Navigating the complex world of student loans often feels like deciphering a financial code. Understanding the average interest rate is crucial, yet the reality is far more nuanced than a single number suggests. This guide delves into the factors influencing these rates, exploring the differences between federal and private loans, fixed and variable interest structures, and the impact of individual borrower circumstances. We’ll examine historical trends, providing insights into how economic shifts have affected borrowing costs over the past two decades. Ultimately, our goal is to empower you with the knowledge needed to make informed decisions about your student loan journey.

From understanding the methodologies used to calculate average rates to analyzing the long-term financial implications of even small interest rate fluctuations, we aim to provide a clear and comprehensive picture. We will explore how different loan types, credit scores, and co-signers affect individual interest rates, and offer strategies for securing the most favorable terms possible. This exploration goes beyond simple averages, providing a detailed examination of the variables that shape the cost of borrowing for higher education.

Defining “Average Rate on Student Loans”

Understanding the average rate on student loans requires careful consideration of how this average is calculated and the factors influencing the final figure. A simple average, calculated by summing all interest rates and dividing by the number of loans, doesn’t reflect the relative size or weight of each loan. A more accurate representation uses a weighted average, where each loan’s interest rate is weighted by its principal balance. This method accurately reflects the overall cost of borrowing for the entire student loan portfolio. Other calculation methods may exist, depending on the data source and intended application, but the weighted average is generally preferred for its accuracy.

The average rate isn’t a static number; it’s influenced by several dynamic factors. These factors significantly impact the overall average and make generalizations about student loan costs challenging.

Factors Influencing the Average Rate

Several key factors contribute to the variability in student loan interest rates and, consequently, the calculated average. These factors interact in complex ways, making the average rate a somewhat imprecise indicator of individual borrowing costs.

The most significant factor is the type of loan. Federal student loans generally have lower interest rates than private student loans, as they are backed by the government and carry less risk for lenders. Within federal loans, different programs (like subsidized and unsubsidized loans) also have varying rates. Private loans, on the other hand, are offered by banks and credit unions, and their rates depend heavily on the borrower’s creditworthiness and the lender’s risk assessment.

Another crucial factor is the interest rate structure: fixed versus variable. Fixed-rate loans maintain the same interest rate throughout the loan’s life, providing predictability for borrowers. Variable-rate loans, however, adjust periodically based on market indices, introducing uncertainty into the repayment schedule. The proportion of fixed-rate versus variable-rate loans in a given dataset significantly affects the calculated average rate. For example, a period of rising interest rates would likely increase the average variable rate more significantly than the fixed rate.

Finally, the borrower’s creditworthiness plays a critical role, especially for private loans. Borrowers with strong credit histories and high credit scores typically qualify for lower interest rates, while those with weaker credit profiles face higher rates. This disparity in creditworthiness contributes to a wider range of interest rates within the overall pool of student loans, making a single average less representative.

Limitations of a Single Average Rate

Using a single average rate to represent the diverse landscape of student loan interest rates presents several limitations. The average masks the significant variations in rates across different loan types, interest rate structures, and borrower credit profiles. A single number cannot adequately capture the wide range of borrowing experiences, from borrowers securing low rates on federal subsidized loans to those facing high rates on private loans with unfavorable terms. Furthermore, the average rate may not accurately reflect the current market conditions, as it’s often based on historical data or a snapshot in time, neglecting the dynamic nature of interest rates. Consequently, relying solely on the average rate can be misleading for individuals trying to understand their personal borrowing costs or for policymakers assessing the overall student loan debt burden.

Data Sources and Collection Methods for Student Loan Interest Rates

Understanding the average interest rate on student loans requires access to reliable data sources employing robust methodologies. Several organizations collect and publish this information, each with its own approach to data gathering and calculation. Differences in methodology can lead to variations in reported average rates, highlighting the importance of understanding the source’s approach.

