Navigating the world of student loans can feel overwhelming, especially when faced with a sea of interest rates and repayment options. Bankrate, a prominent financial website, offers a valuable resource for comparing student loan rates, but understanding how to effectively interpret this information is crucial. This guide delves into the intricacies of Bankrate’s student loan rate presentation, exploring its strengths, limitations, and practical applications for prospective borrowers.

We’ll examine the various loan types Bankrate covers, the factors influencing displayed rates, and how these rates compare to those presented by other financial websites. We’ll also dissect Bankrate’s visual representations of data, analyzing their clarity and potential biases, and providing actionable steps for consumers to interpret the information accurately. Ultimately, this guide aims to empower you to use Bankrate’s data to make informed decisions about your student loan financing.

Understanding Bankrate’s Student Loan Rate Information

Bankrate provides a valuable resource for prospective and current student loan borrowers by aggregating information on student loan interest rates from various lenders. Understanding how Bankrate presents this information is key to making informed borrowing decisions. This section will clarify the types of loans covered, the factors affecting displayed rates, and how Bankrate’s data compares to other financial websites.

Types of Student Loans Covered by Bankrate

Bankrate typically covers the most common types of federal and private student loans. Federal student loans, including subsidized and unsubsidized Stafford Loans, PLUS loans for parents and graduate students, and consolidation loans, are often included. Private student loans, offered by banks and credit unions, are also generally represented, although the specific lenders and loan options may vary. It’s important to note that Bankrate may not display every single lender or loan product available in the market.

Factors Influencing Student Loan Interest Rates on Bankrate

Several factors influence the student loan interest rates displayed on Bankrate. These rates are not set by Bankrate itself, but rather reflect the rates offered by the individual lenders at a given time. Key factors include the type of loan (federal vs. private), the borrower’s creditworthiness (credit score, history, debt-to-income ratio), the loan’s repayment term, and the prevailing market interest rates. A borrower with excellent credit will typically qualify for lower interest rates than a borrower with poor credit. Similarly, shorter repayment terms often come with lower interest rates, but result in higher monthly payments. Market interest rate fluctuations also directly impact the rates offered.

Comparison of Bankrate’s Rates with Other Financial Websites

Bankrate’s displayed rates are generally comparable to those found on other reputable financial websites specializing in student loans, such as NerdWallet or Credible. However, minor variations can occur due to differences in data collection methods, the timing of updates, and the specific lenders included in each website’s database. It’s advisable to check multiple websites to gain a comprehensive understanding of the available rates. Directly comparing rates requires careful attention to the specific loan terms and borrower profiles used for the rate calculations.

Comparison of Fixed vs. Variable Interest Rates

The following table compares fixed and variable interest rates as they might be presented on Bankrate (note that specific rates are constantly changing and these are illustrative examples only).

| Interest Rate Type | Description |

|---|---|

| Fixed | The interest rate remains constant throughout the loan term. Predictable monthly payments. Example: 6.5% |

| Variable | The interest rate fluctuates based on market conditions. Monthly payments can change. Example: 4.5% – 7.5% (Initial rate, subject to change) |

Analyzing Bankrate’s Presentation of Student Loan Rates

Bankrate presents student loan rate information in a manner intended to be easily digestible for consumers comparing loan options. However, a critical analysis reveals both strengths and weaknesses in their approach. Understanding these aspects is crucial for borrowers to make informed decisions.

Bankrate’s visual presentation of student loan rates typically involves charts and tables. These often display rates categorized by loan type (federal vs. private), repayment term, and credit score range. For instance, a user might see a bar graph comparing average interest rates for federal subsidized and unsubsidized loans, or a table listing rates from various lenders alongside their associated fees. These visual aids aim to simplify complex information, allowing users to quickly compare options.

Clarity and Effectiveness of Bankrate’s Rate Presentation Methods

Bankrate generally strives for clarity in its presentation. The use of charts and tables effectively summarizes large datasets, making it easier for users to grasp key differences between loan options. However, the effectiveness is somewhat hampered by the inherent complexity of student loan financing. The numerous variables involved—loan type, credit score, repayment plan, lender—can still be overwhelming despite the visual aids. Further, the lack of granular details about individual lender requirements might lead users to make comparisons based on incomplete information.

