates may vary based on specific lender policies, creditworthiness, and other factors. It’s crucial to check with individual lenders for the most up-to-date information.

| Loan Type | Repayment Plan | Federal Average Interest Rate (Example) | Private Average Interest Rate (Example) |

|---|---|---|---|

| Undergraduate | Standard | 4.5% | 6.0% – 12.0% |

| Graduate | Standard | 5.5% | 7.0% – 13.0% |

| PLUS (Parent/Graduate) | Standard | 7.0% | 8.0% – 14.0% |

| Private Undergraduate | Variable | N/A | 7.0% – 14.0% (Variable) |

| Private Graduate | Fixed | N/A | 8.0% – 15.0% (Fixed) |

Disclaimer: The interest rates provided in the table are examples and should not be considered definitive. Actual rates vary significantly depending on the lender, borrower’s creditworthiness, and the specific loan terms. Always consult official sources for the most accurate and up-to-date information.

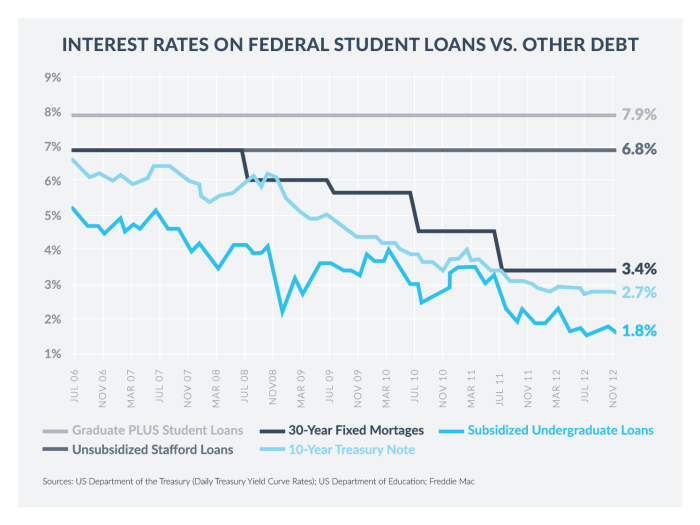

Historical Trends in Interest Rates

Understanding the historical trends in average student loan interest rates provides valuable context for interpreting current rates and anticipating future changes. Fluctuations reflect a complex interplay of economic conditions and government policies. Analyzing these trends reveals patterns that can inform borrowing decisions and policy debates.

The following section examines the historical trajectory of average student loan interest rates over the past decade, considering the influence of economic factors and government interventions.

Average Student Loan Interest Rate Trends (2014-2024): A Graphical Representation

Imagine a line graph charting average student loan interest rates on the vertical axis against the years 2014 through 2024 on the horizontal axis. The graph would show a generally upward trend from 2014 to approximately 2018, followed by a period of relative stability or slight decrease until around 2020. A noticeable increase would then be observed from 2020 to 2022, potentially reflecting the economic uncertainty surrounding the COVID-19 pandemic. Finally, a slight decline or leveling off might be visible from 2022 to 2024, depending on the specific data used. Key inflection points would include the peaks around 2018 and 2022, reflecting periods of economic growth and subsequent uncertainty, respectively. The overall pattern suggests a sensitivity of interest rates to macroeconomic conditions.

Impact of Economic Factors on Student Loan Interest Rates

Economic factors significantly influence student loan interest rates. Periods of high inflation typically lead to higher interest rates as lenders seek to protect their returns against the eroding purchasing power of money. Conversely, during recessions, interest rates may decrease as the Federal Reserve lowers its benchmark interest rate to stimulate economic activity. For example, the 2008 financial crisis led to a temporary decline in student loan interest rates, reflecting the broader trend of lower borrowing costs across the economy. Similarly, the economic uncertainty surrounding the COVID-19 pandemic in 2020-2021 initially caused some instability, with subsequent increases mirroring the overall increase in interest rates as the economy began to recover. The relationship isn’t always perfectly linear, however, as other factors such as government policies and market conditions play a role.

Government Policies Influencing Student Loan Interest Rates

Government policies have profoundly shaped the landscape of student loan interest rates. For instance, the introduction of the Income-Based Repayment (IBR) program aimed to make student loan repayments more manageable for borrowers, potentially indirectly influencing interest rates by reducing the risk for lenders. Changes in federal funding for student loan programs can also affect interest rates; increased funding may lead to lower rates, while reduced funding could have the opposite effect. Furthermore, direct government intervention in setting interest rate caps or subsidies on student loans has historically played a significant role. For example, periods of government-set interest rate caps for federal student loans resulted in artificially lower rates for borrowers compared to market rates. The interplay between government policy and market forces is a dynamic one, constantly shaping the interest rate environment for student loans.

