The weight of student loan debt can feel overwhelming, casting a long shadow over financial futures and personal well-being. But what if we told you that the path to freedom from this burden is paved with significant advantages, extending far beyond mere financial relief? This exploration delves into the multifaceted benefits of paying off student loans early, revealing how this seemingly daunting task can unlock a wealth of opportunities and dramatically improve your overall quality of life.

From the immediate impact on your credit score and monthly budget to the long-term advantages for savings, investments, and even career advancement, the rewards are substantial and far-reaching. We’ll examine both the tangible financial gains and the less quantifiable, yet equally important, psychological and emotional benefits that come with achieving financial independence. Prepare to discover how conquering student loan debt can transform not just your finances, but your entire life.

Financial Benefits

Paying off your student loans early offers significant financial advantages that extend far beyond simply eliminating monthly payments. The positive impact ripples through your overall financial health, creating opportunities for growth and security. By strategically addressing your student loan debt, you can unlock a brighter financial future.

Reduced Monthly Payments and Overall Financial Well-being

Lower monthly payments directly translate to increased disposable income. This extra cash flow can be allocated towards various aspects of improving your financial well-being. For example, imagine you’re currently paying $500 per month on student loans. Eliminating this debt frees up $500 monthly, allowing you to allocate funds towards building an emergency fund, investing in your future, or simply enjoying a higher quality of life without the constant pressure of loan repayments. This improved financial flexibility reduces stress and enhances your overall sense of security.

Improved Credit Scores

Student loan debt significantly impacts your credit score. High balances and late or missed payments negatively affect your creditworthiness. Paying off your student loans early demonstrates responsible financial behavior to lenders, resulting in a substantial credit score improvement. A higher credit score unlocks better interest rates on future loans (like mortgages or auto loans), saving you thousands of dollars over the long term. It can also improve your chances of securing favorable terms on credit cards and insurance policies.

Early Payoff and Increased Savings, Investments, and Financial Goals

The money previously dedicated to student loan repayments can be redirected towards achieving other financial goals. Imagine a scenario where you successfully pay off your loans three years early. That’s three years’ worth of monthly payments that can be channeled into savings accounts, retirement plans (401k or IRA), or investments. This accelerated progress toward financial independence can lead to early retirement, a down payment on a house, or funding your children’s education. The possibilities are significantly broadened by freeing up this substantial capital.

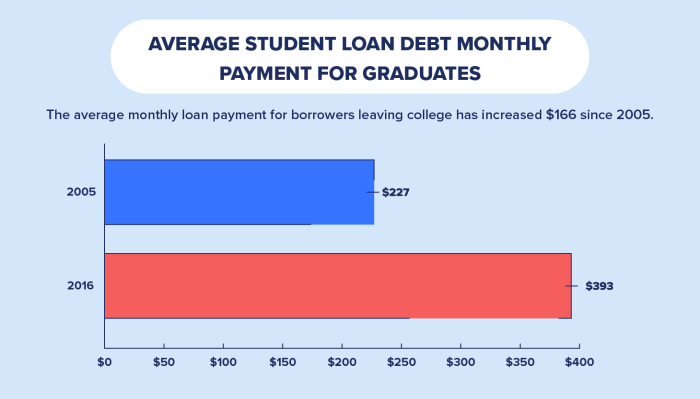

Long-Term Financial Implications: Early Payoff vs. Minimum Payments

Paying only the minimum payment on student loans often leads to accumulating substantial interest over time, significantly increasing the total amount repaid. This contrasts sharply with the benefits of early payoff. For example, let’s consider a $30,000 loan with a 6% interest rate. Paying only the minimum payment might take 15 years and cost you significantly more than the initial loan amount. Conversely, aggressive repayment strategies can drastically shorten the repayment period and save you thousands of dollars in interest. The long-term financial implications of choosing early payoff are far more favorable.

Potential Savings Over Time by Paying Off Student Loans Early

| Years | Minimum Payment Total | Early Payoff Total | Savings |

|---|---|---|---|

| 10 | $40,000 | $32,000 | $8,000 |

| 15 | $55,000 | $35,000 | $20,000 |

| 20 | $70,000 | $40,000 | $30,000 |

Psychological Benefits

Paying off student loans offers significant psychological benefits that extend far beyond the purely financial. The weight of debt can be a constant source of stress and anxiety, impacting mental health and overall well-being. Eliminating this burden can lead to a remarkable improvement in one’s emotional state and sense of control over their life.

