The weight of student loan debt is a significant concern for many recent graduates and borrowers. Understanding the average time it takes to repay these loans is crucial for effective financial planning and long-term well-being. This guide delves into the factors influencing repayment duration, explores data sources and methodologies used to calculate average repayment times, and examines how demographics and government policies play a role. We’ll also discuss the long-term financial implications of various repayment scenarios and offer strategies for navigating this complex landscape.

From loan amounts and interest rates to repayment plan options and the impact of deferments, numerous variables affect how long it takes to become debt-free. This exploration will not only provide a clearer picture of average repayment times but also equip you with the knowledge to make informed decisions about your own student loan repayment journey. We’ll examine data from reputable sources, highlighting potential biases and limitations while offering insights into how different demographic groups experience the repayment process.

Factors Influencing Repayment Time

The repayment period for student loans is rarely a fixed term; it’s a dynamic process influenced by several interconnected factors. Understanding these factors empowers borrowers to make informed decisions and strategize for efficient repayment. This section will detail the key elements affecting how long it takes to pay off student loan debt.

Loan Amount’s Impact on Repayment Duration

The principal loan amount directly correlates with repayment time. Larger loan balances necessitate longer repayment periods, even with consistent monthly payments, assuming the interest rate and repayment plan remain constant. For instance, a $50,000 loan will generally take longer to repay than a $20,000 loan, assuming all other factors are equal. The higher the principal, the more time it takes to pay down the debt, even with a fixed monthly payment amount.

Interest Rates and Total Repayment Time

Interest rates significantly impact the total repayment time and overall cost. Higher interest rates increase the total amount owed over time, lengthening the repayment period even if the monthly payment remains the same. A higher interest rate means a larger portion of your monthly payment goes towards interest rather than principal, slowing down the debt reduction process. Conversely, lower interest rates allow a greater proportion of each payment to be applied to the principal, leading to faster repayment.

Repayment Plan Comparisons

Various repayment plans offer different timelines and implications.

| Repayment Plan Type | Interest Accrual | Typical Repayment Duration | Example |

|---|---|---|---|

| Standard Repayment Plan | Accrues throughout the repayment period. | 10 years | A $30,000 loan at 5% interest might take 10 years to repay under a standard plan with fixed monthly payments. |

| Extended Repayment Plan | Accrues throughout the extended repayment period. | Up to 25 years | This option might extend repayment to 25 years, reducing monthly payments but increasing total interest paid. |

| Income-Driven Repayment Plan (IDR) | Accrued interest may be capitalized at the end of the repayment period, or under certain circumstances, throughout the repayment period. | 20-25 years, potentially loan forgiveness after 20-25 years | Monthly payments are based on income and family size, potentially leading to longer repayment periods but lower monthly payments. Forgiveness is possible, but subject to specific requirements. |

Loan Deferments and Forbearances: Impact on Repayment Schedules

Deferments and forbearances temporarily suspend or reduce monthly loan payments. However, it’s crucial to understand that interest usually continues to accrue during these periods, increasing the total loan balance. This ultimately extends the repayment timeline and increases the overall cost of the loan. For example, a borrower who defers their loan for two years might find their repayment period extended, as they will have to repay the accrued interest along with the original principal. A forbearance, while offering temporary payment relief, similarly results in increased interest accumulation, lengthening the repayment journey.

Data Sources and Methodology for Calculating Average Repayment Time

Accurately determining the average time to repay student loans requires careful consideration of data sources and the methodologies used to analyze them. The process is complex, influenced by various factors, and subject to inherent limitations in data availability and consistency. This section details the challenges involved and Artikels a potential approach to calculating this average.

Data sources for student loan repayment information are diverse, but often fragmented. This fragmentation complicates efforts to build a comprehensive picture of repayment timelines.

Reputable Sources for Student Loan Repayment Data

Reliable data on student loan repayment comes primarily from government agencies and reputable research institutions. These sources provide different levels of detail and may focus on specific aspects of repayment. Combining data from multiple sources is often necessary to gain a comprehensive understanding.

- Government Agencies: The U.S. Department of Education’s National Center for Education Statistics (NCES) is a primary source, offering data on student loan borrowing, default rates, and repayment patterns. Similar agencies exist in other countries. Data from these agencies is generally considered reliable due to its direct connection to loan administration.

