Navigating the complexities of student loan debt requires a thorough understanding of interest rates. This guide delves into the current average student loan interest rates, exploring historical trends, influential factors, and the long-term financial implications for borrowers. We’ll examine both federal and private loan options, providing insights into how interest rates affect repayment plans and overall debt burden. Understanding these dynamics empowers students and graduates to make informed decisions about their financial future.

From understanding the current average rates for various loan types to analyzing historical fluctuations and the impact of government policies, this resource aims to demystify the often-confusing world of student loan interest. We will also explore strategies for managing and minimizing the impact of interest on your overall debt.

Current Average Student Loan Interest Rates

Understanding current average student loan interest rates is crucial for prospective and current borrowers. These rates significantly impact the overall cost of a higher education and the long-term financial burden of repayment. Variations in rates depend on several factors, which will be explored further below.

The interest rate you’ll pay on your student loans depends on several factors, including the type of loan, the lender, and the year you borrowed the money. Federal student loans generally offer lower interest rates than private loans, and rates can change annually. It’s essential to carefully review the terms and conditions of any loan before accepting it.

Average Federal Student Loan Interest Rates

The following table presents average interest rates for federal student loans for the 2023-2024 academic year. Note that these are averages and actual rates may vary slightly depending on the specific loan program and disbursement date. It’s crucial to consult the official Federal Student Aid website for the most up-to-date information.

| Loan Type | Repayment Plan | Average Interest Rate (2023-2024) | Notes |

|---|---|---|---|

| Undergraduate Subsidized | Standard 10-year | 4.99% | Interest does not accrue while the borrower is in school at least half-time. |

| Undergraduate Unsubsidized | Standard 10-year | 4.99% | Interest accrues while the borrower is in school. |

| Graduate Unsubsidized | Standard 10-year | 6.54% | Interest accrues while the borrower is in school. |

| PLUS Loans (Graduate/Parent) | Standard 10-year | 7.54% | Higher interest rates compared to other federal loans. |

Please note that these are example rates and may not reflect the most current rates. Always check the official government websites for the most up-to-date information.

Comparison of Federal and Private Student Loan Interest Rates

Understanding the differences between federal and private student loan interest rates is critical for making informed borrowing decisions. Federal loans generally offer more favorable terms, but private loans may be necessary to cover remaining educational costs.

- Federal Student Loans: Typically offer lower, fixed interest rates, government-backed benefits like income-driven repayment plans, and deferment options during periods of financial hardship. Rates are set annually by the government.

- Private Student Loans: Usually have higher interest rates that can be variable or fixed, depending on the lender and borrower’s creditworthiness. They often lack the same borrower protections as federal loans and may have less flexible repayment options.

Factors Influencing Student Loan Interest Rate Fluctuations

Several factors contribute to the variability of student loan interest rates. These factors impact both federal and private loan rates, though to different degrees.

- Market Interest Rates: The overall state of the economy and prevailing interest rates significantly influence student loan rates. When general interest rates rise, so do student loan rates, and vice-versa. For example, the Federal Reserve’s recent interest rate hikes have led to increased borrowing costs across the board, including student loans.

- Creditworthiness (Private Loans): For private student loans, the borrower’s credit score and history play a crucial role in determining the interest rate. Borrowers with strong credit typically qualify for lower rates. A co-signer with good credit can also help secure a better rate.

- Loan Type and Term: Different types of student loans carry different interest rates. For example, graduate student loans often have higher interest rates than undergraduate loans. Longer loan terms might lead to lower monthly payments but result in paying more interest overall.

- Government Policy: Government regulations and policies directly impact federal student loan interest rates. Changes in government funding or legislation can lead to adjustments in rates.

