Navigating the complexities of higher education financing can feel overwhelming. While federal student loans offer a crucial pathway, private student loans present a valuable alternative, offering unique advantages for certain students. This guide explores the potential benefits of private student loans, examining their accessibility, repayment options, and overall impact on your educational journey. Understanding these benefits empowers you to make informed decisions about your financial future.

We’ll delve into the intricacies of interest rates, loan amounts, and the crucial role of co-signers. We’ll also address potential drawbacks and provide practical advice on choosing the right lender. Ultimately, this exploration aims to equip you with the knowledge needed to determine if private student loans are the right choice for your specific circumstances.

Accessibility and Flexibility of Private Student Loans

Private student loans offer a valuable alternative to federal loans, providing students with additional funding options to cover educational expenses. Their accessibility and flexibility stem from a wider range of lending institutions and diverse loan structures, although it’s crucial to understand the associated terms and conditions carefully. Borrowers should always compare offers to find the most suitable option for their individual financial circumstances.

Private student loans offer a variety of lending options, each with its own set of terms and conditions. These options cater to different financial situations and risk profiles, offering varying levels of interest rates, repayment plans, and eligibility requirements.

Types of Private Student Loans

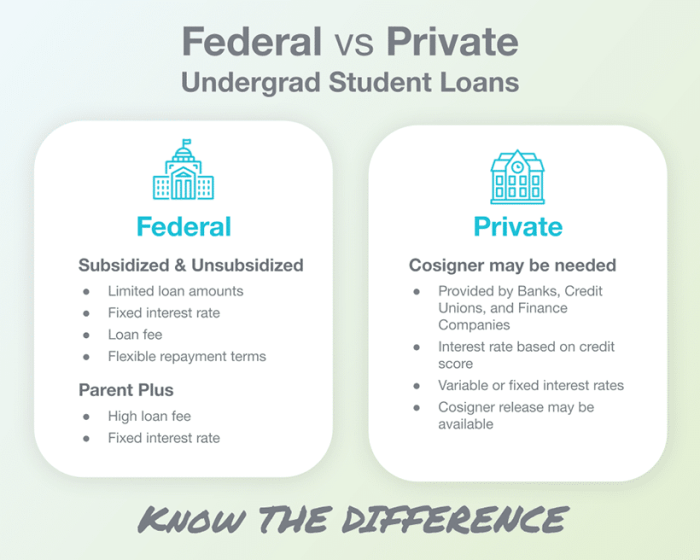

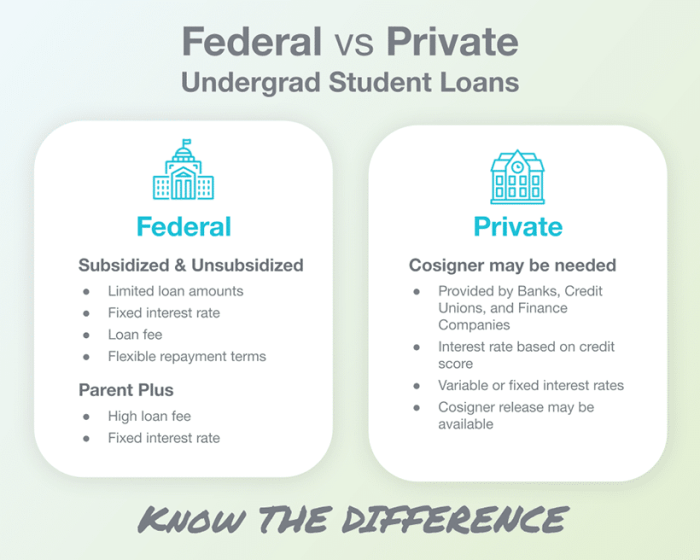

Private student loans are offered by a variety of institutions, including banks, credit unions, and online lenders. These institutions typically offer several loan types, each with different features. For instance, some loans may require a co-signer, while others may not. Interest rates and repayment terms also vary depending on the lender and the borrower’s creditworthiness. Understanding these differences is crucial for selecting the most appropriate loan. Some common types include: undergraduate loans, graduate loans, professional school loans, and parent loans. The specific terms, such as interest rates and repayment periods, will vary greatly depending on the lender and the borrower’s credit history.