Reliable Sources for Student Loan Interest Rate Data

Several organizations provide data on student loan interest rates. The frequency and accessibility of this data vary depending on the source. Understanding the nuances of each source’s data collection is crucial for accurate interpretation.

| Source Name | Data Frequency | Methodology Description | Limitations |

|---|---|---|---|

| Federal Student Aid (FSA) – U.S. Department of Education | Annually, with some data updated more frequently | Aggregates data from all federal student loan programs, calculating weighted averages based on loan volume and interest rates for different loan types (e.g., subsidized, unsubsidized, PLUS loans). | Data reflects only federal loans; does not include private student loans. May not capture the full range of interest rate variations due to variations in loan terms and borrower profiles. |

| The College Board | Annually, often published in reports on trends in higher education financing | Typically uses data from various sources, including government reports and surveys of borrowers, to estimate average interest rates. May use different weighting methods than the FSA. | Data may rely on sampling methodologies and self-reported information, potentially leading to some degree of sampling error or bias. May not provide the same level of detail as the FSA data. |

| National Center for Education Statistics (NCES) | Periodically, often as part of larger surveys on student financial aid | Collects data through surveys and administrative records, analyzing interest rates paid by students on various types of loans. Methodology may involve statistical modeling to account for missing data or to estimate rates for certain subgroups. | Data collection may not be comprehensive, potentially underrepresenting certain segments of the student loan borrower population. Data release frequency is less frequent than the FSA. |

Methodologies for Calculating Average Interest Rates

Each data source employs its own methodology for calculating and reporting average interest rates. The FSA, for example, uses a weighted average, considering the volume of loans at each interest rate. This contrasts with other sources that may utilize simple averages or more complex statistical models. Differences in weighting methodologies and data inclusion criteria can lead to variations in the reported average rates. Understanding these differences is vital for comparing data from multiple sources and drawing accurate conclusions.

Historical Trends in Average Student Loan Interest Rates

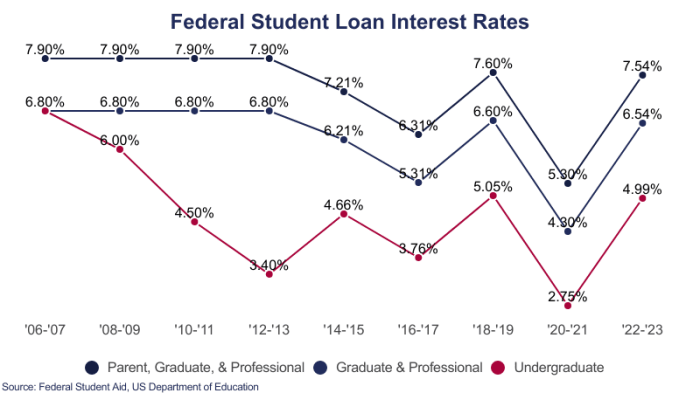

Over the past two decades, the average interest rate on student loans in the United States has experienced significant fluctuations, influenced by a complex interplay of economic factors. Understanding these trends is crucial for prospective and current borrowers, as interest rates directly impact the overall cost of higher education.

The following analysis examines these historical trends, highlighting key economic influences and their effects on student loan borrowers.

Average Student Loan Interest Rates: 2003-2023

A visual representation of the average student loan interest rates from 2003 to 2023 would take the form of a line graph. The horizontal axis (x-axis) would represent the year, ranging from 2003 to 2023. The vertical axis (y-axis) would represent the average annual interest rate, expressed as a percentage. The graph would display a line connecting data points representing the average interest rate for each year. This line would illustrate the overall trend, showing periods of increase and decrease. For example, the line might show a relatively stable period followed by a sharp increase during the Great Recession (around 2008-2009), potentially followed by periods of fluctuation before settling at a certain level. The data points would be clearly labeled, and the graph would include a title and axis labels for clarity. Further, different loan types (e.g., subsidized vs. unsubsidized) could be represented by separate lines on the same graph for comparison, adding visual complexity and offering insights into rate disparities across loan categories.

