The rising cost of higher education has placed student loan debt firmly in the spotlight. Understanding the average monthly payments associated with these loans is crucial for prospective students, current borrowers, and policymakers alike. This guide delves into the complexities of calculating and interpreting average student loan payments, exploring various data sources, influencing factors, and demographic trends.

We’ll examine how different calculation methods yield varying results, highlighting the importance of understanding the underlying data and its limitations. From analyzing the impact of repayment plans and interest rates to exploring how demographic factors shape monthly payments, we aim to provide a clear and comprehensive overview of this critical financial issue.

Defining “Average Student Loans Per Month”

Understanding the average monthly student loan payment requires careful consideration of how this average is calculated and the factors influencing individual payments. The term itself is not a single, universally defined metric; rather, it represents a range of possible calculations depending on the data used and the specific purpose of the analysis.

Methods for Calculating Average Monthly Student Loan Payments

Several methods exist for calculating the average monthly student loan payment. The most common approaches include calculating the average across all borrowers, averaging payments for specific loan types (e.g., federal subsidized loans versus private loans), and focusing solely on the average payment amount regardless of loan type or borrower characteristics. Each approach yields a different result and offers unique insights into the student loan debt landscape. The choice of method significantly impacts the interpretation of the resulting average.

Factors Influencing Variability in Monthly Student Loan Payments

The monthly payment amount for a student loan is not uniform. Several factors contribute to the variability observed in payments across borrowers. These factors include the principal loan amount, the interest rate applied to the loan, the loan repayment term (the length of the repayment period), the type of loan (federal or private), and the repayment plan chosen by the borrower (e.g., standard, graduated, income-driven). Income-driven repayment plans, for example, directly tie monthly payments to the borrower’s income, resulting in significantly lower monthly payments compared to standard repayment plans, but potentially leading to a longer repayment period and increased overall interest paid. Furthermore, deferment or forbearance periods, where payments are temporarily suspended, can also impact the average monthly payment calculation.

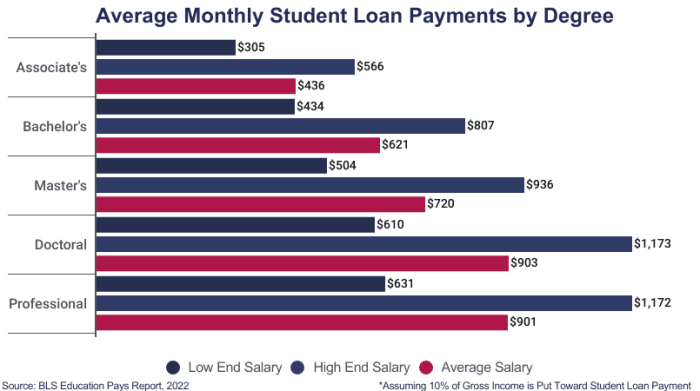

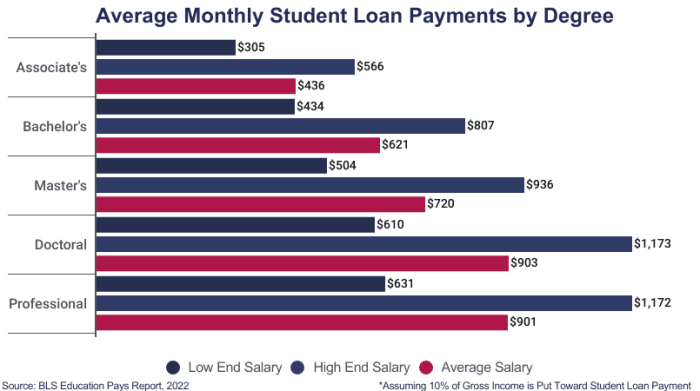

Presentation of Average Monthly Payment Data in Reports and Publications

Data on average monthly student loan payments is frequently presented in various reports and publications. Government agencies, such as the Department of Education, often publish data on average loan amounts and repayment terms, allowing for the calculation of average monthly payments. Private research organizations and financial news outlets frequently analyze this data, presenting it in tables, charts, and graphs to illustrate trends and patterns in student loan debt. These reports often segment the data by loan type, borrower characteristics (e.g., age, income, education level), and repayment plan, providing a more nuanced understanding of average monthly payment amounts. For instance, a report might show a higher average monthly payment for borrowers with private loans compared to those with federal loans, reflecting differences in interest rates and repayment terms. Similarly, a visual representation like a bar chart might compare average monthly payments across different income-driven repayment plans.

