Navigating the complex world of student loans often feels like deciphering a financial code. Understanding average student loan interest rates is crucial for prospective and current borrowers alike, impacting not only monthly payments but also the overall cost of higher education. This guide provides a clear overview of current rates, historical trends, and strategies for managing your student loan debt effectively.

From the fluctuating influences on interest rates to the long-term financial implications of your choices, we’ll explore the key factors that determine the cost of your loan. We’ll cover various loan types, the differences between fixed and variable rates, and practical steps you can take to minimize your debt burden. Understanding these nuances can empower you to make informed decisions about your financial future.

Current Average Student Loan Interest Rates

Understanding current average student loan interest rates is crucial for prospective and current borrowers. These rates significantly impact the total cost of a college education and the repayment burden afterward. Variations exist based on loan type, lender, and borrower creditworthiness.

The following table provides an overview of average interest rates. It’s important to note that these are averages and individual rates may vary. Always check with the lender for the most up-to-date and precise information.

Average Student Loan Interest Rates

| Loan Type | Federal Loan Average Rate (as of October 26, 2023) | Private Loan Average Rate (as of October 26, 2023) | Notes |

|---|---|---|---|

| Subsidized Federal Stafford Loans (Undergraduate) | 5.00% – 7.00% (Variable depending on loan origination year) | N/A | Interest does not accrue while the borrower is in school at least half-time. |

| Unsubsidized Federal Stafford Loans (Undergraduate) | 5.00% – 7.00% (Variable depending on loan origination year) | N/A | Interest accrues while the borrower is in school. |

| Federal Graduate PLUS Loans | 7.50% – 9.50% (Variable depending on loan origination year) | N/A | Loans for graduate or professional students. |

| Private Student Loans (Undergraduate) | 6.00% – 15.00% (Variable, depending on credit score and other factors) | N/A | Rates vary significantly based on borrower’s creditworthiness. |

| Private Student Loans (Graduate) | 7.00% – 18.00% (Variable, depending on credit score and other factors) | N/A | Rates generally higher than undergraduate private loans. |

Note: These rates are estimates and are subject to change. Contact lenders directly for the most current rates.

Factors Influencing Student Loan Interest Rate Fluctuations

Several factors contribute to the variability of student loan interest rates. These factors influence both federal and private loan rates, although to varying degrees.

Federal loan interest rates are often tied to the 10-year Treasury note, meaning they can fluctuate with changes in the overall economy. For example, periods of high inflation might lead to higher interest rates on federal student loans. Legislative changes can also impact rates. Private loan rates are influenced by market conditions, the borrower’s creditworthiness (credit score, debt-to-income ratio), and the lender’s risk assessment. A borrower with a strong credit history and low debt will typically qualify for a lower interest rate.

Fixed versus Variable Interest Rates

Student loans can have either fixed or variable interest rates. Understanding the difference is essential for managing repayment costs.

A fixed interest rate remains constant throughout the loan’s life. This provides predictability in monthly payments. A variable interest rate fluctuates based on an index, such as the prime rate or LIBOR (London Interbank Offered Rate, though this is less common now). This means monthly payments can change over time, potentially increasing or decreasing depending on market conditions. While variable rates might start lower, the risk of unpredictable increases makes fixed rates often a more conservative choice for borrowers who prefer payment stability.

Historical Trends in Student Loan Interest Rates

Understanding the historical trends in student loan interest rates provides valuable context for current rates and helps illustrate the impact of broader economic factors on higher education financing. Analyzing these trends allows for a better understanding of the financial burden faced by students across different generations.

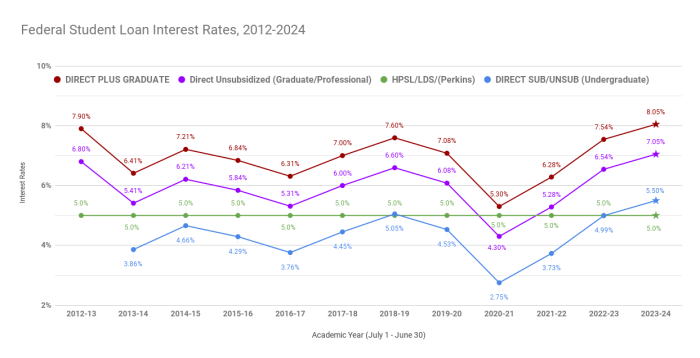

A visual representation of average student loan interest rates over the past two decades would show a fluctuating but generally upward trend. Imagine a line graph with the x-axis representing the years (2004-2024) and the y-axis representing the average interest rate (as a percentage). The line itself would not be smooth; it would rise and fall reflecting periods of economic growth and contraction. For instance, the line might show a relatively low point around the time of the 2008 financial crisis, followed by a gradual increase in subsequent years. The graph would clearly demonstrate periods of higher and lower rates, illustrating the dynamic nature of these interest rates over time. Specific data points would need to be sourced from reputable financial institutions or government agencies to accurately reflect the historical averages.