Interest Rate Calculation and Accrual

Understanding how student loan interest is calculated and accrued is crucial for effective financial planning. This section details the process, including the impact of capitalization and compounding, and provides a method for calculating total interest paid. Different calculation methods employed by lenders will also be discussed.

Student loan interest accrues daily on the outstanding principal balance. The daily interest is calculated by dividing the annual interest rate by 365 (or 366 for leap years) and multiplying this by the principal. This daily interest is then added to the principal balance, increasing the amount on which future interest is calculated. This process is known as compounding. Capitalization occurs when accrued but unpaid interest is added to the principal balance, increasing the amount on which future interest is calculated. This typically happens at specific intervals, such as monthly or annually, depending on the loan terms.

Simple Interest Calculation

While simple interest is rarely used for student loans, understanding it provides a basic framework. Simple interest is calculated only on the principal amount borrowed. It doesn’t compound. The formula is: Simple Interest = Principal x Interest Rate x Time. For example, a $10,000 loan with a 5% annual interest rate over 1 year would accrue $500 in simple interest ($10,000 x 0.05 x 1).

Compound Interest Calculation: A Step-by-Step Guide

Most student loans use compound interest, meaning interest accrues on both the principal and previously accumulated interest. This makes a significant difference over the loan’s life. The following steps Artikel how to calculate the total interest paid over the loan’s lifetime. Note that this is a simplified calculation and doesn’t account for variations in repayment schedules or prepayments.

- Determine the variables: Identify the principal (P), annual interest rate (r), and loan term in years (t).

- Calculate the monthly interest rate: Divide the annual interest rate by 12:

Monthly Interest Rate = r / 12 - Calculate the number of months: Multiply the loan term in years by 12:

Number of Months = t x 12 - Use the compound interest formula: The formula for calculating the future value (FV) of a loan with compound interest is:

FV = P (1 + r/n)^(nt)where n is the number of times interest is compounded per year (usually 12 for monthly). This gives you the total amount owed at the end of the loan term. - Calculate the total interest paid: Subtract the principal from the future value:

Total Interest = FV - P

Example: A $20,000 loan with a 6% annual interest rate over 10 years (compounded monthly):

- P = $20,000, r = 0.06, t = 10

- Monthly Interest Rate = 0.06 / 12 = 0.005

- Number of Months = 10 x 12 = 120

- FV = $20,000 (1 + 0.005)^(120) ≈ $36,416.74

- Total Interest = $36,416.74 – $20,000 = $16,416.74

This example demonstrates that over ten years, approximately $16,416.74 in interest would be paid on the loan.

Interest Rate Calculation Methods Used by Lenders

While the underlying principles of compound interest remain consistent, lenders may employ slight variations in their calculation methods. These variations can impact the final interest amount. Some factors that influence these calculations include:

- Daily vs. Monthly Accrual: Some lenders accrue interest daily, while others use a monthly calculation. Daily accrual generally leads to slightly higher total interest.

- Rounding Practices: The way lenders round interest calculations (up or down) can accumulate over time, leading to minor differences in total interest paid.

- Specific Loan Programs: Different loan programs (e.g., federal subsidized vs. unsubsidized, private loans) may have different interest calculation methodologies Artikeld in their terms and conditions.

It’s essential to carefully review the loan agreement to understand the specific interest calculation method used by your lender.

Impact of Interest Rates on Repayment

Understanding how interest rates influence student loan repayment is crucial for effective financial planning. Higher interest rates significantly increase the total cost of borrowing, extending repayment periods and potentially impacting future financial goals. Conversely, lower rates can lead to substantial savings over the life of the loan.

The total amount repaid on a student loan is directly impacted by the interest rate. A higher interest rate means more money is paid towards interest rather than principal, leading to a larger overall repayment amount. This effect is amplified over longer repayment periods.

Illustrative Examples of Interest Rate Impact

The following table demonstrates how different interest rates and loan amounts affect the total repayment cost over various repayment periods. These figures are simplified examples and do not include any potential fees. Actual repayment amounts may vary based on loan terms and repayment plans.

| Loan Amount | Interest Rate | 10-Year Repayment (approx.) | 20-Year Repayment (approx.) |

|---|---|---|---|

| $20,000 | 4% | $23,000 | $27,000 |

| $20,000 | 7% | $26,000 | $33,000 |

| $40,000 | 4% | $46,000 | $54,000 |

| $40,000 | 7% | $52,000 | $66,000 |

Strategies to Minimize the Impact of High Interest Rates

Borrowers facing high interest rates can employ several strategies to mitigate their impact. These strategies focus on reducing the overall cost and duration of repayment.