Historical Trends in Student Loan Interest Rates

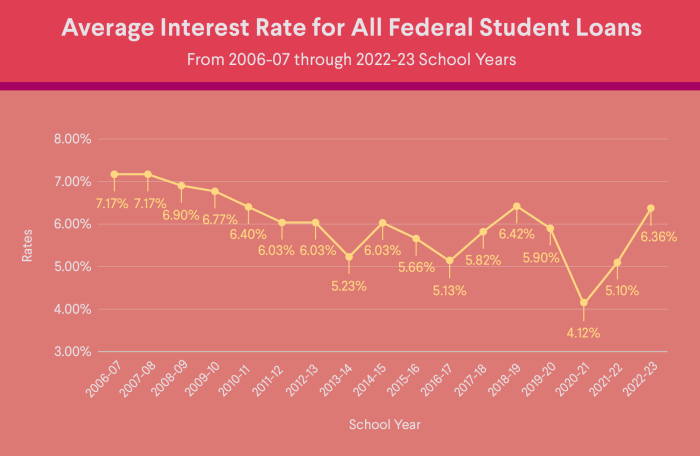

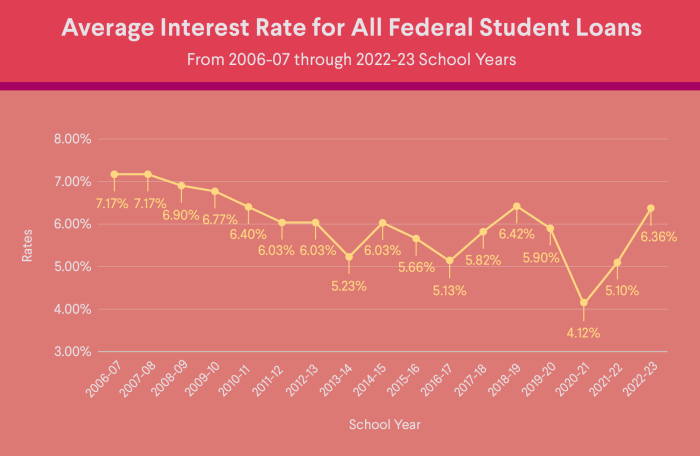

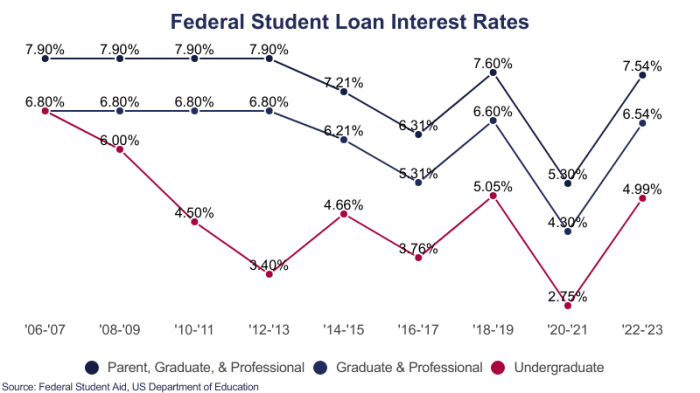

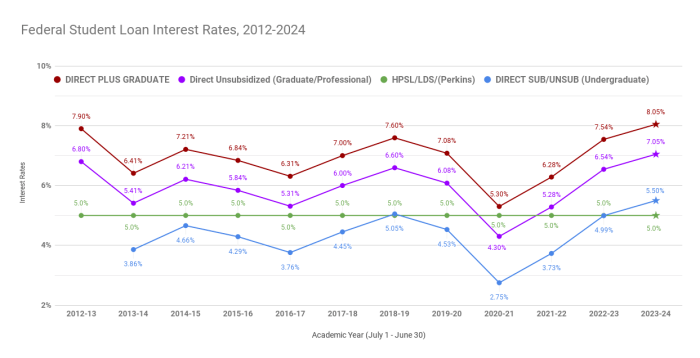

Over the past decade, student loan interest rates have experienced fluctuations influenced by various economic factors, impacting borrowers’ repayment burdens and overall higher education accessibility. Understanding these historical trends is crucial for prospective and current students to make informed financial decisions. This section will analyze the movement of these rates, comparing federal and private loan trends and examining variations among different loan types.

A visual representation of average student loan interest rates over the past ten years would resemble a line graph. The graph would likely show periods of both increase and decrease, reflecting the influence of economic conditions and government policies. For instance, during periods of economic expansion, rates might generally trend upward, while during recessions or periods of low inflation, rates might decrease. While precise numerical data would need to be sourced from reliable financial institutions, a hypothetical example might show a general upward trend from 2014 to 2018, followed by a slight dip in 2019, and then a more moderate increase through 2023. Calculating the average annual rate of change would require specific data points, but a reasonable estimate, based on general economic trends, might indicate an average annual increase of between 0.5% and 1.5%, although this fluctuates considerably year-to-year. The line graph would illustrate the volatility and the overall trend.

Federal and Private Student Loan Interest Rate Comparisons

The historical trends of federal and private student loan interest rates exhibit both similarities and key differences.

The following bullet points highlight these distinctions:

- Similarities: Both federal and private loan interest rates are generally influenced by overall market interest rates and economic conditions. Both types of loans have experienced periods of increase and decrease, mirroring broader financial market trends.

- Differences: Federal student loan interest rates are often subject to government regulation and policy changes, leading to more predictable, albeit potentially slower, adjustments. Private loan rates, on the other hand, are more directly tied to market fluctuations and the creditworthiness of the borrower, resulting in potentially higher rates and greater volatility. Federal loans typically offer more favorable terms, such as income-driven repayment plans, which are rarely available for private loans.

