Navigating the complexities of student loan debt requires a clear understanding of interest rates. In 2024, these rates are influenced by a dynamic interplay of economic factors, government policies, and individual loan characteristics. This exploration delves into the average student loan interest rate for 2024, examining its components and implications for borrowers.

Understanding these rates is crucial for prospective and current students alike. The information presented here will help demystify the process, allowing individuals to make informed decisions about their educational financing and long-term financial planning. We will cover various loan types, explore the impact of economic conditions, and Artikel strategies for effective debt management.

Understanding the Average Student Loan Interest Rate in 2024

The average student loan interest rate represents the typical interest rate charged across all federal student loans disbursed during a given year. Understanding this average provides a general benchmark for the cost of borrowing for higher education, although individual rates can vary significantly. This average is influenced by numerous factors, making it a dynamic figure that changes annually.

Factors Influencing the Average Interest Rate for 2024

Several economic and policy factors impact the average student loan interest rate. These include prevailing market interest rates, the federal government’s borrowing costs, and any changes to federal student loan programs. For instance, increased inflation might lead to higher interest rates to compensate lenders for the reduced purchasing power of future repayments. Conversely, government initiatives to lower borrowing costs for students could result in a decrease in the average rate. The specific economic climate at the start of 2024 will play a significant role in determining the final average.

Types of Federal Student Loans and Their Interest Rates

Federal student loans are categorized into several types, each with its own interest rate structure. These rates are set annually by the government and are generally lower than private loan rates. The primary types include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans for graduate students and parents, and Direct Consolidation Loans. The interest rate for each loan type varies depending on the borrower’s creditworthiness (in the case of PLUS loans) and the loan disbursement date.

Interest Rate Calculation Examples

The calculation of interest on federal student loans typically involves a simple interest formula: Interest = Principal x Rate x Time. For example, a student with a $10,000 Direct Unsubsidized Loan at a 5% annual interest rate will accrue $500 in interest over the first year (10000 x 0.05 x 1). However, the actual calculation may be more complex depending on the loan’s repayment plan and whether interest capitalization occurs. Capitalization means adding accrued but unpaid interest to the principal loan amount, increasing the total amount owed.

Comparison of Undergraduate and Graduate Loan Interest Rates

The interest rates for undergraduate and graduate student loans often differ. Graduate loans usually carry higher interest rates than undergraduate loans, reflecting the generally higher loan amounts and perceived higher risk for lenders. The following table illustrates a hypothetical comparison, emphasizing that actual rates vary annually and are subject to change.

| Loan Type | Undergraduate Interest Rate (Example) | Graduate Interest Rate (Example) | Loan Type Notes |

|---|---|---|---|

| Direct Subsidized Loan | 4.5% | 5.5% | Interest not accrued while in school (under certain conditions) |

| Direct Unsubsidized Loan | 5.0% | 6.0% | Interest accrues while in school |

| Direct PLUS Loan | 7.0% | 8.0% | Higher rates due to credit check; interest accrues while in school |

Impact of Economic Conditions on Interest Rates

Student loan interest rates are not set in isolation; they are significantly influenced by broader economic conditions. Understanding this relationship is crucial for borrowers and prospective students alike, as it allows for better financial planning and informed decision-making. Fluctuations in inflation, Federal Reserve policies, and overall economic growth directly impact the cost of borrowing, including student loans.

The interplay between inflation and student loan interest rates is particularly important. High inflation typically leads to higher interest rates as lenders seek to protect their returns against the eroding purchasing power of money. Conversely, low inflation often correlates with lower interest rates. This is because the Federal Reserve, aiming to manage inflation, will adjust its monetary policy accordingly, influencing the cost of borrowing across the board.

Inflation’s Influence on Student Loan Interest Rates

Inflation, a general increase in the prices of goods and services in an economy, directly impacts interest rates. When inflation is high, the purchasing power of money decreases. To compensate for this loss of value, lenders increase interest rates on loans, including student loans, to maintain the real return on their investment. For example, if inflation is consistently at 5%, lenders might increase student loan interest rates to ensure their return exceeds this inflation rate, protecting their capital from devaluation. Conversely, during periods of low inflation, interest rates tend to be lower.