Examples of Average Monthly Payment Calculations

| Calculation Method | Data Source | Average Monthly Payment | Limitations |

|---|---|---|---|

| Average across all borrowers | National Student Loan Data System | $300 (Example) | Masks variations between borrowers; may not reflect individual experiences. |

| Average for Federal Subsidized Loans | Department of Education | $250 (Example) | Does not account for private loans or income-driven repayment plans. |

| Average payment amount (ignoring loan type) | Private research firm | $350 (Example) | May be skewed by outliers; lacks contextual information. |

| Average for Income-Driven Repayment Plans | Federal Student Aid | $150 (Example) | Highly dependent on income; not representative of all borrowers. |

Factors Affecting Monthly Payments

Several key factors influence the monthly payment amount on student loans. Understanding these factors is crucial for borrowers to effectively manage their debt and plan for repayment. These factors interact in complex ways, so it’s beneficial to consider them holistically.

Loan Amount, Interest Rate, and Loan Type

The most fundamental factors determining monthly payments are the loan’s principal amount (the initial sum borrowed), the interest rate (the cost of borrowing money), and the type of loan. A larger loan amount naturally leads to higher monthly payments. Similarly, a higher interest rate increases the total amount owed and, consequently, the monthly payment. Different loan types (e.g., federal subsidized loans, unsubsidized loans, private loans) may have varying interest rates and repayment terms, further affecting monthly payments. For instance, federal subsidized loans typically offer lower interest rates than private loans.

Impact of Repayment Plans

The repayment plan selected significantly impacts the monthly payment amount. Standard repayment plans typically involve fixed monthly payments over a 10-year period. However, income-driven repayment plans (IDR) adjust monthly payments based on the borrower’s income and family size. This flexibility can result in lower monthly payments, particularly for borrowers with lower incomes, but it may extend the repayment period and increase the total amount paid over the life of the loan.

Repayment Plan Comparison: Hypothetical Example

Let’s consider a hypothetical scenario with a $50,000 student loan. Under a standard 10-year repayment plan with a 5% interest rate, the monthly payment would be approximately $530. However, under an income-driven repayment plan, the monthly payment might be significantly lower, perhaps $200-$300, depending on the borrower’s income and chosen plan (e.g., ICR, PAYE, REPAYE). While the lower monthly payment offers immediate relief, it’s crucial to note that the repayment period will be considerably longer, potentially leading to a higher total amount paid over the loan’s lifetime due to accrued interest.

Monthly Payment Comparison Table

| Repayment Plan | Interest Rate | Monthly Payment (Estimate) | Total Paid (Estimate) |

|---|---|---|---|

| Standard (10-year) | 5% | $530 | $63,600 |

| Standard (10-year) | 7% | $580 | $69,600 |

| Income-Driven (e.g., ICR) | 5% | $300 | $72,000 (estimated, assuming longer repayment period) |

| Income-Driven (e.g., ICR) | 7% | $350 | $84,000 (estimated, assuming longer repayment period) |

*Note: These are estimates and actual payments may vary based on specific loan terms and individual circumstances.

Interest Capitalization’s Impact

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This significantly impacts monthly payments over time.

Imagine a graph with time on the x-axis and loan balance on the y-axis. A line representing a loan without capitalization would show a steady decrease in the balance over time. However, a line representing a loan with capitalization would show a steeper decrease initially, followed by a slower decrease as the capitalized interest increases the principal. The area between these two lines visually represents the extra amount paid due to capitalization. This difference becomes more pronounced over longer repayment periods. For example, if a borrower postpones payments or enters a forbearance period, the accumulated interest will be capitalized, leading to higher future payments.

Trends and Projections

Analyzing the trajectory of average monthly student loan payments reveals a complex interplay of economic factors, government policies, and evolving borrowing behaviors. Understanding these trends is crucial for both borrowers and policymakers alike, as it allows for informed decision-making and proactive strategies to mitigate potential financial burdens.