Making extra principal payments is a highly effective method. By paying more than the minimum monthly payment, borrowers reduce the loan’s principal balance faster, lessening the amount of interest accrued over time. For example, consistently paying an extra $100 per month can significantly reduce the total interest paid and shorten the repayment period.

Another effective strategy involves refinancing the loan. If interest rates have fallen since the initial loan disbursement, refinancing to a lower rate can result in substantial savings. However, borrowers should carefully compare offers from different lenders and consider any associated fees. It is important to ensure that the new loan terms are favorable and don’t increase the overall cost in the long run.

Careful budgeting and financial planning are essential for effective repayment. Creating a realistic budget that prioritizes loan repayment can help ensure timely payments and avoid late fees, which can further increase the total cost.

Long-Term Financial Consequences of High Interest Rates

High interest rates on student loans can have significant long-term financial repercussions. The extended repayment periods can delay major financial milestones, such as homeownership, saving for retirement, or starting a family. The large debt burden can also limit opportunities for career advancement, as individuals may be constrained by their financial obligations. In some cases, high student loan debt can even lead to financial stress and hardship. For instance, individuals might postpone investing in their own businesses or pursuing higher education opportunities due to the weight of their debt. This could impact their earning potential and overall long-term financial well-being.

Factors Affecting Individual Interest Rates

Securing a student loan involves more than just the application process; the interest rate you receive is a crucial factor impacting your overall repayment burden. Several interconnected elements influence the interest rate offered to individual borrowers, ultimately determining the total cost of your education. Understanding these factors empowers you to make informed decisions and potentially secure a more favorable loan.

Numerous variables contribute to the final interest rate on a student loan. These factors interact in complex ways, meaning a borrower’s profile is holistically assessed, rather than each factor being considered in isolation.

Credit Score’s Influence on Student Loan Interest Rates

A strong credit history significantly impacts your eligibility for favorable student loan interest rates. Lenders view a high credit score as an indicator of responsible financial behavior, reducing their perceived risk. Conversely, a low credit score, or lack of credit history, often leads to higher interest rates or even loan rejection. For example, a borrower with a credit score above 750 might qualify for a significantly lower interest rate than a borrower with a score below 600. Lenders use sophisticated algorithms and risk models that incorporate credit history details to determine an appropriate interest rate. Building a positive credit history through responsible credit card use and timely bill payments is a proactive step in securing better loan terms.

Income and Debt-to-Income Ratio’s Role in Interest Rate Determination

Your income and debt-to-income (DTI) ratio play a crucial role in determining your eligibility for student loans and the interest rates offered. Lenders assess your ability to repay the loan, considering your current income against your existing debt obligations. A higher income and a lower DTI ratio generally indicate a lower risk for the lender, potentially resulting in a lower interest rate. For instance, a high-earning individual with minimal existing debt is likely to receive a more favorable interest rate compared to someone with a low income and substantial existing debt. This assessment is crucial for both federal and private student loans.

The Impact of a Co-Signer on Student Loan Interest Rates

Including a co-signer on your student loan application can significantly improve your chances of approval and influence the interest rate offered. A co-signer, typically a parent or other financially responsible individual, agrees to share responsibility for repaying the loan if the primary borrower defaults. This shared responsibility reduces the lender’s risk, often leading to lower interest rates or increased approval chances, particularly for borrowers with limited or poor credit history. The co-signer’s creditworthiness directly affects the interest rate offered. A co-signer with an excellent credit score can help secure a significantly lower interest rate for the primary borrower.

Federal vs. Private Student Loan Eligibility and Interest Rates

Federal and private student loans differ significantly in their eligibility requirements and interest rate implications. Federal student loans are generally more accessible, with eligibility based primarily on enrollment status and financial need. Interest rates on federal loans are fixed and set by the government, making them predictable and often more favorable than private loans. Private student loans, on the other hand, have stricter eligibility criteria, often requiring a good credit history and a co-signer. Interest rates on private loans are variable and determined by market conditions and the borrower’s creditworthiness, potentially leading to higher interest rates compared to federal loans. The selection between federal and private loans depends heavily on individual circumstances and financial profiles.

