The weight of student loan debt in the United States is a significant concern for millions, impacting personal finances and the broader economy. This exploration delves into the current state of average student loan debt, examining historical trends, geographical variations, repayment challenges, and the influence of government programs. We will uncover the complexities of this issue, providing a clear and informative picture of the current landscape.

From the soaring costs of higher education to the evolving repayment options and forgiveness programs, this analysis offers a multifaceted perspective on the student loan crisis. We will examine the impact on individuals, communities, and the national economy, presenting data-driven insights and practical advice for navigating this increasingly complex financial terrain.

Current Average Student Loan Debt

Understanding the current state of student loan debt in the United States is crucial for policymakers, lenders, and borrowers alike. The sheer scale of this debt impacts individual financial well-being and the broader economy. This section will present the most recent available data on average student loan debt, offering a detailed breakdown by borrower type and debt characteristics.

Precise figures on average student loan debt fluctuate slightly depending on the source and the time of year the data is collected. However, consistently reliable sources such as the Federal Reserve, the Department of Education, and the Federal Reserve Bank of New York provide updated statistics. It’s important to remember that these are averages, and individual experiences can vary widely.

Average Student Loan Debt by Borrower Type

The average student loan debt differs significantly between undergraduate and graduate borrowers. Graduate students typically accumulate substantially more debt due to longer programs and higher tuition costs. Recent data suggests that the average debt for graduate borrowers is considerably higher than that for undergraduate borrowers. For example, while the average undergraduate borrower might owe around $37,000, the average graduate borrower could owe upwards of $75,000 or more. This disparity highlights the growing financial burden faced by those pursuing advanced degrees.

Average Student Loan Debt by Degree Type

The type of degree pursued also significantly impacts the amount of debt incurred. Professional degrees, such as medical or law degrees, often lead to the highest levels of student loan debt due to the extensive length and high cost of these programs. Master’s degrees typically result in higher debt than Bachelor’s degrees, reflecting the longer duration and increased tuition costs. A detailed breakdown of average debt by degree type would illustrate this clear correlation between program length, tuition costs, and resulting debt burden.

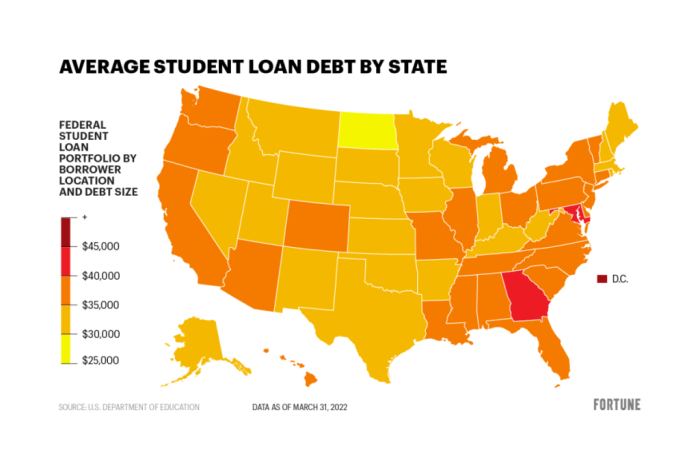

Average Student Loan Debt by Demographic Factors

Several demographic factors influence the average student loan debt. Income level, age group, and the type of loan (federal vs. private) all play a role in shaping the overall debt landscape. The following table provides a hypothetical illustration of how these factors might interact to influence average debt. Note that actual data collection and reporting on these intersections can be complex, so precise figures may vary across different studies and datasets. This table is intended to demonstrate the relationship between these variables and average debt.