Economic Factors Influencing Interest Rate Fluctuations

Several key economic factors have significantly influenced the fluctuations observed in average student loan interest rates. The Federal Reserve’s monetary policy, including interest rate targets set by the Federal Open Market Committee (FOMC), plays a major role. When the FOMC raises interest rates to combat inflation, borrowing costs generally increase across the board, including for student loans. Conversely, interest rate cuts designed to stimulate economic growth typically lead to lower borrowing costs. Additionally, broader economic conditions such as inflation rates and overall economic growth also have an impact. Periods of high inflation often lead to higher interest rates as lenders seek to protect their returns from the erosion of purchasing power. During periods of economic recession or slow growth, lenders may become more risk-averse, leading to potentially higher rates to compensate for perceived increased risk. Government policies, such as changes to student loan programs or subsidies, can also affect interest rates, either directly or indirectly. For instance, changes to the funding mechanisms for student loans can shift the supply of funds, leading to changes in interest rates.

Impact of Interest Rate Fluctuations on Borrowers

Fluctuations in average student loan interest rates have substantial consequences for borrowers. Higher interest rates directly translate into increased total repayment costs, potentially extending the loan repayment period and increasing the overall financial burden. This can have significant long-term implications for borrowers, impacting their ability to save for retirement, purchase a home, or make other significant financial decisions. Conversely, periods of lower interest rates can offer borrowers some relief, potentially reducing the total cost of borrowing and allowing for quicker repayment. The impact of these fluctuations is particularly acute for students borrowing large sums for higher education, making careful consideration of loan terms and interest rates a crucial aspect of financial planning for higher education.

Comparison of Average Rates Across Different Loan Types

Understanding the average interest rates for different student loan types is crucial for prospective borrowers to make informed decisions about financing their education. The rates vary significantly depending on the type of loan, the borrower’s creditworthiness (in the case of private loans), and the lender. This section will detail these differences to provide a clearer picture of the financial implications associated with each loan option.

Federal student loans, offered by the government, generally have lower interest rates than private student loans. However, even within the federal loan program, interest rates differ depending on the loan type and the borrower’s eligibility.

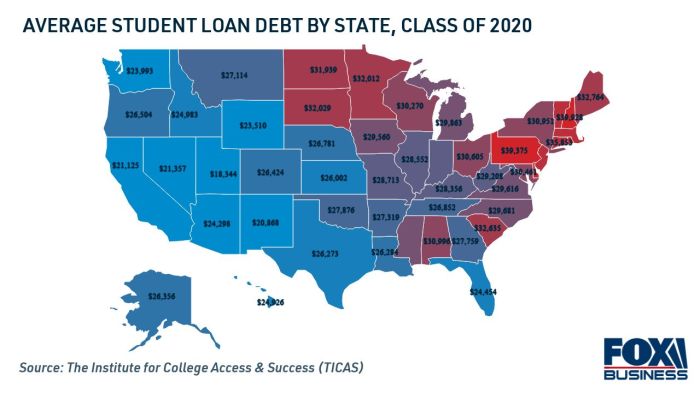

Federal Student Loan Interest Rates

Federal student loan interest rates are set annually by the government and are generally fixed for the life of the loan. These rates are typically lower than those offered by private lenders because the government subsidizes these loans, aiming to make higher education more accessible. The rates vary depending on the loan type and when the loan was originated.

The following bullet points illustrate the average interest rate differences among common federal student loan programs. Note that these rates are subject to change and represent averages over recent years, not a fixed value.

- Subsidized Federal Stafford Loans: These loans are for undergraduate students demonstrating financial need. The government pays the interest while the borrower is in school, during grace periods, and under certain deferment circumstances. Average historical rates have ranged from approximately 2% to 5%.

