Navigating the world of higher education often involves the crucial step of securing student loans. While federal loans provide a well-established pathway, many students and families explore the option of private student loans from banks. These loans offer potential advantages but also come with unique considerations. Understanding the intricacies of bank private student loans, including eligibility requirements, interest rates, repayment options, and potential risks, is vital for making informed financial decisions.

This guide aims to demystify the process, providing a clear and concise overview of bank private student loans. We’ll delve into the application process, explore various repayment strategies, compare them to federal loans, and offer practical advice for managing your debt effectively. By understanding the nuances of these loans, you can make a confident choice that aligns with your financial goals and future aspirations.

Understanding Private Student Loans from Banks

Securing funding for higher education often involves exploring various loan options. Private student loans, offered by banks and other financial institutions, represent a significant alternative to federal student loans. Understanding their nuances is crucial for making informed borrowing decisions. This section will delve into the key aspects of bank private student loans, helping you navigate the process effectively.

Types of Private Student Loans Offered by Banks

Banks offer a range of private student loan products tailored to different needs and circumstances. These typically include undergraduate loans for students pursuing bachelor’s degrees, graduate loans for those enrolled in master’s, doctoral, or professional programs, and parent loans, allowing parents to borrow on behalf of their children. Some banks may also offer loans specifically for medical school or other specialized fields of study. The terms and conditions, including interest rates and repayment options, can vary significantly between these loan types.

Eligibility Requirements for Bank Private Student Loans

Eligibility for private student loans from banks usually involves meeting several criteria. Applicants generally need to be enrolled or accepted at an eligible institution, demonstrate a credit history (often requiring a co-signer if the applicant lacks sufficient credit), and provide proof of income or financial resources. Specific requirements, such as minimum credit scores or debt-to-income ratios, vary across banks and individual loan programs. The applicant’s academic standing may also be a factor in determining eligibility.

Comparison of Interest Rates and Repayment Terms Across Various Banks

Interest rates on private student loans offered by banks are variable, influenced by factors like prevailing market interest rates, the borrower’s creditworthiness, and the loan’s terms. Rates can range considerably between banks, and even between different loan products within the same bank. For example, a borrower with excellent credit might secure a lower interest rate compared to someone with a less-established credit history. Repayment terms, including loan durations and repayment schedules, also differ between banks and loan types. Some banks may offer flexible repayment options, such as graduated repayment plans, while others might have more standard repayment schedules. It’s essential to compare offers from multiple banks to find the most favorable terms. A hypothetical example could show Bank A offering a 6% interest rate with a 10-year repayment term, while Bank B offers 7% with a 12-year term, illustrating the variability in the market.

Common Fees Associated with Bank Private Student Loans

Private student loans from banks often come with various fees. These can include origination fees, charged upfront as a percentage of the loan amount; late payment fees, levied for missed or delayed payments; and prepayment penalties, which may apply if the borrower pays off the loan early. Some banks may also charge fees for specific services, such as deferment or forbearance. Understanding these fees is critical for accurately calculating the total cost of borrowing. For instance, a 1% origination fee on a $20,000 loan would amount to $200, adding to the overall loan cost.

The Application and Approval Process

Securing a private student loan from a bank involves a multi-step process that requires careful preparation and accurate documentation. Understanding this process can significantly improve your chances of approval and help you navigate the application efficiently. The steps generally involve completing an application, providing supporting documentation, undergoing a credit check, and finally, receiving a loan offer or denial.

Applying for a private student loan from a bank typically begins with completing an online application form. This form requests personal information, educational details, and financial information. After submission, the bank assesses your application based on several factors.

Required Documentation

The documentation required for a private student loan application varies depending on the bank and the applicant’s circumstances. However, some common documents include a completed application form, proof of enrollment or acceptance at an eligible educational institution, transcripts showing academic progress (if applicable), and personal identification documents. Furthermore, banks often require financial documentation, such as tax returns, pay stubs, or bank statements, to verify income and assess your ability to repay the loan. Providing complete and accurate documentation is crucial for a smooth and efficient application process. Incomplete applications can lead to delays or rejection.