| Income Level | Age Group | Loan Type | Average Debt |

|---|---|---|---|

| Low (<$40,000) | 25-34 | Federal | $30,000 |

| Low (<$40,000) | 25-34 | Private | $35,000 |

| Medium ($40,000-$80,000) | 35-44 | Federal | $45,000 |

| Medium ($40,000-$80,000) | 35-44 | Private | $55,000 |

| High (>$80,000) | 45+ | Federal | $60,000 |

| High (>$80,000) | 45+ | Private | $70,000 |

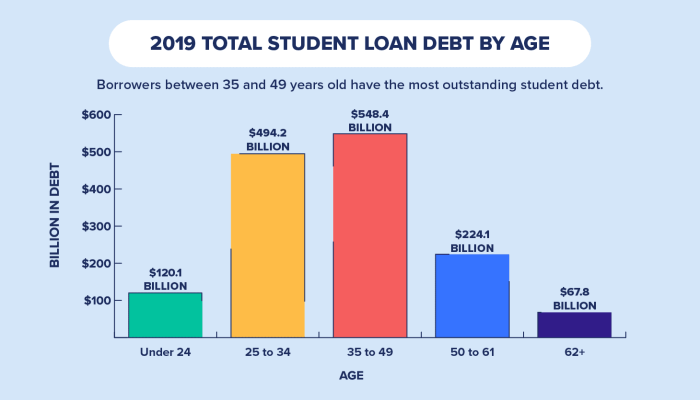

Historical Trends in Student Loan Debt

The past two decades have witnessed a dramatic surge in student loan debt in the United States, transforming it from a manageable financial burden for many into a significant societal and economic challenge. This increase reflects a complex interplay of factors, including rising tuition costs, shifting societal expectations regarding higher education, and evolving federal lending policies. Understanding this historical trend is crucial for developing effective solutions to address the current crisis.

The growth of student loan debt can be visually represented as a sharply ascending line graph. Imagine a graph with the x-axis representing years (from approximately 2000 to 2023) and the y-axis representing total student loan debt in trillions of dollars. The line would start relatively low in 2000, showing a gradual increase initially. However, from roughly 2008 onwards, the line would exhibit a much steeper incline, reflecting the accelerating pace of debt accumulation. This visual representation would clearly demonstrate the exponential growth experienced over this period. A similar graph could also depict the average student loan debt per borrower, showing a parallel, though potentially less dramatic, upward trend.

Factors Contributing to the Increase in Student Loan Debt

Several interconnected factors have fueled the dramatic rise in student loan debt. Firstly, the cost of higher education has increased significantly faster than inflation for many years. Tuition fees at both public and private universities have risen considerably, making it increasingly difficult for students to finance their education without substantial borrowing. Secondly, there has been a societal shift towards viewing a college degree as increasingly essential for career success and economic mobility. This perception has led to a higher demand for higher education, further contributing to the rise in student loan debt. Thirdly, changes in federal student loan programs have made borrowing easier and more accessible. Increased loan limits and streamlined application processes have, in some ways, contributed to greater borrowing. Finally, the Great Recession of 2008 had a significant indirect impact, as reduced family incomes and job opportunities meant many students and families relied more heavily on loans.

Key Legislative Changes and Their Impact on Student Loan Debt

A timeline illustrating key legislative changes and their impact would reveal a pattern of fluctuating policies and their consequences. For instance, the Higher Education Act of 1965 laid the groundwork for the federal student loan program, but subsequent amendments and reauthorizations significantly altered the landscape. The expansion of federal loan programs in the 1990s and 2000s, aimed at increasing access to higher education, inadvertently contributed to the growth in overall debt. The creation of income-driven repayment plans, while intended to provide relief, has also had complex effects, potentially influencing borrowing behavior. Further, legislative efforts to address the growing debt crisis, such as temporary interest rate freezes or expanded forgiveness programs, have provided short-term relief but haven’t fundamentally addressed the underlying causes. The impact of these changes can be illustrated by plotting relevant legislation on a timeline alongside a graph of student loan debt growth, revealing correlations and highlighting the legislative context of the debt crisis.

Debt by State and Institution

Student loan debt in the United States varies significantly depending on the state of residence and the type of institution attended. Understanding this variation provides a more nuanced perspective on the overall student debt crisis and highlights disparities in access to higher education and post-graduation financial stability. This section examines the distribution of student loan debt across different states and educational institutions.