Potential Biases and Limitations in Bankrate’s Displayed Rates

A primary limitation of Bankrate’s displayed rates is that they often represent averages or ranges. These are not necessarily reflective of the rates an individual borrower will receive. Individual rates are heavily influenced by credit history, income, and the specific lender’s underwriting criteria. Thus, the displayed rates act more as a general guideline than a precise predictor of personal loan costs. Furthermore, Bankrate’s revenue model, which relies on lender partnerships, might subtly influence the prominence given to certain lenders or loan products. While not necessarily overtly biased, this aspect should be considered when interpreting the presented information.

Hypothetical Improved Presentation of Bankrate’s Student Loan Rate Data

An improved presentation could incorporate interactive elements and more granular details. Instead of simply displaying average rates, a user-friendly interface could allow borrowers to input their personal financial information (credit score, income, desired loan amount) to receive a more personalized estimate of their potential interest rates. This would require a sophisticated algorithm capable of accurately reflecting individual lender criteria. Furthermore, a clearer disclosure of the methodology used to calculate the average rates and any potential limitations would enhance transparency. A three-column table, as shown below, could present a clearer comparison:

| Lender | Interest Rate Range | Fees |

|---|---|---|

| Lender A | 4.5% – 7.0% | $100 origination fee |

| Lender B | 5.0% – 7.5% | No origination fee |

| Lender C | 4.0% – 6.5% | $50 origination fee |

Interpreting Bankrate’s Student Loan Rate Data for Consumers

Bankrate provides a valuable service by aggregating student loan rate information from various lenders. However, understanding and effectively using this data requires careful attention to detail. Consumers need to actively engage with the information presented to make informed borrowing decisions, avoiding potential pitfalls and ensuring they secure the best possible loan terms. This section Artikels key aspects consumers should focus on when interpreting Bankrate’s data.

Consumers should approach Bankrate’s data with a critical eye, recognizing that the presented rates represent only a snapshot in time and are subject to change. Understanding the factors that influence these rates, and how they might vary depending on individual circumstances, is crucial for a successful loan application process.

Key Information for Consumers

When reviewing Bankrate’s student loan rate data, several key pieces of information should be prioritized. These elements directly impact the overall cost and suitability of a particular loan. Overlooking these can lead to unfavorable loan terms.

- Annual Percentage Rate (APR): This is the total cost of the loan, including interest and fees, expressed as a yearly percentage. It’s crucial for comparing loans, as a lower APR generally means lower overall costs.

- Loan Term Length: The length of the loan repayment period significantly impacts the monthly payment amount and the total interest paid. Shorter loan terms mean higher monthly payments but less interest paid over the life of the loan.

- Loan Fees: Many lenders charge origination fees or other fees. These fees add to the overall cost of the loan and should be factored into the comparison. Bankrate should clearly display these fees.

- Repayment Options: Different lenders offer varying repayment options, such as fixed or variable interest rates, deferment options, and income-driven repayment plans. Understanding these options is essential to choose a plan that fits individual financial circumstances.

- Lender Reputation and Reviews: Before committing to a loan, research the lender’s reputation and read customer reviews to assess their reliability and customer service quality. While Bankrate may not provide detailed reviews, independent research is crucial.

Steps to Effectively Interpret Bankrate’s Data

To use Bankrate’s student loan rate information effectively, consumers should follow a systematic approach. This ensures a thorough comparison and avoids overlooking important details.

- Identify your needs: Determine the loan amount you require and the ideal repayment term.

- Review multiple lenders: Compare APRs, fees, and repayment options from several lenders presented on Bankrate.

- Consider your credit score: Your credit score significantly impacts the interest rate you qualify for. Bankrate might indicate rate ranges based on credit scores, allowing you to anticipate your potential rate.

- Check for hidden fees: Scrutinize the details for any hidden fees or charges beyond the APR.

- Verify information independently: Confirm the rates and terms directly with the lender before making a final decision.

Examples of Misinterpreting Bankrate’s Data

Misinterpreting Bankrate’s data can lead to costly mistakes. Understanding common errors helps avoid such pitfalls.

- Focusing solely on the lowest APR: While a low APR is desirable, it shouldn’t be the only factor considered. Higher fees or less favorable repayment terms could negate the benefits of a slightly lower APR.

- Ignoring loan fees: Overlooking origination fees or other charges can significantly increase the total cost of the loan, making a seemingly low APR less attractive.