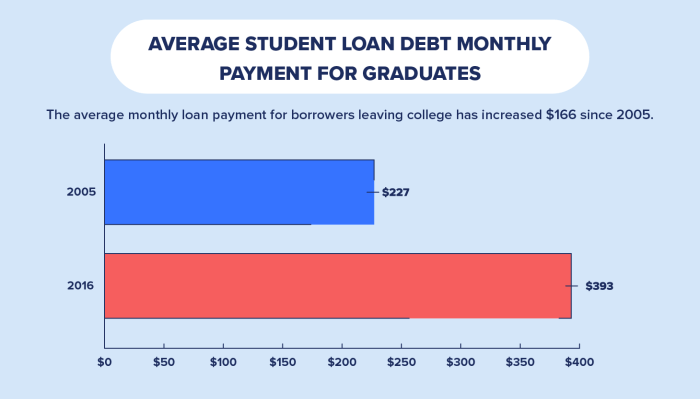

The past decade has witnessed a significant rise in average monthly student loan payments, a trend largely attributable to increasing tuition costs and a growing reliance on student loans to finance higher education. This upward trend, however, is not uniform and has been punctuated by periods of slower growth and even slight decreases, influenced by factors such as economic recessions and changes in government loan repayment programs.

Historical Trends in Average Monthly Student Loan Payments

The average monthly student loan payment has shown a steady increase over the past decade. While precise figures vary depending on the data source and methodology used, a general upward trend is undeniable. For instance, data from the Federal Reserve shows a consistent increase in the average debt burden for borrowers, leading to higher monthly payments. This rise is not solely due to increased borrowing; the cost of education has also climbed significantly, forcing students to take out larger loans. Furthermore, changes in repayment plans, while sometimes offering short-term relief, have often resulted in a longer repayment period and ultimately higher total interest paid, impacting the monthly payment amount.

Factors Influencing Future Average Monthly Payments

Several factors are poised to significantly influence average monthly student loan payments in the coming years. These include: continued increases in tuition costs; changes in interest rates; shifts in student borrowing behavior; and the effectiveness of government interventions aimed at managing student debt. The impact of inflation on the cost of living also plays a crucial role, as it affects both borrowers’ incomes and the value of student loan debt. For example, a period of high inflation could simultaneously reduce the real value of borrowers’ income and increase the real value of their debt, resulting in a higher relative burden.

Impact of Government Policies and Economic Conditions

Government policies play a pivotal role in shaping the landscape of student loan payments. For instance, changes in interest rates directly impact the monthly payment amount. Moreover, the introduction of income-driven repayment plans can lower monthly payments in the short term but often extend the repayment period, leading to higher overall interest payments. Economic downturns can also significantly impact average monthly payments. High unemployment rates can lead to borrowers struggling to make their payments, resulting in loan defaults and potential government interventions such as loan forgiveness programs. These programs, while intended to provide relief, can have long-term fiscal implications and influence future policy decisions regarding student loan repayment.

Timeline of Key Events and Trends

- 2013-2015: Steady increase in average monthly payments, driven by rising tuition costs and increased borrowing.

- 2016-2018: Slight moderation in the growth rate of average monthly payments due to a period of relatively stable interest rates and some government initiatives aimed at managing student debt.

- 2019-2020: The COVID-19 pandemic led to temporary payment suspensions and forbearance programs, impacting the reported average monthly payments but not reducing the overall debt burden.

- 2021-Present: Resumption of payments, coupled with ongoing inflation and potential interest rate hikes, is projected to lead to a renewed increase in average monthly student loan payments. The long-term impact of pandemic-related forbearance remains to be seen.

Final Thoughts

Navigating the landscape of student loan debt requires a nuanced understanding of average monthly payments. While precise figures can be elusive due to data variability and individual circumstances, this analysis reveals key insights into the factors that influence repayment burdens. By understanding these factors and the available resources, borrowers can make informed decisions and navigate their financial futures more effectively. The importance of financial literacy and proactive planning in managing student loan debt cannot be overstated.

FAQ Resource

What is considered a “high” average monthly student loan payment?

There’s no single definition of a “high” payment. It depends on individual income and budget. Generally, payments exceeding 10-15% of monthly disposable income are often considered burdensome.

Can I refinance my student loans to lower my monthly payment?

Yes, refinancing can potentially lower your monthly payment by securing a lower interest rate or extending the loan term. However, carefully compare offers and consider the long-term implications of a longer repayment period (increased total interest paid).

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default. Contact your lender immediately if you anticipate difficulties making a payment to explore options like deferment or forbearance.

Are there government programs to help with student loan repayment?

Yes, several government programs offer income-driven repayment plans, which adjust payments based on income and family size. These programs may also offer loan forgiveness options after a certain number of qualifying payments.