Navigating the world of student loans can feel overwhelming. The sheer number of lenders, varying interest rates, and diverse repayment options can leave prospective borrowers feeling lost. This guide aims to simplify the process by providing a comprehensive overview of key factors to consider when choosing the best bank or lender for your student loan needs. We’ll explore interest rates, repayment plans, loan forgiveness programs, lender reputation, and the crucial differences between federal and private loans, empowering you to make informed decisions about your financial future.

Understanding the nuances of student loan financing is critical for long-term financial health. From understanding the impact of interest rate fluctuations to choosing the repayment plan that best aligns with your post-graduation financial situation, the information presented here will equip you to approach the process with confidence and clarity. We’ll also delve into crucial resources like financial aid and scholarships, helping you minimize your reliance on loans altogether.

Interest Rates and Fees

Securing a student loan involves understanding the financial implications beyond the initial loan amount. Interest rates and associated fees significantly impact the total cost of your education and repayment schedule. Careful consideration of these factors is crucial for making informed borrowing decisions.

Choosing the right student loan requires a thorough comparison of interest rates and fees offered by various lenders. These costs directly affect the total amount you’ll repay. Lower interest rates and minimal fees can translate to substantial savings over the life of the loan.

Student Loan Interest Rates and Fees Comparison

The following table compares interest rates and fees from different hypothetical lenders. Note that actual rates and fees vary based on creditworthiness, loan type, and lender policies. Always check the most current information directly with the lender.

| Lender | Interest Rate (Variable) | Fees | Repayment Options |

|---|---|---|---|

| Lender A | 6.5% – 9.5% | Origination Fee: 1%, Late Payment Fee: $25 | Standard, Graduated, Income-Driven |

| Lender B | 7.0% – 10.0% | Origination Fee: 0.5%, Late Payment Fee: $30 | Standard, Extended |

| Lender C | Fixed 8.0% | No Origination Fee, Late Payment Fee: $20 | Standard, Income-Contingent |

Types of Student Loan Fees

Several types of fees can be associated with student loans. Understanding these fees is crucial for budgeting and managing your loan effectively. Unforeseen fees can significantly impact the overall cost.

Origination Fees: These are one-time fees charged by the lender when the loan is processed. They are typically a percentage of the loan amount. For example, a 1% origination fee on a $10,000 loan would be $100.

Late Payment Fees: These fees are charged when a payment is not made by the due date. The amount of the late payment fee varies by lender. Consistent on-time payments are crucial to avoid incurring these additional costs.

Application Fees: Some lenders may charge an application fee to process your loan application. This fee is usually a fixed amount, regardless of the loan amount. Check with individual lenders regarding their application fee policies.

Impact of Interest Rate Changes

Interest rates, especially variable rates, can fluctuate throughout the life of your loan. These changes directly affect the total amount you’ll pay. An increase in interest rates leads to higher monthly payments and a greater total repayment amount. Conversely, a decrease in rates can result in lower payments and overall savings.

For example, consider a $20,000 loan with a 7% interest rate over 10 years. If the interest rate increases to 9% during the repayment period, the total interest paid will increase significantly, extending the repayment period and potentially increasing the overall cost by thousands of dollars. Understanding this dynamic is key to financial planning.

Repayment Plans and Options

Choosing the right student loan repayment plan is crucial for managing your debt effectively and minimizing long-term financial strain. Different plans offer varying levels of flexibility and monthly payments, catering to diverse financial situations and income levels. Understanding the nuances of each plan is key to making an informed decision.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It typically involves fixed monthly payments over a 10-year period. This plan offers predictability and allows for faster debt repayment compared to other options. However, the fixed monthly payments can be substantial, potentially posing a challenge for borrowers with limited early-career income.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This option can be beneficial for borrowers anticipating income growth, as the increasing payments align with their rising earning potential. However, the initial low payments might lead to a longer repayment period and ultimately higher total interest paid. It’s important to carefully consider the long-term implications.