- Misunderstanding repayment options: Failing to consider the implications of different repayment plans (e.g., fixed vs. variable interest rates) can lead to unexpected financial burdens.

- Not verifying information: Relying solely on Bankrate’s data without verifying it directly with the lender can result in inaccurate information and unforeseen consequences.

Comparing Loan Offers Using Bankrate’s Data

Bankrate’s data facilitates a direct comparison of loan offers. Using a structured approach ensures an accurate and informed decision.

- Create a comparison table: List lenders, APRs, loan terms, fees, and repayment options in a table for easy side-by-side comparison.

- Calculate total cost: Estimate the total cost of each loan by considering the principal, interest, and fees over the loan term.

- Assess repayment affordability: Determine which loan’s monthly payment fits comfortably within your budget.

- Consider long-term implications: Evaluate the long-term financial impact of each loan, considering interest paid and overall cost.

- Choose the best option: Select the loan that offers the best balance of low cost, favorable terms, and repayment affordability.

The Impact of Bankrate’s Student Loan Rate Information on Borrowers

Bankrate’s student loan rate information significantly influences borrower decisions, acting as a crucial resource in navigating the complex landscape of student financing. The website’s presentation of rates from various lenders allows borrowers to compare options and potentially secure more favorable terms. However, the impact of this information varies depending on individual circumstances and the extent to which borrowers rely on Bankrate as their sole source of information.

Bankrate’s presented rates can empower borrowers to make informed choices by facilitating a side-by-side comparison of interest rates, repayment terms, and other loan features. This comparative approach helps borrowers identify loans that best align with their financial situation and long-term goals. However, it’s essential to recognize that Bankrate’s data represents a snapshot in time and rates can change frequently.

Influence of Bankrate’s Information on Borrowers with Varying Credit Scores and Income Levels

Borrowers with higher credit scores and higher incomes generally benefit more from Bankrate’s information. They are more likely to qualify for the lowest interest rates advertised, enabling them to save significantly on interest payments over the life of the loan. Conversely, borrowers with lower credit scores and lower incomes may find that the rates presented on Bankrate are not attainable to them. They may need to explore alternative financing options or consider loan consolidation strategies to improve their financial standing. The information, while useful for comparison, may not reflect their realistic loan options without further investigation.

Potential Consequences of Relying Solely on Bankrate for Student Loan Rate Information

Relying solely on Bankrate for student loan rate information carries potential risks. Bankrate’s data is a valuable starting point, but it does not encompass all lenders or all loan products. Borrowers should independently verify the rates and terms offered by lenders directly before committing to a loan. Furthermore, Bankrate’s presentation focuses primarily on interest rates, but other crucial factors, such as fees, repayment options, and loan forgiveness programs, require independent investigation. Overlooking these details can lead to unexpected costs and financial difficulties.

Scenario Illustrating Informed Decision-Making Using Bankrate’s Information

Let’s consider Sarah, a recent graduate with a good credit score seeking to refinance her student loans.

- Sarah uses Bankrate to compare interest rates from several lenders, noting that Lender A offers a 4.5% fixed rate, Lender B a 5.0% fixed rate, and Lender C a variable rate of 4.0% with potential for increase.

- She examines the repayment terms offered by each lender, considering the length of the loan and the associated monthly payments.

- Sarah checks the fine print on each lender’s website to understand any associated fees or hidden costs.

- After careful consideration of interest rates, repayment terms, fees, and her personal financial situation, Sarah chooses Lender A because their fixed rate offers the best balance of affordability and long-term stability.

This scenario highlights how Bankrate’s information can inform the decision-making process but should be used in conjunction with due diligence and independent verification.

Visual Representation of Key Data Points from Bankrate

Bankrate, like other financial websites, utilizes various visual aids to present complex data on student loan rates in a clear and easily digestible manner. Understanding these visual representations is crucial for consumers to quickly grasp key information and make informed decisions about their borrowing options. Effective visuals translate numerical data into easily understood comparisons and trends.

Effective visual representations are essential for conveying the complexities of student loan rates clearly. Bankrate uses several visual elements to achieve this, focusing on simplicity and direct comparison. These allow users to quickly compare different loan types, lenders, and interest rates over time.

