Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential pathway to greater financial freedom. This process involves replacing your existing student loans with a new loan, often at a lower interest rate or with more favorable repayment terms. This can lead to significant savings over the life of the loan and provide much-needed financial flexibility.

Refinancing can dramatically alter your financial landscape, impacting your monthly payments, overall interest paid, and even your long-term financial goals. Understanding the nuances of refinancing, however, is key to making an informed decision that aligns with your individual circumstances. This guide will explore the key advantages and considerations associated with refinancing your student loans.

Lower Monthly Payments

Refinancing your student loans can significantly reduce your monthly payments, making it easier to manage your finances. This is achieved by securing a new loan with a lower interest rate, a longer repayment term, or both. Lower interest rates directly translate to lower monthly interest charges, while extending the repayment period spreads the total loan amount over a longer timeframe, resulting in smaller monthly installments.

Refinancing allows you to consolidate multiple loans into a single, more manageable payment, simplifying the repayment process and potentially lowering your overall interest rate. This consolidation can be particularly beneficial if you have loans with varying interest rates; refinancing can replace these with a single, lower rate.

Refinancing Scenarios and Their Impact

Let’s examine a few scenarios to illustrate how refinancing can impact monthly payments. Imagine you have $50,000 in student loan debt. In Scenario A, your current interest rate is 7%, and your monthly payment is $500. After refinancing, in Scenario B, you secure a new loan with a 4% interest rate, potentially lowering your monthly payment to $400, saving you $100 per month. This represents a substantial reduction in your monthly financial burden. In Scenario C, keeping the interest rate at 7%, extending the repayment term from 10 years to 15 years can lower the monthly payment, but will result in paying more interest over the life of the loan. Choosing the best scenario depends on your individual financial goals and risk tolerance.

Comparison of Monthly Payments Before and After Refinancing

The following table demonstrates the potential savings from refinancing for various loan amounts and interest rates. These figures are illustrative and actual savings may vary based on individual lender terms and conditions. Note that longer repayment periods result in lower monthly payments but increase total interest paid.

| Loan Amount | Original Interest Rate | Original Monthly Payment (10-year term) | Refinanced Monthly Payment (15-year term, 4% interest) |

|---|---|---|---|

| $30,000 | 6% | $330 | $220 |

| $50,000 | 7% | $560 | $370 |

| $75,000 | 8% | $840 | $550 |

Reduced Interest Rates

Refinancing your student loans can significantly lower your interest rate, leading to substantial savings over the life of your loans. This is because interest rates fluctuate based on various market factors, and refinancing allows you to lock in a potentially lower rate than the one you originally received. This reduction can translate into a faster payoff and a considerable reduction in the total amount you pay.

Lowering your interest rate can save you thousands of dollars. The amount saved depends on several factors, including your original interest rate, the new interest rate you qualify for, and the remaining balance on your loans. Even a small reduction in your interest rate can result in significant long-term savings.

Factors Influencing Refinancing Interest Rates

Several key factors determine the interest rate you’ll receive when refinancing your student loans. Your credit score plays a crucial role, as lenders view a higher score as an indicator of lower risk. Similarly, the type of loan you’re refinancing impacts the rate. Federal loans, for instance, often come with different interest rate structures and eligibility requirements compared to private loans. The overall economic climate also influences interest rates, with lower rates generally available during periods of economic stability.

Real-World Examples of Successful Refinancing

Imagine Sarah, who initially had a $50,000 student loan with a 7% interest rate. After improving her credit score and securing a better job, she refinanced and obtained a new loan with a 4% interest rate. This seemingly small reduction of 3% resulted in significant savings over the life of her loan, allowing her to pay it off considerably faster.

Another example is John, who refinanced his federal student loans into a private loan. His original interest rates were variable, making it difficult to budget effectively. By refinancing, he locked in a fixed, lower interest rate, providing him with greater financial predictability and ultimately saving him a substantial amount of money. These examples highlight the potential benefits of refinancing when circumstances allow for improved terms.

Shorter Loan Term

Refinancing your student loans to a shorter term can significantly impact your repayment journey. While it might seem appealing to pay off your debt faster, it’s crucial to carefully weigh the advantages and disadvantages before making a decision. A shorter repayment period means higher monthly payments, but ultimately, you’ll pay less interest over the life of the loan.

Choosing a shorter repayment term involves a trade-off between affordability and the total amount paid. Let’s examine how the total interest paid varies with different loan terms. For example, consider a $50,000 loan at a 6% interest rate. A 10-year repayment plan will result in significantly higher monthly payments than a 15-year plan, but the total interest paid over the 10 years will be substantially less than the interest accrued over 15 years. This difference can amount to thousands of dollars, depending on the loan amount and interest rate. Accurate calculations are best performed using a student loan amortization calculator readily available online.