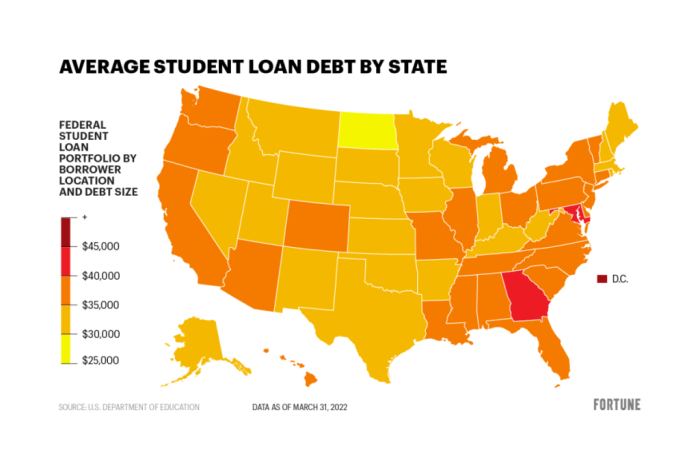

Average Student Loan Debt by State

The average student loan debt burden differs considerably across the United States. States with robust higher education systems and higher concentrations of private institutions often see higher average debt levels, reflecting potentially higher tuition costs. Conversely, states with more heavily subsidized public institutions may exhibit lower average debt. For example, states like Delaware and Pennsylvania consistently report higher average student loan debt, while states in the Midwest and South tend to have lower averages. Precise figures fluctuate yearly and should be sourced from reputable organizations tracking this data, such as the Education Data Initiative or the Federal Reserve. A detailed state-by-state analysis would require a comprehensive table, but a general trend reveals a clear East Coast/West Coast higher debt pattern compared to the interior.

Comparison of Student Loan Debt: Public vs. Private Institutions

A key factor influencing student loan debt is the type of institution attended. Private institutions generally have higher tuition costs than public institutions, leading to a greater reliance on student loans and ultimately higher average debt levels for graduates. Students attending prestigious private universities often accumulate significantly more debt than their counterparts at public colleges and universities. This difference is amplified by the availability of need-based and merit-based financial aid, which is often more readily available at public institutions, particularly those receiving state funding. However, even within public institutions, variations exist. Flagship state universities often have higher tuition than smaller regional public colleges, contributing to differences in average debt among public institution graduates.

Map of Average Student Loan Debt Across the US

A map illustrating average student loan debt across the US would utilize a color-coded choropleth map. Each state would be represented as a polygon, filled with a color intensity corresponding to its average student loan debt. A legend would clearly define the color scale, ranging from a light color (representing the lowest average debt) to a dark color (representing the highest average debt). State borders would be clearly delineated, and the map would include a title clearly stating the year the data represents, the data source, and a brief description of the methodology used to calculate average debt. For improved readability, state abbreviations could be included, and a separate inset map could focus on regions with particularly high or low average debt, allowing for better visualization of regional trends. The map would effectively communicate the geographical distribution of student loan debt, highlighting areas of significant disparity and providing a visual representation of the data discussed previously.

Repayment Options and Challenges

Navigating student loan repayment can be complex, with numerous plans and potential hurdles. Understanding the available options and anticipating challenges is crucial for successful repayment and avoiding financial distress. This section Artikels various repayment plans and common difficulties borrowers encounter.

The federal government offers several repayment plans designed to accommodate different financial situations. These plans vary in monthly payment amounts, loan terms, and eligibility requirements. Borrowers should carefully consider their individual circumstances when selecting a plan. Common options include Standard Repayment, Extended Repayment, Graduated Repayment, and Income-Driven Repayment (IDR) plans. IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), tie monthly payments to a borrower’s income and family size, potentially resulting in lower monthly payments but potentially longer repayment periods and increased total interest paid over the life of the loan.