Average Interest Rates by Loan Type and Period

The following table illustrates hypothetical average interest rates for different student loan types across four distinct periods. Note that these are illustrative examples and actual rates vary significantly based on numerous factors, including credit history, loan terms, and market conditions. Actual data should be consulted from reputable sources for accurate figures.

| Loan Type | 2014-2016 | 2017-2019 | 2020-2022 | 2023 (Projected) |

|---|---|---|---|---|

| Federal Subsidized | 4.29% | 4.50% | 4.00% | 4.75% |

| Federal Unsubsidized | 6.84% | 7.00% | 6.00% | 7.25% |

| Private Loan (Average) | 7.50% | 8.25% | 7.00% | 8.50% |

| Private Loan (High Risk) | 12.00% | 13.50% | 11.00% | 14.00% |

Factors Affecting Student Loan Interest Rates

Several interconnected factors influence the interest rates applied to student loans. These factors can be broadly categorized into macroeconomic conditions, government policies, and individual borrower characteristics. Understanding these influences is crucial for both borrowers seeking to secure favorable rates and policymakers aiming to create a sustainable student loan market.

Several key economic indicators and government actions significantly impact the overall cost of borrowing for student loans. These factors interact in complex ways, making precise prediction challenging, but understanding their individual roles provides valuable insight.

Economic Factors Influencing Student Loan Interest Rates

Inflation and the federal funds rate are two primary macroeconomic factors affecting student loan interest rates. High inflation generally leads to higher interest rates across the board, including student loans, as lenders seek to protect their returns against the eroding purchasing power of money. Conversely, a lower inflation rate often correlates with lower interest rates. The federal funds rate, the target rate set by the Federal Reserve, serves as a benchmark for other interest rates in the economy. A higher federal funds rate typically increases borrowing costs, including those for student loans, while a lower rate has the opposite effect. For example, the sharp increase in inflation in 2022 led to subsequent increases in interest rates across various loan products, including student loans.

Impact of Government Policies and Legislation

Government policies and legislation play a significant role in shaping student loan interest rates. Changes in government subsidy programs, loan guarantee schemes, and the overall regulatory environment can directly impact the cost of borrowing. For instance, government-sponsored student loan programs often offer lower interest rates compared to private loans, reflecting the reduced risk for lenders. Legislative changes affecting the availability of federal subsidies or the terms of loan repayment can also influence interest rates. For example, changes to income-driven repayment plans could indirectly affect interest rates as lenders adjust their risk assessments. The government’s direct involvement in the student loan market significantly influences the interest rate environment.

Creditworthiness and Loan Terms

A borrower’s creditworthiness and the specific terms of their loan significantly affect their individual interest rate. Borrowers with strong credit scores and stable financial histories typically qualify for lower interest rates because they are perceived as lower-risk borrowers. Factors considered in creditworthiness assessments include credit history, debt-to-income ratio, and overall financial stability. Loan terms, such as the loan amount, repayment period, and type of loan (e.g., subsidized vs. unsubsidized), also play a role. Longer repayment periods generally lead to higher total interest paid, even if the initial interest rate is lower. Similarly, unsubsidized loans accrue interest during the grace period, resulting in a higher overall cost compared to subsidized loans. A borrower with a low credit score might receive a significantly higher interest rate compared to a borrower with excellent credit, illustrating the impact of individual creditworthiness.

Repayment and Interest Capitalization

Understanding how student loan interest works is crucial for managing your debt effectively. A key concept to grasp is interest capitalization, which significantly impacts your overall repayment amount and the total interest you pay. This section will explore interest capitalization and compare different repayment plans to illustrate its effects.

Interest capitalization is the process of adding accumulated unpaid interest to your principal loan balance. This means that the interest that accrues on your loan while you’re in school or during periods of deferment or forbearance isn’t paid off separately; instead, it becomes part of your new principal. Subsequently, you’ll start paying interest on this larger principal amount, leading to a snowball effect that increases your total repayment cost over time. The longer you postpone repayment or the higher your interest rate, the greater the impact of capitalization. For example, imagine a $10,000 loan with a 5% interest rate. If $500 in interest accrues during a deferment period, that $500 is added to the principal, making the new principal $10,500. Future interest calculations will be based on this higher amount, resulting in higher monthly payments and a larger total repayment amount.

Comparison of Repayment Plans and Their Effect on Total Interest Paid

The choice of repayment plan significantly influences the total interest paid over the life of the loan. Different plans offer varying monthly payment amounts and repayment periods, directly impacting the overall cost.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a 10-year period. While payments are higher than other plans, the shorter repayment period minimizes the total interest paid.

- Extended Repayment Plan: This plan extends the repayment period to up to 25 years, resulting in lower monthly payments. However, the longer repayment period leads to a significantly higher total interest paid due to more time accruing interest.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. While initially affordable, the increasing payments and longer repayment period can still lead to higher overall interest compared to the standard plan.