Average Interest Rates Across Decades

The past two decades reveal distinct shifts in average student loan interest rates. The 2000s saw relatively lower rates, influenced by low overall interest rates across the economy. The 2010s, however, witnessed a noticeable increase, partly attributed to government policies and shifts in the market. This increase reflects the rising cost of education and the growing reliance on student loans to finance higher education. The early 2020s saw some fluctuation due to the economic impacts of the COVID-19 pandemic, with periods of rate reductions followed by potential increases as economic recovery progressed.

Impact of Economic Conditions on Student Loan Interest Rates

Economic conditions significantly influence student loan interest rates. Periods of high inflation often lead to increased interest rates as lenders seek to protect their returns against the erosion of purchasing power. Conversely, during recessions, interest rates may be lowered by the Federal Reserve to stimulate economic activity. This can translate into lower student loan rates, although this is not always a guaranteed effect. For example, the 2008 financial crisis initially led to lower interest rates across the board, including student loans, as a means of encouraging borrowing and spending. However, the subsequent economic recovery saw a gradual rise in rates. Similarly, the economic uncertainty caused by the COVID-19 pandemic initially resulted in lower interest rates on federal student loans, reflecting the government’s response to the economic downturn.

Interest Rate Calculation and Amortization

Understanding how student loan interest is calculated and how your payments are applied is crucial for effective financial planning. This section will explain the standard method for calculating monthly payments and demonstrate how interest accrues over the life of a loan using a sample amortization schedule.

The most common method for calculating monthly student loan payments is through a process called amortization. This involves dividing the loan into a series of equal monthly payments that cover both the principal (the original loan amount) and the interest accrued on the remaining balance. The formula used is relatively complex, but readily available through online calculators and financial software. Essentially, it considers the loan amount, the interest rate, and the loan term (length of repayment) to determine the fixed monthly payment amount.

Amortization Schedule Calculation

The following table illustrates a sample amortization schedule for a $20,000 student loan at a 5% annual interest rate over 10 years (120 months). Note that this is a simplified example and does not include any additional fees or charges that may be associated with a particular loan. The calculation assumes a fixed interest rate throughout the loan term. Each monthly payment consists of a portion allocated to principal repayment and a portion allocated to interest. As the loan progresses, a larger proportion of each payment goes towards principal repayment and a smaller proportion towards interest.

| Month | Beginning Balance | Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $20,000.00 | $212.47 | $83.33 | $129.14 | $19,870.86 |

| 2 | $19,870.86 | $212.47 | $82.80 | $129.67 | $19,741.19 |

| … | … | … | … | … | … |

| 120 | $129.67 | $212.47 | $0.54 | $211.93 | $0.00 |

Impact of Varying Interest Rates

Different interest rates significantly impact the total cost of a loan. For instance, a $20,000 loan at 5% interest over 10 years will cost significantly less than the same loan at 7% interest. The higher interest rate leads to a larger portion of each payment going towards interest, resulting in a much higher total repayment amount over the life of the loan. A higher interest rate will also result in a higher monthly payment. For example, a 7% interest rate on a $20,000 loan over 10 years would result in a significantly higher monthly payment than the 5% example above. This highlights the importance of securing the lowest possible interest rate when taking out student loans.

Impact of Interest Rates on Student Loan Debt

The interest rate on your student loans significantly impacts the overall cost and the length of your repayment journey. A seemingly small difference in percentage points can translate into thousands of extra dollars paid over the life of the loan. Understanding this impact is crucial for effective financial planning after graduation. This section will explore the long-term effects of varying interest rates and the potential consequences of failing to manage student loan debt effectively.

High interest rates dramatically increase the total amount repaid on a student loan. This is because interest accrues on the principal balance, meaning you’re paying interest on interest. Conversely, lower interest rates lead to significantly lower overall costs and shorter repayment periods. This translates to more disposable income available for other financial goals, such as saving for a down payment on a house, investing, or paying off other debts.

Comparison of Total Interest Paid at Different Interest Rates

The following comparison illustrates the substantial difference in total interest paid over a 10-year period for a $20,000 student loan at two different interest rates: 4% and 8%. This example highlights the compounding effect of interest and the importance of securing the lowest possible interest rate.

- 4% Interest Rate: Assuming a standard 10-year repayment plan for a $20,000 loan with a 4% interest rate, the total interest paid would be approximately $2,768. Monthly payments would be around $203.