Extended Repayment Plan

This plan extends the repayment period beyond the standard 10 years, often up to 25 years. The longer repayment timeline results in lower monthly payments, making it more manageable for borrowers facing financial constraints. However, it’s crucial to acknowledge that extending the repayment period significantly increases the total interest paid over the life of the loan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) link monthly payments to your income and family size. These plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, offer significantly lower monthly payments, often making them the most affordable option in the short term. However, they usually extend the repayment period considerably, leading to higher overall interest costs. Furthermore, remaining loan balances after 20 or 25 years may be forgiven (subject to specific conditions and tax implications).

Comparison of Repayment Plans

| Repayment Plan | Payment Amount | Repayment Period | Total Interest Paid | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Standard | Fixed, higher | 10 years | Lower | Predictable payments, faster debt repayment | Potentially high monthly payments |

| Graduated | Starts low, gradually increases | 10 years | Moderate | Lower initial payments, aligns with income growth | Higher payments later, potentially longer repayment period |

| Extended | Lower | Up to 25 years | Higher | Lower monthly payments | Significantly higher total interest paid, longer repayment period |

| Income-Driven | Based on income and family size | 20-25 years | Highest | Lowest monthly payments, potential forgiveness | Longest repayment period, highest total interest paid, potential tax implications on forgiven amount |

Scenarios and Beneficial Repayment Plans

A recent graduate with a low-paying entry-level job might find an income-driven repayment plan most beneficial, as it allows for manageable monthly payments. Conversely, a borrower with a stable, high-paying job might prefer a standard repayment plan to pay off the loan quickly and minimize interest. Someone anticipating significant income growth in the coming years might find a graduated repayment plan suitable. Finally, a borrower facing unexpected financial hardship might consider an extended repayment plan or an IDR plan to avoid default.

Loan Forgiveness and Deferment Programs

Navigating student loan repayment can be challenging, but several government programs offer relief through loan forgiveness or deferment. Understanding these programs and their eligibility criteria is crucial for borrowers seeking financial assistance. These programs provide temporary or permanent relief from loan payments, potentially reducing the overall cost of higher education.

Several federal programs offer loan forgiveness or deferment based on specific employment, public service, or economic hardship criteria. Eligibility requirements vary depending on the program and the type of loan. It’s important to carefully review the specific requirements of each program before applying.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program is designed to forgive the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. This program significantly reduces the burden of student loan debt for individuals dedicated to public service.

- Eligibility: Borrowers must have Direct Loans, work full-time for a qualifying employer, and make 120 qualifying monthly payments under an income-driven repayment plan.

- Limitations: The program has strict requirements regarding the type of employment, repayment plan, and loan type. Failing to meet these requirements can result in ineligibility for forgiveness.

- Key Aspect: Complete and accurate documentation of employment and payments is crucial for successful application.

Teacher Loan Forgiveness Program

The Teacher Loan Forgiveness Program provides forgiveness of up to $17,500 on eligible federal student loans for teachers who have completed five years of full-time teaching in a low-income school or educational service agency. This program incentivizes individuals to pursue careers in education within underserved communities.

- Eligibility: Teachers must work full-time for five consecutive academic years at a low-income school or educational service agency and meet specific loan type requirements.

- Limitations: The program has a limited amount of forgiveness available and requires consistent employment at a qualifying institution.

- Key Aspect: Documentation of employment and service at a qualifying institution is crucial for loan forgiveness.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. These plans can lower your monthly payments, making them more manageable, and may lead to loan forgiveness after a set number of payments (often 20 or 25 years).

- Eligibility: Available to most federal student loan borrowers. Specific requirements vary depending on the chosen IDR plan (e.g., ICR, PAYE, REPAYE, IBR).

- Limitations: While monthly payments are lower, the total amount paid over the life of the loan may be higher due to the extended repayment period. Forgiveness under IDR plans may be subject to taxation.

- Key Aspect: Regular recertification of income is required to ensure payments remain accurate and reflect your current financial situation.

Deferment and Forbearance

Deferment and forbearance are temporary pauses in your student loan payments. Deferment is typically granted for specific reasons, such as unemployment or enrollment in school, while forbearance is usually granted due to financial hardship. Interest may still accrue during deferment or forbearance, depending on the loan type and program.

- Eligibility: Eligibility criteria vary depending on the reason for the request and the type of loan.

- Limitations: Deferment and forbearance are temporary solutions and do not eliminate the loan debt. Interest may accrue during these periods, increasing the total amount owed.