Federal Reserve Monetary Policy and Interest Rates

The Federal Reserve (the Fed), the central bank of the United States, plays a significant role in influencing interest rates through its monetary policy. The Fed’s primary tools include adjusting the federal funds rate (the target rate banks charge each other for overnight loans) and conducting open market operations (buying or selling government securities). By raising the federal funds rate, the Fed makes borrowing more expensive across the economy, including student loans. Conversely, lowering the federal funds rate stimulates borrowing and economic activity. The Fed’s actions often reflect its efforts to control inflation and maintain economic stability. For instance, during periods of high inflation, the Fed might raise interest rates to cool down the economy, potentially leading to higher student loan interest rates.

Potential Economic Scenarios and Their Effects on 2024 Interest Rates

Predicting future interest rates with certainty is impossible, but we can analyze potential economic scenarios and their likely impact. A scenario of sustained economic growth coupled with moderate inflation might result in a gradual increase in student loan interest rates. Conversely, a recessionary environment could lead to lower rates as the Fed attempts to stimulate the economy. A sudden surge in inflation could trigger a more significant and rapid increase in interest rates. Consider the 2008 financial crisis: The subsequent recession led to a period of historically low interest rates across various loan types, including student loans.

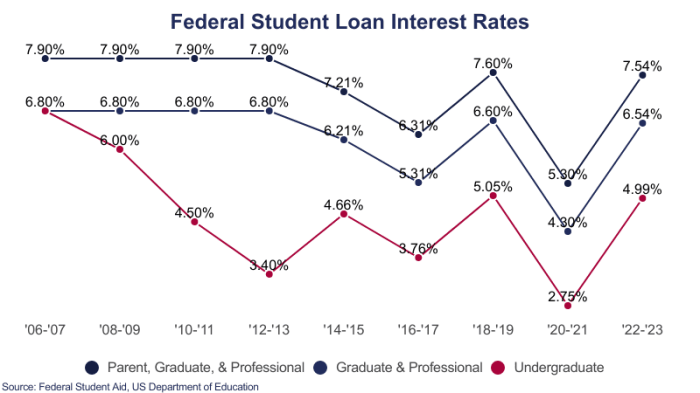

Comparison of 2024 Interest Rates to Previous Years

Comparing 2024 interest rates to previous years requires considering the prevailing economic conditions. For example, if 2023 experienced high inflation, then 2024 might see higher rates than 2023, reflecting the continuing impact of inflation on borrowing costs. Conversely, if 2023 saw low inflation and the Fed implemented a policy of low interest rates, 2024 might witness relatively similar or slightly higher rates depending on the economic trajectory. Precise comparisons necessitate examining the specific interest rates offered by different lenders and the government-backed loan programs throughout these years.

Economic Factors and Their Impact: A Summary

- High Inflation: Leads to higher interest rates to offset the decreased purchasing power of money.

- Low Inflation: Often correlates with lower interest rates.

- Federal Reserve Rate Hikes: Increases the cost of borrowing, including student loans.

- Federal Reserve Rate Cuts: Stimulates borrowing and may lower student loan rates.

- Economic Recession: Typically results in lower interest rates as the Fed tries to boost economic activity.

- Economic Growth: Can lead to higher interest rates, particularly if accompanied by inflation.

Types of Student Loans and Interest Rate Variations

Understanding the different types of student loans and how their interest rates vary is crucial for responsible borrowing and financial planning. Interest rates are a significant factor influencing the total cost of your education, so knowing how they’re determined and what affects them is key to making informed decisions.

Subsidized and Unsubsidized Loan Interest Rate Differences

Subsidized and unsubsidized federal student loans differ primarily in how interest accrues. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, even while you’re still studying. This means you’ll owe more overall with an unsubsidized loan, even if you choose to defer payments. The interest rate for both subsidized and unsubsidized loans is typically the same for a given loan period, but the ultimate cost differs due to the interest accrual differences. For example, a $10,000 unsubsidized loan might accrue several hundred dollars in interest during your studies, while a subsidized loan of the same amount would not.