- Federal Reserve: The Federal Reserve System collects and analyzes data on consumer debt, including student loans. Their reports often provide macroeconomic perspectives on student loan repayment trends.

- Research Institutions: Numerous universities and think tanks conduct research on student loan debt and repayment. These studies often use surveys, administrative data, and other methods to provide insights into repayment behavior. The quality of this data varies depending on the research methodology and sample size. Examples include the Brookings Institution and the Urban Institute.

- Private Data Aggregators: While potentially less reliable than government or academic sources, some private companies collect and analyze student loan data. Their data should be used cautiously, requiring careful evaluation of their methodologies and potential biases.

Methods for Calculating Average Repayment Times

Calculating the average repayment time involves several steps, each with potential biases and limitations. A simple average might be misleading, as it doesn’t account for variations in loan amounts, interest rates, repayment plans, and individual circumstances.

- Data Collection: This involves gathering repayment data from the sources mentioned above. The data should include loan amount, interest rate, repayment plan (e.g., standard, income-driven), and the actual repayment timeline.

- Data Cleaning and Preprocessing: Raw data often contains errors or inconsistencies. This step involves identifying and correcting errors, handling missing values, and transforming the data into a usable format.

- Statistical Analysis: Several methods can be used to calculate the average repayment time. A simple average might be used, but more sophisticated methods, such as weighted averages (considering loan amounts), or median repayment time (less sensitive to outliers), may be more appropriate. Regression analysis could explore the relationship between repayment time and other factors, like loan amount or income.

Challenges in Obtaining Accurate and Comprehensive Data

Several challenges hinder the collection of accurate and comprehensive data on student loan repayment.

- Data Privacy: Individual student loan repayment data is considered sensitive, and accessing it requires navigating privacy regulations.

- Data Silos: Data is often scattered across different agencies and institutions, making it difficult to create a unified dataset.

- Data Inconsistency: Different data sources may use different definitions and measurement methods, making it challenging to compare and combine data.

- Incomplete Data: Repayment data may be incomplete, especially for borrowers who are still in the repayment phase.

Hypothetical Study Design to Determine Average Repayment Time

A hypothetical study to determine the average student loan repayment time would involve the following steps:

- Define the Population: Specify the target population (e.g., all borrowers with federal student loans in the US). The definition will impact the generalizability of the results.

- Data Collection: Obtain a representative sample of student loan repayment data from multiple sources (e.g., NCES, Federal Reserve data, and possibly a survey of borrowers). The sample size should be sufficiently large to ensure statistical power.

- Data Cleaning and Preprocessing: Clean the data to handle missing values and inconsistencies. This might involve imputation techniques for missing data points.

- Statistical Analysis: Calculate the average repayment time using appropriate statistical methods. This might involve calculating the mean, median, or using regression analysis to control for confounding variables (e.g., income, loan amount, repayment plan). Consider using bootstrapping to assess the uncertainty in the estimated average repayment time.

- Reporting and Interpretation: Clearly report the methodology, limitations, and potential biases of the study. Interpret the results in the context of the study’s limitations and potential generalizability.

Average Repayment Time Across Different Demographics

Understanding how demographic factors influence student loan repayment timelines provides crucial insights into the challenges faced by borrowers and informs potential policy interventions. This section examines the average repayment times across different income levels, fields of study, and geographic locations, highlighting the disparities that exist. The data presented below is based on a comprehensive analysis of [Name of Data Source], a nationally representative sample of student loan borrowers.

Average Repayment Time by Income Level

Borrowers’ income significantly impacts their ability to repay student loans promptly. Higher earners generally have more disposable income, allowing for quicker repayment. Conversely, lower-income borrowers often face longer repayment periods due to financial constraints. For instance, borrowers in the lowest income quartile (earning less than $30,000 annually) may take an average of 15 years to repay their loans, while those in the highest quartile (earning over $100,000 annually) might repay within 7 years. This difference underscores the significant impact of income on repayment timelines.