- 8% Interest Rate: With the same loan amount and repayment period, but an 8% interest rate, the total interest paid would nearly double, reaching approximately $5,835. Monthly payments would be around $245.

This comparison demonstrates that a seemingly small difference of 4% in interest rates results in an extra $3,067 paid in interest over 10 years. This significant difference underscores the importance of actively seeking the best possible interest rate on your student loans, perhaps through refinancing or consolidation options.

Consequences of Loan Default Due to High Interest Rates

High interest rates can contribute to loan default, a serious financial consequence. When borrowers struggle to manage high monthly payments, they may fall behind, leading to delinquency and, ultimately, default.

Defaulting on student loans has severe repercussions. It can negatively impact your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. The government can also garnish wages, seize tax refunds, and even take legal action to recover the outstanding debt. In some cases, default can lead to the loss of professional licenses or eligibility for certain government benefits. The long-term financial and personal implications of loan default are significant and should be avoided at all costs. Responsible financial planning and proactive management of student loan debt are crucial to mitigating this risk.

Refinancing and Interest Rate Reduction Strategies

Refinancing your student loans can be a powerful tool for saving money and reducing your overall debt burden. By securing a lower interest rate through refinancing, you can significantly decrease the total amount you pay over the life of your loans. This process involves replacing your existing student loans with a new loan from a different lender, often at a more favorable interest rate. However, it’s crucial to carefully consider the implications before proceeding.

Refinancing involves several key steps and considerations. Successfully navigating this process requires a thorough understanding of your current loan terms and a careful comparison of refinancing options available from various lenders.

Refinancing Student Loans for Lower Interest Rates

The process of refinancing student loans to obtain a lower interest rate generally involves applying to a private lender. This lender will assess your creditworthiness, income, and debt-to-income ratio to determine your eligibility and the interest rate they can offer. If approved, your new loan will pay off your existing student loans, and you’ll begin making payments to the new lender under the terms of your refinanced loan. It’s important to remember that refinancing typically involves private lenders and will not impact federal loan benefits like income-driven repayment plans.

Comparing Refinancing Options from Different Lenders

Before applying for student loan refinancing, it’s essential to compare offers from multiple lenders. This comparative analysis ensures you secure the most favorable terms.

A step-by-step guide for comparing refinancing options includes:

- Check your credit score: Your credit score significantly impacts the interest rate you’ll qualify for. A higher credit score generally leads to lower interest rates.

- Gather your loan information: Collect details about your current student loans, including balances, interest rates, and loan servicers.

- Shop around: Compare offers from several lenders. Consider factors beyond just the interest rate, such as fees, repayment terms, and the lender’s reputation.

- Review loan terms carefully: Pay close attention to the interest rate, loan fees, repayment period, and any prepayment penalties.

- Compare total costs: Calculate the total cost of each loan, considering the interest rate and any fees, to determine which option is most cost-effective.

- Consider your financial situation: Choose a repayment plan that aligns with your budget and financial goals.

Strategies for Reducing Student Loan Interest Rates

Beyond refinancing, several strategies can help borrowers potentially reduce their interest rates or the overall cost of their loans.

These strategies include:

- Income-driven repayment plans: Federal student loan borrowers may qualify for income-driven repayment plans that adjust monthly payments based on their income and family size. While these plans don’t directly lower the interest rate, they can make payments more manageable, potentially reducing the total interest paid over the life of the loan if you qualify for loan forgiveness after a set number of payments.

- Loan consolidation: Consolidating multiple federal student loans into a single loan can simplify repayment, though it may not always lower your interest rate. The weighted average interest rate of your consolidated loans will be your new rate, and this might be slightly higher or lower than your current average rate depending on your existing loans’ interest rates. The main benefit is streamlined payments.

Wrap-Up

Successfully managing student loan debt requires a proactive approach. By understanding average student loan interest rates, their historical trends, and available strategies for reduction, borrowers can significantly impact their long-term financial well-being. Remember, proactive planning, informed decision-making, and a thorough understanding of your loan terms are essential to navigating this significant financial commitment successfully. This knowledge empowers you to make the best choices for your financial future.

Question Bank

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I refinance my student loans if I have multiple loans with different interest rates?

Yes, refinancing can consolidate multiple loans into a single loan with a potentially lower interest rate.

What is an amortization schedule, and why is it important?

An amortization schedule details your loan payments over time, showing how much of each payment goes toward principal and interest. It helps you visualize your loan repayment journey.

What happens if I default on my student loans?

Defaulting on student loans can lead to serious consequences, including wage garnishment, tax refund offset, and damage to your credit score.

How often do student loan interest rates change?

The frequency of changes varies depending on the loan type and lender. Federal loan rates are typically set annually, while private loan rates can fluctuate more frequently.