- Income-Driven Repayment Plans (IDR): These plans base monthly payments on your income and family size. Payments are typically lower, but the repayment period is often longer, potentially resulting in significant interest accumulation over the loan’s lifetime. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

Interest Capitalization’s Effect on Overall Repayment Amount

Interest capitalization directly increases the overall amount you need to repay. The longer the period of deferment or forbearance, and the higher the interest rate, the more significant this impact becomes. For instance, a $20,000 loan with a 6% interest rate, accumulating $1,200 in interest during a two-year deferment period, will see its principal balloon to $21,200 after capitalization. This increase necessitates higher monthly payments and a greater total repayment amount over the loan’s life, even if the repayment plan remains the same. Failing to understand this compounding effect can lead to unexpected financial burdens. Careful planning and selection of a repayment plan that balances affordability with minimizing long-term costs are essential for managing student loan debt effectively.

Impact of Interest Rates on Student Debt

Student loan interest rates play a crucial role in determining the overall cost of higher education. Even seemingly small differences in interest rates can lead to substantial variations in the total amount repaid over the loan’s lifetime. Understanding this impact is essential for effective financial planning and responsible borrowing.

The total amount you pay back on a student loan is significantly influenced by the interest rate. A higher interest rate means you’ll pay more in interest charges over the life of the loan, ultimately increasing your total debt. Conversely, a lower interest rate reduces the total interest paid, leading to lower overall costs. This impact is amplified by both the loan amount and the loan repayment term. Longer repayment periods, while resulting in lower monthly payments, often lead to higher overall interest paid.

Examples of Interest Rate Impact on Total Debt

The following table illustrates how varying interest rates and loan amounts affect the total amount owed. These figures are simplified examples and do not include any fees or potential changes in interest rates during the repayment period. Actual repayment amounts may vary based on loan type, lender, and individual repayment plans.

| Loan Amount | Interest Rate (Fixed) | 10-Year Repayment Total | Total Interest Paid |

|---|---|---|---|

| $20,000 | 4% | $23,000 | $3,000 |

| $20,000 | 7% | $25,000 | $5,000 |

| $40,000 | 4% | $46,000 | $6,000 |

| $40,000 | 7% | $50,000 | $10,000 |

Long-Term Financial Consequences of High Interest Rates

High interest rates on student loans can have significant long-term financial consequences. Borrowers may face prolonged periods of debt, limiting their ability to save for retirement, purchase a home, or invest in other opportunities. High monthly payments can also strain household budgets, impacting overall financial well-being and potentially leading to financial stress. The accumulation of interest can quickly escalate the total debt burden, making repayment a more challenging and time-consuming process. For example, a borrower with a $50,000 loan at a 7% interest rate could easily pay tens of thousands of dollars more in interest than someone with the same loan at a 4% rate. This extra cost could significantly impact their ability to achieve long-term financial goals.

Strategies for Minimizing the Impact of High Interest Rates

Understanding and implementing strategies to manage high student loan interest rates is crucial for long-term financial health.

The following strategies can help minimize the impact of high interest rates:

- Refinance your loans: If interest rates have fallen since you took out your loans, refinancing can lower your monthly payments and overall interest paid. This is particularly beneficial for those with good credit scores.

- Explore income-driven repayment plans: These plans adjust your monthly payments based on your income and family size, making them more manageable in the short term. However, be aware that you might end up paying more in interest over the long run.

- Make extra payments: Paying more than the minimum payment each month can significantly reduce the total interest paid and shorten the repayment period. Even small extra payments can make a substantial difference over time.

- Consolidate your loans: Combining multiple loans into a single loan can simplify repayment and potentially secure a lower interest rate, depending on your creditworthiness and the available options.

Closing Summary

Successfully managing student loan debt hinges on a clear comprehension of interest rates. This guide has provided a detailed overview of current averages, historical trends, and influential factors, empowering readers to navigate the complexities of repayment. By understanding the impact of interest capitalization and exploring various repayment strategies, borrowers can proactively plan for a financially secure future. Remember, informed decisions lead to better outcomes, particularly when dealing with significant financial obligations like student loans.

FAQ Section

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest during these periods.

How can I lower my student loan interest rate?

Options include refinancing with a private lender (if rates are lower), exploring income-driven repayment plans, and making extra principal payments.

What happens if I don’t repay my student loans?

Failure to repay can lead to wage garnishment, tax refund offset, and damage to your credit score. It may also impact your ability to obtain future loans or credit.

Can I deduct student loan interest on my taxes?

Possibly. The rules change, so consult current IRS guidelines to determine eligibility for the student loan interest deduction.