- Unsubsidized Federal Stafford Loans: These loans are available to undergraduate and graduate students, regardless of financial need. Interest accrues from the time the loan is disbursed, even while the borrower is in school. Average historical rates have been slightly higher than subsidized loans, typically ranging from 3% to 6%.

- Federal PLUS Loans: These loans are available to parents of dependent undergraduate students and to graduate students. They typically have higher interest rates than Stafford loans. Average historical rates have ranged from approximately 6% to 8%.

Private Student Loan Interest Rates

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, private loan interest rates are variable and depend on several factors, primarily the borrower’s creditworthiness. Borrowers with strong credit scores and co-signers with excellent credit history tend to qualify for lower interest rates.

The following points highlight the variability of private student loan interest rates.

- Creditworthy Borrowers: Borrowers with excellent credit scores may secure interest rates ranging from 4% to 7%, depending on the lender and the loan terms.

- Borrowers with Moderate Credit: Individuals with average or fair credit scores may face significantly higher interest rates, often ranging from 8% to 15% or even higher.

- Borrowers with Poor Credit: Those with poor credit history may find it extremely difficult to secure a private student loan, or they might be offered rates exceeding 15%, reflecting the increased risk to the lender.

Impact of Average Rate Changes on Student Borrowers

Changes in the average student loan interest rate have significant financial implications for borrowers, affecting the total cost of their education and their long-term financial well-being. Even seemingly small fluctuations in interest rates can translate into substantial differences in the total amount repaid over the life of the loan. Understanding these implications is crucial for borrowers to make informed decisions and plan for their financial future.

Financial Implications of Interest Rate Changes

Changes in the average student loan interest rate directly impact the total interest paid over the loan’s lifetime. A higher interest rate means borrowers pay more in interest, increasing the overall cost of their loan. Conversely, a lower interest rate reduces the total interest paid, making the loan more affordable. This impact is amplified by the loan’s principal amount and repayment term. Longer repayment periods generally lead to higher overall interest payments, regardless of the interest rate. For instance, a 1% increase on a $30,000 loan over 10 years could add thousands of dollars to the total repayment amount, whereas the same increase on a $100,000 loan over 20 years would add significantly more.

Effects of Fluctuating Interest Rates on Repayment Ability

Fluctuating interest rates can significantly affect borrowers’ ability to repay their loans. Unexpected increases in interest rates can strain borrowers’ budgets, particularly those with already tight finances or unstable employment. If a borrower’s income remains stagnant or decreases while interest rates rise, they may struggle to meet their monthly payments, potentially leading to delinquency or default. Conversely, decreasing interest rates can provide some relief, allowing borrowers to allocate more of their income towards other financial priorities. Factors such as job security, unexpected expenses, and overall financial planning significantly influence a borrower’s resilience to interest rate changes.

Hypothetical Scenario: A 1% Interest Rate Change

Let’s consider a hypothetical scenario involving a $50,000 student loan with a 10-year repayment term. We’ll examine the impact of a 1% increase and a 1% decrease in the average interest rate.

For simplicity, we will use a standard amortization calculator to demonstrate this. These calculators are widely available online. A 5% interest rate on a $50,000 loan over 10 years would result in approximately $583 monthly payments and a total repayment of approximately $69,960, with total interest paid of $19,960.

A 1% increase (6% interest rate) on the same loan would increase the monthly payment to approximately $604 and the total repayment to roughly $72,480, with a total interest paid of $22,480. This represents an additional $2,520 in interest paid.

A 1% decrease (4% interest rate) would decrease the monthly payment to approximately $562 and the total repayment to approximately $67,440, with a total interest paid of $17,440. This represents a savings of $2,520 in interest paid.

These calculations highlight the substantial long-term financial impact even a seemingly small 1% change in the average interest rate can have. The difference in total interest paid over ten years is $5,040 – a significant sum that could impact a borrower’s ability to save for a down payment on a house, invest, or address other financial needs.