Comparison of Application Processes: Private vs. Federal Loans

The application process for private student loans differs significantly from that of federal student loans. Federal loans generally involve a simpler application process and often require less documentation. Private loan applications, on the other hand, often involve a more rigorous credit check and may require additional financial documentation.

| Feature | Private Student Loans | Federal Student Loans |

|---|---|---|

| Application Requirements | Credit check, income verification, co-signer may be required, proof of enrollment | FAFSA completion, proof of enrollment |

| Processing Time | Varies depending on lender; can range from a few days to several weeks | Generally faster than private loans; often within a few weeks |

| Documentation Needed | Tax returns, bank statements, credit reports, proof of enrollment, co-signer information (if applicable) | FAFSA, proof of enrollment |

Private Loans for Students with Unique Circumstances

Private student loans can be particularly beneficial for students facing unique financial circumstances that might hinder their eligibility for federal loans. For example, students with gaps in their academic history or credit challenges may find it more difficult to secure federal funding. Private lenders often consider a broader range of factors when assessing applications, potentially offering a lifeline to these students. However, it is important to remember that these loans typically come with higher interest rates and stricter requirements. Careful consideration of the terms and conditions is essential before accepting a private loan. For example, a student with a gap in their academic record due to a family emergency might find it easier to obtain a private loan by providing a compelling explanation and supporting documentation, something not always considered in the federal loan process. Similarly, a student with limited credit history might qualify for a private loan with a co-signer who has a strong credit profile.

Interest Rates and Repayment Options

Understanding the interest rates and repayment options for private student loans is crucial for responsible borrowing. These factors significantly impact the overall cost and your ability to manage your debt effectively. Choosing the right loan and repayment plan requires careful consideration of your financial situation and long-term goals.

Private student loan interest rates are determined by a number of factors, reflecting the lender’s assessment of the risk involved in lending to you. Creditworthiness plays a significant role; a higher credit score typically translates to a lower interest rate. Your income, debt-to-income ratio, and the loan amount itself also influence the rate offered. Additionally, the lender considers the prevailing market interest rates and the specific terms of the loan, such as the loan term length. A longer repayment period might result in a slightly lower monthly payment, but it will lead to a higher total interest paid over the life of the loan. The type of loan (e.g., undergraduate vs. graduate) and the presence of a co-signer can also impact the interest rate. A co-signer with good credit can help secure a lower rate for the borrower.

Repayment Plan Options

Private lenders offer a variety of repayment plans, each with its own advantages and disadvantages. Selecting the right plan depends on your financial circumstances and your ability to manage monthly payments. Careful consideration of the long-term implications is crucial.

- Fixed-Rate Loans: These loans have a consistent interest rate throughout the repayment period. This predictability makes budgeting easier, as your monthly payments remain the same. For example, a $20,000 fixed-rate loan at 7% interest over 10 years would have a consistent monthly payment. The total interest paid would be known upfront.

- Variable-Rate Loans: These loans have an interest rate that fluctuates based on market conditions. While you might initially benefit from a lower rate compared to a fixed-rate loan, the rate could increase over time, leading to higher monthly payments. This unpredictability can make budgeting challenging. For instance, a $20,000 variable-rate loan could start at 6% but rise to 8% after a year, increasing the monthly payments. The total interest paid is uncertain.

- Graduated Repayment: This option involves lower monthly payments in the initial years, gradually increasing over time. This can be beneficial for borrowers who anticipate increased income in the future. However, it’s crucial to understand that you’ll pay significantly more in interest over the life of the loan compared to a fixed payment plan. For example, a $20,000 loan with a graduated repayment plan might start with low payments, but those payments will increase substantially after a few years, and the total interest paid will be higher than with a fixed payment plan.

- Income-Driven Repayment (IDR) Plans (Not always available for private loans): While less common with private lenders than federal loans, some private lenders may offer IDR plans. These plans link monthly payments to your income. If your income is low, your payments will be lower, potentially preventing default. However, the loan repayment period might be extended significantly, resulting in higher total interest paid. For example, if your income decreases, your monthly payment on an IDR plan would decrease accordingly. However, this lower payment may extend the repayment period by many years, leading to significantly higher total interest.