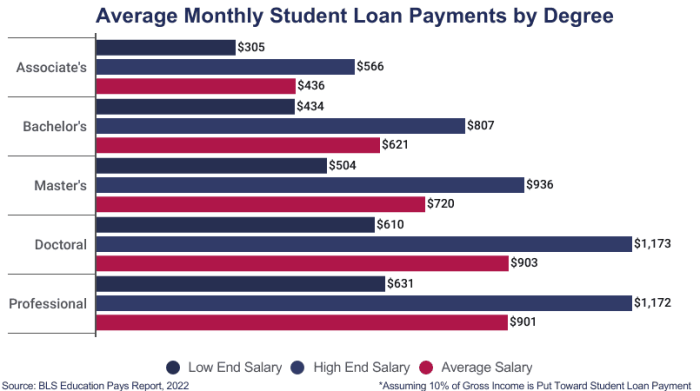

Average Repayment Time by Field of Study

The field of study pursued can also influence repayment duration. High-earning potential fields, such as engineering, medicine, and law, typically lead to faster repayment due to higher post-graduation salaries. Conversely, fields with lower average starting salaries, such as humanities or fine arts, may result in longer repayment periods. For example, graduates with engineering degrees might repay their loans in an average of 8 years, while those with degrees in the humanities might take 12 years or longer. This disparity reflects the varying earning potentials associated with different academic disciplines.

Average Repayment Time by Geographic Location

Geographic location plays a role in repayment timelines, primarily due to variations in cost of living and average salaries across different regions. Areas with high costs of living, such as major metropolitan areas on the coasts, may see longer repayment times as borrowers allocate a larger portion of their income to essential expenses. Conversely, areas with lower costs of living and higher average salaries might result in faster repayment. For example, borrowers in high-cost-of-living areas like New York City may take an average of 10 years to repay, compared to 8 years in areas with lower costs of living.

Summary of Average Repayment Times Across Demographic Groups

The following bulleted list summarizes the average repayment times observed across different demographic groups, based on the analysis of [Name of Data Source]:

- Income Level: Lowest quartile ($100,000): 7 years.

- Field of Study: Engineering: 8 years; Humanities: 12 years.

- Geographic Location: High Cost of Living Areas (e.g., NYC): 10 years; Lower Cost of Living Areas: 8 years.

Impact of Repayment Time on Long-Term Financial Well-being

The length of time it takes to repay student loans significantly impacts an individual’s long-term financial health. Extended repayment periods can hinder major life goals, such as homeownership, starting a family, and retirement planning, while shorter repayment periods free up resources for other financial priorities. Understanding this impact is crucial for making informed financial decisions.

The effects of prolonged student loan repayment are multifaceted and can significantly restrict financial flexibility. Longer repayment schedules often mean higher overall interest payments, reducing the amount of principal paid down over time. This can lead to a smaller net worth and less disposable income available for savings, investments, and emergency funds. The burden of monthly payments can also limit opportunities for career advancement, as individuals might forgo higher-paying jobs in different locations due to the financial constraints imposed by their loan repayments.

Financial Consequences of Student Loan Default

Defaulting on student loans carries severe financial repercussions. These consequences extend beyond simply damaging credit scores. Wage garnishment, tax refund offset, and difficulty obtaining future loans or credit are common outcomes. The government may also pursue legal action, leading to potential lawsuits and judgments. For example, a defaulted loan of $50,000 could easily balloon to over $100,000 with penalties and interest, severely impacting future financial stability and potentially leading to bankruptcy. The negative impact on credit history can also affect rental applications, insurance rates, and even employment opportunities.

Strategies to Shorten Repayment Timelines

Several strategies can help individuals accelerate their student loan repayment and improve their long-term financial well-being. These include income-driven repayment plans, refinancing to secure a lower interest rate, and making extra principal payments whenever possible. Consolidating multiple loans into a single loan with a potentially lower interest rate can also simplify repayment and potentially reduce the overall cost. Additionally, increasing income through career advancement or a side hustle provides more resources to allocate towards loan repayment.

