Navigating the complexities of higher education often involves the crucial decision of securing a student loan. While the prospect of debt can be daunting, student loans can unlock significant opportunities, paving the way for career advancement, personal growth, and improved financial well-being. This guide explores the multifaceted nature of student loans, examining both their potential benefits and inherent risks. We’ll delve into real-world examples, explore various loan types, and offer strategies for responsible borrowing and debt management.

Understanding the true value of a student loan requires a balanced perspective. It’s not simply about the immediate financial burden but also the long-term return on investment in terms of career prospects, earning potential, and personal fulfillment. By examining various scenarios and considering individual circumstances, we aim to provide a clearer understanding of how student loans can be a powerful tool for achieving educational and professional goals.

Definition and Scope of “Benefited Student Loan”

The term “benefited student loan” refers to a student loan that ultimately results in a net positive outcome for the borrower. This is a subjective assessment, however, as the definition of “benefit” can vary greatly depending on individual circumstances, financial goals, and risk tolerance. A loan that proves beneficial for one individual might be detrimental for another. Understanding the nuances of this definition is crucial for making informed decisions about higher education financing.

The interpretation of “benefited” in the context of student loans hinges on whether the increased earning potential and improved life opportunities resulting from the education outweigh the costs of repaying the loan, including interest. This involves a complex calculation considering the length of the repayment period, the interest rate, the type of loan, and the borrower’s post-graduation earning trajectory.

Beneficial and Detrimental Loan Scenarios

A student loan can be considered beneficial when the increased earning capacity directly resulting from a degree or certification significantly surpasses the total cost of the loan, including interest. For example, a medical student incurring substantial debt to obtain their degree might easily recoup their investment given the high earning potential of physicians. Conversely, a student who takes out loans for a degree in a field with limited job opportunities and low salaries might find themselves struggling to repay their loans, rendering the loan detrimental. This highlights the importance of careful consideration of career prospects before incurring significant student loan debt. The potential for career advancement and salary increases also plays a critical role. A student who secures a well-paying job shortly after graduation is more likely to view their student loan as beneficial compared to a student who remains underemployed.

Types of Student Loans and Their Potential Benefits

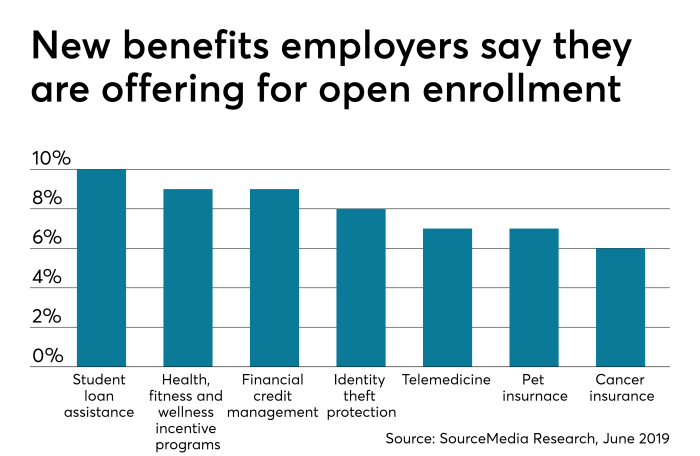

Several types of student loans exist, each with its own potential benefits under specific circumstances. Federal student loans, for example, often offer lower interest rates and flexible repayment options compared to private loans. These benefits can make federal loans more manageable and less likely to become detrimental. However, private loans might be necessary for students who have exhausted their federal loan options and need additional funding. The potential benefit of a private loan depends on securing a favorable interest rate and repayment terms, which can vary significantly depending on the borrower’s creditworthiness. Federal subsidized loans offer an additional benefit by not accruing interest while the student is enrolled at least half-time, reducing the overall cost of borrowing. Unsubsidized loans, on the other hand, begin accruing interest immediately, potentially leading to a higher overall debt burden.

Categorization of Student Loan Benefits

The benefits of student loans can be categorized into several key areas:

Financial Benefits

Financial benefits are the most direct and often the primary motivation for taking out student loans. These include access to higher education, which can lead to higher earning potential and improved financial stability throughout life. The increased earning power can facilitate earlier homeownership, improved retirement savings, and greater financial security overall.