Bar Chart Comparison of Interest Rates Across Loan Types

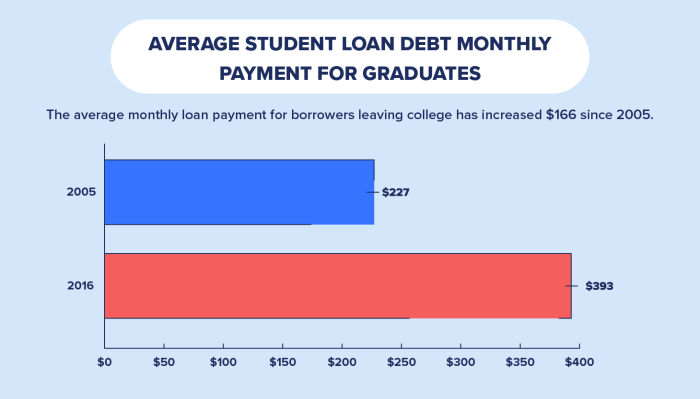

A bar chart provides a straightforward visual comparison of interest rates across different student loan types. For example, a hypothetical bar chart could compare the average interest rates for federal subsidized loans, federal unsubsidized loans, and private student loans. The horizontal axis (x-axis) would list the loan types: “Federal Subsidized,” “Federal Unsubsidized,” and “Private.” The vertical axis (y-axis) would represent the average annual interest rate, perhaps ranging from 0% to 10% in increments of 1%. Each loan type would have a corresponding bar extending vertically to represent its average interest rate. For instance, the bar for “Federal Subsidized” might reach 4%, the bar for “Federal Unsubsidized” might reach 5%, and the bar for “Private” might reach 7%. This allows for immediate visual comparison of the relative costs of different loan options.

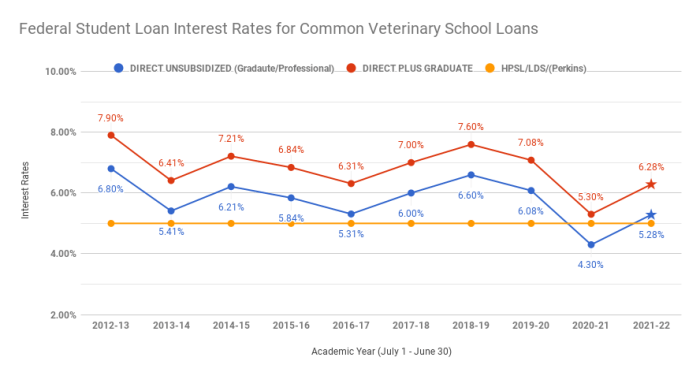

Line Graph Showing the Trend of Student Loan Rates Over Time

A line graph is ideal for illustrating the trend of student loan interest rates over a specific period. A hypothetical line graph could display the average interest rate for federal unsubsidized loans over the past five years. The horizontal axis (x-axis) would represent the year (e.g., 2019, 2020, 2021, 2022, 2023). The vertical axis (y-axis) would represent the average annual interest rate, again perhaps ranging from 0% to 10%. A line would connect data points representing the average interest rate for each year. For example, the data points might be (2019, 4.5%), (2020, 4%), (2021, 3.5%), (2022, 4%), (2023, 5%). This would visually demonstrate any upward or downward trends in interest rates over time, allowing borrowers to assess the historical context of current rates.

Closing Summary

Successfully navigating the student loan landscape requires a keen understanding of interest rates and repayment terms. While Bankrate provides a valuable tool for comparison shopping, it’s essential to remember that it’s only one piece of the puzzle. By critically evaluating the information presented, understanding its limitations, and supplementing it with research from other reputable sources, borrowers can confidently choose a loan that aligns with their financial situation and long-term goals. Remember to always compare multiple offers and carefully consider all aspects of a loan before committing.

Frequently Asked Questions

What types of student loans does Bankrate typically cover?

Bankrate generally covers federal student loans (like subsidized and unsubsidized loans) and private student loans. They may also include information on loan refinancing options.

How often does Bankrate update its student loan rate information?

The frequency of updates varies, but Bankrate aims to keep its information current. It’s advisable to check regularly for the most up-to-date rates.

Does Bankrate consider my credit score when displaying rates?

No, Bankrate displays average rates. Your individual rate will depend on your credit score, income, and other factors. The rates shown serve as a general benchmark.

Can I trust Bankrate’s information completely?

Bankrate is a reputable source, but it’s crucial to remember that the displayed rates are averages and may not reflect your specific circumstances. Always verify information with individual lenders.