Interest Rate Variations Based on Loan Repayment Plans

The repayment plan you choose doesn’t directly impact the initial interest rate of your student loan. However, your choice does influence the total interest you pay over the life of the loan. Longer repayment plans reduce your monthly payments but increase the total interest paid because you’re paying interest for a longer period. Shorter repayment plans have higher monthly payments but result in less total interest paid. For instance, a 10-year repayment plan for a $20,000 loan will have higher monthly payments than a 20-year plan, but will ultimately cost less in total interest.

Determining a Borrower’s Interest Rate

The interest rate on a federal student loan is set by the government and is generally fixed for the life of the loan. The rate is determined based on the 10-year Treasury note auction held in the spring preceding the academic year, plus a fixed margin. This means the interest rate fluctuates from year to year depending on the economic climate. Private student loans, however, have variable interest rates that can change over time, based on market conditions. These rates are influenced by factors like your credit score, co-signer creditworthiness (if applicable), and the loan’s terms.

Impact of Loan Terms on Total Interest Paid

The loan amount and repayment period significantly influence the total interest paid. A larger loan amount naturally results in more interest paid, even with the same interest rate. A longer repayment period means more interest accrues over time, increasing the total cost. For example, a $50,000 loan at 5% interest over 10 years will result in significantly less total interest paid compared to the same loan repaid over 20 years. The difference can be thousands of dollars.

Visual Representation of Interest Accumulation

Imagine a bar graph. The horizontal axis represents time (in years), and the vertical axis represents the total accumulated interest. Three bars represent three different loan scenarios: a subsidized loan, an unsubsidized loan, and a private loan with a variable interest rate. The subsidized loan bar would show the slowest upward curve, reflecting the delayed interest accrual. The unsubsidized loan bar would show a steeper, consistent upward curve. The private loan bar would show a more erratic upward curve, reflecting the fluctuations of the variable interest rate. The difference in height between the bars at the end of the repayment period visually represents the total interest paid for each loan type, clearly demonstrating the impact of loan type and interest rate variations on the overall cost.

Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a proactive approach encompassing various strategies to minimize interest payments, explore refinancing options, and select suitable repayment plans. Understanding your loan details and actively engaging with your lender are crucial steps in this process.

Minimizing Interest Payments

Several strategies can significantly reduce the total interest paid over the life of your student loans. Prioritizing high-interest loans for early repayment is a common and effective tactic. Making extra payments, even small ones, can accelerate loan payoff and save substantial interest. Exploring options such as auto-pay can also lead to small interest rate reductions offered by some lenders. Finally, diligently tracking your payments and maintaining a good credit score can positively influence future refinancing opportunities.

Student Loan Refinancing

Refinancing student loans involves replacing your existing loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over time. However, refinancing might not always be beneficial. For instance, federal student loans offer various protections and repayment options that might be lost upon refinancing into a private loan. Carefully compare interest rates, fees, and loan terms from multiple lenders before making a decision. Consider factors like your credit score, income, and the type of loan being refinanced to determine eligibility and the potential benefits.

Student Loan Repayment Plans

Different repayment plans cater to varying financial situations. Standard repayment plans involve fixed monthly payments over a set period (typically 10 years). Income-driven repayment (IDR) plans tie your monthly payments to your income and family size, resulting in lower monthly payments but potentially extending the repayment period and increasing total interest paid. Deferment and forbearance temporarily postpone payments but typically accrue interest. Choosing the right plan depends on your current financial situation and long-term financial goals. It’s crucial to understand the implications of each plan before making a selection.

Calculating Total Loan Cost

Calculating the total cost of a student loan, including interest, is essential for informed decision-making. A simple formula helps determine this:

Total Cost = Principal + (Principal x Interest Rate x Loan Term)

For example, a $20,000 loan at 5% interest over 10 years would have a total cost of approximately $25,000 (this is a simplified calculation and does not account for compounding interest). Loan amortization schedules, often available from lenders, provide detailed breakdowns of principal and interest payments over the loan’s lifespan, allowing for precise calculation. Using online loan calculators can also simplify this process.