Student Loan Repayment Plans

The choice of repayment plan significantly impacts a borrower’s monthly budget and long-term financial health. Each plan offers a different balance between affordability and repayment speed. For example, while an IDR plan might offer lower monthly payments initially, the extended repayment period could lead to significantly higher total interest paid compared to a Standard Repayment plan with higher monthly payments but a shorter repayment timeline. Borrowers should carefully weigh these trade-offs based on their individual financial projections and risk tolerance.

- Standard Repayment: Fixed monthly payments over 10 years.

- Extended Repayment: Fixed monthly payments over a longer period (up to 25 years), resulting in lower monthly payments but higher total interest.

- Graduated Repayment: Payments start low and gradually increase over time.

- Income-Driven Repayment (IDR) Plans: Monthly payments are based on income and family size, offering more flexibility but potentially leading to higher total interest paid and longer repayment periods. Examples include IBR, PAYE, and REPAYE.

Challenges in Student Loan Repayment

Many borrowers face significant challenges during repayment. Understanding these potential difficulties allows for proactive planning and mitigation strategies. Delinquency and default are serious consequences of failing to make timely payments, leading to damaged credit scores and potential legal actions. Financial hardship, unexpected life events, and insufficient understanding of repayment options are all contributing factors.

- Delinquency: Missing or making late payments. This negatively impacts credit scores and can lead to additional fees.

- Default: Failing to make payments for an extended period. This can result in wage garnishment, tax refund offset, and damage to credit history, making it difficult to obtain future loans or credit.

- High Interest Rates: Accumulated interest can significantly increase the total amount owed, making repayment more challenging.

- Unexpected Life Events: Job loss, illness, or family emergencies can disrupt repayment plans.

- Lack of Financial Literacy: A lack of understanding of repayment options and financial management techniques can hinder successful repayment.

Effective Student Loan Debt Management

Proactive steps can significantly improve the chances of successful repayment. These strategies emphasize budgeting, planning, and seeking assistance when needed. Careful financial planning and consistent effort are key to avoiding delinquency and default.

- Create a Budget: Track income and expenses to determine how much can be allocated to student loan payments.

- Choose the Right Repayment Plan: Carefully consider different plans based on income, expenses, and long-term financial goals.

- Automate Payments: Set up automatic payments to avoid missed payments and late fees.

- Explore Refinancing Options: Consider refinancing to potentially lower interest rates, but be aware of the risks and fees involved. This option is generally available for private loans, not federal loans.

- Seek Professional Help: Consult a financial advisor or credit counselor for personalized guidance and support.

- Communicate with Loan Servicers: Contact your loan servicer immediately if facing financial hardship to explore options like forbearance or deferment.

The Impact of Student Loan Debt on the Economy

The staggering accumulation of student loan debt in the United States has far-reaching consequences, extending beyond the individual borrowers to significantly impact the broader economy. This debt burden affects consumer spending, investment in housing, and overall economic growth, creating a ripple effect that influences various sectors and the nation’s financial health.

The weight of student loan repayments can severely restrict an individual’s financial well-being. High monthly payments often leave little room for saving, investing, or addressing other financial needs. This can delay major life milestones like homeownership, starting a family, or even simply building an emergency fund. The constant pressure of debt can also lead to increased stress and anxiety, negatively impacting mental health and overall quality of life. Individuals may forgo opportunities for career advancement or entrepreneurship due to the fear of taking on additional debt or the need to prioritize repayment.

Effects on Consumer Spending and Homeownership

High student loan debt significantly curtails consumer spending. Borrowers often prioritize debt repayment over discretionary purchases, leading to reduced demand for goods and services. This dampening effect on consumer spending can hinder economic growth as businesses experience lower sales and reduced investment. Furthermore, the significant financial commitment to student loan repayment often delays or prevents homeownership for many young adults. The inability to secure a mortgage, coupled with the need to allocate funds towards loan payments, limits access to a significant wealth-building asset and contributes to slower growth in the housing market. For example, a recent study by the Federal Reserve Bank of New York found a significant negative correlation between student loan debt and homeownership rates among young adults. This illustrates how the burden of student loan debt restricts individuals from participating fully in the housing market, a crucial driver of economic activity.