The reduction in stress and anxiety associated with eliminating student loan debt is profound. The constant worry about repayment, the fear of default, and the pressure to maintain a high income to manage payments can create a significant emotional toll. This chronic stress can manifest in various ways, from sleep disturbances and irritability to more serious mental health concerns. By removing this financial pressure, individuals can experience a noticeable decrease in anxiety levels, allowing them to focus on other aspects of their lives.

Improved Mental Health and Well-being Through Financial Freedom

Financial freedom, achieved through student loan payoff, contributes directly to improved mental health and overall well-being. The feeling of control over one’s finances is empowering and fosters a sense of security and optimism about the future. This newfound stability can translate into improved relationships, increased self-esteem, and a greater capacity to pursue personal goals and passions without the constant shadow of debt looming large. Studies have shown a strong correlation between financial stress and mental health issues, highlighting the importance of financial stability for overall well-being.

Personal Anecdotes Illustrating Positive Psychological Effects

Imagine Sarah, a young teacher who spent years juggling a demanding job with the constant pressure of student loan repayments. The weight of her debt was a constant source of anxiety, affecting her sleep and her relationships. After finally paying off her loans, Sarah described feeling an overwhelming sense of relief and freedom. She reported sleeping better, having more energy, and feeling more confident in her ability to plan for the future. She even started pursuing a long-held dream of traveling abroad, a prospect previously unthinkable due to her financial constraints.

Another example is Mark, a software engineer who felt trapped by his student loans for years. He consistently worked long hours, sacrificing personal time and leisure activities to meet his repayment obligations. Once his loans were paid off, Mark found he had more time and energy to dedicate to his hobbies, his family, and his personal growth. He reported a significant reduction in his stress levels and an increase in his overall happiness and life satisfaction. The feeling of accomplishment from achieving this significant financial milestone boosted his self-esteem and confidence.

Emotional Responses to Student Loan Debt and Post-Payoff Feelings

Before paying off their student loans, many individuals experience feelings of overwhelm, anxiety, frustration, and even hopelessness. The seemingly insurmountable debt can feel like a constant burden, impacting their self-worth and limiting their life choices. The emotional landscape shifts dramatically after loan payoff. The dominant feelings become relief, freedom, empowerment, and a sense of accomplishment. There’s a noticeable shift from a feeling of being trapped to a feeling of being in control of one’s future. This transformation can be incredibly empowering and liberating.

Emotional Journey of Paying Off Student Loans

Imagine the journey of David, burdened by a significant student loan debt. Initially, he felt a sense of dread and despair, constantly worrying about repayments. As he began making consistent payments, a flicker of hope emerged. With each payment, his sense of accomplishment grew. The process was a marathon, not a sprint, but with each milestone achieved – paying down a significant chunk of the debt, reaching the halfway point – his confidence soared. The final payment brought an explosion of relief, joy, and immense pride. The weight of the debt lifted, revealing a future filled with opportunity and freedom.

Career and Life Opportunities

Paying off student loans significantly impacts career and life choices, offering newfound freedom and flexibility previously constrained by debt. The weight of monthly payments can limit opportunities, but financial independence opens doors to a wider range of possibilities, both professionally and personally.

Being debt-free allows for more strategic career decisions.

Career Changes and Entrepreneurial Pursuits

The fear of financial instability often keeps individuals in jobs they dislike or are unfulfilling. Eliminating student loan debt removes a major barrier to pursuing alternative career paths. This newfound financial security enables individuals to take risks, such as starting their own businesses or transitioning to a field they are more passionate about, even if it means a temporary reduction in income. For example, a teacher burdened by student loan debt might hesitate to pursue a less lucrative but more fulfilling career in social work. However, without that debt, the transition becomes significantly less risky and more feasible. Similarly, aspiring entrepreneurs often delay launching their ventures due to financial constraints. Paying off student loans can provide the necessary capital and peace of mind to finally take the leap.

Impact on Homeownership and Family Decisions

Student loan debt substantially affects major life decisions like buying a home or starting a family. High monthly payments can significantly reduce the amount of money available for a down payment, making homeownership more challenging. Furthermore, the financial burden can delay the decision to have children, as the added expenses associated with raising a family can be overwhelming when already struggling with debt repayment. Conversely, eliminating student loan debt frees up significant financial resources. This allows individuals to save more quickly for a down payment, potentially leading to earlier homeownership. It also provides greater financial stability to support a growing family, enabling them to focus on their children’s needs rather than solely on debt repayment.