The Application and Approval Flowchart

Imagine a flowchart with the following steps:

1. Application Submission: The applicant completes and submits the loan application online or in person.

2. Initial Review: The bank reviews the application for completeness and accuracy.

3. Credit Check: A credit check is conducted to assess the applicant’s creditworthiness.

4. Documentation Verification: The bank verifies the authenticity of the provided documents.

5. Financial Assessment: The bank assesses the applicant’s financial situation and repayment ability.

6. Loan Approval/Denial: Based on the assessment, the bank approves or denies the loan application.

7. Loan Offer (if approved): The bank provides a loan offer outlining the terms and conditions.

8. Loan Acceptance/Rejection: The applicant reviews and accepts or rejects the loan offer.

9. Loan Disbursement (if accepted): The bank disburses the loan funds according to the agreed-upon schedule.

This flowchart illustrates a simplified process. The actual process may vary slightly depending on the bank’s policies and procedures.

Reasons for Loan Application Rejection

Several factors can lead to the rejection of a private student loan application. These commonly include poor credit history, insufficient income to demonstrate repayment capacity, incomplete or inaccurate application information, attendance at a non-accredited institution, and a lack of a co-signer if required by the bank’s lending criteria. For example, a history of late payments or defaults on previous loans can significantly impact an applicant’s chances of approval. Similarly, applicants with limited or inconsistent income may face difficulties securing a loan without a co-signer who meets the bank’s creditworthiness requirements. Therefore, addressing these factors proactively can increase the probability of loan approval.

Repayment Options and Strategies

Understanding your repayment options is crucial for effectively managing your private student loan debt. Choosing the right plan can significantly impact your monthly payments and the total interest you pay over the life of the loan. Several factors, including your income, budget, and financial goals, should be considered when selecting a repayment plan.

Bank private student loans typically offer a range of repayment options designed to accommodate varying financial circumstances. These options often include standard repayment plans, graduated repayment plans, and extended repayment plans. Each plan has its own set of advantages and disadvantages, and the best choice depends on your individual needs and financial situation.

Standard Repayment Plans

Standard repayment plans involve fixed monthly payments over a set period, usually 10 years. This predictable structure simplifies budgeting, and the shorter repayment period generally results in less interest paid overall compared to longer-term plans. However, the fixed monthly payments may be higher than other options, potentially creating a financial strain, especially in the early years of repayment.

Graduated Repayment Plans

Graduated repayment plans start with lower monthly payments that gradually increase over time. This can be beneficial for borrowers who anticipate increased income in the future, allowing for more manageable payments in the early stages of their careers. However, the total interest paid will likely be higher than with a standard repayment plan due to the longer repayment period and the accruing interest on the principal balance.

Extended Repayment Plans

Extended repayment plans stretch the loan repayment period over a longer time, typically up to 25 years. This significantly lowers monthly payments, making them more affordable for borrowers with limited income. The downside is that the total interest paid will be substantially higher due to the extended repayment period.

Comparison of Repayment Plans: Impact on Total Interest Paid

The following table illustrates the potential impact of different repayment plans on the total interest paid. These figures are illustrative examples and actual amounts will vary based on the loan amount, interest rate, and specific repayment plan terms. Always consult your loan agreement for precise details.

| Repayment Plan | Loan Amount | Interest Rate | Total Interest Paid (Estimate) |

|---|---|---|---|

| Standard (10 years) | $30,000 | 7% | $10,000 |

| Graduated (15 years) | $30,000 | 7% | $15,000 |

| Extended (25 years) | $30,000 | 7% | $25,000 |

Developing a Personalized Repayment Strategy

Creating a personalized repayment strategy involves a careful assessment of your financial situation and goals. A well-defined plan can help you manage your debt effectively and minimize the total interest paid.

- Assess your financial situation: Calculate your monthly income, expenses, and available funds for loan repayment.

- Review your loan terms: Understand your interest rate, loan amount, and repayment options available.

- Choose a repayment plan: Select a plan that aligns with your financial capacity and long-term goals, considering the trade-off between monthly payments and total interest paid.

- Budget for repayments: Integrate your loan payments into your monthly budget to ensure timely and consistent repayments.

- Explore additional options: Consider options such as refinancing or making extra payments to reduce the principal balance and accelerate loan repayment.

Potential Risks and Benefits

Securing a private student loan from a bank can offer financial flexibility but also carries inherent risks. Understanding these potential drawbacks alongside the advantages is crucial for making an informed borrowing decision. This section will explore the potential risks and benefits of private student loans, comparing them to federal loans and highlighting scenarios where private loans might be a suitable choice.