Interest Capitalization

Interest capitalization occurs when unpaid interest is added to the principal loan amount. This increases the total amount you owe and, consequently, the total interest you pay over the life of the loan. For example, if you defer payments on a loan with interest capitalization, the accumulated interest will be added to your principal balance, increasing your future payments and the total interest you’ll pay. This can significantly impact the overall cost of your loan. It’s essential to understand the implications of deferment or forbearance options and how they relate to interest capitalization. Failing to make payments during periods of deferment or forbearance can result in a substantial increase in your loan balance due to capitalized interest.

Loan Amounts and Loan Limits

Private student loans offer a potentially significant source of funding for higher education, but understanding the loan amounts and limits is crucial for responsible borrowing. Unlike federal loans, which have set limits based on factors like dependency status and year in school, private loan amounts are determined by a lender’s assessment of the borrower’s creditworthiness and the cost of attendance. This means the available loan amount can vary considerably from student to student.

Private lenders typically consider factors such as credit history, income, co-signer availability, and the type of degree program when determining the maximum loan amount. They will also look at the cost of attendance at the chosen institution to ensure the loan amount aligns with the student’s educational expenses. This contrasts sharply with federal loan limits, which are capped based on the student’s need and the cost of their chosen program.

Average Loan Amounts by Educational Level

The average loan amount a student can receive from a private lender varies depending on several factors, including the student’s creditworthiness and the educational level. Generally, graduate students tend to borrow larger amounts than undergraduate students due to the higher cost of graduate programs. The following table provides an approximation of average loan amounts. Remember that these are averages and actual loan amounts can differ significantly.

| Educational Level | Average Loan Amount (Undergraduate) | Average Loan Amount (Graduate) | Notes |

|---|---|---|---|

| Undergraduate | $10,000 – $25,000 | N/A | Amounts vary widely based on credit and need. |

| Graduate | N/A | $20,000 – $50,000+ | Higher amounts are common due to increased program costs and potential for higher earning potential post-graduation. |

Factors Influencing Maximum Loan Amount

Several key factors determine the maximum loan amount a private lender will offer. A strong credit history is often a prerequisite for securing a large loan amount, as it demonstrates financial responsibility. A higher credit score generally translates to more favorable loan terms and higher borrowing limits. Having a co-signer with good credit can significantly improve a student’s chances of approval and increase the loan amount available. The lender will also consider the student’s income and debt-to-income ratio. Finally, the cost of attendance at the chosen institution plays a crucial role, as lenders are unlikely to approve a loan amount exceeding the total cost of tuition, fees, and living expenses.

Risks of Borrowing Large Sums Through Private Loans

Borrowing substantial sums through private student loans carries significant risks. High interest rates are common with private loans, especially for borrowers with less-than-perfect credit. This can lead to a substantial increase in the total amount repaid over the loan’s lifetime. Furthermore, private loans generally lack the same borrower protections as federal loans, such as income-driven repayment plans or loan forgiveness programs. If a borrower encounters financial hardship, it may be more challenging to manage their private loan repayments. Defaulting on a private loan can have severe consequences, potentially impacting credit scores and leading to wage garnishment or legal action. Careful planning and consideration of the long-term financial implications are essential before taking on a large private student loan.

Co-signers and Credit History

Securing a private student loan often involves navigating the complexities of credit history and the potential need for a co-signer. Understanding the roles and responsibilities of both the borrower and co-signer, as well as the impact of credit history on loan terms, is crucial for a successful application process.

The role of a co-signer is significant in the private student loan landscape. A co-signer is an individual with established credit who agrees to share responsibility for repaying the loan if the borrower defaults. This significantly reduces the lender’s risk, making it more likely that the loan application will be approved, even if the borrower has limited or poor credit. For the borrower, a co-signer provides access to potentially more favorable loan terms, such as lower interest rates and higher loan amounts. For the co-signer, the responsibility involves a commitment to repay the loan if the borrower fails to do so, which can impact their credit score. This underscores the importance of open communication and a clear understanding of the financial obligations involved for both parties before entering into such an agreement.