Comparing Loan Offers

Comparing loan offers requires a systematic approach. First, gather information from multiple lenders, focusing on annual percentage rate (APR), loan fees, repayment terms, and any potential penalties for early repayment. Create a comparison table to organize this data, making it easy to identify the best offer. Pay close attention to the APR, which reflects the total cost of borrowing, including interest and fees. Finally, verify the lender’s reputation and licensing before committing to a loan. Consider seeking advice from a financial advisor if needed.

Resources and Further Information

Navigating the complexities of student loan debt requires access to reliable information and support. Understanding your options and responsibilities is crucial for successful repayment and avoiding potential pitfalls. The resources Artikeld below can provide valuable assistance throughout your student loan journey.

Reputable Websites Offering Student Loan Information

Several government and non-profit organizations offer comprehensive resources on student loans. These websites provide valuable tools and information to help borrowers understand their options and manage their debt effectively. For example, the Federal Student Aid website (studentaid.gov – a description: This website, run by the U.S. Department of Education, is the central hub for federal student aid information. It provides details on various loan programs, repayment plans, and resources for borrowers.) offers a wealth of information on federal student loans, including eligibility requirements, repayment options, and loan forgiveness programs. Similarly, the National Foundation for Credit Counseling (NFCC) website (a description: The NFCC is a non-profit organization that offers credit counseling and debt management services. Their website provides educational materials and resources to help individuals manage their finances and navigate debt.) offers resources on managing debt, including student loans, and connects borrowers with certified credit counselors who can provide personalized guidance.

Contact Information for Relevant Government Agencies and Student Loan Servicers

Direct contact with the appropriate agencies and servicers can be crucial for addressing specific concerns or resolving issues. The U.S. Department of Education’s Federal Student Aid office provides a primary point of contact for questions regarding federal student loans. Their contact information can be found on studentaid.gov. Individual student loan servicers, the companies that manage your student loan payments, also provide contact information on their respective websites. It’s important to note that the servicer for your loan may change over time, so it’s essential to regularly check your loan documents for the most up-to-date contact information. Contacting the right agency or servicer promptly can help prevent problems from escalating.

The Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy plays a vital role in effectively managing student loan debt. Understanding budgeting, interest rates, and repayment options empowers borrowers to make informed decisions. A strong grasp of personal finance principles enables borrowers to create a realistic repayment plan, track their progress, and adjust their strategy as needed. This includes understanding the difference between fixed and variable interest rates, the impact of making extra payments, and the benefits of various repayment plans. By developing sound financial habits, borrowers can minimize the stress and financial burden associated with student loan repayment. Without a strong foundation in financial literacy, borrowers risk making poor financial decisions, potentially leading to delinquency or default.

Potential Consequences of Defaulting on Student Loans

Defaulting on student loans can have severe and long-lasting consequences. These consequences extend beyond financial penalties and can significantly impact an individual’s credit score, employment prospects, and even tax refunds. Defaulting can lead to wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Furthermore, default can negatively affect an individual’s credit score, making it challenging to secure mortgages, car loans, or even rent an apartment. The impact of defaulting on student loans can be substantial and far-reaching, highlighting the importance of proactive debt management and seeking assistance when needed. Understanding these consequences underscores the importance of seeking help early if facing difficulties in repaying student loans.

Epilogue

Successfully managing student loan debt hinges on proactive planning and a thorough comprehension of interest rates. By understanding the factors that influence these rates and utilizing available resources, borrowers can navigate the repayment process more effectively. Remember to explore all available options, compare loan offers carefully, and prioritize financial literacy to ensure long-term financial well-being.

Common Queries

What factors influence the fluctuation of student loan interest rates throughout the year?

Several factors can cause fluctuations, including changes in the prime rate, the overall economic climate, and government policies related to student loan programs.

Can I refinance my federal student loans to get a lower interest rate?

While refinancing federal loans into private loans is possible, it carries risks. It may eliminate access to federal repayment programs and protections. Carefully weigh the pros and cons before making a decision.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score and may lead to late fees, penalties, and ultimately, default. Contact your loan servicer immediately if you anticipate difficulties making payments.

Are there any resources available to help me manage my student loan debt?

Yes, many resources are available, including government websites (like studentaid.gov), non-profit credit counseling agencies, and financial advisors specializing in student loan debt management.