Career Benefits

Student loans can facilitate access to career paths that require advanced education or specialized training. This can result in career advancement opportunities, greater job satisfaction, and increased professional mobility. For instance, a master’s degree in engineering might unlock access to higher-paying positions and more specialized roles within the field.

Personal Benefits

Beyond financial and career benefits, student loans can also offer personal growth and development opportunities. Higher education can broaden perspectives, enhance critical thinking skills, and foster personal fulfillment. The skills and knowledge gained through education can contribute to a more enriched and meaningful life.

Financial Benefits of Student Loans

Student loans, while carrying a significant financial responsibility, can unlock opportunities that significantly improve an individual’s long-term financial well-being. They provide access to higher education, which often translates to higher earning potential and improved career prospects. However, it’s crucial to understand the potential benefits and drawbacks before taking on this debt.

Real-World Examples of Career Advancement Facilitated by Student Loans

Many individuals have leveraged student loans to pursue higher education, leading to substantial career advancements. For instance, a nurse who used student loans to obtain a Bachelor of Science in Nursing (BSN) might see a significant salary increase compared to a nurse with only an Associate Degree in Nursing (ADN). Similarly, an individual who financed their Master’s degree in Engineering with student loans could secure a higher-paying position with greater responsibilities and career growth potential. These examples illustrate how student loans can act as a catalyst for career progression and increased earning power.

Long-Term Financial Implications of Student Loans Versus No Higher Education

The long-term financial implications of taking out student loans versus foregoing higher education are complex and highly individual-dependent. While student loan debt represents a considerable financial burden, the potential increase in lifetime earnings resulting from a higher education degree often outweighs the cost of the loans. Conversely, individuals without a college degree may face limited career opportunities and lower earning potential throughout their working lives. This could result in a lower overall lifetime income, potentially impacting retirement savings and overall financial security. The choice must consider individual circumstances, career aspirations, and potential return on investment.

Return on Investment (ROI) of Different Educational Paths Financed by Student Loans

The ROI of different educational paths financed by student loans varies significantly. For example, a medical degree, while requiring substantial student loan debt, typically leads to a high earning potential and a relatively quick repayment of the loans. In contrast, a liberal arts degree may have a lower initial earning potential, requiring a longer time horizon to achieve a positive ROI. The ROI calculation should consider the total cost of education, including tuition, fees, and living expenses, against the expected increase in lifetime earnings. It is important to research specific career paths and their associated salary expectations to make an informed decision.

Hypothetical Scenario Demonstrating Financial Benefits of a Student Loan

Let’s consider Sarah, who wants to become a software engineer. She estimates the cost of a four-year computer science degree, including tuition and living expenses, to be $100,000. She takes out student loans to cover this cost. Upon graduation, she secures a job with an annual salary of $80,000. This is significantly higher than the average salary for someone without a college degree in her area. Over ten years, assuming a modest salary increase, she would likely earn considerably more than the cost of her education, making the investment in her education, financed by student loans, a financially sound decision. Furthermore, her increased earning capacity could positively impact her ability to save for retirement and other long-term financial goals.

Impact on Career Opportunities

Access to higher education, often facilitated by student loans, significantly broadens career prospects. The investment in education translates directly into increased earning potential and access to a wider range of professional opportunities, ultimately improving overall quality of life. This section will explore the relationship between student loan-funded education and career advancement.

Higher education opens doors to specific careers that simply aren’t accessible with only a high school diploma. Many professional fields require a bachelor’s degree or even a postgraduate qualification as a minimum entry requirement. These fields often offer higher salaries, better benefits, and greater job security. This advantage is particularly pronounced in sectors experiencing rapid growth and technological advancement, where specialized knowledge and skills are in high demand.

Industries Where Higher Education Provides a Significant Advantage

A college degree is a significant advantage in numerous industries. Fields like engineering, medicine, law, and finance often demand extensive specialized training and knowledge, making a higher education qualification practically essential. Even in fields that don’t strictly require a degree, a college education often provides a competitive edge, demonstrating dedication, discipline, and a broader skill set to potential employers. The acquisition of critical thinking, problem-solving, and communication skills through higher education are highly valued across a wide range of industries.