Credit History’s Impact on Student Loan Interest Rates: A Deeper Dive

A borrower’s credit history is a pivotal factor in determining student loan interest rates, especially for private loans. Lenders scrutinize credit reports for indicators of responsible financial management, such as timely payments, credit utilization, and the presence of negative marks like bankruptcies or late payments. A positive credit history, demonstrating consistent responsible borrowing and repayment, often results in lower interest rates and improved loan terms. Conversely, a poor credit history can lead to higher interest rates, limited loan amounts, or even loan denial. Therefore, cultivating and maintaining a healthy credit history is a crucial step towards securing favorable student loan terms.

Repayment Options and Interest Rates

Understanding your repayment options is crucial for minimizing the total interest paid on your student loans. Different plans offer varying repayment periods and monthly payments, significantly impacting the overall cost. Choosing the right plan depends on your individual financial situation and long-term goals.

Choosing a repayment plan involves a trade-off between shorter repayment periods (leading to higher monthly payments but less interest paid overall) and longer periods (resulting in lower monthly payments but significantly more interest paid over the life of the loan).

Standard Repayment Plans and Interest Paid

Standard repayment plans typically involve fixed monthly payments over a 10-year period. This option leads to the fastest repayment and, consequently, the lowest total interest paid. However, the fixed monthly payments can be substantial, potentially straining borrowers’ budgets, especially in the early stages of their careers. For example, a $30,000 loan at 7% interest would have a monthly payment of approximately $330 under a standard 10-year plan, leading to a total interest payment of roughly $10,000.

Extended Repayment Plans and Interest Paid

Extended repayment plans stretch the repayment period beyond the standard 10 years, often up to 25 years. This reduces monthly payments, making them more manageable for borrowers. However, this significantly increases the total interest paid over the life of the loan. Using the same $30,000 loan example at 7% interest, a 25-year extended repayment plan might have a monthly payment of around $180, but the total interest paid could easily exceed $25,000.

Income-Driven Repayment Plans and Interest Paid

Income-driven repayment (IDR) plans adjust monthly payments based on the borrower’s income and family size. These plans are designed to make repayments more affordable, especially for borrowers with lower incomes. However, because the payments are often lower, the repayment period can be significantly longer (potentially up to 20 or 25 years), leading to a higher total interest paid compared to standard repayment plans. The long repayment period, coupled with potential interest capitalization (adding unpaid interest to the principal), can result in substantial interest accumulation over time. For instance, a borrower might experience significantly lower monthly payments under an IDR plan but end up paying substantially more in total interest compared to a standard plan.

Comparison of Repayment Options

The following table compares the advantages and disadvantages of various repayment options in relation to interest rates:

| Repayment Plan | Advantages | Disadvantages | Impact on Interest Paid |

|---|---|---|---|

| Standard | Fastest repayment, lowest total interest | High monthly payments | Lowest |

| Extended | Lower monthly payments | Longest repayment period, highest total interest | Highest |

| Income-Driven | Affordable monthly payments based on income | Longest repayment period, potential for high total interest, complex calculations | Potentially high, depending on income and loan amount |

Loan Forgiveness Programs and Interest Rate Calculations

Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), can impact interest rate calculations. These programs typically require borrowers to make a certain number of qualifying payments under an income-driven repayment plan. While the remaining loan balance is forgiven, the interest that accrued before forgiveness is still typically due. For example, if a borrower qualifies for loan forgiveness after 10 years under an IDR plan, they may still owe a significant amount of interest accrued during that period, even though the principal balance is forgiven. The exact impact on interest rate calculations depends on the specifics of the forgiveness program and the borrower’s individual loan details. This means that while the loan balance is erased, the borrower still needs to consider the significant interest paid before forgiveness.

Last Recap

In conclusion, understanding average interest rates on student loans is paramount for responsible financial planning. While the complexities of interest calculations and varying lender practices may seem daunting, this overview provides a framework for navigating these challenges. By considering historical trends, understanding the factors affecting individual rates, and exploring diverse repayment options, borrowers can effectively manage their student loan debt and chart a course towards a secure financial future. Proactive planning and informed decision-making are key to mitigating the long-term financial implications of student loans.

Expert Answers

What is the difference between fixed and variable interest rates on student loans?

Fixed interest rates remain constant throughout the loan’s life, while variable rates fluctuate based on market indices, potentially leading to higher or lower payments over time.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing may offer a lower interest rate, but it often involves consolidating loans and may change repayment terms. Carefully compare offers before refinancing.

How does my credit score affect my student loan interest rate?

A higher credit score typically qualifies you for lower interest rates on private student loans. Federal student loan interest rates are generally not based on credit score.

What are income-driven repayment plans, and how do they affect interest?

Income-driven repayment plans base monthly payments on your income and family size. While monthly payments are lower, you may pay more interest over the loan’s lifetime.