Private Student Loan Risks

Private student loans, unlike federal loans, lack many of the consumer protections afforded by the government. This increased risk necessitates a thorough understanding of the loan terms and a careful assessment of your personal financial situation.

- Higher Interest Rates: Private loan interest rates are typically higher than federal loan rates, leading to a greater overall cost of borrowing. This is because private lenders assess risk differently and often charge a premium for perceived higher-risk borrowers.

- Variable Interest Rates: Some private loans offer variable interest rates, meaning your monthly payments can fluctuate based on market conditions. This unpredictability can make budgeting more challenging.

- Limited Deferment and Forbearance Options: Federal student loans often provide deferment or forbearance options, allowing temporary pauses in payments during financial hardship. Private loans generally offer fewer such options, and the terms are often stricter.

- No Loan Forgiveness Programs: Unlike some federal student loan programs, private loans typically don’t qualify for income-driven repayment plans or loan forgiveness programs. This means you’re responsible for the entire loan amount regardless of your future income.

- Potential for Aggressive Collection Practices: If you default on a private student loan, the collection practices can be more aggressive than those for federal loans. This could involve wage garnishment or legal action.

Private Student Loan Benefits

While the risks are significant, private student loans can offer advantages in specific circumstances. Careful consideration of these benefits is essential when weighing the pros and cons.

- Higher Loan Amounts: Banks may offer higher loan amounts than federal programs, potentially covering the full cost of attendance, including living expenses. This can be beneficial for students attending expensive private institutions.

- Faster Disbursement: Private loan processing can sometimes be faster than federal loan processing, allowing for quicker access to funds.

- Co-signer Options: A co-signer with good credit can improve your chances of approval and secure a lower interest rate. This can be particularly helpful for students with limited credit history.

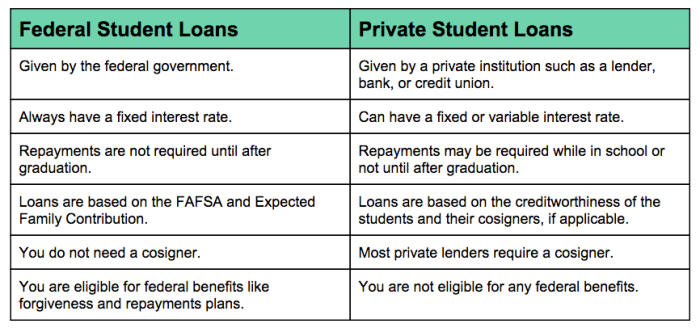

Private vs. Federal Student Loans: A Comparison

The choice between private and federal student loans depends heavily on individual circumstances. Federal loans generally offer more borrower protections, but private loans can provide access to higher loan amounts and potentially faster funding.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower | Generally higher |

| Repayment Options | More flexible, including income-driven plans | Less flexible |

| Loan Forgiveness | Potential for forgiveness programs | Typically no forgiveness programs |

| Borrower Protections | Stronger borrower protections | Fewer borrower protections |

| Loan Amounts | Capped based on need and cost of attendance | Potentially higher |

Scenarios Where Private Student Loans Might Be Suitable

Private student loans can be a viable option in specific situations, but only after carefully weighing the risks and benefits.

- Students attending expensive private universities: When federal loans don’t cover the full cost of attendance, a private loan may be necessary to bridge the gap.

- Students with excellent credit and co-signers: A strong credit profile and a willing co-signer can help secure favorable interest rates and terms.

- Students needing faster access to funds: In situations where quick access to funds is critical, private loans might offer a faster disbursement process.

Comparison with Federal Student Loans

Choosing between federal and private student loans requires careful consideration of several key factors. Understanding the differences in interest rates, repayment terms, application processes, and overall benefits can significantly impact a borrower’s financial well-being. This section will Artikel the key distinctions between federal student loans, primarily offered through the government, and private student loans offered by banks and other financial institutions.

Interest Rates

Federal student loan interest rates are generally lower than those offered by private lenders, such as banks. These rates are set by the government and are often subsidized, meaning the government pays the interest while the borrower is in school (under certain conditions). Private loan interest rates, on the other hand, are variable and depend on factors like the borrower’s credit score, credit history, and the loan amount. A borrower with excellent credit might secure a lower rate, while those with limited or poor credit will likely face significantly higher interest rates. For example, a federal subsidized loan might have a fixed rate of 4%, while a comparable private loan could range from 6% to 12% or even higher, depending on the borrower’s profile.