Total Interest Paid Comparison

The total interest paid is a crucial factor when considering different loan terms. A longer repayment period results in lower monthly payments, but it also leads to paying significantly more interest over the life of the loan. Conversely, a shorter term means higher monthly payments but substantially reduces the total interest paid. The following table illustrates this concept using a hypothetical $30,000 loan at a 7% interest rate:

| Loan Term (Years) | Approximate Monthly Payment | Total Interest Paid |

|---|---|---|

| 10 | $330 | $10,000 |

| 15 | $240 | $16,000 |

| 20 | $200 | $22,000 |

*Note: These figures are approximate and may vary depending on the specific loan terms and interest rate.*

Pros and Cons of a Shorter Loan Term

Understanding the implications of a shorter loan term is vital for making an informed decision. Consider these factors carefully:

The following points highlight the advantages and disadvantages of opting for a shorter loan term:

- Pro: Faster debt payoff: You’ll be debt-free sooner, providing financial freedom and peace of mind.

- Pro: Less interest paid: A shorter term significantly reduces the total interest you pay over the life of the loan, saving you a considerable amount of money.

- Con: Higher monthly payments: Shorter terms mean higher monthly payments, which could strain your budget if not carefully planned.

- Con: Less financial flexibility: Higher monthly payments can leave less room for unexpected expenses or financial opportunities.

Simplified Repayment

Refinancing your student loans can significantly simplify the repayment process, especially if you have multiple loans with varying interest rates and repayment schedules. Consolidating these loans into a single, streamlined payment can reduce administrative hassle and improve your overall financial organization. This simplification can lead to a more manageable and less stressful repayment experience.

Refinancing simplifies repayment primarily by combining multiple loans into one, thereby reducing the number of payments you need to track and make. This single payment, typically with a new, potentially lower interest rate, provides a clearer picture of your debt and makes budgeting significantly easier. Managing one payment instead of several minimizes the risk of missed payments and associated late fees, contributing to improved credit scores.

Consolidating Multiple Student Loans

The process of consolidating multiple student loans through refinancing typically involves several key steps. Understanding these steps will help you navigate the process effectively and make informed decisions.

- Check Your Credit Score: Before applying, review your credit report to identify any errors and understand your current creditworthiness. A higher credit score typically qualifies you for better refinancing terms.

- Research Lenders: Compare offers from multiple lenders, paying close attention to interest rates, fees, and repayment terms. Consider both large national lenders and smaller, specialized lenders.

- Gather Necessary Documents: Prepare your financial information, including income verification, employment history, and details of your existing student loans. This will expedite the application process.

- Complete the Application: Submit your application to your chosen lender, providing all required documentation. Be accurate and thorough in your application to avoid delays.

- Review and Accept the Offer: Once approved, carefully review the terms of the loan offer before accepting. Ensure you understand all fees and interest rates.

- Loan Disbursement: After accepting the offer, the lender will disburse the funds, paying off your existing student loans. You’ll then begin making payments on your new, consolidated loan.

Refinancing Process Flowchart

Imagine a flowchart visually representing the refinancing process. The flowchart would begin with “Assess Your Current Loans,” branching into “Check Credit Score” and “Research Lenders.” These branches would then converge at “Gather Documents and Apply.” Following this is “Review and Accept Offer,” leading to “Loan Disbursement” and finally, “Simplified Repayment.” Each step would be clearly depicted with arrows showing the progression of the process. This visual representation would effectively illustrate the straightforward nature of the process.

Potential for a Fixed Interest Rate

Refinancing your student loans offers the significant advantage of potentially securing a fixed interest rate. This can provide considerable peace of mind and long-term financial stability, especially in an environment of fluctuating interest rates. Switching from a variable rate loan to a fixed rate loan eliminates the uncertainty associated with unpredictable interest rate hikes.

A fixed interest rate locks in your repayment amount for the life of the loan. This predictability allows for better budgeting and financial planning, removing the risk of unexpected increases in your monthly payments. Unlike variable rates, which can rise and fall based on market conditions, a fixed rate provides a consistent and predictable payment schedule, making it easier to manage your finances and avoid potential financial strain.