Career Advancements Enabled by Improved Financial Stability

Improved financial stability, a direct result of paying off student loans, can lead to career advancements. Individuals no longer stressed by debt are better positioned to pursue professional development opportunities such as further education or certifications. This can enhance their skills and marketability, increasing their earning potential and opening doors to promotions or higher-paying positions. For instance, an individual might pursue an MBA, knowing that they have the financial freedom to handle the associated costs without jeopardizing their current financial stability. The reduced financial stress also translates to increased productivity and focus at work, leading to better performance and increased chances of advancement.

Lifestyle Comparisons: With and Without Student Loan Debt

The lifestyle of someone with significant student loan debt often revolves around budgeting meticulously and prioritizing debt repayment. Vacations, hobbies, and other leisure activities might be severely limited. Conversely, individuals free from this debt enjoy greater financial flexibility, allowing them to pursue hobbies, travel, and enjoy a higher quality of life. They have the freedom to make spontaneous purchases or invest in experiences that enrich their lives, without the constant worry of debt repayments. This improved financial well-being directly translates into reduced stress and improved overall mental health.

Accessible Life Choices After Student Loan Payoff

Eliminating student loan debt unlocks a range of life choices previously out of reach.

- Purchasing a home

- Starting a family

- Investing in personal development (courses, certifications)

- Pursuing a passion project or hobby

- Traveling and experiencing new cultures

- Saving for retirement

- Making significant charitable contributions

- Starting a business

- Reducing financial stress and improving mental health

Long-Term Financial Planning

Eliminating student loan debt dramatically alters your long-term financial trajectory, freeing up significant resources for building wealth and achieving your life goals. The consistent monthly payments and interest accrued on these loans often represent a substantial portion of one’s income, hindering the ability to save, invest, and plan for the future. By becoming debt-free, individuals gain control over their finances, paving the way for more robust and secure financial planning.

Increased savings and investment opportunities are a direct consequence of eliminating student loan debt. The money previously allocated to loan repayments can now be redirected towards building an emergency fund, contributing to retirement accounts, or investing in assets that generate long-term growth. This shift allows for a more aggressive savings strategy and access to higher-return investment vehicles, accelerating wealth accumulation.

Advantages of Increased Savings and Investment Opportunities

The financial freedom gained by paying off student loans translates into several tangible advantages. Individuals can significantly increase their savings rate, potentially accelerating their progress towards various financial goals. They can also explore higher-risk, higher-reward investment options, knowing they have a safety net in place. For instance, someone might allocate a larger portion of their income to a Roth IRA, maximizing tax-advantaged growth for retirement, or invest in real estate, which often provides significant long-term appreciation. The ability to diversify their investment portfolio becomes significantly easier, mitigating risk and potentially increasing overall returns.

Achievable Long-Term Financial Goals with Debt Freedom

Debt freedom unlocks the pursuit of various long-term financial goals that may have previously seemed unattainable. Examples include purchasing a home, starting a family, funding a child’s education, or starting a business. Without the burden of student loan payments, individuals can save for a down payment on a house more quickly, accumulate funds for childcare expenses, or save enough to cover tuition for their children’s higher education. They can also allocate funds towards business startup costs or building a substantial emergency fund, which can reduce financial stress and increase overall security. Retirement planning also benefits greatly; a larger portion of income can be directed towards retirement savings plans, increasing the likelihood of a comfortable retirement.

Financial Security in Retirement: Debt-Free vs. Indebted

Individuals who enter retirement with significant student loan debt face considerable financial hardship. Their limited income, combined with ongoing loan payments, can significantly reduce their quality of life during retirement. Conversely, individuals who have eliminated student loan debt prior to retirement enjoy greater financial security. They have a larger nest egg, potentially allowing them to pursue hobbies, travel, or simply enjoy a more relaxed lifestyle without the worry of financial strain. The peace of mind that comes with financial security in retirement is invaluable. Consider two individuals: one who diligently paid off their student loans early and aggressively saved for retirement, and another who carried a significant student loan debt throughout their working life. The former likely enjoys a more comfortable retirement with fewer financial anxieties.