Factors Affecting Individual Student Loan Interest Rates

While the average student loan interest rate provides a general overview of borrowing costs, individual rates can vary significantly. Several factors beyond the average influence the interest rate a student receives, ultimately determining their monthly payments and total repayment cost. Understanding these factors is crucial for borrowers seeking to secure the most favorable terms possible.

The interest rate offered on a student loan is not a static number; it’s a dynamic calculation influenced by a combination of creditworthiness, the type of loan, and the availability of a co-signer. These factors interact to create a personalized interest rate, often diverging substantially from the publicized average.

Credit Score Influence on Interest Rates

A borrower’s credit history plays a pivotal role in determining their interest rate. Lenders use credit scores to assess risk; a higher credit score indicates a lower risk of default, thus leading to a lower interest rate. Conversely, a lower credit score signals higher risk, resulting in a higher interest rate to compensate the lender. For example, a borrower with an excellent credit score (750 or above) might qualify for a rate several percentage points below the average, while someone with a poor credit score (below 600) could face a rate significantly higher than the average, potentially doubling their monthly payments. This demonstrates the considerable impact of creditworthiness on the overall cost of borrowing.

Co-Signer Impact on Interest Rates

The availability of a co-signer, an individual with strong credit who agrees to share responsibility for the loan, can dramatically improve a borrower’s chances of securing a lower interest rate. Lenders view co-signers as a mitigating factor against potential default. The co-signer’s excellent credit history essentially underwrites the loan, reducing the lender’s perceived risk. A student with a limited or damaged credit history might be offered a significantly lower interest rate if they have a creditworthy co-signer. In contrast, a borrower without a co-signer and a weak credit history might receive an interest rate substantially above the average.

Loan Type and Interest Rate Variation

Different types of student loans come with varying interest rates. Federal student loans, for instance, typically offer lower rates than private student loans. Furthermore, within the federal loan program, subsidized loans (where interest is not accrued during periods of deferment) often carry lower rates than unsubsidized loans. Private student loans, on the other hand, are offered by banks and credit unions, and their interest rates are heavily influenced by market conditions and the borrower’s creditworthiness. A borrower choosing a private loan with a less favorable interest rate might find their total repayment cost significantly higher compared to someone who secures a federal loan with a lower average rate.

Improving Chances of Lower Interest Rates

Borrowers can actively work towards obtaining lower interest rates. Building and maintaining a strong credit score is paramount. This involves responsible credit card usage, timely bill payments, and avoiding excessive debt. Exploring the possibility of a co-signer, particularly if credit history is limited, can also be beneficial. Finally, understanding the nuances of federal and private student loan options and carefully comparing rates from multiple lenders allows borrowers to make informed decisions that minimize borrowing costs. By proactively addressing these factors, students can significantly reduce the overall cost of their education financing.

Last Point

In conclusion, while a single “average rate” for student loans offers a broad overview, the true picture is far more intricate. Individual circumstances, loan types, and economic conditions all play a significant role in determining the actual interest rate a borrower will face. By understanding the various factors at play—from historical trends to individual creditworthiness—borrowers can navigate the complexities of student loan financing more effectively and make informed decisions that align with their financial goals. Remember to explore all available options and carefully consider the long-term financial implications before committing to a student loan.

Clarifying Questions

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or during deferment. Unsubsidized loans accrue interest throughout the loan’s life.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it often involves consolidating multiple loans into a single new loan with a private lender. Carefully compare offers before refinancing.

How does my credit score affect my student loan interest rate?

A higher credit score typically qualifies you for lower interest rates, especially with private student loans. Lenders view a good credit score as an indicator of lower risk.

What is the impact of a co-signer on my student loan interest rate?

Having a co-signer with good credit can significantly improve your chances of securing a lower interest rate, as it reduces the lender’s perceived risk.

What are the consequences of defaulting on a student loan?

Defaulting on a student loan can have severe consequences, including damage to your credit score, wage garnishment, and difficulty obtaining future loans or credit.