Fixed vs. Variable Rate Comparison

To illustrate the impact of interest rate fluctuations, consider a simplified example. Let’s assume you have a $30,000 student loan. Scenario A represents a loan with a fixed interest rate of 5% over 10 years. Scenario B shows a loan with a variable interest rate that starts at 4% but increases to 7% after three years due to market changes, remaining at 7% for the remaining loan term. While both scenarios start with lower payments, the variable rate will significantly increase payments after year 3.

Imagine a graph. The x-axis represents the loan repayment period (in years), and the y-axis represents the total amount owed. The line representing the fixed-rate loan would show a steady, downward slope, representing consistent repayment. The line for the variable-rate loan would initially mirror the fixed-rate line but would then sharply deviate upwards after year three, reflecting the increase in interest and slower debt reduction due to higher interest payments. The difference between the two lines at the end of the 10-year period would visually represent the substantially larger amount paid under the variable rate due to the interest rate increase. This visual representation would clearly demonstrate how a fixed rate protects against the risk of increased debt caused by rising interest rates. The total interest paid would be significantly lower with the fixed-rate loan.

Access to Better Loan Terms

Refinancing your student loans can offer access to significantly improved loan terms, potentially leading to substantial savings and a more manageable repayment plan. This is particularly beneficial if your initial loan terms were less favorable, or if your financial circumstances have improved since you first took out your loans. By shopping around and comparing offers, you can find a lender that provides terms better suited to your current needs and financial situation.

Refinancing allows you to leverage your improved credit score or higher income to negotiate more advantageous terms. This could involve securing a lower interest rate, reducing fees, or gaining access to more flexible repayment options, such as extended repayment periods or income-driven repayment plans. Understanding the differences between lenders and their offered terms is crucial in making an informed decision.

Comparison of Lender Terms

Different lenders offer varying terms and conditions, making it essential to compare before making a decision. Factors to consider include interest rates, fees, repayment terms, and eligibility requirements. While specific rates and fees are subject to change, the following table illustrates a hypothetical comparison of terms from three different lenders:

| Lender | Interest Rate (APR) | Origination Fee | Repayment Terms |

|---|---|---|---|

| Lender A | 6.5% | 1% of loan amount | 5-15 years |

| Lender B | 7.0% | 0% | 3-10 years |

| Lender C | 6.0% | 0.5% of loan amount | 5-20 years |

*Note: This table presents hypothetical examples and does not reflect actual rates or offers from any specific lender. Actual rates and fees will vary based on individual creditworthiness and other factors.*

Improved Financial Flexibility

Refinancing your student loans can significantly boost your financial flexibility by lowering your monthly payments. This freed-up cash flow can then be redirected towards other crucial financial goals, improving your overall financial health and reducing stress. The impact extends beyond simply having more money at the end of each month; it allows for strategic planning and proactive financial management.

Lower monthly payments provide breathing room in your budget. This extra money can be strategically allocated to accelerate progress towards various financial objectives. Instead of barely making ends meet, you gain the ability to proactively save, invest, or address other financial priorities. This newfound flexibility is a powerful tool for building a stronger financial future.

Examples of Improved Financial Flexibility

The additional funds resulting from lower monthly payments can be used in several ways. For example, you might increase contributions to your emergency fund, building a safety net to handle unexpected expenses. Alternatively, you could invest more aggressively in retirement accounts, accelerating the growth of your long-term savings. Another option could be to allocate the extra money towards paying down high-interest debt, such as credit card balances, further improving your financial situation. Finally, the increased flexibility could enable you to save for a down payment on a house, a significant step towards building wealth and long-term financial security.

Case Study: The Impact of Refinancing on Financial Well-being

Consider Sarah, a recent graduate with $50,000 in student loan debt. Her original monthly payments were $700, a significant burden on her entry-level salary. After refinancing, her monthly payments dropped to $500. This $200 monthly savings allowed her to make substantial progress towards several financial goals. She increased her emergency fund contributions, building a comfortable three-month buffer. She also began investing $100 per month in a Roth IRA, starting her retirement savings early. The remaining $100 was used to pay down her credit card debt, eliminating high-interest charges and improving her credit score. Within two years, Sarah had significantly reduced her debt, built a solid emergency fund, and started a long-term investment plan – all thanks to the increased financial flexibility provided by refinancing her student loans. This demonstrates the tangible positive impact refinancing can have on an individual’s financial well-being.

Federal vs. Private Loan Refinancing

Refinancing student loans can significantly impact your financial future, but the process and potential benefits differ considerably depending on whether you’re refinancing federal or private loans. Understanding these key distinctions is crucial before making a decision. This section will illuminate the differences between refinancing federal and private student loans, highlighting the potential advantages and disadvantages of each.