Repayment Terms and Flexibility

Federal student loans offer several repayment plans designed to accommodate different financial situations. These include standard repayment, extended repayment, graduated repayment, and income-driven repayment plans. Income-driven repayment plans, in particular, adjust monthly payments based on income and family size, making them more manageable for borrowers facing financial hardship. Private student loans typically offer fewer repayment options, and these options might not be as flexible or forgiving as those offered by the federal government. For instance, while federal loans might allow for deferment or forbearance in times of financial difficulty, private loan lenders may not offer the same leniency.

Application and Approval Processes

The application process for federal student loans is generally simpler and more straightforward than for private loans. Federal loan applications are completed through the Free Application for Federal Student Aid (FAFSA), a centralized online application. The approval process is primarily based on financial need and enrollment status. Private loan applications, in contrast, typically require a credit check and often involve a more rigorous review of the borrower’s financial history. The approval process can be more time-consuming and may depend heavily on the borrower’s creditworthiness. A strong credit history is essential for securing favorable terms on a private student loan.

Situations Where Federal Loans Are Preferable

Several scenarios highlight the advantages of federal student loans over private options. For instance, if a borrower has limited or no credit history, federal loans are usually more accessible. Federal loans also offer various income-driven repayment plans, which can be crucial for borrowers who anticipate financial challenges after graduation. Moreover, federal loans often provide borrower protections, such as loan forgiveness programs for certain professions (e.g., public service) or income-based repayment plans that can significantly reduce the overall repayment burden. Finally, federal loans generally offer lower interest rates than private loans, especially for borrowers with less-than-perfect credit. A student with a low credit score or a co-signer who is unable to secure a private loan with acceptable terms would find a federal loan a much more viable option.

Managing Debt and Avoiding Default

Successfully navigating private student loan repayment requires proactive planning and a firm understanding of your financial obligations. Failing to manage your debt effectively can lead to serious financial consequences, impacting your credit score and overall financial well-being. This section Artikels strategies for responsible debt management and the potential ramifications of default.

Effective strategies for managing private student loan debt involve careful budgeting, exploring repayment options, and seeking assistance when needed. Prioritizing loan payments, even with limited funds, is crucial. Building a robust budget that accurately reflects income and expenses allows for a clear picture of available funds for repayment. This involves tracking all income sources and meticulously recording all expenditures, highlighting areas where savings can be achieved. Consider exploring different repayment plans offered by your lender, such as income-driven repayment options (if available), to tailor your payments to your current financial capacity.

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan has severe repercussions. Your credit score will take a significant hit, making it difficult to secure future loans, credit cards, or even rent an apartment. Lenders may pursue legal action, including wage garnishment or bank levy, to recover the outstanding debt. Furthermore, default can lead to collection agency involvement, resulting in additional fees and persistent harassment. The long-term financial consequences of default can be devastating, significantly hindering your ability to achieve your financial goals. For example, a defaulted loan could prevent you from buying a house or securing a favorable interest rate on a car loan for many years.

Resources for Borrowers Struggling with Loan Repayment

Many resources are available to assist borrowers facing challenges with loan repayment. Your lender may offer hardship programs or forbearance options, providing temporary relief from payments. Nonprofit credit counseling agencies provide free or low-cost financial guidance, helping you create a budget, negotiate with creditors, and explore debt management strategies. The National Foundation for Credit Counseling (NFCC) and the Consumer Financial Protection Bureau (CFPB) websites offer valuable information and resources. Additionally, many universities and colleges have financial aid offices that can provide guidance and support to their alumni struggling with student loan debt. These offices often have connections with local and national organizations specializing in debt management and financial literacy.

Debt Management Tools and Techniques

Several tools and techniques can help manage private student loan debt effectively. Budgeting apps and spreadsheets allow for detailed tracking of income and expenses, facilitating informed financial decisions. Debt consolidation can simplify repayment by combining multiple loans into a single loan with potentially a lower interest rate. However, carefully consider the terms and conditions of any consolidation plan before committing. Debt avalanche and debt snowball methods are two popular strategies for prioritizing loan repayment. The debt avalanche method focuses on paying off the loan with the highest interest rate first, while the debt snowball method prioritizes paying off the smallest loan first for psychological motivation. For example, if you have two loans, one with 7% interest and another with 4%, the avalanche method would tackle the 7% loan first, while the snowball method would prioritize the smaller loan regardless of interest rate. These methods require discipline and commitment but can significantly accelerate the debt repayment process. Finally, exploring refinancing options could lower your monthly payments and overall interest paid. However, it’s crucial to compare offers from different lenders before refinancing to ensure you’re getting the best deal.