Step-by-Step Plan for Building a Strong Financial Future After Paying Off Student Loans

A strategic approach is crucial to maximizing the benefits of debt freedom. The following steps Artikel a plan for building a strong financial future after paying off student loans:

1. Build an Emergency Fund: Establish a savings account with 3-6 months of living expenses to handle unexpected events.

2. Pay Off High-Interest Debt: Prioritize paying off any remaining high-interest debts, such as credit card balances.

3. Maximize Retirement Contributions: Contribute the maximum allowable amount to tax-advantaged retirement accounts, such as 401(k)s and IRAs.

4. Invest for Long-Term Growth: Invest in a diversified portfolio of stocks, bonds, and other assets to build long-term wealth.

5. Plan for Major Purchases: Save systematically for major purchases, such as a home or a car, rather than relying on debt.

6. Regularly Review and Adjust: Periodically review your financial plan and adjust it as needed to align with your evolving goals and circumstances.

Illustrative Examples

Paying off student loans early can significantly impact various aspects of your financial life. The following scenarios demonstrate the tangible benefits, showcasing how eliminating this debt can unlock opportunities and improve long-term financial well-being.

Early Loan Payoff and Homeownership

Imagine Sarah, a 28-year-old teacher with $30,000 in student loan debt and an annual income of $50,000. If she continues making minimum payments, her debt will take several years to repay, impacting her ability to save for a down payment on a home. However, if Sarah aggressively pays down her loans, she could eliminate them within two years. This significantly improves her chances of qualifying for a mortgage. With her student loans paid off, her debt-to-income ratio decreases dramatically, making her a more attractive candidate for a mortgage lender. She could now comfortably afford a larger down payment, potentially securing a lower interest rate and reducing her monthly mortgage payments. For instance, a $250,000 home with a 20% down payment ($50,000) and a 30-year mortgage at a 6% interest rate would result in monthly payments significantly lower than if she were still burdened with substantial student loan debt. This early payoff translates to earlier homeownership and potentially significant long-term savings on interest payments.

Early Loan Payoff and Business Start-up

Consider Mark, a 32-year-old graphic designer with $40,000 in student loan debt. He has a brilliant business idea for a design agency but lacks the initial capital. His student loans consume a significant portion of his income, hindering his ability to save and secure funding. By aggressively paying off his loans within three years, he frees up considerable funds. This freed-up cash flow can now be used for startup costs such as website development, marketing materials, and office supplies. He can also leverage his improved credit score to secure a small business loan with favorable terms. Eliminating his student loan debt significantly reduces his financial risk, making his business venture more viable and less reliant on high-interest debt. This demonstrates how tackling student loan debt can unlock entrepreneurial opportunities.

Early Loan Payoff and Retirement Savings

Let’s look at Jessica, a 25-year-old accountant with $25,000 in student loan debt. If she makes only minimum payments, a considerable portion of her income will be allocated to debt repayment for many years. However, by aggressively paying off her loans in four years, she can redirect those funds towards retirement savings. This allows her to significantly increase her contributions to a 401(k) or IRA. Assuming a conservative annual return of 7% on her investments, eliminating her student loan debt early could result in a substantially larger retirement nest egg. For example, by investing the money she would have spent on student loan payments, she could potentially accumulate hundreds of thousands of dollars more by retirement age, leading to a more comfortable and secure retirement. This illustrates how eliminating student loan debt can dramatically boost long-term savings and retirement income.

Final Review

Ultimately, the decision to prioritize paying off student loans is a deeply personal one, but the evidence overwhelmingly suggests that the benefits far outweigh the perceived sacrifices. By strategically tackling this debt, you’re not just freeing yourself from a financial burden; you’re investing in a brighter, more secure, and significantly more fulfilling future. The journey may require discipline and planning, but the destination – a life unshackled by debt and brimming with possibilities – is well worth the effort. Embrace the power of financial freedom and unlock your full potential.

Q&A

What if I can’t afford to pay off my student loans early?

Explore options like refinancing to lower your interest rate or creating a budget to allocate more funds towards loan repayment. Even small extra payments can significantly reduce the overall time and interest paid.

Will paying off student loans affect my taxes?

Generally, student loan payments aren’t tax-deductible, but check with a tax professional for personalized advice, as rules can change.

How do I know which loans to pay off first?

Consider strategies like the avalanche method (highest interest rate first) or the snowball method (smallest balance first). Your choice depends on your financial goals and motivation.

What if I have multiple student loans from different lenders?

Consolidation might simplify payments, but carefully compare interest rates and fees before making a decision. It may or may not be the most beneficial option.