Average Salaries: College Degree vs. No College Degree

The following table compares average annual salaries for individuals with and without college degrees in selected fields. These figures represent national averages and may vary based on experience, location, and specific job roles. It’s important to note that these are illustrative examples and specific salary data can fluctuate.

| Field | Average Salary (With College Degree) | Average Salary (Without College Degree) | Difference |

|---|---|---|---|

| Engineering | $85,000 | $50,000 | $35,000 |

| Nursing | $75,000 | $40,000 | $35,000 |

| Business Management | $70,000 | $45,000 | $25,000 |

| Education (Teaching) | $60,000 | $35,000 | $25,000 |

Correlation Between Higher Education and Career Progression

Statistical data consistently demonstrates a strong positive correlation between higher education and career progression. For instance, studies have shown that individuals with bachelor’s degrees are significantly more likely to achieve managerial or supervisory positions compared to their counterparts with only a high school diploma. Furthermore, individuals with advanced degrees (master’s or doctoral) often experience faster career advancement and higher earning potential throughout their professional lives. The increased earning potential over a career significantly outweighs the initial investment in education, often funded through student loans. Data suggests that individuals with a college degree earn, on average, significantly more over their lifetime compared to those without one, even considering the cost of tuition and loan repayment. This demonstrates a strong return on investment in higher education.

Personal Growth and Development

Pursuing higher education, even with the financial burden of student loans, offers significant personal growth and development opportunities that extend far beyond the acquisition of specific job skills. The transformative experience of university life fosters intellectual curiosity, critical thinking, and a broader worldview, contributing to a richer and more fulfilling life.

The challenges of managing finances alongside academic pursuits build resilience and resourcefulness, valuable assets in both personal and professional life. Moreover, the diverse social environment of a university setting allows for personal growth through interactions with individuals from various backgrounds, fostering empathy and understanding.

Enhanced Communication and Interpersonal Skills

Higher education provides numerous opportunities to hone communication and interpersonal skills. Participation in group projects, debates, and presentations refines articulation, active listening, and the ability to collaborate effectively. These skills are transferable to various aspects of life, from navigating personal relationships to succeeding in professional settings. For example, a student who initially struggled with public speaking might find their confidence dramatically increase after presenting research findings to a class or participating in a student government initiative. This newfound confidence extends to other areas of their life, leading to greater self-assurance and improved interactions with others.

Development of Critical Thinking and Problem-Solving Abilities

The academic rigor of higher education cultivates critical thinking and problem-solving skills. Students are constantly challenged to analyze information, evaluate arguments, and formulate their own conclusions. This process strengthens analytical abilities and promotes a more nuanced understanding of complex issues. For instance, a student studying engineering might develop problem-solving skills through complex design projects, while a student in the humanities might hone analytical abilities by interpreting literary texts or historical events. These skills are highly valued by employers and contribute to a more effective and efficient approach to life’s challenges.

Expanded Worldview and Increased Self-Awareness

Exposure to diverse perspectives and ideas in a university setting broadens students’ worldviews and promotes self-awareness. Interactions with students and faculty from different backgrounds challenge preconceived notions and foster greater understanding and empathy. Studying abroad, even if only for a semester, can be a profoundly transformative experience, fostering independence and adaptability. For example, a student participating in a service-learning project in a developing country might gain a deeper appreciation for global issues and develop a stronger sense of social responsibility. This heightened awareness contributes to a more informed and engaged citizenry.

Personal Benefits Derived from Higher Education Financed by Student Loans

The pursuit of higher education, even when financed by student loans, yields a wealth of personal benefits. These benefits are not solely limited to improved career prospects but also encompass significant personal growth and development. These include:

- Increased confidence and self-esteem.

- Improved communication and interpersonal skills.

- Enhanced critical thinking and problem-solving abilities.

- A broader worldview and greater cultural understanding.

- Development of resilience and adaptability.

- A stronger sense of purpose and direction.

- Greater independence and self-reliance.

- Expanded network of professional and personal contacts.

Potential Drawbacks and Risks

Student loans, while offering crucial access to higher education, come with inherent financial risks. Understanding these potential drawbacks and employing responsible borrowing strategies is vital to mitigating long-term financial burdens and ensuring a positive return on this significant investment. Failing to do so can lead to significant financial strain and negatively impact overall well-being.