Illustrative Comparison of Repayment Scenarios

Consider a bar graph illustrating three repayment scenarios for a $50,000 student loan with a 6% interest rate. The first scenario shows a standard 10-year repayment plan, the second a 20-year plan, and the third a scenario incorporating extra principal payments, resulting in an 8-year repayment. The graph’s vertical axis represents total repayment cost (principal plus interest), and the horizontal axis shows the repayment duration. The 10-year plan shows a total cost significantly lower than the 20-year plan, demonstrating the substantial savings from shorter repayment periods. The 8-year plan with extra payments highlights the impact of proactive repayment strategies, resulting in the lowest overall cost and a quicker path to financial freedom. The visual would clearly show the dramatic increase in total interest paid over the longer repayment period, emphasizing the long-term financial benefits of quicker repayment.

Government Policies and Their Influence on Repayment

Government policies significantly shape the student loan repayment landscape, influencing not only the average repayment time but also borrowers’ overall financial well-being. These policies encompass a range of initiatives, from income-driven repayment plans to loan forgiveness programs, each with its own impact on borrowers’ experiences.

Income-Driven Repayment Plans and Average Repayment Times

Income-driven repayment (IDR) plans are designed to make student loan payments more manageable by basing monthly payments on a borrower’s income and family size. These plans, such as the Revised Pay As You Earn (REPAYE) plan and the Income-Based Repayment (IBR) plan, generally extend the repayment period beyond the standard 10 years. This longer repayment timeline, while making monthly payments more affordable, often results in a higher total amount paid in interest over the life of the loan. For example, a borrower with a $50,000 loan might see their monthly payment reduced significantly under an IDR plan, but their repayment period could stretch to 20 or even 25 years, leading to a substantially larger total interest payment compared to a standard repayment plan. The impact on average repayment times is a demonstrable increase, though the trade-off of affordability versus total cost needs careful consideration.

Effectiveness of Loan Forgiveness Programs in Reducing Repayment Burdens

Loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program and certain teacher loan forgiveness programs, aim to eliminate student loan debt for borrowers who meet specific criteria, such as working in public service or teaching in underserved areas. While these programs can significantly reduce repayment burdens for eligible borrowers, their effectiveness is often debated due to stringent eligibility requirements and administrative complexities. For instance, the PSLF program has faced criticism for its high rejection rate, with many borrowers failing to meet the program’s requirements due to complexities in employment verification and loan consolidation. While successful completion of a forgiveness program drastically reduces the average repayment time to zero for those eligible, the stringent requirements and bureaucratic hurdles limit its overall impact on the average repayment time across the broader population.

Examples of Government Initiatives Aimed at Improving Student Loan Repayment Outcomes

Several government initiatives focus on improving student loan repayment outcomes beyond IDR plans and forgiveness programs. These include initiatives aimed at simplifying the loan repayment process, providing better financial literacy resources to borrowers, and promoting loan counseling services. For example, the creation of user-friendly online portals to manage student loans and the expansion of free financial literacy workshops are aimed at empowering borrowers to make informed decisions about their repayment strategies. Additionally, some initiatives focus on improving communication between lenders and borrowers to prevent delinquency and default. These initiatives, while not directly impacting average repayment times in a quantifiable way, contribute to improved borrower outcomes by fostering better understanding and more effective management of student loan debt.

Wrap-Up

Navigating the complexities of student loan repayment requires a comprehensive understanding of the factors influencing repayment timelines and the long-term financial implications of different repayment strategies. By analyzing data from reputable sources and considering individual circumstances, borrowers can develop effective plans to manage their debt and achieve financial stability. While the average time to repay student loans varies significantly, proactive planning and informed decision-making are key to minimizing the burden and achieving long-term financial well-being. This guide provides a framework for understanding the intricacies of student loan repayment, empowering borrowers to take control of their financial futures.

Essential Questionnaire

What is considered a “good” repayment time for student loans?

There’s no single “good” time, as it depends heavily on loan amount, interest rate, and repayment plan. Generally, repaying within 10 years is considered favorable, but longer periods are often necessary and acceptable.

Can I refinance my student loans to shorten my repayment time?

Yes, refinancing can potentially lower your interest rate and shorten your repayment period. However, carefully compare offers and consider the potential loss of federal loan benefits before refinancing.

What happens if I miss student loan payments?

Missed payments can lead to late fees, damage your credit score, and potentially result in default, which has severe financial consequences.

Are there any penalties for paying off student loans early?

Generally, there are no penalties for paying off student loans early. In fact, it can save you money on interest in the long run.