- Key Aspect: It’s essential to understand the implications of interest accrual and the total cost of the loan before opting for deferment or forbearance.

Lender Reputation and Customer Service

Choosing a student loan lender involves more than just interest rates and repayment plans. A lender’s reputation and the quality of their customer service are crucial factors that can significantly impact your borrowing experience, potentially saving you stress and time during a potentially challenging financial period. A reliable lender provides readily available support and handles issues efficiently, whereas a poor experience can lead to unnecessary complications and frustration.

Understanding a lender’s track record for customer service is essential for making an informed decision. This involves examining various sources of information and considering the experiences of other borrowers.

Customer Service Experiences Reported by Students

It’s vital to understand the range of experiences students have had with different lenders. While individual experiences can vary, consistent patterns can reveal a lender’s overall customer service approach. Examining reviews from multiple sources helps build a comprehensive picture.

- Positive Experience Example: A student describes easily accessible online resources, prompt responses to inquiries via phone and email, and a helpful representative who patiently guided them through the loan application and disbursement process. They highlight the lender’s proactive communication regarding important deadlines and changes in their loan status.

- Negative Experience Example: A student recounts difficulties reaching customer service representatives, long wait times on hold, and unhelpful responses to their questions. They describe a confusing online portal and a lack of clarity regarding their loan terms and repayment options, leading to significant stress and uncertainty.

- Mixed Experience Example: A student initially had a positive experience with the application process but encountered difficulties later when attempting to modify their repayment plan. While the initial contact was positive, resolving the later issue involved excessive wait times and multiple attempts to reach a helpful representative.

Factors to Consider When Evaluating Lender Reputation

Assessing a lender’s reputation involves looking beyond individual testimonials. Several key indicators provide a more holistic view.

A lender’s Better Business Bureau (BBB) rating provides a summary of customer complaints and the lender’s response to those complaints. A high rating suggests a good track record of resolving customer issues effectively. However, it’s important to note that the absence of complaints doesn’t guarantee perfect customer service.

Online reviews from various platforms (such as Trustpilot, Google Reviews, etc.) offer valuable insights into the experiences of numerous borrowers. While individual reviews may be subjective, analyzing patterns and trends across multiple platforms provides a better understanding of a lender’s strengths and weaknesses in customer service. Pay attention to the frequency of positive and negative comments and the types of issues that are frequently raised.

Examples of Positive and Negative Customer Service Interactions

Positive interactions often involve clear communication, readily available support channels (phone, email, online chat), prompt responses, and helpful, knowledgeable representatives who are empowered to resolve issues efficiently. Lenders who proactively communicate important information, such as upcoming deadlines or changes in loan terms, contribute to a positive borrowing experience.

Negative interactions are characterized by difficulties in contacting customer service, long wait times, unhelpful or dismissive representatives, and a lack of clarity regarding loan terms and repayment options. Inconsistent communication, confusing online portals, and difficulties in resolving issues can lead to significant frustration and negative experiences. A lender’s failure to address customer complaints promptly and effectively is a significant red flag.

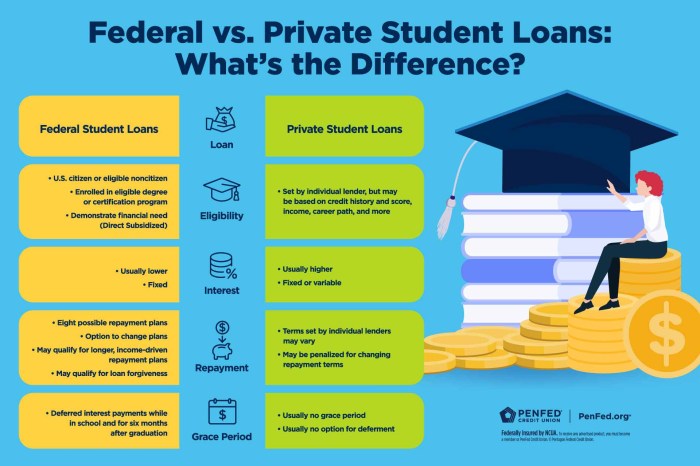

Types of Student Loans (Federal vs. Private)

Choosing between federal and private student loans is a crucial decision impacting your financial future. Understanding the key differences between these loan types is essential for making an informed choice that aligns with your individual circumstances and financial goals. This section will compare and contrast federal and private student loans, highlighting their respective advantages and disadvantages to help you determine which type is best for you.