Refinancing federal student loans involves replacing your existing federal loans with a new private loan from a lender. This process offers the potential for lower monthly payments and interest rates, but it comes with significant trade-offs. Conversely, refinancing private student loans is a simpler process, as you’re consolidating existing private debt into a new private loan. However, the benefits might be less pronounced compared to refinancing federal loans, depending on your current interest rates and loan terms.

Comparison of Federal and Private Loan Refinancing Processes

The processes for refinancing federal and private student loans differ in several key aspects. Federal loan refinancing typically involves a more complex application process due to the involvement of multiple government agencies and stricter eligibility criteria. Private loan refinancing, on the other hand, usually involves a simpler application process with fewer eligibility requirements. The timeline for processing and approval also varies, with federal loan refinancing often taking longer than private loan refinancing.

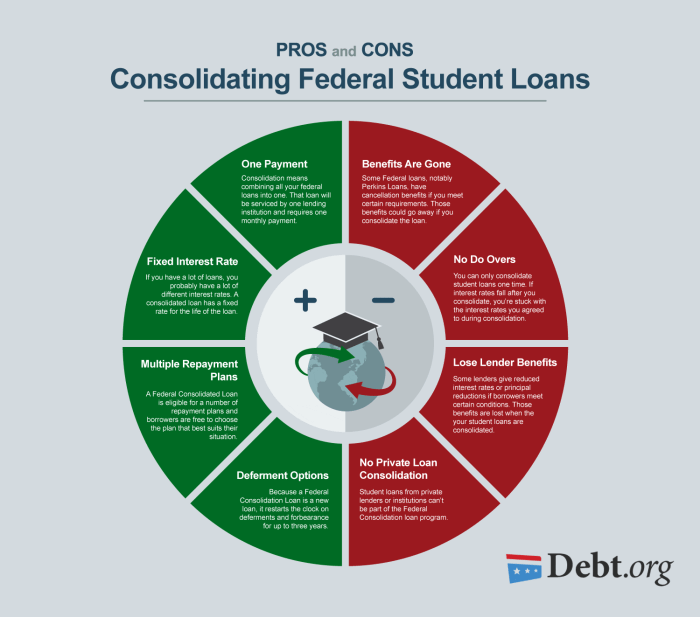

Implications of Refinancing Federal Student Loans

A critical consideration when refinancing federal student loans is the loss of certain federal loan benefits. These benefits can include income-driven repayment plans, deferment and forbearance options, and loan forgiveness programs. For example, borrowers enrolled in Public Service Loan Forgiveness (PSLF) programs will lose their eligibility if they refinance their federal loans into private loans. The potential loss of these benefits should be carefully weighed against the potential advantages of lower monthly payments or interest rates. The long-term financial consequences of this decision should be thoroughly evaluated.

Key Differences in Federal and Private Loan Refinancing

- Eligibility Requirements: Federal loan refinancing generally has stricter eligibility requirements than private loan refinancing.

- Loan Forgiveness Programs: Refinancing federal loans typically results in the loss of eligibility for federal loan forgiveness programs, such as PSLF.

- Repayment Options: Federal loans offer various income-driven repayment plans, while refinanced private loans typically do not.

- Deferment and Forbearance: Federal loans offer deferment and forbearance options, which are usually unavailable for refinanced private loans.

- Interest Rates: Interest rates on refinanced private loans can be lower than those on federal loans, but this depends on individual creditworthiness and market conditions.

- Application Process: The application process for refinancing federal loans is often more complex and time-consuming than for private loans.

Last Point

Ultimately, refinancing student loans presents a powerful opportunity to streamline debt management and improve financial well-being. By carefully evaluating your financial situation, exploring available options, and understanding the potential trade-offs, you can make an informed decision that best suits your needs. Remember to compare offers from multiple lenders to secure the most favorable terms. Taking control of your student loan debt is a significant step towards achieving your financial aspirations.

FAQ Resource

What is the impact of refinancing on my credit score?

The impact on your credit score is typically temporary and minor, as the lender will perform a hard credit check. However, successfully refinancing and making timely payments on your new loan can positively influence your credit score over time.

Can I refinance both federal and private student loans together?

Some lenders allow refinancing of both federal and private loans, while others specialize in one type or the other. It’s crucial to check the lender’s eligibility requirements.

What happens if I default on my refinanced loan?

Defaulting on a refinanced loan can severely damage your credit score and may lead to wage garnishment or legal action. It’s essential to make payments consistently.

How long does the refinancing process take?

The timeframe varies depending on the lender and the complexity of your application. It can generally range from a few weeks to a couple of months.