Illustrative Scenarios

Understanding the complexities of private student loans requires examining both positive and negative scenarios. This section provides examples to illustrate when these loans can be beneficial and when they may lead to financial difficulties. It also details a sample repayment plan and visualizes the impact of varying interest rates.

Beneficial Private Student Loan Scenario

A high-achieving student, Sarah, is accepted into a prestigious private university with a significantly higher tuition than her state school options. Her federal student loan eligibility is insufficient to cover the full cost of attendance. A private loan from a bank, offering a competitive interest rate and favorable repayment terms, bridges the funding gap, allowing Sarah to attend her preferred university and pursue a degree that aligns with her career aspirations. This investment ultimately leads to a higher-paying job, enabling her to repay the loan comfortably and achieve her financial goals.

Financially Hardship Scenario with Private Student Loan

In contrast, consider David, who took out multiple private student loans with high interest rates to finance his education at a less prestigious institution. He chose a program with limited job prospects, resulting in low post-graduation earnings. Combined with unexpected life events like medical bills, David struggles to make minimum payments, accumulating significant debt and facing potential default. His inability to secure a job that matches his educational investment highlights the importance of carefully considering the return on investment before incurring significant private loan debt.

Hypothetical Student Loan Repayment Plan

This example illustrates a simplified repayment plan for a $30,000 private student loan with a 7% annual interest rate, amortized over 10 years. This calculation assumes a fixed interest rate and monthly payments.

The following points Artikel a sample repayment schedule. Actual repayment schedules can vary based on the loan terms and lender.

- Loan Amount: $30,000

- Annual Interest Rate: 7%

- Loan Term: 10 years (120 months)

- Monthly Payment (Approximate): $347 (This is a simplified calculation and doesn’t account for compounding interest precisely. A loan amortization calculator would provide a more accurate figure.)

- Total Interest Paid (Approximate): $11,640 (This is an estimate. Actual interest paid will vary slightly due to compounding.)

- Total Repayment (Approximate): $41,640

Note: These figures are estimates. Actual repayment amounts may vary based on the lender’s calculation methods.

Impact of Different Interest Rates on Loan Repayment

The following text-based representation demonstrates the impact of varying interest rates on a $10,000 loan repaid over 5 years. Higher interest rates significantly increase the total amount repaid.

This illustration highlights the importance of securing the lowest possible interest rate on student loans.

| Interest Rate | Monthly Payment (Approximate) | Total Interest Paid (Approximate) | Total Repayment (Approximate) |

|---|---|---|---|

| 5% | $189 | $564 | $10,564 |

| 7% | $198 | $888 | $10,888 |

| 9% | $208 | $1212 | $11,212 |

Note: These are simplified calculations for illustrative purposes only. Actual repayment amounts may vary slightly.

Last Recap

Securing a private student loan from a bank can be a significant step toward financing your education, but it’s crucial to approach it with careful planning and a thorough understanding of the terms and conditions. By weighing the benefits against the potential risks, comparing options with federal loans, and developing a robust repayment strategy, you can leverage private student loans to achieve your educational aspirations while minimizing potential financial strain. Remember, proactive debt management is key to long-term financial well-being.

FAQ Overview

What is the credit score requirement for a bank private student loan?

Credit score requirements vary among banks, but generally, a good to excellent credit score is needed. A co-signer with good credit may be required for applicants with limited or poor credit history.

Can I refinance my bank private student loan?

Yes, refinancing options exist, allowing you to potentially secure a lower interest rate or more favorable repayment terms. However, eligibility criteria apply, and it’s important to compare offers carefully.

What happens if I miss a payment on my private student loan?

Missing payments can result in late fees, damage your credit score, and potentially lead to default, which has serious financial consequences.

Are there any tax benefits associated with private student loans?

Unlike some federal student loans, private student loans typically don’t offer direct tax benefits for the borrower. However, interest may be deductible depending on your overall financial situation and tax laws.