Federal and private student loans differ significantly in their terms, conditions, and eligibility requirements. Federal loans are offered by the government, while private loans are provided by banks, credit unions, and other financial institutions. This fundamental difference leads to a variety of distinctions in interest rates, repayment options, and borrower protections.

Federal vs. Private Student Loan Comparison

The following table summarizes the key differences between federal and private student loans. Remember that specific terms and conditions can vary depending on the lender and the type of loan.

| Loan Type | Interest Rates | Eligibility | Repayment Options |

|---|---|---|---|

| Federal Student Loans | Generally fixed and tend to be lower than private loans. Rates are set annually by the government. | US citizenship or eligible non-citizen status, enrollment at least half-time in an eligible program, completion of the FAFSA. | Standard, graduated, extended, income-driven repayment plans (IDR), and potential for loan forgiveness programs. |

| Private Student Loans | Variable or fixed, typically higher than federal loans. Rates depend on creditworthiness, co-signer availability, and market conditions. | Good to excellent credit history (often requires a co-signer for students with limited or no credit), enrollment at an eligible institution. | Standard repayment plans, with fewer options compared to federal loans. Limited or no government-backed repayment assistance programs. |

Benefits and Drawbacks of Federal Student Loans

Federal student loans offer several advantages, but also have some limitations.

Benefits: Lower interest rates, various repayment plans including income-driven repayment options, and potential for loan forgiveness programs under certain circumstances (e.g., public service loan forgiveness). They also offer borrower protections, such as deferment and forbearance options in times of financial hardship.

Drawbacks: Eligibility is subject to meeting specific requirements, and loan amounts may not fully cover all educational expenses. The application process can be more complex and time-consuming compared to private loans.

Benefits and Drawbacks of Private Student Loans

Private student loans can be a viable option for some students, but it’s crucial to weigh the potential benefits against the risks.

Benefits: Potentially higher loan amounts compared to federal loans, simpler application process in some cases. May offer more flexible terms depending on the lender.

Drawbacks: Generally higher interest rates than federal loans, fewer repayment options, and less borrower protection. Requires good credit or a co-signer, which can be challenging for many students. Lack of government-backed repayment assistance programs.

Determining the Best Loan Type for Different Student Profiles

The best type of student loan depends heavily on the individual student’s financial situation and credit history. Students with excellent credit and co-signer options may find private loans more appealing due to potentially higher loan amounts and a simpler application process. However, the significantly higher interest rates and lack of borrower protections make federal loans a safer, albeit potentially less lucrative, option for most students. Students with limited or no credit history, or those expecting potential financial hardship during repayment, should prioritize federal loans for their greater flexibility and borrower protections.

Financial Aid and Scholarships

Securing funding for higher education is a crucial step in planning your academic journey. Beyond student loans, a significant portion of your funding can come from various financial aid and scholarship opportunities. Understanding these options and how to access them is essential for minimizing your reliance on loans and potentially reducing your overall debt burden.

Financial aid encompasses a range of programs designed to assist students in meeting the costs of higher education. These programs often consider financial need and academic merit, providing crucial support to students from diverse backgrounds.

Types of Financial Aid

Several types of financial aid are available to help students pay for college. These options offer different levels of support and come with varying requirements.

- Grants: Grants are generally need-based and do not require repayment. They are awarded based on financial need as determined by the Free Application for Federal Student Aid (FAFSA). Examples include Pell Grants and state-sponsored grants.

- Scholarships: Scholarships are awarded based on merit, talent, or specific criteria, such as academic achievement, athletic ability, or community involvement. Unlike loans, scholarships do not need to be repaid. They can be offered by colleges, universities, private organizations, and corporations.

- Work-Study: Work-study programs allow students to earn money while attending college. These programs often involve part-time jobs on or off campus, providing a valuable source of income to offset educational expenses. Eligibility is determined by financial need as reported on the FAFSA.

Identifying and Applying for Scholarships

Finding and securing scholarships requires proactive research and diligent application. Many scholarships are highly competitive, so it’s crucial to start early and apply to numerous opportunities.