Co-signer Responsibilities and Benefits

A co-signer assumes the responsibility of repaying the loan if the borrower defaults. This means that if the borrower fails to make payments, the lender will pursue the co-signer for the outstanding balance. The co-signer’s credit score will be negatively impacted by late or missed payments. However, acting as a co-signer can also build a positive relationship with the borrower and help them establish a good credit history. The co-signer’s credit history can also benefit from consistent on-time payments, as this positive repayment activity is reported to credit bureaus. Therefore, the decision to co-sign should be made cautiously, considering the potential risks and rewards involved. It’s essential that both the borrower and co-signer thoroughly understand the terms of the loan agreement before signing.

Impact of Credit History on Loan Approval and Interest Rates

A borrower’s credit history is a primary factor influencing loan approval and interest rates. Lenders assess credit scores to determine the risk associated with lending money. Borrowers with good credit (generally a score of 700 or higher) typically qualify for lower interest rates and more favorable loan terms. For example, a borrower with excellent credit might receive a loan with a 5% interest rate, while a borrower with poor credit might face an interest rate of 12% or higher, significantly increasing the total cost of the loan over its lifespan. A borrower with no credit history might find it difficult to secure a private student loan without a co-signer.

Finding and Selecting a Suitable Co-signer

Selecting a suitable co-signer requires careful consideration. Ideal candidates possess a strong credit history, stable income, and a willingness to take on the financial responsibility. Before approaching someone, it’s crucial to discuss the implications of co-signing thoroughly. Open communication about the loan terms, repayment schedule, and potential risks is vital. The relationship between the borrower and co-signer should be strong and built on trust, as the financial burden of the loan will be shared. The process involves assessing the co-signer’s creditworthiness and ensuring they understand the potential impact on their credit score. It’s recommended to explore options with several potential co-signers to find the most suitable match.

Potential Drawbacks of Private Student Loans

While private student loans offer certain advantages, it’s crucial to understand their potential downsides. Unlike federal loans, private loans often come with less consumer protection and can lead to significant financial hardship if not managed carefully. This section will highlight key areas of concern.

Private student loans frequently carry higher interest rates than federal loans, leading to a greater overall cost of borrowing. This difference can be substantial, resulting in significantly higher payments over the life of the loan. For example, a private loan might have an interest rate of 8% while a comparable federal loan carries a rate of 5%. This seemingly small difference can translate into thousands of extra dollars in interest paid over the loan’s repayment period. The interest rate you qualify for is heavily influenced by your credit score and credit history, which is a major differentiating factor from federal loans that use different qualification criteria.

Interest Rates and Repayment Terms

The interest rates on private student loans are variable, meaning they can fluctuate over time, making it difficult to budget accurately. Repayment terms are also less flexible than those offered on federal loans. For instance, federal loans often provide income-driven repayment plans, which adjust monthly payments based on income. Private lenders typically offer fewer such options, leaving borrowers with potentially higher monthly payments even during periods of financial difficulty. Deferment or forbearance options, which temporarily postpone or reduce payments, might be limited or unavailable on private loans.

Consumer Protection Measures

Federal student loans benefit from robust consumer protection measures. These protections include access to loan forgiveness programs under certain circumstances (like public service loan forgiveness), clear and standardized repayment options, and protections against unfair lending practices. Private student loans generally lack these comprehensive protections. For example, there’s no equivalent to the federal government’s robust system of consumer advocacy and recourse in the event of lender misconduct. Borrowers must rely on state-level consumer protection laws and potentially lengthy legal processes to address disputes with private lenders.

Consequences of Default

Defaulting on a private student loan can have severe financial consequences. Unlike federal loans, which have established processes for dealing with default, private lenders have more leeway in their collection methods. This can include wage garnishment, bank levy, and negative impacts on credit scores. The impact on credit scores can be significantly more severe than with a federal loan default, making it harder to obtain future credit, such as mortgages or auto loans. Furthermore, private lenders may aggressively pursue legal action, potentially resulting in judgments and further debt accumulation. The lack of standardized processes for default management with private loans leaves borrowers with less predictable outcomes.