Impact on Economic Growth

The accumulation of student loan debt casts a long shadow over economic growth. Reduced consumer spending, as discussed above, directly impacts economic activity. Moreover, the potential for delayed or forgone higher education due to the high cost of tuition and the subsequent debt burden can lead to a less skilled workforce. This, in turn, can hinder innovation and productivity growth in the long run. For instance, if aspiring entrepreneurs are unable to pursue advanced degrees or start businesses due to crippling debt, it limits the potential for job creation and economic expansion. Additionally, the resources allocated to servicing student loans could be channeled into other productive investments, such as research and development or infrastructure projects, further boosting economic growth. The potential for a decrease in entrepreneurial activity due to student loan debt represents a significant loss of potential economic contribution. Consider the missed opportunities for innovation and job creation that result when promising entrepreneurs are forced to prioritize debt repayment over pursuing their business ideas.

Student Loan Forgiveness Programs

Navigating the complexities of student loan debt often leads borrowers to explore available forgiveness programs. These programs offer the potential for partial or complete loan cancellation, providing significant relief to those struggling with repayment. However, it’s crucial to understand the eligibility criteria and application processes for each program, as they vary significantly.

Types of Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each designed to target specific groups or situations. These programs are not always mutually exclusive; borrowers may qualify for multiple types of forgiveness. Understanding the differences is vital for maximizing potential benefits.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program offers forgiveness for Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer and consistent payments. The program has faced criticism for its stringent requirements and complexities, leading to changes aimed at improving accessibility. For example, temporary waivers have been implemented to address past payment discrepancies.

Teacher Loan Forgiveness Program

This program provides forgiveness for up to $17,500 in federal student loans for teachers who have completed five years of full-time teaching in low-income schools or educational service agencies. Eligibility hinges on teaching in a qualifying school and maintaining consistent employment. This program specifically targets educators working in underserved communities.

Income-Driven Repayment (IDR) Plans

While not strictly forgiveness programs, Income-Driven Repayment (IDR) plans, such as PAYE, REPAYE, IBR, and ICR, significantly reduce monthly payments based on income and family size. After a set number of years (typically 20 or 25), any remaining loan balance may be forgiven. However, this forgiven amount is considered taxable income. The specific terms and conditions vary depending on the chosen plan. These plans provide long-term relief and potential forgiveness, but the forgiven amount is taxed upon forgiveness.

Other Forgiveness Programs

Beyond the major programs, other avenues for loan forgiveness exist, often specific to particular circumstances. These might include forgiveness for borrowers with disabilities or those who have experienced total and permanent disability. These programs typically require extensive documentation and verification of the qualifying circumstances. Detailed information on these niche programs is available through the Federal Student Aid website.

Criteria and Processes for Loan Forgiveness

The application process for loan forgiveness programs can be complex and time-consuming. Generally, it involves submitting detailed documentation proving eligibility, such as employment verification, tax returns, and loan repayment history. Applicants must carefully follow the specific instructions for each program to avoid delays or denials. Regular monitoring of application status and communication with loan servicers is crucial for a successful application. The process often includes multiple steps and requires meticulous record-keeping. Failure to meet specific requirements, even minor ones, can lead to rejection.

Conclusion

The pervasive impact of student loan debt in the US necessitates a comprehensive understanding of its multifaceted dimensions. From its historical growth and regional disparities to the challenges faced by borrowers and the broader economic consequences, the issue demands ongoing attention and innovative solutions. This overview has aimed to illuminate the key aspects of this critical topic, offering a foundation for informed discussion and effective policymaking.

FAQ Section

What is the difference between federal and private student loans?

Federal student loans are offered by the government and generally have more favorable repayment options and protections for borrowers. Private student loans are provided by banks and other financial institutions and often have higher interest rates and less flexible repayment plans.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment plan. This can simplify repayment but may not always reduce the overall cost.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to credit score. It can also make it difficult to obtain future loans or credit.

Are there income-driven repayment plans?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size. These plans can lower your monthly payments, but may extend the repayment period and potentially increase the total interest paid.