Borrowing responsibly involves careful consideration of the loan amount, interest rates, and repayment terms. It’s crucial to borrow only what is absolutely necessary to cover educational expenses and to prioritize affordable repayment options. Over-borrowing can lead to overwhelming debt, delaying financial independence and hindering long-term goals.

Managing Student Loan Debt Effectively

Effective student loan management involves a proactive and strategic approach. This includes creating a realistic budget that accounts for loan repayments, exploring various repayment plans, and consistently making on-time payments to avoid late fees and penalties. Careful financial planning and consistent monitoring of debt levels are crucial for successful management. For example, creating a detailed budget that Artikels monthly income and expenses, including loan repayments, can help borrowers stay on track and avoid falling behind. Additionally, exploring options such as income-driven repayment plans, which adjust payments based on income, can significantly alleviate financial pressure.

Comparison of Repayment Plans

Several repayment plans exist, each with varying terms and implications for overall financial well-being. Standard repayment plans involve fixed monthly payments over a set period, typically 10 years. Income-driven repayment plans, like the Income-Based Repayment (IBR) and Pay As You Earn (PAYE) plans, adjust monthly payments based on income and family size, potentially extending the repayment period but lowering monthly payments. Extended repayment plans offer longer repayment periods, reducing monthly payments but increasing the total interest paid. The best plan depends on individual circumstances and financial goals. For instance, a recent graduate with a low income might benefit from an income-driven plan, while a higher-earning individual might prefer a standard plan to pay off the debt faster.

Potential Risks Associated with Student Loans and Mitigation Strategies

Several risks are associated with student loans, including default, high interest rates, and the impact on credit scores. Defaulting on student loans has severe consequences, including wage garnishment, tax refund offset, and damage to credit scores. High interest rates can significantly increase the total cost of borrowing, especially if the loan is not repaid promptly. Negative impacts on credit scores can affect future borrowing opportunities, such as mortgages or auto loans. Mitigation strategies include careful budgeting, proactive repayment planning, and seeking assistance from loan counselors if financial difficulties arise. For example, exploring options like loan consolidation or refinancing can help reduce monthly payments or lower interest rates. Furthermore, maintaining open communication with lenders and promptly addressing any financial challenges can prevent default and protect credit scores.

Illustrative Examples

Understanding the impact of student loans requires examining real-world scenarios. The following examples illustrate both the potential benefits and the challenges associated with utilizing student loans to finance education.

Case Study: A Successful Engineer

Maria, a bright and ambitious student from a low-income family, secured a student loan to pursue a degree in chemical engineering. Her family lacked the financial resources to support her education, and without the loan, college would have been unattainable. Maria excelled academically, securing internships during her studies which enhanced her resume and provided valuable work experience. Upon graduation, she secured a well-paying position at a leading chemical company. Her starting salary significantly exceeded the average earnings for her age group, allowing her to quickly begin repaying her student loan debt while simultaneously building a comfortable lifestyle. Her career trajectory continues to be positive, with regular promotions and increasing responsibility. Her initial investment in education, facilitated by the student loan, has yielded substantial returns, both financially and professionally.

Last Word

In conclusion, the decision to utilize a student loan is a significant one, demanding careful consideration of individual circumstances and long-term financial implications. While the potential for debt can be a source of concern, the benefits—in terms of career opportunities, personal growth, and enhanced earning potential—can be substantial. By approaching student loan financing with a well-informed and responsible strategy, individuals can leverage this powerful tool to unlock a brighter future. Responsible borrowing, diligent debt management, and a clear understanding of the potential risks and rewards are key to maximizing the positive impact of a student loan.

Answers to Common Questions

What types of student loans are available?

Several types exist, including federal loans (subsidized and unsubsidized) and private loans. Federal loans generally offer more favorable terms and repayment options.

How can I determine if I qualify for a student loan?

Eligibility depends on factors like credit history (for private loans), enrollment status, and financial need (for federal loans). Check with your chosen lender or the federal government’s student aid website.

What are the common repayment options for student loans?

Options include standard repayment, graduated repayment, extended repayment, and income-driven repayment plans. The best option depends on your income and financial situation.

What happens if I default on my student loan?

Defaulting can lead to serious consequences, including damage to your credit score, wage garnishment, and tax refund offset. It’s crucial to contact your lender immediately if you’re struggling to make payments.