Choosing the Right Private Lender

Selecting the right private student loan lender is crucial for securing favorable terms and ensuring a smooth borrowing experience. The process involves careful consideration of various factors to find a lender that aligns with your individual financial situation and needs. Failing to do so could result in higher interest rates, less flexible repayment options, or poor customer service.

Criteria for Choosing a Private Student Loan Lender

Several key criteria should guide your selection process. A thorough evaluation of these factors will help you identify the lender best suited to your circumstances.

- Interest Rates: Interest rates directly impact the total cost of your loan. Compare interest rates offered by different lenders, paying close attention to both fixed and variable rates. Fixed rates remain constant throughout the loan term, offering predictability, while variable rates fluctuate with market conditions, potentially leading to savings or increased costs.

- Fees: Lenders often charge various fees, such as origination fees, late payment fees, and prepayment penalties. These fees can significantly add to the overall cost of your loan. Carefully review the fee schedule of each lender to understand the potential added expenses.

- Repayment Options: Flexible repayment options are essential for managing your loan effectively. Explore the different repayment plans offered, such as graduated, extended, or income-driven repayment. Consider your expected post-graduation income and choose a plan that aligns with your financial capabilities.

- Customer Service: Excellent customer service is vital, especially when dealing with financial matters. Check reviews and ratings of different lenders to gauge their responsiveness, helpfulness, and overall customer satisfaction. Easy access to support through various channels (phone, email, online chat) is a valuable asset.

Types of Private Student Loan Lenders

Private student loans are offered by a variety of lenders, each with its own strengths and weaknesses. Understanding these differences can help you make an informed decision.

- Banks: Banks are established financial institutions offering a wide range of financial products, including student loans. They often have a strong reputation and extensive branch networks, but their interest rates may not always be the most competitive.

- Credit Unions: Credit unions are member-owned financial cooperatives that typically offer lower interest rates and more personalized service than banks. However, membership requirements might limit access for some borrowers.

- Online Lenders: Online lenders offer convenience and often streamlined application processes. They may have more competitive interest rates, but may lack the personal touch of traditional lenders. Thorough research into their reputation and security measures is crucial.

Checklist for Comparing Loan Offers

Before making a final decision, use this checklist to compare loan offers from different lenders:

- Interest Rate: Note both the fixed and variable rate, if applicable.

- Fees: List all fees associated with the loan (origination, late payment, prepayment penalties).

- Repayment Options: Compare the terms and conditions of different repayment plans.

- Loan Term: Consider the length of the repayment period and its impact on your monthly payments.

- Customer Service Ratings and Reviews: Research the lender’s reputation and customer service experience.

- Eligibility Requirements: Ensure you meet the lender’s criteria for loan approval.

- Total Loan Cost: Calculate the total amount you will repay, including interest and fees.

Closing Summary

Securing funding for higher education requires careful consideration of various options. Private student loans, while carrying potential risks, offer unique advantages in terms of accessibility and flexibility. By understanding the factors influencing interest rates, repayment plans, and loan amounts, you can make an informed decision that aligns with your financial situation and long-term goals. Remember to carefully weigh the pros and cons, compare lenders, and seek professional financial advice when necessary to navigate this crucial aspect of your educational journey successfully.

Questions Often Asked

What is the difference between a fixed and variable interest rate on a private student loan?

A fixed interest rate remains constant throughout the loan term, making your monthly payments predictable. A variable interest rate fluctuates with market conditions, potentially leading to varying monthly payments.

Can I refinance my private student loans?

Yes, refinancing can lower your interest rate or change your repayment terms, but it typically requires good credit. Shop around and compare offers before refinancing.

What happens if I default on a private student loan?

Defaulting can severely damage your credit score, potentially leading to wage garnishment, lawsuits, and difficulty obtaining future loans. Contact your lender immediately if you are struggling to make payments.

How long does it take to get approved for a private student loan?

Approval times vary depending on the lender and your application completeness, but generally range from a few days to a few weeks.