Begin by researching scholarships relevant to your academic interests, skills, and background. Look for scholarships offered by your college or university, professional organizations, community groups, and corporations. Carefully review eligibility requirements and deadlines for each scholarship to ensure you meet the criteria before submitting an application.

Crafting a compelling application is crucial. Highlight your achievements, skills, and experiences in your essays and personal statements. Ensure your application materials are well-written, error-free, and accurately reflect your qualifications.

Reputable Scholarship Search Websites

Several reputable online resources can help you locate and apply for scholarships. These websites aggregate scholarship opportunities from various sources, providing a centralized platform for your search.

- Fastweb: Fastweb is a popular scholarship search engine that allows users to create a profile and search for scholarships based on their criteria.

- Scholarships.com: Scholarships.com is another widely used resource that provides a large database of scholarships and financial aid opportunities.

- Peterson’s: Peterson’s offers a comprehensive range of college planning tools, including a robust scholarship search engine.

Understanding Loan Terms and Conditions

Navigating the world of student loans requires a thorough understanding of the terms and conditions Artikeld in your loan agreement. These details significantly impact your repayment schedule, overall cost, and potential consequences of non-payment. Failing to understand these terms can lead to unexpected financial burdens. Let’s clarify some key concepts.

Key Loan Terms and Conditions

Understanding the terminology used in student loan agreements is crucial. Common terms include the Annual Percentage Rate (APR), grace period, and the critical concept of loan default. The APR represents the annual cost of borrowing, encompassing interest and any fees. A grace period is the time after graduation or leaving school before you’re required to begin repayment. Default occurs when you fail to make your loan payments according to the agreed-upon schedule.

Consequences of Defaulting on a Student Loan

Defaulting on a student loan has severe repercussions. These can include damage to your credit score, wage garnishment (where a portion of your paycheck is seized to repay the loan), and potential legal action. The impact on your credit score can make it difficult to obtain future loans, rent an apartment, or even secure employment. Furthermore, the government may take action to collect the debt, potentially leading to significant financial hardship. For example, a default could lead to the loss of future federal student aid eligibility.

Glossary of Common Student Loan Terminology

Understanding the language of student loans is vital for informed decision-making. Here’s a glossary of common terms:

- Annual Percentage Rate (APR): The yearly cost of borrowing, including interest and fees.

- Capitalization: The process of adding unpaid interest to the principal loan balance, increasing the total amount owed.

- Deferment: A temporary postponement of loan payments, often granted under specific circumstances like unemployment or enrollment in school.

- Forbearance: A temporary reduction or suspension of loan payments, typically granted due to financial hardship.

- Grace Period: The period after graduation or leaving school before loan repayment begins.

- Interest: The cost of borrowing money, calculated as a percentage of the principal loan amount.

- Loan Consolidation: Combining multiple student loans into a single loan with a new interest rate and repayment plan.

- Principal: The original amount of the loan, excluding interest and fees.

- Repayment Plan: A schedule outlining the amount and frequency of loan payments.

Example: If you borrow $10,000, the principal is $10,000.

Outcome Summary

Securing student loans is a significant financial undertaking, demanding careful consideration and informed decision-making. By thoroughly researching lenders, comparing interest rates and fees, understanding repayment options, and exploring available financial aid, you can significantly reduce the burden of student debt. Remember to prioritize lenders with a strong reputation for customer service and transparency, and always carefully review the terms and conditions before signing any loan agreements. Taking a proactive and informed approach to student loan financing will set you up for a more secure and successful financial future.

FAQ Corner

What is the difference between a federal and private student loan?

Federal loans are offered by the government and typically have more favorable terms and repayment options, including income-driven repayment plans and loan forgiveness programs. Private loans are offered by banks and credit unions, often with higher interest rates and less flexible repayment options.

How can I improve my chances of getting approved for a student loan?

Maintain a good credit score (if applicable for private loans), have a co-signer with good credit, demonstrate a clear financial need, and complete the FAFSA application for federal loans.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score, making it difficult to obtain future loans or credit.

Can I consolidate my student loans?

Yes, you can consolidate multiple student loans into a single loan, potentially simplifying repayment and potentially lowering your monthly payment. However, be aware that this may affect your overall interest rate and loan term.